InvestMate|USOIL Strong support, watch out for increases🛢🛢USOIL Strong support, watch out for increases.

🛢As I predicted in the previous post the dips, this time it is time for an upward scenario:

🛢We are at a key point in the level.

🛢A strong support zone determined by the 0.618 level of the entire upward wave and the points where the price has reacted in the past.

🛢Also we are at the lower edge of the downtrend channel, which undercuts the possibility of an upward breakout.

🛢I have determined the resistance zone based on the 0.236 level of the entire upward wave and the points where the price has previously stopped multiple times.

🛢The scenario I am playing out is a breakout from the support zone and a retest of the resistance zone.

Comodities

InvestMate|Gold Attention falls!🥇🥇Gold Attention falls!

🥇As I wrote in a previous post on gold about the declines, link below:

🥇There has been a breakout from the distribution I wrote about.

🥇We have also broken out of the uptrend channel.

🥇The nearest strong support zone is the 0.236 cluster of the entire upward wave and the outer 127.2 of the last upward impulse.

🥇Please watch this level closely.

🥇The upward correction of the new downtrend may start from it.

🥇The scenario I'm playing out is a decline to the support zone, and waiting for the correction to end.

🥇To look for downside opportunities afterwards.

🚀If you appreciate my work and effort put into this post then I encourage you to leave a like and give a follow on my profile.🚀

InvestMate|Gold important level before declines🥇🥇Gold important level before declines.

🥇Gold didn't bring us much news today, the price once again tried to oscillate at the current peaks, while making 2 attempts to enter higher levels which ended in failure and a price slide

🥇I think we are currently at an intervening level if we were to talk about dips.

🥇We are at the level of 0.618 of the whole downward wave since the failed attack on new peaks.

🥇My scenario remains unchanged. I refer you to previous posts:

🥇*Please do not suggest the path I have drawn with the lines this is only a hypothetical scenario for further increases.

🚀If you appreciate my work and effort put into this post I encourage you to leave a like and give a follow on my profile.🚀

InvestMate|Silver's time for falls🥈🥈Silver's time for falls.

🥇Gold has already been mentioned so now it's time for silver.

🥇Link to posts about gold:

🥈In my analysis of silver I used several tools to catch key price points.

🥈At the very beginning I marked out a downtrend channel, as we can see we are very close to the upper edge and knowing that there is no rule that the price always reaches every point with scalpel precision. This is the first indication that the price is expensive.

🥈Next I measured the fibo grid of the whole downward wave and again I see that we are close to the important level of 0.382 of the whole wave.

🥈I also measured the current upward impulse from the bottom using the fibo.

🥈I also measured the range of the largest correction of this impulse to determine the 1:1 range level.

🥈With the help of these measurements I was able to determine two support zones.

1. the 0.236 cluster of the entire downward wave plus 0.382 of the entire upward wave.

2. the 0.618 level cluster of the current upward impulse and the 1:1 level.

🥈Looking at where we are, the occurrence of a correction is highly likely. I have set a resistance zone given that it is a cluster of the 0.382 level and an important price point that has provided support in the past.

🥈The scenario I am playing out is the execution of a downward correction of the current upward momentum with a long term perspective of continued declines.

🥈*Please do not suggest the path I have drawn with the lines this is only a hypothetical scenario for further increases.

🚀If you appreciate my work and effort put into this post I encourage you to leave a like and give a follow on my profile.🚀

🪙GOLD A correction and then a continuation of the increases?🪙GOLD A correction and then a continuation of the increases?

🪙Another technical look from my side. This time on gold.

🪙As in my last post on gold I predicted the increases perfectly:

www.tradingview.com

🪙This time it was time to play for a correction.

🪙I will break down all the tools I used in turn:

🪙1. a downward channel from peak to bottom.

🪙2. fibo measure from peak to bottom.

🪙3. fbo measurement from the largest correction of the upward impulse to the bottom.

🪙4. harmonic formation, former largest upward correction in a downward implosion. I will present it below so as not to superimpose too many elements on the chart:

🪙5. 2 resistance zones have been identified.

1. local, a cluster of the 0.382 level of the entire downward wave and the outer level of 1.618 measuring the largest correction in the upward impulse.

2. strong, defined by the 0.5 level of the entire downward wave and the previous strong price interest at the 1850 levels.

🪙6 A support zone defined by the 0.236 level of the entire downtrend and previous resistance that has been difficult to overcome on several occasions.

🪙My scenario assumes a correction and then a continuation of the increase to the resistance line.

🚀If you appreciate my work and effort put into this post I encourage you to leave a like and give a follow on my profile.🚀

🥇Gold where will it fall?🥇Gold where will it fall?

🥇Post is obviously an extension/update of my last post, if anyone wants to get a broader perspective I encourage you to read it. Link below:

🥇This time the legacy I'm playing out, I'll put it in closer perspective.

🥇But one step at a time.

🥇First, I have mapped out the uptrend channel. Of the current upward momentum. You can see that the channel was indeed very respected.

🥇Next, I plotted a fibo grid from bottom to top to find interesting levels

🥇I measured the previous downward wave using the fibo.

🥇I marked the current distribution zone.

🥇Based on the cluster of fibo levels and the fact that I do not expect a deep correction here (for more info I refer you to the previous post) I have marked a potential support zone.

🥇Based on the current peaks, the distribution level and the fact that the uptrend is not continuing today on gold, I have set a resistance zone.

🥇The scenario I am playing out is a descent to a support point.

🥇*Please do not suggest the path I have drawn with the lines this is only a hypothetical scenario for further increases.

🚀If you appreciate my work and effort put into this post I encourage you to leave a like and give a follow on my profile.🚀

InvestMate|GOLD Increases on the horizon?🥇GOLD increases on the horizon?

🥇As in my previous post on gold I predicted downtrend correction:

🥇This time we change direction and set our sights on an uptrend correction

🥇Gold showed strength on Friday last week. Breaking out of its local minima by a full 4%

🥇In this case, can we speak of the start of an upward correction in a downtrend?

🥇The downtrend has now lasted 244 days and the decline has been -22%

🥇This is a really significant correction. All because of the strengthening dollar since the outbreak of Russia's invasion of Ukraine

🥇The situation may change on the dollar. Which I described in a previous post

🥇In a nutshell, what happened in America last week was:

🥇The event everyone was waiting for was the interest rate decision, which rose to 4%.

🥇This was followed by a press conference in which Jerome Powell spooked the markets with a hawkish tone, which first triggered a sharp wave of dollar weakness, and Powell's words were followed by a speculative attack to strengthen the dollar.

🥇4 November Non Farm Payrolls performed very well with 261k new jobs created compared to the 200k the market was expecting.

🥇After which the rate from the data we found out unemployment rose to 3.7%

🥇All this data could have a positive impact on future inflation readings. Which has been falling for over 4 months.

🥇All this data from the US economy could gradually contribute to a weaker dollar in the future. Which the market may already be discounting at this point.

🥇Long-term chart of the dollar:

🥇With which the price of gold may gain. Not in the same way as the global addition during the pandemic. But in a noticeable way.

🥇Moving to the chart. The 1720 and 1790 price levels are still the most sensible levels.

🥇The former seems more local in the current week's range, the latter would be reached if the dollar scenario plays out.

🥇Between these levels there is another level which is the one to one correction, that is the range of the largest recent upward correction in the whole downtrend, it falls equally at 1740

🥇Looking for a good place to join the upside, I would probably look at the zone between the 0.236 and 0.382 levels of the current uptrend. Waiting there for some strong signs of buying interest

🚀If you appreciate my work and effort put into this post I encourage you to leave a like and give a follow on my profile.🚀

Copper (COPPER/INR) Commodity Analysis 18/07/2021 Technical Analysis:

As you can see, there exist a hidden Bullish Divergence with MACD which is the sign of bullish trend continuation as Copper has started its bullish wave since March 2020. It is moving in an ascending channel. We draw Fibonacci retracement from the low to the top of last impulsive wave which are defined as the Fib levels on chart. The commodity fell to 78% Fibonacci Retracement and it is consolidating and accumulating on Fibonacci Golden Zone currently. we believe this commodity is getting ready to shoot to the higher targets which are defined by Fibonacci Projection tool of the past wave.

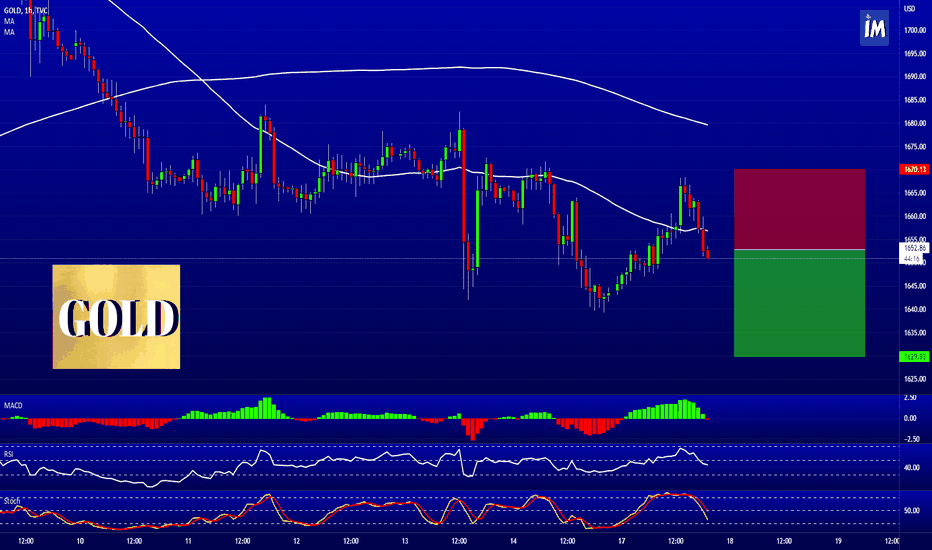

InvestMate|GOLD Continuation of declines🪙GOLD Continuation of declines

🪙Quick play

🪙Gold has been in a downtrend for some time now

🪙Gold has been in a sideways trend for a few days now

🪙There is a high probability of declines to the 1643 levels of the cluster 2 fibo levels 0.236 and 0.786 measuring the largest upward wave and correction

🪙Taking entry now at 1657 level

Stop is set at 1667 level

Take profit at the level of 0.236 or 1643$

🚀If you appreciate my work and effort put into this post I encourage you to leave a like and give a follow on my profile.🚀

🪙 Gold ready to fall, quick analysis 🪙🪙 Gold ready to fall, quick analysis

🪙 In today's analysis, we will again look at gold this time on the 1H interval which, for me, has performed many confirmations of weakness.

🪙 Starting with indicators which all generate downward signals, ending with the fact that we are under key moving averages.

🪙 I encourage you to read the previous post on gold and observe this commodity in the next few days

🚀 If you like my analysis leave a like and follow my profile 🚀

Brent oil will Explode soonDon't be surprised if Brent has a strong upward move in the coming weeks

Elliott waves, the key to market behavior

Market outlookThe S&P500 has done exactly as I feared.

Thesis: The US is transitioning. The US dollar was the reserve currency of the world. We exported dollars and it either sat in banks or was imported back as investment (Bonds and stocks). When we locked up Russia's money we made EVERY country re-evaluate their relationship with us. A significant pivot is happening on the macro scale. The US's future lies in how we make use of the US coming back home. I expect production of goods and base commodities to begin to truly take over for years to come. I do NOT expect to invest significantly in the S&P500 again until 2028-2032.

Things to keep in mind:

1. Valuations are still absurd. and either significant inflation or a drop in price is needed to bring them back to levels I would purchase at.

2. Relief rally should happen soon. Remember bear market rallies rip harder and faster than rallies in a bull markets.

3. The fed is squeezing the economy trying to reduce inflation. Until they pivot, expect lower lows.

4. There is a non-zero percent chance we enter a sustained bear market until 2028 ish. The first "real" one in 40+ years.

5. Commodities are looking great. They may drop for a bit longer but if you look back 50 years and adjust for inflation we are in the initial innings. For reference silver is 21.93$ and based on my calculations of inflation, its high was above 800.00$.

6. I am forecasting gold to go to 8000 over the next 6 years even if everything goes "well" for the west just due to the USD being revalued lower. If things get truly dicey I am expecting gold to reach 25,000 an ounce.

7. Remember the insidious nature of inflation. Even if we assume official levels of inflation are accurate and expect 5% for the next 5 years, cost of living will increase by at LEAST 29%. I expect levels closer to 80-300% increase cost of living based on my macro thesis.

Large unknown factors:

1. Europe is looking terrifyingly weak. If Europe begins to destabilize I expect a rush into the dollar for a time. This will have many unpredictable problems. We may see inflation cool for a time due to that but it just makes the problem bigger down the line.

2. If the US gov suddenly finds a cause that allows them to bless off on 50-200T in money printing I expect that to drastically shift what happens. It may prop up the stock market or it may be the final proof to investors they lost control and create a global bank run.

3. Contagions: in 2008 we saw one of the largest expressions of a contagion event. The entire financial world locked up. There are 100X's more dangers of similar events now than there where in 2008 because we never fixed the underlying problem and allowed it grow exponentially.

4. Food and energy are becoming huge global risk factors. Don't underestimate the global effects of wide spread starvation and loss of energy augmentation to humanity. My call is just based on the worlds Covid response. This is not even factoring in Russia and Ukraine. Western countries will be buffered from both of these trends but we will still strongly feel this through second and third order effects. Don't underestimate the power of starvation and lack of energy to produce large scale contagious risks unlike we have ever experienced in anyone's memory.

Gold (Fibonacci Analysis) Idea:

Long Gold (~May 22, 2022)

Price Entry @ $1,704.00.

Price Target @ 2000.00

XAU/USD long term sell scenarioFrom my study of price action from the daily timeframe I observed the following

1.From 1st March to the 8th March we saw price very bullish

2.From 9th March to 15th March we saw price strongly bearish

3.From the 16th March to 31st March we saw price play within a range

Currently i'm looking foward to how price will react below the range, i'm anticipating a strong sell off if I should see strong price break below structure.

COMPOUND looks to make a new high trend with breakout effect.Hello trading friends,

This is an update for COMPUSDT.

Depending on the study trend - we could enter a new high trend with a possible breakout of the compound.

Depending on the chart show, it shows the box close possibility trend.

60% + could be a possible increase trend for COMP coming time.

Don't expect to fast changes - market going on their way.

- This is not a trading call - Trade only depends on your setups.

Good time

SP500 Analysis Long SP500 Analysis Long Chart Daily Target 4588.6 Holding Period 12 Days Good Luck.

DISCLAIMER: These videos are for educational purposes only. Nothing in this video should be construed as financial advice or a recommendation to buy or sell any sort of security or investment. Consult with a professional financial adviser before making any financial decisions. Investing in general and options trading especially is risky and has the potential for one to lose most or all of their initial

Oil on the breakout...Amid the current geopolitical news oil has tanked on the passed days pulling many energy prices up along with fuel prices. There are strong plans to maintain the current global oil prices with support from the US.

On a technical level, oil is also breaking out from an outstanding comeback from the 2020 lows of below $0.00. We are now trading above the $100 per barrel level with eyes set on the next levels of resistance. All time highs are not too far away and with current strength holding, this could continue to the upside over the coming days/weeks. Downside opportunities are looking unlikely heading into the remaining trading days of this week.