BTC/USD 4 HOUR CHART FALL WARNING BARTS HEADIn this idea I illustrate how we are on a Barts head falling to 86-87k range. The reason I believe this has been missed by a lot of people is the slanted angle of it as we are on a hard uptrend. Tilt your head and see what I mean...I hope this helps you. Much love - ND

Crashincoming

1929 Stock Market & Today The story of 1929 -

The Great Depression was a severe worldwide economic depression that lasted from 1929 to the late 1930s. There were several factors that contributed to the trigger of the Great Depression, but the key trigger is often attributed to the stock market crash of 1929.

In the 1920s, there was a period of economic growth and prosperity in the United States, also known as the "Roaring Twenties." During this time, people invested heavily in the stock market, and the prices of stocks rose rapidly. However, in September and October of 1929, the stock market began to decline, and on October 24, 1929, known as "Black Thursday," panic selling began, causing the stock market to crash.

The stock market crash led to a chain reaction of events that contributed to the Great Depression. Banks had invested heavily in the stock market and had also made loans to individuals and businesses that were unable to repay them. As a result, many banks failed, leading to a loss of confidence in the banking system.

The collapse of the banking system led to a decrease in the money supply, which caused a decline in spending and investment. The decline in spending and investment led to a decrease in production and employment, which caused a further decline in spending and investment, and the cycle continued.

In summary, the key trigger for the Great Depression was the stock market crash of 1929, which led to a chain reaction of events that caused the collapse of the banking system and a severe decrease in spending and investment.

I am seeing similarities between its technical and fundamental.

My view on technical as a study into "Behavioral price movement" , it refers to the fluctuations in the price of a financial asset that are caused by the collective behavior of investors, traders and events. And they tend to repeat itself.

Trading & Hedging in Nasdaq -

E-mini Nasdaq Futures & Options:

Minimum fluctuation

0.25 index points = $5.00

Micro E-mini Nasdaq Futures & Options:

Minimum fluctuation

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

The Stock Market Crash Is Right Next To You... [WARNING]

Hello all. Today I unexpectedly found a great discovery on AAPL, Apple. Yes, I will talk about the holy stock market crash today.

These days everyone wondering: Is that really true that stock market is going to crash? I am also one of them, so on the other day, I did a quick analysis on the VIT stock. But the analysis was wrong, I NEEDED to do analysis on a REAL stock, but not a ETF or likes.

But why Apple? It's obvious. The Apple stock is, literally, the number one stock on the market. Nasdaq, DOW, S&P 500, the stock is on the "very top" on the variety of indexes. Knowing Apple's future price, you could safely say that it's equivalent to knowing the future of the entire stock market, financial market.

So, the key indicator on this analysis is: A fibonacci retracement

While fibonacci retracement is an amazing tool, you need to take a closer look at how precisely the fibonacci retracement is working on the chart. How nicely the prices are fitting to the fib retracement lines decides the level of trustworthiness for the fib retracement, like the above.

(Pro tip: Use the magnet tool; Toggle the logarithmic mode to see a clear view where is the true peak and the true valley; Find a best fibonacci retracement, take a closer look at horizontal supports)

Other than the fibonacci retracement, there are two (three) reasons why I believe that the stock market is going to crash.

1. Three peaks

A three peaks, this is my original term. As you can see on the chart, you can see a three tops, where the each is all on the nearly same level, but not far from each other. This is a big signal that you can vaguely tell if the market is not performing well. You can find the pattern on the recent Bitcoin 65K crash in the early 2021.

2. RSI bearish divergence

RSI divergence is a huge help to precisely tell if the asset is going to crash on the timeframe. Apple is marking a big bearish divergence on its monthly timeframe and its weekly timeframe. It's very important here to ensure that the 1M timeframe is as well bearish but not the 1W timeframe.

3. EMA ribbon crossunder

This is also my original term. An EMA ribbon crossunder is when an EMA ribbon crossunders the SMA 50. In other words, When the SMA 50 crossovers the EMA ribbon. An EMA ribbon is an array of EMAs, exponential moving average. Usually EMA 25, 30, 35.. 50, and 55, or likes.

The crossunder of an EMA ribbon under a higher moving average such as SMA50, means that a shorter or more reactive moving crossunders a longer or less reactive moving average. Fundamentally, EMA ribbon crossunder is the same concept to a death cross, where SMA 50 crossunders SMA 200 or SMA 100. But an EMA ribbon crossunder is more visual friendly. An EMA ribbon crossunder also happened on the Bitcoin crash, and often on other assets.

So, that's it. Hope this helps for your exit strategy.

Oh, and also note that it's also highly possible that you will see a bull trap, a.k.a dead cat bounce. You also could say the complacency phase in the market cycle.

I'm very scared of the market crash, not because I could lose big, but it could lead some more serious side effects to the real world. You know what I mean. Perhaps you'd better prepare some gold and foods in your house XD

Stay safe.

// This is NOT a Financial Advice. This is For Educational Purposes Only. //

Boulevard Of Broken DreamsWhatever will going to happen will happen, and what we need appeared.

Why the market had likely overshot when the economy still struggle? Because it is the nature of stock market, people like to run away from reality, wanna live in richness fantasy. "The more sweet dreams are the more hurtful when wake up" . The economy will affect the stock market, never the opposite.

When the music stop? We will find out in the next 2 weeks.

We can see a big pullback in 3500 resistance but the next 2 weeks could decide the market destiny. Keep your head objective, conscious, calm and cool. You will make a better decision.

Short below 3450, recommend if weekly price close under this position. (Stop loss >3600)

Press like & follow to support my work.

Thanks for your attention !

US100 Bull Trap 6/25, 40hr crossed 400hr MA; Crash incomingI was right about the last theory, so I'm expanding on it. The MAs don't lie. Today had all the markings of a Bull Trap; and may continue tomorrow, though I'm hoping for the sell off tonight. By Monday 7/6 we should be near a bottom support. The 12yr Bull trend broke above it's channel's resistance; which has always resulted in a major sell-off. The new long-term Bear trend emerging has a 3:1 steeper angle in a wedge; and the short term bear corrections are bout 12% steeper than the bull corrections. The new long term bear trend that could emerge next year will be a decline twice as steep as the 12yr Bull trend.

Perma-bulls are gonna lose a lot of money soon believing in the Fed and the Trump lies. Trump and Barr are beginning to file anti-trust lawsuits against most of the FAANG and social media companies. This will surely hurt US Tech. Last, but not least, the U.S. Semi market is in a very vulnerable position with China the trade deal off, and war drums beating around the world. The U.S. doesn't even have the materials and foundries to produce it's current products. All the rare earth materials come from China; and TSMC is the world's leading foundry by leaps and bounds. WHEN China Annexes Taiwan, the US Semi market will take decades to catch up, if ever.

All China needs to be self-sufficient in the semi market is to build newer foundries and infrastructure(10-12yrs); OR the could just steal Taiwan's foundries in a short war. Trump will just denounce and beg for them to honor the deal; like he did with HK and Muslim Camps. For the U.S. to become independent we have to discover new rare earth deposits and mine them.(decades) Then we have to build several semi foundries.(decades)

To give you an idea of how far behind we are: TSMC agreed to build a 7nm foundry for $40BN in AZ that will take 10-12yrs to complete. They currently have 5nm foundries of their own and are nearing 3nm capabilities. By the time we theoretically get foundries built for dated current tech, they may have 1nm or smaller capabilities. This is not something that happens in a few years. It takes tens of Billions of dollars and decades. We fell behind because we used Asia for cheap labor, at the expense of the American middle class. Now those cheap laborers took over the farm and are about to put us in the dog house. That's what we get for electing greedy, racist, impulsive idiots and those who supported these trends will pay the most for it.

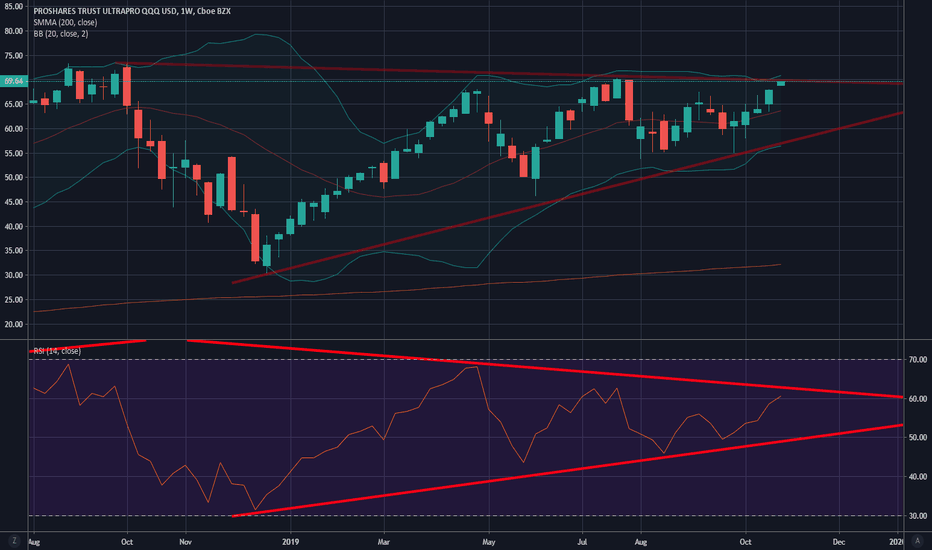

Testing new heights - TQQQ Going to Drop from this ResistanceBased on very simple technical analysis on the weekly chart, it's looking like TQQQ is about to ricochet off the top and likely end up crashing due to decreased trading volumes in the NASDAQ. Without the volume to artificially prop up the stock prices underlying the TQQQ ETF, I'm predicting a stunning downside movement. History shows us that when this topline resistance is hit, things go down. At the minimum, I'm predicting a 15% downside movement. If this week's economic data continues to point negative, I think it'll lock into a downward cycle.

This is not trading advice, but merely an observation and prediction.

We are SHORT'ing the FUCK out of NYSE: $NGVC | #NaturalGrocers!We are SHORT'ing the FUCK out of NYSE: $NGVC | #NaturalGrocers! We are in the 5th wave of the smaller 5th wave! Unfortunately, I can't zoom in on the 1 minute chart, but this baby is going to COLLAPSE HARD! Higher highs in price + Lower highs in RSI = MASSIVE PROFITS!