Eye of sellers will be active soon...!

Channel Resistance is 1745 nearby .

Hit: Take confirmation from lower-frame chart. If you want to analysis on a lower timeframe, kindly say in a comment.

Almost many things are till remaining on the chart although i have plotted following:

Flag pattern

Major and minor channel

Initiative move

Responsive move

major and minor support level

Waves

-----------------------------------PAST PERFORMANCE--------------------------------

You can see what is the power of support.

Comex

Silver - WHERE TO NEXTHi, thanks for viewing.

I just posted this because the chart is the definition of neutral on the 4 hourly chart;

The price is side-ways,

RSI is almost at the 50 mid-point,

MACD (not shown because I don't have sub) is right on the zero line as well.

So, I watch with interest to see what is next. I am a bit less stressed about the price of silver dropping of late - as demand is super high for physical, the price between futures contract silver and physical have become unrelated in the last few weeks, but most of all - you price it at any level you want on the futures markets - but you have very little chance of getting any in your hand. Soon, you will have no chance - the supply chains will be frozen, many silver mines are already in care and maintenance due to you-know-what. This will also mean no secondary market for holders - but I don't think anyone buys silver because they have a short time horizon. The markets will re-open again and the world will be a different place. Then we will see how things look.

In the meantime, there are a lot of interesting developments to cover. Developments like;

- The Fed buying bonds, debt, and equities,

- The Fed balance sheet increasing my trillions a week,

- Helicopter money,

- Mine closures,

- The growing near-term potential for the failure of paper futures markets www.bullionstar.com The article relates to 100oz gold futures - not silver. However, if one should buy 100oz futures contract for physical delivery you are being told - I think quite explicitly - that you should not expect physical delivery. What you are primed to expect as settlement is in fact a promissory note. A 25% claim on a 400oz gold bar held in LBMA vaults. Why? It seems that COMEX has no 100oz bars. They are offering contracts on 25% shares of 400oz bars that are likely in London (who is willing to bet that air routes will be open in a month?). Its all very strange.

I was expecting the gold and silver price to be more volatile, even to significantly sell-off - as happened in the last recession. It's not all about futures contracts manipulation - people and businesses (maybe even some hedge funds too) will be forced to liquidate collateral (although I am aware of two hedge funds carrying around 10% of their long positions in gold. Actually both invest in GLD ETF - not physical metel) during a recession.

Again, its not silver. But a number of bullion suppliers have announced that the physical bullion prices have become unrelated to prices from COMEX. I tend to believe the suppliers, as they deal in finite metal (supply chains are freezing up while bullion demand it through the roof - I have heard levels between 477 and 1000% above 2019 demand levels in NZ, Australia, Singapore, and the US) and the futures contracts are not similarly limited. So, they can drive the prices down on the futures markets as much as they like - they will still have to settle some contracts with a physical delivery (I am aware most futures contracts are not for physical delivery). It is looking increasingly likely that physical settlement will not be possible at the end of the month. That realisation - effectively a default - will likely lead to a gap up re-pricing.

Ok, check ya later.

TOTAL BULLSHIT!SOMEONE DOESN'T WANT YOU TO SEE HOW RIGGED SILVER WAS IN 1980!

CURRENCYCOM REMOVED ALMOST 40 YEARS OF PRICE ACTION!

SEE PREVIOUS POSTS! LOOKING INTO IT FOR YOU GUYS!

Gold Futures | Broadening WedgePlease support this idea with LIKE if you find it useful.

Price formed a Right-Angled Broadening Wedge (descending) - bullish pattern. The market closed near the Ichi Cloud support zone. In case we have a confirmed retracement of the Ichi Cloud we can initiate a Long position.

If there is a confirmed breakout of the pattern we can also initiate a long position

Thank you for reading this idea! Hope it's been useful to you and some of us will turn it into profitable.

Remember this analysis is not 100% accurate. No single analysis is. To make a decision follow your own thoughts.

The information given is not a Financial Advice.

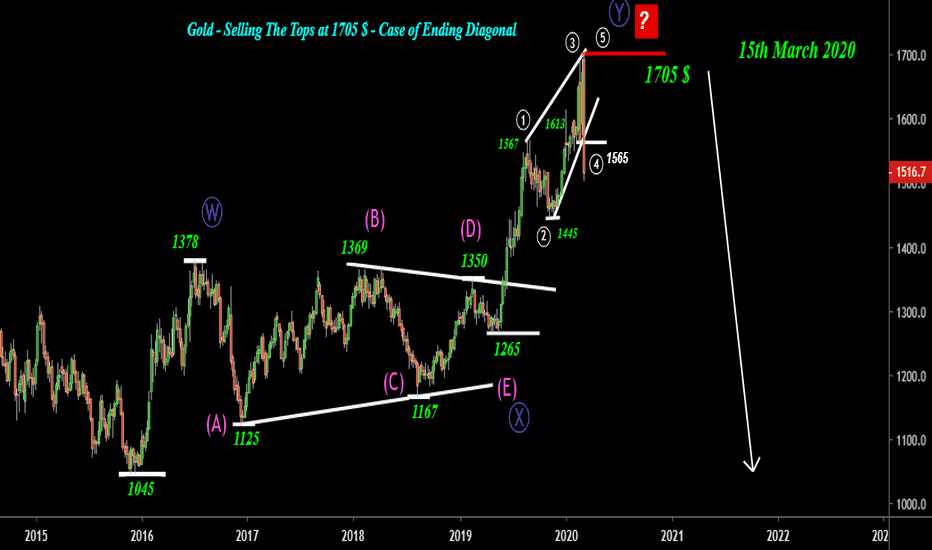

Comex Gold - Selling The Tops at 1705 $-Case of Ending DiagonalDisclaimer

-----------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Happy to get the clue straight from the yellow metal & to see it unfolding as expected on 7th March 2020 video idea which was published on Indian Version - Nifty / Gold / USDINR - The important Juncture.

Video Idea (Click the Idea Below)

------------------------------

Long Term Outlook

-------------------------------

A possible case of Ending Diagonal which suggest that the rally which started from 1045$ to 1705$ has completed & we look for downside Targets - 1045$ / 900$ / 750$

Short Term Outlook

Wait for some bounce above 1500$ in the zone 1590 - 1625$ zone - If you see the commodity getting rejected in the suggested zone then putting stops above 1635$ could be an opportunity for selling the commodity for

Targets - 1500$ / 1445$

Thanks for watching the video & stay classy till next idea.

Corona fear drained gold, Upwards channel intact

A corrective bounce is being seen as intraday charts are reporting bullish divergences and a possible sign of return? (Check blue arrowed trend line below the chart and on the RSI)

For a clearer Picture -

Corona fears have drained Gold prices, and caused a massive market panic and printed the lowest level since Feb. 5 @ 151.21 after dropping for a third straight day on Thursday.

However, there's appears good news for Gold buyers as it's on strong support and seems to return.

(after bumping into SMA 200 on Daily chart)

Gold price settles around 1588.00 since morning, and as long as the price is above 1545.00, the bullish overview will remain valid for the upcoming period.

Import resistance levels to watch - 1624.81 - 1635

-----------------------------

Follow the channel for more strong and in-depth analysis like this.

Share the love with your friends and let me what do you think, Leave a comment :)

Learn candlesticks and improve trading - bit.ly/Learn_candlesticks

(After trading if you decide to keep using that account for trading, you can get a 50% bonus, which you can actually keep and withdraw!)

to learn more about the offer and live trading signals Telegram - @Tradingmoore

SILVER PRICE SUPPRESSION IMPLODING!CRIMEx FUTURES/OPTIONS VOLUME ALL-TIME HIGH FEBRUARY 25TH!

MORE THAN 1.5B$ OF DIGITAL DERIVATIVES DUMPED ONTO THE MARKET!

CRIMEx TRADING FLOOR SHUTTING DOWN! TRADERS BEING SENT HOME!

U.S. MINT SELLING A RECORD AMOUNT OF PHYSICAL BULLION!

RISING METALS WILL ATTRACT TOO MUCH EXITING CAPITAL, IT CANNOT BE ALLOWED!

HOWEVER, ALL MARKET SUPPRESSION EVENTUALLY FAILS!

Silver trade in range bounded Rational of Recommendation

1. Bullish pennant formation on the daily time framework

2. Price trade-in a range bounded take the opportunity with favourable risk-reward ration.

3. Buy on a support level of Pennant pattern and Sell on Upper range of resistance with respective stop loss level of previous daily High/Low.

XAUUSD gold plan for 29.08.2019XAUUSD looks shorty. But there is no point now for open position.

Maybe it will appear after pullback to 1542.

Anyway I need high volume, now I do not see it.

If I will see good opportunity I will sell and write idea with Enter, SL and TP.

Subscribe to my channel on YouTube and Telegram named as USOIL WTI.

Every Monday at 11:00AM by Chicago I answer your questions on YouTube.

XAUUSD gold plan for 06.08.2019Main price move is up. Main target remains 1500.

I wait for pullback to 1450.

For open long I need some other conditions. For example one of them is high volume.

If I will trade, I will write post with numbers of Enter, Stop loss and Take profit.

All trades I make between 9:00 - 11:00 AM by Chicago only.

Write comments, ask questions.

Gold: what's happeningHi Guys,

the first time I thought it could form a Cup & Handle it was on March 26, 2019 when I published the idea on TradingView. For easy reference please click the image below:

Since then I've been trying to undestand gold behavior until it broke out the handle for the upside which confirmed the overall bias as a bullish continuation pattern.

Factors that helped Gold to breakout the handle for the upside are:

1) US China stalemate beginning of May,

2) Theresa May stepping down with increase uncertainties over Brexit;

3) Raising tensions in ME;

4) FED posture;

All these ingredients increased appetite for safe havens and Gold reacted in accordance with fundamentals and technicals.

The main reason why I neglected Gold these days is because I could not find a target after the breakout. I knew it was running high but when it slowed down at 1360 I thought it was topping. Instead it went to 1440 following the FED on Jun 19.

The day after the FED markets expected a rate cut in July. But the following week FED members inlcuding Bullard didn't sound dovish at all. This "U-Turn" made gold hit 1440 and retreat IMHO.

Technically the move is completed IMHO as 1440 was the perfect Take Profit following the breakout of the handle.

Infact, according to Investopedia: "A profit target is determined by measuring the distance between the bottom of the cup and the pattern’s breakout level, and extending that distance upward from the breakout."

For full detail about Cup&Handle please refer to the full article:

1300 - 1160 = 140

1300 + 140 = 1440

Now we have to wait for the G20.

Thank you for your support and for sharing your ideas.

Don't forget to put a like if you appreciate the post and to follow me if you want to receive notifications on new and updated ideas.

Disclaimer:

Please note that I am not a professional trader and these are my personal ideas only. The information contained in this presentation is solely for educational purposes and does not constitute investment advice. The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation. Cozzamara is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

GOLD: focusing on the 4H chart (and triple S)Hi Guys,

following my previous post please find above 4H chart focusing on the triple S support before the pullback at the end of week17.

Thank you for your support and for sharing your ideas.

Don't forget to put a like if you appreciate the post and to follow me if you want to receive notifications on new and updated ideas.

Disclaimer:

Please note that I am not a professional trader and these are my personal ideas only. The information contained in this presentation is solely for educational purposes and does not constitute investment advice. The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation. Cozzamara is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.