CRON

Bullish Daily Chart on $MJDaily Chart is looking like a great long-term buy down here. Watching for a move over the daily 50sma and a continuation higher above $20.

It's been a rough ride down since March of 2019, We trended all the way back down to 2017 support on the North American Cannabis Sector shown here -> charts.stocktwits.com

I'm anticipating for this to hit $50 in the 5 years

GLTA and Reinvest those dividends back into MJ :)

XLY looking slightly bullishUnderlying weakness, with bullish divergence on several indicators. Could possibly see a correction to $0.70 support/resistance soon. Excellent fundamentals, undervalued and a strategic investment by Imperial Brands. Monthly/weekly falling wedge likely to remain in play until Q2 2021, but there should be some significant bounces. Currently trading at $0.57, a bounce to $0.70 would mean a significant profit, while a drop below $0.54 would be an opportunity to buy more shares.

I am long Auxly, but I'm selling every extended bounce, locking in profits, then retrace it to load up again.

If you aren't familiar with this company, then you should research it. Their business model is similar to that of CRON. With UK based Imperial Brands on board, there is no reason why CRON should be favoured over XLY, though CRON enjoyed a $1.7B strategic investment, while XLY thus far received $200M. Still, strategically, CRON is expected to have that money sustain its business for the next 15 years, which suggests to me that $200M is actually very good money to sustain operations in the next few years.

CRON – Bearish BananaWaiting for pattern to complete or $4.62 to enter long

Trade Entry

All bearish options entries are poor risk/reward. $140 risk for $30 reward.

I would prefer waiting until bottom to buy shares or long calls.

The other alternative is to short CRON.

Break of current bearish banana pattern to bullish is low probability IMO here. Curve of pattern is midway.

Will re-post if entry presents.

Chart Details

Price running inside the current banana/shoe pattern.

Very small gap fill at yellow dash line.

Price alert set at $5 to prepare for entry at end of pattern.

About Me

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

I am transitioning to my new website www.moneypatterns.com and have updated my name previously jbird7839. Same guy - new name. :)

Website will be ready for launch mid-January 2020. Thank you for your patience while I try to juggle everything and maintain the same standards.

Disclosure - I am long BTCUSD, GBTC. Short term GDX Bullish, SPXS Bullish

CRON Vanguard Purchase - Cronos Group @$6.20 on 11/15/19Got a Vanguard notification of a purchase this morning. I'd like to attempt to document, on the same day, all individual stock purchases for future reference and timing studies.

Purchases are Long-to-Ultra Long term holdings. This will not be one of my forever-holdings.

Companies purchased reflect positive outlooks on - Valuation, Growth potential, Technicals, and Future societal trends.

I want to make these public so that I keep myself honest by allowing everyone to view my winning trades and losing trades.

Sometimes months go by where I won't purchase anything, I have my limit orders preset. I wait for price to come to me.

Core Thesis:

- Cronos is the best company among it's industry peer group. Plus they're profitable, which cannot be said for many peers.

- I believe the industry is in the early growth stage.

- It's fallen 75% since the beginning of the year.

- Performance is uncorrelated from the broader market, with global operations - i.e. 'diversification'

www.gurufocus.com

Best,

RH

LONG CRONI have been following the weed sector closely as it has a favorable vol indication for someone with my size and have determined that there is a strong probability that we are due for some oversold bounces in this sector. Might be worth throwing in a bet and calculating RR accordingly. Modify as needed according to your risk tolerance and size.

God Speed,

Mr. Manbearpig

THE WEEK AHEAD: CRON, TLRY, CGC EARNINGS; EWZ; VIXHIGH RANK/IMPLIED EARNINGS:

CRON (32/82) (Tuesday Before Open)

TLRY (50/97) (Tuesday After Close)

CSCO (44/27) (Tuesday After Close)

WMT (48/23) (Thursday Before Open)

NVDA (24/43) (Thursday After Close)

AMAT (17/34) (Thursday After Close)

CGC (95/87) (Thursday Before Open)

JC (30/43) (Friday Before Open)

Notes: Looks like it's the "Week of Weed" with CRON, TLRY, CGC announcing and all in states of high implied/high rank ... . If you're hesitant to go into single name here, MJ (47/51) has decent rank/implied metrics, although it's less liquid than I would like.

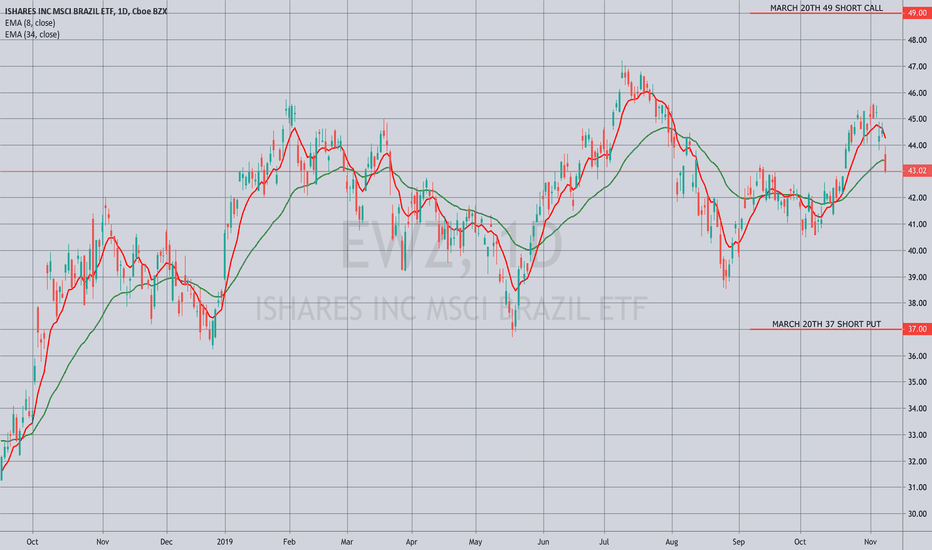

EXCHANGE-TRADED FUNDS:

TLT (56/12)

EWZ (47/28)

SLV (44/22)

GDXJ (37/31)

GLD (34/11)

EEM (33/16)

First Expiries In Which At-the-Money Short Straddle Pays >10% of Stock Price:

TLT: January of '21

EWZ: March: 5.64 verus 43.02 (13.11%)

SLV: April: 1.72 versus 15.70 (11.0%)

GDXJ: January: 3.99 versus 36.33 (11.0%)

GLD: January of '21

EEM: June: 4.97 versus 43.68 (11.4%)

Notes: Pictured here is an EWZ delta-neutral short strangle camped out at the 20 delta in the first expiry in which the at-the-money short straddle pays greater than 10% of the value of the underlying. Paying 1.61, it has break evens of 35.39/50.61 with delta/theta metrics of -.36/1.49; .40 at 25% maximum; .80 at 50%.

BROAD MARKET:

Broad market premium selling simply isn't paying here in short duration (an understatement).

FUTURES:

/6B (72/9)

/NG (74/60)

/SI (44/21)

/GC (34/12)

/ZS (32/20)

Notes: Natty is frisking up, which should be no surprise. Having put on a bullish assumption seasonality play in UNG way back in August at lows, I'm just waiting for things to top out in January or February before doing something in the other direction.

VIX/VIX DERIVATIVES:

Term structure trades* in VIX remain viable for the December, January, and February expiries with the correspondent futures contracts trading at 16.05, 17.33, and 18.07 respectively.

On the other end of the stick, continue to consider a VXX Super Bull or similar setup to potentially catch a modest volatility expansion running into the end of the year without sticking your entire pickle in the grinder, particularly if VIX continues to trundle along at 2019 lows: the December 20th 16P/-18P/18C/-20C pays a small credit (.17), has a 17.83 break even versus spot of 18.64, and max profit/max loss metrics of 2.17/1.87, with max being realized on a finish above 20, which does not exactly require a massive pop from here.

* -- Generally short call verticals with break even near where the correspondent /VX futures contract is trading (e.g., the December 20th 15/18, paying .90, with a 15.90 break even versus the December /VX contract trading at 16.05; the January 22nd 16/19, 1.00, with a 17.00 break even versus 17.33; February 19th 17/20, with an 18.00 break even versus 18.07).

GWPH Long IdeaMJ Sector heating up. GWPH is a buy here IMHO. CRON, MJ, FLWPF, HEMP, CGC, CVSI all look like a good starting point.

CRON - Cup & Handle or W PatternCould do with some more volume, but broader market sentiment appears to be changing. With the HEXO's, CTST's, TGOD's and the likes, in turmoil, I suppose it is scary to stay true to your thesis. CRON is one of the potential long term winners, and even though it is trading at a ridiculous multiple, it is currently above resistance.

If we look at the hourly chart, we see a short term Cup & Handle emerging, and we're currently looking at a beautiful Bull Flag. If we look a bit broader, we see that the current Cup & Handle are part of a larger W pattern, which in this case seems to have started to form at the temporary bottom.

I was hoping that CRON would close the week above $9.30, but with peers just leisurely laying off hundreds of workers, I suppose it is impressive that she stayed above resistance on a typical low volume Friday. Indicators do show a good underlying strength. I'm looking for a test of the lower $10 levels next week, so that we soon may seen CRON attempt a double top, or even a higher high.

What are your thoughts?

Some thoughts on where Cron may be heading in the next 12 monthsI am basing this off of the patterns seeing in the first Elliot cycle which just completed. Obviously, it is difficult to see this far out, but Cron trades well technically. Here is the possible formation that waves 1,2 and 3 might take, based on the patterns seen in the last cycle.

Long Weed As We Will See Unwinds In Popular ShortsGreat setup to go long weed stocks right now. This may seem counterintuitive during what looks to be a coming market selloff and fears over recession, but this is shaping up to look as a great mid-term trade.

Some Quick Thoughts...

From a chart pattern perspective, this chart is almost a perfect "v" type dip, with accelerating selloffs eventually leading to a very large short positioning and sentiment extremely negative.

The selloff has left this extremely oversold on all levels. Even if weed continues to be a shit investment, it will likely see a rebound, which is mostly what we're playing here.

As a popular short, it may outperform during a broad based market selloff. We saw many factor reversals recently, and during 2018, we saw many popular shorts actually rise during the big selloff as Hedge Fund redemptions forced funds to sell their momentum longs, and cover their momentum shorts. TSLA was a great example of this last year.

This has hit Demark 13 exhaustions on both a weekly and daily level.

Today's selloff saw this outperform popular market indexes and end in the green despite the rest of the market being taken to the woodshed. It's a decent indicator that the marginal seller is no longer here.

We are hitting the lower long term trendline in a widening pattern. These are almost always good for a bounce. Set a stop loss if you want some protection here.

Just note this is a trade. Not necessarily a long term thesis on owning weed stocks.