Bearish drop?COPPER is reacting off the resistance level which is an overlap resistance that lines up with the 23.6% Fibonacci retracement and could drop from this level to our take profit.

Entry: 5.0325

Why we like it:

There is an overlap resistance level that aligns with the 23.6% Fibonacci retracement.

Stop loss: 5.1220

Why we lik eit:

There is a pullback resistance levle that line sup with the 50% Fibonacci retracement.

Take profit: 4.8933

Why we like it:

There is a pullback support level that is slightly above the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Copper

Copper Preparing up for a BIG MoveCAPITALCOM:COPPER Weekly Chart Analysis 📈

Current Price: $5.05(-1.43%)

🎯 Key Levels:

Support Levels: $5.00 (Major), $4.92 (Next support)

Resistance Levels: $5.50 (Next major target)

📊 Trend & Market Structure

Breakout Confirmed: Price has broken above previous resistance (~$5.00) and is sustaining.

Retest in Progress: Currently testing support at $5.00-$4.92.

💡Trade Plan 📝

Bullish Setup (Buy on Retest) ✅

Entry: $5.00 - $4.92 (Support retest)

Stop-Loss: $4.85 (Below support break)

Target: $5.50 and $6.50

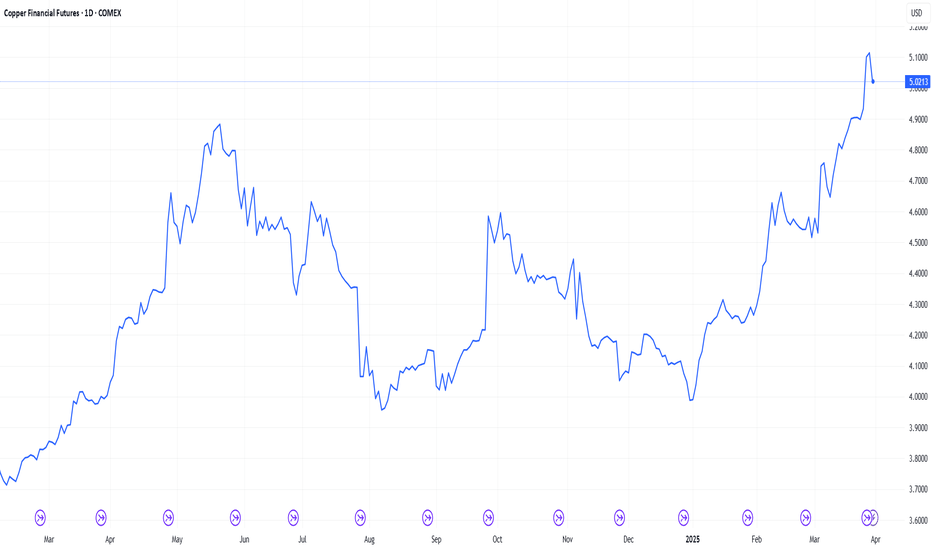

Copper is red hot right now. Here’s whyCopper’s COMEX price hit a new high on 26th March making the red metal red hot right now. The first three months of 2025 have seen industrial metals make noticeable gains with the Bloomberg Industrial Metals Subindex up 10.55% year to date1. Copper’s gains, however, stand out for numerous reasons.

Tariffs

The additional premium of COMEX prices over the London Metal Exchange (LME) prices reflects aggressive buying by US traders importing copper in anticipation of a possible 25% tariff on copper imports. This speculation has been fuelled by President Trump last month ordering a probe into the threat to national security from the imports of copper. As aluminium imports were also recently subjected to tariffs, markets are speculating that copper might be next.

This rush has triggered a shift in global flows, with metal moving out of LME warehouses and into US Comex facilities, where copper is held on a “duty paid” basis to avoid future levies. As traders front-run potential policy changes, this behaviour is tightening global supply and fuelling price gains, adding to a market already under pressure from rising demand and a looming supply squeeze.

Demand

China has given an additional boost to copper prices having announced a new action plan to boost domestic consumption by raising household incomes. The stimulus is seen as a positive signal for copper demand, especially as retail sales have already shown stronger-than-expected growth early in the year. China has also set itself a GDP growth target of 5% for 2025, and so far this year, its manufacturing Purchasing Managers' Index (PMI) has remained in expansionary territory — a sign that the economy is holding steady. With momentum building across consumption and manufacturing, copper is getting a fresh tailwind despite lingering weakness in the property sector.

Further support for industrial metals, including copper, has come from Germany’s recently unveiled €1 trillion infrastructure and defence spending plan — a move that will inevitably drive greater demand for base metals.

Supply

Supply tightness in the copper market is being driven by several structural and emerging challenges. Exceptionally low processing fees—caused by an oversupply of smelting capacity, particularly in China—have placed financial strain on global smelters, prompting companies like Glencore to halt operations at its facility in the Philippines. Looking ahead, Indonesia’s proposal to shift from a flat 5% copper mining royalty to a progressive rate of 10–17% risks discouraging future production growth. These supply-side pressures come as the International Copper Study Group reported a slight global copper deficit in January 2025. While a similar shortfall at the start of 2024 eventually turned into a surplus, this time the combination of weakening smelting economics, policy headwinds, and solid demand could make the current deficit more persistent and impactful.

Several major copper miners have recently downgraded their production estimates for 2025, adding further pressure to an already tight market. Glencore suspended output at its Altonorte smelter in Chile2, while Freeport-McMoRan delayed refined copper sales from its Manyar smelter in Indonesia due to a fire3. Anglo American expects lower output from its Chilean operations amid maintenance and water challenges, and First Quantum Minerals faces reduced grades and scheduled downtime4. These disruptions are likely to tighten global copper concentrate supply, potentially widening the market’s supply-demand imbalance just as demand continues to strengthen.

Sources:

1 Source: Bloomberg, based on total return index as of 28 March 2025.

2 Reuters, March 26, 2025

3 Reuters, October 16, 2024

4 Metal.com. February 14, 2025

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Copper Set to Rally: Bullish Setup with Massive Upside PotentialCopper is holding firmly at a key support level and poised for a potential breakout. The combination of bullish macroeconomic factors and tightening supply suggests significant upside potential.

China’s Growth Push:

Chinese leaders are targeting 5% annual growth in 2025, with plans to boost domestic consumption and infrastructure spending, key drivers of copper demand.

Robust Demand Drivers:

Industries like EVs, power grids, and air conditioning continue to drive structural demand for copper, aligning with the global shift toward electrification and renewable energy.

Supply Challenges:

Multi-month low inventories in Shanghai warehouses signal tight supply conditions.

Peru’s flat output and Chinese smelter profitability issues add further pressure to global supply.

With these factors converging, copper prices are primed for a bullish move from current levels.

Trade Setup

TP1: $4.3498

TP2: $4.6347

TP3: $5.000

Stop Loss: $3.8622

This trade setup offers an excellent risk-to-reward ratio, with tightening supply and robust demand creating a solid foundation for bullish momentum.

Copper's Grip: Stronger Than Oil's?Is the U.S. economy poised for a red metal revolution? The escalating demand for copper, fueled by the global transition to clean energy, the proliferation of electric vehicles, and the modernization of critical infrastructure, suggests a shifting economic landscape where copper's significance may soon eclipse oil. This vital metal, essential for everything from renewable power systems to advanced electronics, is becoming increasingly central to U.S. economic prosperity. Its unique properties and expanding applications in high-growth sectors position it as a linchpin for future development, potentially rendering it more crucial than traditional energy sources in the years to come. This sentiment is echoed by recent market activity, with copper prices hitting a new record high, reaching $5.3740 per lb. on the COMEX. This surge has widened the price gap between New York and London to approximately $1,700 a tonne, signaling strong U.S. demand.

However, this burgeoning importance faces a looming threat: the potential imposition of U.S. tariffs on copper imports. Framed under the guise of national security concerns, these tariffs could trigger significant economic repercussions. By increasing the cost of imported copper, a vital component for numerous domestic industries, tariffs risk inflating production costs, raising consumer prices, and straining international trade relationships. The anticipation of these tariffs has already caused market volatility, with major traders at a Financial Times commodities summit in Switzerland predicting copper could reach $12,000 a tonne this year. Kostas Bintas from Mercuria noted the current "tightness" in the copper market due to substantial imports heading to the U.S. in anticipation of tariffs, which some analysts expect sooner than previously anticipated.

Ultimately, the future trajectory of the U.S. economy will be heavily influenced by the availability and affordability of copper. Current market trends reveal surging prices driven by robust global demand and constrained supply, a situation that could be further exacerbated by trade barriers. Traders are also anticipating increased industrial demand as major economies like the U.S. and EU upgrade their electricity grids, further supporting the bullish outlook. Aline Carnizelo of Frontier Commodities is among the experts forecasting a $12,000 price target. However, Graeme Train from Trafigura cautioned that the global economy remains "a little fragile," highlighting potential risks to sustained high demand. As the world continues its march towards electrification and technological advancement, copper's role will only intensify. Whether the U.S. navigates this new era with policies that ensure a smooth and cost-effective supply of this essential metal or whether protectionist measures inadvertently hinder progress remains a critical question for the nation's economic future.

Copper Bounce? $HG1! at Key Demand Zone!Back at a strong demand level on COMEX:HG1! (Copper futures). The key invalidation is a 4-hour close below 3.92, so I'll be watching closely to manually close.

I'm looking for a potential bounce from here, and if the weekly candle closes bullish, I may consider this a reversal setup. The confluence between the weekly support and the current demand zone gives me confidence to take the trade.

If the move fails, my next level to watch is 3.7 for another potential entry.

Let’s see if COMEX:HG1! behaves this time.

XCU/USD "The Copper" Metals Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XCU/USD "The Copper" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (9500) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 10050 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook:

XCU/USD "The Copper" Metals Market is currently experiencing a bullish trend,., driven by several key factors.

⭐Fundamental Analysis⭐

Overview: Fundamental analysis of XCU/USD involves evaluating the intrinsic value of copper based on economic, industrial, and external influences. At $9.70/lb, copper is at an unusually high level, suggesting strong demand, supply constraints, or external pressures.

Economic Growth: Copper is a key industrial metal tied to global GDP growth, particularly in manufacturing, construction, and electrification (e.g., EVs, renewable energy). A price of $9.70 could reflect robust economic expansion, especially in emerging markets like China and India.

Inflation and Currency: High inflation in 2025 could weaken the USD, pushing commodity prices like copper higher. Alternatively, a strong USD might temper this rise unless offset by other factors.

Industrial Demand: Increased demand from green energy (e.g., solar, wind, EVs) and infrastructure projects could justify this price.

Supply Constraints: Disruptions in major copper-producing countries (e.g., Chile, Peru) or reduced mining output could tighten supply, driving prices up.

⭐Macroeconomic Factors⭐

Interest Rates: If the Federal Reserve maintains high rates in 2025 to combat lingering inflation, this could strengthen the USD, typically pressuring commodity prices downward. However, at $9.70, demand might outweigh this effect.

Global Growth: Strong GDP growth in China (a top copper consumer) or a global infrastructure boom (e.g., post-2024 recovery) could support high prices. Conversely, a recession would cap upside potential.

Inflation: Persistent inflation in 2025 could make copper a hedge, boosting prices. A cooling inflation trend might signal a peak.

USD Strength: A weaker USD (e.g., due to Fed rate cuts) would naturally lift XCU/USD, while a stronger USD could challenge the $9.70 level unless supply/demand dynamics dominate.

⭐Geopolitical Factors⭐

Trade Policies: Escalating U.S.-China tensions or tariffs in 2025 could disrupt copper flows, raising prices if China stockpiles or seeks alternative suppliers.

Regional Instability: Political unrest in copper-rich regions like Peru or Chile (e.g., protests, strikes) could reduce output, supporting high prices. For instance, Peru’s flat production trends (noted in prior data) might persist.

Sanctions/War: Geopolitical events, such as sanctions on Russia (a minor copper player) or conflicts affecting shipping routes (e.g., Red Sea disruptions), could increase costs and prices.

Energy Transition: Global commitments to net-zero (e.g., post-COP29 agreements) might amplify copper demand, reinforcing the $9.70 level.

⭐Supply and Demand Factors⭐

Demand: Copper’s role in electrification (EVs, grids) and construction suggests strong demand. At $9.70, industries might face cost pressures, potentially curbing consumption unless offset by growth.

Supply: Multi-month low inventories (e.g., Shanghai warehouses) and challenges in mining (e.g., declining ore grades, environmental regulations) could limit supply. A price this high implies significant tightness.

Substitution Risk: High prices might encourage substitution (e.g., aluminum in wiring), though copper’s conductivity makes this limited in key applications.

Stockpiles: LME warehouse data showing declining stocks would support $9.70; rising inventories could signal a reversal.

⭐Technical Factors⭐

Price Levels: At $9.70, XCU/USD might be testing a major resistance (e.g., a psychological $10.00 level). Historical highs (around $4.90 in 2022) suggest this is a breakout, potentially overextended.

Moving Averages: If the 50-day MA ($9.50) and 200-day MA ($9.00) are below the current price, this indicates bullish momentum. A drop below these could signal a correction.

RSI: An RSI above 70 (overbought) at $9.70 suggests a potential pullback; below 50 would indicate bearish momentum.

Support/Resistance: Support might lie at $9.00–$9.20 (former resistance turned support), with resistance at $10.00–$10.50.

⭐Sentiment Factors⭐

Market Sentiment: At $9.70, sentiment is likely bullish, driven by optimism about industrial demand and supply fears. However, over exuberance could lead to profit-taking.

X Trends: Discussions on X about unexpected commodity price spikes (akin to trending weather surprises) might reflect surprise at this level, hinting at speculative froth.

Media: Positive coverage of copper’s role in green tech could fuel bullish sentiment; negative economic outlooks might shift it bearish.

⭐Seasonal Factors⭐

Construction Cycles: Spring (March–May) typically sees higher copper demand due to construction in the Northern Hemisphere, supporting $9.70.

Chinese Demand: Post-Lunar New Year (Feb 2025) often boosts industrial activity in China, aligning with this price spike.

Historical Patterns: Copper prices can peak mid-year if supply lags seasonal demand, suggesting $9.70 might hold short-term but face pressure later.

⭐Intermarket Analysis⭐

USD Index: A declining DXY (e.g., below 100) would support higher XCU/USD; a rising DXY could cap gains.

Gold (XAU/USD): Copper often correlates with gold as an inflation hedge. If gold is also at highs (e.g., $2,900+), this reinforces bullish commodity trends.

Oil Prices: High oil prices (e.g., $90+/barrel) increase mining costs, supporting copper prices but potentially slowing industrial demand.

Equities: Strong industrial stocks (e.g., mining, EV firms) suggest copper demand; a broader market sell-off could drag prices down.

⭐Market Sentiment Analysis of All Types of Investors⭐

Retail Investors: Likely bullish at $9.70, chasing the trend via ETFs or futures, but prone to panic selling on dips.

Institutional Investors: Hedge funds and banks might be long copper, betting on supply shortages, though some could hedge if overbought signals emerge.

Industrial Users: Manufacturers (e.g., EV makers) might lock in prices via forwards, supporting the market, but high costs could prompt hedging or substitution.

Speculators: High volatility at $9.70 attracts traders; sentiment could turn bearish if momentum fades.

⭐Next Trend Move and Future Trend Prediction⭐

Short-Term: Likely a pullback to $9.20–$9.50 due to overbought conditions (RSI > 70) and profit-taking. Target: $9.30.

Medium-Term:

If supply remains tight and demand grows (e.g., China’s 5% growth goal), prices could test $10.00–$10.50. Target: $10.20.

Long-Term:

Sustained electrification trends might push prices to $11.00+, but economic slowdowns or substitution could cap at $9.00. Target: $10.50 (bullish) or $8.50 (bearish).

⭐Overall Summary Outlook⭐

Current Stance: At $9.70 on March 12, 2025, XCU/USD is in a Long/Bullish phase short-term, driven by strong demand, supply constraints, and a weaker USD. However, the extreme price suggests a Short/Bearish correction is imminent medium-term due to overbought signals and potential demand softening.

Bullish Case: Continued supply disruptions (e.g., Peru/Chile strikes), robust Chinese growth, and green tech demand could push prices toward $10.50–$11.00 long-term.

Bearish Case: Economic slowdown, USD strength, or inventory buildup could trigger a decline to $8.50–$9.00 within 6–12 months.

Recommendation: Hold long positions short-term but prepare for a correction. Watch $9.50 support and $10.00 resistance for trend confirmation.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

COPPER Approaching Key Resistance — Potential Sell SetupPEPPERSTONE:COPPER is approaching a significant resistance zone, highlighted by previous price reactions and strong selling interest. This area has previously acted as a key supply zone, increasing the likelihood of a bearish reversal if sellers step in.

The current market structure suggests that if the price confirms resistance within this zone, we could see a pullback toward the 4.7100 level, a logical target based on previous price behavior and current market structure. However, a clear breakout above this resistance could challenge the bearish outlook and open the door for further upside. It's a pivotal area where price action will likely provide clearer clues on the next direction.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

Falling towards overlap support?COPPER is falling towards the support level which is an overlap support that is slightly below the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 4.7641

Why we like it:

There is an overlap support level that is slightly below the 38.2% Fibonacci retracement.

Stop loss: 4.6909

Why we like it:

There is a pullback support level that line sup with the 61,8% Fibonacci retracement.

Take profit: 4.8933

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Copper The Week Ahead 17th March ’25 Copper maintains a bullish sentiment, supported by a longer-term uptrend. However, the recent price action suggests a corrective pullback toward a key support zone, which could determine the next major move.

Key Levels to Watch

Resistance Levels: 9850, 9970, 10086

Support Levels: 9500, 9370 (200 DMA), 9260

Bullish Scenario

A successful retest and bounce from the 9500 support level, which aligns with the rising trendline and previous consolidation zone, could reaffirm bullish momentum. If this level holds, Copper could target the 9720 resistance, with further upside potential toward 9850 and 9977 in the longer term.

Bearish Scenario

A confirmed breakdown below 9500, with a daily close beneath this level, would weaken the bullish outlook. This could lead to a deeper retracement toward the 9370 support (200 DMA), with extended downside risk toward 9260 if selling pressure persists.

Conclusion

While Copper remains in a broader uptrend, the 5000 level serves as a key pivot point. A bullish bounce from this level could signal trend continuation, while a breakdown below it may indicate further corrective weakness. Traders should monitor these levels closely for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Copper (HG): Red Metal Rally or Rusty Bet?(1/9)

Good afternoon, everyone! ☀️ Copper (HG): Red Metal Rally or Rusty Bet?

With copper at $4.88 per pound, is this industrial darling a steal or a trap? Let’s dig into the dirt! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 4.88 per pound as of Mar 13, 2025 💰

• Recent Move: Up slightly this week (Mar 10-13), per data 📏

• Sector Trend: Industrial metals volatile, with tariff impacts 🌟

It’s a mixed bag—let’s see what’s driving the price! ⚙️

(3/9) – MARKET POSITION 📈

• Global Demand: Key in construction, electronics, renewable energy ⏰

• Supply Dynamics: Major producers in Chile, Peru, China; tariff risks loom 🎯

• Trend: Green energy demand up, but economic slowdowns could dampen growth 🚀

Firm in its industrial roots, but facing new challenges! 🏭

(4/9) – KEY DEVELOPMENTS 🔑

• Trade War Escalation: U.S.-China tensions on Mar 13, 2025, per data, could hit supply chains 🌍

• China’s Response: Uncertain, but likely to affect prices due to its role in copper 📋

• Market Reaction: Prices volatile but up slightly, indicating cautious optimism 💡

Navigating through geopolitical storms! 🛳️

(5/9) – RISKS IN FOCUS ⚡

• Economic Slowdown: Reduced industrial activity could lower demand 🔍

• Supply Disruptions: Tariffs or geopolitical issues could disrupt supply, per data 📉

• Substitution: Other materials or technologies could reduce copper’s importance ❄️

It’s a risky ride, but potential rewards are there! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Increasing Demand from Green Energy: Solar panels, wind turbines, EVs require copper 🥇

• Industrial Staple: Essential in construction and electronics, ensuring steady demand 📊

• Price History: Historically, copper has been a good long-term investment, especially during expansions 🔧

Got solid fundamentals! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Price volatility due to economic cycles and supply disruptions 📉

• Opportunities: Expansion in emerging markets, new applications in tech and infrastructure 📈

Can copper shine through the challenges? 🤔

(8/9) – 📢Copper at $4.88 per pound—your take? 🗳️

• Bullish: $5+ soon, green energy boom drives prices up 🐂

• Neutral: Steady, risks and opportunities balance out ⚖️

• Bearish: $4 looms, economic slowdown hits demand 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Copper’s $4.88 price reflects a mix of optimism and caution 📈. With green energy demand rising but economic and geopolitical risks lingering, it’s a volatile market. DCA-on-dips could be a strategy to average in over time, banking on long-term growth. Gem or bust?

Bullish bounce off 61.8% Fibonacci support?COPPER is falling toward the support level which is a pullback support that is slightly below the 61.8% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 4.5711

Why we like it:

There is a pullback support level that is slightly below the 61.8% Fibonacci retracement.

Stop loss: 4.4640

Why we like it:

There is a pullback support level.

Take profit: 4.6871

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

CHINA FIN MARKETS | Investing in China & AIChina's market resurgence might pose some great opportunities for investors, especially after a long bearish cycle for the global Chinese financial markets.

February 2025 saw a significant shake-up in global markets, with China emerging as a key player driving investor sentiment. The MSCI China Index surged by 11.2% for the month, vastly outperforming the MSCI US Index:

One of the biggest catalysts behind China’s recent rally has been its advancements in Artificial Intelligence (DeepSeekAI being one of the key drivers).

By operating at a fraction of the cost of their US counterparts, such as OpenAI and Meta, DeepSeek's competitive advantage has given China an edge in the AI space, which can be seen in the market confidence.

XIAOMI has been one of the top gainers, largely as they are expanding their market penetration:

Chinese markets in February saw a boost when President Xi Jinping was warmly received by tech industry leaders. A handshake between Xi and Alibaba’s Jack Ma who previously stepped back from the public eye following regulatory crackdowns, was seen as a major gesture of reconciliation between the government and the private sector. This renewed support for private enterprises.

China’s long-term strategy has been paying dividends in high-tech industries. China has increased its global market share in nearly all industries and is outperforming competitors in cost-efficiency, particularly in sectors like copper smelting.

Despite recent gains, China’s stock market has yet to fully recover from its underperformance over the past decade. While the MSCI China Index has risen 34.6% over the past year, long-term returns still lag behind global markets. A US$100 investment in an MSCI World Index tracker in 2010 would have grown to US$480 by early 2024, whereas the same amount invested in an MSCI China Index fund would have only reached US$175.

China’s resurgence has brought a renewed sense of optimism, but investors remain cautious. While AI advancements and low cost of labor have positioned China as a competitive force, historical challenges like regulatory intervention, tariffs and economic instability still loom.

_________________________

Copper The Week Ahead 10th March '25Copper maintains a bullish sentiment, supported by a longer-term uptrend. However, the recent price action suggests a corrective pullback toward a key support zone, which could determine the next major move.

Key Levels to Watch

Resistance Levels: 9440 (200 DMA), 9650, 9950

Support Levels: 9260, 9160 (50 DMA), 9060

Bullish Scenario

A successful retest and bounce from the 9260 support level, which aligns with the rising trendline and previous consolidation zone, could reaffirm bullish momentum. If this level holds, Copper could target the 9440 resistance (200 DMA), with further upside potential toward 9650 and 9950 in the longer term.

Bearish Scenario

A confirmed breakdown below 9260, with a daily close beneath this level, would weaken the bullish outlook. This could lead to a deeper retracement toward the 9160 support (50 DMA), with extended downside risk toward 9060 if selling pressure persists.

Conclusion

While Copper remains in a broader uptrend, the 9260 level serves as a key pivot point. A bullish bounce from this level could signal trend continuation, while a breakdown below it may indicate further corrective weakness. Traders should monitor these levels closely for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Copper Overbought uptrend, The Week Ahead 03rd March ‘25Copper maintains a bullish sentiment, supported by a longer-term uptrend. However, the recent price action suggests a corrective pullback toward a key support zone, which could determine the next major move.

Key Levels to Watch

Resistance Levels: 9440 (200 DMA), 9650, 9950

Support Levels: 9260, 9160 (50 DMA), 9060

Bullish Scenario

A successful retest and bounce from the 9260 support level, which aligns with the rising trendline and previous consolidation zone, could reaffirm bullish momentum. If this level holds, Copper could target the 9440 resistance (200 DMA), with further upside potential toward 9650 and 9950 in the longer term.

Bearish Scenario

A confirmed breakdown below 9260, with a daily close beneath this level, would weaken the bullish outlook. This could lead to a deeper retracement toward the 9160 support (50 DMA), with extended downside risk toward 9060 if selling pressure persists.

Conclusion

While Copper remains in a broader uptrend, the 9260 level serves as a key pivot point. A bullish bounce from this level could signal trend continuation, while a breakdown below it may indicate further corrective weakness. Traders should monitor these levels closely for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

COPPER above 200DMA, The Week Ahead 24 Feb ‘25 The COPPER price action sentiment appears bullish, supported by the longer-term prevailing uptrend. The recent intraday price action appears to be a corrective pullback towards the previous consolidation price range and also the rising support trendline zone.

The key trading level is at the 9260 level, the previous consolidation price range and also the rising support trendline zone. A corrective pullback from the current levels and a bullish bounce back from the 9260 level could target the upside resistance at 9445 (200-day moving average) followed by the 9650 and 9950 levels over the longer timeframe.

Alternatively, a confirmed loss of the 9260support and a daily close below that level would negate the bullish outlook opening the way for a further retracement and a retest of 9130 (50 Day Moving Average) support level followed by 9060.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bearish drop off 50% Fibonacci resistance?COPPER is rising towards the resistance level which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 4.6819

Why we like it:

There is a pullback resistance level that lines up with the 50% Fibonacci retracement.

Stop loss: 4.7856

Why we like it:

There is a pullback resistance level.

Take profit: 4.5406

Why we like it:

There is a pullback support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

LONG ON COPPERPrice is in Great uptrend structure from the HTF.

Price has completed its pullback all the way to a Key Demand area.

Its also built up liquidity to be swept right above that demand zone.

I expect price to swept buy side liquidity to the downside, tap into demand, then take off to the upside.

I am buying copper.

Copper The Week Ahead 17th Feb 25The COPPER price action sentiment appears bullish, supported by the longer-term prevailing uptrend. The recent intraday price action appears to be a corrective pullback. towards the previous consolidation price range and also the rising support trendline zone. .

The key trading level is at the 9260 level, the previous consolidation price range and also the rising support trendline zone. A corrective pullback from the current levels and a bullish bounce back from the 9260 level could target the upside resistance at 9445 (200-day moving average) followed by the 9650 and 9950 levels over the longer timeframe.

Alternatively, a confirmed loss of the 9260support and a daily close below that level would negate the bullish outlook opening the way for a further retracement and a retest of 9130 (50 Day Moving Average) support level followed by 9060.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.