XAUUSD - Daily | More Consolidation??Gold is back in the upper range of this consolidation zone. You can see the high of the range is 3430, and the low is 3240 roughly.

Bulls:

Gold is pulling back into an Inverted FVG. If the price is bullish, then we should clear the gap with ease. Gold has just eliminated 4 days' worth of choppy bearish price action. Look for gold to give clear signs to enter a buy.

**A new daily candle should appear, creating a new FVG showing buyers are winning

Bears:

So with that said... If Gold fails to remain bullish after Friday's (Aug 1st) 700-pip jump, then the iFVG may have the price react bearishly. Watch for gold to give a clear sign of rejection before entering a sell

**Price may drop to cover Friday's gap. Doesn't mean it's bearish

Commodities

XAUUSD Weekly Outlook – August 4–8, 2025

The question isn’t whether gold is strong. The question is — will price expand, or rebalance?

🔸 Macro Overview

Gold begins the week consolidating just below its final HTF supply zone (3439), while USD weakens amid mixed macro data and growing speculation of future rate cuts. Markets await fresh catalysts, and gold’s recent impulsive rally is now facing the big test: break the wick, or pull back?

🔸 Weekly Structure & Bias

Element Observation

🔹 Trend Bullish continuation — clean structure

🔹 Last BOS March 2025 — impulsive, with imbalance below

🔹 Price Action Top wick rejection forming near 3439

🔹 Bias Still bullish, but entering exhaustion zone

🔹 RSI Above 70 — overheated

🔹 EMAs EMA5 > EMA21 > EMA50 > EMA100 — perfect trend

🔸 Key Weekly Levels (Zones + Confluences)

Zone Type Price Range Confluences

🔴 Supply 3350 – 3439 HTF wick supply + FVG + RSI 70+ + liquidity trap

🔵 Demand 3270 – 3215 Weekly OB + FVG + EMA21 support

🔵 Demand 3120 – 3070 Old BOS + deep FVG + psychological level

🟢 Support 3000 zone EMA50 + historical consolidation

🔸 Fibonacci Extensions (Above 3439)

Extension Level Price Target Confluences

1.0 (Swing Full) 3439 Supply wick high

1.272 3505 Next psychological milestone

1.414 3560 Mid-extension + liquidity

1.618 3610 Golden expansion target

2.0 3740 Full trend extension (max)

🔺 These levels serve as potential breakout targets ONLY if we get a confirmed weekly close above 3439 with clean BOS on LTF.

🔸 Weekly Scenarios

🟢 Scenario 1 – Break and Expand

If gold breaks 3439:

Expect clean continuation to 3505 → 3560 → 3610

Best entries come from new OBs on H4/D1 around 3350–3370

Follow momentum — but don’t chase without retrace confirmation

🔻 Scenario 2 – Rejection + Retracement

If price holds below:

Pullback toward 3270 – 3215 expected

EMA21 acts as dynamic support

If selloff gains strength, next demand = 3120 – 3070

🎯 This zone aligns with macro OB + re-entry for long-term bulls.

🔸 Conclusion & Gameplan

Gold is pressing against its final weekly ceiling.

Structure remains bullish, but every sniper knows — at the edge of premium, timing is everything.

✅ Above 3439 → expansion opens to 3505 → 3560 → 3610

🟦 Below 3439 → retracement into 3270 → 3215 → 3070

The best setups will be born from confirmation, not prediction. Let the market decide.

—

What would you do if 3439 rejects hard this week?

Comment your plan, tag your sniper level, and let’s stay ahead together 💬

—

With clarity, confidence, and perfect timing,

GoldFxMinds 💙

Disclosure: Analysis based on Trade Nation (TradingView) chart feed.

USOIL Technical Analysis – Black Mind Curve Breakout & Reversal🔍 Overall Market Context:

The current USOIL structure is a great example of market shift from compression to expansion, characterized by a breakout of the Black Mind Curve followed by a measured impulse move. This chart is not just reacting technically, but it reflects how institutional smart money manipulates curves, breaks minor structures, and then retests zones to refill orders before continuing directionally.

Let’s break the market psychology and price action phase by phase:

🔄 Phase 1: Black Mind Curve Breakout ✅

The Black Mind Curve represents long-standing supply pressure that had been capping price.

Its breakout marks a shift in market intention, often signaling the end of a distribution phase and beginning of a possible accumulation or re-accumulation.

Price broke above this curve cleanly with strong bullish candles, which also broke minor structure levels, confirming short-term bullish sentiment.

The breakout was also backed by momentum and volume as the market pushed 130+ pips upward—an aggressive impulse that trapped late sellers below.

📉 Phase 2: Retracement to Interchange Zones

Now, we’re in the retracement phase, where price is pulling back toward:

🔹 SR Interchange Zone ($66.80 - $67.30)

This zone was previous resistance, now flipping to support.

In MMC terms, this area is expected to serve as a refill zone where smart money will look to accumulate again after the breakout.

We are watching for confirmation candles or MMC-style reversal patterns here (e.g., inside bar breakouts, demand imbalances).

🔹 Main Zone ($65.80 - $66.50)

If the first zone fails, this is the next key demand base.

It holds historical value from previous accumulation phases (see July 10–25) and aligns with the origin of the last impulse.

Expect a sharper wick or deeper liquidity grab if price moves into this area.

📉 Phase 3: Final Defensive Zone – Major Support ($63.70 - $65.20)

This zone marks the last line of bullish defense.

A move here would mean the bullish structure is being reevaluated or absorbed by sellers.

However, if price hits this level, it could also attract significant institutional demand, setting up for a more powerful long-term leg up.

Reactions here are typically large and volatile, with a risk of fakeouts and fast reversals.

📈 Possible Scenarios (MMC Based Forecasting):

✅ Scenario 1 – Bullish Continuation (Primary Path)

Price finds support inside SR Interchange Zone.

Forms a base (MMC reversal structure) and pushes back to recent highs near $71.

Breakout above $71 opens room for next supply zones between $72.50 - $74.00.

⚠️ Scenario 2 – Deeper Liquidity Grab

Price breaks below SR Interchange and tests Main Zone for a deeper accumulation.

A wick or shakeout may happen before bullish continuation.

This trap zone could give the best R:R entry.

❌ Scenario 3 – Breakdown to Major Support

If both zones fail and bearish pressure sustains, price may revisit Major Support.

That would reset the bullish structure and require fresh MMC assessment.

🧠 MMC Logic at Work:

The curve break symbolizes the shift from supply dominance to a possible demand-led phase.

Minor structure breaks add fuel to trend shift and indicate participation from larger players.

Retracements are not weaknesses—they are refills for those who missed the move.

Smart money uses these zones and flips (SR interchanges) to hide in plain sight.

🎯 Key Takeaway for Traders:

This is a textbook MMC setup that combines:

Curve Breakout + Impulse

Zone Retest + Interchange Logic

Liquidity Engineering before Continuation

Traders should remain patient and observe reactions at each zone. Don’t chase—wait for the market to reveal its hand via MMC entry signals (break-of-structure, bullish engulfings, imbalance fills, etc.)

XAUUSD H4 Update – The Battle Has Moved to 3350

“From deep demand to key supply. The next move is decisive.”

🔸 Sunday Plan Recap

Price was falling aggressively into the HTF demand zone (3265–3240).

The plan anticipated a bounce only if that deep zone held.

Above price, major zones included:

3314 – mid-structure

3330–3345 – supply zone

3368–3380 – final retracement targets

🔸 What Changed?

✅ The deep demand zone worked — H4 CHoCH bullish was confirmed.

✅ Price climbed through 3285 and 3314, confirming a retracement leg.

🔥 Now, price sits at 3349.57, testing the same supply zone marked in Sunday’s plan (3330–3345).

🔸 Current H4 Structure

🔼 Short-term bias = bullish retracement

📍 Price = inside HTF premium zone

📈 EMAs aligned bullish (5/21/50), confirming short-term momentum

💡 RSI = approaching overbought

⚔️ Liquidity above 3355, trapped shorts below 3314

🧠 Today’s Battle Plan (August 1)

🔴 Sell Zone (live) – 3345 to 3355

Price just entered the key H4 supply zone. Watch for rejection signs:

Bearish confirmation needed (e.g. M15/M30 CHoCH or engulfing)

If confirmed → downside targets: 3314 → 3285 → 3265

High RR short only if structure confirms

🔵 Breakout Bullish Case

If 3355 breaks with a clean body + HL at 3340 → bullish continuation active

Next upside target: 3368 → 3380

🧭 Final Thoughts

We’ve reached the exact decision zone from Sunday’s plan.

The market will now reveal: retracement over... or breakout coming?

Patience is key — this is a high RR zone, but only if structure reacts.

💬 Did you catch the move from deep demand? Or waiting for confirmation here at supply?

📈 Share your thoughts in the comments and let’s break it down together.

🔔 Follow for real-time market insights, sniper plans, and structured trading logic you can trust.

❤️ Like if you enjoy clean, actionable updates🚀🚀🚀

🔁 Share with traders who love structure over noise

📉 Price data from Trade Nation feed

EURUSD BUYING CORRECTION AND SHORTThe price is now at a strong support level and if it can be a double bottom it will retest the descending channel line and reach the orange resistance, but in the general direction the price prefers to fall due to breaking the black uptrend line. We also have a more beautiful scenario, which is if it can break the strong support we will go with the downward trend.

Bitcoin’s Game Has Changed: Fresh Support Zone, Targets Sky-HighHey Dear Friends,

Until recently, Bitcoin had been stuck in a range between 112,331 and 105,344 for quite some time. But that range has now been clearly broken. So, what does this mean? This zone, which used to act as resistance, is now expected to flip and act as support.

According to my weekly trading model, the long-term target levels I’m tracking for Bitcoin are: 127,818 – 137,000 – 146,000.

Since this is a weekly setup, it might take a while for these targets to play out. Even if we see pullbacks to the 112K, 105K, or even 100K levels, I expect to see strong buying pressure from that zone.

I’ll keep sharing regular updates as this setup develops.

To everyone who’s been supporting and appreciating my work—thank you, truly. Your encouragement means the world to me and keeps me motivated to keep showing up. Much love to all of you—I’m grateful we’re in this journey together.

Sell NATGAS into OCT/NOVNatalie has fromed a H&S and has broke through all of the supporting EMAs leading to most of the indicators turning bearish.

My approach for the forseeable is seeling bounces until the winter season approaches.

Of course Natalie is extremely susceptible to trend changes due to economical data and has to be monitored closely. Currenlty I'm a bear.

Only selling once it breaks and retests, where I will once again reasses based on economics such as storage, production, imports and demand.

Target around $2.5 where interestingly a gap (red rectangle) sits from Nov - 24.

Elliot Wave (although not a great fan) kind of aligns as well as the 0.786 fib level which began forming at the beginning of 2024.

Storage | Volatility | Price Outlook

U.S. natural gas markets are stabilizing as volatility trends back toward seasonal norms.

📉 Volatility has dropped from 81% in Q4 2024 to 69% in mid-2025

🏪 Storage is currently at 3,075 Bcf,

🔻 4.7% lower YoY

🔺 5.9% higher than the 5-year average

🚢 LNG exports remain strong—up 22% YoY and 74% above the 5-year average

🔌 Domestic demand is seasonally weaker but steady

➡️ Despite being below last year’s levels, storage surplus vs. the 5-year average acts as a soft ceiling on price.

➡️ Historical analogs suggest a fair value range between $2.50–$3.20/MMBtu in the short term.

📊 Current price action around $3.00–$3.40 looks slightly overheated unless a fresh catalyst emerges (heatwave, export spike, etc.).

🧭 Watching for:

Injection trends over the next few weeks

Cooling demand in power sector

Resistance around $3.40

Support near $2.80

GOLD Short From Resistance! Sell!

Hello, Traders!

GOLD surged up sharply

On Friday and is already

Retesting the horizontal

Resistance of 3377$

From where we will be

Expecting a local pullback

On Monday as Gold

Is locally overbought

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER My Opinion! SELL!

My dear friends,

Please, find my technical outlook for SILVER below:

The price is coiling around a solid key level - 37.026

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 36.725

Safe Stop Loss - 37.189

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

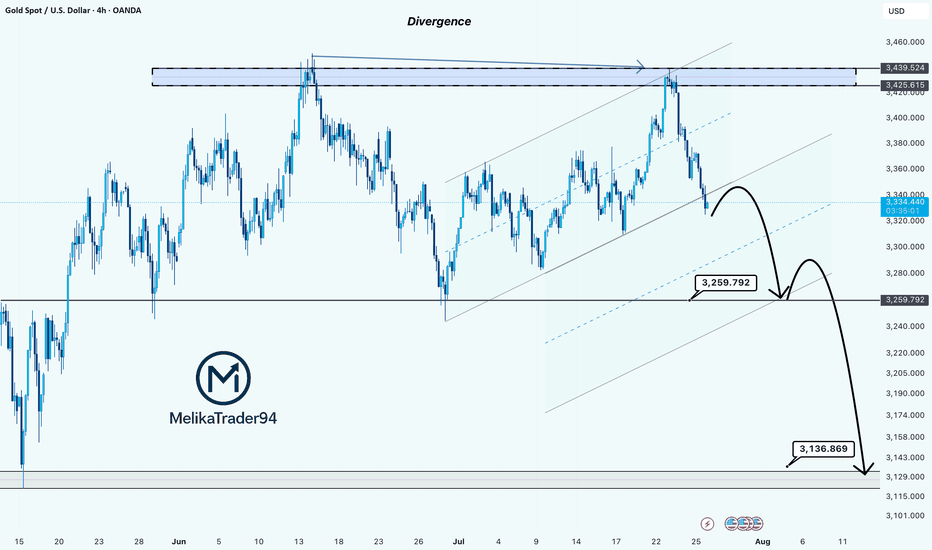

Gold Showing Signs of Reversal After Hitting Key ResistanceHello Guys.

Gold has reached a major resistance zone around 3439–3425, which has already acted as a strong ceiling in the past. The price tapped into this area again, forming a clear divergence, and failed to break higher.

Here’s what stands out:

Divergence signals a weakening bullish momentum at the top.

The price rejected the resistance and is now breaking structure to the downside.

A minor pullback may occur before continuation, as shown in the projected moves.

First target: 3259.792

Second target (if support breaks): 3136.869, a deeper zone for potential bounce or further drop.

This setup hints at a bearish trend building up. Stay cautious on longs unless the price structure changes again.

Gold’s on a Roller Coaster — and We’re Riding It Down🎢 Gold’s on a Roller Coaster — and We’re Riding It Down 🎢

Gold just snapped up like it saw Trump tweet “TARIFFS ARE BACK” — but the move smells like a knee-jerk algo pump, not real conviction. We just rejected right into a thin-volume imbalance zone and tagged the underside of a long-standing trendline.

📉 Short Setup Locked In:

💥 Entry: 3405

🛑 Stop: 3415

🎯 Target: 3353

💰 R:R ≈ 5:1

🔍 Why I'm In This Trade:

That rip? Total headline panic, not structural strength.

Low volume shelf above, with a massive POC magnet below at 3353.

We tapped the Developing VAH (3414) and got rejected — classic trap setup.

SQZMOM showing the energy is already fizzling. Green flash, no follow-through.

🧠 The Narrative:

Gold’s trying to price in volatility from every angle — Trump talk, tariffs, macro chaos — but under the hood, this pop looks unsustainable. If this is just a liquidity grab, we could see a flush back into the meat of value fast.

Grab your helmets — this roller coaster might just be heading downhill 🎢📉

USOIL Is Bearish! Short!

Please, check our technical outlook for USOIL.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 69.178.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 66.684 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

HelenP. I After correction to support level, Gold start to growHi folks today I'm prepared for you Gold analytics. An examination of the chart highlights a well-established long-term uptrend, with the bullish structure being clearly defined by a major ascending trend line that has consistently provided dynamic support. Currently, the price is undergoing a healthy correction after being rejected from the major resistance zone around 3430. This pullback is now guiding the price towards a critical confluence of support, where the aforementioned ascending trend line intersects with a strong horizontal support zone at 3305 - 3285. My analysis for a long position is based on the high probability of a bullish reaction from this key area. I believe that as the price enters this support confluence, it will be met with strong buying pressure, as it represents a logical point for buyers to defend the trend. A confirmed bounce from this zone, demonstrated by a rejection of lower prices, would be the main condition to validate the continuation of the uptrend. Therefore, the primary goal for the subsequent rally is set at the 3430 resistance level, as a retest of the recent high is the most logical objective following a successful defense of the trend. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

XAUUSD: Market Analysis and Strategy for July 31stGold Technical Analysis:

Daily chart resistance: 3351, support: 3250

4-hour chart resistance: 3335, support: 3270

1-hour chart resistance: 3315, support: 3290.

Gold was trading sideways between 3320 and 3333 yesterday before the New York market. During the US trading session, the release of US ADP employment figures and PCE price data was bearish for gold, causing it to plummet below Monday's low of 3301. The Federal Reserve held interest rates steady, and Powell's hawkish speech sent gold plummeting to around $3268.

Affected by the news, gold prices fell rapidly yesterday, reaching a low near the lower Bollinger band on the daily chart. It rebounded in the Asian session today, reaching a high near 3315. Selling is recommended in the sideways range between 3310 and 3320. The US PCE data will be released in the New York market, so avoid the news release period.

BUY: near 3290

SELL: near 3270

U.S. NATURAL GAS SUCCESSFULLY REBOUNDED FROM FIRM SUPPORT.U.S. NATURAL GAS SUCCESSFULLY REBOUNDED FROM FIRM SUPPORT.

Yesterday the natural gas storage report came out higher than expected. U.S. natural gas inventories increased by 48 billion cubic feet last week to 3,123 Bcf, increasing the surplus over the five-year average to 195 Bcf from 171 Bcf the week before, the EIA reports. The storage increase was bigger than the 24 Bcf average for the week, and above the 36 Bcf estimate. However, the price rised on 2.35% afterwards, supported by increased volume, which indicates the strength of the level. The upward movement towards the 3.3000 level is highly expected.

Additionally, seasonals suggest us that current prices may become the lowest till the end of the year. Historically, since August the natural gas prices increase in anticipation of a new heating season and higher energy demand (pic2).

GOLD BEST PLACE TO SELL FROM|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,309.55

Target Level: 3,288.24

Stop Loss: 3,323.69

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 45m

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GOLD: Short Trading Opportunity

GOLD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry Level - 3299.9

Sl - 3304.2

Tp - 3291.3

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Gold deeper consolidation supported at 3266The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3266 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3266 would confirm ongoing upside momentum, with potential targets at:

3335 – initial resistance

3351 – psychological and structural level

3366 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3308 would weaken the bullish outlook and suggest deeper downside risk toward:

3250 – minor support

3230 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Gold holds above 3266. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GOLD falls sharply, fundamental analysis and technical positionOANDA:XAUUSD fell sharply below the $3,300/oz price level as Chairman Jerome Powell did not signal any rate cuts at his next press conference on September 16-17. He only said that “no decision has been made on September” and that “more data will be evaluated in the coming months.” Economic data undermined the case for a rate cut, while geopolitical play remained a potential support.

The Fed and Interest Rates

The Federal Reserve kept interest rates unchanged for a fifth straight meeting on Wednesday, defying persistent pressure from President Donald Trump and White House officials.

However, two members of the central bank's board dissented, a rare move in three decades that underscored growing divisions within the central bank over the impact of Trump's tariff policies.

At the meeting, the Fed kept its benchmark federal funds rate in a range of 4.25% to 4.5%, in line with policy through 2025. Last fall, the Fed cut rates by a total of 100 basis points.

However, Federal Reserve Board Governors Christopher Waller and Michelle Bowman opposed cutting interest rates by another 25 basis points, marking the first time since Alan Greenspan in 1993 that two board members have opposed a majority resolution at a meeting.

At the press conference, Chairman Jerome Powell did not signal a rate cut at the next interest rate meeting on September 16-17, saying only that “no decision has been made about September” and that “more data will be evaluated in the coming months.” Powell also noted that despite Trump’s call for a sharp 3% rate cut to reduce interest costs on US debt and stimulate the housing market, the Fed will continue to monitor the longer-term impact of tariffs on the path of inflation and economic recovery.

Market expectations for a Fed rate cut in September fell to 47% in Powell's speech.

Economic data

ADP jobs data beats expectations and is bearish

US ADP payrolls jumped 104,000 in July, beating market expectations of 75,000 and marking the biggest gain since March. The data showed continued strength in the labor market, reinforcing the Federal Reserve’s stance on keeping interest rates high. Meanwhile, the preliminary estimate of annual GDP growth in the second quarter came in at 3% (2.4% expected), and the core personal consumption expenditures price index rose 2.5% year-on-year (2.3% expected), indicating both economic resilience and inflation stability, further weakening expectations for a rate cut.

Keep an eye on the ISM manufacturing PMI and non-farm payrolls data on August 1. If the jobs numbers continue to be strong, this could reinforce the Fed’s dovish stance.

Geopolitical and Policy Plays

News of a 90-day extension of the US-China tariff deal has eased some safe-haven demand, but Trump’s August 8 deadline for a new Russia-Ukraine deal, coupled with tensions in the Middle East, continue to provide potential support for gold.

Continued purchases by central banks (such as China and India) are a positive signal in the medium to long term, but are unlikely to offset short-term pressure from the Federal Reserve’s policies.

Technical outlook for OANDA:XAUUSD

On the daily chart, gold has been sold below the $3,300 level and now the $3,300 level has become the nearest resistance at present. For now, gold will be limited by the area of the 0.382% Fibonacci retracement with the original price point of $3,300, along with that it has formed a short-term downtrend with the price channel, the next target will be around $3,246 in the short term followed by the Fibonacci retracement level noted with readers in previous publications.

On the momentum front, the Relative Strength Index is operating below 50 and is far from the oversold zone (20-0), indicating that there is still plenty of room for downside ahead.

In addition, the gold trend will also be pressured by the EMA21, as long as gold remains below the EMA21, the current technical conditions continue to favor the downside.

For the day, the technical outlook for gold is bearish with notable positions listed as follows.

Support: 3,246 – 3,228 USD

Resistance: 3,300 USD

SELL XAUUSD PRICE 3345 - 3343⚡️

↠↠ Stop Loss 3349

→Take Profit 1 3337

↨

→Take Profit 2 3331

BUY XAUUSD PRICE 3240 - 3242⚡️

↠↠ Stop Loss 3236

→Take Profit 1 3248

↨

→Take Profit 2 3254

How to maintain stable operations before NFP dataYesterday, gold closed the month with a long upper shadow doji candlestick, indicating strong upward pressure, with monthly resistance at 3439-3451. Today marks the beginning of the month, and with the release of numerous data indicators such as NFP, unemployment benefits, and PMI, there is considerable uncertainty, so intraday trading should proceed with caution.

Judging from the daily chart, the current MACD indicator is dead cross with large volume, and the smart indicator is running oversold, indicating a low-level fluctuation trend during the day. At present, we need to pay attention to the SMA60 moving average and the daily middle track corresponding to 3327-3337 on the upper side, and pay attention to the intraday low around 3280 on the lower side. The lows of the previous two days at 3275-3268 cannot be ignored. There is a possibility that the low-level oscillation will touch the previous low again.

From the 4H chart, technical indicators are currently flat, with no significant short-term fluctuations expected. Low-level volatility is expected to persist within the day. Then just focus on the support near 3275 below and the middle track pressure near 3307 above. Looking at the hourly chart, gold is currently oscillating below the mid-range band, with resistance at 3295-3307 to watch in the short term.

Overall, the market is expected to remain volatile before the release of today's data. Based on Wednesday's ADP data, this round of data is also expected to be around $100,000. The contrast between ADP and NFP last time deserves our caution. The current market is basically optimistic about the short-selling situation, which is exactly what I am most worried about. If the gold price can stabilize above 3,300 before the NY data, the possibility of NFP data being bullish cannot be ruled out.

Intraday European trading suggestion: if the current gold price falls back to 3285-3280 and stabilizes, you can consider short-term long positions, with the target at 3295-3305. If the gold price tests the low of 3275-3268 again and does not break through, you can consider a second chance to go long. After making a profit of $10-20, you can consider exiting the market with profits. The market is volatile and unstable, so be sure to bring SL with you and pay close attention to the impact of the NFP data. Conservative investors can enter the market after the data is released.

Gold Slips After Powell Speech Below 3320 Bearish Pressure BuildGOLD Overview

Market Context:

Gold declined from the 3333 level, as anticipated in yesterday’s analysis, ahead of Fed Chair Powell’s speech. Powell reiterated that it is still too early for rate cuts, citing persistently high inflation, which supported the U.S. dollar and pressured gold.

Technical Outlook:

As long as gold trades below the 3320–3310 zone, the bearish momentum is expected to continue, with the next target at 3285. A confirmed break and stability below 3285 could open the way toward 3255.

To regain bullish traction, the price must stabilize above 3320.

Support Levels: 3285 • 3255

Resistance Levels: 3333 • 3349

Silver coiling price action support at 3600The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3600 – a key level from the previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3600 would confirm ongoing upside momentum, with potential targets at:

3756 – initial resistance

3855 – psychological and structural level

3915 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3600 would weaken the bullish outlook and suggest deeper downside risk toward:

3544 – minor support

3480 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 3600. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bullish Rejection from Support, Upside in FocusMarket Overview: On the M15 timeframe, XAUUSD shows signs of a short-term bullish reversal after a prolonged sideways range around the key support zone of 3,286 – 3,289 USD. Price faked out below this support but quickly recovered, forming a V-shape reversal, suggesting strong buying interest has returned.

Key Levels to Watch:

Support Zones:

- 3,286 – 3,289: Strong intraday support, tested multiple times with sharp rejections

- 3,274: Next significant support if the above zone fails

Resistance Zones:

- 3,300 – 3,304: First resistance target aligned with the recent high

- 3,308 – 3,312: Higher resistance area where supply may emerge

Technical Indicators:

EMA: Price has reclaimed the short-term EMAs, indicating bullish momentum on lower timeframes

RSI: Rising above 50 but not yet overbought – there’s room for further upside

Volume: Increasing volume during the bounce confirms buying strength

Trading Strategy:

- Bullish Scenario (Preferred): Entry Zone: Watch for pullback toward 3,290 – 3,292

Stop Loss: Below 3,285

Take Profit 1: 3,300

Take Profit 2: 3,304

Extended Target: 3,308 – 3,312 (if bullish momentum continues beyond breakout zone)

- Bearish Scenario (Alternate): Only valid if price breaks and closes strongly below 3,286

Short Target: 3,274 – 3,270

Note: Counter-trend strategy – higher risk, requires strong confirmation

Conclusion: Gold is showing a bullish price structure on the 15-minute chart. As long as price holds above the 3,286 – 3,289 support zone, the path of least resistance appears to be upward, with 3,300 and 3,304 as the next logical targets. Monitor price action closely during the U.S. session for a potential long setup.

- Follow for more real-time gold trading strategies and save this idea if you find it helpful!