CHFJPY - The Bulls Are Exhausted!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

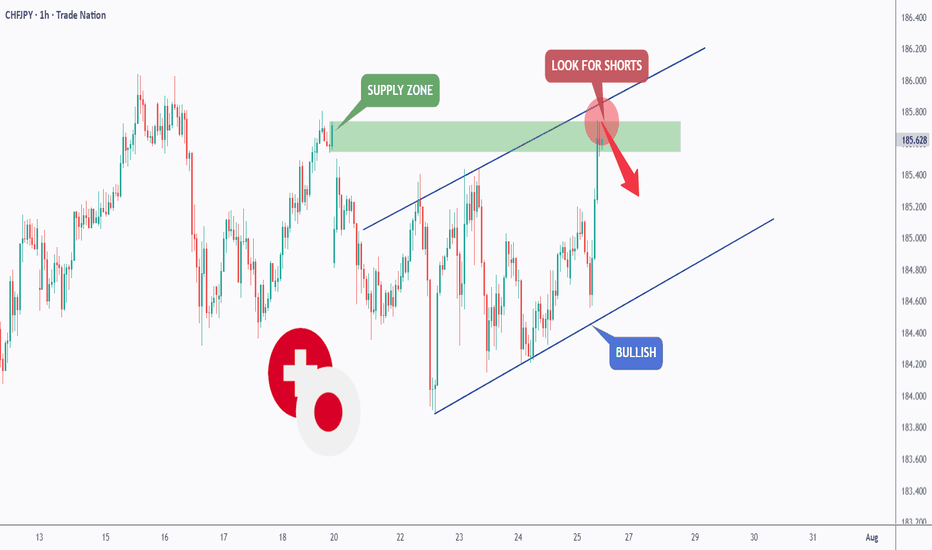

📈CHFJPY has been overall bullish trading within the rising channel marked in blue and it is currently retesting the upper bound of it.

Moreover, the green zone is a strong supply.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper blue trendline and green supply.

📚 As per my trading style:

As #CHFJPY is hovering around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Confirmation

AUDJPY Ready To "Drop A Shoulder"? Multi-Timeframe May Help!OANDA:AUDJPY is beginning to form a very convincingly strong Reversal Pattern, the Head & Shoulders!

Starting with the Daily Chart we can see that Price is Forming a Doji Candle just after trying to Breakout of a Major Resistance Zone created from the Highs of March 18th and if Price is unable to close above this level, this strengthens the Bearish and Reversal Bias.

Now the 4 Hr Chart shows both the "First Shoulder" or Previous Higher High that was surpassed by the "Head" which is the New Higher High, has formed quite quickly with a slightly Ascending "Neckline" or Support Line where Bulls were able to make their Last Stand.

With a Reversal Pattern, you want to see a Change in Trend, in this case, would be a Lower High then that of the Higher High or "Head" @ 96.204.

*If Bulls are able to Push Price above the "Left Shoulder" or Previous Higher High @ 95.952, this will Invalidate the Head & Shoulders Set-up!

**If Bulls are unable to Break Above 95.952 and Price is pushed back down to the Confirmation or "Neckline" for a 3rd time, this Confirms the Head & Shoulders Set-up!!

Based on the Distance between the Head and Neckline, we can project a potential drop down to the next Support Level as a Price Target @ 95.00 once:

1) Pattern is Confirmed

2) Breakout is Validated

Adjustments for Better ReadingsMany traders rely on technical indicators to identify opportunities for profit—that's the whole point of this game. Whether it’s scalping, day trading, swing trading, or shorting the market, most trading decisions are based on indicator readings—be it a single indicator or a combination of several.

But here’s the truth: not all traders truly understand what an indicator is. They don’t grasp its nature—let alone the fact that this nature can be adjusted.

Those who don’t understand how or why an indicator works often find themselves in stressful and uncomfortable situations. It’s no coincidence that we often hear the common phrase: “Only 1% of all traders succeed, while 80% blow their accounts, and the remaining 19% barely break even.”

Why? Because the elite traders understand something most don’t:

Whether an indicator is leading or lagging, it can be customized to behave differently across different timeframes.

These adjustments can be found in the settings section of every indicator.

Let’s take the Relative Strength Index (RSI), which I’ve mentioned in previous ideas. Some of you may have noticed that my RSI plot looks different from yours. That’s because I don’t use the default 14-period RSI, which averages out the last 14 candles.

RSI is naturally lagging by default—but that doesn’t mean it can’t be trusted. In fact, with the right adjustments, that lagging nature can become leading. Learn how to do this. Push yourself. Educate your mind. Master this, and you might just find yourself among the top 1%.

Markets react to signals—signals that are often hidden in plain sight, created by the big players who always leave behind footprints. This is the trader’s true skill: seeing the whole picture.

A good friend once told me: Be a detective.

Now let’s go to the chart.

We clearly see a bearish strength unfolding.

Not only is the 9-period RSI plot trending below the yellow 28-period Weighted Moving Average (WMA), but we also observe a healthy continuation of the downtrend, confirmed by the WMA itself.

Using a 9-period RSI gives faster signals, while the 28 WMA offers smoother confirmations. This combo is applied on the daily timeframe—but every timeframe has its own ideal settings.

Now, when the RSI plot trends above the WMA, this can act as a potential reversal signal or even a confirmation of a trend change, depending on the broader market structure and volume context. It's not just about the crossover—it’s about what follows next. That’s where the detective work begins.

What do we see today?

Looking solely at the daily timeframe, the downtrend seems far from over. But to analyze it professionally, we must wait for the candle of Friday, June 6th, 2025 to close.

Switching to the lower timeframes, we see something interesting—a sort of bullish dominance unfolding during this incomplete trading day. But the real question is: Is it actual dominance?

Let’s break it down:

We have a clearly formed Head & Shoulders pattern.

The bearish Marubozu candle from June 5th made a new lower low (LL).

But—it did not close below the key swing low at 100.718.

Therefore, the Head & Shoulders pattern is not confirmed—it hasn’t broken and closed below that swing level.

So what’s happening in the lower timeframes?

In the 4-hour timeframe, we’re seeing a real-time crossover above the WMA (though the session isn’t closed yet).

In the 1-hour timeframe, the crossover has already occurred.

Now, such a crossover—where the RSI plot moves above the WMA—can often act as an early signal for a reversal, or at the very least, indicate a strong pullback. But don’t take it at face value—context is king. This is why we pair it with other signals like divergence, price action, and volume behavior for confirmation.

Across the 4H, 3H, and 1H timeframes, we’re observing this bullish pullback, yet it’s accompanied by an RSI Hidden Bearish Divergence (see: Macro Noise vs Micro Truth: The Art of Hidden Divergences).

Is this pullback a true reversal?

According to Volume Spread Analysis (VSA) (read: VSA vs BTC: Into a Bearish Scenario or Not?), a new narrative is emerging—but not without contradiction.

Price is climbing, yes.

But bullish volume spikes are declining, supporting our RSI hidden divergence. This volume-price disagreement is a clue.

What will reveal the truth?

Today's closing candle.

If price action (PA) creates a higher high (HH) but RSI creates a lower high (LH) → Bearish Divergence

If RSI makes a HH but PA creates a LH → Hidden Bearish Divergence

And for those of you who truly understand market structure:

The 100.718 level was a buy opportunity to secure profits.

If you caught that—congratulations. You’ve done your homework.

Now, you can sit back, relaxed, and wait for the next signal.

The market is a breathing organism. If you’re in sync with it—you’ll feel it.

And for those who believe there’s more to learn—but are struggling to find answers—there’s no shame in asking questions.

Till next time, take care—and trade wisely.

P.S. RSI plot, WMA, candlestick patterns, and Volume Spread Analysis (VSA)—when combined and used properly—can become a powerful toolset. For those willing to go deeper, they’re more than enough.

What is a Bearish Breakaway and How To Spot One!This Educational Idea consists of:

- What a Bearish Breakaway Candlestick Pattern is

- How its Formed

- Added Confirmations

The example comes to us from EURGBP over the evening hours!

Since I was late to turn it into a Trade Idea, perfect opportunity for a Learning Curve!

Hope you enjoy and find value!

XAUUSD (CONFIRMATION + OB + OTE)Hello traders!

From our previous analysis we expected reversal in 705 zone, now we have confirmation already and our target to close imbalance. Last open zone for interest is OB and mitigation(possible pullback with LG)

Have a profitable day and don't forget to subscribe for updates!

XRP/USDT — Structure-Driven Strategy (1H Chart)Just price, structure, and volume — tracked in real time.

🧠 Chart Breakdown:

✅ Reversal Buy — Price flushed, then snapped back into the range with follow-through. That became the base structure for everything that followed.

⛔ Top Exhaustion / Rejection — Clean reversal after a strong rally. Volume dropped off, candles showed hesitation, and sellers stepped in.

⚠️ Small Rejection Mid-Range — Structure failed to push higher. This area marked a trap — no volume confirmation, no continuation.

🚨 Major Breakdown & Recovery Setup — Price dropped hard but reclaimed key levels quickly. The recovery candle and volume spike were the first clues buyers were stepping in again.

👀 Current Watch Point — Price is now pressing back into that same resistance zone. The structure here is everything — a clean reclaim could mean trend continuation. But hesitation again? Fade it.

Always happy to be helpful.

XAUUSD WILL IT MAKE NEW ATH OR DUMP?🚨 Attention Traders! 🚨

🟡 Gold is in a no-trade zone! 🛑 Stay patient as we monitor key levels.

📊 Critical Zone: 2947 - 2954 (Support & Resistance)

🔻 Bearish Breakout? If the price drops below 2947, we’ll target:

🎯 TP1 = 2936

🔺 Bullish Breakout? A move above 2954 signals upward momentum:

🎯 TP1 = 2964

🔥 Stay sharp & trade wisely! 💰📈

XAUUSD CONFIRM 100 PIPS MOVE IS HERE🚨 Attention Traders! 🚨

🟡 Gold is in a no-trade zone! 🛑 Stay patient as we monitor key levels.

📊 Critical Zone: 2919 - 2945 (Support & Resistance)

🔻 Bearish Breakout? If the price drops below 2919, we’ll target:

🎯 TP1 = 2909

🔺 Bullish Breakout? A move above 2945 signals upward momentum:

🎯 TP1 = 2955

🔥 Stay sharp & trade wisely! 💰📈

#TRBUSDT remains bullish📈 LONG BYBIT:TRBUSDT.P from $38.35

🛡 Stop Loss: $38.00

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:TRBUSDT.P is in a strong uptrend, breaking the key $38.35 resistance level.

➡️ POC (Point of Control) at $34.47 indicates the highest liquidity zone far below the current price, confirming strong buyer support.

➡️ The price has broken through the $38.30 area and is consolidating above, opening potential upside toward $39.30.

➡️ If the price holds above $38.35, bulls may continue pushing towards target levels.

⚡ Plan:

➡️ Enter long after confirmation above $38.35, signaling a bullish continuation.

➡️ Risk management via Stop-Loss at $38.00, placed below the support zone.

➡️ Primary upside targets:

🎯 TP Targets:

💎 TP1: $38.90

🔥 TP2: $39.30

🚀 BYBIT:TRBUSDT.P remains bullish—expecting further upside!

📢 BYBIT:TRBUSDT.P shows strong buying momentum, breaking key resistance levels.

📢 If $38.35 holds as support, the probability of reaching $39.30 increases.

📢 However, if the price drops below $38.00, a pullback to lower levels may occur.

AUD/USD Bullish Trade Set Up! A lot of Confirmation! Tap In Now!We are seeing AUD/USD rebound from a 4-day bearish push to .61300 to new highs around the .62000 level. The .62000 level has been holding strong as a resistance level; four separate times it has held the market below it.

It has now broken back above previous lows and is now retesting to the support line and is looking to move around the .61800 level.

We are also hovering between the 50 and 200 EMA levels, with the EMAs starting to converge.

Another sign we see is an inverse shoulder head shoulder on the 1 hour. The low of the right shoulder is the black box at .61700, and we don't want to see the market break below that point. If it breaks below the black low box, it is an indication of bearish strength.

Move Summary: We want to see it make a move to break through the .62000 level to break into more buy territory and create new highs. A break above the 200 EMA would be another signal for bullish confirmation. Our target will be the MONEY box for a 3:1 trade.

Like, Comment, and Follow if you agree with this Idea! Let's Connect!

AES Corporation - Short term view with strong supportSo first of all both price and indicators are confirming the downtrend.

Today NYSE:AES opened with a gap succeeding yesterday's equilibrium in price with doji candles.

The price is still in the middle of the regression line and in the next few days the price don't seems to be close to upper 2 SD.

In the print above the yellow line shows the support at $11.43. The image's time horizon starts at the end of 2006.

Furthermore looking at short ratio available online the value is about 2,7 from mid October as well as more than 22M short interest

Gold - Wave 5, plus CCI and RSI confirmationAt the trough we had the RSI close to oversold, and we can say that CCI showed an oversold condition.

The CCI that measures the deviaton its smoothed with an 14-ma and adding the RSI above we have the market confirmation.

The candles formed three white soldiers that seems very strong.

We are in the beginning of wave 5 with the objective to go to a new high above wave 3.

EURNZD strong bearish expectations

EURNZD BEARISH FLAG pattern visible, we are have break first time on 17.Oct but its not be confirmed, from today expecting confirmation is visible and higher bearish continuation.

We are have and ECB last week on Thursday, which is not make some big bullish changes on EUR, taking ECB like bearish imact on EUR

SUPP zone: 1.79650

RESS zone: 1.77800, 1.77200, 1.76600

CHFJPY 4H LONG setup

CHFJPY has been consolidating for a long period of time and finally broke the resistance level recently, which possibly helped to form an upward Break of Structure(BOS) confirmation too, seen on 4H chart. Look at the Daily or Weekly chart, you can see that we are in clear uptrend, it is a good idea to follow the big trend. Now when the price pulls back to the 4H Order Block, we can BUY, this is a classic trend-following trade.

Entry: 172.060

Stop Loss: 171.471

Take Profit: 180.117

Risk Reward Ratio: 13.8

EURUSD 2H Which Way Will It Choose?

EURUSD has come into a potential Demand Zone based on 2H chart, but the question is: Will it bounce back up from here to the the Daily Supply Zone or will it keep pushing down to further support areas down below?

The answer is we need wait for additional confirmation signals to give us a hint on which direction the market will be heading, such confirmations might be found on lower timeframes. Two brief prediction paths are drawn on the chart.

Caution: Jobless Claims news release soon in less than 2 hours. Be careful trading around that time period.

Will BTC Push Up Soon? The Key Level is at 65000.00 !!!

I will be looking for LONG opportunities on BTC after the resistance level at 65000.00 has been broken and thereafter forms an upward confirmation Break of Structure(BOS) signal, and the two reasonable take profit levels are set as "TP1" at 70000.00 and "TP2" at 72000.00, shown on the 8H Chart.

At the moment, BTC is consolidating locally. It seems that the market needs to grab more liquidity from supporting areas down below in order to push up later and the 8H green Demand Zone can be a potential area for that.

If the "Caution level" at 58000.00 below the 8H Demand Zone has been broken first, then new analysis on BTC will be made.

GOLD 1H Situational Analysis

Gold has been pushing up for a long period of time, now it has finally slowed down and started consolidating seen on 1H chart.

For LONG opportunities, we need a upward confirmation signal Break of Structure(BOS) to happen at level 2517.580 first, which increases the probability of the market going towards the TP level 2531.765, after which we can start seeking for entry area at lower timeframes to BUY. There are two scenarios for the market to reach BOS, briefly marked by the blue and green prediction paths.

At current moment, it is not easy to Short the Gold, since the uptrend in higher timeframes still seems very strong. But I've suggested a rough "Caution level" at 2491.000, indicating a potential trend reversal signal once it's broken, it's lying below a 1H green demand zone.

The "Wedge" Confirms the "Nod" - EUHere I have EUR/USD on the 4 Hr Chart!

The Head & Shoulders Reversal Pattern took all mid-July to form with Price finally Breaking the Low @ 1.08715 and giving us the New Lower Low @ 1.08256!

Price has been working back up to test the Break of Confirmation of Pattern but remains unable to break above, and with this Price Action, we begin to see a Bearish Wedge formation!!

This Wedge is a Continuation Pattern and is textbook confirmation to see the Head & Shoulders being true to the Reversal Behavior!

*As long as Bears remain solid at the 1.087 level, the Bearish Break to the Rising Support of the Wedge will be Confirmation of the Wedge Continuation Pattern itself, therefore strengthening the Bearish Bias on the Pair to CONTINUE!

-We see Price on the RSI is remaining BELOW the 50 reassuring Bearish Pressure

-BB Trend Printing strong Red Bars

-Fundamentals-

EUR - CPI's & GDP (Tue), CPI's (Wed), PMI's (Thur)

USD - Consumer Confidence & JOLTS (Tue), ADP Non-Farm/GDP/Pending Home Sales/Funds Rate (Wed) Unemployment Claims ISM Manu. PMI (Thur) Average Hourly Earnings, Non-Farm Employment, Unemployment Rate (Fri)

Ultimate Trading Strategy: Reaction to Supply and Demand Levels!🔍 Identifying Potential Buy or Sell Zones: In this step, you need to identify the zones that are likely to react and wait for the price to potentially reach them. ⏳📊

🌟 With the reaction to the first area, a buy trade is activated. 🌟

📝 Confirmations:

📉 Reaction to the expected area – Watch for a price movement hitting our anticipated zone!

🛠️ Formation of a combined hammer pattern – Look out for this powerful reversal signal!

📈 Formation of a bullish engulfing pattern – A strong indicator of upward momentum!

🔍 Trading Tips:

💡 High-risk stop-loss location:

👉 Place it below the candlestick pattern. At least twice the spread to ensure you're covered! 📏🔒

💡 Lower-risk stop-loss location:

👉 Place it below the expected area. Again, at least twice the spread for extra safety! 📏🔒

💰 Take-profit strategy:

👉 Base it on risk management mathematics, such as risk-reward ratios of 2, 4, and 6.

👉 Alternatively, observe reactions to past market areas, especially near important market highs and lows. 📊📈

🎯 Entry point strategies:

👉 Enter at the close of the confirmation candle.

👉 Or, set a limit order around 50% of the confirmation candle for a bigger volume opportunity! 📉📈

🌟 Buying in Two Phases: A Smart and Exciting Strategy! 🌟

🔹 Phase One:

When you reach a profit of twice the risk, exit the trade. Why? Because the Asian high has been hunted and the candlestick formed has a long upper shadow. 🌄💹

💡 Analysis:

The price hasn’t reached other zones yet and has risen in reaction to the first expected zone. Therefore, we expect a pullback and continued upward movement. 💪📈 So, I’ll place a second buy trade. 🚀💵

🔍 Confirmations for the Second Buy Trade:

A double bottom has formed, marked with an X. ❌❌

A small hammer candlestick has swept the double bottom. 🔨

A long positive shadow candlestick has swept the bottom and reacted to a small order block on the left. 🌟

💡 Tips for the Second Buy Trade:

Enter at the close of the long-shadowed doji candlestick or place a stop limit order above the long-shadowed doji candlestick. 📉📈

The stop loss should be below this candlestick. 📏🔒

🔹 Phase Two:

Next, the price has reached an expected reaction zone from where we expected a price drop. 🌐💡

🔍 Confirmations for the Sell Trade:

Reaction to the expected zone. 🔍

An inverse hammer candlestick reacting to the zone. 🔨

💡 Tips for the Sell Trade:

The entry point should be in a candlestick with a negative signal indicating a price drop. This hammer candlestick can indicate a decline. 📉🔻

The target can be a reward of 2 or the last price bottom. 🎯💰

The stop loss should preferably be behind the expected zone. 📏🔒

🔥 Important Points!!:

Since the price hasn’t deeply penetrated the zones, there’s a chance it might go higher or even mitigate this zone twice, ultimately turning it into a pullback for a further price rise. 🚀📈

Continuing on, the price reached the upper zone area.

We expected a price drop from this zone, but it reached at 03:15,

which is outside our trading session. However, we could have traded on it.

🔍 Sell Confirmations:

The price has reached the expected zone.

An inverse hammer candlestick pattern.

💡 Interesting Fact:

If you had placed a limit order around the midpoint of the previous two zones,

you would have profited by now. So, for this zone, you can also place

a limit order around 50% of it.

Continuing further, other zones have formed below that could be useful

for new trades.

✨ Successful Sell Trade Achieved, Reaching a Reward of 4 Times the Risk.

📉 During the session continuation, the trend line was broken, triggering an upward price pullback.

🔹 Now, at the beginning of the session, we have a new zone, likely a selling order placement area. We're taking the risk on this zone. This time, we can place the trade around 50% of it. 🚀💼

🔥 Alright, what's your take now? 🔥

🌟 Is the price reacting to this level or not? 🌟

🚀📈 or 📉💥

Where are the upper zones located?

What do you think? 🤔💬

STRONG "HEADED" REVERSAL COOKING UP?? - UCADHere I have USD/CAD on the 1 Hr Chart!!

Price attempted a BULLISH BREAK of the Falling Resistance but was quickly halted and retuned to the Low created before the MASSIVE PUMP!

Now on closer examination, price seems to have a underlaying Reversal Pattern beginning to take "Face".

A HEAD AND SHOULDERS PATTERN!!

Now with our "Neckline" @ 1.36567 being confirmed after the formation of the First Shoulder and Head, we can expect to see 1 last attempt at a HIGH!!

This HIGH I believe will be at the Same level as the First Shoulder, forming the Second, which will be CONFIRMATION OF PATTERN!! Then, upon arrival back at the Neckline, we will be looking for SELLING OPPORTUNITIES!!

**IF Price BREAKS & CLOSES ABOVE the First Shoulder @ 1.36984, Pattern is INVALIDATED!!

First Profit Target Zone will be at the SUPPORT ZONE @ ( 1.3627 - 1.3600 ) Range

Ethereum Move As Expected, Continuation Or Reversal?!Hi my friends, I hope everybody of you is doing well in today's volatile times, for now, Ethereum provided good signs to rely on the last weeks different to bitcoin and other cryptocurrencies the signals with Ethereum were highly worthwhile for me with some good opportunities in the schedule, therefore, I highly recommend that you read the last ideas I made on ETHEREUM these are living examples for how well technical analysis can work and that is a science which can be applied on today's markets. The triangle which I forecasted broke out as expected and the bearish pull-back came, in the trading-perspective, these observations can be measured highly profitable. Friends, I see many people distracting with giving wild promises that bitcoin or ETHEREUM skyrocket to 1.000.000, etc, this is mere speculation and we should always keep an unattached cool head to consider the best opportunities with the highest possibility the market gives us. The market is full of many contrary signals which has to be ordered rightfully. Great, let's look at the current situation and what ETHEREUM is doing right now, we have some important signs which shouldn't be ignored therefore I am looking at the 4-hour locally time-frame.

When looking at the current chart which is building a coherent follow-up to the previous ideas I published about ETHUSD, we can see that it almost did what I expected it will do, we had a downturn from the strong resistance level at 170 USD, the market was at resistance. For now, we have a support-base between 145 USD and 150 USD this support base will be respected because there are many confluence factors coming together building up a highly possible confluence-zone where the price will surge, from there we can see two possible price-action-scenarios coming. At the first hand, it is the scenario in which we get a bullish up-move bringing ETHEREUM into resistance and then falling back again, this moves us possibly because we still see selling pressure. The other way will be that ETHEREUm stabilizes at the support and establishes to move above resistance.

What is important to be said in this structure is that we have a very very very bearish zone confirmed when we fall with ETHEREUM under the 145 confluence-zone you can see in my chart. When we cross this level to the downside I do not see a fast reversal coming so soon. The next support below that level will be at 128 and the next one at 120. On the other hand for a bullish reversal in the confluence-zone, we have to cross above purple EMA and finally to get a middle-term bullishness with ETHEREUM take out the upper red resistance level which already confirmed once to the downside.

Alright, friends, this should give you a good overlook of the current situation facing ETHEREUM, remember that each scenario has to be confirmed properly before looking for a pleasant trade-entry.

In this manner have a good day and rest of the weekend ;) Feel free to support for more market insight.

Success comes from elevated concentration on the projected goals

FAREWELL

Information provided is only educational and should not be used to take action in the markets