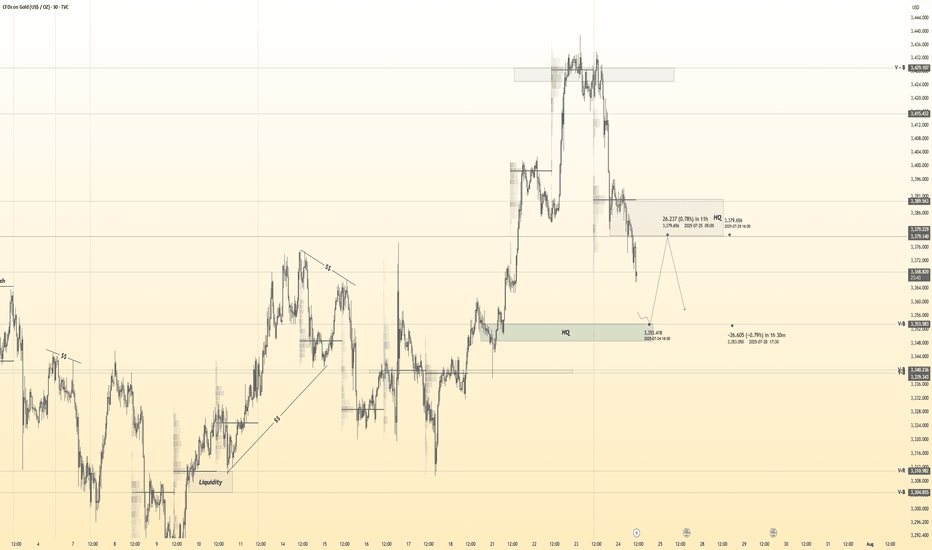

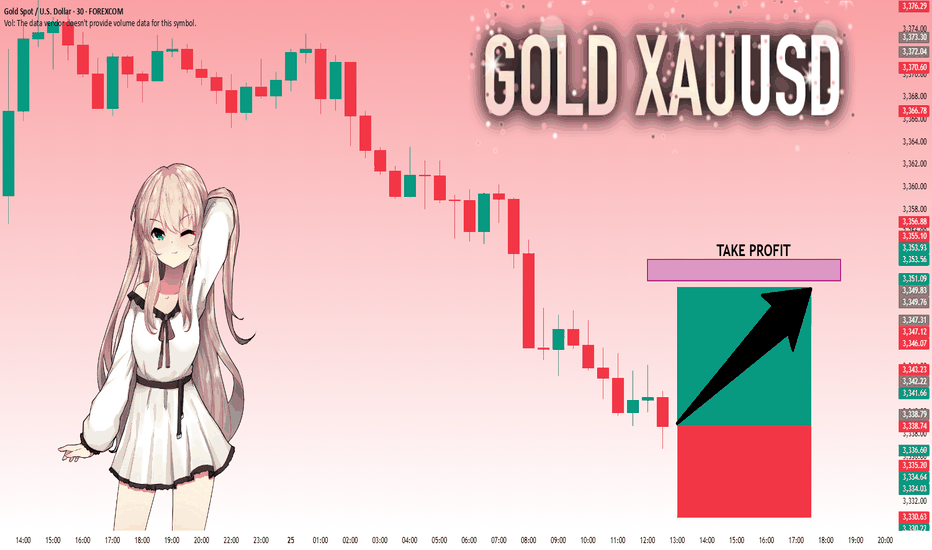

Gold 30Min Engaged ( Bullish & bearish Reversal Entry Detected )————-

➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish Reversal : 3354

🩸 Bearish Reversal : 3378

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

Commodities

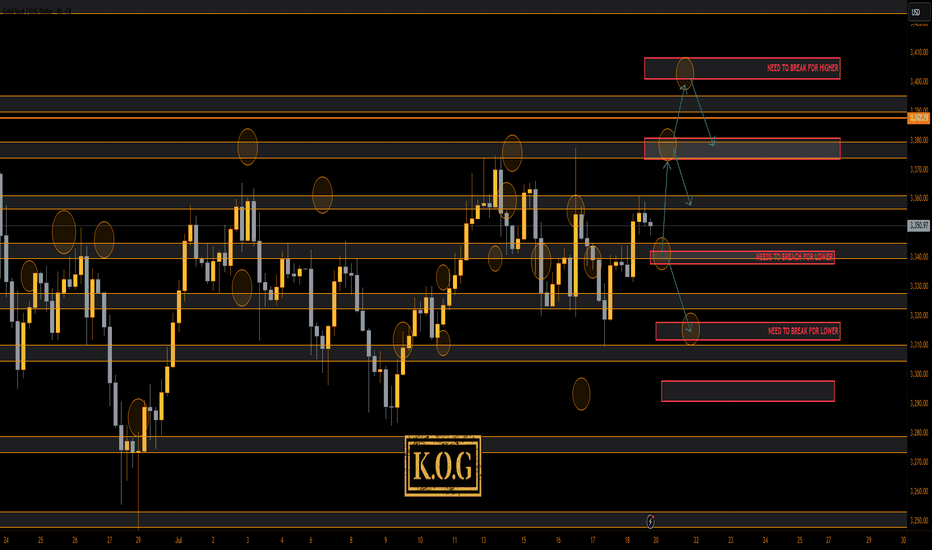

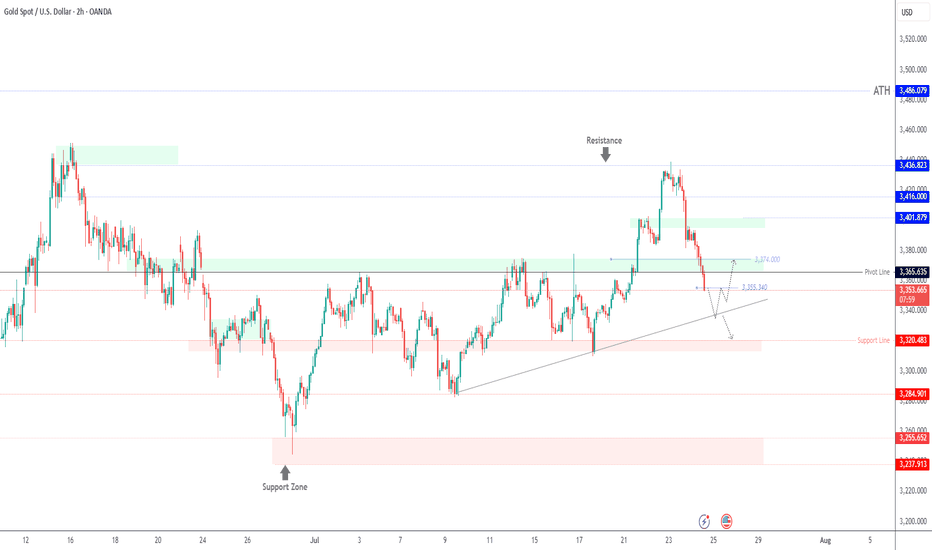

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for a price to attempt the higher level red box sitting around the 3370-75 region and if not breached, we felt an opportunity to short would be available from that region. We said if that failed and the move commenced, we would be looking at a complete correction of the move back down into the 3330-35 region, where we would then monitor price again in anticipation of a long from there or the extension level of 3310 which was also a red box short target (move complete). As you can see from the above, not only did we get that higher red box, we rejected, completed the move downside and then our traders managed to get that long trade all the way back up into the Excalibur target, red box targets and the hotspots shared in Camelot.

A decent week again, not only on Gold but also the numerous other pairs we trade, share targets on and analyse.

So, what can we expect in the week ahead?

For this week we can expect more ranging price action, but due to the previous range from last week being so tight, it looks like we’ll see a breakout coming in the latter part of the week unless there is news to bring us unexpected volume.

We have the key level below 3335-40 support and above that resistance and a red box sitting at 3375-80. This is the region that needs to watched for the break, and if broken we should hit the range high again at 3400-10. However, if rejected, we could again see this dip to attack that lower order region 3310-6 before attempting to recover.

Last week we wanted to see that curveball and although we did see some aggressive price action, I think we will see something extreme for this week. It’s that lower level 3310-6 that is a key region for bulls, if broken we can see a complete flush in gold taking us down into the 3250’s before we start the summer run. That for us would be the ideal scenario going into the month end, but, we’ll play it how we see and as usual, we go level to level and update any changes as we go along.

KOG’s Bias for the week:

Bullish above 3340 with targets above 3355, 3361, 3368, 3372 and above that 3385

Bearish below 3340 with targets below 3335, 3330, 3322, 3316, 3310 and below that 3304

RED BOX TARGETS:

Break above 3350 for 3355, 3361, 3367, 3375 and 3390 in extension of the move

Break below 3340 for 3335, 3330, 3320, 3310 and 3306 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

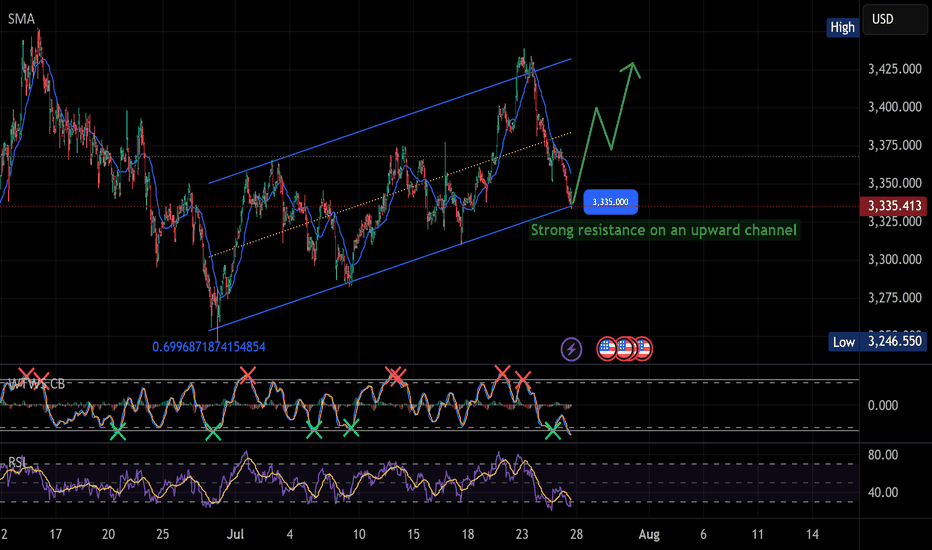

Gold is holding strong at support!GOLD – Bullish Bounce Coming? CAPITALCOM:GOLD

Gold is moving inside an upward channel.

A bounce is likely from $3,335 – eyes on $3,425 📈

Don’t miss the move. Let the market pay you! 💰

📈 If the bounce happens, price may rise toward:

Target 1: $3,375

Target 2: $3,425+

✅ Price just touched the bottom of the channel around $3,335 – a strong support area.

✅ RSI is oversold ➜ This usually means a bounce is coming.

✅ Momentum indicators are showing signs of bullish reversal.

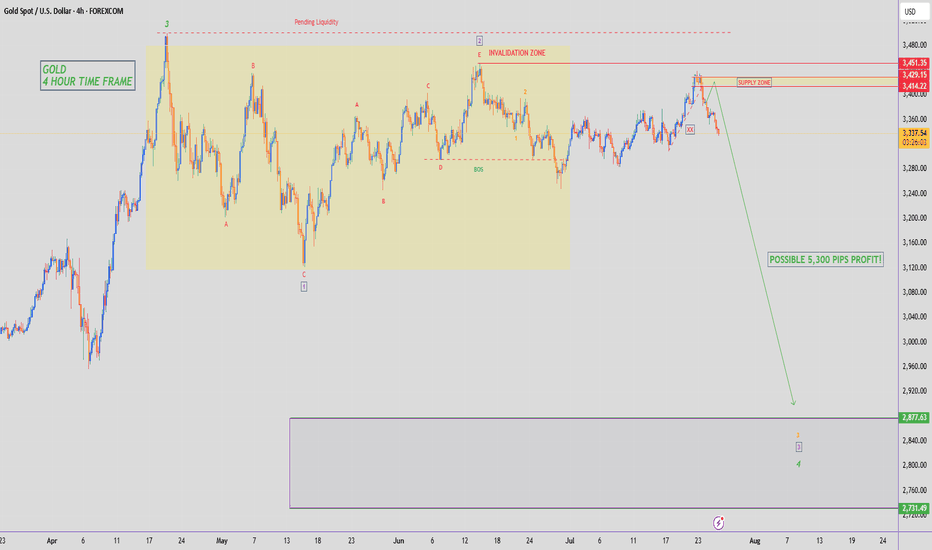

GOLD - SHORT TO $2,880 (UPDATE)Gold sellers have now pushed down to where price opened on Monday, turning the weekly candle bearish. A huge move down, compared to where price was at on Tuesday high!

R.I.P to those who bought the top. But this is what happens when you trade without a strategy or guidance⚰️

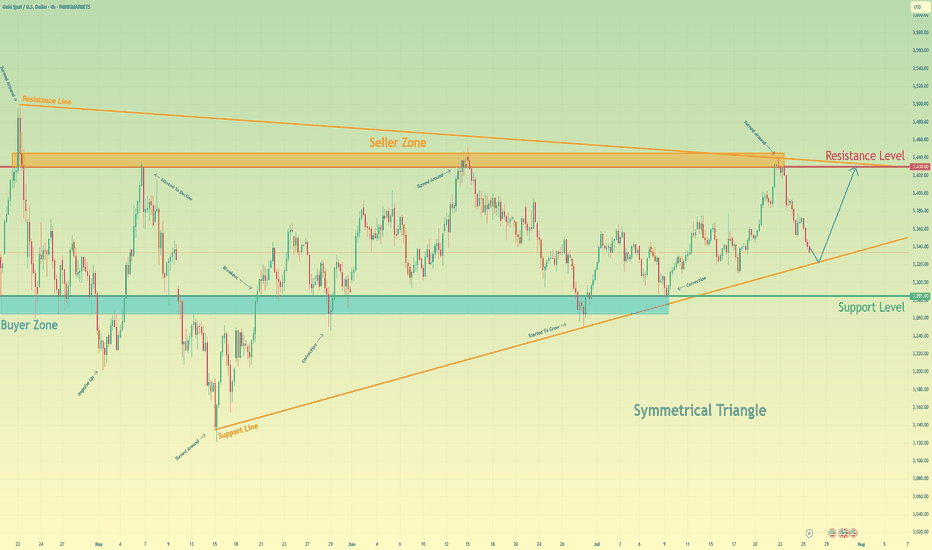

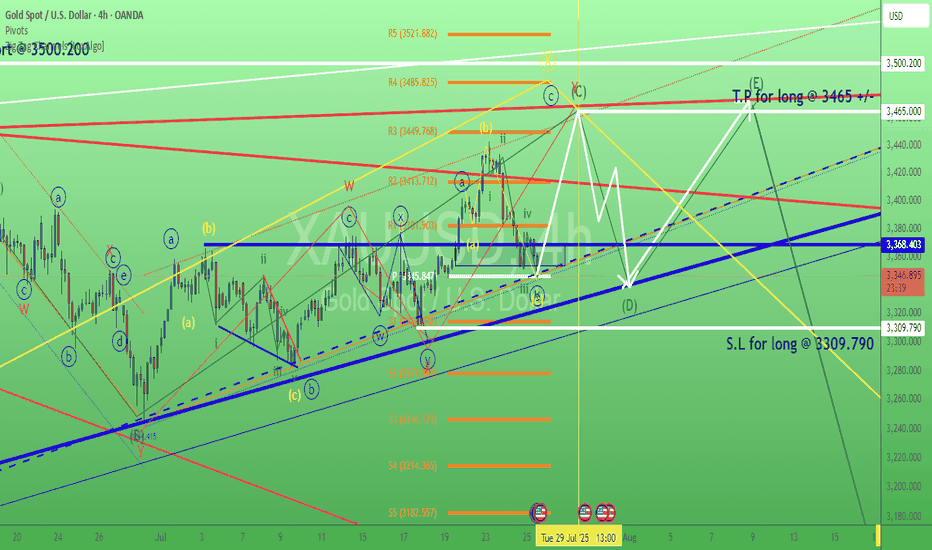

Gold will rebound from support line of triangle and rise to 3430Hello traders, I want share with you my opinion about Gold. Following a sequence of significant upward trends and the subsequent downward corrections that defined its range, gold has entered a broad market zone of consolidation. This battleground is clearly anchored by the historically significant buyer zone around 3285 and a formidable seller zone near 3430. Currently, the asset's price action is coiling and contracting within the confines of a large symmetrical triangle, a classic pattern that signifies a period of equilibrium and energy build-up before a potential high-volatility breakout. After a recent upward rebound was decisively rejected by the upper resistance line, the price is now in a corrective descent, heading towards the crucial ascending support line of the triangle. The primary working hypothesis is a long scenario, which is based on the expectation that this downward move will find strong buying interest on this key trendline, respecting the pattern's integrity. A confirmed and strong bounce from this level would signal another complete upward rotation within the triangle is underway. Therefore, the tp is logically and strategically set at the 3430 resistance level, as it not only aligns with the formation's upper boundary but also represents the major seller zone, a natural magnet for price on such a rebound. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

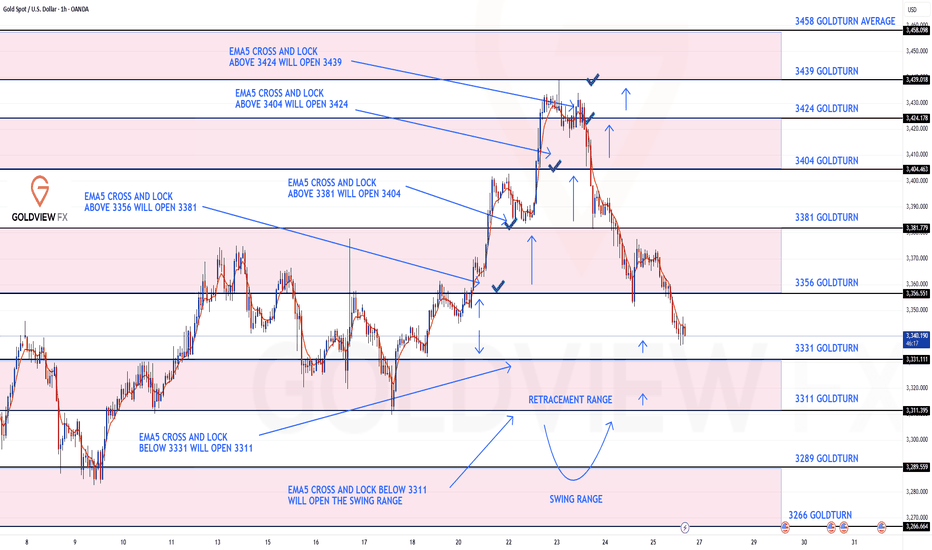

GOLD 1H CHART ROUTE MAP UPDATEHey Everyone,

Great finish to the week with our chart ideas playing out, as analysed.

We completed all our Bullish targets on this chart with ema5 cross and lock confirmation. We were also able to step away today after the final target with no further ema5 cross and lock, confirming the rejection that we are seeing now.

BULLISH TARGET

3356 - DONE

EMA5 CROSS AND LOCK ABOVE 3356 WILL OPEN THE FOLLOWING BULLISH TARGETS

3381 - DONE

EMA5 CROSS AND LOCK ABOVE 3381 WILL OPEN THE FOLLOWING BULLISH TARGET

3404 - DONE

EMA5 CROSS AND LOCK ABOVE 3404 WILL OPEN THE FOLLOWING BULLISH TARGET

3424 - DONE

EMA5 CROSS AND LOCK ABOVE 3424 WILL OPEN THE FOLLOWING BULLISH TARGET

3439 - DONE

We will now come back Sunday with a full multi timeframe analysis to prepare for next week’s setups, including updated views on the higher timeframes, EMA alignments, and structure expectations going forward.

Thanks again for all your likes, comments, and follows.

Wishing you all a fantastic weekend!!

Mr Gold

GoldViewFX

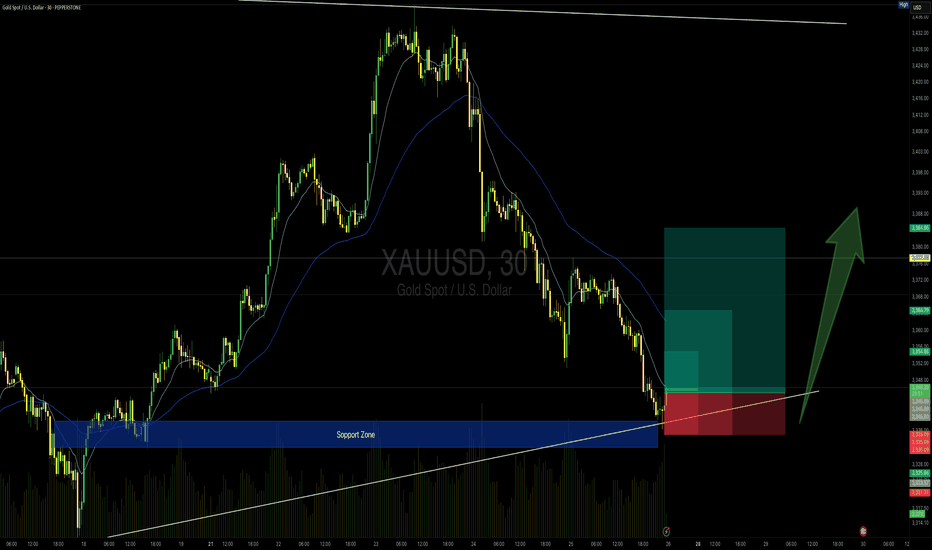

GOLD 30min Buy Setup (High Risk - High Reward)📍 TVC:GOLD 30min Buy Setup – MJTrading View

After an extended bearish leg, price has tapped into a strong support zone that previously acted as a launchpad. Also touching the main Uptrend...

We now see initial signs of absorption with potential reversal setup forming just above the ascending trendline.

🔹 Entry Zone: 3344–3346

🔹 SL: Below 3335 (under structure & wick base)

🔹 TP1: 3355

🔹 TP2: 3365

🔹 TP4: 3385+ (if momentum sustains)

🔸 RR: Up to 1:4 depending on target selected

🧠 Context:

– Still inside broader bullish structure (macro HL)

– Support zone coincides with rising trendline

– Potential for bullish reaccumulation after sharp drop

– Volume spike near zone suggests active buyers

Stay sharp and manage your risk please...

See the below Idea for full concept:

"Support isn't just a level — it’s a battlefield. If buyers win, they don’t look back."

#MJTrading #Gold #BuySetup #PriceAction #SmartMoney #ChartDesigner #ReversalSetup #MarketStructure

Psychology Always Matters:

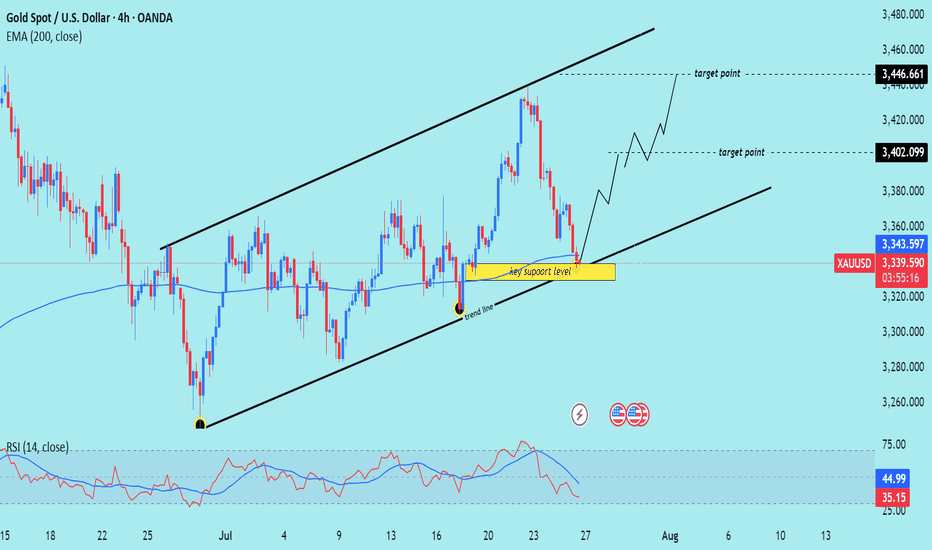

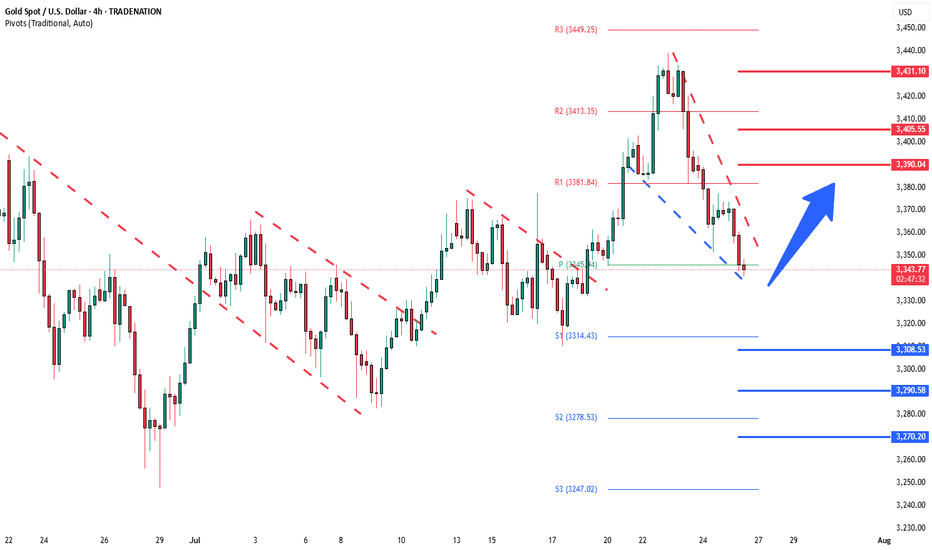

XAU/USD) bullish the support Read The captionSMC Trading point update

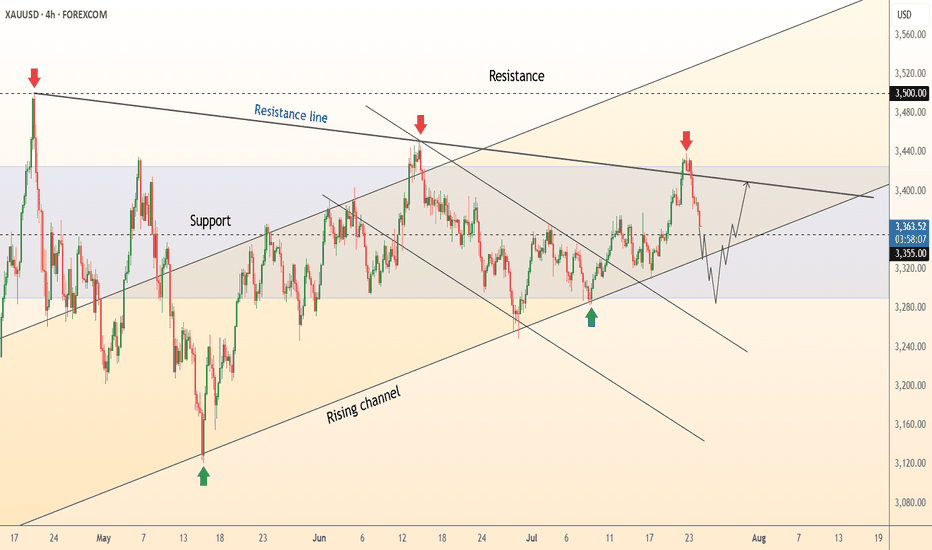

Technical analysis of (XAU/USD) on the 4-hour timeframe, indicating a potential bounce from a key trendline support within a rising channel.

---

Analysis Summary

Pair: XAU/USD (Gold Spot vs. USD)

Timeframe: 4H

Current Price: 3,338.715

Bias: Bullish rebound within ascending channel

---

Key Technical Elements

1. Ascending Channel:

Price has been respecting a well-defined rising channel, bouncing between support and resistance levels.

2. Key Support Zone:

The yellow highlighted area marks a critical support level and lower boundary of the channel.

Also intersects with the trendline, strengthening the potential for a bounce.

3. 200 EMA (Dynamic Support):

The 200 EMA at 3,343.616 lies just below current price, acting as a dynamic support level.

4. RSI (14):

RSI is around 34.93, nearing the oversold zone, suggesting a buying opportunity may be near.

---

Target Points

First Target: 3,402.099

Second Target: 3,446.661

---

Trade Idea

Direction Entry Zone Stop-Loss Target Zones

Buy 3,330–3,345 Below 3,320 3,402 / 3,446

Mr SMC Trading point

---

Summary

Gold is currently testing a key support level and ascending trendline. If price holds above this area, we can expect a bullish rebound toward 3,400–3,446 levels, aligning with the upper channel resistance.

Please support boost 🚀 this analysis)

Gold Spot / U.S. Dollar (XAU/USD) with a 1-hour timeframeOverall Trend and Market Structure:

The chart displays a mix of bullish and bearish movements, but recent price action (from around July 23rd onwards) shows a significant downturn after a peak.

There are "SMS" (Structural Market Shift) and "ChoCH" (Change of Character) labels, indicating shifts in market structure. Initially, there were bullish shifts, but the recent price action suggests a potential bearish shift or at least a significant retracement.

A large "50% - Order Block 4H" is highlighted in blue, which acted as support and led to a strong upward move previously.

Current Price Action and Setup:

The current price is around 3,340.670.

There's a proposed short-term trading setup, indicated by:

Entry: 3,335.500 (red dashed line)

Stop Loss (SL): 3,328.500 (red shaded area)

Profit Targets (TP):

3,360.000 (green shaded area, "Profit 3,360.000")

3,373.000 (green shaded area, "Profit 3,373.000")

The setup is highlighted with a gray shaded area, indicating the potential path of price for this trade. It appears to be a long (buy) setup, anticipating a bounce from the current levels.

The "CHOCM: 29.46%" at the bottom suggests some kind of indicator or calculation related to market character.

Key Observations and Considerations:

Previous Bullish Momentum: The price rallied strongly after touching the "50% - Order Block 4H" around July 17-18, reaching a high near 3,430.

Recent Bearish Retracement: Since July 23rd, the price has pulled back significantly from its peak, almost revisiting the higher levels of the previous order block.

Potential Support: The proposed entry point for the long trade (3,335.500) is within a zone that previously acted as support or a level from which price bounced. It's also near the top of the "50% - Order Block 4H" area, suggesting this could be a retest or a bounce from a key support zone.

Risk-Reward: The setup shows a relatively tight stop loss compared to the potential profit targets, which is generally favorable for risk management.

GOLD: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse GOLD together☺️

The market is at an inflection zone and price has now reached an area around 3,338.79 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 3,351.09.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

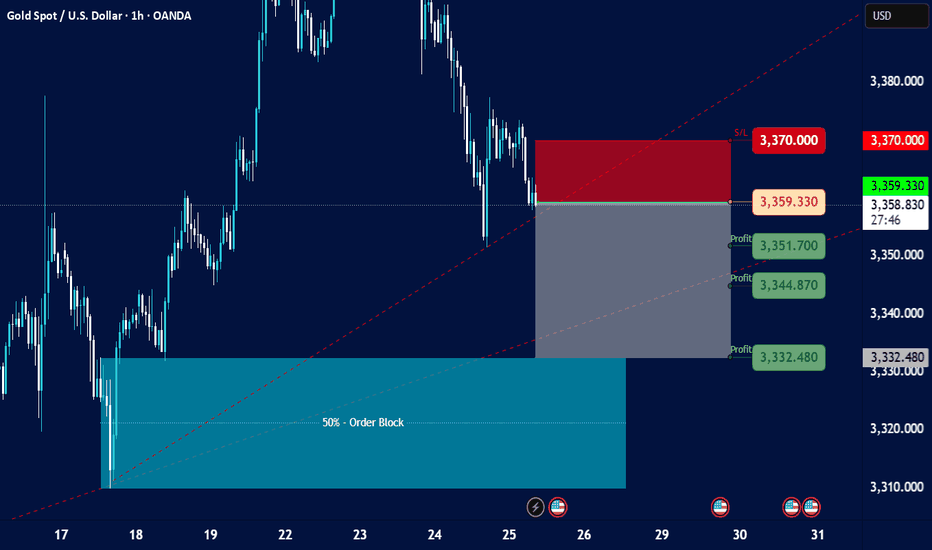

Gold Spot / U.S. Dollar - 1h on TradingView, dated July 25, 202Current Price and Trend:

The current price is shown as 3,359.330, and the last traded price is 3,359.005.

The chart indicates a downtrend in recent sessions, with the price having fallen significantly from higher levels around 3,380.000 to 3,390.000 down to the current levels.

There's a dashed red line (possibly a trendline or resistance) indicating a downward slope.

Key Zones and Levels Identified:

Resistance/Stop Loss Zone (Red Rectangle):

This zone is marked from approximately 3,365.000 up to 3,370.000.

A "S/L" (Stop Loss) level is explicitly marked at 3,370.000. This suggests that a short position (selling) is being considered, with a stop loss placed above this resistance.

Entry Point (Grey Line):

An entry point for a trade is indicated by a grey horizontal line at 3,359.330. This is very close to the current price, suggesting a potential entry for a short trade.

Profit Target Zones (Grey Rectangle with Green Labels):

Three "Profit" levels are identified below the entry point:

3,351.700

3,344.870

3,332.480

These levels suggest potential targets for taking profit on a short position. The grey shaded rectangle represents the area where these profit targets lie, extending downwards from the entry point.

50% - Order Block (Teal Rectangle):

At the bottom left of the chart, there's a large teal-colored rectangle labeled "50% - Order Block."

This typically represents an area where significant institutional buying interest (or an accumulation of orders) is expected, potentially acting as strong support. The price has previously bounced off this area.

Possible Trading Strategy Implied:

The setup suggests a potential short-selling strategy for Gold Spot / USD, likely based on a continuation of the downtrend or a retest of previous resistance levels.

Entry: Around 3,359.330 (current price level).

Stop Loss: At or above 3,370.000, to limit potential losses if the price moves against the short position.

Take Profit: Phased profit-taking at 3,351.700, 3,344.870, and 3,332.480.

Target Support: The ultimate target appears to be within the "50% - Order Block" zone, suggesting the expectation of the price reaching or testing this strong support area.

Considerations and Further Analysis Needed:

Confirmation: The chart doesn't show any specific indicators (e.g., RSI, MACD) that might confirm the downtrend or potential entry.

Volume: Volume analysis would be beneficial to assess the strength of price movements.

News/Fundamentals: Any upcoming economic data or geopolitical events could significantly impact gold prices.

Risk-Reward Ratio: A calculation of the risk-reward for each profit target would be useful to determine the attractiveness of the trade.

Market Structure: A deeper analysis of the market structure (higher highs/lows, lower highs/lows) could provide more context.

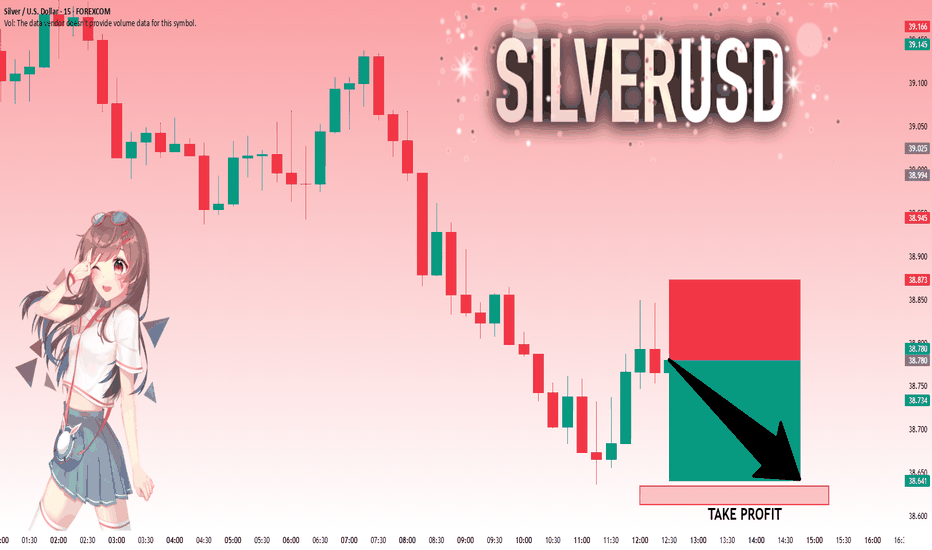

SILVER: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 38.780 will confirm the new direction downwards with the target being the next key level of 38.635.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

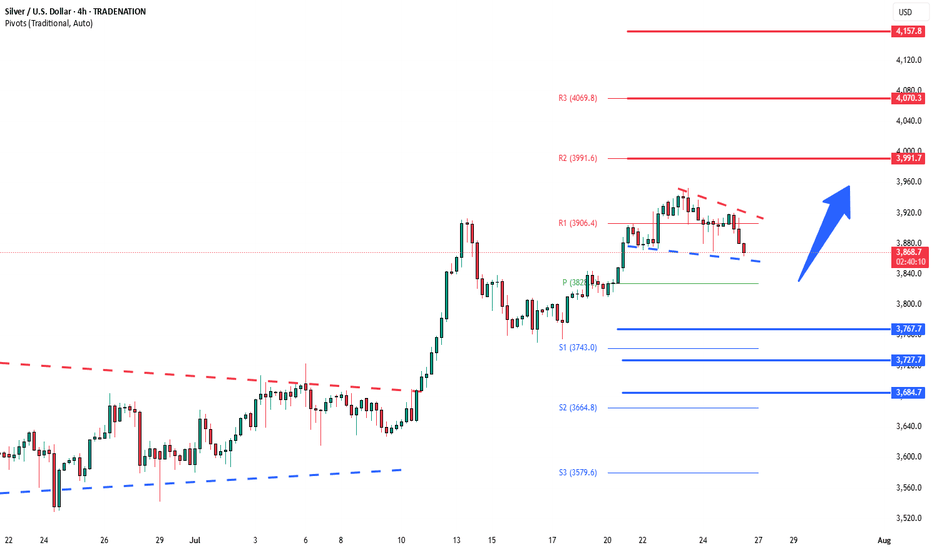

Silver bullish sideways consolidation The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3686 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3686 would confirm ongoing upside momentum, with potential targets at:

3814 – initial resistance

3865 – psychological and structural level

3920 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3686 would weaken the bullish outlook and suggest deeper downside risk toward:

3645 – minor support

3590 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 3686. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

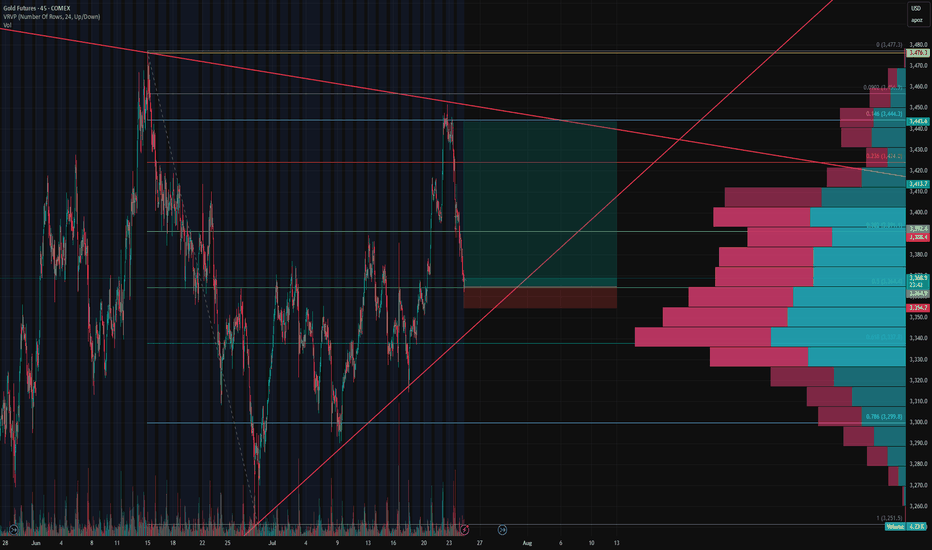

Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce🟡 Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce

After nailing the long from the bottom and perfectly shorting the top, we’re stepping back in for another calculated move.

📉 Price pulled back to the 0.5 Fibonacci retracement, aligning perfectly with the upward trendline support and a key HVN on the Volume Profile.

📈 Entered long at 3,365 with a tight stop below 3,354 (0.3% risk), targeting the descending trendline near 3,444 for a clean 7.7R setup.

🧠 Context:

Price reacted hard at resistance, but volume support and structure still lean bullish.

Clear invalidation if we break trend and lose 3,350 support cluster.

Let’s see if this bounce gets legs. 🚀

Gold energy buildup supported at 3308The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at:

3387 – initial resistance

3400 – psychological and structural level

3435 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3308 would weaken the bullish outlook and suggest deeper downside risk toward:

3290 – minor support

3268 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Gold holds above 3308. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Gold Tests Year-to-Date TrendlineGold is getting a breather from recent newsflow and is now testing the trendline on the daily timeframe. The Japan deal, some positive developments in the EU–US negotiations, and yesterday’s Trump–Powell "sitcom" have helped ease concerns about the economy.

Although the trend began in December, when viewed from April, it clearly forms an ascending triangle pattern. Ascending triangles typically break to the upside, which could favor gold bulls. However, the lower support line is being tested very aggressively and has been challenged multiple times, which is not a good signal.

Today could be decisive, potentially leading to a downside break or an upward move that sets the tone for the weekly close. For gold traders, today and Monday could be key in determining the medium-term direction.

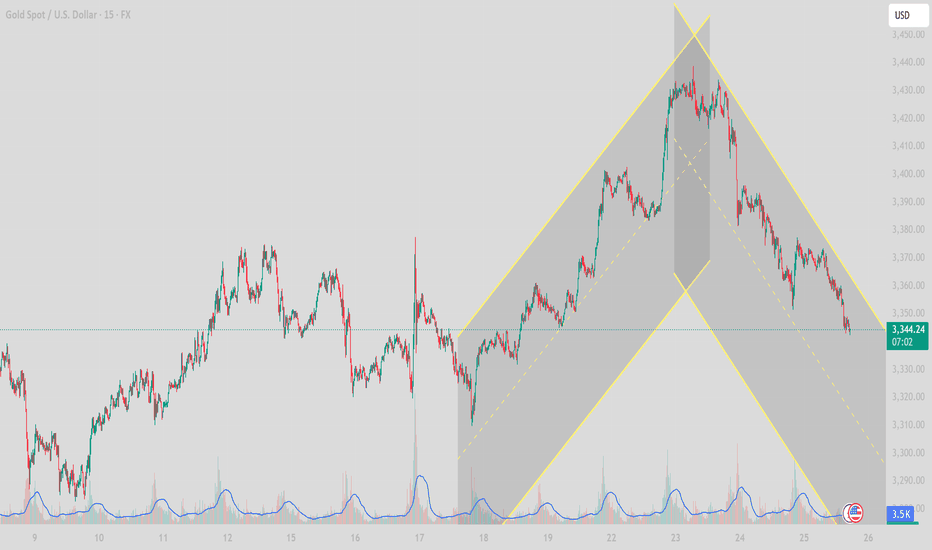

Bearish Channel Development and Key Support Zone Test1. Technical Overview (15m timeframe):

Gold (XAUUSD) is currently trading around 3,342.80, showing signs of continued downward momentum after forming a bearish reversal pattern from the 3,404–3,410 USD resistance area. The price action has now developed into a clear descending channel, with lower highs and lower lows forming in a structured manner.

2. Key Price Levels to Watch:

Immediate Support Zone:

🔹 3,335 – 3,330 USD – This zone aligns with previous structure and the lower bound of the descending channel. A break below this area could accelerate selling pressure toward deeper Fibonacci zones.

Next Major Support (Medium-term):

🔹 3,310 USD – A critical zone where price reacted strongly during the last pullback. A breakdown here would shift sentiment fully bearish in the short-term.

Resistance Levels:

🔹 3,358 – 3,360 USD: Minor intraday resistance near the upper bound of the descending channel.

🔹 3,375 USD: EMA21 and previous structure level.

🔹 3,404 – 3,410 USD: Major confluence resistance from recent highs.

3. Price Action and Indicators:

Descending Channel: Price is respecting the upper and lower trendlines of the bearish channel. No bullish breakout signal confirmed.

Volume: Decreasing on the bounce, rising on the decline – a bearish volume structure.

RSI: Near oversold (not shown, but implied from price exhaustion), could suggest a bounce, but no divergence confirmation yet.

EMA Trend: EMA21 and EMA50 (not shown but assumed from price slope) are likely crossing downward on higher timeframes, reinforcing bearish pressure.

4. Strategy Suggestion – Scenarios for Intraday Traders:

🔻 Scenario A – Continuation Short (Sell on Retracement)

Entry: Around 3,358–3,360 (upper bound of descending channel).

SL: Above 3,365.

TP1: 3,335

TP2: 3,310

Confirmation: Look for bearish engulfing or pin bar rejections on the 5m–15m timeframe.

🔺 Scenario B – Countertrend Long (Bounce from Channel Base)

Entry: Near 3,330–3,335 (support zone).

SL: Below 3,325.

TP1: 3,350

TP2: 3,360

Note: This is a riskier trade and should only be taken with bullish reversal confirmation (hammer, bullish divergence on RSI, or break of structure on LTF).

5. Summary:

Gold is currently in a short-term bearish correction, respecting a well-defined descending channel. Price is approaching a critical support zone (3,330–3,335), where a potential intraday bounce may occur, but trend remains bearish unless a clear break

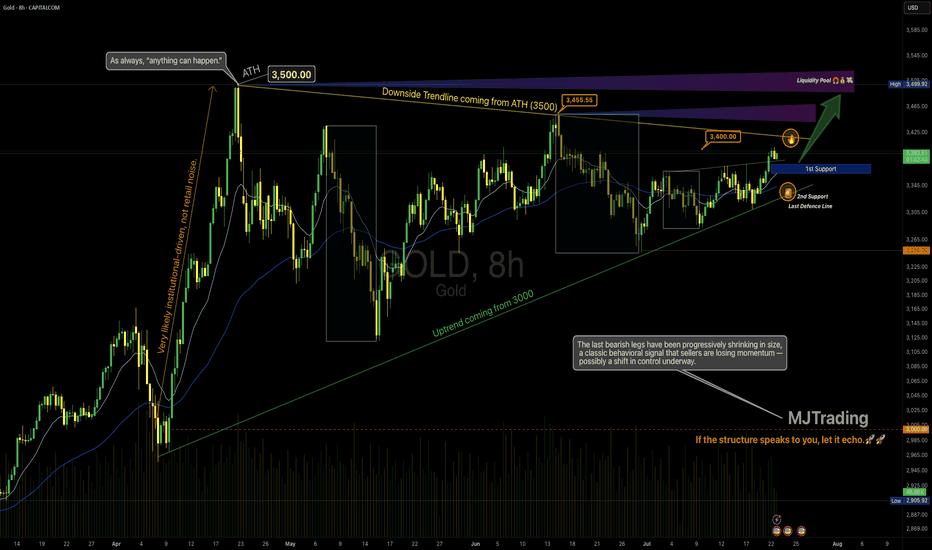

Gold – Bear-to-Bull Transition in Motion?🧠 MJTrading:

TVC:GOLD – 8H Chart: Bulls, It’s Your Move.

📸 Viewing Tip:

🛠️ Some layout elements may shift depending on your screen size.

🔗 View the fixed high-resolution chart here:

The impulsive move from 3000 to 3500 wasn’t just a trend — it was a statement of strength.

That rally carved the ATH, then left behind weeks of digestion and structural compression.

Now, the market may be setting up for its next decision.

Notice how each bearish leg has been shrinking — a classic behavioral signal that sellers are losing momentum — possibly a shift in control underway.

We’re also pressing above the downtrend line from the ATH (3500), while the uptrend from 3000 remains clean and respected.

We’re now testing the 3400 zone — a key battleground.

📍 If bulls want to reclaim the momentum and show dominance, this is the moment to act.

🔹 1st Support: 3363–3377

🔹 2nd Support: Rising trendline

🎯 Target Zone: 3455–3500+ (Liquidity Pool & ATH proximity)

⚠️ Break back inside the triangle could delay the breakout narrative.

⚠️ If momentum fails to increase from here, and bulls can’t break out with conviction, the market is likely to remain range-bound for longer — extending the sideways phase between 3250–3500.

💭 If you’re watching for a new ATH… stay sharp, stay structured — the market rewards patience and readiness.

“If the structure speaks to you, let it echo, boost it.”

📐 MJTrading 🚀

What do you think?

#GoldAnalysis #XAUUSD #MarketStructure #LiquiditySweep #AnythingCanHappen

#MJTrading

#ChartDesigner

Psychology Always Matters:

Click on them for the caption...

GOLD Drops $60 – Bearish Bias Holds Below 3365GOLD | OVERVIEW

As expected, gold continued its bearish momentum, dropping from the 3430 level and delivering a move of approximately $60.

For today, the bearish bias remains valid as long as the price stays below 3365, with potential targets at 3337 and 3320.

However, if the price reverses and stabilizes above 3365, it could signal a shift to bullish momentum.

Key Levels:

Support: 3355 · 3337 · 3320

Resistance: 3374 · 3388

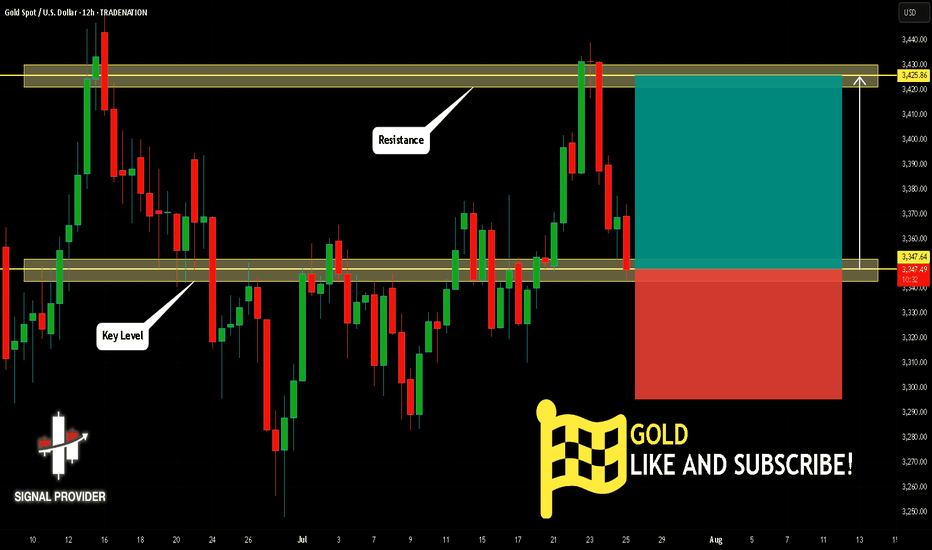

GOLD Will Move Higher! Buy!

Here is our detailed technical review for GOLD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 3,347.64.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 3,425.86 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

DeGRAM | GOLD will retest the channel boundary📊 Technical Analysis

● Fresh rejection at the blue resistance line (~3 435) pushed XAU back to the 3 355 mid-band, yet successive higher-lows (green arrows) keep price inside the May-origin rising channel.

● The pullback is probing 3 328-3 355 — confluence of the former flag roof and triangle top; holding this zone should launch another test of 3 400/3 435, with the channel crest targeting 3 500.

💡 Fundamental Analysis

● U-S S&P-Global PMIs softened, nudging 2-yr real yields to three-week lows, while cautious ECB rhetoric limits dollar gains — both supportive for gold.

✨ Summary

Long 3 328-3 355; above that aims 3 400 ➜ 3 435, stretch 3 500. Invalidate on an H4 close below 3 293.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!