GLD & BTC Correlation?I struggle to fully understand the connection here, if anything I would have thought the direct correlation between these two assets would exist. Flight to safe haven be it a cryptocurrency or an asset like gold, I would have thought the same fear drives these actions.

This chart is contrary to that view / idea, here we have seen a pronounced tracking since early 2015, before this its very supurious, I can only link its rise to the complications arising with monetary policy experimentation in the US coming to and end and bitcoin settling down from its explosion in value.

If anyone has any ideas here of whats going on and how its likely to develop going forward I would be interested to hear!

Correlation

Possible EUR/JPY and NZD/JPY Correlation TradeContinuing on from yesterday's chart, this extract comes from the Possible EUR/JPY and NZD/JPY Correlation Trade blog on the Vantage FX News Centre.

Zooming into the NZD/JPY chart on its own, you can see that price is still sitting right on resistance while EUR/JPY got the beginnings of a potential rejection yesterday.

If you took yesterday’s EUR/JPY short and have some floating profit, the opportunity to now take a correlated NZD/JPY short could be there.

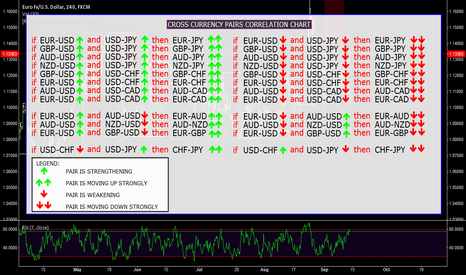

CROSS CURRENCY PAIRS CORRELATION - ADVANCED ANALYSIS Hi all, I wanted to share this chart with you - I am hoping it works when I publish it and the arrows stay inline with the text - something very interesting we all know about currencies moving in tandem with each other to some degree different economic events causing them to stop moving together but eventually they will again.

As a forex trader, if you check several different currency pairs to find the trade setups, you should be aware of the currency pairs correlation, because of two main reasons:

1- You avoid taking the same position with several correlated currency pairs at the same time and so you do not increase your risk. Additionally, you avoid taking opposite positions with the currency pairs that move against each other, at the same time.

2- If you know the currency pairs correlations, it may help you predict the direction and movement of a currency pair, through the signals that you see on the other correlated currency pairs.

If you would like more information describing the affects - reply with a short note and I will paste a URL

Bearish Bat / Alt Bat / AB = CDMan.. There is a lot going on in this chart. Please excuse the mess everyone.

I've been monitoring the USDCHF for quite some time now, and we've almost reached our target zones. We're currently setting up for a nice long term trade than could easily come into our favor given that there are so many clues and indications that we could very well see a major drop in not only the Dollar Swissy, but the Dollar as a whole. Given some fundamentals and the correlation between Dollar Swissy and the Euro Dollar, we could see the Euro also rising substantially.

We're looking for the test of the 88.6% Fib drawn from X-A which just so happens to correlate into the Supply Zone established earlier this year in March. If this test is confirmed at 1.00012, we can take this pair all the way back down to our overall target of .94655 for 535.7 pips while risking only 104.5 pips. Patience will be the determining factor in this trade, along with concrete analysis and solid evidence for the next few weeks or so, but we also have the reassurance of a Bearish AB = CD Harmonic directly at the Supply Zone also.

Although this is shaping up to be a very nice looking trade, we still have nearly 300 pips to go before any of our target are touched. Make sure you are patient on this pair, and identify the swings correctly to ensure proper flow of the overall trend.

Take care

MACRO VIEW: USDRUB IS TESTING ITS UPTREND!Following WTI OIL downtrend failure last Friday, USDRUB tagging its relevant uptrend border first time since it started its descend back in July, marked by lower 1st standard deviation from quarterly (66-day) mean (@65).

If the price manages to break below the border, chances are the uptrend is over (or at least current leg of it).

Full stop of the uptrend, however, can only be declared when the price trades above the quarterly mean (@59).

MACRO VIEW: USDRUB CAN REVERT ON CENTRAL BANK SUPPORTUSDRUB was trending upwards in correlation with WTI Oil descend since beginning of July

Currently Oil fell to its 2015 lows (slightly below them now) while USDRUB was holding 65 level with apparent Central Bank of Russia support.

CBR is selling USD against RUB in attempts to stabilize the national currency.

If the Oil trend down stops at this level, USDRUB is likely to bounce back to 1st st deviation from quarterly (66-day) mean, and then to the mean itself, ceasing its uptrend.

JBLU & USDCAD - Long to 26JBLU has shown a strong correlation with USDCAD, as both financial instruments are inversely correlated with oil (shown below). It should also be noted that USDCAD has recently broken out of a cup and handle pattern on the monthly chart and a continued rise could be an early indication of similar price action in the aerospace sector. The wave count for USDCAD suggests that an extended fifth may be in progress, which if true would provide a confluent fifth wave target. JBLU targets may be placed at 26 and 30, extensions of wave ((3)). These extensions proved to be important in sub-degree 5th wave targets and the fractal characteristic of EW suggests that these levels may also play an important role on the larger degree. A SL may be placed below wave (1) high at around 21.40.

Correlation with USDCAD:

USDCAD Monthly Cup and Handle:

USDCAD Wave Count:

10 YEAR TREASURY YIELD SIGNALLING INFLATION EXPECTATIONSSince mid-summer 2014 the 10-Year Treasury Yield started correlating with WTI Crude Oil, which can be seen on the image below:

The correlation was established as a result of dynamics of oil prices, when falling oil was perceived as a risk to inflation. Expectations of lower inflation have driven the 10-Year Yield down with the WTI Oil. Market has perceived the situation correctly, as the CPI inflation has fallen down to about 0% on y/y basis consequently, where it stands now.

Recently, however, the 10-Year Yield started to diverge from WTI Oil price dynamics. As can be seen on our chart, the oil is trading laterally in the range of 57-62 USD per barrel since May 2015. The 10-Year Yield, on the other hand, actually started to move upwards since then, along the upper 1-st standard deviation from its quarterly (66-day) moving average.

Our idea is that current upwards dynamics of the 10-Year Yield in relation to lateral WTI Oil reflects positive inflation expectations of market participants. It means that in the observable future the CPI and PPI inflation measures are likely to start bottoming out on y/y basis.

If our proposition is true, it will be a positive development in terms of financial markets, as higher inflation expectations will offset the deflationary impact of current slow CPI and PPI inflation measures on the perceptions of market participants.

Correlation Trade Between EUR/USD & GBP/USD*Position Update: As of 05/15/2015 @ 7:41 EST we liquidated both sides of this correlation trade with a profit of 28.6 Pips.

The Trade: Long EUR/USD & Short GBP/USD

The correlation between these two pairs is 96% over the past year. The widest the spread has got over that time is about 700 Pips. Over the past 18 months we saw the spread widen to approximately 800 Pips. Currently these two pairs are 700 Pips apart.

With that said we will be entering 1/2 our intended position size with the intentions of easing into the second half if the spread widens significantly. We expect to see this spread narrow over the coming days/weeks. If it happens before we can put our entire position on we will feel comfortable closing out the position with a profit of any amount.

A Nice Correlation Trade Is Setting Up Between AUD/JPY & CAD/JPY*Position Update: On 05/05/2015 we liquidated both sides of this correlation trade with a profit of 73.1 Pips while taking advantage of the correlation spread narrowing after the interest rate decision in Australia.

A nice correlation trade is setting up between AUD/JPY & CAD/JPY. The spread in the correlation is currently 200 Pips, over the past year the max spread has been approximately 400 - 450 Pips.

We will be taking 1/2 our intended position size, if the spread widens to that max spread mentioned above we will add the second 1/2. Australia is announcing interest rates in 3 hours which could provide that opportunity or present us with a profit. The trade is Long AUD/JPY & Short CAD/JPY.

Correlation Trade USD/SGD to USD/JPY *We booked a profit of 27 Pips. Even though the spread is from from closing we decided to take the profit and move back into cash. Of course if this spread narrows we will be leaving a lot on the table but we are happy with the gain from a low level risk trade.

We will be initiating 1/2 our position in a correlation trade of USD/SGD to USD/JPY. The spread is currently 500 Pips and could potentially get wider, if it does we will then have the opportunity to add to our position, hence reducing our costs. The spread should narrow over time as it has done during the past year. One could wait until the correlation completely narrows to the point that both pairs touch or one could take their profit at any time during the closure of the correlation. Please see the chart for more information.

Non Charting Tools for Forex TradersI am listing the tools I use daily, during my trading schedule, when I trade the Forex market. I am using general descriptions in this list since I am not endorsing any particular paid service, or website.

Tradingview

A high quality charting platform with all the price charts and many powerful yet intuitive tools. Every single trade I take I chart it here first, marking exact entry, exit and stop loss levels. Some of my potential trades I publish, some I keep to myself. The forex chat is a great “tool” to share views on the market in real time and get other opinions to see if I missed anything.

Execution Platform

I see brokers as a necessary evil and use mine only to execute my trades. I don’t use its charting package, newsfeed, calendar, signals, expert advisors or anything like that. As soon as Tradingview will provide chart trading where we can select a broker of our choosing and execute our trades straight from the charts, this tool can be eliminated.

Economic Calendar

Even if you are a 100% technical trader and don’t take any news into account, at least you would know when major news events are happening (NFP, FOMC rate statement, etc) that could impact your trades, so you might want to stay out of the market. For traders who do take fundamentals into account, it provides you with the previous period and the expectation for the data to be released. It helps to build the picture for how events may move the markets. There are several to be found, find one that suits you.

Premium News Service

This is a feed of headlines that will inform you in real-time on what is happening in the markets. If a pair suddenly moves fifty pips, this news service will tell you why this is happening. The audio feed is the fastest so with urgent news you will not miss out. With un-planned news events this is essential. It’s a paid service and there are several on the market, I am not endorsing any in particular but am using one myself and I am always in the know.

Market Background News Sites

These are websites / financial blogs with markets news, background stories and editorial opinions that differ from the real time premium news services in that the articles are more research based and provide a deeper understanding into fundamental drivers behind the markets and how market players are positioning themselves. I usually read up on them once a day before I start trading. There are several good websites to be found.

Currency Correlation Overview

Pairs don’t move completely independent of each other. Trading highly correlated pairs simultaneously can increase your overall risk or eat your profits. Before entering a potential trade, I crosscheck the currency correlation of that pair with my already open trades (if any) and if its highly correlated (either positively or negatively) to one of them, I do not enter the trade. Since correlation differs per timeframe and changes over time, I use a real time online source.

Position Size Calculator

The difference in pips between entry and stop loss (pips at risk), your equity size and the trade risk you allow as a percentage are what you need to calculate the position size that does not exceed your risk tolerance. You can create a spreadsheet where you calculate this yourself for each trade, you can also find an online position size calculator and some brokers have this feature built into their interface. Regardless how you do it, this will be an essential tool.

Forex Cheat Sheets

I have created cheat sheets with overviews of all candlestick formations, basic and advanced price patterns, key Fibonacci ratios, etc. They help to quickly validate potential trading opportunities. Nowadays I hardly use them anymore, but I still have a hard copy on my desk just in case and they certainly helped me a lot as a beginning trader. I like the feeling that if I need to check a pattern, I have the information easily accessible at my fingertips.

Currency Correlation, Does It Matter?Currency correlation measures the extend in which two individual currency pairs move in the same or in opposite directions. It´s usually expressed as a percentage, from -100% to +100%. Positive correlations (from 0% to 100%) indicate how much two pairs move in the same direction. Negative correlations (from 0% to -100%) indicate how much two pairs move in opposite directions. As a general rule of thumb we can say two pairs are very highly correlated if the correlation is either -80% or lower (highly negatively correlated) or 80% or higher (highly positively correlated).

In my trading plan (see link to this publication under Related Ideas) I take currency correlation into account. I use a fixed fractional money management system and the risk per trade is a stable % of my trading capital. Before entering a potential trade, I crosscheck the currency correlation of that pair with my already open trades (if any) and if its highly correlated (either positively or negatively) to one of them, I do not enter the trade, even if the setup itself is valid. This is a sometimes fiercely debated topic in the forex chat and I have seen members and traders with very different opinions on it.

Some say I am crazy for doing this check, because I deliberately pass on valid trade setups this way and I could make more pips if I would just ignore correlation and always trade an opportunity when it present itself. “Think opportunity!”, they say. Others are even bolder and claim I should deliberately look for highly correlated sister pairs and always trade them both at the same time. “Double your profit in almost any trade!”, they proclaim. And then there are traders who believe I should already exclude a potential trade setup, if it’s moderately correlated (40%) to an open trade. “Anything above that % is too risky!”, they say.

Here is my reasoning:

Highly positively correlated pairs

If I were to buy or sell two highly positively correlated pairs, I would basically be doubling up on my position in one of them, since both pairs move in the same direction. I would not really get two independent chances to win or lose a trade; I would get only 1 due to the very strong correlation. In doing so, I would be doubling my traderisk, which would be a breach of my risk management rule.

Highly negatively correlated pairs

If I were to buy or sell highly negatively correlated pairs, I would basically be hedging against myself (since the two positions would cancel each other out) so the profit of one would be eaten by the loss of the other. The only exception here could be a higher timeframe trade on one of the pairs with a scalp on a lower timeframe on the other, to benefit from both timeframes.

A common misconception is that pairs with the same currency either as the base or as the quote are always highly correlated. Like EURGBP would be highly correlated to EURJPY, since buying those pairs would in both cases mean buying the euro. This is not always the case. Not only the base currency Euro has an effect here, the quote currencies Pound and Yen have an effect as well and those move independently of each other. So correlation is not fixed, it is different per timeframe (correlations on the 1h might not be in line with those on the daily) and it changes over time as well. That is why I use a real-time source to determine the correlation between two pairs on a particular timeframe. There are several sources to be found on the internet, I don’t want to endorse any trading website, but Google is your friend.

Pairs don’t trade completely independent of each other. And trading highly correlated pairs at the same time can increase your overall risk or eat your profits. All in all, I would say currency correlation does matter and its best not to ignore it. It can help you to manage your portfolio.

AXJO V's Aussie BondsI am a little bit confused here. I always thought that Bonds trade in different direction to indices. But as per the chart they seem to be going same way.

Any inputs, anyone??

The fall in Bund yield do not mean the same than beforeAs you could remember during the last Greek crisis the Bund Yield fell even to negative territory, this was due the haven factor in the biggest economy in EZ

Now that every body says that the situation is much better than in the 2012 the Yield (as you can see in brown, remember that the price of Bund is inverse to it's yield) is even lower. Why?

The mail reason is the demand that is expected from March due the QE announced by the ECB.

This expectancy of scarcity of bunds is pushing the price of the bund upper (or the yield lower) so now by this ECB QE we can not use the Bund as a measure of fear so plain as we did in the past.

The main evidence of it is the behavior of the DAX, the Equity is still rising (not as happened in the last peek of Bund price)

Any Way the rise in Bund still very good correlation with the EUR.

Somthing to Think About #2In the grand scheme of things it looks as though a shift is ready to take place. It has taken me some time to realize that shift but it is finally here. Take look at the GBPEUR to the left. Notice how its price moves are converse to that of WTI, EURUSD, and XLE.

The yellow circles you see are areas where similar behavior is forming. In the GBPEUR the opposite behavior is forming to the downside. You can see this correlation is approaching a long time resistance level. Just as the EURUSD is approaching a long term support level.

Oil looks to correlate positively with the movement of the EURUSD. As it also moves in exaggeration to the XLE. Using specific points on the XLE as support and resistance. Could I be on to something.....YESSSSS or Maybe I"m reaching...?

This can all simply be money moving back and forth. Most regular people like to sit in cash. There are times where this is good reasoning. Don't just sit in it. Swim in it till you are ready to strike and when you strike do it with the speed to the Millennium Falcon in hyperdrive.

Note: Might be a good idea to run some spreads on these instruments.

Should we be watching the EU and UK to know where we are going?

Somthing to Think AboutIn the grand scheme of things it looks as though a shift is ready to take place. It has taken me some time to realize that shift but it is finally here. Take look at the GBPEUR to the left. Notice how its price moves are converse to that of WTI, EURUSD, and XLE.

The yellow circles you see are areas where similar behavior is forming. In the GBPEUR the opposite behavior is forming to the downside. You can see this correlation is approaching a long time resistance level. Just as the EURUSD is approaching a long term support level.

Oil looks to correlate positively with the movement of the EURUSD. As it also moves in exaggeration to the XLE. Using specific points on the XLE as support and resistance. Could I be on to something.....YESSSSS or Maybe I"m reaching...?

This can all simply be money moving back and forth. Most regular people like to sit in cash. There are times where this is good reasoning. Don't just sit in it. Swim in it till you are ready to strike and when you strike do it with the speed to the Millennium Falcon in hyperdrive.

Note: Might be a good idea to run some spreads on these instruments.

Should we be watching the EU and UK to know where we are going?

NBL bearish gap downThere are a lot of energy stocks, which have gapped down, on our list today. Many provide near-term sell opportunities but I felt the best of them was NBL.

Looking at pivot highs and lows on the weekly chart, NBL seemed to have plenty of room to manoeuvre (about 800 points before the next major support). The daily gap down (on higher volume) broke below longer-term pivot highs (and the recent pivot low) as well as $50. The breakout bar was bearish and price is trading below the 200ma (weekly and daily).

While I don't trade fundamentals I do feel that it is the fall in oil prices which may well have affected so many energy stocks. So trading oil may be a more straightforward alternative to shorting correlated stocks.

The comparative strength or weakness of Gold vs. US DollarIn this study, I'm looking at the performance of gold, in terms of percentage gains/loss compared to the performance of the US dollar, tracked by the dollar index (DXY). As gold moves inversely with the US dollar, I inversed the DXY to set a comparative benchmark, hence 1/DXY.

Please see notes on chart.

EUR/USD Channeling up to previous High, Resistance & Fib. levelBased On: Structure, Fibonacci levels, Channel, Stochastics, RSI, Momentum..

IF EUR/USD Reaches 1.3648. Economic Calendar events will effect this heavily, i am looking forward to a volatile day (TODAY:EUR Interest Rate, Decision, ECB Press Conference, US Nonfarm Payrolls, US Unemployment Rate, ISM Non-Manufacturing PMI ) If these events will be positive for EUR and Negative for Dollar, this could be a fast move (1day).

Then ==> I will Buy EUR/USD, I may however buy it at a slightly higher price as the price action up has already strated, but it would be safer to wait till the price drops and then but, it could also not happen.

(IF EUR/USD will go up very slowly THEN i will take some profits of early)

IF Today's big economic calendar events goes in conflict with a move up THEN ==> i will close my position and possibly open it again if an opportunity presents itself.

Thoughts & Why's

UP SIDE

There is a clear channel that is going up and is likely to continue.

Stochastics RSI is Oversold at 11 (11.4)

Momentum is gaining

Strong structure (6-8 points)

US Dollar INDEX (DXY) look's like a sell along with USD/CHF ( ) so EUR/USD should go up as dollar weakens.

There is also a double bottom, which is also a medium sign that EUR/USD is going to go up in short term.

DOWN SIDE

1. Major Fibonacci Level 0.382

2. Structure (Confluence with Fib Level 0.382)

A major 0.382 Fibonacci level at 1.3689 that and structure right there as well.

When Fib Level 0.382 (EUR/USD=1.3689) a retracement will probably take place if Dollar index goes down.

IF you like my ideas and want to say thanks, please like&share them. As always thank you for viewing & till next time.

SPX500 vs CADJPYCADJPY pair is preempting to move of SPX500 as you will see on the daily graphic.

The momentum and the move of CADJPY is bigger, but when CADJPY is UP, SPX500 is up

and when CADJPY is down, SPX500 is down after a while...

But of course bare in mind that

CORRELATION DOESN'T IMPLY CAUSATION ;-)

HSBC vs FTSE which will perform better? 130days forecast #spreadIndex Arbitrage Forecast: FTSE100 will outperform HSBC

Supporting Strategies: Cointegration, Correlation and Technical

Analysis Pattern : Elliott Wave 5

The trade should be opposite to the "gap". HSBC has performed better than FTSE100, in order to close the gap FTSE will now perform better in the next 131 days.

Targets and notes on charts