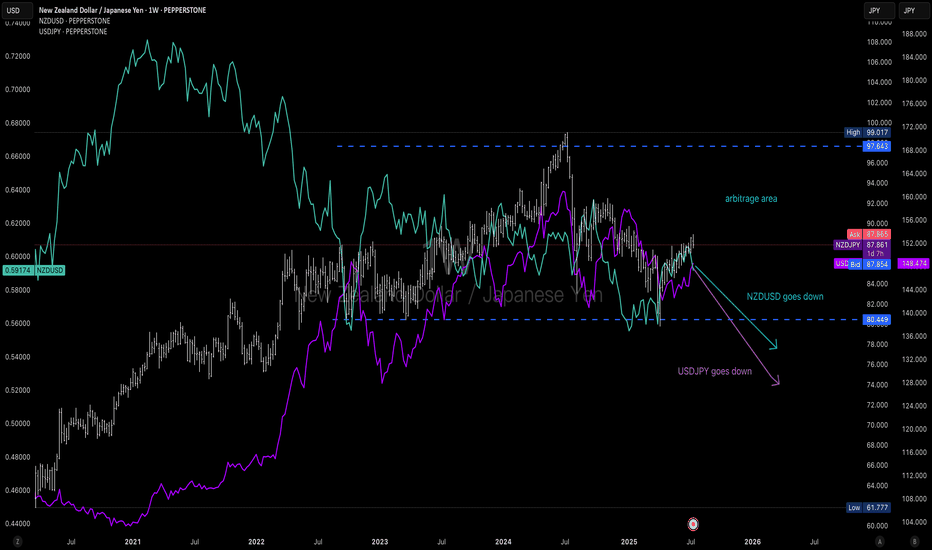

An arbitrage chance: NZ Dollar goes down & JP Yen goes upDue to economies trends and currency policies, USDJPY is going down in a long term (3 to 5 years) and NZDUSD is also going down in the next 3 years

Except for trend following trade for these 2 pairs, you can also set buy limit at the bottom of a value box for NZDJPY and sell limit at the top boarder of this box. Will take good P/L and good win rate positions for this crosspairs

Crosspairs

AUD/NZD: BOS & CHoCHAUD/NZD: BOS & CHoCH

- major trendbreak

- break of structure (BOS)

- change of character (CHoCH)

- Major support break

- POC above current price levels

- Low Volume on the way to target zone

✅ Check our bio for Wall Street Setups

✅ LIVE MyFxBook Performance

✅ Real deal Wall Street Trader

Meikel & Team WSI

Bearish Dollar Index? We have been on a strong overall downtrend with the DYX. Currently in a bullish pull back, looking for a trending sell off of the Dollar. All dollar cross pair can be impacted heavily this week! I'm keeping an eye on ETHUSD, BTCUSD, NAS100, AUDUSD & GBPUSD ! A weak dollar can push all my primaries higher! Set your alerts as we approach a trending entry!

GJ INTRA-WEEK ANALYSISWhats Up! Mr. Pipzz back here with another analysis

These are my thoughts for GBPJPY this week.

I can see the market pulling into either direction. So, I've identified a few key targets for both the bulls and the bears.

Not going to over explain, I'm just getting straight to the point. This week started off extremely bearish following a pullback to a small, but nice liquidity zone. Last weeks close has already been filled, so I'm not seeing any bullish confluence for that. If price does manage to close above 139.75, I predict sniper entries from the 15m, & 30m indicating a push back to the upside.

On the other hand, because the trend has been bearish its safe to follow simple rules like following the trend. If break of bearish structure occurs, it would be easy to spot because of the amount of pips it has already dropped. Overall I think we could see a push back to the lower liquidity zone to either test and break, or form a triple bottom. (137.15)

Leave a like or comment if this benefited you in any way.

Thanks, & have a Happy New Year!

-Mr.Pipzz

GBPJPY Testing Major 4HR Zone...$GJ is currently testing 4HR Support turned Resistance. We could see price breakthrough resistance & head towards the 38% Fib Level. Vice versa, price could fail the retest of Resistance & continue its bearish movements. I;m leaning more towards a bullish bias. *Made this post befpre big movements. Accuracy was on 100%* Trade screenshot in comment section

GBPJPY Cross Pair: 🐻 Bear In Action Matter of fact knowing poor equity market performance from last night we got a strong dollar and yen. This two currencies had gain against other currencies well through out the day. Lower risk appetites market situation favored the yen leading this cross pair price further lower. Bear 🐻 has already weighed over this pair and I think if market players aren't willing for risk bets and dumb their moolahs in yen. This cross pair will continue it's bearish trend until the risk sentiment favor for risk bets. Also pound isn't doing well seeing the GBPUSD we can know that bears are weighing slowly over that market and knowing the huge plunge over EURJPY cross pair makes us think that GBPJPY may take advantage equally.

EUR/NZD Daily Update (27/9/17)Price is still in a slow downwards momentum.

1.6 zone will be a nice support zone

R:R = 1 : 1.75

Lets wait for a good level to take some action.

Disclaimer :

This analysis not include personal feeling/opinion, and pure base on technical analysis

Trading foreign currencies can be a challenging and potentially profitable opportunity for investors. However, before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience, and risk appetite. Most importantly, do not invest money you cannot afford to lose.

please inform me with post a comment if it reach some critical point/break pattern, reach target/reach stop level.

or if there is any question about this analysis/need new update.

Because im not monitoring this chart all time