Continuation

EURNZD - SHORT PLANLooking to EURNZD, there is a good setup in this pair.

Based on EW, I would like to see the price getting higher to my "Area of Value" and I will go to lower timeframe to get into short opportunity.

We can call this intraday trade, in order to confirm my short bias of course I would love to see if the price makes a Lower Low in Daily TF before doing any pullback. In this case also, its finishing all impulsive waves.

Let's see how it goes.

AU shortNow that we have a clean impulse out of a very corrective ascending structure, I am looking for an entry on this continuation.

Need price to stay within the previous high and current low as it forms this counter trend move.

This small break out of structure can now potentially evolve into a simple fake out and price could now fall all the way back into the pattern.

AU shortNow that we have a clean impulse out of a very corrective ascending structure, I am looking for an entry on this continuation.

Need price to stay within the previous high and current low as it forms this counter trend move.

This small break out of structure can now potentially evolve into a simple fake out and price could now fall all the way back into the pattern.

EU shortPrice has given us a very nice impulse out of a corrective ascending channel. This was forecast in a previous post.

All we need now is clean continuation within the previous high and current low and i will be entering this position with 2 trades one to manage aggressively and one to

hopefully hold for the larger move to the downside.

EU shortPrice has given us a very nice impulse out of a corrective ascending channel. This was forecast in a previous post.

All we need now is clean continuation within the previous high and current low and i will be entering this position with 2 trades one to manage aggressively and one to

hopefully hold for the larger move to the downside.

$MDU Consolidation Before BreakoutTo wrap up the year I'm going to leave you all with one more idea I have my eyes on. In this situation, we're looking at $MDU.

MDU Resources Group is a stock that we have seen consolidate into two different patterns over the course of the last nine years. Both respective patterns have yielded excellent results as both have reached their respective targets. Now it is almost time for our third pattern to breakout.

This time we are seeing price consolidate into a three and a half year long rectangle.

I'm looking for a clear break (1W candle close) above the price of $30 (dotted purple line.) After we get a clear breakout above that level, I'm looking to enter a long position targeting the price of $36.20 for a gain of ~22%.

To further support the idea of a bullish breakout, we can see the 200 EMA resting below the breakout level, which adds to my conviction that we will see a breakout to the upside.

If you would like to see more of these ideas on a regular basis, follow me as I will be posting many more exciting chances to earn on chart pattern breakouts this upcoming year!

Drop a like or comment if you found this idea informational or helpful in any way. I wish everyone a happy and healthy new year!

Cheers

$INTC Bullish Consolidation Before Possible BreakoutAs this week of trading is nearing an end, I wanted to share another potential trading setup I've had my eyes on. In this setup we're looking at Intel Corp.

Back in late 2014/early 2015 this instrument began consolidating into an ascending triangle (bullish continuation pattern) and sure enough, price broke through the top side of the triangle and continued heading up to the point we're at now. Following the breakout of the previously mentioned ascending triangle, we can see price is now consolidating into a rectangle.

The 200 EMA has been resting comfortably below both setups as added support - giving me more conviction that we're about to see another break upwards.

I'm looking for a clear break and close above the $59.50 (dotted purple line) area.

Price is attempting to break that boundary with this week's 1W candle close.

If we get a clear close above this chart pattern boundary, I'm targeting price to reach previous all-time highs around $72.50

I hope everyone is having a great holiday season.

If you found this idea informative or helpful in any way, please leave a like or comment to let me know!

Cheers

Confusing market? let me make it easy on you... bear power!Most of you who've been following my market weekly analysis (Also my fav' TF since it ignores all the news in the background) for the past few months know how I like chaotic messy rainbow colored charts ^_^ but also that I been super bearish since top to bottom =D

I love to see many basic but important TA/PA elements on my charts and thus I have to break it into parts for you guys <3, so lets begin:

1. The big trend:

- Main/noise -

The main obvious trend is bearish, and thus the main focus should be on shorts at important resistance levels as this way you catch all/most of the really big moves.. I already seen many groups/socialPeople talking about that we hit bottom, sure rare few of them have some valid points but until there aren't confirmations for the bull run it is all just a guess which is followed by the noise of smaller TFs which is caused by corrections to the downtrend/bull traps/SLHunts.. these groups/people tend to say we bottomed on almost every rise we had so far, while ignoring the bigger picture..

- Fibunachi:

I tend to say that a parabolic run should correct itself to around 0.7'-1' (3880-6k$) fib' levels, why?

because fundamentally a parabolic run isn't healthy/natural growing market, it brings to much money without real worth and can be very aggressive when panic sells going out..

and sentimentally the buyers are very hesitating and aren't rushing in when a market is falling..

thus a parabolic correction will never be good correction at the regular 0.6', 0.5', 0.3' fib levels, it will be much more aggressive..

* bearish/correction? - parabolic runs from my perspective usually end up in bearish market, BUT! from my perspective this can also be defined as a 'more aggressive correction' with expected results... my main target is 5.5k and I do expect the price to stop somewhere between 5-5.5k (Very strong S/R zone for last and current parabolic), it dosn't mean we can't spike below that, but if we go below 3880k for more then a couple of days? then even I have no idea and can't expect where the market will stop..

- trend lines -

Basic and yet the most important PA from my perspective... these are the guide lines to see how strong is the overall vibe/more of the market, this was also one of my main reasons to call the top on last parabolic run at around 15-20k, and this current parabolic run since 12-14k, notice how the market reacts when we go below a trend line that the bull run created, everytime we break a treanline its more likely to try and find support on the next one, I tend to think that for a new bull run to happen after a parabolic run then we need to reset that parabolic run, how we do that? by breaking all the trend lines which were created above the first one, thus I believe we will also break below the 5th trend line before we can really start the next bull run.

- MAs - e21 was one of the final confirmations for this bear run, staying below e21+e50 is very bad and leads to very strong death cross (while both E's on down trend) which if will happen then expect a whole 6 months of bear run (which also fits to my idea about that we will start the bull run only 4-6 months after the halving)...

- Ichinoku cloud -

Tenken and Kinjun death crossed (on a down trend) which is another confirmations for the big bear trend

also the Chinkou also went below the overall market movement which shows long term bear trend

and I overall as I mentioned on my last updates that if we won't see any strong push up at the 16/12 above the cloud then continuation for a bear run is more likely under the cloud until we see any sort of recovery...

- S/R zones -

I showed here all the important S/R zones we need to deal with before next bull run, these zones are ideal to plan positions with market direction...

If we enter below the red S/R again, it will turn to a very strong resistance and most likely push us to 6900 line, touching this line 4-5 (1-2 more to go) times will create a very strong move crush towards the next support zones..

2. Pattern:

- Falling wedge -

Yep, falling wedge is a bullish reversal/continuation pattern, so in the end we should break it at some point (with confirmed volume, and confirmed new trend after the breakout), I suspect that the best area to do so is my target support area..

3. Volume:

- Volume - if we break the bearish trend line it must be confirmed with volume,we are getting close to breaking the descending volume activity... successful break should also be high enough above the the red volume candle.

- OBV - or as I love to call it as volume buying power, should confirm next bull run, without it we will run breakouts without active fuel to push the price up and thus if we dont have enough then we won't hold higher interest price levels.

- VPVR - showing that we are at good price interest area for liquidity, this actually a big confirmation for accumulation and very important for our next bull run.

* Conclusion: It looks like we still 'might' have a strong manipulation push trend up (with PA rules) all the way to 7840 (e50 weekly + e21 3d), if we break these then the next target is 8230-8325 (e21 weekly + e50 3d), but do remember: this type of market movement is just a natural noise of correction/bullTrap/slHunts, and is there to divert your attention form the big picture, on a bearish market you which was forming since 12-14k which I warned about since then and which was confirmed by many aspects until now, you should focus on shorts at critical resistance areas, and even if your sl hits don't panic, just move your next position to the next resistance, this is how I always catch up all the main big moves, as simple as that... don't fall for this 'btc botomed' crap as long as it wasn't confirmed and proven otherwise, our main target should remain as 5-5.5k unless we really confirm the next bull run.

my current laddering short positions are focused around 7535-7835 zone (sl: 7845), so if we come back to that area I might ladder more positions to my existing ones as well.. and another focus for me is to trade a breakdown point under 6880..

GBPCAD Documentted MA Trade +47 Pip PotentialToday we started with a GBP bullish view but after the GBP pairs pushed down, we set-up an MA trade on this pair. Although this was not the last to reach the MA, price pulled back to the confluence of the MA and the 60 KS. Those who trade the Gold Method Ichimoku and have been in the training, know exactly what I am talking about.

Since this trade triggered later in the London session only about 75% in the trading room took advantage of either this pair or GUSD. All who got in made money :)

Just keep stacking those positive days :)

Allen

ORBEX 360°:EURCAD Minor Correction Likely to Drive Prices Down!LONG short-term to complete the complex correction; 1.4700-1.4860

SHORT medium-term, where intermediate wave (3) concludes its course; 1.39120-1.3425

SHORT medium/long-term, where primary wave 3 completes its course - only valid if the primary impulse is not an A,B,C correction; 1.3625-1.3150

SHORT longer-term, where primary 5 completes the cycle degree correction; 1.29

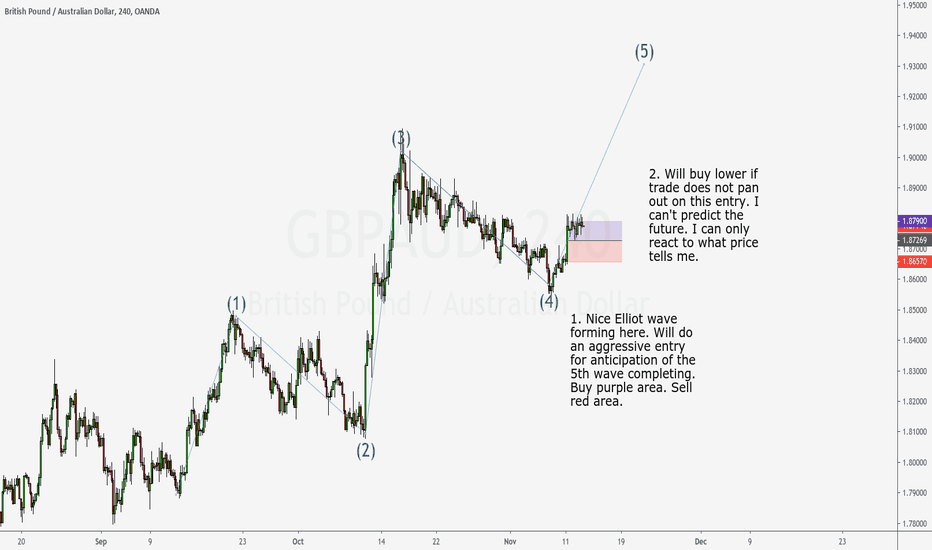

GBPAUD - 5th Elliot WavePlease refer to text on chart.

Price is forming a nice Elliot wave pattern here, I'll do an aggressive, low risk entry. However if the trade doesn't work and get in lower. The R/R for this trade is amazing so I don't mind having to take a few tries.

** Remember, we do not predict future price. We simply react to current price movements based on our interpretations of past data.

EURUUSD: Support Firmness At 1.10 Hints to Further Upside!EURUSD could have found support at 1.10 round level!

This assumes that we are still correcting towards intermediate wave (4), and are currently completing minor wave B of the A,B,C correction. Wave B is a minute a,b,c with subminute wave (v) being a triangle. Wave C of this correction could take prices to fresh highs above 1.1181.

In case prices slide lower than the 1.094 support, this could turn out to be an impulsive move to the downside.

AUDUSD 4H AROON PULLBACKS & TREND TRADING STRATEGY#3 Aroon Pullback & Trend Trading Strategy

The Aroon-Up continuous reading close to the 100 level is an indication of a very strong trend. However, at some point in time one or two trade scenarios can happen:

To expect a trend reversal

Or, to expect a pullback

The Aroon interpretation of this type of reading suggests that we’ve been forming these higher highs for a very long period of time. For Aroon-Down we would be forming lower lows.

Often times these excessive readings on the Aroon oscillator signals the presence of a strong trend. However, if you’re looking to just scalp the market, you can exit your trade as soon as the Aroon-Up crosses below the centerline.

But, we’re looking to trade with the trend.

And, we have developed a proven way to differentiate between a pullback and a full reversal.

We call it the law of effort vs. result.

The effort is the activity measured by the Aroon lines (in our case Aroon-Up). And, the result is the activity measured by the price action. The theory is that if the Aroon-UP resets itself by moving away from the 100 readings and going to 0 readings, the price should follow the lead of the Aroon-Up reading.

We would expect the effort put to translate into lower prices. If it does not, and we see only a slight change in the price, we know the uptrend is very strong.

This is how you can catch pullbacks with Aroon and trend trading.

We combined the Aroon trend strength strategy and Aroon pullback trading strategy into one big market edge.

EURUSD 4H AROON TREND STRENGTH STRATEGY#2 Aroon Trend Strength Strategy

The underlying strength of the trend can be revealed through the Aroon lines.

After we reach the 100 level sometimes we’re starting to get periods of little changes.

The Aroon UP will simply hang, kind of like reaching a plateau.

This is the same kind of activity that can be found when a traditional oscillator reaches overbought readings. And, it stays in overbought reading for a good amount of time.

The Aroon-Up continuous reading close to the 100 level is an indication of a very strong trend. However, at some point in time one or two trade scenarios can happen:

To expect a trend reversal

Or, to expect a pullback