3 month H&S completed in home depot; expect a sharp move in decYou can watch this in conjunction with my Lowe's trade posted below. Essentially they're a play on the same industry and overall market crash in dec; (they're price is strongly correlated to the general market). Choose whichever one works better for your risk management.

Like always, thanks for the constructive feedback

Contrarian

Power of Investing lies in your Individual Method Everything can be thought. But not everything can be learnt. Developing a risky instinct in investing is not something you learn. It’s something you are born with. Then you are given the power to share it. Agree? Probably not. It’s understandable. I went into stock trading not because I dig and sturdy deeply into companies’ financial and books at first hand, or mastering the art of options trading, rather I went into it simply because of self possessed gift of intuition to make risky calls that contradicts the majority, which often turn out favorably.

Investing is a game, not a gamble.

Contrary to the general method of investing, I buy a stock based on instinct then I start digging further in its books and financials to justify the instinctive decisions. Yes, I often lose. But yes, I often gain more. The reward comes from balances and checks that falls in favor of more profits at the end of the day. Take an example, on a 3 day stretch Oct 25th-28th, we all witnessed over 95% of stocks thrown downwards to a darkening red (nearing all time lows). Meanwhile, calls on Ford, GE, and Kodak (I made back in July when the market downgraded them to “Strong Sell”) kept a shiny bright green of blocks (upwards momentum). Now that was some risky calls that paid off.

So it begs to ask… What exactly is the rule in stock investing for winning profits? Are there standardized rules to follow? And are these rules created by the 10% of winners, and gets passed down for the mass to follow?

There’s the old saying: Read all that works, but never follow them, there’s a reason it only works for the less than 10%. (OK I made that up, but its true).

The power of investing lies in your individual method... not the market (standards).

Is the top behind us ? Has the downtrend begun ? I think so Key concepts I talked about in this video are outlined below. I wish I could cover more concepts and go into more detail but had a 20min time limit for the video. Maybe I could make a part 2.

- false breakouts

- global indices showing topping patterns and breaking down

- FED balance sheet peaked in june 2020

- parabolic mania in tech stocks

- PUT/ CALL ratio reflecting extreme complacency

- 2nd wave of lockdowns and layoffs due to the virus

Calling the top in the shipping industry (UPS, FedEx, STMP) In this video I've shown 3 independent forms of technical analysis that make a strong case that the top is already in for these 3 stocks ! In general, I'm bearish the overall market so wouldn't be surprised to see these correct significantly.

Let me know what you guys think ! Always open to comments and critiques.

Volatility decreased, but price hasn't responded.Chainlink crypto (LINKUSD) 3 hour timeframe volatility as measured by williams VIX Fix Indicator has decreased which would normally indicate higher prices. however price has remained below green horizontal line. Expecting price to rally in short term at least to above green line.

Is Tesla overvalued ?Hello Traders,

I am back from holidays and a lot of action happened during the past month.

The SP 500 Future did hold the 3000 and broke above the 3150 to make a fresh high at 3290.

Dollar weakened due to the colossal amount of money printed by the FED and as a consequences pushed the GOLD to an All time high (Around 1950$).

So inflation is most likely to eat the value of your dollar and smart people are looking at the stock market as a way to protect their wealth.

Tech is profiting big time from this strategy and an outsider is also taking advantage of this fear, tech heaven oriented market aka TESLA . NASDAQ:TSLA

Tesla which is directed by Elon Musk who is seen as a modern hero is profiting from a big inflow of cash which in my opinion is due to several factors.

Fundamentally :

Pros:

1.Tesla is revolutionary in this way of making car as they aim for Powerfull electric driverless cars .

2.Demand for green and sustainable product are increasing after the Covid19 crisis, consciousness in the mass has apparently shifted for a greener economy..

3.Tesla is considered as a tech company even though they produce car, so they are also profiting from the flight to tech observed since march.

4.After the last earnings, it's seem that Tesla meets the requirements to be included in the SP500 Index and will profit of massive flow from ETFs.

Cons:

1.Tesla is barely profitable (Earning Per Share) is 1.14$ vs 1500$ Share Price .. (Source Investopedia)

2. Sells declined this year and might continue to do so if the real economy doesn't pick up

3. Valuation is way too big compared to the other big player in the sector as they are massively invested in EVs and will continue to do so.

4. Trade War with China could slow down the access to the Chinese market which is a huge factors in Tesla's future profitability in my opinion as China need more than anyone else this type of vehicules.

5.Classic Long/short market neutral Strategy becomes attractive to hedge fund to short Tesla and Buy all the others auto companies

6. SP 500 inclusion will take time

Technically :

1.Tesla return of 542.6% over the last 12 months, more than 60 times greater than the S&P 500's total return of 8.9%. All figures are as of July 20, 2020. (Source Investopedia)

2. Tech stocks are in overvalued and Tesla could come down if techs enters in correction or sector rotation.

Levels :

The stock holds on a daily support at 1374 $ and helped by the 20 days MA

On a weekly basis the stock is overextended and we could see a consolidation or even a sharp sell off to 1000 $

On a monthly chart a correction on the 650/700$ could be healthy which would be in line with others automakers market cap but still on top.

Always risk management according to the Trade probability

Speculative Contrarian Trade Idea :

if breakdown Short below 1374$

Stop 1500$ (Above the break)

Target 1000$ (Weekly Support)

Invalidation of the scenario would a break above the al time high (1800$) with the support of the SP500 and Nasdaq 100,

Thanks for reading,

Like if you like and/or leave a comment below to share new ideas,

Peace,

Lower oil prices in mid term will benefit trucking companies.TFI International is North American transportation and logistics leader, partnering with a diverse group of customers in the US, Canada and Mexico. The stock, TFII now trades in New York (as well as Toronto). Fuel is a large component of cost structure. I'm accumulating on down days in the market.

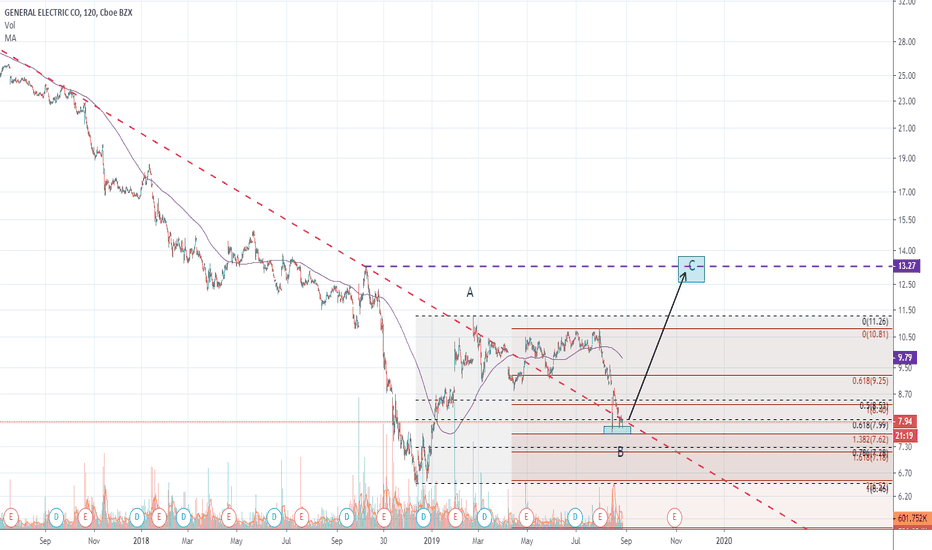

General Electric - contrarian buy?NYSE:GE is not the stock you probably want to own given all the heat experienced by the company recently.

But from contrarian perspective, nice levels right now to attempt speculative buy. Price retraced by 61.8% of previous bounce and is holding the line of previous resistance. Today may be the third daily candle when 7.8 is held, indicating that good support zone might be formed at around current levels.

Trade: stop at 6.39 (previous low), target at ~13$

Fertilizer Stocks look ready to bottom and Nutrien best pick.The promise of better weather this growing season (Farmer's Almanac) than terrible 2019, Locusts in Africa destroying crops and possible higher demand in China for agricultural products should improve sales for nutrients. Canada has the 2nd largest reserves of Potash in the world, and is the leader in terms of global production. One advantage for the price of potassium chloride is the fact that more than one producer has curtailed production of late. Low natural gas prices an advantage for Nutrien in Canada when it comes to Nitrogen fertilizer. They also have large retail network worldwide. At a P/E of 16X trailing earnings, a 4% dividend yield and substantial free cash flow, the stock seems good value here.

$DXY rumors of death greatly exaggeratedEveryone's talking about a weaker dollar, but I don't think we're there yet. Only a break of 95.80 would confirm. Have taken a fairly tight stop, although the full stop to, say, 95.50 would still be an acceptable trade.

In fundamentals, there is no particular reason that EUR should go up, which is 57.6% of DXY.

Contrarian trade

BUY 96.80 (Market)

SL 96.20

TP 100.00

RR 5.3

Want some ETH for 45 bucks?Want some ETH for 45 bucks? Well, this could be your lucky year. Blood is going to flow on the streets and the ones' that are prepared are going to bate in it. What we are about to see in the following months is fear and greed gripping the minds of everyone in this crypto world, everyone that has remained oblivious to the true nature of this market that is. ETH could possibly retrace back to 228$ before the big fall. The count gives a technical opportunity that is usually realized by manipulation, but nonetheless the count usually comes true. I personally believe that BTC dominance is going to retrace a little bit, giving the major altcoins the opportunity to "stretch their legs". After that false hope, there is going to be a massacre, pure and simple. Subscribe for this channel and prepare your popcorn, because the following months are going to be remembered in history as some of the most outrageous and painful for bulls.

Trapping Breakout and Retracement TradersThis is by no means to be anti-breakout/anti-retracement. I find these entry methods as a valid entry method. As valid as it is, the triggers for such entry method are mostly obvious hence easily to be taken advantage of by the institutional traders.

For breakout traders, how these banks would trap is the normal fake breakouts. We all know this as it is a guarantee that it is part of a retail trader, to be the receiving end of this stop hunt. Even if the breakout turns out to be the start of a trend, the institution would tap into the breakout traders stop-loss first (if there is not enough liquidity) before the move continues away from the breakout level.

For retracement traders (who prefers the price to retrace first upon the breakout before entry) are not safe with this stop hunt as well. Whatever triggers it was, the stop loss for this traders tends to reside the recent highs or lows of the underlying move. In this example, let's assume the trigger was a bearish engulfing candle. The stop loss would normally be a few pips above the high of the candle.

This is just my personal preference with all due respect for those who trades breakouts and retracements (and I am sure some of you made tons of profits trading this way, I just can't make it work and I never able to be comfortable with it, for these reasons I tend to fade breakouts and avoid "retracement" and "continuation" trade triggers respectively.

Read my other posts on that has titles like "Navigating the Market" and other educational posts which I share how I navigate the market to eliminate the noise and finding the optimal time to trade.

Trade the Other Side of RetailSpotting where the buy stops and sell stops (which the institutional traders would look for and eventually consume it) is not that difficult. All you need is to think "when I was a newbie trader, where would I put my stops based on xyz method"

The most common stop losses that is easy to spot are ones for reversal traders (using reversal candlestick pattern such as the bearish engulfing candle for a short signal) and retracement traders (and MA crossover traders)

You can refer to the chart what I am talking about.

Once you determine the potential stops, then that becomes your own discovered liquidity pool. It will come very handy for your own entry points, bias setting or simply knowing which levels to avoid to put your stops. Remember, institutional traders have BIG positions to make and with big positions you need liquidity so there will be no slippage when they make their market order

(i.e Bank Trader in Canada wants to buy 500 million units AUD at 0.90600 but not enough supply/sellers at that price, so to avoid being filled at much more expensive price (slippage), then he wait and/or manipulate the price where there are enough sellers for him to buy the AUD that is at a better price than 0.90600.

Liquidity Pool is the area where the Bank Trader in Canada would look to buy the AUD and where that liquidity pool would be? Where there are a lot of stops. 0.89800 resides a lot of stops that would be enough for the 500 million order to be filled without slippage (This is just an oversimplification, sometimes Banks would split their orders)

Using my own personal market navigational method, I draw Friday High and Low, and see where the price would close above/below.

If price breaks above Friday low, I would see if it could breaks above the blue line where the bank would take out all the stops around 0.90400-0.90800 (the higher the better) there and then perhaps push the price down after that.

If price breaks below Friday low, I would see if it could break the stops around 0.89800-0.89600 (the deeper the better) and then I would be looking for a bullish trigger to long AUDCAD

Ford - time to buy?Contrarian buy in NYSE:F looks relatively attractive. We continue to see some very nice MACD divergence on daily and price has already retraced by 50% of the move up in early 2019. Today's bullish engulfing candle (if formed) might indicate first sign that the bottom is in.

Trade is to buy at current levels, with stop at around 7.4$ and target of around 11.5-12$. Stop is likely to be moved higher, if more evidence is received that the bottom is in.

$GME Has Gaps To Fill and Room To RunMichael Burry, whose prescient bet against subprime mortgages before the financial crisis was depicted in the book and movie The Big Short, is making another contrarian call: going long shares of GameStop.

We believe the low of $3.15 will hold and can go long off a stop just below.

As always, trade with caution and use protective stops.

Good luck to all!

Could Bitcoin double-top at ATH ($20k) end of THIS month?!Hi everyone,

Welcome to another unpopular idea on Bitcoin.

ATH end of this month?!

I present it because I don't see anyone offering it as a possibility.

Could Bitcoins current parabolic rise since beginning of the year be mimicking almost exactly the parabola of the 2nd half of 2017?

We present the 2019 parabola as an exact replica of the 2017 parabola.

If price action rhymes and day range of parabola too, Bitcoin could hit $20,000 end of August 2019 or early September. Yep, that's end of THIS month.

How likely is this scenario? Not much. But then again, our job is to offer all possibiilities. And since everyone seems to be talking about a relatively boring sideways action re-accumulation phase for a few months, this idea then becomes juicy as a contrarian - not thinking the same as all analysts.

This is not financial advice - just an idea :)

Cheers,

Leb Crypto