PINS Pinterest Options Ahead of EarningsIf you haven`t bought PINS before the previous earnings:

Now analyzing the options chain and the chart patterns of PINS Pinterest prior to the earnings report this week,

I would consider purchasing the 39usd strike price Calls with

an expiration date of 2025-8-8,

for a premium of approximately $2.22.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Course

META Meta Platforms Options Ahead Of EarningsIf you haven`t bought META before the rally:

Now analyzing the options chain and the chart patterns of META Platforms prior to the earnings report this week,

I would consider purchasing the 710usd strike price in the money Calls with

an expiration date of 2026-6-18,

for a premium of approximately $89.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

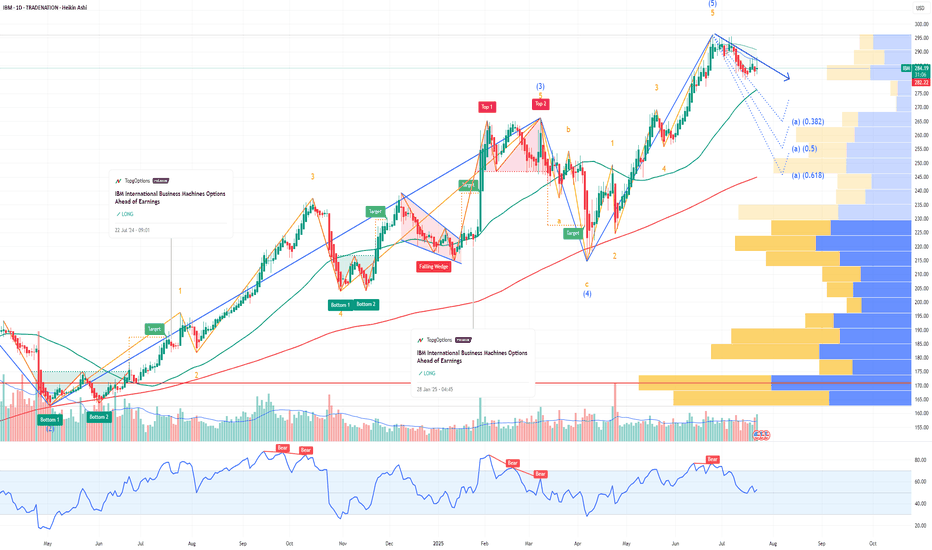

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the rally:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 290usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $17.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

LVS Las Vegas Sands Options Ahead of EarningsIf you haven`t bought LVS before the rally:

Now analyzing the options chain and the chart patterns of LVS Las Vegas Sands prior to the earnings report this week,

I would consider purchasing the 48.5usd strike price Puts with

an expiration date of 2025-7-25,

for a premium of approximately $1.22.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

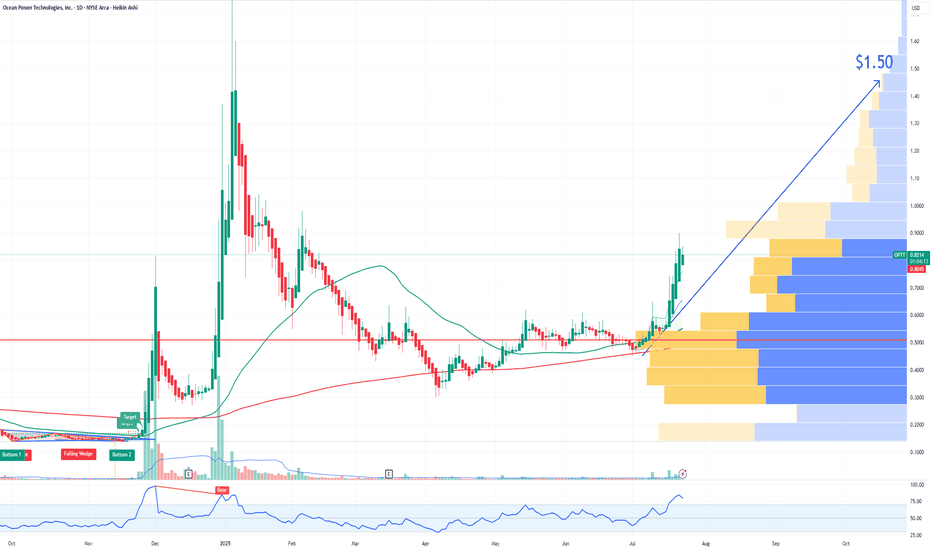

OPTT Ocean Power Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of OPTT Ocean Power Technologies prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $0.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

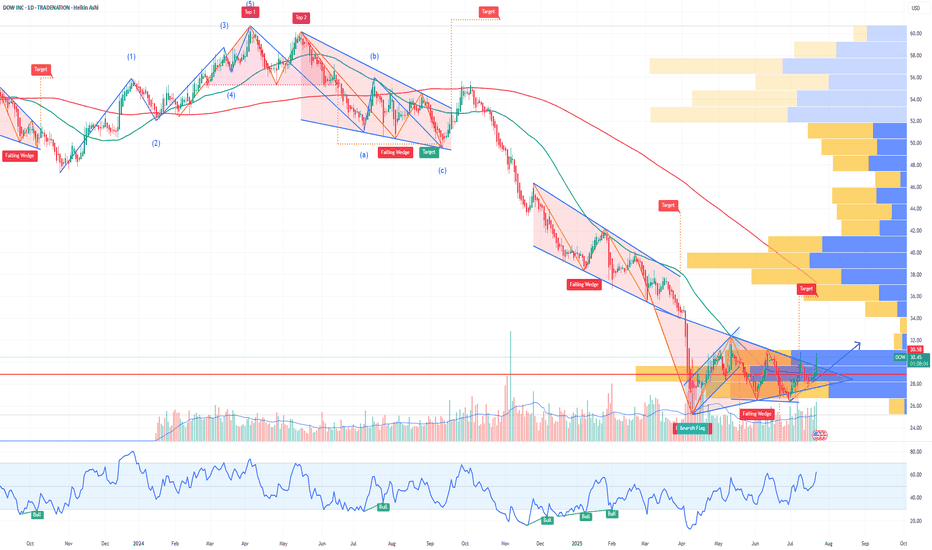

DOW Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DOW prior to the earnings report this week,

I would consider purchasing the 30usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $2.36.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Arbitrage Opportunity!I believe I’ve identified an arbitrage opportunity involving the DEFI cryptocurrency: it trades at $0.003200 on Bybit, compared to only $0.002390 on MEXC.

I recall encountering a similar situation with Shiba Inu, when the price gap between Binance and Coinbase was as high as 8X. Feel free to play the chart below to see the outcome:

I also remember the 2016–2017 period, when such arbitrage opportunities existed even with Bitcoin, due to price discrepancies between Asian exchanges and those available to European traders.

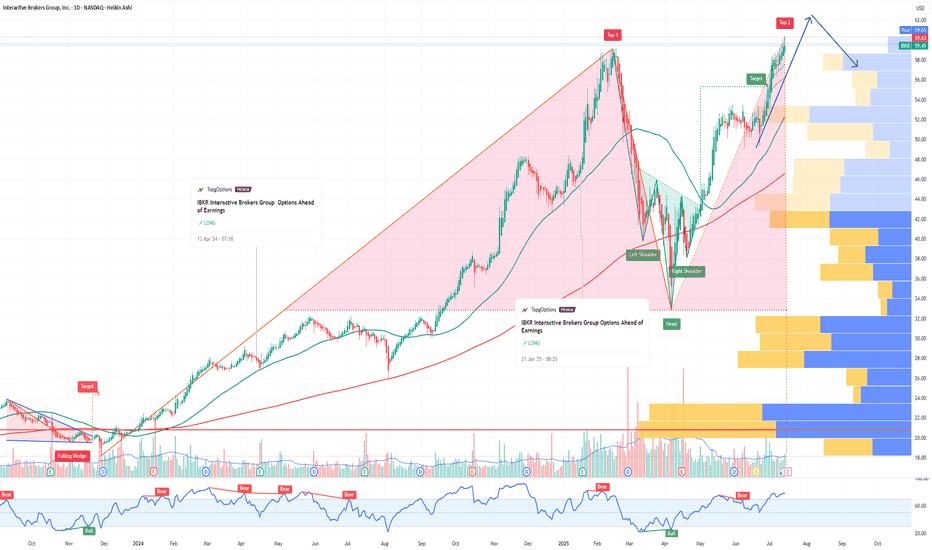

IBKR Interactive Brokers Group Options Ahead of EarningsIf you haven`t bought IBKR before the rally:

Now analyzing the options chain and the chart patterns of IBKR Interactive Brokers prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $3.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

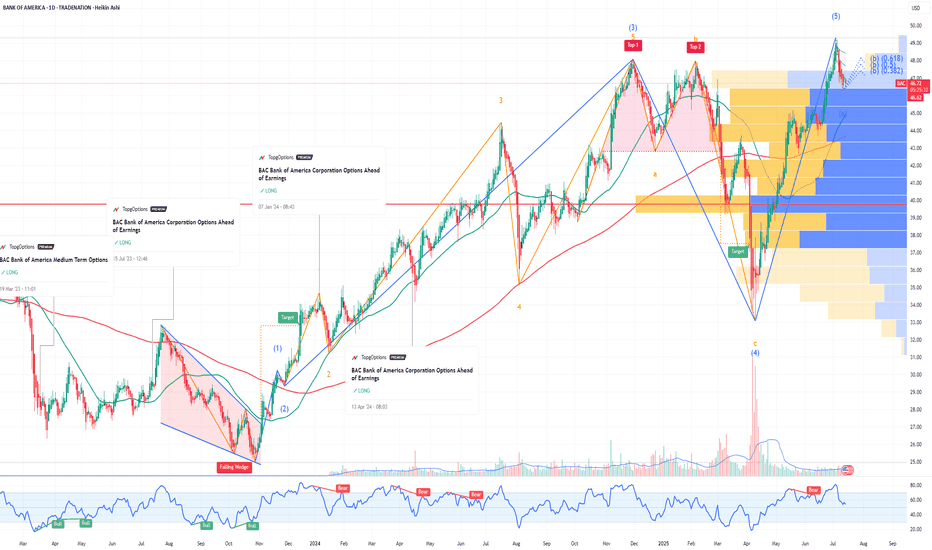

BAC Bank of America Corporation Options Ahead of EarningsIf you haven`t bought BAC before the rally:

Now analyzing the options chain and the chart patterns of BAC Bank of America Corporation prior to the earnings report this week,

I would consider purchasing the 48usd strike price Calls with

an expiration date of 2025-7-18,

for a premium of approximately $0.34.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

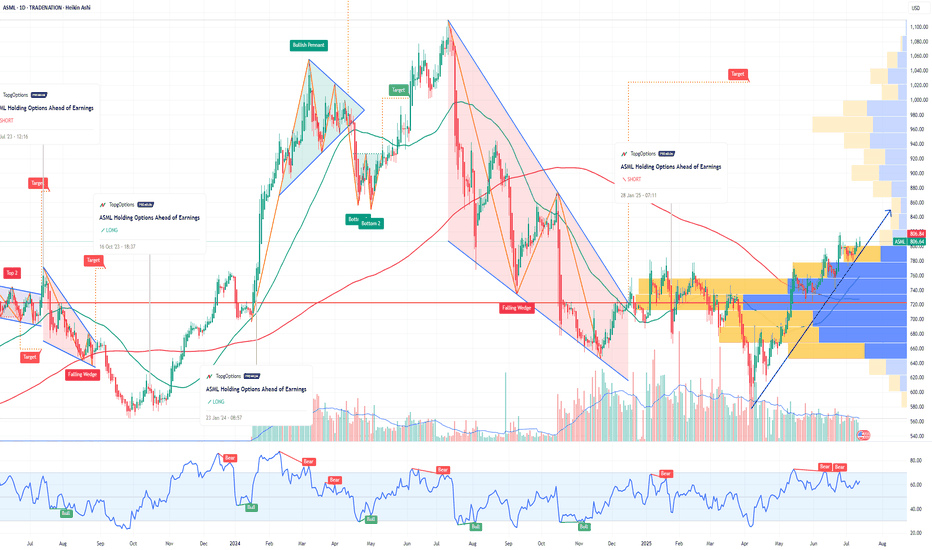

ASML Holding Options Ahead of EarningsIf you haven`t bought the dip on ASML:

Now analyzing the options chain and the chart patterns of ASML Holding prior to the earnings report this week,

I would consider purchasing the 800usd strike price Calls with

an expiration date of 2025-7-25,

for a premium of approximately $32.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

TSLA bearish: Musk vs Trump! Subsidy Spotlight & Sentiment RisksIf you haven`t bought TSLA before the recent breakout:

Now you need to know that Tesla (TSLA) is sitting around $315, but the vibe is getting shakier. Elon Musk’s feud with Donald Trump — complete with jokes about “putting the DOGE on him” if deported — might feel like another meme moment, but it spotlights Tesla’s huge dependency on federal and state support.

Estimates show Tesla could face up to $48 billion in lost government contracts and incentives over the next decade if the political tide turns. With Trump’s base calling out “green subsidies” as wasteful, Tesla’s funding pipeline could get squeezed — just as competition ramps up and margins get tighter.

Key Bearish Points

1) Political Risk Is Real

Musk’s public fight with Trump is a double-edged sword: he risks losing goodwill on both sides of the aisle. If the next administration decides to gut EV credits, Tesla could take a huge hit — far more than its rivals who rely less on U.S. incentives.

2) Subsidy Dependence

Tesla’s success is partly built on a foundation of tax credits, carbon credits, and favorable policies. $48B in potential lost value is nothing to shrug off — especially when competitors like BYD are gaining ground.

3) Bearish Technical Setup

TSLA’s chart is rolling over inside a bearish channel. It recently failed to hold the $330 level and now sits around $315. A clean breakdown below $300 could open the door to your target zone at $262 — a major support area from earlier this year.

Catalysts:

Any new comments from Trump’s camp about EV subsidies

Weak delivery/margin numbers from Tesla

Broader tech/equity pullback

Musk’s crypto distractions no longer propping up sentiment

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

VKTX: Unusual Options Flow & a Breakthrough Weight-Loss DrugIf you haven`t bought CKTX before the recent rally:

Now you need to know that Viking Therapeutics (VKTX) is a speculative biotech stock in the GLP-1/GIP agonist space, aiming to challenge market leaders like Eli Lilly and Novo Nordisk. Recently, I noticed unusual options flow — specifically, Jan 16, 2026 $60 strike calls

Key Bullish Points

1) Riding the Obesity Drug Boom

VK2735 is Viking’s dual agonist candidate showing promising early weight-loss efficacy, with potential overlap benefits in NASH (liver disease). The obesity treatment space is expected to exceed $100B by 2030—huge upside if their trials continue positively.

2) Options Flow Tells a Story

Those Jan 2026 $60 calls caught my attention precisely because the stock currently trades in the mid-$60s. These aren’t cheap lottery plays—they’re strategically timed wrt trial readouts, partnerships, or acquisition interest. Essentially, someone anticipates meaningful upside in the near future.

3) Descending Wedge — Chart Looks Bullish

VKTX peaked near $100, then pulled back into a well-defined descending wedge. If it breaks out above $70–$72 with volume, that could kick off a classic reversal trade.

Smart Money Options Flow — Near-Term Bet:

Recently, I spotted unusual open interest in $60 strike calls expiring Jan 16, 2026 — that’s only about 7 months away.

This means someone is positioning for a big upside move relatively soon, likely betting on positive Phase 2b/3 data, a partnership deal, or even buyout chatter within the next few quarters.

Short-dated, out-of-the-money call flow like this often hints at near-term news — not just a long-dated hedge.

KWEB: China’s Internet Sector - AI Catch-Up and Cheap ValuationsChina’s internet and tech stocks have been hammered for years — regulatory crackdowns, slowing growth fears, and geopolitical tension have crushed sentiment. But as investors know, the best opportunities often hide in what everyone hates.

Enter KWEB, the KraneShares CSI China Internet ETF.

It’s a diversified, liquid way to play a bounce in major names like Alibaba, Tencent, JD .com, Baidu, Meituan and PDD.

Here’s why I think the risk/reward looks compelling now — especially if you believe in AI closing the gap.

Key Bullish Points:

1) Valuations at Rock-Bottom

Many big China internet stocks are still trading at single-digit P/E ratios, even as their cash flows recover. Compared to U.S. big tech trading at 30–50x, this is a huge valuation gap.

Regulatory fears seem largely priced in — Beijing wants growth, not stagnation, and some policies are easing.

2) China’s AI Push — Just “Months Behind”

Jansen Whang recently argued that China’s generative AI development is only “months behind” the U.S. Players like Baidu, Alibaba Cloud, Tencent, and SenseTime are all racing to launch new LLMs and integrated AI tools.

If you believe the gap closes, Chinese platforms could see a major earnings rebound as they roll out AI upgrades across search, cloud, e-commerce and social media.

3) Sentiment So Bad, It’s Good

When the headlines scream “China is uninvestable,” that’s often when big mean reversion trades set up. Even a small policy pivot, stimulus plan, or positive AI news cycle can spark a sharp rally.

KWEB is one of the cleanest ways to express this view because it holds a diversified basket — you don’t have to pick a single winner.

Why IonQ (IONQ) Could Be the NVDA of Quantum ComputingIf you haven`t bought IONQ before the rally:

Now you need to know that IonQ isn’t just another speculative quantum stock — The company is building a robust ecosystem around its best‑in‑class trapped‑ion architecture and targeting fault‑tolerant, networked quantum systems. With record bookings, major acquisitions, and a strong balance sheet, IonQ could emerge as the NVIDIA equivalent for quantum infrastructure.

Key Bullish Arguments

1) Superior Quantum Tech – Trapped‑Ion Advantage

IonQ’s trapped-ion processors boast 99.9% two-qubit fidelity, demonstrating higher accuracy and scalability than superconducting alternatives

These systems also operate at room temperature, meaning simpler deployment and lower costs

2) Ecosystem Strategy & Acquisitions

The $1.08B acquisition of Oxford Ionics (expected close in 2025) expands IonQ’s qubit control tech, pushing toward planned 80,000 logical‑qubit systems by decade’s end

Combined with ID Quantique and Lightsynq, IonQ is building a full-stack quantum and networking offering

3) Strong Revenue Growth & Cash Runway

Revenue soared from $22M in 2023 to $43.1M in 2024, with bookings of $95.6M

. Q1 2025 saw $7.6M revenue and EPS –$0.14, beating expectations; cash reserves near $697M provide years of runway

4) Real Commercial Deployments

IonQ sold its Forte Enterprise quantum system to EPB ($22M deal) for hybrid compute and networking, marking real-world commercial applications

5) AI & Quantum Synergy

Involvement in NVIDIA’s Quantum Day and hybrid quantum‑classical AI demos (e.g., blood pump simulation with Ansys, ~12 % faster) indicates strategic synergy and positions IonQ as a critical piece in the future AI stack

Recent Catalysts:

Texas Quantum Initiative passes – positions IonQ at forefront of U.S. state-backed innovation

Oxford Ionics acquisition pending – major expansion in qubit scale & tech

Barron’s analyst buys – industry analysts see long-term potential; IonQ among top quantum picks

Broader quantum optimism – McKinsey & Morgan Stanley forecasts highlight synergy between quantum and AI, benefiting IonQ

CRSP Could Crack the Holy Grails of Medicine: Cancer & AlzheimerWhen Tesla (TSLA) started, few believed a scrappy EV startup could transform the entire auto industry and ignite a green energy revolution. But it did.

Today, CRISPR Therapeutics (NASDAQ: CRSP) is quietly doing something similar for medicine — and if you squint, its upside might be even bigger than Tesla’s.

Gene Editing: The Next Industrial Revolution — For Your Cells

CRISPR/Cas9 gene editing is like biological software. It gives scientists the power to cut, delete, or rewrite genes — the source code of life — with surgical precision.

CRISPR Therapeutics was co-founded by Dr. Emmanuelle Charpentier, a Nobel Prize winner who helped pioneer this breakthrough. The company’s lead therapy, exa-cel — just FDA approved in the U.S. — is the first-ever CRISPR-based gene-editing treatment to hit the market.

First up: curing devastating blood disorders like sickle cell disease and beta-thalassemia — a $10 billion+ opportunity. But that’s only the start.

Aging: The Ultimate Disease

What if we treated aging itself as a disease?

Many scientists now argue that growing old is the result of accumulated genetic errors, cellular damage, and mutations — processes that can be slowed or even reversed.

Gene editing holds the promise to repair DNA damage, reprogram cells, and treat the root causes of age-related decline. If successful, it could extend healthy human lifespan by decades.

Think about that: Tesla made cars last longer and burn cleaner. CRSP could make you last longer and live healthier.

The Two Holy Grails: Cancer and Alzheimer’s

Beyond blood disorders, CRISPR Therapeutics is working on a pipeline targeting solid tumors, diabetes, and more. But the real game-changers are cancer and Alzheimer’s disease — the twin mountains every biotech company dreams of conquering.

With gene editing, we could one day rewrite the genetic mutations that fuel cancer growth or remove the faulty proteins that clog the brain in Alzheimer’s. These are trillion-dollar problems — and the company that cracks them will reshape human history.

Built for Scale — Like Tesla

CRSP isn’t going at it alone. Partnerships with Vertex, Bayer, and ViaCyte help spread risk and amplify impact. With over $2 billion in cash, it has the runway to execute — just as Tesla used capital to build factories and charging networks at scale.

The market still underestimates that this is a platform company — not a single-drug biotech. If Tesla went from cars to batteries, solar, and AI, CRSP could go from blood disorders to rewriting the code for life itself.

Bottom Line

Aging. Cancer. Alzheimer’s. These are the holy grails of medicine.

If you missed Tesla at $20 a share, CRISPR Therapeutics could be your second chance — the TSLA of Gene Editing.

Because the greatest disruption of all is not electric cars. It’s the chance that, one day, growing old will be optional.

QQQ Nasdaq 100 Year-End Price Target and Technical Rebound SetupIf you haven`t bought the previous oversold area on QQQ:

Now the Nasdaq-100 ETF (QQQ), which tracks the performance of the largest non-financial companies in the Nasdaq, has recently entered oversold territory, suggesting that a technical rebound may be imminent. Similar to the Russell 2000, QQQ has experienced significant selling pressure, driving key technical indicators into oversold zones and creating favorable conditions for a bounce.

The Relative Strength Index (RSI) has dropped below 30, a level that typically signals oversold conditions and the potential for a reversal. Additionally, QQQ is trading near key support levels, with a large portion of its components underperforming their 50-day and 200-day moving averages — a classic setup for a mean reversion rally.

From a historical perspective, QQQ has shown a tendency to rebound strongly after similar oversold conditions, particularly when macroeconomic factors stabilize and buying pressure returns. Given the current technical setup, my price target for QQQ is $550 by the end of the year. This represents a recovery of approximately 8-10% from current levels, aligning with previous post-oversold rallies in the index.

While downside risks remain — including potential volatility around Federal Reserve policy and broader economic data — the technical backdrop suggests that QQQ is well-positioned for a recovery in the coming months.

RIOT Stock: Leveraged Bet on Bitcoin’s Next Leg UpMy Bullish Thesis:

1. Leverage to Bitcoin Without Holding BTC

RIOT is one of the largest publicly traded Bitcoin miners in the U.S., offering investors exposure to the upside of Bitcoin — without directly owning the coin.

If Bitcoin goes to $100K or higher, miner stocks like RIOT historically outperform BTC in percentage terms.

This makes RIOT a high-beta play on the ongoing crypto bull market.

2. Post-Halving Upside

The April 2024 Bitcoin halving cut block rewards by 50%, which squeezes less-efficient miners — but RIOT benefits from:

Low-cost mining operations due to cheap electricity agreements in Texas.

Recent upgrades in hardware efficiency (with high-performance ASICs).

Greater share of the network hash rate as weaker players drop out.

Historically, Bitcoin and miners perform best in the 6–18 months after a halving, positioning RIOT for strong gains through year-end 2025.

3. Massive Infrastructure and Expansion

RIOT owns a 400+ megawatt mining facility in Texas, one of the largest in North America.

They’re expanding capacity and have locked in long-term energy deals that give them a key advantage during spikes in energy costs.

The company also earns revenue through demand response credits, essentially being paid to shut down power usage during Texas grid stress — a unique hedge for a miner.

4. Regulatory Edge Over Offshore Miners

As U.S.-based and NASDAQ-listed, RIOT is better positioned than foreign or unregulated competitors if/when the U.S. passes legislation around digital assets and mining.

This could lead to greater institutional adoption of RIOT versus other miners.

It’s also eligible for ETF inclusion or institutional funds focused on digital infrastructure or U.S. innovation.

RIOT is a classic “picks and shovels” play on the Bitcoin bull run — offering levered upside without having to buy BTC directly. With post-halving tailwinds, institutional favorability, and a strong technical breakout in progress, RIOT may be one of the top speculative growth plays in the crypto equity space heading into the second half of 2025.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MU Micron Technology Options Ahead of EarningsIf you haven`t bought MU before the rally:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report this week,

I would consider purchasing the 128usd strike price Calls with

an expiration date of 2025-6-27,

for a premium of approximately $5.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MKC McCormick & Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MKC McCormick & Company prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NKE NIKE Options Ahead of EarningsIf you haven`t sold NKE before the previous earnings:

Now analyzing the options chain and the chart patterns of NKE NIKE prior to the earnings report this week,

I would consider purchasing the 62usd strike price Calls with

an expiration date of 2025-7-3,

for a premium of approximately $2.29.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

PTON Peloton Potential Buyout Interest from Amazon or NikeIf you haven`t bought the dip on PTON, before the rally:

Now Peloton Interactive PTON remains a compelling bullish candidate in 2025, supported not only by strategic buyout interest from major players like Amazon and Nike but also by significant unusual options activity signaling strong investor conviction in a near-term upside move. These factors combined create a powerful catalyst for a potential stock rally.

1. Confirmed Buyout Interest from Amazon and Nike

Since 2022, credible reports have indicated that Amazon and Nike are exploring acquisition opportunities for Peloton, recognizing its value as a leading connected fitness platform with over 2 million subscribers.

Amazon’s interest fits its broader health and smart home ambitions, while Nike sees Peloton as a strategic extension of its digital fitness ecosystem.

Such buyout interest implies a potential premium valuation, which could trigger a sharp upward re-rating of Peloton’s shares if a deal materializes or even if speculation intensifies.

2. Massive Unusual Call Option Activity for July 18, 2025 Expiry

A mystery trader recently purchased over 80,000 call options on Peloton with a $7 strike price expiring July 18, 2025, representing a $3.1 million bet on a price rise within the next few months.

On May 20, 2025, over 90,000 contracts of the $7 strike call expiring July 18, 2025 traded, equating to roughly 9 million underlying shares—well above Peloton’s average daily volume.

This unusually high call volume signals strong bullish sentiment and possible insider or institutional anticipation of a positive event, such as a buyout announcement or operational turnaround.

3. Strategic Fit and Synergies for Acquirers

Peloton’s subscription-based connected fitness platform offers Amazon and Nike a valuable recurring revenue stream and engaged user base.

Amazon could integrate Peloton’s offerings into its ecosystem of devices, health services, and e-commerce, while Nike could leverage Peloton’s content and hardware to deepen its digital fitness presence.

The potential for cross-selling, brand synergy, and data monetization enhances Peloton’s attractiveness as an acquisition target.

4. Attractive Valuation and Growth Potential

Peloton’s market cap has contracted significantly, making it an affordable target for large corporations with strategic interests in health and fitness.

Recent product launches, cost-cutting measures, and renewed marketing efforts aim to stabilize and grow Peloton’s subscriber base and revenue.

The connected fitness market continues to expand, driven by consumer demand for at-home and hybrid workout solutions.

5. Technical and Sentiment Indicators

The stock has shown signs of stabilizing after recent volatility, with support forming near $6–$6.50.

The surge in call options activity, especially at strikes above current prices, suggests growing investor confidence in a near-term breakout.

Historical patterns show Peloton’s stock reacts strongly to buyout rumors and unusual options volume, often resulting in rapid price appreciation.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WULF TeraWulf Leader in Clean Crypto Mining & HPC InfrastructureIf you haven`t bought WULF before the rally:

Now TeraWulf WULF is emerging as a compelling growth story in the digital infrastructure and cryptocurrency mining sectors, distinguished by its commitment to zero-carbon energy and expanding high-performance computing (HPC) hosting capabilities. Despite near-term financial challenges, the company’s rapid capacity growth, strong cash position, and strategic initiatives position it well for substantial upside in 2025 and beyond.

1. Rapid Expansion of Mining Capacity and Hashrate Growth

TeraWulf energized Miner Building 5, increasing its total mining capacity to 245 MW and boosting its Bitcoin mining hashrate to 12.2 exahashes per second (EH/s), a 52.5% increase year-over-year.

This significant growth in self-mining capacity enhances revenue potential and operational scale, positioning TeraWulf among the more efficient and sizable clean-energy miners.

The company’s vertically integrated model, powered primarily by zero-carbon energy, aligns with increasing regulatory and investor demand for sustainable crypto mining.

2. Strategic Buildout of High-Performance Computing (HPC) Infrastructure

TeraWulf commenced the buildout of dedicated HPC data halls and remains on track to deliver 72.5 MW of gross HPC hosting infrastructure to Core42 in 2025.

The company is actively pursuing additional HPC customers, targeting 200–250 MW of operational HPC capacity by the end of 2026, which diversifies revenue streams beyond crypto mining.

HPC infrastructure is a high-growth segment driven by demand for AI, big data, and cloud computing, offering TeraWulf exposure to secular technology trends.

3. Strong Financial Position and Capital Allocation

As of March 31, 2025, TeraWulf held approximately $219.6 million in cash and bitcoin holdings, providing liquidity to fund expansion and weather market volatility.

The company has repurchased $33 million of common stock in 2025, signaling management’s confidence in the business and commitment to shareholder value.

While total outstanding debt is around $500 million, TeraWulf maintains a strong current ratio (~5.4), indicating solid short-term liquidity.

4. Industry-Leading Sustainability Profile

TeraWulf’s focus on zero-carbon energy for its mining operations differentiates it in an industry increasingly scrutinized for environmental impact.

This green positioning not only appeals to ESG-conscious investors but may also provide access to incentives, partnerships, and preferential contracts as governments and enterprises emphasize sustainability.

5. Revenue Growth Outlook and Market Opportunity

Despite a temporary revenue dip to $34.4 million in Q1 2025, the company is projected to deliver a 53% increase in revenue for the full year 2025, significantly outpacing industry averages.

The combination of expanding mining capacity and HPC hosting services positions TeraWulf to capitalize on the growing demand for digital infrastructure powered by clean energy.

6. Navigating Financial Challenges with Growth Focus

TeraWulf reported a GAAP net loss of $0.16 per share in Q1 2025, reflecting ongoing investments in capacity and infrastructure.

Operational cash flow remains positive and improving, with management focused on scaling efficiently and improving margins over time.

SNAP Upside PotentialIf you haven`t bought SNAP before the previous earnings:

SNAP Key Fundamental Strengths in Q1 2025:

Metric Q1 2025 Result Year-over-Year Change

Revenue $1.36 billion +14%

Daily Active Users (DAU) 460 million +9%

Monthly Active Users (MAU) 900 million+

Net Loss $140 million -54% (improved)

Adjusted EBITDA $108 million +137%

Operating Cash Flow $152 million +72%

Free Cash Flow $114 million +202%

SNAP strong fundamental performance in Q1 2025, marked by accelerating revenue growth, expanding user engagement, sharply improving profitability, and robust cash flow generation, sets a solid foundation for a potential stock rally this year.

The company’s innovation in AR, diversified revenue streams, and healthy balance sheet further support a bullish outlook. Investors focusing on fundamentals can view Snap as a growth stock with improving financial health and significant upside potential in 2025.

My price target is $14.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.