Why Is CrowdStrike's Stock Soaring Amidst Cyber Chaos?The digital landscape is increasingly fraught with sophisticated cyber threats, transforming cybersecurity from a mere IT expense into an indispensable business imperative. With global cybercrime costs projected to reach $10.5 trillion annually by 2025, organizations face severe financial penalties, operational disruptions, and reputational damage from data breaches and ransomware attacks. This escalating threat environment has created an urgent and inelastic demand for robust digital defenses, positioning leading cybersecurity firms like CrowdStrike as critical enablers of economic stability and growth.

CrowdStrike's remarkable ascent is directly tied to this surging demand, fueled by pervasive trends such as widespread digital transformation, extensive cloud adoption, and the proliferation of hybrid work models. These shifts have vastly expanded attack surfaces, necessitating comprehensive, cloud-native security solutions that can protect diverse endpoints and cloud workloads. Organizations are increasingly prioritizing cyber resilience, seeking integrated platforms that offer proactive detection and rapid response capabilities. CrowdStrike's Falcon platform, with its AI-native, single-agent architecture, effectively addresses these needs, providing real-time threat intelligence and enabling seamless expansion across various security modules, which drives high customer retention and significant upsell opportunities.

The company's strong financial performance underscores its market leadership and operational efficiency. CrowdStrike consistently reports impressive Annual Recurring Revenue (ARR) growth, healthy non-GAAP operating margins, and robust free cash flow generation, demonstrating a sustainable and profitable business model. This financial strength, combined with its continuous innovation and strategic partnerships, positions CrowdStrike for sustained long-term growth. As enterprises seek to consolidate security vendors and simplify complex operations, CrowdStrike's comprehensive platform is ideally situated to capture a larger share of global cybersecurity spending, solidifying its role as a cornerstone of the digital economy and a compelling investment in a high-stakes environment.

Crowdstrike

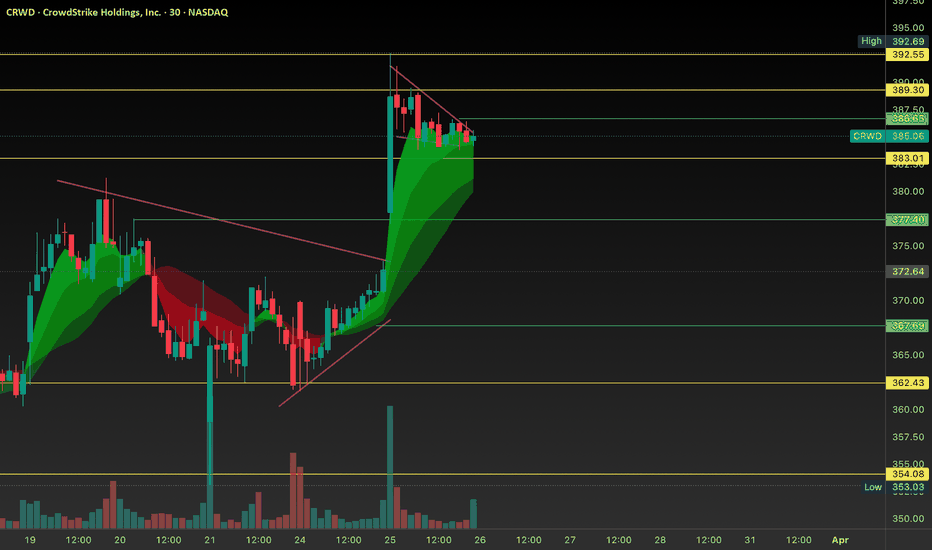

CRWD – Flat Top Breakout to All-Time HighsCrowdStrike ( NASDAQ:CRWD ) is breaking out of a flat top consolidation, pushing to new all-time highs — a clean momentum setup that’s hard to ignore.

🔹 Price has been compressing just under ATHs with multiple tests of the same level — a classic flat top breakout pattern.

🔹 Today’s breakout candle is strong, with solid volume and follow-through.

🔹 This setup is all about price acceptance at new highs — and the bulls are showing up.

My Trade Plan:

✅ Entry: On breakout through the flat top

⛔️ Stop: Just below today’s low — keep risk tight

🚀 Target: Ride momentum — trail stop as price extends

Why I like this setup:

Clean structure, strong trend, defined risk

ATH breakouts often lead to trend acceleration if supported by volume

panw had their earnings today and gapped down it still has broken loose this is a good sign

CrowdStrike Holdings, Inc. – AI-Native Cybersecurity Powerhouse Company Snapshot:

CrowdStrike NASDAQ:CRWD remains a top-tier cybersecurity leader, redefining endpoint and cloud protection through its AI-powered Falcon platform, securing some of the most critical digital infrastructures in the world.

Key Catalysts:

Falcon Platform – AI-First, Cloud-Native 🧠☁️

Unified security architecture: endpoint, identity, cloud, and data

Leverages real-time analytics, automation, and continuous threat hunting

Widely recognized as a gold standard in modern cybersecurity (GigaOm, Gartner)

Elite Partnerships = Ecosystem Synergy 🤝

Named Google Cloud’s 2025 Security Partner of the Year

Deep collaborations with AWS, Microsoft Azure, and NVIDIA

Embedded in cloud-native DevOps workflows = high stickiness and TAM expansion

AI + Cyber = Next-Gen Growth Tailwind 🚀

Integrating generative AI and autonomous detection to proactively prevent threats

Strategic positioning at the intersection of cloud security and AI operations

Key enabler of Zero Trust architectures for global enterprises

Massive Market Opportunity 🌍

Global cyber budgets rising amid escalating threats

CrowdStrike well-positioned for land-and-expand growth via Falcon modules

Expanding presence in identity protection, XDR, and managed services

Financial Edge:

Consistent 30%+ YoY revenue growth

High gross margins (~77%)

Strong free cash flow generation, underpinning long-term profitability

📈 Investment Outlook

✅ Bullish Above: $370.00–$375.00

🚀 Upside Target: $600.00–$620.00

🎯 Thesis: Platform leverage, elite partnerships, and AI innovation make CrowdStrike a core cybersecurity growth leader for the AI era.

#CrowdStrike #Cybersecurity #AI #CRWD #FalconPlatform #CloudSecurity #NextGenTech

Compelling Entry OpportunityKey arguments in support of the idea.

The stock has adjusted to an attractive valuation.

Cybersecurity continues to be an essential priority for businesses and government entities alike.

AI and automation serve as significant competitive advantages for CrowdStrike.

Investment Thesis

CrowdStrike Holdings, Inc. (CRWD) is a leading U.S. cybersecurity firm that specializes in providing cloud-based solutions and endpoint protection. The company is esteemed for its CrowdStrike Falcon platform, which integrates artificial intelligence, machine learning, and behavioral analytics to thwart cyber threats in real-time. Falcon protects businesses and government entities from cyberattacks, such as viruses, ransomware, and zero-day vulnerabilities. Established in 2011, CrowdStrike is headquartered in Austin, Texas.

The stock price of CrowdStrike Holdings has adjusted to attractive levels. CrowdStrike’s stock experienced a downturn, mirroring the trend of the broad market index, due to weak U.S. macroeconomic data for February, trade policy tightening, potential changes in U.S. macroeconomic and fiscal policy, and statements from Trump about the possibility of a U.S. recession. We think these factors are already priced into the stock, suggesting an upside potential from the current levels, reinforced by the robust fundamentals underpinning CrowdStrike’s business.

Cybersecurity continues to be an essential priority for both businesses and government agencies. Unlike other IT expenses that might be reduced during economic downturns, investment in data and infrastructure protection remains indispensable. The prevalence of cyberattacks is unaffected by economic conditions; in fact, they often surge during crises. Historical evidence highlights notable increases in phishing, account breaches, and ransomware activities during periods of economic instability. Additionally, strict regulatory frameworks such as GDPR, NIST, and SOC 2 impose significant penalties for non-compliance, compelling companies, even those struggling financially, to maintain rigorous cybersecurity measures. Amid the widespread transition to remote work and cloud-based technologies, securing digital infrastructure is of utmost importance. CrowdStrike’s Falcon platform is strategically positioned to address these needs, offering a holistic solution that supersedes traditional endpoint, cloud services and corporate accounts protection systems. Organizations striving to reduce IT budgets are increasingly adopting platform solutions like Falcon XDR, which enhances cost efficiency and defense effectiveness.

AI and automation serve as significant competitive advantages for CrowdStrike. The company distinguishes itself from competitors through its innovative use of artificial intelligence and machine learning. Unlike conventional antivirus tools that rely on signatures, Falcon processes up to 2 trillion events daily, predicting attacks before they occur. Such automation reduces labor costs and reliance on costly IT personnel, especially crucial in the context of rising inflation and increasing wage pressures. AI solutions enable businesses to achieve both cost savings and superior protection. Moreover, the predictive accuracy of CrowdStrike’s AI improves with the breadth of data it processes, creating a network effect that strengthens its competitive edge over rivals such as Palo Alto Networks and SentinelOne.

The target price for the shares is $350, the rating is Sell. We recommend setting a stop loss at $280.

$CRWD: Crowdstrike – Cybersecurity Titan or Overvalued Hype?(1/9)

Good afternoon, investors! ☀️ NASDAQ:CRWD : Crowdstrike – Cybersecurity Titan or Overvalued Hype?

With NASDAQ:CRWD at $322, is this cyber guardian still leading the pack or is it time to cash in? Let's dive into the digital trenches! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 322 as of Mar 11, 2025 💰

• Recent Moves: Down from $360+ post-Q4, per X posts 📏

• Sector Trend: Cybersecurity demand remains robust, per market insights 🌟

It’s a steady ride with potential for growth! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: ~$75B (based on 232.5M shares) 🏆

• Operations: Leader in endpoint security and threat intelligence ⏰

• Trend: Expanding into AI-driven security solutions, per recent developments 🎯

Firm, standing tall in the cyber battlefield! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Earnings Win: Q1 FY25 beat estimates, guidance raised, per X posts 🔄

• Cyber Boom: Threats fuel demand, per Mar 6 chatter 🌍

• Market Reaction: Stock jumped, then dipped, per X sentiment 📋

Battling, with innovation driving the narrative! 💡

(5/9) – RISKS IN FOCUS ⚡

• Competition: Intense from Palo Alto Networks, Zscaler, etc. 🔍

• Valuation: High P/E ratio may concern some investors 📉

• Regulatory Shifts: Potential new laws impacting data privacy ❄️

Navigating challenges in a dynamic landscape! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Market Leader: Dominant in endpoint security 🥇

• Innovation: AI and ML-driven solutions keep it ahead 📊

• Financial Health: Strong cash position, no debt 🔧

Built to withstand cyber storms! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: High valuation, competitive pressures 📉

• Opportunities: Growing demand for cloud security, new market segments 📈

Can it capitalize on the digital expansion? 🤔

(8/9) –📢Crowdstrike at $322—your investment move? 🗳️

• Bullish: $400+ soon, cyber threats fuel growth 🐂

• Neutral: Holding steady, balancing risks and rewards ⚖️

• Bearish: $280 drop, overvalued in a cooling market 🐻

Cast your vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Crowdstrike’s $322 stance shows resilience 📈, but cautious investors eye valuation and competition 🌿. Dips are our DCA playground 💰. Grab ‘em low, ride the wave! Gem or bust?

CrowdStrike’s Earnings Miss Sends Shares Tumbling: What’s Next?CrowdStrike Holdings Inc. ( NASDAQ:CRWD ) faced a significant setback in the market after issuing disappointing earnings guidance, leading to a sharp decline of nearly 9% in extended trading. While the cybersecurity firm reported solid revenue growth, concerns over weaker-than-expected earnings projections overshadowed its performance.

Earnings Disappoint, But Revenue Holds Strong

CrowdStrike reported earnings per share (EPS) of $1.03 for the quarter. However, this number wasn’t directly comparable to analysts’ expectations. Revenue came in at $1.06 billion, surpassing the forecasted $1.03 billion and marking a 25% year-over-year increase from $845.3 million in the prior period.

Despite the revenue beat, the company posted a net loss of $92.3 million, or 37 cents per share, compared to a net income of $53.7 million, or 22 cents per share, a year earlier. This shift into the red raised investor concerns, especially given the company's prior profitability momentum.

Technical Outlook

At the time of writing, NASDAQ:CRWD is down 7.3% in premarket trading, reflecting strong selling pressure. The stock is approaching oversold territory, with the Relative Strength Index (RSI) sitting at 37.80. A further decline could push it below the key 30 level, indicating a deep oversold condition and potential for a short-term bounce.

From a trend perspective, NASDAQ:CRWD is teetering on the edge of a bearish breakout. If the market opens with further downside pressure, a breach of key support levels could trigger an extended decline. Investors should watch for potential support around $340, while resistance remains near $380.

$CRWD Up 29% Following 100% Accuracy in SE Labs Ransomware TestCrowdStrike Holdings, Inc. (NASDAQ: NASDAQ:CRWD ), a global leader in cybersecurity, has made headlines with a groundbreaking achievement in the 2024 SE Labs Enterprise Advanced Security (EDR) Ransomware Test. The company’s Falcon® platform achieved an unprecedented 100% detection, 100% protection, and 100% accuracy against ransomware threats, setting a new benchmark in cybersecurity. This news has fueled a significant 29% surge in NASDAQ:CRWD ’s stock value, signaling strong investor confidence.

Achievements

In the largest real-world ransomware test to date, CrowdStrike ( NASDAQ:CRWD ) demonstrated its superiority by thwarting all known and unknown ransomware threats without a single false positive. SE Labs awarded CrowdStrike its AAA Award for Advanced Security EDR Protection for the third consecutive year, citing the company’s ability to “exceed the challenges” posed by increasingly sophisticated cyberattacks.

Key Highlights from the Test:

- Unified Protection Across the Attack Lifecycle: CrowdStrike’s Falcon platform provided complete detection and protection at every stage of the attack, offering security teams detailed insights into network breaches and lateral movement attempts.

- AI-Driven Detection and Response: Powered by advanced behavioral AI and machine learning, the platform blocked all direct ransomware attacks, including zero-day threats, while maintaining flawless accuracy.

- Cloud-Native Architecture: CrowdStrike’s cloud-native design enabled real-time threat detection and rapid response without straining system resources, effectively neutralizing advanced ransomware families like LockBit and GandCrab.

Simon Edwards, CEO of SE Labs, praised CrowdStrike, stating, “Every year, we raise the bar to mirror the increasing complexity of real-world attacks, and CrowdStrike not only meets but exceeds these challenges.”

Technical Analysis

As of the time of writing, NASDAQ:CRWD is up 7.85% in intraday trading, following a 29% surge in the past 24 hours. This rally marks a significant breakout, as the stock surpassed the psychological resistance level established in July 2024. The recent price action reflects strong bullish momentum, positioning NASDAQ:CRWD for potential new highs.

Key Technical Indicators:

- Relative Strength Index (RSI): Despite the price surge, the RSI remains at 68.77, suggesting more room for upward movement before reaching overbought territory.

- Support and Resistance Levels: If a pullback occurs, immediate support lies at the 61.8% Fibonacci retracement level. This zone serves as a key buying opportunity for traders, reinforcing the stock’s potential for a continued rally.

- Market Comparison: While NVIDIA has faced a historic loss of nearly $600 billion in market capitalization, CrowdStrike’s rise highlights its resilience and growing prominence in the tech sector.

Outlook and Implications

CrowdStrike’s achievements underscore its leadership in the cybersecurity space. The Falcon platform’s success not only bolsters the company’s reputation but also positions it as a preferred choice for enterprises seeking robust ransomware protection. As modern adversaries grow more sophisticated, CrowdStrike’s innovative approach ensures comprehensive security across endpoints, cloud, identity, and data.

For investors, NASDAQ:CRWD ’s recent performance and technical setup indicate a promising trajectory. With its psychological resistance breached and strong fundamentals in place, the stock is poised to attract further attention, potentially reaching new highs in the near term. Traders should monitor the 61.8% Fibonacci level for potential entry points in case of a retracement.

Conclusion

CrowdStrike’s perfect scores in the SE Labs ransomware test and its subsequent stock surge underscore the company’s innovation and resilience. As the cybersecurity landscape evolves, CrowdStrike continues to set the standard, ensuring organizations stay one step ahead of adversaries. With its unified, AI-driven approach, the Falcon platform empowers businesses to tackle the most sophisticated threats, solidifying CrowdStrike’s position as a market leader in cybersecurity.

Investing in Cybersecurity: PANW vs CRWD vs FTNT◉ Abstract

The cybersecurity landscape is rapidly evolving, with emerging threats and innovative solutions driving growth in the industry. This article examines the competitive dynamics between three leading cybersecurity stocks: Palo Alto Networks (PANW), CrowdStrike (CRWD), and Fortinet (FTNT). As these companies sprint to become the top cybersecurity provider, we analyse their strengths, weaknesses, and strategies for success.

◉ Global Cybersecurity Market Overview

The global cybersecurity market has experienced significant growth and is projected to continue expanding in the coming years. As of 2023, the market was valued at approximately USD 192.4 billion and is expected to reach between USD 501 billion and USD 608 billion by 2033, with compound annual growth rates (CAGR) ranging from 9% to 12% depending on the source and forecast period considered.

◉ Growth Drivers

1. Increasing Cyber Threats: The frequency and sophistication of cyber-attacks, including ransomware and data breaches, are rising, prompting organizations to enhance their security measures.

2. Digital Transformation: The rapid adoption of digital technologies, such as cloud computing and the Internet of Things (IoT), expands the attack surface and necessitates robust cybersecurity solutions.

3. Regulatory Compliance: Stricter regulations regarding data protection, like GDPR and CCPA, compel organizations to invest in cybersecurity to ensure compliance and protect sensitive information.

4. Proliferation of Smart Devices: The increasing use of connected devices in homes and industries creates more entry points for cyber threats, driving demand for advanced security solutions.

5. E-commerce Growth: The rise in online transactions increases the need for secure payment systems and data protection, further fuelling the cybersecurity market.

Remote Work Trends: The shift towards remote work has heightened the need for secure remote access solutions to protect organizational data from cyber threats.

◉ Regional Insights

● North America: This region dominates the global cybersecurity market, accounting for over 36% of the market share. The presence of major tech firms and a high incidence of cyber threats contribute to its leadership position.

● Europe: The European market is also growing rapidly due to increased digital transformation efforts and regulatory pressures that emphasize data security.

● Asia-Pacific: Expected to exhibit the fastest growth rate during the forecast period, driven by industrialization, rising internet penetration, and awareness of cybersecurity risks.

◉ Major Players in the Cybersecurity Market

1. Palo Alto Networks NASDAQ:PANW - $132.7 B

2. CrowdStrike Holdings NASDAQ:CRWD - $89.7 B

3. Fortinet NASDAQ:FTNT - $75.26 B

In this comparative analysis we are focused to provide a detailed understanding of the competitive dynamics of three cybersecurity giants: Palo Alto Networks, CrowdStrike Holdings, and Fortinet.

◉ Company Overviews

● Palo Alto Networks

Palo Alto Networks, Inc. is a leading provider of cybersecurity solutions worldwide. The company offers a range of products and services, including network security platforms, cloud security solutions, security operation solutions, subscription services, and professional services. Headquartered in Santa Clara, California, Palo Alto Networks was incorporated in 2005 and has since become a trusted partner for organizations seeking to protect themselves from cyber threats.

● CrowdStrike Holdings

CrowdStrike provides cloud-delivered cybersecurity solutions, offering endpoint, cloud workload, identity, and data protection. Its Falcon platform provides various security services, including threat intelligence, vulnerability management, and AI-powered workflow automation. Headquartered in Austin, Texas, CrowdStrike was incorporated in 2011.

● Fortinet

Fortinet, Inc. was founded in 2000 and is headquartered in Sunnyvale, California. The company provides comprehensive cybersecurity and converged networking and security solutions worldwide. Its offerings include secure networking solutions, network firewall solutions, wireless LAN solutions, and secure connectivity solutions. Additionally, Fortinet provides Unified SASE solutions, security operations solutions, and a range of security services and support. The company serves a diverse customer base, including enterprises, service providers, governments, and small and medium-sized businesses.

◉ Strategic Growth Initiatives of Leading Cybersecurity Players

● Palo Alto Networks

1. Platformization: Transitioning from a traditional firewall vendor to a comprehensive cybersecurity platform provider, offering a wider range of security solutions.

2. Next-Generation Security: Continuing to deliver advanced security solutions to address evolving cyber threats.

● CrowdStrike

1. Innovation: Leveraging AI-powered capabilities to enhance the Falcon platform and maintain a competitive edge in the cybersecurity market.

2. Expansion: Expanding into adjacent markets, such as cloud security and identity protection, to broaden its customer base and product offerings.

● Fortinet

1. "Rule of 45" Framework: Adhering to the "Rule of 45" framework to balance revenue growth with profitability, ensuring a sustainable business model.

2. Product Refresh Cycle: Implementing a strategic product refresh cycle to drive upgrade activity among existing customers and stimulate revenue growth.

◉ Technical Standings

● Palo Alto Networks

➖ The stock has been on a strong upward trajectory, marked by a consistent pattern of higher highs and higher lows.

➖ Following a significant breakout last month, it is currently trading at an all-time high, with expectations for further increases.

● CrowdStrike Holdings

➖ In general, this stock is trending upward, although it has faced considerable price volatility over an extended period.

➖ After reaching an all-time high close to the 400 mark, it underwent a sharp correction.

However, the stock is now climbing again and nearing its previous peak.

● Fortinet

➖ This stock had undergone a lengthy consolidation phase lasting nearly three years, resulting in the development of a Broadening pattern.

➖ After a recent breakout, the price is now targeting new highs.

◉ Relative Strength

➖ The chart clearly demonstrates Fortinet's exceptional performance, showcasing an impressive return of nearly 88%. In comparison, Mastercard and Visa have generated returns of 53% and 41%, respectively.

◉ Revenue & Profit Analysis

● Palo Alto Networks

◾ Year-over-Year

➖ In FY24, Palo Alto Networks (PANW) celebrated an impressive revenue surge of 16.5%, achieving $8,027 million, a notable increase from $6,893 million in FY23.

➖ The EBITDA for FY24 also experienced a substantial boost, reaching $1,094 million, up from $590 million in FY23.

◾ Quarter-over-Quarter

➖ In the most recent October quarter, PANW reported revenues of $2,139 million, a slight dip from the $2,190 million recorded in July 2024. However, this still represents a year-over-year growth of nearly 14% from $1,878 million in the same quarter last year.

➖ The company also reported its highest-ever EBITDA of $413 million in October, an increase from $314 million in July 2024. Compared to the same quarter last year, this figure has risen by almost 20% from $279.5 million.

➖ In October, the diluted EPS rose to $7.69 (LTM), up from $7.28 (LTM) in July 2024, marking an extraordinary year-over-year increase of 333% from $1.78 (LTM).

● CrowdStrike

◾ Year-over-Year

➖ CrowdStrike (CRWD) saw a robust revenue growth of 36.3% in FY23, reaching $3,055 million, up from $2,241 million in FY22.

➖ Conversely, the EBITDA for FY24 has seen a decline, reporting $106 million, down from $118 million in FY23.

◾ Quarter-over-Quarter

➖ In the latest October quarter, CRWD's revenue rose to $1,010 million, compared to $964 million in July 2024. This reflects a year-over-year increase of nearly 28.5% from $786 million in the same quarter last year.

➖ The EBITDA for the most recent June quarter was $15.3 million, showing a significant drop from $52.4 million in July 2024.

➖ In October, the diluted EPS decreased to $0.51 (LTM), down from $0.69 (LTM) in July 2024.

● Fortinet

◾ Year-over-Year

➖ In fiscal year 2023, Fortinet reported a remarkable revenue increase of 20%, reaching $5,304 million, up from $4,417 million in fiscal year 2022.

➖ The EBITDA also saw a significant rise, with the 2023 fiscal year totaling $1,350 million, compared to $1,070 million the previous year.

◾ Quarter-over-Quarter

➖ In the latest September quarter, revenue continued to grow, hitting $1,508 million, an increase from $1,434 million in June 2024. This represents a substantial year-over-year growth of nearly 13% from $1,335 million.

➖ Furthermore, EBITDA for the September quarter neared $500 million, up from $465 million in the prior quarter, reflecting an impressive increase of nearly 51% from $330 million in the same quarter last year.

➖ The diluted earnings per share (EPS) also saw a significant increase in September, rising to $0.7 (LTM) from $0.5 (LTM) in June 2024, marking a notable jump of 70% compared to $0.41 (LTM) in the same quarter last year.

◉ Valuation

● P/E Ratio

➖ PANW stands at a P/E ratio of 48.6x.

➖ CRWD is at a P/E ratio of 707.9x.

➖ FTNT shows a P/E ratio of 49.2x.

◾ These numbers indicate that CRWD is considerably overvalued when compared to its competitors.

● P/B Ratio

➖ PANW's P/B ratio stands at 22.5x.

➖ CRWD's P/B ratio is 29.3x.

➖ On the other hand, FTNT's P/B ratio is significantly higher at 82.9x.

◾ FTNT's high P/B ratio may indicate overvaluation, but its asset-light business model reduces the significance of this metric.

● PEG Ratio

➖ PANW boasts a PEG ratio of 0.14.

➖ CRWD's PEG ratio is recorded at 0.66.

➖ FTNT, meanwhile, has a PEG ratio of 1.26.

◾ Analyzing the PEG ratios reveals that PANW is currently undervalued relative to its peers.

◉ Cash Flow Analysis

➖ PANW has achieved an impressive operating cash flow of $3,257 million for the fiscal year 2024, a substantial rise from $2,777 million in fiscal year 2023.

➖ In a similar vein, CRWD has also seen a positive trend in its operating cash flow, which has climbed to $1,166 million in fiscal year 2024, compared to $941 million the year before.

➖ Furthermore, FTNT has reported a remarkable increase in its operating cash flow, growing from $1,730 million in fiscal year 2022 to $1,935 million in fiscal year 2023.

◉ Debt Analysis

● Palo Alto Networks

➖ Debt to Equity Ratio: Approximately 0.1 as of October 2024, indicating a stable financial structure.

➖ Total Debt: About $645 million.

➖ Total Shareholder Equity: $5,911 million.

◾ PANW's ratio reflects a cautious debt approach, balancing equity and debt financing, with net debt well-supported by operating cash flow, enhancing financial stability.

● CrowdStrike

➖ Debt to Equity Ratio: Approximately 0.24.

➖ Total Debt: $743 million.

➖ Total Shareholder Equity: $3,096 million.

◾ CRWD's ratio suggests a thoughtful strategy regarding debt, maintaining a balance between equity and debt financing.

● Fortinet

➖ Debt to Equity Ratio: Approximately 1.1, indicating a significant level of debt relative to equity.

➖ Total Debt: $993 million.

➖ Total Shareholder Equity: $908 million.

◾ FTNT’s ratio shows a considerable reliance on debt financing, which can facilitate growth but also introduces risks related to interest obligations.

◉ Top Shareholders

● Palo Alto Networks

➖ The Vanguard Group has significantly increased its investment in Palo Alto Networks, now holding an impressive 9.13% stake, which marks a 1.53% rise from the last quarter.

➖ In comparison, Blackrock holds a notable 7.65% share in the company.

● CrowdStrike

➖ Turning to CrowdStrike, The Vanguard Group has also enhanced its position, elevating its ownership to an impressive 8.76%, reflecting a 1.84% increase since the previous quarter.

➖ Conversely, Blackrock possesses a considerable 7.35% stake.

● Fortinet

➖ Regarding Fortinet, The Vanguard Group commands a substantial 8.79% share in the firm.

➖ In contrast, Blackrock holds a 7.44% stake.

◉ Conclusion

After conducting an exhaustive analysis of the major players in the cybersecurity sector, which included an in-depth look at both technical features and financial reports, we have determined that although Palo Alto Networks (PANW) might seem more appealing in terms of valuation, Fortinet (FTNT) stands out as the leading candidate in the industry due to its solid financials. Although concerns about debt exist, the company's strong cash reserves mitigate these worries significantly.

On the other hand, CrowdStrike (CRWD) has faced a recent setback with an outage that has shaken investor trust, leading to a decline in its stock price and rendering it a less favourable investment option for the foreseeable future.

Moreover, the cybersecurity sector is set to grow significantly due to rising cyber threats, fast-paced technology changes, and stricter regulations. Investors are advised to conduct thorough research, define clear investment goals, and maintain a long-term outlook to take advantage of this growth while minimizing risks.

CROWDSTRIKE $CRWD | EARNINGS TARGETS Nov. 26th, 2024CROWDSTRIKE NASDAQ:CRWD | EARNINGS TARGETS Nov. 26th, 2024

BUY/LONG ZONE (GREEN): $375.00 - $407.50

DO NOT TRADE/DNT ZONE (WHITE): $359.00 - $375.00

SELL/SHORT ZONE (RED): $330.00 - $359.00

Weekly: Bullish

Daily: Bullish

4H: Bullish

NASDAQ:CRWD earnings release today, Nov 26 post market. Expected move based on ATM straddles is $30 or roughly +/-8.24%. Bullish price target is based off of my expected optimistic upside movement to be around +12% post earnings. A near mirrored move, comparable to the bullish target estimate, more accurately should be around $320. Can easily extend bearish target area down to $300.

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, options, optionstrades, earningsmove, crwd, crwdearnings, crowdstrikeearnings, earningsplay,

CrowdStrike is about to push to ATH's, 60% Move Inbound!CrowdStrike is about to push to ATH's, 60% Move Inbound!

NASDAQ:CRWD is going higher and presenting a buying opportunity!

60% Potential Upside! 📈

In this video, we dive into this Cyber Security Goliath:

💡 Key Highlights:

-Breaking out of Bull Flag

-H5 Indicator: Flashing green for a bullish signal

-Volume Insights: Massive GAP to fill

-Technical Analysis: Consolidation box formed on WR%

Targets:

🎯$399

📏$537

Don't miss out on the potential explosive growth of CrowdStrike! Tune in to see why this stock could be a game-changer!

NFA

When Does a Digital Guardian Become a Digital Liability?In a dramatic turn of events that has captivated both Wall Street and Silicon Valley, a routine software update has spiraled into a half-billion-dollar legal battle between two industry titans. Delta Air Lines' lawsuit against cybersecurity leader CrowdStrike raises fundamental questions about corporate accountability in our increasingly interconnected world. The incident, which paralyzed one of America's largest airlines for five days, serves as a stark reminder of how thin the line has become between digital protection and digital vulnerability.

The case's implications stretch far beyond its $500 million price tag. At its core, this legal confrontation challenges our basic assumptions about cybersecurity partnerships. When CrowdStrike's update crashed 8.5 million Windows computers worldwide, it didn't just expose technical vulnerabilities—it revealed a critical gap in our understanding of how modern enterprises should balance innovation with stability. Delta's claim that it had explicitly disabled automatic updates, only to have CrowdStrike allegedly circumvent these preferences, adds a layer of complexity that could reshape how businesses approach their cybersecurity relationships.

Perhaps most intriguingly, this case forces us to confront an uncomfortable paradox in corporate technology: can the very systems we deploy to protect our infrastructure become our greatest point of failure? As businesses pour billions into digital transformation, the Delta-CrowdStrike saga suggests that our cybersecurity paradigm might need a fundamental rethink. With federal regulators now involved and industry leaders watching closely, the outcome of this battle could redefine the boundaries of corporate liability in the digital age and set new standards for how we approach the delicate balance between security and operational stability.

CrowdStrike’s Earnings Beat Expectations, Outlook Clouds Future Key Takeaways:

- Revenue Surprise: CrowdStrike’s revenue surged 32% year-over-year, surpassing analysts' expectations.

- Outage Fallout: The first earnings report since a significant global outage reveals lowered revenue guidance and potential long-term customer trust issues.

- Financial Forecast Adjustment: Revised revenue guidance for the fiscal year ending January 31, 2024, lowered to $3.89 billion - $3.9 billion from the previous $3.97 billion - $4 billion projection.

CrowdStrike’s Revenue Beat Amid Challenges

CrowdStrike Holdings ( NASDAQ:CRWD ), a leading cybersecurity firm, delivered better-than-expected earnings this quarter, posting a 32% increase in revenue year-over-year to $963.9 million. However, despite these solid top-line numbers, the company lowered its full-year revenue guidance following a substantial software update failure that led to a global outage affecting numerous clients.

The Aftermath of the Global Outage

The recent report marks CrowdStrike’s first public disclosure since the critical July 19th incident, which disrupted services globally and caused significant operational issues for major clients, including Delta Air Lines. To manage the fallout, CrowdStrike has committed to a $60 million "customer commitment package," offering credits to affected clients. Still, this amount is likely only a fraction of the actual damages incurred, with Delta alone estimating losses of around $500 million.

Despite these setbacks, CrowdStrike has managed to retain a 98% customer retention rate, suggesting a robust level of client loyalty. CEO George Kurtz emphasized the company’s resilience, stating, "Working with customers to recover from the July 19 incident, we emerge as an even more resilient and customer-obsessed CrowdStrike."

Financial Adjustments and Market Reactions

CrowdStrike ( NASDAQ:CRWD ) adjusted its revenue forecast for the fiscal year, now expecting between $3.89 billion and $3.9 billion, down from its earlier prediction of $3.97 billion to $4 billion. This revision aligns with the company's strategy to manage customer relations and mitigate the fallout from the outage.

The market reaction has been mixed: CrowdStrike shares ( NASDAQ:CRWD ) initially climbed in after-hours trading but later fell by about 2%. As of Wednesday’s close, the stock remains down over 20% since the outage but has rebounded 33% from the post-outage low three weeks ago. Investors appear cautiously optimistic, recognizing both the risks and the potential for recovery.

Balancing Revenue Growth and Customer Retention

The company's annual recurring revenue (ARR) increased by 32% to $3.86 billion, with $217.6 million added in the quarter, highlighting the ongoing demand for cybersecurity solutions despite recent hiccups. The challenge, however, lies in maintaining this growth trajectory. Moody’s recently revised its outlook on CrowdStrike from "positive" to "neutral," reflecting concerns about potential revenue growth slowdowns and the company's ability to manage customer relationships post-incident.

Legal Battles and Future Outlook

CrowdStrike ( NASDAQ:CRWD ) is gearing up for potential legal disputes, particularly with Delta Air Lines, which is preparing to sue the company over the outage losses. CrowdStrike has a contractual liability cap of less than $10 million with Delta, but the extent of the financial impact remains uncertain.

Moody’s analyst Raj Joshi commented, "If performance is deteriorating, it’s not going to show up in the numbers immediately. There’s a lag." He pointed out that while existing customers may take time to switch providers, the bigger challenge for CrowdStrike will be to rebuild trust and continue selling additional services to clients affected by the outage.

Conclusion

While CrowdStrike’s recent earnings report underscores its robust revenue capabilities, the company faces an uphill battle to manage customer trust, retain business, and mitigate the financial and reputational damage caused by the outage. The next few quarters will be crucial in determining whether CrowdStrike ( NASDAQ:CRWD ) can maintain its growth momentum or if the lingering effects of this incident will prove more detrimental to its long-term prospects.

Crowdstrike May Signal Stock Market Top But Crypto Trump Pump!Traders,

I tried very hard to upload a video to the TV platform today but was unsuccessful. It may be that TV is also affected in some ways by the Crowdstrike update, I don't know? Needless to say, my video will not be shown here and due to house rules I am unable to say where you might find it or if it is even available. So, in keeping with those rules, I will only give the written preview of what the video will be when/if I can eventually upload to Tradingview. Sorry for the inconvenience. Here is my prelude to the video that I made for this post.

-----

To help us understand the broad, over-arching view and where our economy may be headed, both in the U.S. and abroad, we must sometimes tackle some subject matter that appears to be political on the surface and makes some people rather uncomfortable. But if we are going to be accurate traders, then we also need to be honest. Being honest involves setting aside our political dogma and preferences and viewing current events with as little bias as possible. Removing bias involves removing emotion. Let's attempt to do that today as I dive in with a closer inspection of the Crowdstrike-caused Microsoft BSoD outage and discuss Trump's recent assassination attempt. We are going to cover how each of these recent events has impacted the stock market and our crypto space. If this subject matter makes you uncomfortable, you may want to skip this video. I'm cutting straight to the chase here and I'll explain why it matters. You see, I learned the hard way a long time ago that if you want to make money in this market then you have to understand what the world rulers are up to and what their end game might be. It's often uncomfortable to explore motives here because they appear to be so uncompassionate, calloused, and uncaring, but we must put them on the table as options at least if we are going to determine market direction and become the best traders that we can be. Following the money and potential motives of the deep state(s) can help us win. This is what we'll do a bit of in today's video. Enjoy.

CRWD - Crowdstrike, this looks similar. Crowdstrike has been demolished in recent session on the back of poor Cybersecurity news / IT OUTAGES.

This type of sell usually gets a dead cat bounce like we saw in December of 2021.

However this decline usually proceeds more selling.

Notice how price respected each Fib level, but it did challenge and pierce each Fib level, shaking out buyers and sellers.

Im eyeing a quick bounce soon but a move lower move we complete that bounce.

3 Events to Watch: CrowdStrike, 25th Amendment, & US weather 3 Events to Watch: CrowdStrike, 25th Amendment, & US weather

CrowdStrike Oversold?

A widespread outage on Friday left computer screens blue, grounded flights, halted hotel check-ins, and disrupted freight deliveries, forcing businesses to revert to paper and pen.

The incident, allegedly triggered by an update from CrowdStrike (down ~12%), also affected Microsoft’s Windows (down 0.7%).

Running into the fire is Cathie Wood's ARK ETFs, with a significant acquisition of CrowdStrike valued at approximately $13.24 million, through ARKW and ARKF ETFs.

Biden Steps Aside

President Joe Biden announced today his decision to drop out of the 2024 presidential race, endorsing Vice President Kamala Harris as the Democratic Party’s nominee.

While Harris is poised to become the nominee, confirmation will come at the Democratic National Convention from August 19-22 in Chicago.

The key market-moving news from this event could hinge on Harris’s choice of running mate.

There is also speculation around the use of the 25th Amendment, which could theoretically see Biden removed from office early, though no officials have indicated such intentions.

US Natural Gas Futures Plummet

US natural gas futures plummeted over 10% to below $2.1/MMBtu last week, influenced by milder weather and reduced feedgas to LNG export plants. This price drop occurred despite expectations of a return to hot weather in late July and early August, which should increase demand for gas-fired electricity to power air conditioners. Meteorologists project near-normal temperatures across the Lower 48 states through July 25, with a hotter-than-normal trend anticipated through at least August 3.

CrowdStrike Holdings. Post-Earnings Call to 600CrowdStrike Holdings, Inc. is an American cybersecurity technology company based in Austin, Texas. It provides cloud workload and endpoint security, threat intelligence, and cyberattack response services.

CrowdStrike shares surged in late trading Tuesday after the security software company posted better-than-expected financial results for its fiscal fourth quarter ended Jan. 31. The company also offered guidance for both the April quarter and the January 2025 fiscal year that topped Wall Street estimates.

CrowdStrike was up 22% in after-hours trading following the results.

For the January quarter, CrowdStrike posted revenue of $845.3 million, up 33% from the year earlier quarter, beating Wall Street's consensus as tracked by FactSet of $839 million. Annual recurring revenue rose 34% from a year ago, to $3.44 billion.

On an adjusted basis, the company earned 95 cents a share in the quarter, well ahead of the Street consensus at 82 cents. Under generally accepted accounting principles, the company earned 22 cents.

For the April quarter, the company expects revenue of between $902.2 million and $905.8 million, with adjusted profits of 89 to 90 cents a share, ahead of Wall Street's consensus for $900 million in revenue and adjusted profits of 82 cents a share.

CrowdStrike projects revenue for the January 2025 fiscal year of $3.925 billion to $3.989 billion, with adjusted profits of $3.77 to $3.97 a share; Analysts have been calling for $3.938 billion in revenue and profits of $3.76 a share.

In a statement, CrowdStrike CEO George Kurtz said that "customers favor our single platform approach...CrowdStrike is cybersecurity's consolidator of choice, innovator of choice and platform of choice to stop breaches."

That statement appears aimed at rival Palo Alto Networks, which recently said it was " facing spending fatigue in cybersecurity."

Palo Alto is making an aggressive "platformization push," in some cases offering to give features away for free in the short-run to capture more customer IT spending budget in the long run.

Technical chart illustrates potential target can be in $500 - 600 range, that is 40 to 60 per cent above even post-earnings robust surge.

Crowdstrike pushing towards all time highs!Crowdstrike has been in a strong upward trend since the beginning of 2023. Pullbacks were generally short-lived, and the trend accelerated early this year.

CRWD reached its ATH in March, surpassing the 300 mark it reached in 2021. A significant consolidation occurred after that, but it seems like the bulls have garnered sufficient strength to test 360 again, after failing to breach the level 2 weeks ago, and maybe push the stock to new highs. The stock's 7% jump after beating the Q1 earnings estimate proved to be a perfect launchpad for this, CRWD is now trading above the 50, 100 & 200 SMA again.

Should the 360 mark be broken, traders can start looking up to the 400$ mark.

Fundamentally speaking, the threat of novel cybersecurity attacks is unfortunately not going to go away. Black hats are developing smarter-than-ever malware. To the eyes of many, Crowdstrike's AI-boosted cloud-based cybersec solutions offer powerful counters to those threats, so it is probably unlikely that Crowdstrike will see a sharp drop in demand in the near future as companies and their IT-teams are still catching up. According to the IDC (International Data Corporation) GenAI (Generative AI) in the cybersecurity market is growing at a CAGR of 23.6% and projects that it will reach a $46.3 billion market value by 2027.

Stay safe out there and trade responsibly!

CrowdStrike (CRWD) Analysis Market Leadership:

CrowdStrike NASDAQ:CRWD , a global cybersecurity leader, is experiencing increased spending from existing clients, with 64% of customers using five or more cloud modules as of January 31, 2024. This customer loyalty drives CrowdStrike toward its target adjusted subscription gross margin of 82% to 85%.

Investor Confidence:

Prominent investors, including Ken Griffin of Citadel Advisors and Israel Englander of Millennium, are accumulating positions in CRWD, indicating strong confidence in its future prospects.

Advanced Technology:

CrowdStrike's Falcon platform, a cloud-native solution utilizing AI and machine learning, oversees trillions of events weekly. This advanced technology has boosted retention rates from below 94% to a steady 98% over seven years, showcasing high customer trust.

Leadership Insight:

CEO George Kurtz emphasizes the company's appeal: "Customers favor our single platform approach. CrowdStrike is cybersecurity's consolidator of choice, innovator of choice, and platform of choice to stop breaches."

Investment Outlook:

Bullish Outlook: We are bullish on CRWD above the $295.00-$300.00 range.

Upside Potential: With a target set at $485.00-$490.00, key drivers include increasing customer spending, advanced technology adoption, and strong investor confidence.

📊🛡️ Monitor CrowdStrike for promising investment opportunities! #CRWD #Cybersecurity 📈🔍