CBDS crossing upward MACD/CCICBDS

Entry $4.5275 with crossing MACD just below 0, upward CCI.

For own reference.

Commodity Channel Index (CCI)

ICC Labs - break-out Aug 21About: ICC Labs ICCLF

ICC Labs Inc., through its subsidiaries, produces and sells cannabis in Uruguay. It offers recreational cannabis, medicinal cannabis, cannabinoid extracts, and by-products for medicinal, recreational, and industrial use, as well as industrial hemp. The company is headquartered in Vancouver, Canada.

Blocked at the border?

Break-out Aug 21 on MACD, buylongselllong @MarxBabu, and CCI using 1 day chart.

Note for own use. Industrial HEMP & Cannabis stock, Uraguay?

XXII - Falling wedge reversalMarket settling down and XXII poised for recovery at 0.236 Fib entry of $3.25.

Not good if it goes below this.

Wait for CCI to turn upward -150 range, likely within next day trading.

Look for resistance to break upward in next week for next area most likely 0.5 (2.50).

Solid stock for nicotine free tobacco and acquisition candidate.

Cannabis stocks started upward this week as safe have and Cboe IX hitting 16. Currently at safer 13.45.

Links:

www.tradingview.com

www.finstead.com

Q2 2018 Earnings report: finance.yahoo.com

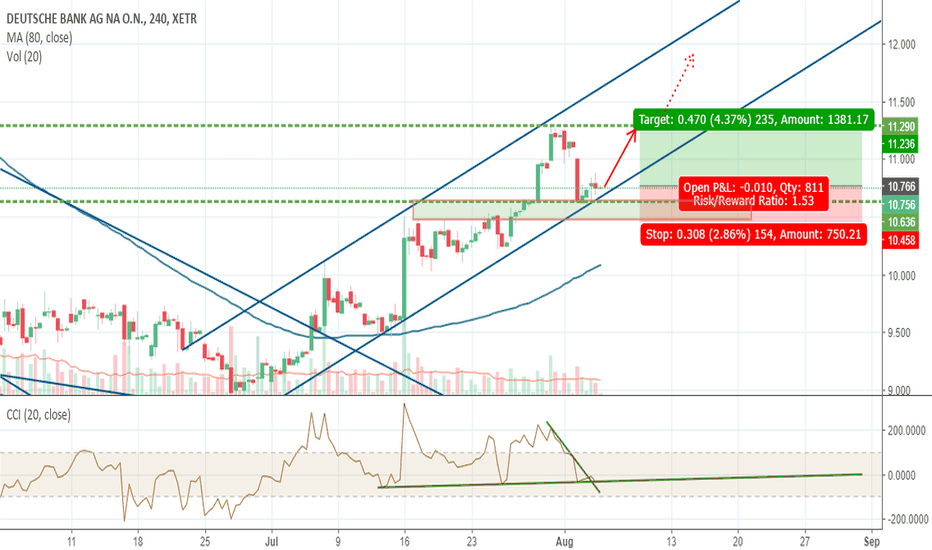

Deutsche bank - bulls at the helm again?Detsche bank looks that the worst times are over. Bulls are getting stronger and downtrend can be possibly at the end.

Actualy, the price is in bullish channel and the price is on the support. In my opinion this is good setup and tradable. CCI looks that is turning over.

ETHUSD 4H CCI SHORT TRADEStep #1: Wait until the CCI indicator crosses below -100 level

When we get a CCI reading below the -100 level, that shows statistically the USD gained more strength than average and therefore great for selling opportunities.

As a leading indicator, the Commodity Channel indicator can provide us with excellent great trade signals.

When the CCI crosses for the first time below the -100 level that’s the signal that a new bearish trend is about to start or at least a rally will emerge from where you can extract sound profits.

Step #2: Wait for a retracement and make sure that during that retracement the CCI indicator holds below the zero line.

Waiting for a pullback in price is a more defensive trading approach. However, you can also sell right away when the CCI crosses below -100. In this case, you need to make sure enough time has elapsed between now and the last time the CCI passed below -100.

We’re going to apply the more conservative approach and wait for a retracement and the CCI indicator to hold below the zero line during this retracement.

We want to see a weak retrace in the CCI indicator that barely goes above the -100 level, but at the same time, we need to look at the price action retracing more than the CCI did.

We want to have strength to the downside, if we’re going to sell ETH/USD we want to see continued strength in the CCI reading when the price is pulling back.

When the retracement happens, it’s important for the CCI indicator to remain below the zero line. If the CCI crosses above the zero line during the retracement, we’re no longer interested in going short ETH/USD.

This is one perfect example of how to filter bad trades from the right trades.

Note* The less the CCI turns up, the more powerful the rally should be.

Step #3: Sell after 3 or 5 candles “worth” of retracement. Or, sharp Corrections are sold at the closing price.

Now, we’re looking for short trades.

We have two options for our entry strategy.

We either sell after we have seen the market pulling back over the last 3-5 candles or we sell straight away if we have sharp corrections.

The natural ebb and flow of the market are given by these short-term pullbacks that we’re going to use to trigger our entry.

If the retrace was weak, it means the dominant energy of the market remains. The CCI indicator strategy reflects quite well what is happening behind the scene where the actual buying and selling pressure takes place.

Step #4: Place your protective Stop Loss below the most recent swing low

We’re proposing a very easy strategy to manage your stop loss. Simply place your protective stop loss below the most recent swing low.

However, it’s important to also watch the CCI indicator for further clues of weakness, and if the CCI crosses above the +100 level after you’ve entered the market, you can close the trade at the market price if your stop loss wasn’t triggered in the process.

Step #5: Take profit if CCI touches -200 or if CCI drops above the zero level. Whichever happens first.

We have two trading tactics to implement when dealing with exits.

The more profitable exit strategy is to take profits when the CCI touches the +200 level. However, since the market will only occasionally give us such big trading opportunities we need to have a backup plan.

So….

As soon as the CCI indicator turns below the zero level, we want to exit our trade. The first sign that the rally is running out of steam is when the CCI indicator crosses below the zero line.

I have also shown here 2 other options of taking profit. One is risk reward ratio (1to1, 2to1, 3to1). The second is a fib extension take profit. This trade hit the 227.2% fib.

Note** the above was an example of a SELL trade using our CCI trading strategy PDF. Use the same rules for a BUY trade – but in reverse.

PM me if you want to read the complete CCI trading strategy. Some intro information is on the update below.

How To: Profit with CCI Colored Candles / Bars w/ Histogram You have SPY Trending down today CCI and Candles are red pink and purple buy the 1st or 2nd pullback where CCI goes near ZERO line on CCI

I use 5min charts minium Indicator link:

Color of your candles matches your CCI with Histogram indicator and trend line . CCI EMA or SMA based option, traditional or modern formula calculation options ect. Can change Length, source, Trigger Lines, colors of candles and histogram and more

The CCI compares the current price to an average price over a period of time. The indicator fluctuates above or below zero, moving into positive or negative territory. While most values, approximately 75%, will fall between -100 and +100, about 25% of the values will fall outside this range, indicating a lot of weakness or strength in the price movement.

A basic CCI strategy is used to track the CCI for movement above +100, which generates buy signals, and movements below -100, which generates sell or short trade signals. Investors may only wish to take the buy signals, exit when the sell signals occur, and then re-invest when the buy signal occurs again.

The CCI compares the current price to an average price over a period of time. The indicator fluctuates above or below zero, moving into positive or negative territory. While most values, approximately 75%, will fall between -100 and +100, about 25% of the values will fall outside this range, indicating a lot of weakness or strength in the price movement.

When the CCI is above +100, this means the price is well above the average price as measured by the indicator. When the indicator is below -100, the price is well below the average price.

1 CCI strategy is used to track the CCI for movement above +100, which generates buy signals, and movements below -100, which generates sell or short trade signals. Investors may only wish to take the buy signals, exit when the sell signals occur, and then re-invest when the buy signal occurs again.

Long-term chart is used to establish the dominant trend, short-term chart establishing pullbacks and entry points into that trend. A multiple timeframe strategy is commonly used by more active traders and can even be used for day trading, as the "long term" and "short term" is relative to how long a trader wants their positions to last.

When the CCI moves above +100 on your longer-term chart, this indicates an upward trend, and you only watch for buy signals on the shorter-term chart. The trend is considered up until the longer-term CCI dips below -100.

When using a daily chart as the shorter timeframe, traders often buy when the CCI dips below -100 and then rallies back above -100. It would then be prudent to exit the trade once the CCI moves above +100 and then drops back below +100. Alternatively, if the trend on the longer-term CCI turns down, that indicates a sell signal to exit all long positions.

When the CCI is below -100 on the longer-term chart, only take short sale signals on the shorter-term chart. The downtrend is in effect until the longer-term CCI rallies above +100. The chart indicates that you should take a short trade when the CCI rallies above +100 and then drops back below +100 on the shorter-term chart. Traders would then exit the short trade once the CCI moves below -100 and then rallies back above -100. Alternatively, if the trend on the longer-term CCI turns up, exit all short positions.

Make the strategy more stringent by only taking long positions on the shorter time frame when the longer-term CCI is above +100. This will reduce the number of signals, but will ensure the overall trend is very strong.

Entry and exit rules on the shorter timeframe can also be adjusted. if the longer-term trend is up, you may allow the CCI on the shorter-term chart to dip below -100 and then rally back above zero (instead of -100) before buying. This will likely result in a paying a higher price, but offers more assurance that th

NEW Indicator: CCI Colored Candles / Bars w/ HistogramIndicator Overlay

Color of your candles matches your CCI with Histogram indicator and trend line . CCI EMA or SMA based option, traditional or modern formula calculation options ect. Can change Length, source, Trigger Lines, colors of candles and histogram and more

The CCI compares the current price to an average price over a period of time. The indicator fluctuates above or below zero, moving into positive or negative territory. While most values, approximately 75%, will fall between -100 and +100, about 25% of the values will fall outside this range, indicating a lot of weakness or strength in the price movement.

A basic CCI strategy is used to track the CCI for movement above +100, which generates buy signals, and movements below -100, which generates sell or short trade signals. Investors may only wish to take the buy signals, exit when the sell signals occur, and then re-invest when the buy signal occurs again.

The CCI compares the current price to an average price over a period of time. The indicator fluctuates above or below zero, moving into positive or negative territory. While most values, approximately 75%, will fall between -100 and +100, about 25% of the values will fall outside this range, indicating a lot of weakness or strength in the price movement.

When the CCI is above +100, this means the price is well above the average price as measured by the indicator. When the indicator is below -100, the price is well below the average price.

1 CCI strategy is used to track the CCI for movement above +100, which generates buy signals, and movements below -100, which generates sell or short trade signals. Investors may only wish to take the buy signals, exit when the sell signals occur, and then re-invest when the buy signal occurs again.

Long-term chart is used to establish the dominant trend, short-term chart establishing pullbacks and entry points into that trend. A multiple timeframe strategy is commonly used by more active traders and can even be used for day trading, as the "long term" and "short term" is relative to how long a trader wants their positions to last.

When the CCI moves above +100 on your longer-term chart, this indicates an upward trend, and you only watch for buy signals on the shorter-term chart. The trend is considered up until the longer-term CCI dips below -100.

When using a daily chart as the shorter timeframe, traders often buy when the CCI dips below -100 and then rallies back above -100. It would then be prudent to exit the trade once the CCI moves above +100 and then drops back below +100. Alternatively, if the trend on the longer-term CCI turns down, that indicates a sell signal to exit all long positions.

When the CCI is below -100 on the longer-term chart, only take short sale signals on the shorter-term chart. The downtrend is in effect until the longer-term CCI rallies above +100. The chart indicates that you should take a short trade when the CCI rallies above +100 and then drops back below +100 on the shorter-term chart. Traders would then exit the short trade once the CCI moves below -100 and then rallies back above -100. Alternatively, if the trend on the longer-term CCI turns up, exit all short positions.

Make the strategy more stringent by only taking long positions on the shorter time frame when the longer-term CCI is above +100. This will reduce the number of signals, but will ensure the overall trend is very strong.

Entry and exit rules on the shorter timeframe can also be adjusted. if the longer-term trend is up, you may allow the CCI on the shorter-term chart to dip below -100 and then rally back above zero (instead of -100) before buying. This will likely result in a paying a higher price, but offers more assurance that the short-term pullback is over and the longer-term trend is resuming.

GBPUSD: Buy into strength, bears failed to get follow throughThe Pound offers a great set up to enter longs here, with very good risk/reward. If filled, we may average in during the next 3 days, with the same stop, if we enter a half position initially with our buy stop order, breaking above Friday's high. Stop just below Friday's low.

Best of luck,

Ivan Labrie.

BTCUSD :: Bull's Failed Longs Killing BTCBitcoin margin traders have been the primary cause of volatility, it would seem.

What I see here is that for the most part, bears have much less impact on the market than the bulls (I would have thought the reverse!). True, a big bear paw helped knock BTC off the high horse, but the next day bulls started a path of self-destruction. This battle played out for a bit, with the bears seeming more strategic and the late coming bulls having major FOMO. The early bulls falsely inflated the CCI which was easy to do the day after all those shorts opened.

The price continued to go downward as people took their profits before they weren't profits anymore and this caused a lot of bull nuts to be squeezed. Everyone decided to give it another shot and, you can see that as L&S activity stabilizes the market tries to return to normality...which has been a down trend but it's trying to normalize the 6-11K range.

The long bulls finally gave up in the last week of march, falsely *deflating* the market as they had done previously.

At this point every has had their ass torn from both directions and I'm lmfao at how all these smart people out smart themselves. I, having no financial eduction or even skills or responsibility, have also had my ass handed to me so .. This pot is also black.

Everyone had a good LOOONG as week to analyze the crap out of every micro & macro pattern possible and a lot that aren't.

As mentioned, the bears seemed more strategic and you can see that a large number of shorts were opened at the PERFECT time.. when the 100 MA is crossing the 200 .. AND the market is hitting nearly 200 on the CCI.

The rest of the week was mostly Joe Blow grabbing big handful of FOMO. He's the one who is going to cry elephant tears. :(

We're at a crazy pinnacle of resistances from literally every direction and that hammer is super crazy ready to pounce on a market full of bulls who have run out of steam driving their precious lambo straight into the ground.

Ironic eh?

Checking USDJPY Month Week and DailyOne of my first full analysis of USDJPY feel free to comment /correct any of my mistakes

*Some of my terminology that I personally use*

South = Price moves down

North = Price moves up

Monthly

- Price is at 105.660 area approaching a Monthly resistance zone at 104.00

- Kumo Twist to south and price inside of Green Cloud with Lagging line approaching cloud and Tenkan|Kijun cross happening in January and price forming under candlesticks

- By end of month if trend continues south 3 Black Crows (www.investopedia.com) formation appears to look for price to test/breakthrough 99.000 area (25% on Fib) and several months of downtrend but will look to take sells for the rest of the month as well as the rest of April if 3BC forms from March candle

- Looking at RSI (40 area) and CCI (-99) Shows downtrend continuation but is not far from oversold territory which also makes me believe further that price will push south to the resistance area

- A possible alternative is price testing 104.00 area then begin forming a Harmonic Pattern after a short retracement to 112.441 - 115.84 (50%-61.80% on Fib) which would make the 5th and final line of the Elliot Wave before making a XABC formation

Weekly

- Price is consolidating in 23.60% area on Fib Last time price was in this area (June 6th, 2016 - November 14th, 2016) Price tested 99.00 area, consolidated in Major Support area, then moved north for a straight 4month north movement and testing and breaking resistance area before a smooth move south testing resistance 4 times before coming to where pice is now

- CCI shows Oversold price my bias is price will play/consolidate in 23% area if price breaks structure (I’m positive that it won’t … yet because of CCI oversold and RSI not showing oversold conditions )

- According to Ichimoku price has broken previous structure but I would like to see price break Major support area to take any long-term sells because of ichi on Monthly

Daily

- So far price is oversold on every chart (CCI)

- Witnessing newly formed TK Bounce from two days ago if price closes below current area forming another 3BlackCrows possible daily trades to the south to 104.00 area

- If price does not break current support look for Double bottom Formation with price to go north to 109.00 area

- Placed two possible pending depending on what price does in next few days both 1:2 trades

- (If double bottom forms) Buy Stop - Entry 107.500 | TP 109.309 | SL 106.592

- (If price breaks support) Sell Stop - Entry 105.223 | TP 104.000 | SL 105.883

Long entry. Here is why. (Past performance is not indicative of future results. This is by no means a signal - trade at your own risk. )

I took a break from trading last week to set this up. MACD and CCI both indicate a reversal - even if short term - it could mean a bit of profit. Price has finally broken through downtrend (light blue line) almost perfectly at the Pitchfork projection. While price may continue to drop ultimately, the probability of it retesting the 61.8 line at least once more before either plummeting (or skyrocketing) is looking pretty good.

Time will tell, friends. Time will tell.

Here are my personal entry numbers.

Will update this as I go so you can all laugh at me or laugh with me all the way to the bank.

Resolution: Daily

Long Entry: >108.25 by 3pm Friday. ($9.50/contract)

Potential TP: 107.90 - 108.00

SL: 105.90 - 106.10

MACD, CCI, Median, S/R, Fib and Breakout all with standard settings.

FOREXCOM:USDJPY

ADX ready to break out?After a serious decline in their prices last days, ADX is recovering. When we take a look at the daily chart (not shown here) signs for a bullish market are there. MACD is close to a golden cross and also the CCI indicates a bullish signal. Meaning that the big players are preparing to bring the ADX price back to a higher level.

When we have a look at the 4h chart we see that the MACD is in a good bullish position and de CCI is also showing some bullish signals. ADX broke through the 0.236 Fibonacci retracement level and tested the upper retracement level and 0,392 (long wig of decline) which resists. At the moment we can see that the price is going sideways with a support on the 0.236 fib and resist on the upper fibonacci level.

As the daily is also showing bullish signals, following the big players is always a good idea. If price breaks through the upper Fibo level it will skyrock. Keep an eye on the ADX movement coming hours and don't miss if it breaks out.

$USDJPY: Potential weekly shortI like this entry here, long the yen. It's possible to see a sharp decline soon, and here the weekly chart is calling for a short entry with low risk and good risk/reward. First target is 105.402 but it could extend lower, so, just follow the trend with a wide enough trailing stop once in profit matching the stop loss distance here.

Best of luck,

Ivan Labrie.

-YOUTUBE VIDEO-No reason to sell yet.Wait for your sell signals!Welcome! Check out my YouTube video explaining how to use technical analysis to trade $LUV. It is 20 minutes long. But I promise you that I am not wasting your time

youtu.be

Last week I posted a 5 minute chart on $LUV claiming that it was screaming a buy. I was right. So today (In the video) we are going to review how we could have traded this like the pros!!!'

Remember the best traders have a process and a system. In this video you will see the idea of systematic trading from the ground up.

A lot of the concepts seen on the 5 minute chart review came from my video i did on "How to trade $AMD on the 5 minute chart". It was a great video with an outstanding strategy and I highly recommend watching :)

I hope you enjoy this and find this helpful :)

Please if you have questions or comments POST THEM!!!!!!!!!!!

Daily Long Opportunity on GoldGold has came back down to the 100 SMA on the Daily timeframe which is also in confluence with a support level. On the weekly timeframe, a bullish hammer has formed and to make this trade even better, in terms of oscillators, gold is oversold. TP for me is the previous weekly high and my stop will be just under the weekly bullish hammers low.