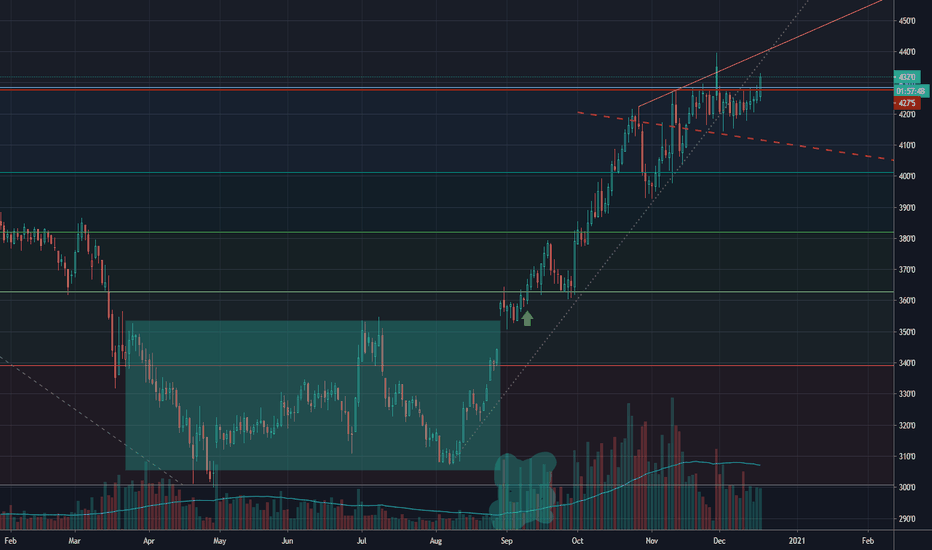

Naked Bitcoin through AprilStrictly price action indicators.

Bitcoin is in the midst of a full on bull cycle.

Don't short BTC.

Expect a more than likely touch of the 21 EMA, and a possible touch of the 50 EMA.

Don't expect anything below $42k unless you are expecting a big correction. I don't think it needs one here.

The most bullish outlook has Bitcoin retesting that upper trend line at the 2.618 extension by early march, which would be a doubling in price in just around 3 weeks which is hard for even myself to imagine.

I am looking for almost 100k by end of April.

CORN

Corn: A Potential Fade Approaching Corn seems to be in the final stage of a bullish run here. In terms of % gain, it is almost at the psychological 100% increase area from Mar'20 low. Short risk exposure is becoming more risky at these levels. With another push higher, some decent supply inflows are expected.

$600k BitcoinDon't look at me,

talk to the chart, bro.

The chart says what the chart says.

I used fibonacci extensions to create this unquestionable chart.

Is it time to short the Corn Market???CBOT:ZC1!

In recent times most commodities have been heavily inflated. So when is it time to short these things on a macro scale? Well, if seasonality tells us anything, typically corn prices start to fall once we enter the month of June.

There are 2 areas of supply on this chart, 1 of which we are already sitting in while the other is sitting at 627-680.

Rising agricultural prices bode well for NutrienWith prices for corn futures, wheat and soybeans on fire, the prospects for fertilizer companies like Nutrien have never been better. The stock trades at only 1.4x book value and pays a 3.5% dividend yield. Earnings surprises (like the prior two quarters) are likely to continue.

Bearish rising wedge on CORN after the extended runOn the daily time frame of CORN, there is a nice looking bearish rising wedge. It has been a quite a run and now it has gone up too quickly. RSI is reading extreme over bought. PPO is poised to make a bearish high level cross over. Also, when it falls back into the price channel, it will be very bearish as it will be a bull trap. I entered long $11.60 range so it's time to take profit and reversing to short. Long term bullish but short term bearish.

CORN Possible Long UnfoldingCorn has been on a rip lately. Today we have a nice pullback. If CORN cant hold the $15.79 level I expect to see somewhere around $15.00. Due to a confluence of support with the current upwards trendline, the horizontal support from the past and the 50 day simple moving average all being in the same area I will look to lean in off the bounce (if it happens).

Corn (CBs can print money but they can't print Food)View On Corn (20 Jan 2021)

While everyone is myopically focusing (including myself), soft commodities world have been "quietly" running up.

And moving forward, I expect it go higher and higher as the "inflation" go up higher.

So, it is better to adopt BUY (or) Wait/Buy approach.

Remember CB (Central Banks) can prints money but they can't print food.

Let's see

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

CORN 4hr PlanThe BEARS are hanging around looking for snacks.

Don't become a snack.

I have buy orders inside the RISING WEDGE pattern, with a planned escape if the bounce doesn't clear the 21 DEMA -and would also confirm the potential for further SIGNIFICANT DOWNSIDE.

BULLISH CASE:

This could end up becoming a "W" pattern, short term reversal -long term CONTINUATION.

FUNDING RATE (Bitmex) is trending negative, which is BULLISH.

Looking for PA to hold support above the local 81.8 FIB RT -if there is a candle body close above the 50%, that is a GREAT SIGN.

HOWEVER -there is much more BEARISH confluence right now.

A $20K BTC would be A GIFT, and a VERY WELCOME one.

BEARISH CASE:

DXY was looking very bullish heading into the weekend

TOTAL MKCP is not getting much volume, bouncing between $961BB and $1.06TT

Bearish PRICE STRUCTURE -low volume.

PA is meandering just above a crucial support, a break below will flip my bias to BEARISH (short term)

Plan not set in stone, it is only SATURDAY -but we have been getting some serious PA over the weekend when the CME has been closed.

Also, the DXY heading into the weekend was looking pretty BULLISH.

That chart and idea en route.

What are you looking at? BULLISH OR BEARISH?

JNY

Decision time for CORNIf BTC can break out across the 0.5 Fib logarithmic curve resistance @ $36.6K (with volume), we could be looking at a $45K BTC in just a matter of days.

Crazy, right?

If PA is rejected at this resistance, I would expect a corrective move between $34.85K and $28.4K, with $31.525 the median target -followed by a retest of the resistance.

Let's see how powerful this move is, could be a "blow off top" of this strong parabolic move letting us know re entry opportunities are quickly approaching.

Happy Trading!

Agricultural Commodities Ripping! Food Prices to Rise in 2021!Ending my posts of major themes to look for in 2021, I want to end with the agricultural commodities. Particularly Corn, Wheat and Soybeans. The agricultural commodities are some of my favorite assets to trade, and I do not think many people pay too much attention to them. I focus on the three mentioned above, but you can also trade sugar, coffee, cocoa, orange juice (yes seriously), cattle, hogs, and pork bellies to name a few more.

Let me give you a quick run down on the ag commodities.

Corn is the most traded agricultural commodity, and is an important food source for both humans and animals. What makes Corn important is that it can be grown in a variety of climates and conditions, unlike the other agricultural commodities. Other uses include starches, corn oil and fuel ethanol. According to my handy dandy commodity handbook, approximately 35 million hectares are used exclusively for corn production world wide.

Just as Oil has different qualities (Brent, West Texas, Canadian West etc), Corn does as well. There are different grades but the most important are high grade number 2 corn and number 3 yellow corn.

The futures ticker for corn contracts is ZC. The top 5 producers of Corn in the world are: The United States, China, Brazil, Mexico and India (Canada makes it in 9th place).

Corn has had an amazing run since June. We will get to the why when at the end of this post, but pay attention to the commodity charts. These are all going to be LONG term weekly charts. You can see that Corn is breaking out, and in fact, will confirm a breakout with this weeks close, which occurs today. Lot of room higher to go in 2021. The breakout zone will be our support, and as long as we remain above, Corn moves higher.

Wheat is the second most produced agricultural commodity. Rice comes in at third for those that are interested. No country necessarily dominates wheat production a la Saudi Arabia with Oil and Kazakhstan with Uranium.

China, India, Russia, the United States, and France produce the most wheat in the millions of tons. Canada, Australia, Germany, Pakistan, and Ukraine also boast significant production.

The future contract ticker for Wheat is ZW.

Wheat on the weekly is setting up to breakout. Just like Corn, we would confirm a breakout on the weekly chart by the end of today.

Finally, Soybeans. Perhaps the more ‘mainstream’ financial media agricultural commodity that has seen plenty of coverage due to the US-China trade deal. Part of the phase 1 deal was for China to increase their purchases of US Soybeans.

I am focusing on the the whole soybean, but most soybeans are used for soybean oil and soybean meal.

The United States dominates the Soybean market, composing 50% of the total global production. Brazil comes in second at around 20%. Many analysts predicted Brazil to be the big winner in a US-China trade war spat, as China could look to Brazil for more Soybean exports.

The futures contract for Soybeans is ZS. Let’s take a look at the other traded forms of soybeans which have their own futures ticker.

Soybean Oil is a vegetable oil and is one of the most used culinary oil in the world. Soybean Oil is also popular as a biodiesel. Believe it or not, but there are cars that have engines which can convert from regular diesel to Soybean Oil during production. They are known as ‘frybrids’. The futures ticker for Soybean Oil is ZL.

Soybean Meal is a quick one. Whatever is left from the extraction of Soybeans into Soybean Oil can be converted into Soybean Meal. This is used for high-protein, high-energy food for feedstock for cattle, hogs, and poultry. The futures contract for Soybean Meal is ZM.

Soybeans have been ripping in 2020. Again, China demand and the US-China Trade war headlines play a large part, but there was some other factors which we will discuss soon. Just like Corn and Wheat, Soybeans is set to confirm yet another breakout with a weekly candle close today.

The agricultural commodities do not get the attention they deserve, and as you can see, they have made huge moves. For traders, they present a great trade opportunity due to the volatility, but also add on some more risk. Consider at least watching them if you do not want to trade them.

M readers know I am extremely bullish on the agricultural commodities and agriculture in general. Jim Rogers is the one who got me excited about this sector. His argument is that most young people do not want to become farmers anymore, and that the average age of farmers is well above 60. Governments may need to create larger incentives to get young people to take up farming.

I see some issues and challenges for agriculture, but will be rectified by human ingenuity. The first issue is soil. A lot of soil sucks due to the pesticides and other chemicals we use. If the soil is not great, the crop will not have the full dose of nutrients and could lead to health issues down the road. As many of you are aware, the organic food movement is a huge trend, and will grow year by year. Soil replenishment will be big. I have head some things in the past about zinc being used to replenish soil, particularly in California. Phosphorus and Potash also come in mind. In fact, some foresee a phosphorus faming crisis.

A big issue for farming has been climate change. Obviously farming is cyclical. Winter has been lingering longer, especially on the East Coast. Farmers tend to await for certain birds to return to let them know Spring is here and it is time to plant crops. But Spring has been coming later while Winter lingers longer. Climate change will continue to disrupt agriculture and this could lead to a shortage of crops.

In fact, this is the primary reason for the spike in Corn and Soybeans this year. Iowa is where the majority of these crops are grown in the US. Millions of acres were destroyed due to the storm in Iowa in August. This has led to spikes in agricultural commodities, and some say, points to a food crisis in 2021.

Finally, something not many people consider are the ramifications of green energy. This info I learned from Peter Zeihan’s book, “Disunited Nations“. Highly recommended for anyone with an interest in geopolitics and where the world is going in the future.

Green energy is coming. We all know it. Governments will be spending a lot for green infrastructure. Due to the fiscal policy required to combat covid, taxes need to go up. The best way is through green taxes because they know the people will not complain. Government will say these taxes are going to be used for green infrastructure which will aid in an economic recovery and creating jobs.

The issue, as Mr. Zeihan states, is that solar panels and wind turbines need to be put in areas that are very sunny and/or windy. These areas tend to be where the best agricultural land is situated. So nations would have to sacrifice agriculture for energy. In his book, Zeihan states that there only a few nations which can come out as winners in this predicament. China is not one of them.

Do not panic, a lot of these issues can be remedied. In house and Greenhouse farming can be a way to cope with the effects of climate change and unpredictable weather patterns. Vertical integrated farming can be a solution to allow for green energy infrastructure to be built in the best agriculture lands, and can also be a solution for nations that do not have much agricultural lands. So yes there will be issues, but human ingenuity will get us through it. The question is how long will it take?

I want to end of with Covid. It seems we are setting up for a food crisis next year. Tons of articles about supply chain disruptions due to covid and worsening food insecurity for many nations. If this winter turns out to be a dark winter due to covid cases, the likelihood of empty shelves increases.

A lot of this could also have an impact on the prices of agricultural commodities. Canada is already preparing for this. In Canada’s Food Price Report 2021, bread, meat and vegetable prices are set to rise between 3-5% in 2021. The average Canadian family will pay up to $700 more for food in 2021.

The agricultural charts are pointing to higher food prices. Covid and Climate will have impacts, and hence why I am bullish on this sector going forward.

Long C H1 as it is both bullish in FA & TACorn continues to trade along the lower end of the trend channel. Both daily and weeklies are still on the uptrend but watch carefully as some of the momentum indicators continue to flatten.

On the fundamental side, erratic weather patterns in South America and continuous large demand from the Chinese continue the bullish case for the corn and the grains complex. My initial TP on the trade is around 4.50 for starters, entry is 4.25, and stop loss level is set at 4.20. Thinking of an R-Multiple of 5. Though as soon as the trade goes my way, will lift my stops to breakeven.

Corn Short, Based on COT data and TAZC1!

Commercial accounts are currently net short on corn futures contracts (-355k contracts), while as noncommercial accounts aka, Retail traders, are net long (+411k contracts). These two positions are at extreme polarized ends of the play. Usually commercials tend to be net short on any asset but its the extremes one should keep an eye on.

Corn is currently at a basing pattern, with a previous impulsive move to the downside. Entering at a base is relatively risky, since the pattern can either turn into a drop base drop or a drop base rally pattern. So one can play this two ways, enter short at the base with a tight SL so if an impulsive move to the upside were to occur, you will stop out with minimal damage. Or, wait for the pattern to play out and if the pattern is a drop base rally, then short a potential double top. The play I am making is short at the base of this pattern with a SL at 407'5.

Targets for the short are

- 0.5 retracement

- 0.618 retracement

- 0.786 retracement

- 305'4

I will be taking profits at each target, with the last target being a runner position.