KSS: Key Hidden Levels signalsIn this chart I describe the trading signals generated by Tim West's techniques, in particular the methods revolving around the RgMov and Key Earnings Support indicators. You can see signals that failed are very few, and the trade setups obtained in one year have been really precise if executed correctly.

If you're interested in learning the specifics of this discipline, and getting information of new stocks to watch, trade setups fresh from the oven, or in private tuition or trading signals, contact me, and don't forget to stop by the KHL chatroom ( www.tradingview.com ), where me, my good friend Nick Coulby and our mentor, Tim West, usually share ideas and commentary, and new members and subscribers to the indicator pack, can discuss and ask for advice as well.

Cheers,

Ivan Labrie.

Commodity Channel Index (CCI)

Euro top This is another play I have been placing around the dollar strength. Last week DXY seems to have bottomed and this pair is also showing signs of topping. The 1,618 fib extension from last retrace is quite close to the top, and not frar from pitchfork upper limit.

The CCI already came back from the overbought and that signal was useful on last retrace. First target on channel around 1,118 and second target on pitchfork centerline.

Down underAfter a trip along the side of the Bolli band, aussie seems now ready for a nice short. The shape of the last two candles and the fact that he's soon to go back to the sub-100 region of the commodity channel are factors enough to think about shorting it.

A couple of fibs converge on the price labels shown.

Like to hear your comments.

GOLD - SHORT_1365 TO 1272Trying to write ideas - the taste of the pen ...

GOLD - SHORT_1365 TO 1272

SL = stop slightly higher than the monthly maximum

The deal - is counter, risky, but the risk can be justified!

Causes: overbought - Slow Stochastic, divergence - CCI relative to trend.

Be careful and attentive.

All successful trades!

MikleKey

* This publication is not a trading recommendation for decisions on the basis of its decisions and their consequences publication reader responds independently.

** Author of publication and ideas, as well as its affiliates, liable for the acts or omissions of the publications readers do not carry.

USDTRY: Resuming the uptrendDear traders, it seems like it's time to reenter USDTRY longs. Now with price moving firmly back above the (fake)coup key level, I think it's highly likely to see the dollar rally resume, against the fundamentally weakened Turkish Lyra.

My signals group is long for a day already, from 2.9920 with stops at 2.9707. We're looking to add to longs here, and trail our stops up gradually. You can take the long here and use the stop and take profit depicted on chart. Risk 0.5%-1% on it.

Check out my updated track record here: pastebin.com

If interested in my real time whatsapp alerts and swing trading newsletter, or in personal tuition, contact me privately. I'm offering a considerable discount on a packaged course which includes access to my private trading signals list for a year.

Cheers!

Ivan Labrie

Link to Tim West's chatroom: www.tradingview.com

We discuss setups like this often there. Feel free to stop by and subscribe to his indicator pack. If you have any questions ask.

Risk disclaimer: My analysis is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

USDCAD and AUDUSD up: Long AUDCADWe have a nice setup in the making here. With oil looking ready to break down hard, I favor AUDCAD longs, (as well as CADJPY and USDCAD longs, perhaps GBPCAD), I do like AUDUSD, but I'd rather pass on the long there for now and focus on AUDCAD at this time, with risk of the risk on pairs suffering losses in the coming 2 months.

You can enter longs at market, or on a slight retracement with stops under the recent swing low.

I have no tp, just looking to rejoin the uptrend.

AUDCAD: Fundamental trend gives us great opportunitiesThe underlying trend is that oil production won't slow down anytime soon and that the oil price will continue to plunge, whereas copper and gold fall at a much slower rate in general.

Both currency pairs correlations and Central Banks agendas make them lose value periodically vs the dollar, but that isn't a problem for these setups I outline here.

In fact, the mild correlation between the two makes it possible to have an independent trend, born out of these peculiar characteristics of the instruments that we pit against each other, which are basically audusd and cadusd.

Rgmov implies that the trend is bullish for the AUD, and I think it makes a lot of sense. We can observe how large and sharp the bullish swings are, specially when under the yearly and quarterly averages.

The setups are detailed on chart, feel free to experiment with the concept.

Trading it in pairs provides us with more flexibility and no fear of getting stopped, so that will be my favored approach when trading it from now on, but I'd also take the oversold CCI trades in the AUDCAD pair since they are quite sharp and one directional when they occur.

Yen TWI chart: Bearish continuationWe have a very clear setup with the market rolling over after hitting an options expirations key level, since the Yen pairs soared due to Bernanke's helicopter money suggestion to Kuroda. In this chart you can observe the trade weighted index chart behavior, to more clearly illustrate the true strength in the Yen, clearly, this year's top investment, closely tied with precious metals and mining company's shares, and to a lesser extent bonds.

I reccomend going long the Yen, pick your desired instrument, give it enough breathing room and let it run. We seem to be ready to resume the downside push with force. Hold on tight!

Check out my updated track record here: pastebin.com

If interested in my real time whatsapp alerts and swing trading newsletter, or in personal tuition, contact me privately. I'm offering a considerable discount on a packaged course which includes access to my private trading signals list for a year.

Cheers!

Ivan Labrie

Link to Tim West's chatroom: www.tradingview.com

We discuss setups like this often there. Feel free to stop by and subscribe to his indicator pack. If you have any questions ask.

Risk disclaimer: My analysis is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance% on such information.

JPYUSD: The yen rally continuesAfter Bernanke visited Japan, and whispered into Kuroda's ear, the market reacted with a strong decline in the Yen, accompanied by a broad risk on rally that absorbed the Brexit losses. It's possible that this rally has topped, with all or most bears forced to cover their shorts, collaborating with the momentum run.

If you are a 'Key Hidden Levels' subscriber, one look at the RgMov indicator here will tell you what the main trend is, and when to enter long to rejoin this trend. It'll be a good idea to enter longs above today's high on Monday, with stops under today's low, or you can speculate on this new daily high, and just enter at market now. It's up to your risk aversion and discretion, just keep in mind the setup's rules involve buying the new daily high on Monday, and sacrificing a couple pips, for a lower risk entry.

Check out my updated track record here: pastebin.com

If interested in my real time whatsapp alerts and swing trading newsletter, or in personal tuition, contact me privately. I'm offering a considerable discount on a packaged course which includes access to my private trading signals list for a year.

Cheers!

Ivan Labrie

Link to Tim West's chatroom: www.tradingview.com

We discuss setups like this often there. Feel free to stop by and subscribe to his indicator pack. If you have any questions ask.

Risk disclaimer: My analysis is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

ETHUSD: Fundamentals improving, uptrend resumingETHUSD has a very nice chart setup, showing proof that bulls stepped in right around the Key level associated with the DAO crowdsale announcement, where major players and new money came into ETH pairs, making ETHUSD and ETHXBT rally as a result of the increase in speculative interest in it, and its love-child, the DAO (descentralized autonomous organization).

The weekly chart is clear as well, and presents a sound technical argument for further upside, so, I'm holding the longs I'm in from around the 10 handle, give or take.

If you're not long, you can jump in now, and risk one average daily range below the key level to be extra safe.

Minimum target would be a retest of the DAO hack key level above, from where the fundamental damage, eroded buyers confidence, sending the pair down rapidly, although, with very little follow through. An excellent buying opportunity...

Once we break over the highs, we could continue to march even higher, fulfilling one of the potential weekly uptrend targets on chart. See comments for the weekly setup.

Check out my updated track record here: pastebin.com

If interested in my real time whatsapp alerts and swing trading newsletter, or in personal tuition, contact me privately. I'm offering a considerable discount on a packaged course which includes access to my private trading signals list for a year.

Cheers!

Ivan Labrie

Link to Tim West's chatroom: www.tradingview.com

We discuss setups like this often there. Feel free to stop by and subscribe to his indicator pack. If you have any questions ask.

Risk disclaimer: My analysis is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance 0.02% on such information.

Erickson Inc SwingErickson Inc set up for a swing trade. Reasons shown on the chart, but several other reasons are also the RSI is gaining strength, CCI has moved up over 0, and MACD is showing a buy signal.

EnteroMedics Swing Chart 2Looking like a solid swing trade, reasons shown on the chart, along with another chart with supporting reasons linked to this one.

Copper opportunityCopper just peaked and today's candle seems to be the beginning for a few days of more down pressure. The first target is on the centerline of the pitchfork around 2,15 and another one on the lower line at 2,09.

Indicators signaling the coming back from the overbought region are well aligned for this short.

BTC, Gold, 10 year notes: UpdateAs I had explained in my previous post, it was likely to see an 'emotional high' in these instruments, followed by a sharp decline.

After this break down, all these instruments are at a major support level once again, and in sync too.

Notes:

I'd get out of shorts here and maybe flip long in a few days.

Gold:

It might have some more room to fall, but if it makes a higher daily high tomorrow, it is possible to see a rally.

If short, cover half and trail the stop to today's high after the close perhaps.

BTCUSD:

I went long with a small risk position, considering a 10% downside risk as worst case scenario. I used spot, have no stop, and no margin. I also bought ETH with a 20% downside tolerance here.

The plan is to capture the upside in BTC and ETH once they resume the weekly uptrends they are in, and avoid losses in a choppy enviroment in gold and notes. The trades have been good so far, so try to protect profits first.

We will see volatility, so it's good to be prepared.

Good luck!

Ivan Labrie.

Silver: Uptrend continuation setupIf you missed the long entry in Silver, you can still get in as depicted on this chart, either after price makes a new daily high, or on a dip to 16.185, with stops under 15.942.

In related ideas you can see my long term analysis of silver, as well as the latest trade signal I emailed as part of my trading signals newsletter.

I'll be looking to add on dips, since our first entries are out of danger currently. It's still early to join this trend, and I expect it to evolve over the course of weeks. We'll monitor price action and the reaction to the Fed on June 15th, as well as the UK Brexit vote by the 23rd.

I reccomend risking between 0.5 and 1%.

Check out my updated track record here: pastebin.com

If interested in my trading signals, or in personal tuition, contact me privately. I'm offering a considerable discount on a packaged course which includes access to my private trading signals list for a year.

Cheers!

Ivan Labrie

Link to Tim West's chatroom: www.tradingview.com

We discuss setups like this often there. Feel free to stop by and subscribe to his indicator pack. If you have any questions ask.

Risk disclaimer: My analysis is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance0.00%% on such information.

Sugar: Topping against a monthly modeSugar is at a very interesting spot for a short trade. Although this is an aggressive entry, the potential reward makes the trade be worth a try. We have a clear sentiment extreme, and rgmov alerts of hidden selling, plotting lower lows when the market is going for a sharp climactic ascent. We also have divergence in CCI, so you could consider shorts if the next day turns down. Either sell under the last daily close, or short any new daily low. Stops should be over 17.62 as a bare minimum.

If interested in my trading signals, or in personal tuition, contact me privately. I'm offering a considerable discount on a packaged course which includes access to my private trading signals list for a year.

Cheers!

Link to Tim West's chatroom: www.tradingview.com

We discuss setups like this often there. Feel free to stop by and subscribe to his indicator pack. If you have any questions ask.

Short drawback tomorrow, then bull run for a few daysNNA has solid fundamentals, but obviously that's not enough these days to mean much in short term trading.

Dailys are showing solid bull set up with the indicators. Hourly indicators are a bit mixed.

Daily Fib-arc, Bullish Gartley, pitchfork, and pitchfan are showing gradual-immediate bull. I'm in, are you?

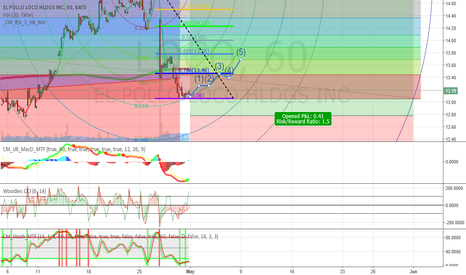

Loco long next monthI'm seeing a set up for a bull run.

Trend lines have been upward slanted the last few months and is still be tested (currently we are on/around the median).

Fibonacci resistance/support lines are being tested too.

I'm thinking either in pre-hours, or early hours after opening the price very well might fall due to exterior motives (SPY tanking); but I don't think it will go below the previous support of 12.80. If it does, it will bounce on it back into a bull Price Action.