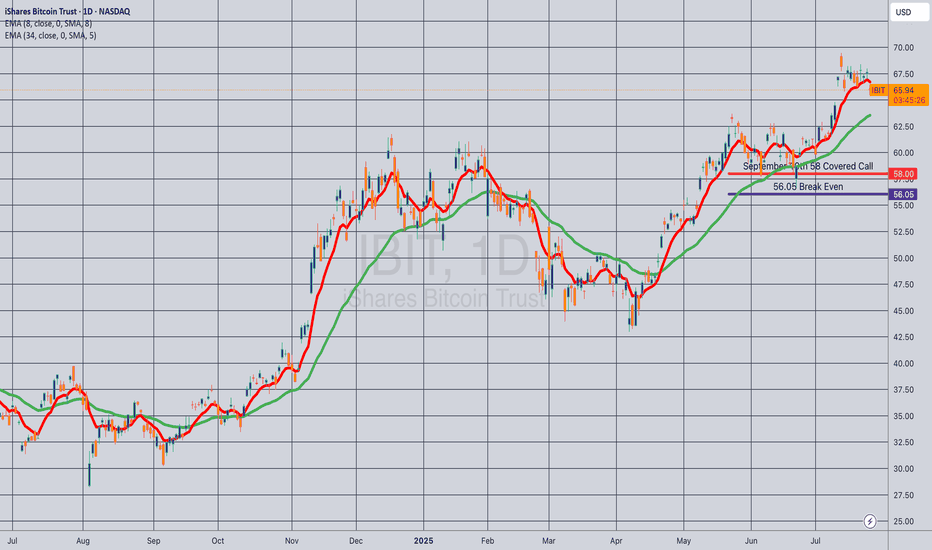

Opening (IRA): IBIT Sept 19th 58 Covered Call... for a 56.05 debit.

Comments: Selling the -75 delta call against shares to emulate the delta metrics of a +25 delta short put to take advantage of higher IV on the call side and the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 56.05

Max Profit: 1.95

ROC at Max: 3.48%

50% Max: .98

ROC at 50% Max: 1.74%

Will generally look to take profit at 50% max, add at intervals assuming I can get in at break evens better than what I have on.

Coveredcall

Opening (IRA): PLTR May 17th 100 Covered Call... for a 86.55 debit.

Comments: After closing out my long-dated covered call for a realized gain, re-upping with a shorter duration setup with a max profit potential of greater than 11.18, which is what I'm net down on this underlying YTD.

Metrics:

Buying Power Effect/Break Even: 86.55

Max Profit: 13.45

Will look to roll out the short call at 50% max to reduce my break even.

Update: EWZ December 2026 32 Covered CallHere, starting to break my EWZ position (See Post Below) into its constituent pieces.

The first piece involves shares I acquired way back at 31.65/share. (Ugh). Rather than go back and calculate trade to date break even, I'm going out far in duration to sell the short call at or above my break even. Sometimes, you have to go way longer dated than you'd like, but I'm fine with devoting some buying power to this, particularly since EWZ pays a fairly decently dividend, albeit only twice a year.

The remaining legs are the January 17th 26 short put -- on which I'm pretty sure I'll be assigned shares, and the January 17th 23 short put, which is in-the-money by .50 or so. On assignment, I'll look to sell the call at the strike at which I was assigned and go from there ... .

Opening (IRA): TLT May 16th 96 Covered Calls... for a 92.13/contract debit.

Comments: Taking refuge in 20 Year + Paper until this market sorts itself out, targeting the strike that pays around 1% of the strike price in credit (the -96C paid 1.15).

Will generally look to roll the short call down at 50% max to the strike paying 1% of the strike price in credit if greater than 30 DTE remain; roll out at 50% to the next available monthly if <35 DTE remain.

Opening (IRA): PLTR May 16th 90 Covered Call... for a 76.56 debit.

Comments: After taking off my iron condor for a loss, structuring a covered call such that the max profit potential is greater than the loss experienced by the nondirectional of 13.11.

Metrics:

Buying Power Effect/Break Even: 76.56

Max Profit: 13.44

ROC at Max: 17.55%

Will generally look to roll out the short call out and/or down and out at intervals to increase profit potential and/or reduce downside break even ... .

Update: TLT March 21st 95 Covered CallsA "refresh" of a fairly long-running cash flow setup, with the cash flow emanating from (a) short call premium and (b) dividends.

As of the 12/18/24 dividend, my break even is at 85.81 (including dividends). (See Post Below).

One of my New Year's resolutions is to be a little more patient and roll out the short call on approaching worthless, targeting the short call strike paying around 1% of the strike price in credit, but my mouse hand occasionally seems to have a mind of its own ... .

Opening (IRA): TAN Nov 15th 37 Covered Call... for a 35.89 debit.

Comments: Relatively decent IV here at 42.8%. Selling the -75 delta call against stock to emulate the delta metrics of a +25 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 35.89

Max Profit: 1.11

ROC at Max: 3.09%

50% Max: .56

ROC at 50% Max: 1.55%

Will generally look to take profit at 50% max; roll out short call on test.

AIPIExploring the AI Covered Call ETF: AIPI

Let’s take a look at AIPI, a covered call ETF that focuses on stocks in the AI sector and trades on the US stock exchange. If you're analysing the chart, you might notice that dividend indicators don’t appear. That’s because this ETF doesn’t technically pay dividends. Instead, it collects dividends from its holdings, pays taxes on them, and distributes the rest to investors as taxable income. This is important to understand for tax planning, as it may impact how you report income depending on where you live.

The Strategy Behind AIPI

Being a covered call ETF, it limits your upside, especially in strong bull markets. However, the fund managers often adapt by writing covered calls at higher target prices when markets are bullish, capitalizing on demand for options. Most option buyers lose, which benefits the ETF's income strategy.

If you dive into the distributions and run the numbers, you’ll see that AIPI has been yielding approximately 30% annually. It’s a strong performer, but as with any investment, diversification is key. You might want to start small—maybe one or ten shares—and hold it for a few months to see how it performs for you.

Research the Components

When you look at AIPI, understanding its holdings is crucial. While the components might not show up directly on TradingView, a quick Google search can reveal the ETF's portfolio. You can also use benchmarks like SMH (a semiconductor ETF) as a rough gauge, but digging into the individual stocks within AIPI will give you a clearer picture of its trajectory.

A Trading Strategy Idea

Here’s a potential strategy for those interested in short-term moves:

Buy before the ex-dividend date.

Hold to collect the distribution.

Set a limit order at your purchase price or slightly higher to sell after the payout.

This approach could net you around 30%/12 per month, depending on timing and execution. Of course, this requires monitoring and is not guaranteed.

Other Covered Call ETFs to Explore

While AIPI is exciting, there are other options out there depending on your region and goals. For example:

On the TSX (Canadian markets):

BANK or UMAX, which focus on Canadian stocks or are hedged to the Canadian dollar.

On the US markets:

QDTE, a weekly payout ETF.

Run the math on annual distributions and compound that over time. If you’re young, this can be a powerful strategy for long-term growth.

Final Thoughts

Covered call ETFs like AIPI aren’t a secret ATM, and you shouldn’t expect them to churn out cash indefinitely. However, they can be a great addition to a diversified portfolio, especially for income-focused investors. I personally own AIPI and think it’s flying under the radar. Many websites don’t display full annual gains until the ETF has traded for at least a year, so it might not yet be on everyone’s radar.

Do your research, calculate potential returns, and explore different strategies to see what works for you!

SPY Covered CallThis is a trade I've held for a while. I did this with a couple of WMT covered call trades I made and simply felt like sharing this trade.

I will do my best to update this as I roll from this point forward.

I will also try to share if I enter a second SPY ITM covered call.

No commission will be recorded, only trade prices.

Opening (IRA): USO December 20th 68 Covered Call... for a 66.48 debit.

Comments: Back into the slippery stuff with /CL trading at 70.48. Selling the -75 delta call against stock to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call.

My basic approach here is to dink and donk on the underlying when /CL is at $70/bbl. or below.

Metrics:

Break Even/Buying Power Effect: 66.48

Max Profit: 1.52

ROC at Max: 2.29%

50% Max: .76

ROC at 50% Max: 1.15%

Will generally look to take profit at 50% max; roll out short call on take profit test. I'll also look to add "rungs" should I be able to do so at strikes/break evens better than what I currently have on.

Opening (IRA): IWM Dec 20th 195 Covered Call... for a 193.79 debit.

Comments: Re-upping with a monied covered call in the December 20th expiry at a strike that is slightly higher than the one I just took off to "capture" the next little increment of up move that I missed out on. I'm not expecting much out of this (it has a 1.21 max), but didn't want to set up my tent in January yet either.

Opened (IRA): USO Dec 20th 63 Covered Call... for a 61.26 debit.

Comments: (Late Post). High IV (67.7% as of Tuesday close) + weakness.

Added a "rung" to my existing position at a strike better than what I currently have on, selling the -75 delta call against shares to emulate the delta metrics of a 25 delta short put, but with the built-in defense of the short call.

Metrics:

Buying Power Effect/Break Even: 61.26

Max Profit: 1.74

ROC at Max: 2.84%

50% Max: .87

ROC at 50% Max: 1.42%

Will generally look to take profit at 50% max, roll out in-profit short call on test of take profit. Here, the 50% max take profit would be .87 + 61.26 or 62.13.

Opening (IRA): MU Nov 15th 95 Covered Call... for a 92.53 debit.

Comments: Post-earnings, IV remains somewhat decent here at 45.2%. Selling the -80 delta call against long stock to emulate the metrics of a 20 delta short put, but with built-in short call defense.

Metrics:

Buying Power Effect/Break Even: 92.53/share

Max Profit: 2.47

ROC at Max: 2.67%

50% Max: 1.24

ROC at 50% Max: 1.33%

Will generally look to take profit at 50% max, roll out the short call on test.

Rolling (IRA): TLT Feb 21st 100 Calls to the 95 Calls... for a 1.09 credit.

Comments: Looked at all my options here for the rolling of the short call aspect of my covered calls -- rolling down, rolling down and out, rolling out as is, rolling to shorter duration and down ... . Going with rolling down in the same expiry for a 1.09 credit.

Resulting cost basis: 89.11.

It still remains a bet that the Fed will cut rates at some point, just with lower max profit potential.

TSLA covered call over earnings *again* I've sold $250 and $255 covered calls recently. Obviously huge gap down because of SELL THE NEWS style event... ;-)

I really am not concerned. This is a buy the dip opportunity. I am happy to capture the premium from the call sale which is 1% and IF I sell at $255 in two weeks... amazing...

:-)