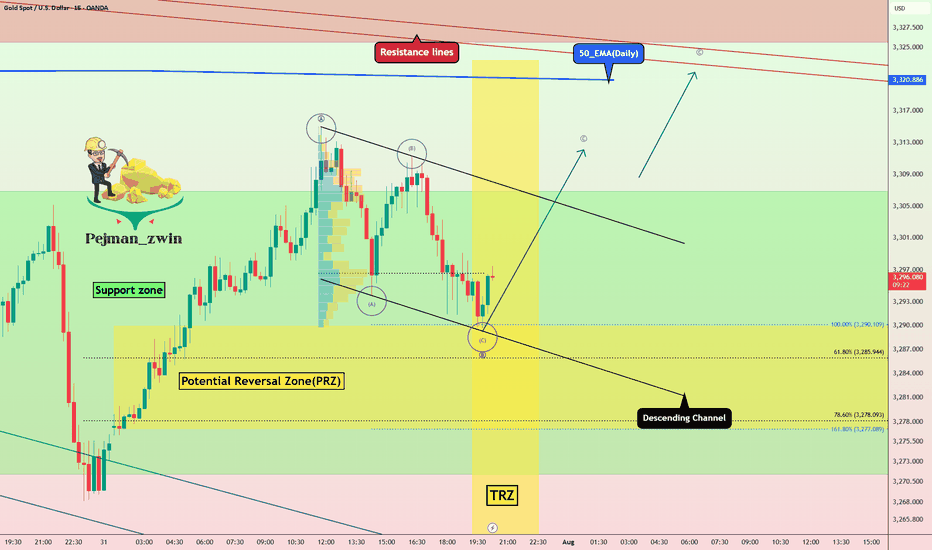

Gold in PRZ + TRZ: Is a Bullish Reversal Brewing(Short-term)?Gold , as I expected in yesterday's idea , fell to the Potential Reversal Zone(PRZ) and started to rise again .

Today's Gold analysis is on the 15-minute time frame and is considered short-term , so please pay attention .

Gold is currently trading in the Support zone($3,307-$3,275) and near the Potential Reversal Zone(PRZ) and Time Reversal Zone(TRZ) .

In terms of Elliott Wave theory , it seems that Gold can complete the microwave C of wave B at the lower line of the descending channel.

I expect Gold to trend higher in the coming hours and rise to at least $3,311 .

Note: Stop Loss (SL) = $3,267

Gold Analyze (XAUUSD), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Commodities

GOLD → The market is waiting for NFP. What could happen?FX:XAUUSD is bouncing off resistance at 3310, confirming the upper limit of the new trading range. The dollar continues to rally, but the market as a whole is stagnating ahead of upcoming news—NFP is coming up!

Gold is consolidating at monthly lows around $3268, awaiting key US labor market data (NFP). Trump's new tariffs (10% globally, 35% for Canada, 39% for Switzerland) have boosted demand for the dollar, putting pressure on gold. Markets are waiting for NFP: forecast +110K jobs, unemployment 4.2%. Weak data (<100K) → gold may rise to $3400. Strong (>150K) → the dollar will strengthen, gold will continue to fall. The probability of a Fed rate cut in September is <50%.

Based on yesterday's data, I would cautiously suggest that NFP will be in the range of 125K–145K, slightly above the consensus (110K). This will play into Trump's hands (I think you understand what I mean...).

Resistance levels: 3300, 3310, 3320

Support levels: 3287, 3268, 3255

The news has a negative nuance — unpredictability. Be careful.

Technically, based on the data we have at the moment, I would assume that the market may test resistance at 3300-3310 before a possible pullback to the specified support. BUT! Unpredictable data could turn the game around, and in that case, if the dollar falls, gold could start to rise.

Best regards, R. Linda!

GOLD - Price can fall to support level and then start to riseHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

The price was consolidating for an extended period inside a wide, horizontal range.

A strong bullish impulse eventually broke the price out above the resistance of that flat channel.

This breakout move created a new significant high before sellers forcefully rejected the price downwards.

This rejection marked the beginning of the current falling wedge pattern, which has guided the price lower since.

The decline within the wedge has now brought the asset down to a critical historical support zone at $3285.

I expect that this key support will hold, causing a reversal and a new rally that targets the $3345

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

XAU/USD (Gold) - Triangle Breakout (1.08.2025)The XAU/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 3249

2nd Support – 3225

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Simple Psychology Tips Using Volume for Better TradingMany newer traders assume that when someone says "psychology" in trading, they are referring to mindset.

It is also widely believed that trading is about the BEST entries.

Now, think of it this way. It is not about winning trades, it is actually about managing losses well to allow you to take the winners over and over again. You might think that a 3 to 1 risk-to-reward strategy is boring, you might have gone all in on your favourite crypto project. But what makes the difference between gambling and trading is actually very, very simple. So simple, in fact, many overlook it or simply ignore it.

Most seek a silver bullet - high win rates and perfectly timed entries, then they overleverage and move stops on the one "good trade" they are seeking to make.

Whilst doing this, they tend to overload the 6 monitors they have purchased to trade with a thousand indicators, which they don't really need.

The candlesticks tell a story, volume supports that story. When you learn any technique from Elliott Waves to Wyckoff, they all have a dependence on volume - even if the correlation is not apparent.

Look at this first image.

Price had moved down since the vertical line, the AD line also moved down - sell-off, in full swing. But then volume starts to shift before the AD line starts to increase.

Now, look at what happens next...

As we move forward and the new vertical line shows where volume spiked, the AD line starts to decrease as the price continues to rise.

This is enough of a story to start your analysis.

We then get a move with a lower high formed.

As this plays out, the sell-side volume rises, creating momentum for the short position.

Look a little closer and you will see, that the volume on the move up just before the drop was also decreasing. Making a divergence to price.

You might feel that the market is against you, or that the big players are single-handedly seeking your stops. But the truth is, the psychology in moves such as this one shown is where most retail traders either have greed that markets will only go up for ever or the fear that they are missing out on a market that only goes up forever.

It is that herd mentality that generates the liquidity for the professionals.

Losing 1% on a trade, is part of the process, risking 80%> on a single move will make you paper rich for about 10 minutes before the real losses set in.

This is where the psychology and the basic techniques such as risk management and understanding what candlesticks and volume bars are telling you, will make a world of difference to your results.

A/D line and volume are free on @TradingView and to be fair you don't need to overcomplicate it more than that!

Stay safe, have a great weekend all!!!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

GOLD ROUTE MAP UPDATEHey Everyone,

What a PIPTASTIC finish to the week! 🚀. We tracked the move down with precision durung the week and then rode the momentum right back up.

Yesterday, we confirmed the swing range activation and bounce, and that bullish follow through carried beautifully into today, completing our Bullish Target at 3348. Just perfect execution all around.

BULLISH TARGET

3348 - DONE

BEARISH TARGETS

3328 - DONE

EMA5 CROSS AND LOCK BELOW 3328 WILL OPEN THE FOLLOWING BEARISH TARGET

3305 - DONE

EMA5 CROSS AND LOCK BELOW 3305 WILL OPEN THE SWING RANGE

3289 - DONE

3267 - DONE

We will now come back Sunday with a full multi timeframe analysis to prepare for next week’s setups, including updated views on the higher timeframes, EMA alignments, and structure expectations going forward.

Thanks again for all your likes, comments, and follows.

Wishing you all a fantastic weekend!!

Mr Gold

GoldViewFX

Gold keeps falling – is there more to come?Hello everyone, great to see you again!

Today, gold remains under pressure following a series of strong U.S. economic data releases, which have reinforced expectations that the Federal Reserve will keep interest rates elevated for longer. As a result, the U.S. dollar has strengthened, Treasury yields have climbed, and gold has lost its footing.

On the H1 chart, XAUUSD is clearly trading within a descending price channel. Both the EMA 34 and EMA 89 are acting as dynamic resistance zones. Recent attempts to rally have consistently failed at these levels, mirroring the bearish setup seen before July 29.

Currently, price is retesting a minor resistance area. If this retest fails, the next downside targets lie near 3,270 – and potentially down to 3,230 USD, which aligns with the lower boundary of the price channel.

From my perspective, the bearish momentum is likely to continue.

What about you? How do you think gold will close the day?

XAU/USD | Next Key Zone: Watch for Rejection at $3334! (READ)By analyzing the gold chart on the 4-hour timeframe, we can see that, just as expected, the price dropped from $3310 to $3288 in the first leg, where it hit a demand zone and bounced up to $3305, delivering a 170-pip rally. The main bearish move from $3333 to $3288 yielded 450 pips, bringing the total return on this analysis to over 620 pips!

In the second phase, gold dropped sharply again to $3268, and once more found demand, currently trading around $3307. If the price holds above $3294, we could expect further upside toward the $3322–$3334 zone. Once gold reaches this area, a strong bearish rejection is likely, with a potential return of 250 to 400 pips.

All key supply and demand levels are marked on the chart — make sure to monitor them closely and study the chart in detail. Hope you’ve made the most of this powerful analysis!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Gold 30Min Engaged ( Bearish Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bearish Reversal - 3325

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

DXY Just Broke Through the Lock… Where’s the Market Headed Now?🌅 Good Morning, Friends!

A few days ago, I marked 98.950 as a key threshold for the DXY index. As of today, that level has officially been broken—and the bullish momentum we anticipated is now kicking in. 📈

The next target? 101.000.

That said, it’s crucial to remember: DXY is heavily influenced by fundamental data. Stay alert and keep a close eye on key economic developments—they’re essential for navigating this move.

This breakout validates the analysis I shared with you all. And it wasn’t just about charts—it was about discipline, precision, and timing.

Every single like from you is a huge boost to my motivation. Thanks from the heart—your support drives me to keep sharing these insights! 💙

Gold suddenly increased sharply Hey everyone, let’s dive into what’s happening with XAUUSD!

Gold is experiencing a remarkable rally this weekend, skyrocketing from the $3,285 zone to around $3,362 — gaining over 700 pips. This sharp move comes amid weakening U.S. labor market data, which has fueled speculation that the Federal Reserve may begin cutting interest rates as early as September.

According to the U.S. Bureau of Labor Statistics (August 1st), non-farm payrolls rose by just 73,000 jobs in July — well below economists’ expectations of 106,000. The disappointing figures have shaken confidence in the U.S. economy and placed pressure on the U.S. dollar, as markets increasingly anticipate a dovish shift from the Fed.

For gold, this weak jobs report reinforces its role as a safe-haven asset, driving strong demand as investors seek protection from economic uncertainty. At the same time, lingering fears around global trade tensions and new tariffs imposed by President Donald Trump continue to support the flight to safety.

From a technical perspective, gold has broken out of its descending price channel and is moving fast. According to Dow Theory, a short-term correction may occur soon, but if price holds above key support levels, the rally could extend toward the $3,432 region — the 1.618 Fibonacci extension zone.

This move might mark the beginning of a new bullish phase after weeks of consolidation.

What do you think — is gold just getting started?

GOLD (XAUUSD): Bearish Continuation Ahead?!

Gold retested a recently broken significant liquidity cluster.

I see a clear sign of strength of the sellers after its test

with multiple intraday confirmation.

I think that the price will retrace to day to 3276 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold 30Min Engaged ( Buy & Sell Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bearish Reversal - 3304

🩸Bullish Reversal - 3275

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

Gold can reach resistance area and then continue to fallHello traders, I want share with you my opinion about Gold. Over an extended period, the price action of Gold has been contained within a large descending triangle, a pattern characterized by a series of lower highs testing a descending resistance line and a relatively flat support base. The major seller zone around the 3415 resistance level has consistently capped upward rebounds, establishing a clear downward pressure on the asset. The most critical recent development has been a decisive breakdown, where the price broke below a key ascending trend line and, more importantly, below the horizontal support at 3310. This structural break has shifted the immediate market dynamics, turning the former support area of 3310 - 3320 into a new ceiling of resistance. The primary working hypothesis is a short scenario based on the principle of a breakdown and retest. It is anticipated that the price will attempt a corrective rally back towards this new resistance area around 3310. A failure to reclaim this level, confirmed by a strong rejection, would validate the breakdown and signal the continuation of the larger downward trend. Therefore, the tp for this next bearish leg is logically placed at the 3240 level. This target represents a significant area of potential support and a measured objective following the resolution of the recent consolidation. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

HelenP. I After correction to support level, Gold start to growHi folks today I'm prepared for you Gold analytics. An examination of the chart highlights a well-established long-term uptrend, with the bullish structure being clearly defined by a major ascending trend line that has consistently provided dynamic support. Currently, the price is undergoing a healthy correction after being rejected from the major resistance zone around 3430. This pullback is now guiding the price towards a critical confluence of support, where the aforementioned ascending trend line intersects with a strong horizontal support zone at 3305 - 3285. My analysis for a long position is based on the high probability of a bullish reaction from this key area. I believe that as the price enters this support confluence, it will be met with strong buying pressure, as it represents a logical point for buyers to defend the trend. A confirmed bounce from this zone, demonstrated by a rejection of lower prices, would be the main condition to validate the continuation of the uptrend. Therefore, the primary goal for the subsequent rally is set at the 3430 resistance level, as a retest of the recent high is the most logical objective following a successful defense of the trend. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

THE KOG REPORT - NFPTHE KOG REPORT – NFP

This is our view for NFP, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

Following on from the FOMC KOG Report which worked quite well, we’ll stick with the same chart and for today suggest caution. It’s the first day of the month and the last day of the weekly candle. The close here for gold is important and will give us further clues to the next few months.

We’ve shared the red boxes and the red box targets are below. There is a key level above 3306-10 which will need to be breached to correct the move back up to the 3330-34 region for the weekly close. However, we now have an undercut low which is potential if there is more aggressive downside to come and that level is sitting around the 3240-50 region which for us may represent an opportunity for a swing low. We’re a bit low and stretched here to short and as we’ve already hit our target for the day so we’ll wait for the extreme levels and if hit and our indicators line up, we may take some scalps. Otherwise, as usual on these events, the ideal trade will come next week.

RED BOXES:

Break above 3290 for 3295, 3306, 3310 and 3320 in extension of the move

Break below 3275 for 3267, 3260, 3255 and 3250 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

XAUUSD Daily Sniper Plan – August 4, 2025🧠 Macro & Context

Gold is surging back toward premium structure after sweeping 3287. With no major news today, flow is dictated by structure, liquidity, and the residual strength from July’s closing push. Bulls have reclaimed internal control, but are now pressing into major resistance zones. This is the perfect battleground for sniper entries.

🔥 Bias: Bullish short-term, but hitting premium exhaustion

The current candle is testing prior supply and imbalance. Unless we break 3375–3380 cleanly, price remains vulnerable to rejection from premium. Above that, clean air until external zones. Any pullbacks into discount (under 3310) remain buyable — if the structure holds.

🎯 Daily Sniper Zones

🔷 3360–3375 – Decision Supply

📍 Where we are now

This is the current premium pressure zone. Built from a bearish OB + unmitigated imbalance from late July. First contact is live. If price rejects this level, sellers may regain control short-term. But if buyers break and hold above 3375 → bullish expansion is open. This is our Decision Zone.

🔷 3387–3405 – External Supply Block

📍 Premium target for breakout move

Clean HTF OB + imbalance resting above liquidity. If 3375 gives way, this is the next sniper target. Expect strong reaction — either reversal or inducement wick. Ideal for shorts if price shows exhaustion and BOS on LTF.

🔷 3430–3439 – Final Supply Cap (Weekly)

📍 Extreme supply wick

This is the highest defined zone on the Daily/Weekly chart before unknown territory. Full wick zone, untouched since early May. Reactions from here tend to be sharp. A strong rejection could initiate a new sell cycle.

🔷 3310–3325 – Mid-Demand Support

📍 Pullback buy zone

If price rejects 3375 and pulls back, this is the first area to monitor for higher low formation. Built from bullish OB, Fibonacci 50%, and alignment with internal structure. RSI supports buyers here if retested cleanly.

🔷 3285–3300 – Key Reversal Demand

📍 The origin of the current rally

Strong institutional footprint. Last BOS + OB confluence area. Any retest here is valid for sniper buys as long as no bearish HTF shift appears.

🔷 3240–3260 – Final Daily Demand Base

📍 Only valid if structure breaks down

If we lose 3285, this is the last demand zone holding Daily structure. Deep discount + HTF mitigation block. A visit here would require bearish breakdown first.

🧠 Game Plan Summary

⚠️ Right now, we are in a decision zone (3360–3375). Do not rush. Wait for confirmation.

✅ If we break 3375, next bullish target = 3405, then 3439.

🔻 If we reject 3375, watch for controlled retracement into 3325 or 3300 for buys.

⛔️ Do not sell blindly into current price — we are at equilibrium.

💬 If this sniper breakdown sharpened your vision, show some love ❤️

Comment, follow, and hit that like to stay locked in with GoldFxMinds.

More sniper updates dropping 💥

Powered by Trade Nation – for clear structure and no chart noise.

DeGRAM | GOLD fixed below the triangle📊 Technical Analysis

● XAUUSD is forming a bearish descending wedge within a broader symmetrical triangle, facing rejection at 3,310 near prior support-turned-resistance.

● Repeated failure to hold above trendlines and continued lower highs favor a drop toward the 3,246.56 level, with possible overshoot if support breaks.

💡 Fundamental Analysis

● Rising real yields and hawkish Fed tone continue to pressure gold; ISM Manufacturing Prices and NFP loom as next volatility catalysts.

● Reduced ETF inflows and strong dollar on resilient US macro data weigh on demand for non-yielding assets.

✨ Summary

Short bias below 3,310. Breakdown eyes 3,246 → 3,200 zone. Resistance holds while trendline caps recovery.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

XAUUSD H4 Outlook – August 4, 2025Structure is bullish — but supply is layered. Precision now matters more than bias.

—

Gold is trading at 3362, sitting right inside the heart of a key structural zone. After a strong breakout from 3285–3260, price reclaimed imbalance, broke internal structure, and powered higher into premium. The trend is bullish — but we’ve just stepped into stacked supply.

Let’s break down every zone that matters now, from top to bottom:

🟥 3360–3375 – Valid H4 Supply Zone

This is the first active supply block — the origin of the last bearish leg. It holds a clean OB + imbalance and is currently being tested for mitigation.

We're inside it right now. This zone is critical:

→ If price breaks and holds above it, continuation is likely

→ If we reject here, it confirms sellers are defending their level

🟥 3385–3398 – Internal Supply Trap

A secondary supply zone built from previous order flow.

If bulls push through 3375 without rejection, this is the next area to watch for weakness.

This zone often creates fake breakouts, especially when momentum slows. RSI is already showing signs of exhaustion approaching this level.

🟥 3420–3440 – HTF Supply Trap

This is the top — the last unmitigated supply on the weekly.

It's not in play yet, but if bulls break above 3398 decisively, this is where the bigger trap could form.

Any long into this zone must be backed by strong structure and continuation candles — otherwise, it’s a liquidation magnet.

🟫 3322–3310 – Flip Reentry Zone

If we reject from current supply, this is the first high-probability reentry for bulls.

It’s where the last CHoCH confirmed, and it aligns with EMA confluence and minor imbalance.

Buy setups from here must be confirmed on M15/M30 — no blind longs.

🟦 3285–3260 – Breaker Demand Base

The true origin of the bullish move.

This zone caused the structural flip — clean OB, FVG stack, and liquidity sweep.

If price returns here, it becomes a must-hold for bullish continuation. One of the best sniper zones for longs.

🟦 3222–3205 – Final Demand Layer

Deep structure zone holding imbalance + previous HL base.

Only comes into play if 3260 fails. A break below this would shift bias to neutral or bearish on H4.

🎯 Bias Summary

✔️ H4 bias = bullish

✔️ Price is inside 3360–3375 supply

✔️ EMA 5/21/50 aligned, but RSI is elevated

⚠️ This is not a breakout — it’s a test zone

🔁 Execution Plan

📍 Rejection from 3360–3375 → sell scalp toward 3322

📍 Clean break of 3375 → watch for next short at 3385–3398

📍 Failure of 3398 → HTF draw toward 3430–3439

📍 Pullback toward 3322–3310 → potential long zone

📍 Clean drop to 3285 → high-RR buy area

📍 Break below 3260 → only valid demand left is 3222

—

This is not the time to chase. It’s the time to stalk.

You’re in premium. Supply is active. Let structure decide — you just execute with clarity.

—

Which zone are you watching for your next move?

Comment your bias below 👇🏼 Smash the ❤️ if this brought clarity, and follow GoldFxMinds to trade with precision every day.

Disclosure: Chart based on Trade Nation feed (TradingView).

XAUUSD H4 Update – The Battle Has Moved to 3350

“From deep demand to key supply. The next move is decisive.”

🔸 Sunday Plan Recap

Price was falling aggressively into the HTF demand zone (3265–3240).

The plan anticipated a bounce only if that deep zone held.

Above price, major zones included:

3314 – mid-structure

3330–3345 – supply zone

3368–3380 – final retracement targets

🔸 What Changed?

✅ The deep demand zone worked — H4 CHoCH bullish was confirmed.

✅ Price climbed through 3285 and 3314, confirming a retracement leg.

🔥 Now, price sits at 3349.57, testing the same supply zone marked in Sunday’s plan (3330–3345).

🔸 Current H4 Structure

🔼 Short-term bias = bullish retracement

📍 Price = inside HTF premium zone

📈 EMAs aligned bullish (5/21/50), confirming short-term momentum

💡 RSI = approaching overbought

⚔️ Liquidity above 3355, trapped shorts below 3314

🧠 Today’s Battle Plan (August 1)

🔴 Sell Zone (live) – 3345 to 3355

Price just entered the key H4 supply zone. Watch for rejection signs:

Bearish confirmation needed (e.g. M15/M30 CHoCH or engulfing)

If confirmed → downside targets: 3314 → 3285 → 3265

High RR short only if structure confirms

🔵 Breakout Bullish Case

If 3355 breaks with a clean body + HL at 3340 → bullish continuation active

Next upside target: 3368 → 3380

🧭 Final Thoughts

We’ve reached the exact decision zone from Sunday’s plan.

The market will now reveal: retracement over... or breakout coming?

Patience is key — this is a high RR zone, but only if structure reacts.

💬 Did you catch the move from deep demand? Or waiting for confirmation here at supply?

📈 Share your thoughts in the comments and let’s break it down together.

🔔 Follow for real-time market insights, sniper plans, and structured trading logic you can trust.

❤️ Like if you enjoy clean, actionable updates🚀🚀🚀

🔁 Share with traders who love structure over noise

📉 Price data from Trade Nation feed

XAUUSD August 2025 Monthly OutlookWelcome to August — and welcome to the top of the macro ladder. Gold is not just rising. It’s rewriting structure.

🔸 Macro & Fundamentals

Gold opens August with a fresh impulsive breakout above $3360, fuelled by a weaker USD, rising global risk sentiment, and continued speculative positioning from institutional buyers. The upcoming Jackson Hole meeting and shifting Federal Reserve expectations create the perfect climate for volatility. All eyes are now on the premium structure top — but will gold expand beyond it or retrace to refill?

🔸 Monthly Trend & Bias (HTF Overview)

🔹 Structure: Clean bullish BOS, continuation leg in progress

🔹 Last CHoCH: April 2023 → Confirmed full trend shift bullish

🔹 Current Monthly Candle: Explosive push into supply with top wick rejection beginning to show

🔹 Bias: Still bullish but in extreme premium — watch for cooling/rebalancing

🔸 EMA Structure

| EMA Type | Status | Signal |

| ----------- | -------------- | ------------------------------------- |

| EMA 5 / 21 | Strong Bullish | Dynamic expansion, steep angle upward

| EMA 50 | Below | Clean breakout from range

| EMA 100/200 | Far below | Long-term uptrend deeply intact

🔸 Key HTF Levels (Wick-to-Wick Mapping)

Zone Type Price Range Confluences

🔴 Premium Supply 3350 – 3439 Monthly FVG + Wick exhaustion + RSI 80+

🔵 Bullish Imbalance 3180 – 3270 Monthly FVG + old BOS + EMA5 baseline

🔵 Mid-Level Support 2920 – 3000 Monthly OB + FVG + structure base

🔵 Deep Demand 2670 – 2780 HTF equilibrium zone + RSI support

✅ The current candle has pierced into the final wick supply, but with clear signs of loss in momentum.

⚠️ If 3439 breaks cleanly, next expansion zone opens toward 3505 → 3610 (Fibonacci projection). Otherwise, expect cooling to 3270–3180 first.

🔸 Fibonacci Context

🔻 Swing Low: 1810

🔺 Swing High: 3439

🎯 Current price ($3363) sits just below the 100% Fibonacci projection, with the 1.272 and 1.618 extensions at 3610 and 3740.

This confirms we are in a macro premium, and any long positions from here forward must be built only on strong LTF confirmation or clean pullbacks into value.

🔸 August Scenarios

🟢 Scenario 1 – Breakout + Price Discovery

If bulls break 3439 with strong volume and close:

New leg toward 3505 → 3610 opens

Watch for LTF continuation on H4–D1 with bullish OB reentry

Only valid if 3350 holds as new support

🔻 Scenario 2 – Rejection + Healthy Pullback

If price holds below 3439 and monthly wick exhausts:

Clean retracement toward 3270 → 3180 expected

EMA5/21 rebalancing will support bullish structure

Deeper rejection could retest 3070 zone if volatility spikes

🔸 Conclusion & Action Plan

We open August fully inside the last monthly supply zone. Trend is still bullish, but RSI, FVGs, and EMA distance warn us: this is not the time to chase — it’s time to wait for structure to speak.

📌 Key pivot = 3439.

Above it → Expansion.

Below it → Retracement.

Let August unfold — but stay sharp. The next big move will be born from this compression.

—

What’s your take — are we just getting started or about to cool off?

Drop your thoughts, chart it out, and stay ready for what August brings. ⚔️

—

❤️ Like if you enjoy clean, actionable updates🚀🚀🚀

🔁 Share with traders who love structure over noise

With clarity, confidence, and control,

GoldFxMinds

XAUUSD Daily Outlook – August 4, 2025We’re not in breakout. We’re deep in premium — and supply is stacked.

—

Gold is now trading at 3362, sitting right inside the first valid daily supply zone — the same block between 3355 and 3375 that caused the last rejection. The bullish rally from 3272 was clean: liquidity sweep, CHoCH, imbalance filled, HL confirmed. Bulls did their job. Now they’re walking straight into pressure.

Above this zone, things don’t get easier — they get trickier.

Just a bit higher, we have an internal supply trap between 3398 and 3412. It’s a reaction zone built from imbalance and inducement — not strong enough to hold a reversal on its own, but perfect to fake out breakout buyers. If price pushes through 3375 and enters this pocket, snipers should be watching carefully for early signs of weakness.

And finally, at the top of the current structure sits the HTF supply trap at 3430–3439 — the last weekly wick, the macro reversal zone. That level is sacred. If price makes it there, either we’ll see full-blown expansion… or a violent reversal born from overconfidence.

So what do we do now?

We wait.

If price starts to reject from this 3355–3375 supply with bearish intent, we target the flip reentry zone at 3318–3328 — the previous CHoCH break and dynamic EMA cluster. That’s your first intraday long trigger if bulls want to come back strong.

If that breaks, next is the demand base at 3287–3267, the origin of this entire bullish move. Below that? Imbalance support near 3225 — the final line before structure shifts.

—

🟥 Valid Supply Zone → 3355–3375

🟥 Internal Supply Trap → 3398–3412

🟥 HTF Supply Trap → 3430–3439

🟫 Flip Reentry Zone → 3318–3328

🟦 Demand Base → 3287–3267

🟦 Imbalance Support → 3225–3205

—

This isn’t a breakout. It’s a build-up inside premium.

The smartest move today might be no move — until structure speaks.

—

Are you watching for the rejection? Or the breakout trap?

Let us know your bias below 👇🏼

Tap that ❤️ if this gave clarity, and follow GoldFxMinds to stay ahead of every key level — no noise, just structure.

—

With sniper calm and strategic clarity,

GoldFxMinds 💙

Disclosure: Analysis based on Trade Nation TradingView chart feed.