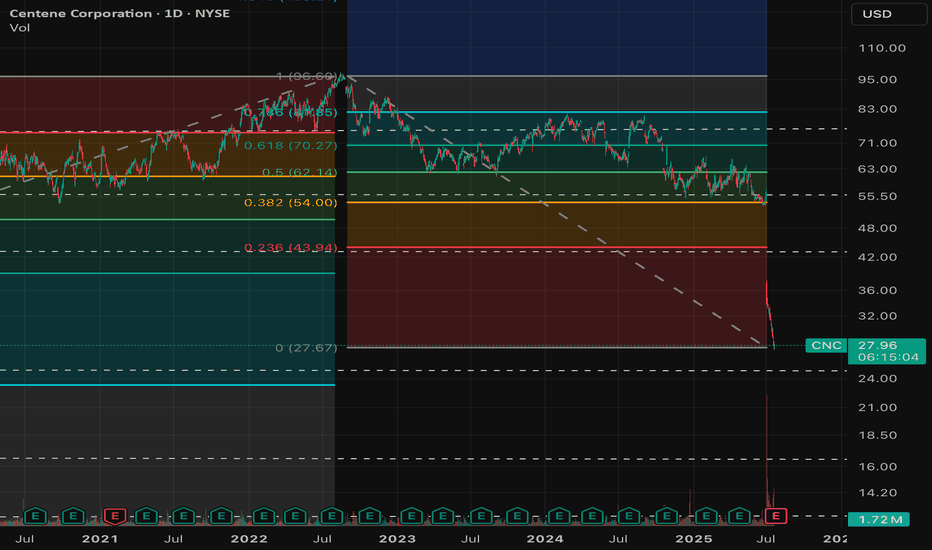

Math isn't mathing! Long $CNC for earnings- I'm taking contrarian stance on NYSE:CNC as fears are overdone.

- NYSE:CNC has cash in hand around14 billion and market cap is around 13.5 billion.

- I call bullshit on the market. Math isn't mathing.

- Company isn't going bankrupt. There are headwinds but they will navigate the headwinds and return capital to investors.

- This is not a startup coming out of no where. It has 2 decades of experience navigating difficult times than this in the past be it GFC, Dot Com crash, Covid crash or other bureaucratic hurdles.

Contrarian

Markets bottom on fearA short term relief is due in the coming days.

I will buy QQQ at the opening of the market, for a few days.

Only the fundamentals (and Trump) will decide if it will be the bottom of a correction or the first bottom of a huge market crash.

I am using here:

- The RSI(14), weekly (below 40).

- The ROC(2), daily (below 10%).

- One other personal indicator

- My personal quant strategy

Snow White's very low ratings - Bullish Disney stock ?The SnowWhite IMDB rating can't get any worse - could the same be said of Disney stock?

Price is the ultimate proof but buying the shares of a well established company when sentiment is at a low point can be a fruitful endevour.

The poor box office showing + very weak ratings for Snow White - maybe a contrarian buy signal ?

A) The stock is attempting a long term double bottom via is 2020 + 2023 lows

B) A breakout over the downtrend line (orange) could confirm a bullish trend change

Bottom of the ratings ➡️ Bottom in the stock? NYSE:DIS

NVDA SHORT to $100?After an epic run NASDAQ:NVDA appears to be testing its uptrend from April (green line), we could see a bounce but with the gaps present in the chart, I see a cheeky short to previous support around $100 (white line). RR is low, this is just an attempt to feel out this contrarian take.

TSLA's bulls trapThe last bullish move was quite strong, with the price moving above a large consolidation zone from March to April. Now, we have something that looks like a bull flag—the price is crawling slowly down, finding some support near the consolidation POC. This is a very tempting opportunity to enter a LONG position with a potential upside of 15% or more. However, it is likely to fail. Here is why:

1. The price is in a monthly/weekly downtrend. For the monthly downtrend to reverse, we need a trend change at the weekly level. So far, the bulls have NOT even managed to set a higher low on the weekly chart.

2. TSLA is much weaker than the market. While the S&P has been rallying for the last two weeks, TSLA has been declining.

3. TSLA's last earnings report was bad. Although the price rallied for a short period, it doesn't mean that the sentiment has significantly changed.

To sum it up, the context is very bearish. I wouldn't seriously consider any LONG positions at this stage.

Disclaimer

I don't give trading or investing advice, just sharing my thoughts.

Google search trend for BTCWorldwide, 90days, search trend in Google for bitcoin (red arrows). Orange arrows represent " bitcoin use case ", ie the educated investor?

It shows you the mainstream peak euphoria, enthusiasm or fear , usually at market extremes?

Highest search volume coincides with trade volume.

Other indicator for "hype" would be bitcoin hashtag in twitter/X. According to theory - during enthusiasm people would ignore the bad news or events, and only see everything as positive.

This is a contrarian style, which is often the opposite of T.A., ie strong trend can be longterm bad.

Pessimistic or skeptical sentiment is usually good (opposite of mainstream view or mood), or usually it means more money is left at sidelines.

The Contrarian Trader - Going Against The Crowd

Have you ever noticed that when you speak to other traders about the market, your view tends to be the opposite view a lot of the time? You think the market is going down when they think it is going up, and vice versa.

Going against the crowd can be looked down upon by traders, as the majority of them will question your motives or reasoning and tell you that "the trend is your friend." However, it is possible to profit in the markets by trading against the crowd, as the markets rarely go up and down in a straight line. You might just have a contrarian style and way of thinking when it comes to trading the markets, which is perfectly fine as there is more than one way to be consistently profitable trading the markets. In this post, we will delve further into this trading style.

Contrarian traders base their trading strategies on the underlying principle that the market tends to overreact at both extreme highs and lows (supply and demand). These traders see these extremes as opportunities to profit from sharp reversals that can occur when the market corrects from a recent overreaction. All markets are looking for areas of fair value; in other words, buyers and sellers are constantly vying for balance in the markets. If the price of a product has gone up too high (overbought), the demand for that product will come down, so as the demand comes down, the price comes down with it. On the other side, if the price of a product has gone down too low (oversold), the demand for that product will increase, so as the demand goes up, the price goes up with it. In both cases, the price will eventually go to an area that buyers and sellers are satisfied with (fair value), and after some time, the market will look to trend again, either to the upside or downside, and the cycle continues.

A trader taking a contrarian approach will constantly look to determine when the market has reached a level that cannot be sustained with either more buying or more selling. This is why contrarian traders are usually seen as going against the crowd, as this style goes against the current market trend.

Taking a contrarian view to trade the markets requires a very disciplined approach and precise analysis of the market to determine optimal entry and exit points for trades due to the trader trading against the current trend. Contrarians' analysis methods can come in the form of technical, fundamental, or market sentiment.

Technical Contrarian Trading

Technical contrarians typically specialise in going against current trends, not following them. Therefore, when used by a contrarian, their technical analysis tends to be employed to look for situations that are primed for a significant market reversal. These can be in the form of chart price action or technical indicators.

Price action reversal trading

Reversal traders strive to pinpoint the moments when the market will change direction; these are mostly known as 'market tops and bottoms'. These traders anticipate a reversal at these market extremes, as they tend to take the other side of the crowd's market view. Contrarian traders will often look for reversal patterns that tend to take place near market tops and bottoms; candlestick patterns such as 'morning/evening stars' and reversal chart patterns such as 'double tops/bottoms' are very popular price action confirmation signals for contrarian traders. A key benefit of these setups is that they provide great risk-to-reward opportunities for contrarians due to the fact that the trader can place their stop loss just above or below the market high or low to potentially earn multiple amounts of their risk if the trade does not get stopped out.

Double Top

Morning Star

Indicators

Contrarians might use oscillators that can help them identify overbought or oversold market situations that are due for a reversal. Oscillators operate by plotting the output of that specific indicator between two extreme values. These two extreme values are used by the trader to help predict the overbought and oversold points in the market. The Relative Strength Index (RSI) or the Stochastic Oscillator can both be used for this purpose. Moving averages and their crossovers, or a related technical indicator like the MACD, can also be used in this manner. These also provide traders with great risk-reward opportunities, as oscillators usually (but not all the time) provide overbought and oversold signals near market tops and bottoms.

RSI and Stochastic Oscillator

Fundamental Contrarian Trading

A contrarian trader that uses fundamental data in their trade analysis might use the release of major economic data to enter or exit a position. This can be a country's central bank interest rate decision or a country's gross domestic product (GDP) reading as a contrarian indicator. An example of this would be that instead of entering a long position in a product after an interest rate hike, the contrarian might wait for the release of the data and then sell the product once it has reached a certain overbought level in response to the favourable news. They would do this in anticipation of the market buyers exiting their long positions to profit-take as the upside momentum starts to fade and the profit-taking activity sets in. The same goes with a negative data reading; instead of entering a short position with the crowd after the negative reading, a contrarian trader might wait for the release of the data and then enter a buy position once the product has reached a certain oversold level in response to the unfavourable news. They would do this in anticipation of the market sellers exiting their short positions to profit-take as the downside momentum starts to fade and the profit-taking activity sets in.

US Dollar Index: US Pending Home Sales for June 2023

Market Sentiment: Contrarian Trading

Contrarians use this to assess the overall mood or sentiment of market participants. This is particularly crucial to contrarian traders when it is overwhelmingly positive or negative, as these could indicate an impending market reversal. Famous contrarian trader and investor Warren Buffet has a saying: "Be fearful when others are greedy, and greedy when others are fearful." When you hear this quote, you can't help but question if he has a point, as on average, around 75–80% of traders are unprofitable. Monitoring the crowd’s mood or sentiment gives the contrarian the insight and resolve needed to determine an ideal entry point for initiating a trading position. The psychology behind the crowd’s position is also very important, since excessive optimism in a rising market or constant pessimism in a falling market are well-recognised signs of incoming market reversals that a contrarian trader looks for.

Psychology plays a key role in all markets because supply and demand factors reflect the different opinions of participants in the market. In practice, applying the contrarian theory means looking for situations characterised by very one-sided or "crowded" market psychology. This allows smart money to call market reversals ahead of the actual countertrend market movement occurring, and contrarians typically set up their trading plans to reflect this understanding.

Risks and Challenges of Contrarian Trading

Contrarian trading carries significant risk. A market that continues trending in one direction longer than a contrarian trader anticipates, potentially leading to severe losses. Effective risk management is paramount in contrarian trading. Traders should use strict stop-loss orders to limit potential losses and take-profit orders to secure profits when the price moves in the desired direction. This makes accurately predicting market reversals quite challenging, and contrarians can get severely burned trying to pick tops and bottoms, especially in aggressive bull or bear market runs. While technical analysis tools can offer valuable insights, they are imperfect and should be used with other forms of analysis. Additionally, contrarian trading often requires a great deal of patience, as the market may take time to correct and profitable opportunities may not present themselves immediately.

Bitcoin's Bull Market Run 2021

Contrarian trading may not be suitable for all traders. It requires a high level of expertise and very quick thinking under stressful conditions, along with the fortitude not to get influenced or pressured by other traders. A trader that is limited by these requirements and trades this way will have very inconsistent results that will leave the trader feeling guilty about losing money due to trading against the market and will most likely quit due to the frustration from these losses.

Contrarian trading is a strategy that can be highly profitable if used correctly. However, it is important for traders to approach this strategy with caution and a clear understanding of its risks and limitations, and most importantly, to understand that the market must be respected; otherwise, it will humble you very quickly. Correctly identifying potential opportunities to take contrarian positions takes dedicated planning in setting entry and exit points and managing risk correctly. If all this is done consistently, traders can increase their chances of being profitable by trading this way.

BluetonaFX

GOLD 16/05 : Nice sell entryTVC:GOLD Gold prices push the lower line of a two-month-old bullish channel as XAU/USD traders brace for key US Retail Sales and debt ceiling negotiations among US policymakers.

However, the 200 SMA adds strength to the $2000 support, making it key for the XAU/USD bears to break before taking control.

Even if Gold prices drop below 2003$, the 2,000$ round figure could act as an additional filter south before heading XAU/USD towards mid-April lows around 1,975$ .

On the downside, a two-week-old descending resistance line, around 2,025$ at press time, protects the Gold price rally in the short term.

Following that, the previous monthly high near 2,050$ could test XAU/USD's upside momentum before directing the bulls to the recent record high near 2,085$.

It is worth noting that the top line of the stated bullish channel, near 2,095$ at the latest, stands ahead of a round figure of 2,100$ to challenge the subsequent Gold buyers.

Overall, Gold price is likely to move higher unless it sustains a breakout of 2,000$.

SELL GOLD zone 2024 - 2029

Stoploss: 2034

Take profit 1: 2019

Take profit 2: 2014

Take profit 3: 2009

Long 🤔 or Short 🤡Its funny seeing everyone posting about how ETH is about to fall off the face of the earth because of THEIR analysis... Well MY analysis is that shorts get wrecked and we go to 1500 and beyond. (From green zone) 😎

Mainly fundamentals at play here with Eth being more of a safe haven while USDC crumbles before our eyes, along with a contrarian outlook that every Joe and his Grandma are starting to short ETH so the market will take back from them little retailers shortly like every market does. Lots of FUD around at the moment and its at times like this I am happy to be a long term spot holder over options.

DCA is your best friend on dips! I honestly can not see this going to 700, outrageous! Nor am I concerned about a decline as I love a fire sale! (I personally think we will close above 1550 by April 1st (Filling the gap in liquidity if you just look left))

What's your thoughts? Do you agree or not? Leave a comment and discuss!

Great shorting entry point on SPX as it hits resistanceOn today's CPI report, inflation rose 0.5% in January, which was higher than expected (according to CNBC ), yet the market rallied.

With this rally, the market is hitting a supply zone, which was the swing high for two of the most recent swings. In the shorter term, it has also been seen that the recent rally has been rejected twice at the bottom of this supply zone, which corresponds with the 0.236 Fibonacci level, showing strong resistance. Furthermore, SPX is hitting its 300-day SMA, adding further resistance. Back in 2008 when $SPX approached its 300-day SMA after the first part of the fall, a 50% drop in the S&P 500 followed over the next year.

To trade this, I have entered a short position.

Disclaimer:

This is not financial advice, I have never worked professionally in finance in any capacity.

KBE Banking Sector ETF Long Swing LongKBE is in the middle of a beatdown with two of the biggest bank failures in history this week.

The share price action is reflecting overall distribution. The moving averages ( SMA 100 and SMA 200) are

parellel and not crossing. Today, the price action had a little pullback on the drop and perhaps an

early sign of reversal or at least the end of the trend into a consolidation. Price action today

is a symmetrical triangle at the POC line suggesting some dynamic stability and perhaps a pause

awaiting a reversal.

My idea is to buy weaknesses and later sell some new strengths ( or at least the weakness fixed).

Dip buying ( pull backs on the big picture) has risks associated with the rewards.

This would be with shares on the way down ( or a call option ) getting cheaper and cheaper buyers

and then start selling once shares are 10% above the cost and calls 25% above their cost once

the reversal is trending. ( Another idea is to buy a given dollar amount of shares and then 5%

as much dollar amount in put options two strikes above current price with DTE 3/24) as a

hedge ( insurance on risk).

Wait... What! but Why???What's going on here?

Probably nothing

Everything is just fine...

Zero-sum game

15b vs 300m

David vs Goliath

Follow the money...

I have 0 clue what's going on! that's pure abstract imagination! Do your own research!

Look First/ Then Leap

1+1 = ?Are you all gone?

I am still here...

Summer 21 retail bought high because wish was going to the moon with 0 justification and stock +100% in 2 days with zack morris pump.

February 23 retail sold low because wish was a dead company due to earnings and stock went -50% in couple of days from the citron pump.

I am curious if smart money sold high and bought low...

This is either a scam and the company is going to ZERO or a trick and the company will be a hero!

Do your own research

Look First / Then Leap

US Market Sentiment: Risk ModelGeneral Market Update

Stock market uptrend continues to show strength and shrugged off Big Tech losses.

The stock market made a show of strength by surging despite disappointing Big Tech earnings reports. But it is still too early for investors to be getting excited, with another Federal Reserve meeting rapidly approaching.

The Nasdaq composite turned in a 2.9% gain for the day and is on track to end October with a 5% gain. It still sits 1.9% under the key 50-day moving average, a key resistance area to watch.

The S&P 500 turned in a 2.5% gain for the day. Using the SPDR S&P 500 ETF (SPY) as a proxy, it is up 8.9% for the month with one more session left in October. The index has made a move above its 50-day line, an encouraging sign.

Breadth was also positive, with advancers outnumbering decliners by about 3-to-1 on the NYSE and by more than 2-to-1 on the Nasdaq. Volume fell on the Nasdaq, and early data showed lower NYSE volume.

Blue-chip stocks also excelled, with the Dow Jones Industrial Average popping 2.6%. Its 14.4% gain so far for October is on track for its best since January 1976. t closed above the 200-day line for first time since Aug. 1

However : The coming week will be crucial, with speculation rising that the Federal Reserve may be considering slowing the pace of rate hikes. Investors should remain wary until this meeting is behind us.

Update Risk Model:

Several technical indicators significantly improved their reading in course of last weeks' trading sessions. The following critical indicators are now showing green light:

- New 52w Highs / Lows

- Stocks above / below their 200d MA

- Up/Down volume

- Advance/Decline-Line

Additionally, key psychological / contrarian indicators still showing reading which could suggest that we have reached the bottom already, or are at least close to that. Margin debt is negative which means there is a lot of buying power in the market to push individual stocks much higher. Also, we still habe a very bearish sentiment which is very good considering this being a contrarian indicator - exactly when most investors give up and make more and more bearish comments, the bottom of a correction / bear market might be very close.

Remember, there will be another FED announcement next week. At the very least, we have to expect increased volatility.

Swing-Traders should be invested by 30-50% by now but only further increase exposure on the back of gains in their own portfolio.

While the risk model has significantly improved, we are not out of the woods yet. Stay cautious and remain disciplined!

Long GEO Group niche REIT - cool ticker, book valueThe cliche about prison life is that I am actually integrated into it, ruined by it,

when my accommodation to it is so overwhelming that I can no longer stand or even imagine freedom, life outside prison, so that my release brings about a total psychic breakdown, or at least gives rise to a longing for the lost safety of prison life.

The actual dialectic of prison life, however, is somewhat more refined. Prison in effect destroys me, attains a total hold over me, precisely when I do not fully consent to the fact that I am in prison but maintain a kind of inner distance towards it,

stick to the illusion that "real life is elsewhere" and indulge all the time in daydreaming about life outside, about nice things that are waiting for me after my release or escape.

I thereby get caught in the vicious cycle of fantasy, so that when, eventually, I am released, the grotesque discord between fantasy and reality breaks me down.

The only true solution is therefore fully to accept the rules of prison life and then,

within the universe governed by these rules, to work out a way to beat them.

In short, inner distance and daydreaming about Life Elsewhere in effect enchain me to prison, whereas full acceptance of the fact that I am really there, bound by prison rules, opens up a space for true hope.

if there ever was such a thing as no-brainer easy money

this is it.

Republican sweep up in the November Primary is what the market will begin to front-run this summer

targets are potentially conservative.

Real Estate and Construction costs are already massively inflated, the market has not yet revalued the enterprises like GEO Group

short squeeze can happen here if the retail cohort swarms it

9 weeks rally and then what? Similar pattern to 08, everyone talking about repeating the same pattern, even the news about banks defaulting are the same, and even the hero of 08 is the same Dr . Burry.

Move to 100ma and then back to 200ma? and then everyone sees it and goes short? yea......

I am contrarian here if everybody sees it and talks about it I would rather do the opposite.

Do your own research, all of the above is out of my imagination, please trust no one's opinion.

Look first/ Then leap

Total Contrarian Trade/SetupAs much as I believe in "Don't Fight The Fed", I'm starting to think the bottom for the US markets (Technology/SPY/QQQ) may be much closer than some people think.

My cycle research suggests a 2022.5 cycle pattern (late in the second half of 2022) is highly likely. Have we seen that yet? Maybe. Maybe it is the recent bottom in June 2022 and the change of direction (higher) after that bottom.

Here are some of the KEY CYCLE PATTERNS that catch my attention.

9-27~10-8 : Harami, CRUSH, Gap, Top, Consolidation, Temp Bottom, Gap Reversal, Breakdown, Breakaway, Rally, Carryover, Bottom

10-11~10-25: Inside/Breakaway, Harami, CRUSH, GAP, Gap Reversal, Breakdown, Breakaway, Carryover, Temp Bottom, Top/Resistance, Consolidation, CRUSH, GAP, BIG GAP

These patterns, and the fact that I'm seeing some strength in the consumer sector, align with a potential Elliot Wave setup that suggests we may see some extreme volatility as we shift into a moderate Christmas Rally Phase.

It all depends on HOW DEEP (if anything) we see the markets move after the Fed rate decision. If the markets fall back into bullish trending and attempt to move away from lower support levels, then there is a very solid chance we may see an extended Bullish price trend starting a new Christmas Rally phase - possibly lasting into Q1:2023.

The CRUSH patterns are the only thing that concerns me. These are typically very aggressive downward price moves - but can sometimes represent pullbacks in an uptrend. I've seen them happen in very strong uptrends and I'm thinking capital may be shifting away from the same risks that were in the markets in late 2021. We've seen technology and other sectors fall 45% to 76% in some cases.

The contrarian trade (bullish if support holds) may be a very low risk trade right now.

The Dow could appeal to bullish (or contrarian) swing traders Price action on the DJI (Dow Jones Industrial) and several other markets have flagged the potential for a contrarian setup (favourble for bulls).

The Dow Jones has seen a relatively deep pullback against the rally from the June low, and there has been two false breaks of trend support over the past two sessions. Furthermore, a bullish engulfing candle formed yesterday which shows demand just above 3100. The stochastic oscillator is also oversold, although yet to general a traditional 'buy signal' by crossing bac above 30. But given we saw USD/CNH stall just below 7.000 and 145 reverse after tapping 145 suggests we may have reached an important inflection point in sentiment (at least over the near-term).

If we want to think bigger and bolder, wave 2's tend to be the deepest - and bullish rallies generally begin during times of uncertainty. Against that backdrop the Dow Jones (and US indices in general) become contrarian candidates for bulls.

Here's two ways to look at this, depending on anticipated hold time.

1 - For near-term longs: We'd like to see prices hold above yesterday's low and continue higher towards 3200 - 3250, before reassessing its upside potential. This approach requires a tighter stop and we're looking for a momentum / swing trade higher (sooner than later).

2 - For a 'longer-term' bullish setups: Perhaps the low is not yet but it is close. Instead, we see a volatile shakeout around current levels before a bullish move unfolds. In which case we'd want prices to remain above the 30,500 area (near a bullish engulfing candle from July) with a view for it to eventually break above the March high. This scenario allows for a wider stop and requires more patience.

As we saw after the DAX reached out bearish target, prices have failed to reach new lows and have now turned higher. And if we consider how bad things are in Europe and the DAX is rising, perhaps we have reached that phase of the cycle where a countertrend move for global indices are the path of least resistance.