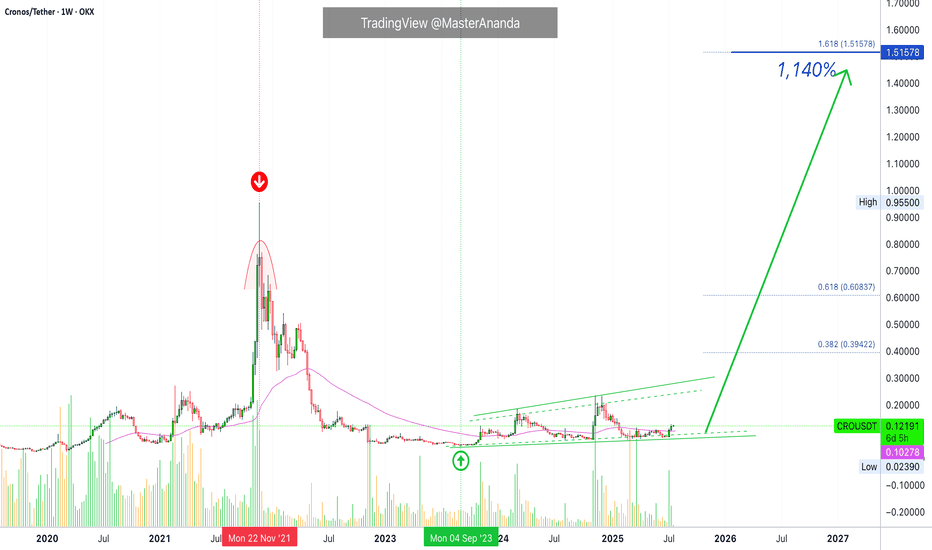

Cronos 2025/26 New All-Time High Revealed · PP: 1,140%Cronos has all the classic signals ready, confirmed and combined. RCC. And this opens the doors for a major advance which will not be shown fully on this chart. That is because I am using the linear chart for perspective but the log chart is needed to see all the major targets. Just trust, it is going to move very high in this bullish cycle run.

Good afternoon my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Didn't I told you that you would see so much growth, that you will become complacent at some point? We are not there yet, but we will get there and you will have new challenges to face. Believe it or not, taking profits, using your earnings, will be one of the hardest things to do but the only right choice. A win is only a win when you close when prices are up.

Just as you cannot incur a loss unless you sell when prices are down; you cannot secure a win unless you sell when prices are up. When a pair grows 1,000%, you should take profits, period. When a pair growths 500%, it is wise to secure, 10%, 20%, etc. A plan is needed to achieve maximum success.

How you approach the market will depend on your goals, your capital, your trading style, which projects are available to you in your home-country, and so on.

A long-term investor does not need to sell, can continue to buy, accumulate and hold for a decade or more. Can you see? Each strategy is dependent on the person behind it.

CROUSDT · Trading weekly above EMA55 while still near the bottom. The bottom is revealed when we compare current candles size and location to the 2021 high price.

Last but not least, notice how each time there is a strong increase in trading volume the weekly session ends up closing green. Bullish volume is dominating this chart. A long-term accumulation phase.

Without further ado, the next and easy all-time high target is $1.51 but it can go much higher. Total profits reaching 1,140%.

Thank you for reading.

Namaste.

CRO

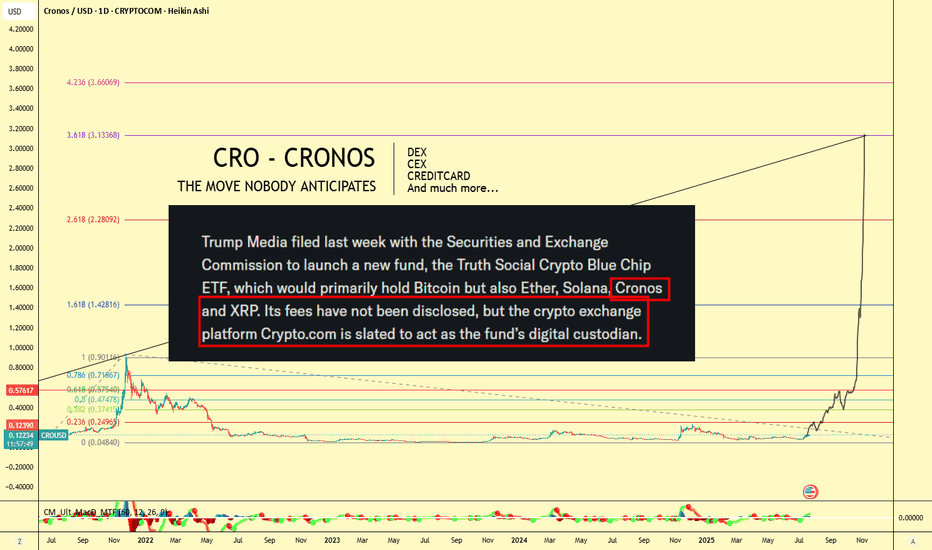

CRO (Crypto.com) $3 Target! Don't Miss This Move🪙 Ticker: OKX:CROUSDT

🕰 Chart: 1D (Heikin Ashi)

🔧 Tools Used: Fibonacci Extension, Fundamental News (ETF Filing)

🔍 Chart Analysis: Fibonacci Extension Targeting $3+

The Fibonacci Extension tool has been applied to the major CRO impulse wave from its peak near $0.90 (late 2021) to the 2022–2023 bottom at $0.0484, confirming a multi-year retracement and consolidation period.

Let’s break down the major Fib levels:

Extension Level Price Target

0.236 $0.2495

0.382 $0.3741

0.618 $0.5745

1.0 $0.9011

1.618 $1.4281

2.618 $2.2809

3.618 $3.1336

📌 Current Price: ~$0.12

🔥 Upside Potential to $3.13+ — a 25x move from current levels if full extension plays out!

📣 Fundamental Catalyst: CRO in Trump Media ETF

According to the chart note (sourced from SEC-related headlines):

"Trump Media filed with the SEC to launch a new ETF, the Truth Social Crypto Blue Chip ETF, which would primarily hold Bitcoin, but also Ether, Solana, Cronos (CRO), and XRP."

Even more important:

"Crypto.com is slated to act as the fund’s digital custodian."

This is massive fundamental validation for CRO — not just as a token, but as an ecosystem and financial infrastructure provider.

🌐 Why Crypto.com Matters: Utility, Ecosystem, Adoption

Crypto.com isn't just an exchange — it's a comprehensive Web3 ecosystem, which includes:

🔁 CEX (Centralized Exchange):

Buy, sell, stake, and trade hundreds of cryptocurrencies with high liquidity and low fees.

🔄 DEX (Decentralized Exchange):

Cronos Chain supports decentralized trading and DeFi apps — with low gas fees and EVM compatibility.

💳 Visa Credit Card Integration:

Crypto.com offers one of the most popular crypto Visa debit cards — earn cashback in CRO and enjoy perks like Spotify/Netflix rebates.

📱 Mobile Super App:

Buy/sell/stake/farm on-the-go with a seamless user interface.

📈 Earn & Lending Services:

Stake CRO or other assets for up to double-digit yields.

🤝 Strategic Partnerships

Crypto.com has been aggressively investing in brand and adoption:

🏟 Official partner of UFC, FIFA World Cup, and Formula 1

🏀 NBA’s Los Angeles Lakers Arena naming rights (Crypto.com Arena)

💼 Member of Singapore's regulated exchanges

🔐 ISO/IEC 27701:2019, PCI:DSS 3.2.1, and SOC 2 compliance — one of the most secure platforms in the industry

🧠 Conclusion: The Perfect Blend of TA + FA

With CRO being included in a potential U.S.-regulated ETF, the Crypto.com ecosystem booming, and technical patterns pointing to a Fib-based target above $3, CRO might be the sleeper play of the next bull run.

"The move nobody anticipates" might just be the most explosive one.

🎯 Short-Term Targets:

$0.25

$0.37

$0.57

🎯 Mid-Term Bull Targets:

$0.90 (prior ATH)

$1.42

$2.28

🎯 Full Cycle Extension:

$3.13

📢 Let me know in the comments:

Are you holding GETTEX:CRO ? What do you think about its inclusion in the ETF?

#CRO #CryptoCom #ETF #TrumpMedia #Altcoins #Bullrun #CryptoTrading #DeFi #FibTargets #CronosChain

CRO at a Turning Point ?This is CRO on the daily chart.

Price has interacted multiple times with the key resistance at **0.10649** (black line). It’s now testing that level again, and there's a real possibility it flips it into support.

On top of that, CRO is attempting to reclaim the 200MA, while the 50MA is starting to flatten out—potential signs of a longer-term shift.

That said, this process might take some time and could be volatile. CRO’s relatively small market cap of \$3.33B and this week’s major macro events (starting today with CPI) could add pressure in both directions.

Always take profits and manage risk.

Interaction is welcome.

Cronos Holds Key Trendline – Will Resistance Crack Next?CRO is bouncing off its rising support line again.

The price has respected this trendline multiple times, showing steady accumulation. It’s also sitting just below a key resistance zone, if it breaks above that, we could see momentum kick in.

For now, the structure looks healthy as long as the support holds.

DYOR, NFA

Cronos Rallies 18% After Truth Social Files for Blue-Chip ETFOKX:CROUSDT is a leading candidate for a Binance listing this month, following the proposed Crypto Blue-Chip ETF filed by Truth Social with the SEC. The fund includes 70% Bitcoin, 15% Ethereum, 8% Solana, 5% Cronos, and 2% XRP , positioning Cronos as a key asset in the fund.

Of the tokens in the proposed fund, only Cronos (CRO) is not currently listed on Binance. If the SEC approves the Crypto Blue-Chip ETF, Binance could fast-track the listing of Cronos . This move would likely draw more liquidity and investor interest toward CRO, fueling its price growth.

OKX:CROUSDT price surged by 17.8% over the last 24 hours, signaling strong momentum. If the ETF listing is approved and Binance acts swiftly, CRO could break through key resistance levels, potentially surpassing $0.1007. This upward movement would benefit investors, continuing the positive trend for the altcoin.

Cronos: Bear Market VibesCronos is resisting the persistent selling pressure after last week's low, but it should soon turn sustainably downward again. We anticipate the imminent bottom of the overarching turquoise corrective wave 2 within the green Target Zone between $0.06 and $0.02. According to our primary scenario, once CRO reaches this new bear market low, it can quickly move upward in the next impulse wave, with the resistances at $0.14 and $0.23 serving at most as temporary pauses.

CRO - Building Block!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Let’s keep it simple!

📈 Short-Term Bullish:

CRO is currently hovering around a key weekly support level. As long as the $0.07 support holds, we can look for short-term long opportunities.

With bullish momentum picking up, the next target/resistance is around $0.11 (marked in blue).

🚀 Long-Term Bullish:

For the bulls to fully take control and aim for the next major resistance at $0.163 (marked in red), a confirmed breakout above the $0.115 level is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Cronos is on the move, Could we see it hit $1 soon?The chart is a weekly candlestick chart of CRONOS (CRO) against USD on TradingView, showing price action from late 2023 to a projected point in 2025. Let’s break down the key elements:

Price Movement and Trend:

CRONOS experienced a notable peak around mid-2024, reaching approximately $0.24000, followed by a sharp decline.

After the peak, the price entered a downtrend, forming a descending triangle pattern, which is typically bearish but can lead to a breakout in either direction.

The price has since stabilized in an "Accumulation Zone" between $0.07197 and $0.08925, with the current price at $0.08925 as of April 1, 2025.

Descending Triangle Pattern:

The descending triangle is defined by a downward-sloping resistance line (yellow) and a horizontal support line around $0.08925.

This pattern often signals a potential breakout. A break above the resistance could indicate a bullish reversal, while a break below support might lead to further downside.

The resistance line is currently around $0.13000 to $0.15000, based on the slope.

Accumulation Zone:

The price is in an "Accumulation Zone" between $0.07197 and $0.08925, suggesting that buyers are holding this level and potentially accumulating positions.

Multiple tests of this support level indicate strong buying interest, which could set the stage for a breakout if bullish momentum builds.

Target Projection (TG 1S):

The chart projects a target labeled "TG 1S" at $0.42000, a significant increase from the current price.

This target is likely based on the height of the descending triangle pattern added to the breakout point, a common technical analysis method.

However, reaching $1 (as requested) would require a much larger move, approximately an 11x increase from the current price of $0.08925.

Support and Resistance Levels:

Key support is at $0.07197, with the current price at $0.08925.

Resistance from the descending triangle is around $0.13000 to $0.15000, with a previous high at $0.17018.

A break above $0.17018 could open the door to higher levels, but reaching $1 would require sustained momentum and likely strong fundamental catalysts.

Historical Context and Feasibility of $1:

CRONOS reached an all-time high of around $0.96 in November 2021 during a crypto bull market, so $1 is within historical precedent.

However, the current market environment (as of April 2025) would need to see significant bullish momentum, possibly driven by broader crypto market trends, adoption of the Cronos ecosystem, or major developments in the Crypto.com platform (which CRONOS is tied to).

The $0.42000 target is a more immediate goal, but $1 would require an extraordinary rally, likely over a longer timeframe.

Timeframe:

The chart extends into mid-2025, and the $0.42000 target appears to be a medium-term projection.

Reaching $1 might take longer, potentially into late 2025 or beyond, depending on market conditions.

Cronos To Grow 1,500%, 2,500% Or More In 2025The same August 2024 support that led to a 250% rise is being activated again in February 2025. This will lead to a new and very strong rise. This time the bullish wave will be many times bigger compared to previous ones. Instead of 250% we might end up seeing 1,500%, 2,500% or more.

Good afternoon my fellow Cryptocurrency trader, this is indeed a very wonderful day.

Notice the high volume present on the chart as support is activated with a higher low, technical double-bottom, and notice all the green sessions. Four consecutive 2D sessions closing green. That's big.

The new b-wave is already developing, already in the making. We have higher highs with a flat bottom, a perfect wide, long-term, bullish consolidation signal.

The first resistance is the upper trendline. This will be broken easily but once it is challenged it is sure to produce a retrace, either big or small. After the retrace, we will see additional growth and this growth is the one that is likely to reach 2,000%+ in the coming months, from bottom to top.

Patience is key. Buy and hold.

Thanks a lot for your continued support.

Namaste.

CRO 30 Min TA by ChartMasterAI

Let's dive into an in-depth technical analysis (TA) of the CRO/USD 1-hour chart provided, breaking down each element:

Price Action Analysis

Current Price: The price of CRO/USD is at 0.13663, which is down by 21.25% from the previous period, indicating a strong bearish trend.

Trend: The chart shows a clear downtrend, with the price making lower highs and lower lows. This is characteristic of a bearish market where sellers dominate.

Support and Resistance:

Support: The immediate support level is around 0.1300, which has been tested multiple times and could act as a psychological support due to the round number.

Resistance: The resistance is around 0.1500, where the price has previously struggled to break through, acting as a ceiling.

Fibonacci Retracement Levels

The chart includes Fibonacci retracement levels which are used to identify potential reversal points:

0.236 (0.13753): This level has been breached, indicating a deep retracement.

0.382 (0.13521): The price is currently near this level, which could act as a minor support.

0.5 (0.13344): Below the current price, this could be the next support if the price continues to fall.

0.618 (0.13145): A deeper Fibonacci level, potentially significant if the price drops further.

0.786 (0.12881): The deepest level on the chart, indicating a strong bearish move if reached.

Indicators Analysis

Volume:

There's a note that the data vendor doesn't provide volume data for this symbol, which limits our ability to analyze trading activity directly. However, the absence of volume spikes during the downtrend suggests the bearish move might be driven by lack of buying interest rather than heavy selling.

Stochastic RSI (3, 3, 14, close):

Current Reading: -0.00 (extremely oversold).

Explanation: The Stochastic RSI is an oscillator that ranges from 0 to 100, with readings below 20 typically indicating oversold conditions. Here, it's at -0.00, which is beyond the normal range, suggesting an extreme oversold condition. This might indicate that the selling pressure is possibly overdone, and a short-term bounce could be expected. However, in strong downtrends, oversold conditions can persist.

Chande Momentum Oscillator (ChandeMO) (9, close):

Current Reading: -74.12 (bearish momentum).

Explanation: The ChandeMO measures momentum by comparing the sum of gains and losses over a period. A reading below -50 indicates strong bearish momentum. At -74.12, it's deeply in bearish territory, reinforcing the current downtrend.

MACD (12, 26, close):

Current Values: MACD line at -0.00028, Signal line at -0.00009, Histogram at 0.00019.

Explanation: The MACD (Moving Average Convergence Divergence) consists of the MACD line (12-period EMA - 26-period EMA), the Signal line (9-period EMA of MACD), and the histogram (difference between MACD and Signal lines).

The MACD line is below the Signal line, which is a bearish signal.

The histogram turning positive suggests a slight decrease in bearish momentum, but since both lines are negative, the overall trend remains bearish. This could hint at a potential short-term relief rally or consolidation before possibly continuing the downtrend.

Market Sentiment and Potential Scenarios

Bearish Sentiment: The overall sentiment remains bearish given the price action, Fibonacci retracement levels, and momentum indicators. The strong downtrend, lack of significant buying volume (though not shown), and deep oversold conditions in Stochastic RSI with strong bearish momentum in ChandeMO all point towards continued selling pressure.

Short-term Potential: Given the extreme oversold condition of the Stochastic RSI, there's a possibility of a short-term bounce or consolidation, especially if the price hits the support at 0.1300 or the Fibonacci level around 0.13344. However, without a change in the broader trend, this might only be a temporary respite.

Long-term Outlook: For a reversal, watch for:

A break above the resistance at 0.1500 with volume confirmation (if available in future analysis).

Positive divergences in momentum indicators like the MACD or ChandeMO.

A sustained move above key Fibonacci levels, particularly the 0.382 level.

Conclusion

The CRO/USD chart shows a strong bearish trend with potential for short-term relief due to oversold conditions. However, for a more sustainable recovery, more bullish signals are needed. Traders should watch for support levels and look for confirmation from momentum indicators before considering long positions, while bearish traders might look for opportunities to short on any bounces until a clear reversal pattern emerges. Always consider using stop-loss orders to manage risk, especially in volatile markets like cryptocurrencies.

Cronos: Dive!Cronos has dived into our beige Target Zone between $0.1322 and $0.0884 and should soon reach the projected low of the green wave . In our Zone, the coin should succeed in a bullish reversal, and the following impulsive wave should propel the price significantly above the resistance at $0.23. As CRO has fulfilled the minimum requirements for the wave correction by entering our Zone, it might even head above the $0.23 mark immediately.

CRO Chart TA by GrokAI

Analyzing the provided chart for technical insights:

Price Movement: The price has been on an upward trajectory since late December, moving from around $0.14 to testing the $0.1650 level. It's currently facing resistance around $0.1650, as indicated by the price action at this level.

Volume: There's a noticeable increase in volume as the price approaches and tests the resistance level. This could signify strong buying interest or potential selling pressure at this resistance. If the price breaks through with sustained high volume, it could confirm a breakout.

MACD: The MACD shows a bullish crossover with the MACD line crossing above the signal line, but it's quite close to the zero line. This suggests that while bullish momentum is present, it's not particularly strong. A move further above the zero line with increasing histogram bars would strengthen the bullish case.

Stochastic RSI: The Stochastic RSI is overbought, which often signals that an asset might be due for a correction or at least a period of consolidation. However, in strong uptrends, assets can remain overbought for extended periods.

RSI Divergence Indicator: The chart shows bear divergences on the RSI indicator, where the price makes higher highs but the RSI does not, indicating potential weakening momentum. This could precede a price correction if the RSI continues to diverge negatively.

Stock RSI: The RSI is currently at 57.90, which is neither overbought nor oversold, suggesting room for movement in either direction. The RSI has been trending upwards, aligning with the price trend, but the recent bear divergences are a cautionary sign.

Summary: The chart displays a bullish trend with the price testing significant resistance around $0.1650. The volume increase at this level could either confirm a breakout if sustained or indicate potential resistance if it drops off. The MACD supports a bullish view but with caution due to its proximity to the zero line. The overbought Stochastic RSI and RSI bear divergences suggest that despite the bullish price action, there's a risk of a correction or consolidation.

Action: For those considering long positions, look for a confirmed breakout above the resistance with strong volume for confirmation of the upward trend. For potential short positions or taking profits, watch for signs of rejection at this resistance level or if the RSI divergences lead to a price pullback. Always consider your risk management strategy in light of these technical indicators.

CRO - 4h - Accumulation RangeREMEMBER that a lot of investors sell stocks or crypto for fiscal conditions in 2024 to close the year.

For that, we have low buy liquidity , and even with that pressure on the price , CRO is trying to remaning in the same range as 1 week ago, so a breakout can restart a new HH , so patience.

Im bullish on it if the 0,17usd resistance its broken and became a support.

Cronos: Target Zone AheadCronos (CRO) has recently been steering a less volatile sideways course. We have identified a beige Target Zone between $0.13 and $0.08, which should catch the low of the ongoing wave in green, thus presenting an opportunity to open long positions. However, if the price directly breaches the resistance at $0.23, we will have to consider the green wave alt. as complete, and the outlined Target Zone will be missed. We assign a 33% probability to this alternative scenario.

#Cronos $CROUSD Is testing a breakout wedge#Cronos CRYPTOCOM:CROUSD is currently testing a significant breakout wedge where it is anticipated to bounce off it.

In case of a daily close below 0.1300 there could be a free fall back to 0.0800

A daily close above 0.2400 is a breakout and will unlock a new zone up to 0.4500

#Cronos #Cro #Crypto #CryptoCurrency #Crypto.com

WHAT IS TRUE...Hello friends

This coin is placed in a channel.

Now, according to the rising market, we have two scenarios:

1_ To break the channel from here and go to register new ceilings.

2- You cannot succeed in a channel failure and buy in the lower range that we specified.

There is another mode, according to the rising market, if the channel succeeds in a valid failure, we should buy a pullback.

Be successful and profitable.

Cryptocom in Bearland- Like most altcoins, CRO remains deep in its bear market.

- Until BTC rallies significantly, altcoins will likely stay overshadowed.

- BTC dominance (BTC.D) is climbing near 60%, putting pressure on altcoins.

- As always, check the bubbles, follow the trends

- Everything you need is in the chart.

- What’s the best approach?

- Be patient and continue DCA.

- Buy at the good time.

Buying CRO in this market:

Option 1: Wait for a return to the bottom around $0.05—(ideally a full-buy range).

Option 2: Wait for a breakout and weekly close above $0.10 for confirmation.

- Whether trading or holding, consider taking partial profits on the way up.

- For the short term, consider taking profit around $0.50, as there’s resistance in this area.

- For those waiting on the altcoin bull run, a max target of $1.5 to $2.5 is reasonable.

Happy Tr4Ding !