COTIUSDT

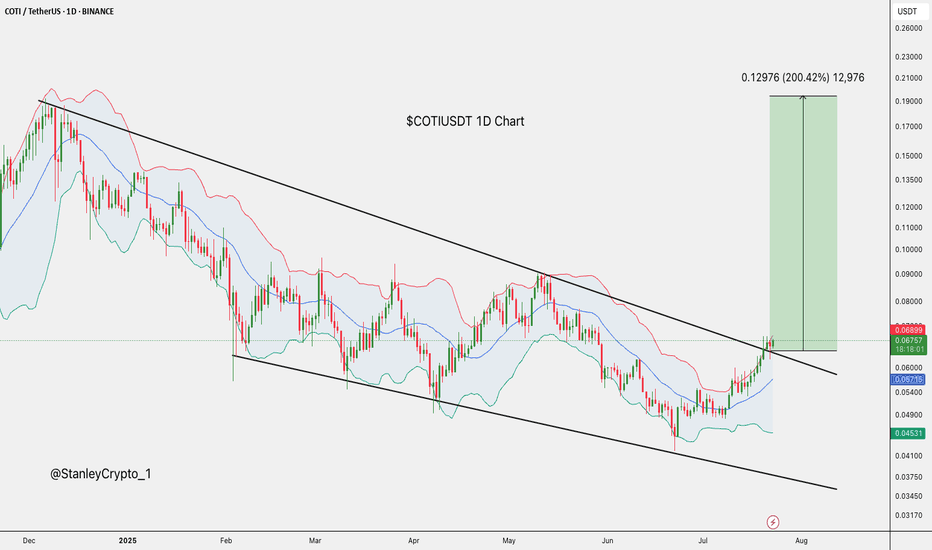

COTI Analysis (1D)The price is breaking out of an important trendline and is also reclaiming a key support zone.

⚠️ Make sure to wait for a daily candle to close above the trendline and the key level, and then enter a position on the pullback.

Targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

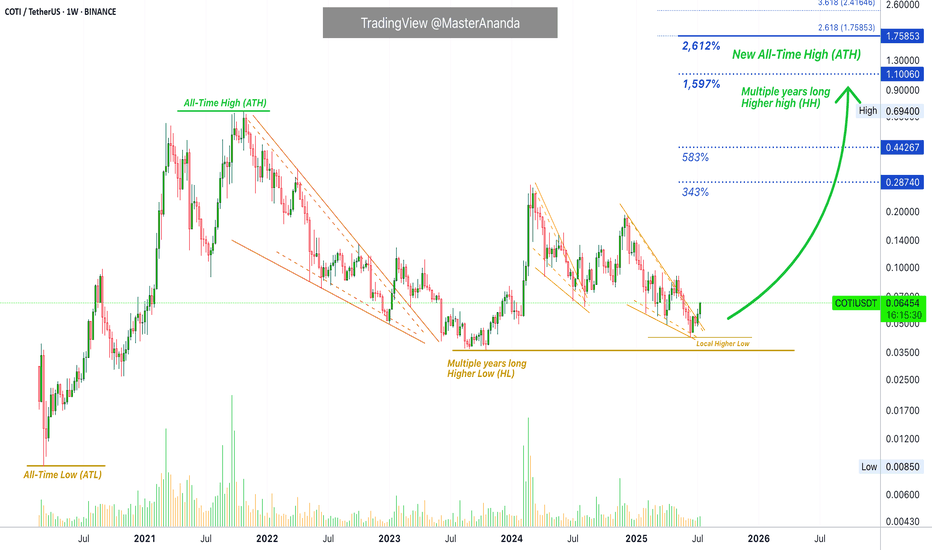

COTI Higher High (All-Time High) Confirmed · 2,612% Pot. ProfitsLet me remind you of one of the classic sayings, "higher lows will lead to higher highs —always."

While some charts are mixed; some projects produce shy lower lows and we don't know if this counts as a true lower low from a TA perspective; other pairs produce lower lows but still have potential for a new all-time high, some pairs produce double-bottoms and the situation becomes mixed; other pairs remain 100% clear. Here we have COTIUSDT with long-term higher lows.

The end of the bear market produced a bottom price that is many times higher compared to the start of the last bull market. A new all-time low (ATL) is simply not a question on this pair. The situation is 100% perfectly clear. Since we have an ultra-strong multiple-years long higher low, we can easily expect a higher high, which simply means a new all-time high (ATH) in the coming months. That's the beauty about TA and Crypto, you can predict the future if you know what to look for.

The easy targets here opens more than 580% profits potential.

COTIUSDT is trading with a full green candle today as it breaks out of a falling wedge pattern. The falling wedge is simply a downtrend. This downtrend is being broken.

On top of the long-term higher lows we have a local higher low, which is between June 2025 and October 2023. This is also long-term but not as long compared to the March 2020 market bottom and all-time low.

All this to say that market conditions are really good for this pair. The chart is super strong. This week we have a full green candle, trading at the top of the range and the session is about to close. When the session closes full green next week will be straight up. You will be witnessing the strongest action on this pair since early 2024 but with a big difference. It will be sustained. In early 2024 the big candles here only lasted three weeks. In 2025 you can have anywhere between 8-16 weeks straight up or even 24-32, etc. Whatever is needed for maximum growth to unravel. You won't be disappointed. You will be happy with the results.

Namaste.

COTI - Crazy Breakout Soooooon- COTI is trading inside the falling wedge pattern

- Price is currently nearing the resistance trendline,

- A clear breakout of this trendline will push the price higher

- we will enter a long trade after the breakout

Entry Price: 0.06696

Stop Loss: 0.03793

TP1: 0.07746

TP2: 0.10366

TP3: 0.14599

TP4: 0.25150

Don't forget to keep stoploss

Cheers

GreenCrypto

COTI/USDT – Approaching Make-or-Break Zone | Multi-Leg Reversal📌 Overview:

COTI is currently at a critical inflection point in its long-term structure. After a prolonged distribution phase since 2021 and a steady decline throughout 2023–2025, price action is now testing a historical support zone that has repeatedly triggered strong reversals. This area could be the foundation of a macro bottom formation—or the gateway to further downside if broken.

🔍 Technical Breakdown & Key Price Zones:

🟨 Major Demand Zone (Support Block):

Range: $0.030 – $0.048

This is a historically significant support area, previously acting as a launchpad for bullish impulses.

There is a strong chance of forming a double bottom or even an Inverse Head & Shoulders pattern here on the weekly timeframe, which would hint at a trend reversal if confirmed.

📏 Layered Resistance Levels (Profit-Taking Zones):

1. $0.05600 – Minor resistance, first validation of bullish strength

2. $0.07460 – Previous structural resistance from early 2024

3. $0.08995 – Key breakout level that may trigger mid-term momentum

4. $0.13211 – $0.18230 – Medium-term targets on sustained breakout

5. $0.25157 – $0.41854 – Long-term targets if macro bullish trend forms

🟢 Bullish Scenario (Reversal Setup):

✅ If price holds the $0.030–$0.048 demand zone:

Expect gradual bullish momentum toward $0.05600, followed by confirmation above $0.08995.

Weekly breakout candle with strong volume would confirm reversal structure.

Mid-term price target could reach $0.132 – $0.182, or even higher during an altseason rotation.

🔴 Bearish Scenario (Breakdown Setup):

❌ If the support zone fails:

Price could break below $0.030, exposing $0.0259 or even $0.020 as next downside targets.

This would negate the potential reversal structure and resume the bearish continuation trend.

Traders should wait for a new base or re-accumulation signal before re-entering long positions.

📊 Pattern Focus:

Double Bottom / Inverse Head & Shoulders (Potential Formation)

Descending Channel breakout watch

Volume Drying Up = Possible prelude to trend reversal if volume spikes follow

💡 Trading Strategy:

Aggressive Long Entry: Buy within the yellow support zone, stop-loss below $0.030

Conservative Entry: Wait for breakout and successful retest above $0.056

Bearish Setup: If breakdown occurs, short-term shorts or sidelining recommended

📈 Momentum Outlook:

Weekly structure suggests seller exhaustion is setting in.

Swing reversal is likely if price holds above the support range for the coming weeks.

Gradual accumulation strategy is suitable for swing traders.

🧲 Key Takeaway:

> COTI is entering a golden zone for potential mid-term reversal. If the support holds and a reversal pattern forms, a 200%+ upside is realistic. However, failure to hold this zone could lead to a breakdown and deeper correction. Patience and confirmation are key.

#COTI #COTIUSDT #CryptoAnalysis #AltcoinSeason #DoubleBottom #SupportZone #TrendReversal #TechnicalAnalysis #WeeklyChart #BreakoutWatch

COTI/USDT Weekly Analysis – Potential Macro Reversal in PlayThe chart displays a long-term downtrend structure for COTI/USDT, yet a significant accumulation zone is forming around the $0.036–$0.045 range (highlighted in yellow). This area has acted as a key support level multiple times since 2021, suggesting strong demand and a potential bottoming pattern.

🔍 Key Observations:

Macro Support Zone:

Price is currently trading within a strong historical support zone between $0.03607 (multi-year low) and $0.04500, where buyers have consistently stepped in over the past few years.

Potential Reversal Path:

The projected yellow path indicates a bullish scenario with a potential rally from current levels toward a series of resistance levels if a reversal is confirmed.

Major Resistance Levels to Watch:

$0.05046 – Minor local resistance

$0.06500 – Psychological resistance

$0.07403 – Structural level

$0.08998 – Previous rejection zone

$0.12000 – Psychological mid-range target

$0.13210 – Prior support turned resistance

$0.16000–$0.25207 – Key macro targets

$0.46767–$0.69400 – Long-term bullish targets if momentum continues

Bullish Breakout Triggers:

A confirmed breakout above $0.065–$0.074 may trigger momentum-based entries, especially if volume supports the breakout. Sustained price action above $0.12 would further validate the bullish trend reversal.

📉 Risk Management:

This setup is still speculative until a clear reversal structure forms on the weekly timeframe. Invalidation of the setup occurs if weekly candle closes decisively below $0.036.

Conclusion: COTI is currently at a pivotal zone. While the broader trend has been bearish, the current setup offers an attractive risk/reward for mid to long-term bulls if reversal confirmation appears. Watch for bullish weekly structure and volume expansion to validate the thesis.

COTI WAVE 3 is coming COTI has completed its initial phases, Wave 1, 2 of Elliot waves and is preparing for Wave 3📈.

Also COTI V2, released recently, aims to revolutionize web3 privacy.

COTI’s market capitalization is $96 million, suggesting substantial potential gains during the upcoming bull market🚀.

This information is not financial advice. Conduct thorough research before making investment decisions.

COTI ANALYSIS 📊 #COTI Analysis

✅There is a formation of Descending Channel Pattern in weekly time frame in #COTI.

Also there is a perfect breakout and retest. Now we can expect a bullish move from major support zone. If not the we will see more bearish move and then a reversal in #COTI.

👀Current Price: $0.06390

🎯 Target Price : $0.08660

⚡️What to do ?

👀Keep an eye on #COTI price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#COTI #Cryptocurrency #Breakout #TechnicalAnalysis #DYOR

#COTI/USDT#COTI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.06870.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.06870

First target: 0.07471

Second target: 0.09799

Third target: 0.08660

METISUSDT UPDATEMETISUSDT is a cryptocurrency trading at $17.57. Its target price is $32.00, indicating a potential 80%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about METISUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. METISUSDT is poised for a potential breakout and substantial gains.

#COTI/USDT#COTI

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.07800

Entry price 0.08236

First target 0.08376

Second target 0.08576

Third target 0.08878

#COTI/USDT#COTI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.08530

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.08863

First target 0.09110

Second target 0.09362

Third target 0.09677

#COTI/USDT Ready to take off upwards#COTI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.06000

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.08850

First target 0.1020

Second target 0.10810

Third target 0.1147

#COTI Getting Ready for a Mega Bullish Wave | Key Levels Yello, Paradisers! Is #COTIUSDT about to break out, or are we heading for a bearish breakdown? Let's break down the latest setup of #COTI:

💎The current falling wedge formation on the 8-hour chart is showing high potential for a bullish reversal. This pattern, coupled with a liquidity sweep at the lower boundary, has already shaken out impatient traders. But remember, no move is confirmed until we see a decisive breakout. #COTIUSD is moving to retest the descending resistance.

💎 OTC:COTI is facing a tough resistance at $0.142, aligning perfectly with the descending wedge’s upper boundary. A clean break and close above this level on the 8-hour timeframe could spark a rally toward the $0.18–$0.19 major supply wall, where sellers are likely to pile in.

💎On the downside, $0.09719 remains a strong support zone, where buyers have historically stepped in. If #COTI closes below this level, we may see a sharper decline toward the $0.077 demand zone, which is the last line of defense for bulls.

💎A close below $0.07780 would invalidate the bullish setup entirely and signal a potential plunge to lower lows. This breakdown would open the door for further bearish momentum, with sellers fully in control.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴