Crash

SPX: Eye of The StormIn a hurricane the EYE of the storm is region of "calm" and even blue skies

To the unaware, the break in the clouds and the blues skies may bring a sense of relief that "the worst is over"

But the informed know that the OTHER SIDE of the storm is coming and the worst has yet to happen

IMO the aforementioned scenario accurately describes what we are about to see in markets

The Administration is slowly backing off the more severe of the tariffs

Over the weekend they removed tariffs on major electronics and associated components coming from China which should bring a sense of relief to markets

We will most likely see continued softening on the worst of the tariffs as the administration grapples with the true reality of things: MARKETS ARE IN TROUBLE

This softening will give the appearance that things will be OK and we may even see markets rally to new ALL TIME HIGHS

But a rally to new ATHs will be akin to the "eye of the storm" as just like with a Hurricane..the other side of the storm is coming

The Spring of OM: Wyckoff Signals a Rebirth After the CrashMANTRA ( BYBIT:OMUSDT.P ) Technical Analysis: Post-Crash Recovery and Wyckoff Accumulation Insights

TradingView

On April 13, 2025, MANTRA (OM) experienced a significant price drop, declining approximately 88% within 24 hours. This sharp downturn was attributed to a combination of factors, including market-wide volatility and potential large-scale sell-offs. Despite this abrupt decline, technical indicators suggest that OM may be entering a Wyckoff Accumulation Phase, presenting potential investment opportunities.

Understanding the Recent Price Movement

Following the crash, OM's price stabilized around $0.70, with a 24-hour trading volume exceeding $2.3 billion. The Relative Strength Index (RSI) and Commodity Channel Index (CCI) indicators both entered oversold territories, indicating a potential for price reversal.

CoinMarketCap

CentralCharts

Wyckoff Accumulation Phase Analysis

The Wyckoff Method identifies specific phases in market cycles, with the Accumulation Phase characterized by large investors ("smart money") buying assets at lower prices. Key features of this phase include:

Selling Climax (SC): A sharp price decline with high volume, as seen in OM's recent drop.

TradingView

Automatic Rally (AR): A quick rebound following the SC, indicating initial buying interest.

Secondary Test (ST): Price revisits the SC level to test support, often with lower volume.

Spring: A false breakout below support levels to shake out weak holders, potentially observed in OM's price action.

Mudrex

Sign of Strength (SOS): A strong price increase with higher volume, signaling the end of accumulation.

Currently, OM's price behavior aligns with the early stages of this accumulation pattern.

Investment Considerations

For investors considering entry points:

Risk Tolerance: Given the recent volatility, only risk capital should be used.

Technical Confirmation: Await confirmation of the SOS phase before significant investment.

Volume Analysis: Monitor trading volumes for signs of increased institutional interest.

Understanding the Wyckoff Accumulation Phase can provide insights into potential market reversals.

$OM MANTRA coin analysis Hi 👋🏻 it's me your " Raj_crypt0 " ..... 💚

will BINANCE:OMUSDT next KRAKEN:LUNAUSD

" Yes , I hope so - 90% new High not possible

I hope it's not possible "

coin already got squeezed at $5/5.5 in weekly to 3 month time frame as weakness we can observe

Upcoming downtrend 📉 target 🎯 is - $0.1

$0.1 / 0.0875 ...... 🎯 Support 💪🏻 let me meet u there 😂

" U have a question ⁉️ does ' alts season ' & ' BULL RUN ' completed - obviously 🙄 ' NO ' "

CRYPTOCAP:TOTAL haven't reached 5T 🎯 - still season was around corner

" Some coins complete early bull , some late _&_ some on time " nothing much ✔️

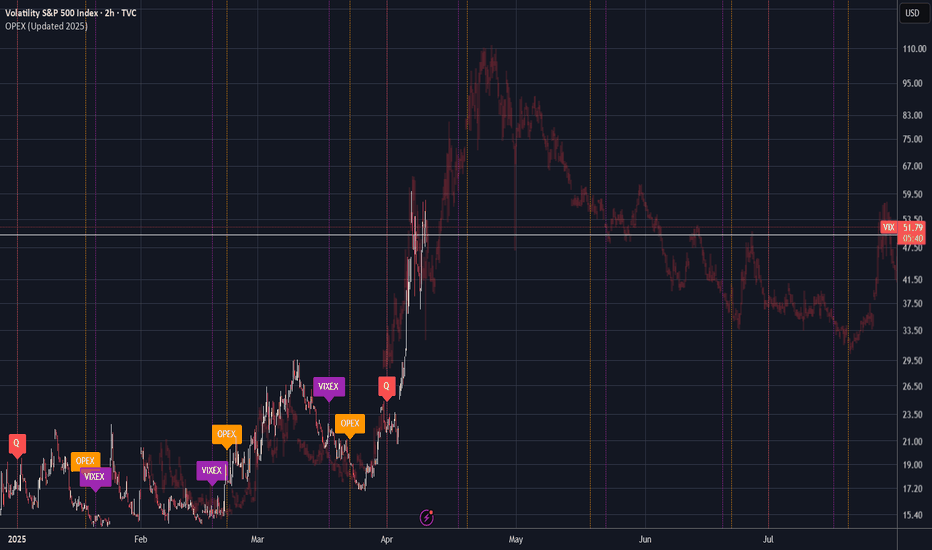

Path to 100 VIXI wrote this note on TVC:VIX a few days ago:

www.tradingview.com

And am now expanding it a bit more.

As someone who was working middle office during the original 2016 Trump Election, Brexit, during the Taper Tantrum and a few other major events - I want to lay out my principles on trading the VIX because spikes like this bring a lot of "first time" VIX traders to something that trades like NOTHING ELSE in the market.

This is not a stock in a short squeeze, this is not a generic index.

This is like nothing you've ever traded before. In fact, I'd encourage you to take advantage of TradingView's chart options and instead look at the chart of -1*$TVC:VIX.

That alone should give you pause.

----------------------------------

So - let's start with the principles of the finance business as laid out in the masterclass which was the movie "Margin Call" .

"John Tuld: There are three ways to make a living in this business: be first, be smarter, or cheat."

1. Be First.

You are not first if you are buying above the historic average of VIX 20-21.

If you were buying CBOE:UVXY since Jan 2025, you'd be up 175% right now and likely looking to re-balance into your desired long term asset positions.

2. Be Smarter.

* Are you taking into consideration the VIXEX Cycle?

* Do you know the effect of VIXEX before or after monthly OpEx?

* Do you know the current implied volatility curve of options ON the VIX?

* Do you know that of the last 4 times the VIX has hit 50, it went on to 80+ 50% of the time after that?

* Yes, I've seen the charts going around about forward S&P X year returns but did you know that after the VIX spike to 80 in October 2008, the market (in a decreasing volatility environment) went on a further 35% decline in the next 4-5 months?

* Where is the MOVE? What are the bond indexes & bond volatility measures doing? And if you don't yet understand that equities ALWAYS reacts to what is going on in the rates / yield world... you'll find out eventually. I hope.

3. Cheat

When things start going wrong, everyone wants an easy solution.

That's why its called a relief rally. It feels like relief - the bottom is in, the worst part is over.

But that is what the really big players have the biggest opportunity to play with the day to day environment.

They know our heuristics. They encourage the formation of cargo cult style investing whether that's HODL in the cryptocurrencies or Bogleheads in the vanguard ETFs.

It's all the same and encourages you to forgot first principles thinking about things like:

1. Is this actually a good price or is it just relatively cheap to recent history?

2. Who's going to have to dilute to survive the next period of tighter lending, import costs from tariffs, or whatever the problem of the day is.

3. VIX correlation - volatility is just a description of the markets. Its not a description of the direction. There is periods where volatility is positively correlated to the price movement (like during earnings beats). Know about this and know when it changes.

4. Etc.

Some have pointed out that is more appropriately a measure of liquidity in the SPX.

When VIX is low, that means there is lots of "friction" to price movement. It means that there is tons of orders on the L2 book keeping the current price from moving in any direction too quickly.

When VIX is high, that means there is very low "friction" to price movement. It means there are very few orders on the L2 book and market makers can "cheat" by appearing to create a low volume rally and then rug pull that price movement very quickly (not via spoofing, more just dynamic management of gamma & delta hedging requirements).

Additionally - volume itself becomes deceptive. Volume is just indicating that a trade happened.

Its not telling you to what degree the spread between the bid and ask has blown out to 1x, 2x, or 5x normal and that trades are executing only at the highest slippage prices in that spread.

All of these things are considerations that the market makers can use to make a "buy the dip" situation that works heavily to their advantage.

TLDR: "If you can't spot the sucker in your first half hour at the table, then you are the sucker"

----------------------------------

So - why / when would VIX go to 100?

In 2020, its easy to forget that a culmination of things stopped the crash at -35%.

* March 17, 2020 VIXEX wiped out a significant amount of long volatility positions.

* March 20, 2020 Opex wiped out a significant proportion of the short term put positions

* March 20, 2020 Fed Reserve announced to provide "enhanced" (i.e. unlimited) liquidity to the

markets starting Monday March 23, 2020.

* April 6th, 2020 Peak of Implied Volatility (point where options "most expensive") - which meant that buyers / sellers started providing more & more liquidity following this point.

In 2025, we have yet to see:

* Any motion towards intervention from the Fed for liquidity.

* Any motion from the significant fundamental investors (we're not close to an attractive P/S or P/E on most stocks for Buffett & Co to start buying)

* Any significant motion from companies on indicating strategies about capital raises, layoffs, or other company level liquidity reactions.

* Any "reset" of options in either volatility or hedging. Numbers below as of April 9, 2025:

- SPY 2.8M Put OI for April 17

- VIX 3.5M Call OI for April 16

Just an example but maybe IF we see those clear and NOT get re-bought for May Opex... we might be ready to call a top here at 50 VIX.

Otherwise.... we're just at another stop on the path to 100.

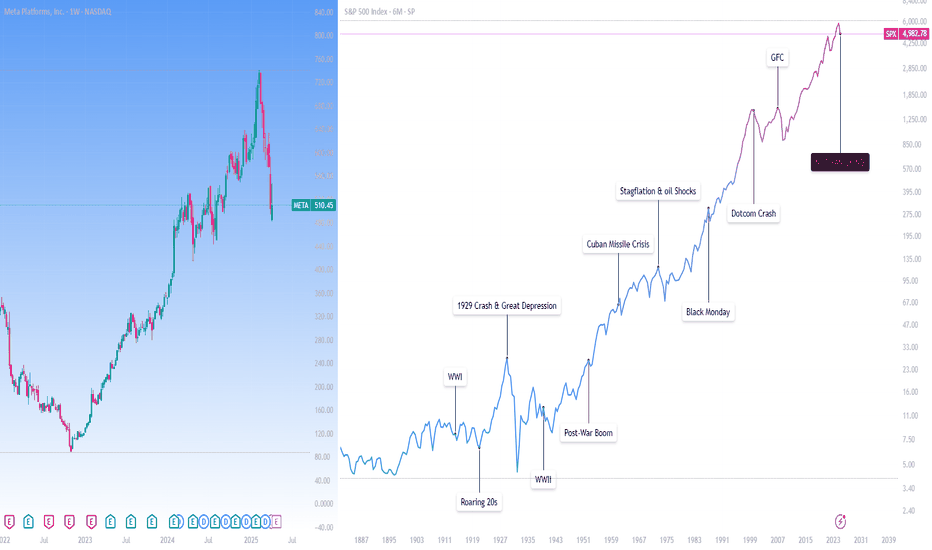

So here’s what I’m doing: Not Panicking.This analysis is provided by Eden Bradfeld at BlackBull Research.

Listen, the US has survived the depression of WWI, the Great Depression, the depression of WWII, oil shocks, the dot com bubble, the GFC, the COVID-sell off. It’ll likely survive this.

In the scope of history, that $1 survived very well indeed. Panicking and running for the hills does not do so well. Winston Churchill was a great and flawed man but a terrible investor; he bought and sold shares prior to the 1929 crash in such speculative investments as mining companies, railways, and so on — most of them lost money (hence why Churchill continued to write at such a pace — to fund his Champagne-and-spec stock lifestyle). Hetty Green, on the other hand, (known as the “Queen of Wall Street”, managed to do very well her time — her quote?

I buy when things are low and no one wants them. I keep them until they go up, and people are crazy to get them.

Now, that’s something I can get behind.

Nobody wanted Meta a few years ago. I wrote an internal memo, close to its plummet in ‘22 (it got to $99 or so a share!). I wrote this:

ii) Yet what if we were to tell about about a company with this set of heuristics? Let’s call it “Company A”

Company A has a 31% return on equity and a 20% return on capital.

It has a net income margin of 37% and a FCF margin of 21%

Its income has a compounded annual growth rate over the last 5 years of 41%

If we add in numbers, now, let’s say the net income for 2020 was $29 billion, and $10 billion of that was used to repurchase stock from shareholders?

Let’s say the unlevered FCF is around $6 billion per quarter, and let’s say the debt to equity ratio is about 9x.

In other words, Company A is grows at a quick clip, and has done sustainably for the majority of its life. Its return on capital and return on equity would make any investor happy. Its FCF is an absolute machine.

Would you buy Company A?

Company A was Meta . You would’ve roughly made 4x or 5x’d your money if you’d bought around then. The point is, the fundamentals of a business matter, and right now there a quite a few exceptional businesses with good fundamentals trading at a good price. Alphabet (Google) trades at ~16x earnings. LVMH trades at ~18x earnings. And so on. Brown-Forman trades at ~15x earnings. These are all “inevitables” — Google will continue to be a dominant advertising platform, LVMH will continue to sell luxury, and Brown-Forman will continue to sell Jack Daniel’s and so on.

I talked to my ma in the weekend. She is not really a share person. Her portfolio is a bunch of “inevitables”. It’s done very well. She said “aren’t you worried about this stock market?”, and I said “You love supermarket shopping, Mum. If you see something at a 25% discount you buy it. You come home, and you’re delighted that you found some mince on special²”

She was like, “oh, that makes sense”.

The problem is you have a lot of people looking at charts and catching worry that the world will end. The world, I am delighted to say, has a magnificent disposition to carry on.

Bond Futures Back At SupportTrade is fairly simple here. Go long treasuries and if it breaks down cut.

- A bounce and push back up could be another ugly catalyst for the US stock market.

- A breakdown however would push yields up (and economic growth forecasts) which would be quite bullish for stocks especially down at these levels

Party's OverDow Futures daily forming a downwards channel with price targets potentially down to 34k and 31k. These drops would be about 20-40% which is considered a true market crash. The falling wedge pattern plays out until potentially June of 2027, but wedges from the top of the range are dangerous as they can turn into bull traps.

- Economic fundamentals have been disconnected from the financial system for some time but as the underlying economy begins to falter (ex. unemployment wave) markets begin to price in data such as falling retail sales.

- President Trump is going through with mass layoffs in the Federal Government which creates unemployment as the private sector has been going through layoffs and has halted actual new hiring since 2023.

- As more traders have become accustomed to "bad news is good news," they will most likely be wiped out trying to buy dips or chase false breakouts doing what they have always done.

- Tariffs regionalize trade which make global economies and supply chains less interconnected. A global economy that is also very levered up on USD denominated debt needs dollar liquidity to continue to function. By regionalizing trade that liquidity is starved which can lead to financial problems on a global scale if not handled carefully.

- Markets are likely to price in these risks over the next 2-3 months leading asset prices and interest rates lower. Expect individual companies to do well at times but then rotate to others while the Dow index itself falls.

- Even if the Dow were to play out the wedge during 2026, without significant improvements to the global financial system expect that move to be a bull trap or a best lead to minimal gains without a new wave of monetary inflation.

Bitcoin Retests 77k Neckline Support! This is huge!Traders,

As we watch the tariff FUD destroy traders everywhere, I want you to be aware that we have just landed on something extremely critical for support, the neckline of our long-standing CUP and HANDLE that began forming at the end of 2021. The neckline currently stands at an approximate price of 76-77k. If you'll remember in my last post a couple of days ago regarding the SPY, I suggested that SPY could drop as low as 467 and Bitcoin could hit 76k. Bitcoin has arrived at it's 76k support and if this doesn't hold, crypto is in serious trouble. I am not trying to be an alarmist here. You all know that I am an eternal optimist when it comes to crypto, but in this case we have to prepare our trades accordingly. The break of 76k support could send Bitcoin and crypto down as far at 50k. I know this is hard to believe. Even as I am typing this I am having a hard time grasping that we'd get there, but this is what I am seeing and I have to inform you all accordingly. If we're lucky, that neckline holds. But plan accordingly.

✌️Stew

Some stocks do +1,650% verticals while the rest of market dropsNot all stocks follow overall market direction, just 80% of them. NASDAQ:AREB wasn't one of them.

We focus on the other 20% which are having massive verticals no matter the overall market or economy situation.

TOTAL Week: +121.4% realized profit from alerts posted in chat 💯

To good to be true?

Been doing it for 20+ years.

When should one beat the market with perfected strategy if not after 2 decades and nearly 100k hours invested?

Ever heard of 10,000 hours invested to master something.

Then what does 100k make you?

Master Jedi?

Sure feels like it if your 2 stocks are doing +70% +300% in a day while the world is crashing 🤷🏻♂️

All fully verified with timestamps, feel free to check and verify.

Bitcoin Outlook Amid Uncertainty and Mempool Congestion

This chart captures the current critical juncture for Bitcoin as it tests the 0.618 Fibonacci retracement level (~$74,277), a zone historically associated with trend reversals. The bounce or breakdown from this region may shape the mid-term trajectory.

The recent drawdown is not happening in a vacuum. Global macroeconomic turbulence including increasing U.S. tariffs, rising bond yields, and parallels to the 1985 Plaza Accord suggests deeper structural fragility. If history rhymes, we may be staring at the early tremors of a broader economic reset, possibly invoking a modern black swan event.

Technically, if support holds, Bitcoin may attempt a retracement back to the 0.5 or 0.382 levels (~$81,000–$87,000), but failure to defend this zone could open the door to the 0.786 retracement at $64,753 or worse, the full retrace to $52,622.

Compounding the uncertainty, network congestion continues to pressure transaction times and fees, especially during volatility spikes. Traders and institutions seeking faster confirmation may benefit from acceleration services to avoid critical delays during times of stress.

To help mitigate transaction bottlenecks during peak periods, a BTC accelerator Like fujn.com offers a Bitcoin transaction accelerator service for users who need faster confirmation times. This becomes especially valuable during mempool congestion, which often spikes alongside macro-driven volatility and sell-offs.

As technicals and fundamentals intertwine, keep an eye on both the chart and the mempool.

US Recession Imminent! WARNING!Bond traders are best when it comes to economics. Stock traders not so much.

As the chart shows, historically, when rates bunch up, what follows is a recession. During the recession, the economy tries to fix itself by fanning out the yield curve, marking it cheaper to borrow and boosting the economy.

The best time to be buying up stocks and going long the market is when the yield curve is uninverted and fanned out wide—not when it is bunched up like this.

My followers know this is my first warning of a recession since FEB. 2020.

WARNING! Things can get ugly from here very quickly!

SPX: You Need To PrepareLast time I posted on SPX I said that I was sounding the Alarm

I'm going to reiterate that you need to prepare

No fear mongering, no fancy Elliott Wave Charts and no History Lessons in economics

Lets just ask ourselves some really simple questions:

If you lost your job today, how easy do you think it would be to find replacement employment that could maintain your current lifestyle?

How many months of emergency savings do you have?

What is your level of credit card/ debt in general and are you paying more than the minimum payment?

Do you want to own a home? How hopeful are you about your chances to own in the near future?

Are you saving for retirement? No really are you saving..be honest. If not, why?

How happy, hopeful, worried, sad are you? Be honest

And finally:

Do you believe everything will be ok financially for you 10/20 years from now? Be honest

Now ask yourself: What do I have to do so that I can move from believing/not believing to KNOWING that things will be ok?

2025-04-02 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: This is the event bears have prayed for, full blown trade war and this market is not positioned for any downside risk. Let’s see where we close this week. Below 21500 would be amazing but let’s close below 22000 first.

current market cycle: trading range

key levels: 21800 - 23000

bull case: Tbh, best bulls can hope for, is to stay above 22000. I can’t see this going above 22800 for the near future. If bulls do it, I am clearly wrong.

Invalidation is below 21900.

bear case: Bears got the event gift and now it’s about how fast do they want to get out of this. I expect the worst but stops for now are 22800. First target is a strong move below 22300, then bears need to break 22000 and print a lower low. If they do that, we most likely freefall to 22000. If things become real bad, we hit the big bull trend line from August tomorrow, likely around 21800.

Invalidation is above 22800.

short term: LFG. Trade small with wide stops.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

trade of the day: Big up, big down. Triangle on the 4h chart and both sides made decent money today.

Robinhood: Turn Off the SELL Button?I don't have to remind you what Vlad and the boys did back in 2021

Crime has always been a part of Markets..I get that

Crime will ALWAYS be a part of markets as long as GREED is rewarded

But thats where Regulators are supposed to help hold the crooks accountable..right?

As we all know that has NEVER happened

Why? Because the size of fines are never large enough to truly deter..they are simply a cost of doing business

But hey...according to the crooks we see paraded across our TV screens we need LESS REGULATION anyways because you know..FREE MARKETS!..and all that stuff right

Ok cool, well then lets do the whole Free Market thing..you know the whole, "We need LESS REGULATION because Free markets will take care of Bad Businesses" thing

Well then thats fine by me...

MAJOR PUT POSITION COMING SOON..Vlad

And GME is going to provide me with the ammo..now isnt that poetic :)

TIA: 40% Crash in Sight – What's Next?TIA recently lost its strong $4 support, and that level is now acting as resistance. For the past two months, the price hasn’t been able to climb back above $4, leaving us with one burning question: Is more blood on the table?

Broken Support: TIA has given up its $4 support, which now serves as resistance.

Looking at November 2024: The low from November 2024 was around $1.9. Revisiting that level could provide us with a high-probability long trade.

Trade Setup Opportunity

Entry Point: Set an alarm for the $1.9 low. A successful bounce here would signal a potential long trade opportunity.

Target & Reward: With the goal of targeting the $3 level, this trade could offer a risk-to-reward ratio of at least 5:1.

Implication: If the $1.9 level is revisited and holds, we could be looking at a scenario with roughly 40% more downside in the current trend—but also a setup for a low-risk long if the bounce holds.

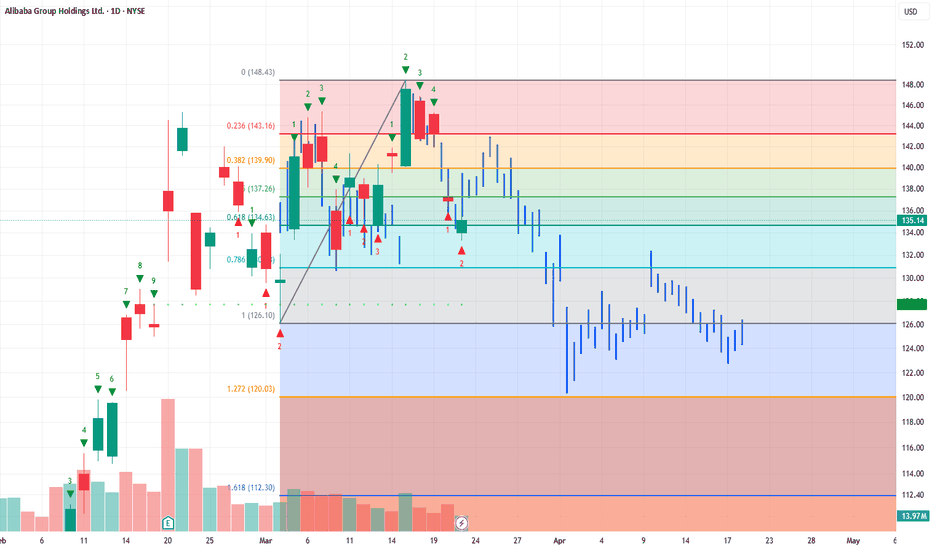

$BABA on its way to $120s into AprilI would honestly be surprised if it doesnt gap down this Monday before the open. The weekly imo, looks like a mess atm and could gap into $120s easy. If it doesn't, I would expect some consolidation for a fall into the First week of April. We're right at the golden pocket retrace at the .618, very common retracement level, if we look at Fibs with a bearish perspective and measure a retrace back to the lower golden pocket at 1.61 fib from highs, $112.30 would be my ultimate target if we can break $126. $126 opens the flood gates to our ultimate target at $112.