Cotanalysis

The Cocoa Code - Smart Money is Preparing for a Bullish MoveCocoa is setting up for a long trade upon a confirmed daily bullish trend change.

The fundamentals underlying this market suggest a bullish move of some significance is brewing, and would confirm if we see a daily bullish entry trigger.

Commercials at extreme in long positioning relative to last 26 weeks of positioning.

Advisor Sentiment Index at bearish extreme, a great contrarian signal when juxtaposed with the commercials positioning.

Open Interest is at a 3+ year low. Low levels of open interest are generally associated with market bottoms.

Valuation measure against Treasuries & Gold shows Cocoa is undervalued.

True Seasonal tendency for Cocoa to rally into April.

Front month premium implies the commercials want this commodity so bad that they are willing to pay more to acquire it now than later in the future. This implies a commercially driven bull market is at hand.

130 day cycle points to bullish momentum for Cocoa until May.

Accumulation by the commercials is evident via the ProGo & Ultimate Oscillator divergence.

What does this all mean? It means the fundamental conditions underlying this marketplace point towards a bullish move on the horizon.

Cotton Futures: Decoding the Matrix of Market ForcesCotton, a seemingly unassuming commodity, is quietly aligning for a significant bullish move. But remember—this is not a prompt for reckless action. The entry is reserved for those who wait for the Daily timeframe to confirm the trend change.

The Codes of the Cotton Conspiracy

Code #1: The Commercial COT Index

Commercials are not merely dabbling—they are at an extreme in positioning, maxed out over a 26-week lookback. Their hands are heavy with longs, signaling a brewing storm that only the wise will prepare for.

Code #2: All-Time Extreme Positioning

For the first time since 2019, commercials hold their maximum long positions. Unlike 2019, these positions are at higher prices, implying deeper convictions. Meanwhile, Large Speculators are excessively short—a telltale sign that the tide may soon turn. Both are at an all-time extreme in positioning.

Code #3: Valuation Metrics

Cotton stands undervalued against the pillars of Gold, DXY, and Treasuries. The market’s mispricing is your opportunity, should you dare to seize it.

Code #4: Open Interest Analysis

Open Interest (OI) has been climbing steadily, a silent crescendo. Who is fueling this growth? The commercials—those orchestrators of market moves—are discreetly accumulating, signaling an impending bullish wave.

Code #5: ADX Over 60—The Endgame Approaches

The ADX has breached the critical threshold of 60, a harbinger of trend exhaustion. Confirmation lies in the ADX’s roll-over or the Large Speculators’ retreat from their short positions.

Code #6: Spread Divergence

As prices sink to new lows, the spread between the front and next month contracts defiantly rises—commercials are eager for the front month, a potent sign when paired with extreme positioning.

Bonus Codes: Hidden Layers of Accumulation

Insider Acc Index and ProGo hint at quiet accumulation. Momentum shows bullish divergence, %R enters a buy zone, and the oversold stochastic adds another layer of intrigue.

The Flaws in the System

Yet, no system is without its anomalies. Small Speculators are excessively long—a peculiar deviation, given their knack for misjudging bottoms. This anomaly presents two scenarios: a merciless long squeeze forcing out the naive, or a rare stroke of luck for the masses. Moreover, while True Seasonal is misaligned, remember that seasonals reflect historical ghosts, while positioning unveils the machinations of today's masters. Always lean towards positioning as your guide, not seasonals.

The Red Pill Awaits

The stage is set. The players are in position. The market whispers secrets only a few are willing to hear. Cotton’s matrix is laid bare—whether you act or remain a spectator is the choice only you can make.

But beware, the rabbit hole goes deeper than you think. Are you ready to follow?

Choose wisely.

The Coffee Code: A Short Opportunity Hidden in Plain SightThere is a difference between seeing the market and truly understanding it. Most traders react. The enlightened anticipate.

This week, the COT strategy has illuminated a setup so clear, yet so overlooked, that only those who understand the deeper language of the markets will act. Coffeewhispers a warning, and few are listening.

The Codes Have Been Revealed:

🔻 Code 1: Commercials' COT Index – The real insiders, the ones who move markets, are at a bearish extreme. The last time we saw this setup? A major reversal followed.

🔻 Code 2: Positioning Extremes – Large specs are at an all-time high in longs. When the herd rushes in, exits become crowded.

🔻 Code 3: Advisor Sentiment – The so-called “experts” are euphoric. When advisors scream bullishness while commercials quietly stack shorts, it’s a sign. A big one.

🔻 Code 4: Valuation – Coffee is severely overvalued relative to Gold, Treasuries, and the Dollar. The weight of reality will soon press down.

🔻 Code 5: ADX Over 60 – A high ADX signals a trend’s climax. The moment it rolls over is the key to this code triggering the move.

🔻 Code 6: Seasonality – Mid-February to March? Historically, a time of decline. The cycle repeats for those who see it.

🔻 Code 7: Cycles Colliding – Multi-timeframe cyclical pressure is now aligned against coffee.

The rarest and most powerful force in motion.

Additional indicators confirm it. Distribution. Divergences. Ultimate Oscillator. Williams ProGo. %R sell zones. Every signal is flashing red.

And yet, most will hesitate. Most will ignore the signs. They will wait until it's too late.

The question is not whether the opportunity exists. It’s whether you can see it.

If you understand what’s written here, you already know what comes next.

If you don’t... then perhaps it’s time we talked.

Disclaimer

The information provided in this content is for educational and informational purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy or sell any securities or financial instruments.

Trading financial markets involves significant risk, including the potential loss of capital. Past performance is not indicative of future results. You are solely responsible for your trading decisions and should conduct your own research or consult with a licensed financial advisor before making any financial decisions.

The creator of this content assumes no liability for any losses or damages resulting from reliance on the information provided. By engaging with this content, you acknowledge and accept these risks.

Acknowledgment

The strategies and concepts taught in this class draw significant inspiration from the works and teachings of Larry Williams, a pioneer in trading and market analysis. His groundbreaking research and methodologies have shaped the foundation of modern trading education.

While this class incorporates Larry Williams’ principles, the content has been adapted and presented to reflect my own understanding and application of these ideas. Full credit is given to Larry Williams for his original contributions to the field of trading.

What If I Told You... Soybeans Are Ripe for a Short? | COT StratFollow Me Down the Rabbit Hole: The Soybeans Market Setup for Shorts

What if I told you... the soybean market is on the verge of a paradigm shift? That the signals are all around you, hidden in plain sight, waiting for those who can read the code. The Commitment of Traders (COT) data is flashing red, and the truth is undeniable: the smart money is preparing for a downturn.

Take the red pill, and let’s decode why the path of least resistance points down.

The COT Index: A Matrix of Sell Signals

The COT Index is the Oracle, revealing the intentions of the market’s architects. Commercial traders – the ones who truly understand the construct – have loaded up on shorts at levels even more bearish than May. And they’re doing it at lower prices.

This isn’t just resistance to the rally. It’s a calculated move. A whisper in the system that the rally is but an illusion, built on a fragile code.

Overvalued in the Grand Simulation

When you step back and compare soybeans to the benchmarks of reality – gold, Treasuries, and the almighty DXY – their overvaluation becomes clear. The system’s balance demands equilibrium, and soybeans are poised to correct.

Sentiment: The False Prophet

The Advisor Sentiment Index reveals an uncomfortable truth: the herd is ecstatic. But as you’ve learned, the crowd rarely escapes the Matrix unscathed. Bullish sentiment at these extremes is a trap, and the smart money is already fading this illusion of strength.

Spread Divergence: Cracks in the Code

The spread divergence between the front-month and the next-month contracts is a glitch in the system. Short-term excitement isn’t aligning with the longer-term structure. When spreads diverge like this, it’s a signal: the construct is destabilizing.

Distribution: The Hidden Hand

The POIV (Price-Open Interest Volume) divergence reveals a pattern of distribution. The architects of the market are selling into the rally, while the unwitting masses continue to buy. The code doesn’t lie. This is the calm before the storm.

The Technical Trinity: %R, Stochastic, and Oscillator

Three powerful indicators align, pointing to an impending shift:

%R Indicator: Overbought and ready to turn.

Stochastic Oscillator: Rolling over, signaling exhaustion.

Ultimate Oscillator: Confirming the downward momentum.

Combine this with the down-sloping 52-day SMA, and the dominant trend reveals itself: the Matrix is designed to move lower.

Patience: The Key to the System

This isn’t a call to blindly short. No one escapes the system without discipline. Wait for the daily chart to confirm the trend change. Only then can you move with precision, ensuring that every move aligns with the code.

The Choice Is Yours

The soybean market is more than what it seems. The smart money, the sentiment extremes, the divergences – they all point to a single truth: this rally is an illusion. But as always, the choice is yours.

Will you take the blue pill and believe what you want to believe? Or take the red pill, follow me, and see how deep the COT hole really goes? The trend is your ally – until it isn’t. And this one is collapsing before your eyes.

Stay tuned, stay sharp, and remember: the Matrix rewards those who see beyond the veil.

Acknowledgment

The strategies and concepts taught in this class draw significant inspiration from the works and teachings of Larry Williams, a pioneer in trading and market analysis. His groundbreaking research and methodologies have shaped the foundation of modern trading education.

While this class incorporates Larry Williams’ principles, the content has been adapted and presented to reflect my own understanding and application of these ideas. Full credit is given to Larry Williams for his original contributions to the field of trading.

Disclaimer

The information provided in this content is for educational and informational purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy or sell any securities or financial instruments.

Trading financial markets involves significant risk, including the potential loss of capital. Past performance is not indicative of future results. You are solely responsible for your trading decisions and should conduct your own research or consult with a licensed financial advisor before making any financial decisions.

The creator of this content assumes no liability for any losses or damages resulting from reliance on the information provided. By engaging with this content, you acknowledge and accept these risks.

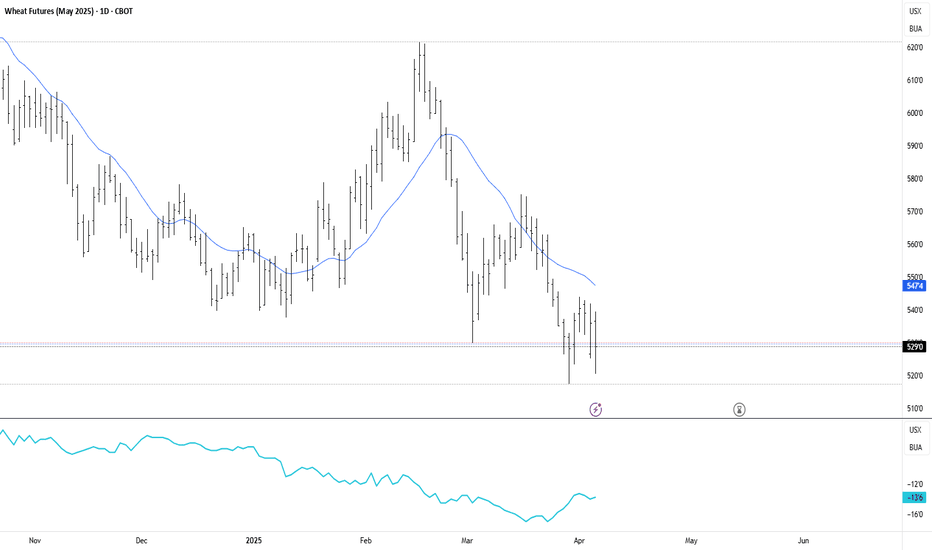

The Wheat Revelation: A Privilege to See the CodeThe Wheat Revelation: A Privilege to See the Code

"You’ve always felt it—the hum of something deeper beneath the markets, the unseen forces at play. Today, you are invited to glimpse the truth."

The Commitment of Traders (COT) strategy has unveiled another red pill: the Wheat market is primed for a bullish move. This is no ordinary signal; it is a rare alignment of forces, a convergence of codes that point to a potential market shift. But we do not act blindly. We do not rush headlong into the storm. Instead, we wait for the signal—a confirmed bullish trend change on the daily timeframe. Patience will unlock the reward.

Let me show you the code:

CODE 1: The COT Index

The commercials, the smartest players in the market, are very long relative to the 26-week index lookback. This positioning is not noise; it’s a whisper from those who understand the market’s heartbeat better than anyone else.

CODE 2: Net Positioning Extremes

Commercials are hovering around their maximum long positioning since December 2023. But it gets better: we see the "Bubble Up" phenomenon between the net positions of Commercials and Large Specs. This divergence is a hallmark of major market turning points.

CODE 3: Open Interest

The recent multi-week downtrend has coincided with a large increase in Open Interest. The question is: who is driving this increase? The answer is as bullish as it is clear—Commercials are loading up, signaling a seismic shift beneath the surface.

CODE 4: Valuation

Wheat is undervalued relative to US Treasuries. This imbalance cannot persist indefinitely. Markets correct, and when they do, the opportunity to ride the wave is immense.

CODE 5: True Seasonal Strength

Seasonality is on our side. History tells us that Wheat often exhibits strength until May, and this year appears no different.

CODE 6: Accumulation

The code is crystal clear:

Bullish spread divergence between front and next-month contracts.

Indicators like POIV, Insider Accumulation Index, and ProGo point to heavy accumulation by smart money.

CODE 7: Large Speculators Moving to Buy Side

In this week’s COT data, we see the Large Speculators reducing their shorts. The Large Specs are the ones that will drive a trend. It appears that maybe, the large specs see what you and I see, and are preparing for an impending bullish move.

Other Signals of Strength

Technical indicators like %R, Ultimate Oscillator, and Stochastic all converge, painting a picture of imminent bullish potential.

What Does This Mean for Us?

We do not jump into the market simply because the conditions are ripe. Instead, we wait for confirmation. A bullish trend change on the daily timeframe is the key that unlocks the door. Until then, we prepare. We watch. We wait.

Are you ready to see beyond the noise of the markets? To decode the signals others overlook? Follow me for more insights, and if you’re ready to take the red pill, join me on this journey to uncover the truth behind the markets. The choice is yours.

The Sweet Truth: Sugar’s Bullish Code UnlockedThe Sweet Truth: Sugar’s Bullish Code Unlocked

Not everyone gets to see the market for what it truly is. Most remain trapped, chasing shadows and noise. But you—you're here. You're ready to decode the signals hidden in plain sight.

This week, the COT strategy has unveiled a powerful truth: Sugar is setting up for a bullish move.

But let me be clear—this isn’t a call to recklessly jump into a trade. The market whispers, and we must wait until it speaks clearly. A daily bullish trend change is the signal we need to confirm the move. Until then, we stand ready, armed with knowledge.

Let’s break down the codes that have revealed this opportunity:

Code #1: Extremes in Positioning

Commercials are heavily long, while small speculators are positioned at historic extremes relative to the 26-week lookback index. This is a classic fingerprint of a market ready to shift.

Code #2: Undervaluation

Sugar is undervalued relative to Treasuries and the DXY. The market is quietly signaling that its current price doesn’t reflect its true worth.

Code #3: Supercharged Seasonality

The True Seasonal tendency supports a rally into April. But here’s the kicker—current price action is diverging bullishly from its seasonal trend, creating what Larry Williams calls a "Supercharged Seasonal." This is a rare and potent setup.

Code #4: Front Month Premium

The demand for the front month contract is undeniable. Commercials are paying a premium for earlier delivery, signaling the potential ignition of a commercially driven bull market. The spread between the front month and the next is also diverging bullishly—another signal of strong demand.

Additional Indicators

The Insider Accumulation Index shows clear evidence of accumulation.

The Weekly %R is in the buy zone.

The Weekly Stochastic is oversold, hinting at a market ready to pivot.

What Does This Mean for You?

It means you’re ahead of the herd, seeing what they can’t. But knowledge without discipline is dangerous. We wait for the market to confirm. A daily trend change is our signal to act. Until then, we remain patient, prepared, and poised.

Decode the Market

This is just one piece of the puzzle. Each week, I uncover opportunities like this—markets primed for moves that most won’t see until it’s too late. If you’re ready to step beyond the noise, to decode the hidden messages of the market, follow along.

The question is: Will you act when the market reveals its truth, or will you be left watching from the sidelines?

The choice, as always, is yours.

Unlocking the Wheat Matrix: The Code to Dominating CommoditiesUnlocking the Wheat Matrix: The Code to Dominating Commodities

What if I told you there is a way to see the hidden signals of the market? To move not with the herd but ahead of it, where clarity reigns and profits follow. This week, we delve into Wheat (ZW) — a market where the COT strategy reveals its secrets. The choice is yours: read on and learn, or remain blind to the patterns all around you.

Decoding the Setup

Understand this: this is not an invitation to blindly leap into the market. No, we wait. Patience is the cornerstone of mastery. When the technical tools confirm the market’s strength, only then do we act. Now, let’s break down the wheat matrix:

Code 1: Commercial and Small Speculator Positioning

The Commercial COT Index, using a 26-week lookback, reveals that commercials are at an extreme in long positioning. At the same time, the Small Speculator COT Index shows small specs aligning at a similar extreme. In the wheat market, unlike others, we follow the small specs rather than fading them. A deviation from the norm—an anomaly in the matrix.

Code 2: Commercial Extremes in Net Positioning

Commercial entities are nearing their most bullish stance in three years. History whispers a truth: when commercials move like this, the market often follows.

Code 3: Contrarian Signal from Investment Advisors

The masses of investment advisors are overwhelmingly bearish. Against this backdrop, the extreme bullish positioning of commercials sends a powerful contrarian signal. The matrix is showing its hand.

Code 4: Valuation Metrics

Wheat stands undervalued against U.S. Treasuries. When value aligns with positioning, the code becomes clearer.

Code 5: Seasonal Patterns

Seasonal truths tell us that wheat’s true bottom often forms in early January. This aligns perfectly with the cyclical and technical signals currently emerging.

Additional Signs in the Matrix

Spread Divergence: Bullish spread divergence between front and next month contracts.

Accumulation Indicators: Insider Accumulation Index and Williams ProGo confirm accumulation.

Technical Tools: %R is in the buy zone, and Weekly Ultimate Oscillator Divergence further supports the bullish narrative.

Cycles: The Recurring Patterns

44-Month Cycle: A major bottom forms now.

830-Day Cycle: Signals an upward move into March.

151/154-Day Cycles: Align with a cyclical bottom occurring now, projecting strength into March.

The Red Pill of Action

With these signals converging, the urge to act immediately can feel irresistible. Don’t. The matrix requires patience. Let the market reveal its strength. When the time comes, you’ll ride the wave with confidence.

The Path to Mastery

Trading isn’t merely a series of moves; it’s a philosophy. The COT strategy is a key, but only those who seek mastery will unlock its full potential. If you’re ready to see the market for what it truly is, join Tradius Trades. Here, we don’t just navigate the matrix of commodities—we redefine it. Are you ready to free your mind?

The Market Code: Decoding Opportunity in the Canadian Dollar**The Market Code: Decoding Opportunity in the Canadian Dollar**

There is a moment when the veil is lifted, and the truth becomes clear—when the illusion of chaos resolves into perfect order. This week, I have read the code written within the Commitment of Traders (COT) data, and it reveals a symphony of opportunity, waiting for those who are ready to listen.

The markets are alive with setups—Currencies, Energies, Metals, Grains, Treasuries—all pulsing with hidden potential. But let me be clear: not all secrets are free. I will offer you only a taste, a glimpse of what lies beneath the surface. The rest? That’s reserved for those who dare to journey deeper into the rabbit hole.

Among the revelations, one stands above the rest: **The Canadian Dollar is primed for longs**. But do not mistake this for a call to rush blindly into the market. This is the *setup*, not the signal. To act with precision, you must wait for the *trigger*. This distinction is critical, yet misunderstood by most.

The Codes Decoded

-Commercial Positioning: The commercials—those who understand the market better than anyone—are close to holding their longest positions in three years. The last time they were this long was in August, just before a sharp bullish move. Coincidence? Hardly. This is the first code of the Canadian Dollar setup.

-Open Interest Surge: During the recent multi-week price decline, Open Interest has spiked. Ask yourself: *Who is driving this increase?* The data reveals it’s the commercials, increasing their longs. This is not noise—it’s a signal.

-Bearish Sentiment Extreme: Investment advisors are at a relative extreme in bearishness. Contrarians thrive on such moments, as extremes are where the most compelling opportunities are born.

-Valuation Insight: The Canadian Dollar is undervalued relative to U.S. Treasuries. When valuation and positioning align, the market is speaking in a language few understand.

-Seasonal Trends: The true seasonal trend supports a long, pointing to upward movement into January. History doesn’t repeat, but it rhymes.

-Small Speculator Shorts: Small speculators are heavily short—an extreme in their positioning over the last 26 weeks. This is yet another clue in the unfolding narrative.

-Technical Support: %R is signaling a buy zone, and the weekly stochastic is oversold. The technicals align with the fundamentals—yet another piece of the puzzle.

The Question

What will you do with this knowledge? Will you watch from the sidelines, content to let the markets continue to elude you? Or will you take the red pill, embrace the truth, and step into a new understanding of how the markets truly operate?

The Invitation

I’m not here to sell you illusions or half-truths. I’m here to show you how to *see*. The Commitment of Traders strategy isn’t a system—it’s a lens that reveals the market’s music, the hidden rhythm that guides price action.

If you’re ready to go beyond the surface, to see the *why* behind the *what*, reach out. I’ll teach you how to decode these markets for yourself. The rabbit hole goes deep, but I will guide you.

The choice is yours: stay in the comfort of ignorance, or step into the unknown and discover what lies beyond.

Are you ready to see how deep the rabbit hole goes?

Red Pill of Trading: A Glimpse into Hidden Market SetupsIn the depths of the market matrix, few can see beyond surface price action.

The Commitment of Traders data is a revelation, a signal that speaks to those ready to see the true forces at work. This strategy has uncovered potent setups across currencies, energies, grains, and metals—all primed for major moves.

But I cannot offer this knowledge freely. Information that comes cheap is rarely valued. True insight, like the red pill, demands a commitment. A choice to see beyond the veil. Today, I offer you just a glimpse—one of many market truths revealed by this strategy.

The Canadian Dollar.

The CAD is positioned for longs. But let me be clear: we don’t blindly long this market. Instead, we wait, watching for a confirmed entry trigger on the daily timeframe. Yet everything points towards a powerful move.

Commercials are positioned extremely long relative to the last 26 weeks, and approaching levels we last saw in August—right before CAD surged. Open interest has been increasing, and when OI increases, we ask ourselves: "Who is causing this open interest increase?". In this case, it is increasing while the Commercials are getting very long, which is bullish.

Last week, investment advisor sentiment hit a bearish extreme, a contrarian signal that lingers now into this week. CAD is undervalued against both gold and treasuries—another indication of buy potential. Two weeks ago, we saw ADX drop below 20, while commercials heavily increased their longs, creating a bullish divergence that grows with each new indicator.

Supplementary indicators stand by this setup: Insider Accumulation, Stochastics, %R, even a bullish momentum divergence is setting up, though it’s not yet confirmed.

And this is just the beginning.

If you want to uncover the full array of setups across markets this week and next, to see the real truth behind the moves, then take the red pill. Reach out. This is an opportunity, a privilege to step beyond mere price action and learn the market’s deepest secrets.

Inquire with me, and together, we’ll peel back the layers of the matrix. The choice is yours.

Soybean Oil’s Red Pill Moment: The Short Signal Just Hit"You’ve been waiting, watching, wondering when the veil would lift. Today is that day."

Soybean oil just crossed a threshold, one that turns theory into action. This isn't just a hint anymore; it’s a red pill moment. Today, we got the confirmation we needed: a Daily bearish momentum divergence trigger has sealed the deal. If you've been waiting for a sign, here it is—the entry point is here.

Decoding the Signs from the Commitment of Traders (COT)

"What if I told you that the market leaves clues? And only the most discerning see them."

Our strategy isn’t based on surface-level movements but on patterns and signals that tell the deeper story. Soybean oil is primed for a down move. Let’s break down the intel:

Commercials’ Short Stance

Relative to their positioning over the last 26 weeks, commercials have positioned themselves heavily short. Last time they were this committed was December 2023, a setup that spelled trouble for the long side.

Overvaluation Across Key Metrics

Against gold and treasuries, soybean oil is flashing overvalued based on our WillVal indicator. This isn’t random; the market is overextended and vulnerable to the downside.

Bearish “Pinch” Confirmation

Two weeks ago, a Bearish Pinch formed on ADX/Stochastic—one of the most reliable indicators of an impending pullback. Today’s momentum divergence confirms it. The alignment is uncanny, if you’re paying attention.

Seasonal Trends: Down to December

True Seasonal points down, favoring the bears. It’s as if time itself is backing this move.

Supplementary Indicators Are Aligned

Insider Acc/Dis, %R, and Stochastic are all signaling in unison: the tide is turning. Each of these alone is meaningful, but together, they mark a rare convergence that few recognize.

"The trigger is pulled, and now we walk the path."

This isn’t a drill. Today’s bearish momentum divergence confirmation is the daily trend trigger we needed, a line in the sand between potential and execution. For those who see beyond the surface, this is your sign to take action.

To uncover more of these market signals and gain the insights no one else is sharing, follow @Tradius_Trades. Because once you’re in on the code, everything changes.

Natural Gas Goldmine: Are You Ready to Take the Red Pill?Unlocking the Natural Gas Goldmine: Are You Ready to Take the Red Pill?

In the ever-shifting sands of the financial markets, the truth often lies buried beneath layers of noise and confusion. Today, we delve into the Commitment of Traders (COT) data, a powerful tool that reveals a compelling opportunity in the natural gas market. What if I told you that the signs are aligning for a potential rally? But heed this warning: This does not mean to blindly dive into long positions. Instead, we stand poised, awaiting the moment of a confirmed trend change on the daily timeframe—a moment that transforms potential into profit.

The Market Signals: A Gathering Storm

The data speaks volumes. Commercial traders, the real players in this game, are currently positioned at a major extreme in long holdings—the highest they’ve been in over three years. This is not mere coincidence; it’s a clear indication that something significant is brewing beneath the surface.

As we analyze the net open interest, we observe a phenomenon I like to call the “Bubble Up.” This surge occurs when Commercials outpace Large Speculators, and such dynamics often foreshadow market turning points. The whispers of a shift in power are growing louder, and it’s time to listen closely.

Furthermore, we cannot overlook the increasing open interest during this multi-week decline. But we must ask ourselves: Who is driving this increase? The answer is clear—commercial traders are loading up on long positions. This is a bullish sign, indicating confidence in a market reversal.

The Premium Charge: An Ominous Signal of Change

Adding another layer to our bullish thesis is the current premium charge in the market. We observe that the front months, extending out to April, are trading at a premium compared to later delivery months. This indicates a strong demand for immediate delivery—a sign that the market expects an uptick in prices.

But let us not forget the supplementary indicators that further bolster our long stance: the Price Oscillator Indicator Value (POIV), %R, and the Ultimate Oscillator are all aligning in favor of the bulls. They whisper of impending change, urging us to prepare.

The Seasonal Anomaly: A Moment of Reflection

Yet, as we pursue this truth, we encounter an obstacle. The traditional seasonal patterns suggest a decline until February, but the extreme positioning of commercial long traders casts doubt on this warning. Sometimes, the path to enlightenment requires us to look beyond conventional wisdom.

In this moment, we find ourselves at a crossroads. The insights we’ve gathered are akin to a revelation, a glimpse into the potential future of natural gas.

The Choice is Yours

Will you take the red pill and see how deep the rabbit hole goes? Embrace the knowledge, or remain in the shadows. The markets are waiting, and so is your potential.

Welcome to your awakening.

Take the Red Pill: The EURO COT Long Play RevealedTake the Red Pill: The EURO Long Play Revealed

"Let me tell you why you're here. You're here because you know something. What you know, you can't explain, but you feel it." – Morpheus

Most traders move blindly through the markets, buying and selling on impulse, on what they think they know. But for those who understand how to read deeper signals, patterns begin to emerge—patterns that separate the merely active from the truly informed. Right now, if you're willing to look, Commitment of Traders (COT) data is showing us something intriguing about the EURO. This is your red pill: a glimpse into how those in the know see beyond the chart.

The Setup: A Commercial Long Play

Behind the scenes, commercials—the ones who have true skin in the game—have loaded up on longs, reaching a 26-week extreme in positioning. Not only that, but they're holding their longest exposure in three years, a sign that those with the best intel in the market believe in a coming shift. Meanwhile, the "small specs," often driven by emotion rather than insight, have gone nearly max-short. Historically, this group isn't just wrong; they’re almost predictably wrong.

The result? A textbook setup. But if you’re looking to take advantage, know this: jumping in without discipline is how people get burned. We wait for a confirmed trend change on the daily timeframe. Nothing less. Because only the disciplined get to see beyond the shadows and reap the rewards.

The Undervaluation: Gold, Treasuries, and the EURO’s True Position

If you look at the EURO in comparison to gold and treasuries, something stands out—it’s undervalued. This doesn’t show up in headlines or make for easy soundbites, but for those who know how to look, it’s a flashing signal. And there’s a seasonal edge, too: the EURO’s tendency to rally through mid-December. It’s another puzzle piece that, when added up with positioning extremes and market sentiment, paints a picture that only a few will truly grasp.

Supplementary Signals: Layers of Confirmation

For those still seeking confirmation, additional indicators are lining up: %R, Stochastic, and even bullish momentum divergence are signaling alignment. But understand this—the market doesn’t reward the impatient. We wait, observe, and move only when the trend change is confirmed on the daily chart.

The Truth Beneath the Surface

This is no ordinary trade idea. It’s a blueprint to help you see the hidden dynamics that move the market. Those who look only at surface price action may be blindsided by the moves yet to come. But for those willing to see beyond—those ready to know what the COT data, the fundamentals, and the seasonal tendencies are saying—this is a rare opportunity.

Now, if you’re ready to see what the rest don’t, follow Tradius Trades. You’ll be one of the few with eyes open, equipped to move with purpose.

---

> "I didn’t say it would be easy, Neo. I just said it would be the truth."

COT Red Pill: Canadian Dollar Primed for a Long The Red Pill of Trading: Illuminating the Canadian Dollar's Long Potential

In the vast and enigmatic expanse of the financial matrix, truths often lay hidden, obscured by layers of complexity and uncertainty. Today, I offer you an opportunity—an invitation to take the red pill and awaken to the profound insights that the market has to reveal. We turn our gaze to the Canadian Dollar (CAD), a currency poised for potential transformation, waiting for the discerning trader to recognize its worth.

The Commercials

Let us begin with the Commitment of Traders (COT) data, a powerful tool that unveils the positioning of the market's key players. The commercials—those seasoned entities whose knowledge and resources run deep—are currently positioned significantly long. Their holdings approach levels last seen in August 2024, a time of significance with extreme long positioning that heralded a remarkable four-week upswing in prices. This is no mere coincidence; it is a bullish signal, a whisper from the market that should not be ignored.

However, wisdom demands patience. To embark on this journey, we must first wait for a confirmed trend change entry trigger on the daily timeframe. The fundamentals are ripe for a rally, yet we must ensure our actions are grounded in calculated strategy rather than impulsive enthusiasm.

Open Interest: A Window into Market Dynamics

As we delve deeper into the market's secrets, we uncover the insights offered by open interest analysis. During the recent multi-week downtrend, we have witnessed a spike in open interest—a phenomenon that warrants our attention. Here, we must pose a critical question: who is driving this increase?

in this case it is the commercials, accumulating long positions and enhancing their stake, we find ourselves looking at a robust bullish indicator. The increase in open interest driven by those with intimate market knowledge signifies a potential shift in the market’s direction. This insight is a crucial key to unlocking the doors of opportunity.

The Contrarian’s Edge

But the revelations do not end there. Investment advisor sentiment has plummeted to bearish extremes, a classic contrarian signal that savvy traders know to watch. As the masses succumb to pessimism, history has shown us time and again that opportunity often lies in the shadows of despair.

The WillVal indicator further illuminates our path, revealing that the Canadian Dollar is currently undervalued compared to Gold and Treasuries. This mispricing signals an impending revaluation—a chance for the discerning trader to seize the moment. Seasonal trends indicate that we should anticipate price movements upward as we approach January, and the positioning of small speculators(the usually wrong public)—excessively short—presents yet another contrarian opportunity, one that the wise trader can capitalize on.

The Choice Before You

You now stand at a significant juncture, a crossroads where knowledge and opportunity intersect. The insights I have shared are akin to taking the red pill—a revelation that exposes the true nature of the market, laying bare the possibilities that await those willing to see.

As you contemplate your next move, remember that successful trading is not about surrendering to the whims of the crowd but about embracing the hidden truths that lie beneath the surface.

Join me on this journey into the unknown. Follow Tradius Trades, where we dissect the intricate patterns of the market and equip you with the insights necessary to navigate this complex landscape. The truth is out there, and together, we can unveil the secrets of trading with clarity and conviction. Choose wisely, for the matrix of opportunity awaits your command.

Gold Flashing Warning SignsGold Flashing Warning Signs: Why We’re Taking a Cautious Short Position

Today, our Commitment of Traders (COT) strategy triggered a short trade on gold. Yes, we know—shorting gold at all-time highs feels like swimming upstream. But if you’ve been with us long enough, you know we don’t follow the crowd. We follow the data. And the signals? Well, let’s just say they’re getting hard to ignore.

To clarify, this setup wasn’t made on a whim. We got the green light when key technical indicators—Momentum, the Detrended Price Oscillator (DPO), and the Commodity Channel Index (CCI)—all confirmed a bearish divergence on the Daily timeframe.

Here’s a closer look at what’s guiding our trade:

1. Commercial Traders Are on High Alert

Commercial players—those who deal with gold at its core—are positioned short like we haven’t seen in over three years. They’re the steady hands here, and their caution is hard to overlook. It suggests that even in a market frenzy, they’re seeing potential downsides others may not be watching.

2. Retail Speculators Are Leaning Long

While not at full extremes, small speculators are heavily positioned on the long side, nearing a six-month high. This confidence could mean trouble—when retail traders load up, it can mark the late stages of a rally. We’re paying attention to this; it’s a classic contrarian indicator.

3. Open Interest Is Surging—But Why?

Open interest in gold futures has been climbing steadily. That’s usually a good thing for bulls, but here’s the twist: large and small speculators have been driving this uptrend. If these buyers lose momentum, who’s left to push prices higher?

4. Sentiment Is Peaking—But Is It Too High?

Market sentiment is at a bullish extreme, with advisors optimistic about gold’s rally. High sentiment can be a double-edged sword. It often means there are few people left to buy, and that’s when reversals happen. It’s a classic market psychology moment—and we’re taking note.

5. Gold Is Pricey Relative to Treasuries

Using our WillVal indicator, we see that gold is hitting valuation peaks compared to treasuries. This isn’t an automatic sell, but it’s a signal that the precious metal might be pushing its limits.

6. ADX Shows Intense Momentum, But There’s Caution

Our ADX indicator is above 40, confirming strong momentum. But we’re cautious here—when the market gets this heated, we often see shifts. Combined with those commercial short positions and high investor sentiment, this momentum could be due for a reality check.

7. Bearish Spread Divergence Is Emerging

There’s divergence between the front-month and next-month gold contracts, a sign that underlying strength may be weakening. It’s a small detail, but one that hints the rally might be overextended.

8. Supplementary Indicators Aren't Looking Optimistic

Rounding things out, our Insider Acc/Dis, %R, and Stochastic indicators are all showing bearish signals. We don’t rely on these alone, but together, they reinforce the caution signals we’re already seeing.

The Bottom Line

Shorting gold during a run like this isn’t a decision we take lightly. But the COT data, market positioning, and sentiment suggest a cooling-off period could be near, and the trade was triggered today via the divergence on the daily. Markets have a way of humbling even the most confident predictions, so we approach this trade with an open mind and a healthy dose of caution.

If you’re interested in seeing how we analyze trades and approach market extremes, stay tuned.