Cosmos

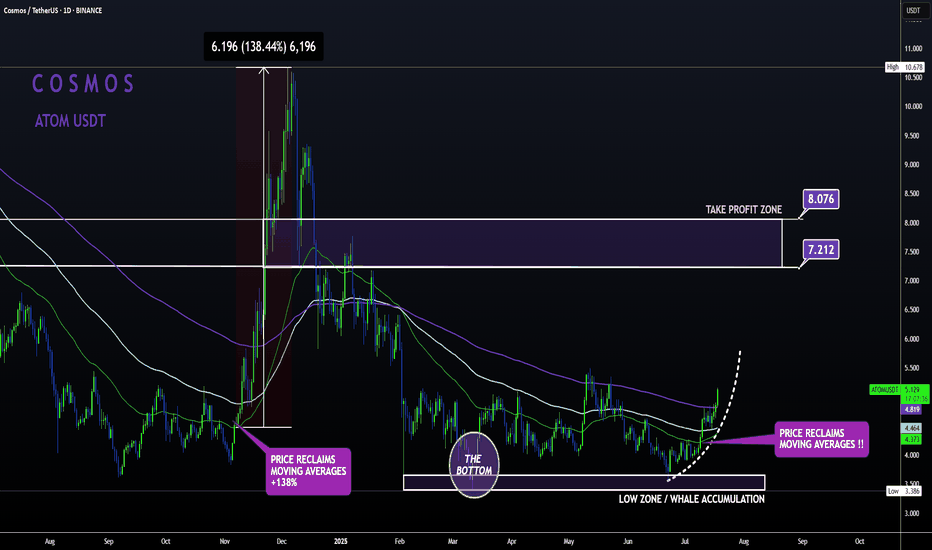

ATOM Sleeping GIANT ALT | Moving Averages BULLISH like NOV24'ATOM is slowly but surely making a turn up towards the first Take Profit point.

From the bottom, Cosmos has already increased a whopping 52% , with even more room to grow:

In my previous update, the 4 was still bearish when looking at trend lines and moving averages.

However, this has flipped to bullish from the 4h upward, with the price trading high above the moving averages in the 4h and in the daily timeframe:

4H:

Daily:

Note how previously, the big increases started as soon as the price regained the moving averages as support.

Cosmos (ATOM) Trading At Bottom · Bear Markets End ForeverCosmos is still trading near its market bottom, the "opportunity buy zone" as I call it. This is nothing more than great news.

Remember how I mentioned that some pairs are really advanced, trading already very high and this is risky if you want to go LONG? Well, when projects are trading near the bottom of the range; support, all-time lows, this is great news because there is little room for lower and plenty of room for prices to grow. ATOMUSDT is now in this highly desirable situation.

This a trading pair that is "yet to move."

It is awesome.

Potential for growth goes beyond the chart, literally. The chart you are seeing here now does not show the potential ATOMUSDT has for growth. The size of the candles should tell you everything you need know.

Bullish waves, corrections, bullish waves and corrections and see how small the candles are. Compare to the action in 2021 and you know we are looking at a true bottom. This opportunity does not repeat often and with the market evolving as it is evolving now, this might be the last chance in the history of Cryptocurrency to buy this low.

This is because we are entering an extended bull market that will last for years to come. When a new bear market develops, a long-term correction, it will be nothing like before. Instead of down, down, down forever, we will have some sideways then down, a strong swing followed by a recovery and additional growth. Just like Bitcoin. Look at Bitcoin since November 2022, that is how most of the big altcoins projects will evolve.

The wild-wild west of Crypto is going to an end. Think of it this way, Cryptocurrencies credit application has been approved.

Remember how the bear markets became shorter and the bull markets longer when the Federal Reserve came into the picture in the early 20th century? That is because with credit easily available, there was no more need for the companies to crash nor take a long time to recover from a major downturn. Here the situation is the same.

With the Cryptocurrency market now being accepted as the amazing technology that it is, we have access to credit. Instead of long and wild crashes, we will have short-term corrections. In short, demand will be too strong for the market to stay depressed for too long.

There will always be corrections of course, night and day (market cycles), but from now on, these will be short.

Namaste.

ATOM (COSMOS)🔹 Accumulation Phase in Play

We’re currently sitting in a clear accumulation zone — price is holding steady, showing signs of position-building by stronger hands.

📈 The next key areas are distribution zones, all of which are already marked on the chart. If you're entering a position now, odds are high you'll be able to secure profits as we move up. Just make sure to set a stop-loss — and don’t get greedy if you're aiming for the top.

⚠️ Even though it’s less likely, there’s a small chance of a shakeout near the yellow zone, but I personally doubt it — the market is already heavily shaken, sentiment is fearful, and many have been waiting for a move for too long.

🕰️ We’re also running out of time — the 4-year cycle is coming to a close by the end of this year. Historically, this aligns with significant market moves

ATOMUSDT Channel Breakout Alert!ATOMUSDT Technical analysis update

NASDAQ:ATOM is bouncing from a major support zone and has formed a descending channel at the bottom of the zone on the 4H chart. Currently, the price is breaking above the channel's trend resistance and trading above both the 50 and 100 EMAs on the 4H timeframe — a bullish signal for ATOM.

ATOM | COSMOS - REVERSAL SIGNALS & KEY LEVELS💫Here’s a detailed weekly ATOM/BTC analysis—focusing heavily on the Directional Movement Index (DMI) combo—and a forward-looking forecast.

💫 While ATOM/BTC is currently in a strong downtrend, the presence of bullish RSI divergence on a weekly scale suggests that the strength of this trend may be fading, opening the door for a possible upside shift.

💫 Trend Shift Scenarios:

👎 Bearish continuation if:

• –DI remains above +DI, AND

• ADX sustains above 30, reinforcing downtrend strength.

👍Bullish reversal begins when:

• +DI crosses above –DI on the weekly chart, and its starting to curve;)

• ADX remains elevated or climbs, confirming the new uptrend.

📉 Bear scenario:

If +DI continues to lag and ADX remains strong—price may retest recent support levels in BTC terms (around 0.000037–0.000038 levels.)

📈 Bull scenario:

Look for +DI to crossover above –DI while ADX sustains high values. Weekly RSI divergence (already visible!!!!) supports this &suggests potential 30–50% upside if ATOM breaks out against BTC resistance.

💫 Price Target:

In such a breakout, expect ATOM to outperform BTC by ~30–40% short-term, with room for up to 100% upside if momentum builds more!

💫 Summary

Weekly ATOM/BTC shows a strong downtrend (–DI > +DI, ADX ~33), but bullish RSI divergence hints at a possible reversal.

💢Catalyst: +DI crossing above –DI with ADX sustaining signal strength.

💢Potential: 30–50% upside short-term, 100% mid-term if breakout holds.

💢Plan: watch weekly DMI/ADX and price action in 0.000037–0.000038 BTC range, manage risk with stop-loss under support.

*Noteable: Also Watch RSI confirmation: upward breakout off of divergence is a strong signal.

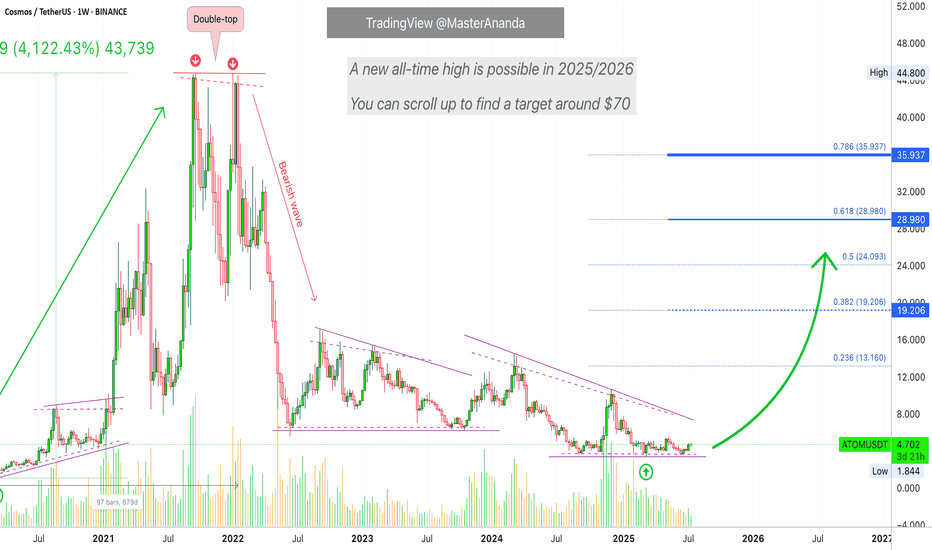

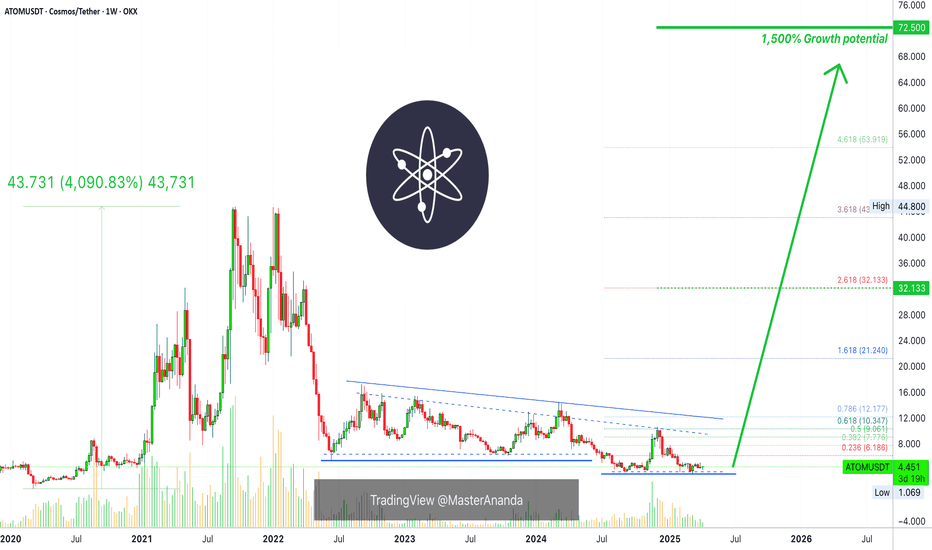

Cosmos (ATOM) $70 New All-Time High, Market Dynamics & MoreCurrent price for ATOMUSDT matches the low from September 2020. The same range was also active in July of the same year and between December 2019 and February 2020.

From a low point in March 2020 Cosmos (ATOMUSDT) grew 4,122% to peak in September 2021. Giving us a 560 days long bull market.

The double-top in January 2022 extended the bull market to a total of 679 days. Those that didn't sell in September 2021, after a correction, had an additional month to sell at the highest possible.

Back in those days we had a rising bottom after the all-time low. This time around we have a stable (flat) bottom.

The lowest price for Cosmos happened March 2025. A one year long bull market would give us a top around March 2026. If we get 560 days like last time this would give us a top around September 2026. Compare this to September 2021, same month. Things will be pretty interesting that's for sure.

We cannot generalize anymore and each pair/project needs to be considered individually.

For example, Ethereum hit bottom June 2022, here Cosmos hit bottom March 2025, huge difference. Many projects bottomed also mid-2022 but others bottomed around August 2023, others August 2024 and many others just recently, 7-April 2025 and some even last month.

We are entering uncharted territory.

The big projects and the ones with ETFs will have their own charts. Corrections will be minimal and we cannot expect the same highly volatile and crazy dynamics as when Crypto was underground, it is public now and it has all the attention in the world. The altcoins can't crash down too strong when everybody is waiting to buy when prices go low.

The flat bottom in 2024-2025 for Cosmos can tell of two things: 1) There is the possibility of one final flush, lasting only a few hours or days and this would mark the start of the next bullish phase. Or, 2) the next cycle can start uneventfully. Normally there is always a strong shakeout before the change in trend.

A pair can grow for years, as some projects are already doing based on higher lows while others can be doing things differently.

I am just trying to get the point across that each project needs to be considered individually, this is very important for the future because everything is changing now but the effect will be felt only after many months. Even the bear market will spread out; not like before. The bull market is very likely to be extended because the projects move in groups and since the market is so big now it will take time for each group to jump.

Start late, ends late.

This chart allows for a new all-time high. $70 is the standard projection and I should say also the minimum. But this one is tricky because of the chart structure. It can also end with no new all-time high so all will depend on the demand. How strong is the project, the team behind it, how active are the participants, etc.

There will be enough capital for everything to shine but only those with a plan and the right tools will attract our attention. It is a huge game, competition is very strong. Those that neglect their projects are likely to stay behind. Those that are active with a positive mindset and plan, should come to the front.

You know how it is... Regardless of any individual project, Crypto is going up.

Namaste.

ATOM | SLEEPING GIANT | Altcoin GEMATOM is an alt that I have high expectations for.

From a 4h perspective, we can see the short term price is still very bearish.

This is confirmed by trading under the moving averages, which indicates that the sellers are in control.

The great news about this is that the price doesn't stay long UNDER the moving averages in the 4h. From the chart below, we see a very evident bearish trend - the price STAYS under the moving averages, with occasional, random wicks above and to the upper purple (200d MA).

After the bottom, marked the " BIG TURNAROUND ", we see the price trading mostly just under or just above, as we observe range trading. This is how we know, the bottom is in / close. And from here, it's only a matter of time until we start turning around to another bullish cycle . Where the gains far outweigh the risk.

Following this logic, the next reasonable ( very reasonable ) target, is the purple moving averages, and beyond. Currently at $4.3, a nice +8% from here.

_______________________

Cosmos (Atom) 11 Months Within Accumulation ZoneThis is a repeating theme and pattern; this is a classic. Cosmos is now sideways after a correction. The correction is preceded by a bullish wave.

The bullish wave in late 2024 was a short-term, it lasted only one month. But what is interesting is the fact that the bottom range is the same now as it was before the last bullish wave.

If you count the period from the September 2024 low until present day, we have more than 280 days. A very long time. If we start counting from August 2024, when the current accumulation zone was activated, this gives us a total of 314 days, more than 10 months. This is truly all that we need to know. The same low holds for almost a year, getting very close.

If ATOMUSDT does not rise within 2 weeks, this would give us a total of 11 months within the same zone. But it doesn't break, each time a low point is activated there is strong buying and this has been happening long-term.

August 2024, September 2024, November 2024. Then again February 2025, March 2025, April, May and the same accumulation zone is still active today.

The whales are accumulating now, this is their buy-range. Once the accumulation phase is over, we will experience a strong bullish phase. Not a small jump as back in late 2024, but an uptrend, higher highs and higher lows.

Ravencoin weekly is a great example. See the 'related publications.'

Thanks a lot for your continued support.

Namaste.

TradeCityPro | ATOM: Major Support Test in Cosmos Ecosystem Coin👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the ATOM coin for you. This project is part of the Osmosis network ecosystem.

🔍 ATOM, with a market cap of $1.68 billion, is currently ranked 51st on CoinMarketCap.

📅 Daily Timeframe

As you can see in the daily timeframe, ATOM is currently sitting on a very significant support zone. It has tested this area multiple times, and once again, it’s hovering around that level.

⭐ If the price finds support here and begins to move upward, we can consider entering a long position with a trigger at 4.588. The main bullish trigger will be the 5.380 level, and if that breaks, spot buying can also be considered.

✨ As I always mention with spot triggers on altcoins, it’s best to wait for Bitcoin dominance to start declining before entering. If that happens, ATOM could potentially move toward targets at 7.514 and 10.4.

⚡️ If the key support at 4.075 breaks, we can open a short position targeting 3.501. The 35.68 level on the RSI is a critical support, and a break below it would serve as a momentum confirmation.

📊 Also, keep an eye on market volume. It has been declining recently, and once volume starts flowing in on either side, we can prepare to act on the corresponding trigger.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ATOM | Sleeping GIANT Altcoin Gem 1️⃣ATOM is probably one of my favorite altcoins at the moment.

If you look at ATOM from a macro timeframe such as the weekly, it seems like there is barely any hope and that it's just been one big liquidity run.

And although ATOM has retraced nearly 92% since it's ATH, we see a much brighter picture when we look at the daily, or 3D timeframe.

______________________

BINANCE:ATOMUSDT

TradeCityPro | Deep Search: In-Depth Of ATOM👋 Welcome to TradeCity Pro!

Today we have a deep research analysis of the ATOM project, and in this report, I’m going to review the project completely. Let’s first go over the project’s fundamentals and then analyze the ATOM chart technically.

🌌 What Is Cosmos?

Cosmos is a blockchain ecosystem designed to solve major challenges in the blockchain industry, such as low speed, high cost, lack of scalability, and the environmental impact of proof-of-work algorithms like Bitcoin. Cosmos enables cross-chain interaction (interoperability) by connecting independent blockchains through a protocol called Inter-Blockchain Communication (IBC).

Cosmos aims to simplify the development of blockchains and decentralized applications (dApps) using a modular framework known as Cosmos SDK, which makes it easier for developers to build blockchain networks.

🛠 How Does Cosmos Work?

The Cosmos network is composed of three main layers:

Application Layer: Handles transaction processing and updates the network state

Networking Layer: Manages communication between blockchains and their transactions

Consensus Layer: Establishes the final state of the blockchain using a consensus algorithm

At the core of this structure is the Tendermint BFT engine, which enables developers to build custom proof-of-stake (PoS) blockchains without coding from scratch.

🔗 Cosmos Hub and Zones

Cosmos Hub was the first blockchain created within the Cosmos network and serves as a central hub for other blockchains—called zones.

These zones are independent blockchains that can interact through Cosmos Hub.

Validators on Cosmos Hub are responsible for maintaining consensus across all zones and are compensated with transaction fees.

The native token of the network, ATOM, is used for transaction fees, governance participation, and staking.

🎯 Key Features of Cosmos

Interoperability: IBC allows blockchains to interact directly

High Scalability: Blockchains run in parallel without overloading a single chain

Ease of Blockchain Development: Cosmos SDK lets developers build customized networks

Decentralized Governance: Users participate in governance by staking ATOM

💡 Interchain Accounts Upgrade

In February 2022, the Interchain Foundation introduced the Interchain Accounts upgrade, allowing blockchains to control accounts on other chains. This enables remote actions like staking, voting, token swapping, and more—without needing full network upgrades.

This significantly enhances interoperability and composability within the IBC ecosystem.

👥 Founders of Cosmos

Jae Kwon

Zarko Milosevic

Ethan Buchman

Cosmos was initially developed by Tendermint Inc. In 2020, Jae Kwon stepped down as CEO and was replaced by Peng Zhong.

🔐 Network Security

Cosmos uses a proof-of-stake consensus algorithm with Byzantine Fault Tolerance (Tendermint BFT):

Validators are selected based on staked ATOM

Malicious behavior results in slashing (loss of tokens)

Rewards are distributed proportionally among validators and their delegators

📍 Where Can You Buy ATOM?

ATOM is available on most major exchanges, including:

Binance

Coinbase

OKX

Kraken

📈 ATOM Token Information

📊 Initial Token Distribution

In 2017, Cosmos raised approximately $16 million through public and private sales. The initial token distribution was as follows:

Public Fundraise:

Share: 44.1%

Unlocked: 35.6%

Block Rewards:

Share: 39.5%

Unlocked: 31.7%

Strategic Investors:

Share: 7.03%

Unlocked: Unknown (likely still locked)

All in Bits, Inc. (Tendermint):

Share: 6.53%

Unlocked: 5.26%

Interchain Foundation:

Share: 6.51%

Unlocked: 5.26%

Seed Investors:

Share: 3.31%

Unlocked: 2.67%

💰 Supply and Inflation

Initial supply: 236,198,958 ATOM

Current supply: ~292 million ATOM

Maximum supply: Unlimited

Inflation rate: Between 7% and 20%, targeting ~2/3 of total supply to be staked

The inflation rate is dynamically adjusted to incentivize staking. If the staking ratio drops below the target, inflation increases, and vice versa.

🔐 Staking and Rewards

Unbonding period: 21 days

Annual reward rate (APR): Between 14% and 20%, depending on network conditions and staking service provider

By staking ATOM, users help secure the network and earn rewards funded through inflation and transaction fees.

🧾 Economic Mechanisms

Burning: If a governance proposal is vetoed, the deposited tokens are burned

Slashing: Validators engaging in malicious or negligent behavior lose part of their staked tokens

🧠 ATOM Tokenomics Models: 1.0 vs 2.0

Recent analysis reveals different impacts of tokenomics models on network sustainability:

ATOM 1.0 with a 10% inflation cap has shown a 10% improvement in token price and treasury health

ATOM 2.0 suffers from stability issues and is often replaced by ATOM 1.0 to maintain network security

Community Treasury in ATOM 1.0: May face depletion within ~24 months due to limited token supply

🔚 Conclusion

Cosmos represents a significant advancement in blockchain infrastructure by addressing some of the core limitations of earlier networks—most notably, interoperability, scalability, and developer accessibility. Through its modular architecture, innovative Tendermint consensus engine, and the IBC protocol, Cosmos has laid the foundation for a truly interconnected web of blockchains.

The network’s native token, ATOM, not only fuels this ecosystem through staking and governance but also underpins its dynamic economic model. While challenges remain—especially around inflation control and treasury sustainability—Cosmos continues to evolve as a leading force in the multichain future of decentralized technologies.

Now that we’ve reviewed the project, let’s move on to the chart for a technical analysis.

📅 Weekly Timeframe

In the weekly timeframe, as you can see, the price has formed a support bottom at the 3.812 level and has tested it multiple times.

✨ This support is very important because if it’s lost, the price could move down toward the 1.863 bottom.

💥 On the other hand, if the price is supported at this level, a bullish cycle could begin. The resistance levels ahead are 6.602 and 10.135.

🔍 The 6.602 zone isn’t very strong, and if the price gets rejected there, it signals that sellers are much stronger than buyers.

✔️ But if the price breaks through this level and moves upward, the 10.135 zone becomes very significant, because if that level is broken, a Double Bottom pattern will be activated and we can get confirmation of a trend reversal.

💫 If this pattern is confirmed, the first target will be 15.704.

📊 Right now, it’s better to pay attention to oscillators like volume and RSI. Volume is currently decreasing, and we need to wait for volume confirmation alongside price movement. If the price starts to move with volume convergence, the likelihood of continuation increases.

🔔 The RSI oscillator also has a small bullish divergence with price. The reason it’s considered small is that the price made an equal low while the RSI made a higher low. If RSI makes a new higher low again, we may start to see the effect of the divergence in the chart.

🎲 A breakout above the 50 level on RSI could also be a confirmation of bullish momentum.

📅 Daily Timeframe

In the daily timeframe, we can see more details of the price action.

🧩 As observed, the price has formed a range box between 3.989 and 5.380, and within this range, RSI has shown a strong divergence.

📈 I think if RSI doesn’t stabilize below the 50 level, and if the price sets a new higher low above 4.588, the chance of breaking the 5.380 resistance on the next test will be much higher.

🔑 If 5.380 is broken, the price could rally to 7.514. The next target after that would be 10.135, a level I also emphasized in the weekly timeframe.

🔽 For a bearish scenario and short positions, the first trigger is a break below 4.588, which can act as a lead-in to a possible break of 3.989. The main short trigger will be the confirmed break of 3.989.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

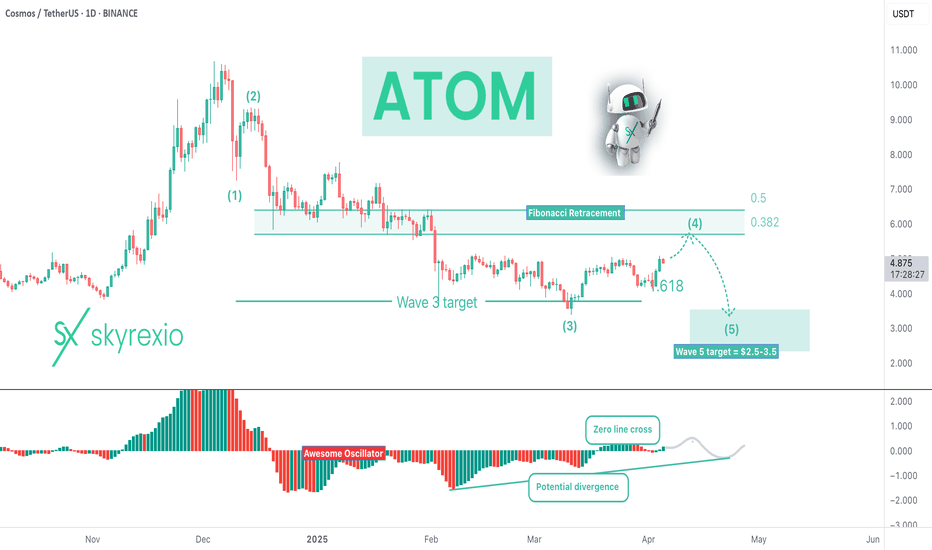

WARNING For ATOM Holders: -50% Crash Incoming!Hello, Skyrexians!

As you know I was not sure last couple of days if altseason started or not and finally decided that not. Bitcoin dominance will reach 67% and large altcoin like BINANCE:ATOMUSDT gives me the hint that altcoins can drop 50% in the upcoming 2-3 weeks!

Let's take a look at the 2 days time frame. To measure the impulse this is valid now. We can see that after reaching the wave 3 target price bounced in the wave 4. Wave 4 has reached the 0.38 Fibonacci and started to go down after red dot on Bullish/Bearish Reversal Bar Indicator . Moreover Awesome Oscillator crossed the zero line signaling that wave 4 could be finished. Now price is in wave 5. The target is $2-3.5. I think it will reach slightly lower low at $3 in this bear market which is almost 50% crash from the current price.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Cosmos - Manipulation?This idea is valid as long as the structure in the orange box maintains its three wave structure.

To prepare for a big run, it goes without saying that there must be some sort of accumulation and manipulation to occur.

In this case, I propose this expanded flat structure where we took the high out to kill the shorts and also trap buyers. Then, terminate that low to take out the buyers and trap sellers.. where we will enter a long into the big move.

TradeCityPro | TIA: Key Support Test in Cosmos-Based Token👋 Welcome to TradeCity Pro!

In this analysis, I want to review the TIA coin for you. This project is one of the protocols in the Cosmos ecosystem and currently ranks 53 on CoinMarketCap with a market cap of $1.51 billion.

📅 Daily Timeframe

As you can see on the daily chart, there's a descending trendline, and the price has been moving down along with it. Currently, the price has reached its main support zone at 2.274.

✨ This is the most critical support for this coin, and if it breaks, the price will move toward a new all-time low. So, buyers will do everything they can to protect this support.

💥 If the price gets supported at this level, the first trigger for opening a long position would be the breakout of the descending trendline. That trigger level is the break of 2.956.

🛒 You can also use this trigger for spot buying. The main trend reversal confirmation comes with a break above 4.324. However, in any case, if any of these triggers are activated, I personally will wait for Bitcoin dominance to show a trend reversal before buying altcoins on spot using the first solid trigger I find.

🔽 For short positions, the key point to remember is that the trend is already downward, so we don’t need a trend reversal confirmation to go short.

⭐ The short trigger is very clear and straightforward — if the 2.274 level breaks, you can enter a short position. Additionally, a pullback to the trendline can also be used as an entry point.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ALTCOINS | ALTSeason | Buy Zones PART 3⚜TRX

TRX has been really strong over the past few days, continuously making higher lows which is early signs of a bullish sentiment. Though, I would want to see the price hold the highlighted support zones before making any decisions. A close UNDER would likely lead to a lower drop.

In that case, I'd be willing to buy at 0,22:

⚜GRT

GRT I'd be looking to buy very low, between the two following prices:

⚜RNDR

Render has bounced from the first buy-zone, but it seems likely we'll retest again soon since the bounce did not equate to a reversal:

⚜MAKER

Optimistic longer term on this coin. Strong decline, lower buy likely here:

⚜AAVE

Strong short-term bearish sentiment, weighted heavier towards the lower zone:

Make sure you don't miss part 1 and part 2 !!

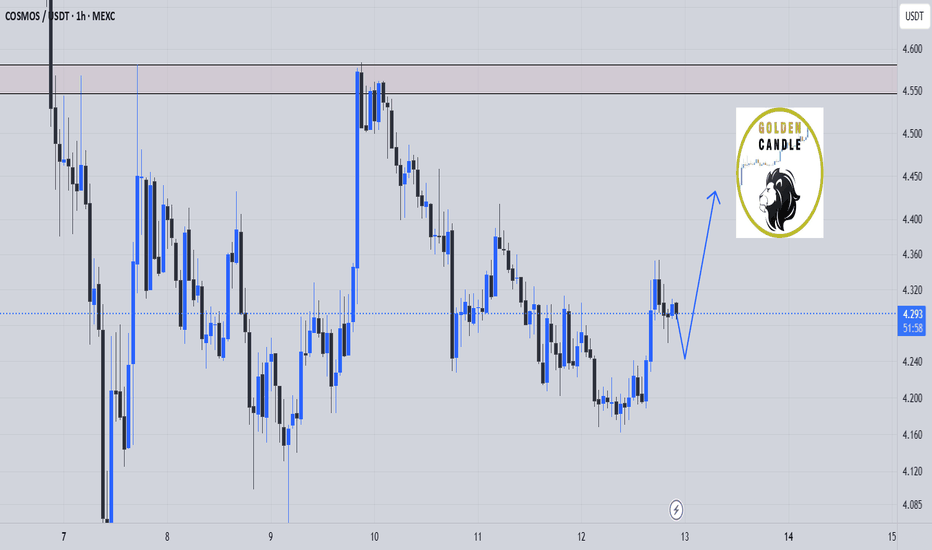

atom buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

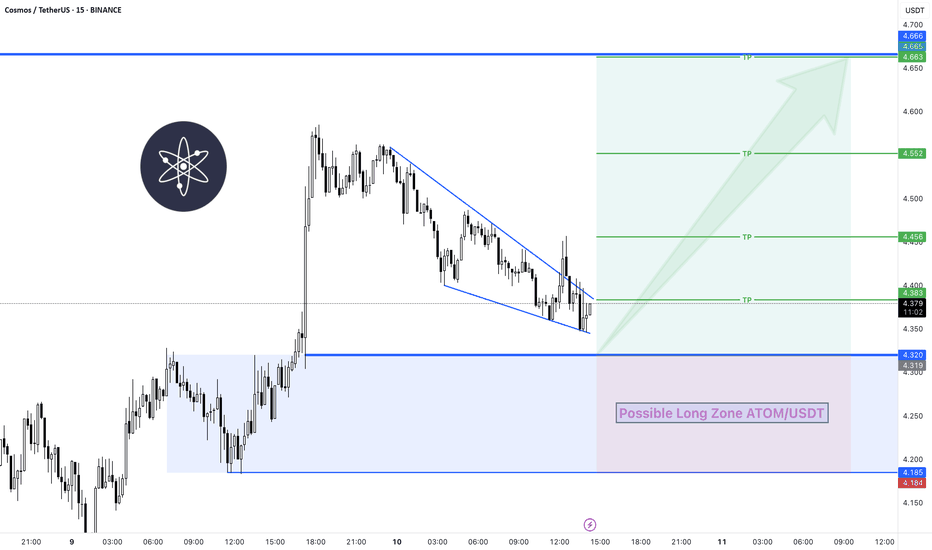

Long Position ATOM/USDT🚀 ATOM/USDT – Falling Wedge Breakout in Progress

The price just broke out of a falling wedge for retesting the major support zone (🔵 4.32 to 4.185). This is a classic bullish reversal setup forming at the right spot.

📈 Long Bias Activated

Momentum is building for a potential multi-TP run if the breakout holds.

🟢 LONG Position Entry: 4.32 to 4.185

✅ Target1@ 4.383

✅ Target2 @ 4.456

✅ Target3 @ 4.552

✅ Target4 @ 4.663

🔴 Risk Level: Invalid below 4.185

🧠 Why it matters:

Wedge formations often lead to explosive breakouts. With the structure forming at demand, this could be a liquidity sweep followed by a rally.

POINT: Next Possible 🔴 Short Zone could be around 4.666

Cosmos: Your Altcoin ChoiceATOM is performing perfect market bottom behavior. It bottomed first in late 2024, around September. A higher low in November. Now, in 2025, we have a lower low in March but the session close happened above the 2024 bottom, much higher.

So you can count all the action between late 2024 and present day as the formation of the bottom. This is where and when smart money buy Crypto. This is the whales buy-zone. Retail traders and investors can also buy if they are smart.

The best prices are available only now and won't continue to be available for long.

The orthodox end of the bear market for Cosmos (ATOMUSDT) happened in June 2022, almost three years ago.

The bear market was down, clearly. The end of the bear market heralds the start of a neutral period. This neutral period can be seen as sideways action on the chart. This sideways action can also be called consolidation before the next major bullish phase. We are in front of this new phase. There will be a major rise, look at the arrow on the chart. Believe it or not, this is exactly what will take place.

This is nothing new. After the March 2020 low, ATOMUSDT went through a similar consolidation period but with an upward bent. After a few months, the market developed a strong bullish phase. Total growth amounted to more than 4,000%. Are you ready for the 2025 bull market?

Cosmos is ready to grow more than 1,000%.

Targets can be seen on the chart.

Expect surprises. Prepare for something great.

Everything will grow more than anything you can imagine, calculate or expect.

The only reason I will be wrong is because the All-Time High will end up being much higher than my projected targets, and this is ok.

Just let the market the grow.

The more it grows, the better it will get.

We are ready for 1 billion users trading Crypto.

Thank you for reading.

Namaste.

Cosmos ATOM price analysisThere are signs that they are trying to keep the NASDAQ:ATOM price in the global buying zone of $3.80-5.50

🟡 If this is true, then the risky buying zone is $3.80-4.30 and the OKX:ATOMUSDT price should not be allowed to fall below that.

🟢 Well, a safe medium-term purchase of #Cosmos is possible only after the price is confidently fixed above $5.50 with a growth potential of at least $7.60-8.20. And if you're lucky, up to $10.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

ATOM Will Reach $3 In This Bear MarketHello, Skyrexians!

As we shared with you earlier we suppose that the last bearish wave will happen for all altcoins in April and BINANCE:ATOMUSDT is not the exception. Despite the growth against the market the waves order shall be remained and we will finally see this dump.

Let's take a look at the daily chart. You can tell us that wave 5 has been already finished recently and now this is bull run but pay attention that Awesome oscillator has not crossed the zero line. It means that it was wave 5 inside wave 3. Now price is in wave 4 and entering the target area. The most optimistic scenario if price will reach $5.7 at 0.38 Fibonacci retracement, but it can reverse even now as well. Finally it will reach $2.5-3.5 in the wave 5 in April.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

ATOM is bullish (12H)It appears that the ATOM symbol has initiated a bullish wave at the swing degree. The structure and bullish signals such as the trigger line break, bullish CH (Change of Character), and momentum in the candles are evident on the chart.

There is a resistance flip zone ahead of the price. If this zone is broken, two targets on the chart will be in play for ATOM.

A daily candle closing below the invalidation level would invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

ATOMUSD: Channel Down bottomed. Strong buy signal.Cosmos turned bullish on its 1D technical outlook (RSI = 60.498, MACD = 0.008, ADX = 27.015), which raised 1W to a neutral state. This is perfectly aligned with the market structure at the moment, which is a technical rebound at the bottom of the 3 year Channel Down. The 1W RSI is on a HL trendline, which is a bullish divergence as far as the Channel's LL are concerned. This means that there is potential to break this Channel to the upside, but until this happens, we will be targeting the 0.786 Fibonacci retracement level (TP = 9.500), like the previous bullish wave did.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##