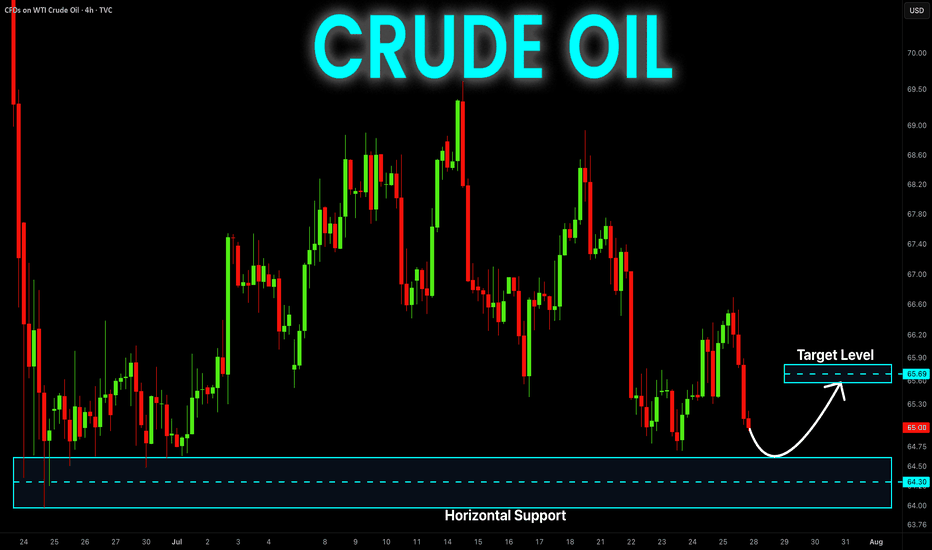

CRUDE OIL Risky Long! Buy!

Hello,Traders!

CRUDE OIL will soon hit

A horizontal support

Of 64.50$ and as it is

A strong level we will be

Expecting a local bullish

Rebound on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Crude Oil

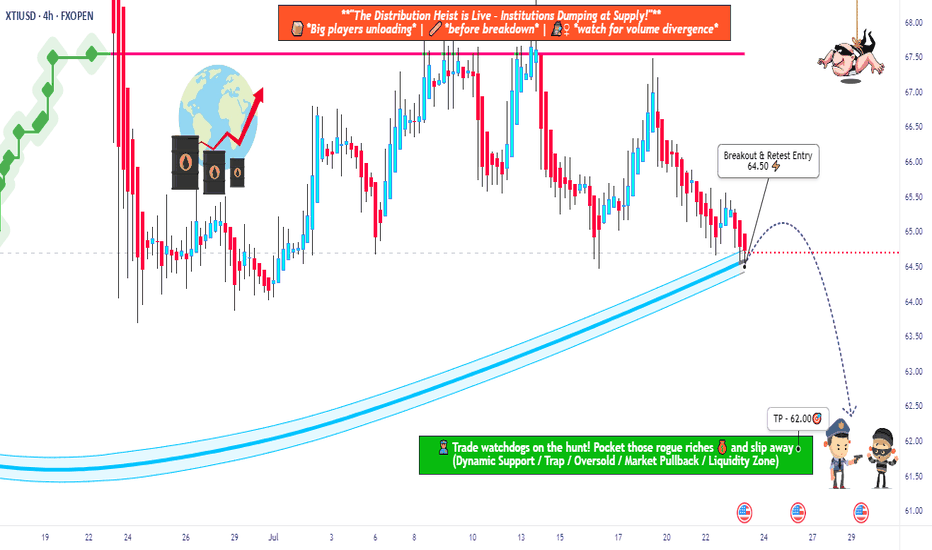

USOIL Robbery Alert! Smart Entry Plan Below Key MA Level🔐💥 “WTI Energy Heist: Thief Trader’s Bearish Master Plan” 💥🔐

The Official Robbery Blueprint for Smart Traders

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

💸 Welcome, Money Makers & Market Robbers! 💸

🚨 Get ready to break into the "US Oil Spot/WTI" market with precision-crafted bearish strategy from the one and only — Thief Trader Style!

📉💣 THE HEIST IS ON: SHORT PLAN LOADED! 💣📉

We’ve analyzed the charts using Thief Technicals + Fundamental Lockpick Tools and spotted a high-risk GREEN zone – a consolidation trap where greedy bulls usually get caught. This is where we strike.

🔑 ENTRY:

"Wait for the Neutral Moving Average to Break — Then Make Your Move!"

🎯 Focus zone: 64.50

☠️ Wait for the breakout – do NOT enter before it happens.

✅ Use sell stop orders above the MA line or place sell limit orders on the pullback after the breakout (target within the 15–30 min candle near swing high/low).

🧠 Thief Tip: Layer in entries using the DCA (layered attack strategy) to catch price on its way down. Set a chart alert so you don’t miss the strike moment.

🛑 STOP LOSS:

"Set it smart or don’t set it at all — you choose the fire you want to play with!"

📍 SL only gets placed AFTER breakout.

🎯 Recommended SL at 66.00 on the 4H swing level.

☠️ DO NOT place any orders or SL before confirmation breakout.

📊 Your SL depends on your risk %, lot size, and number of entries stacked.

🎯 TARGET ZONE: 62.50

💸 Lock profits before the bulls wake up. This level is based on market exhaustion zones and historical bounce areas.

🧠 WHY WE'RE SHORTING THIS?

This isn’t just a chart move — it’s backed by full-scale robbery research:

📰 COT Reports

📈 Macro & Seasonal Trends

🛢️ Crude Oil Inventories

💹 Sentiment & Intermarket Correlation

📉 Supply-Demand Dynamics

📚 Before pulling the trigger, educate yourself with the fundamentals. Dive into COT, Seasonal, and Macro reports. Don’t rob blindly — rob smart.

⚠️ Risk Management Alert:

Major news releases? Step back.

Trailing stops? Lock it in.

Position sizing? Know your risk.

Trade like a professional robber, not a street pickpocket.

💥💖 SUPPORT THE ROBBERY PLAN 💖💥

🧨 Smash that BOOST button to support this trading style and help more traders rob the market clean. Every like, every boost makes this community stronger.

💬 Drop a comment, share your entry levels, or post your winning trades.

This is a trading crew – we rob together, we profit together.

🔔 Stay tuned — more heist plans dropping soon.

Until then... Rob Smart. Trade Hard. Take Profits. 💰💪🎯

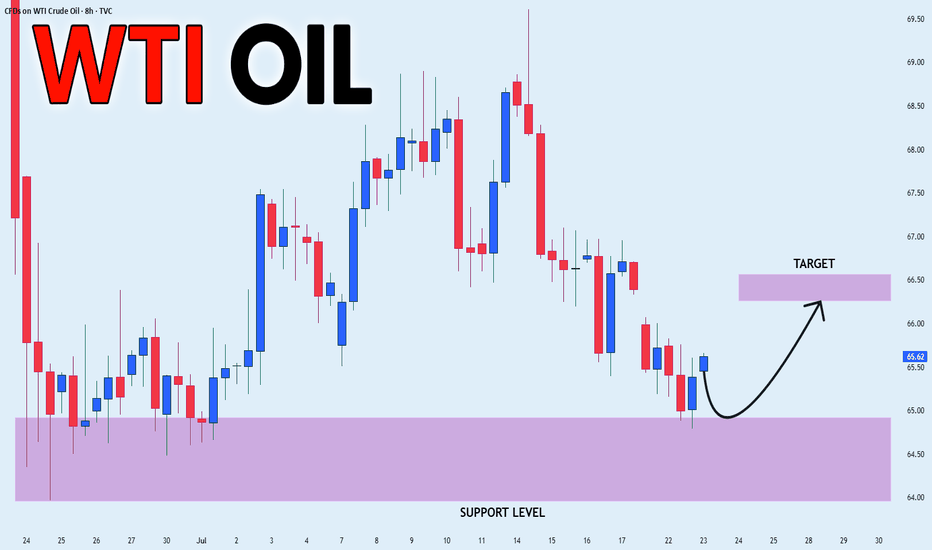

USOIL POTENTIAL LONG|

✅CRUDE OIL has retested a key support level of 65.00$

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 66.27$ is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL Long From Support! Buy!

Hello,Traders!

USOIL made a retest of

The horizontal support

Level of 64.86$ from where

We are already seeing a bullish

Reaction so we will be expecting

A further local move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

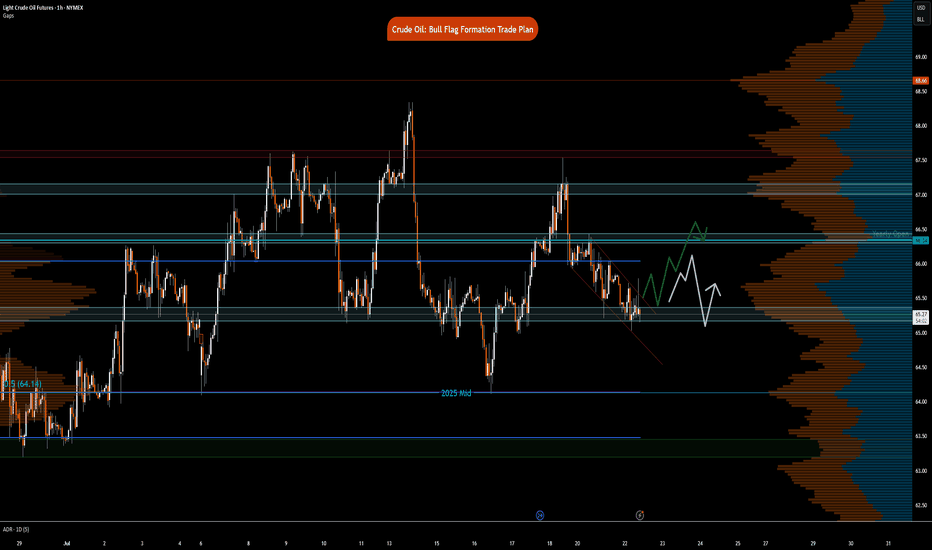

Crude Oil- Bull Flag formation Trade PlanNYMEX:CL1! NYMEX:MCL1!

Big Picture:

Let the price action and market auction be your guide

What has the market done?

The market has consolidated and pushed higher. There is an excess high at 67.87 from July 14th RTH. Market pushed lower, leaving behind excess with single prints above this showcasing strong area of resistance.

What is it trying to do?

The market is accepting prices in this range and building value. It has been in price discovery mode with a multi-distribution profile since June 24th.

How good of a job is it doing?

The market is currently forming a bull flag formation and attempting to push higher on the hourly time-frame.

What is more likely to happen from here?

Key Levels:

Neutral Zone 1: 67.16-67

Neutral Zone 2 : 66.45-66.30

Yearly Open: 66.34

Neutral zone 3 : 65.23-65.03

2025- Mid Range : 64.14

Scenario 1: False break, pull back and push higher

In this scenario, we expect prices to attempt to break bull flag formation, fail, however, neutral zone 3, acts as support for buyers to step back in to push prices towards yearly open and neutral zone 2.

Scenario 2: Break but fail to sustain push higher

In this scenario, we expect prices to break out of bull flag formation, however, fail around the 66 zone. Price reverts lower towards neutral zone 3 to further consolidate.

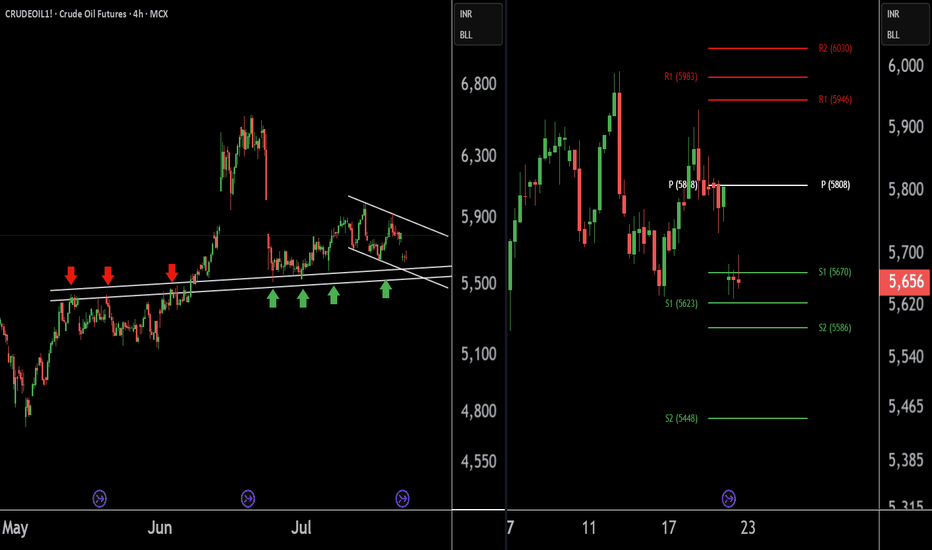

Crude Oil Buying Alert: Strategic Entry Point IdentifiedThere are two charts of Crude Oil on the 4-hour timeframe.

In the first chart, Crude Oil is sustaining near its lower point (LOP), with a support range of 5540-5580.

A-VWAP is also providing support to Crude Oil around the 5580 level.

The Pivot Point is also supporting Crude Oil around the 5580-5620 level.

If this level is sustain then we may see higher prices in Crude Oil.

Thank you !!

LONG ON USOIL OIL has just completed a sweep of sell side liquidity, leaving behind lots of BUY side liquidity.

DXY is falling on top of economic news stating trump will possibly fire Jerome Powell.

All this with OPEC increase oil production.

I expect oil to make a $5-$10 move throughout the rest of the week.

That's 500-1000 pips!

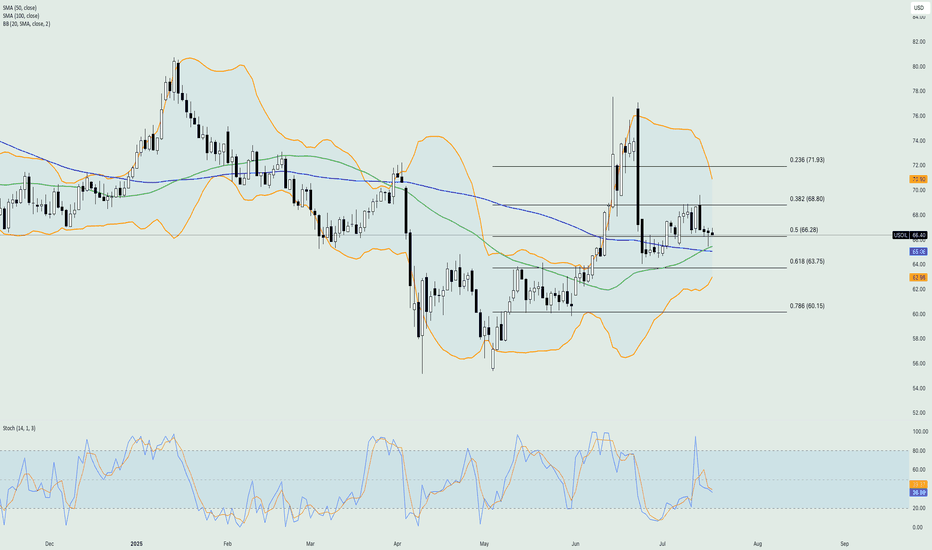

Crude Oil -DAILY- 21.07.2025Oil prices were steady after their first weekly decline this month, as attention shifted to U.S. trade negotiations and the European Union’s push to tighten restrictions on Russian energy exports. The EU is preparing new sanctions, including a lower price cap on Russian crude, limits on fuel refined from Russian oil, banking restrictions, and bans targeting an Indian refinery and Chinese firms. Despite western sanctions, Russian oil continues flowing to China and India. Meanwhile, diesel margins in Europe remain strong, signaling tight supply.

On the technical side, the price of crude oil has failed to break below the major technical support area, which consists of the 50-day simple moving average and the 50% of the weekly Fibonacci retracement level. The Stochastic oscillator has been in the neutral level since last week hinting that there is potential for the price to move to either direction in the near short term. On the other hand, the Bollinger bands have contracted rather massively showing that volatility has dried up therefore, the recent sideways movement might extend in the upcoming sessions.

Disclaimer: The opinions in this article are personal to the writer and do not reflect those of Exness

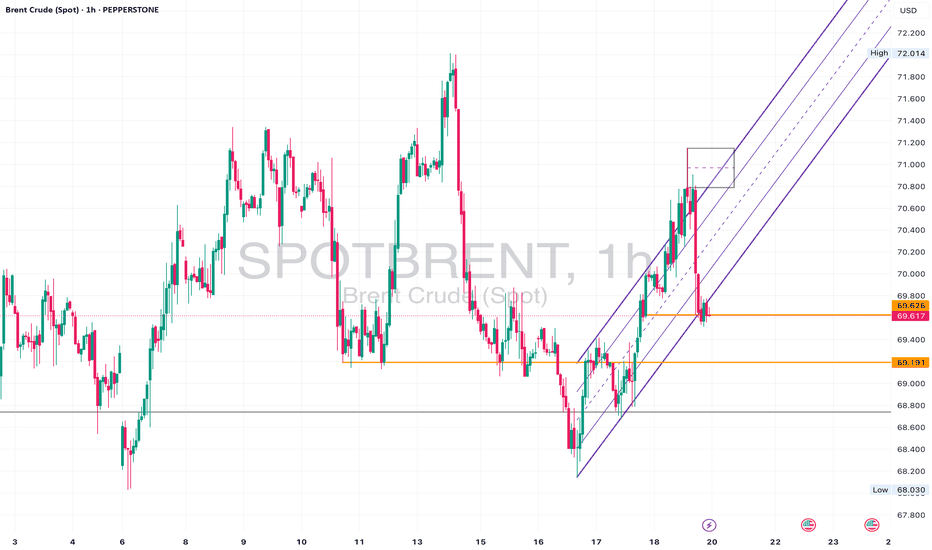

Brent UKOil - Neutral Slightly Bearish • Daily: Price is sitting above long-term trendline support, but momentum is waning.

• 4H: Structure looks indecisive with constant failures near 71.00.

• 1H: Recent break of the upward channel. Now retesting that zone from below.

⚠️ Watch For:

• Retest of 69.60–70.00 as resistance.

• Break and close below 69.20 could signal deeper downside.

• If it holds above 70.20 again, bullish bias resumes.

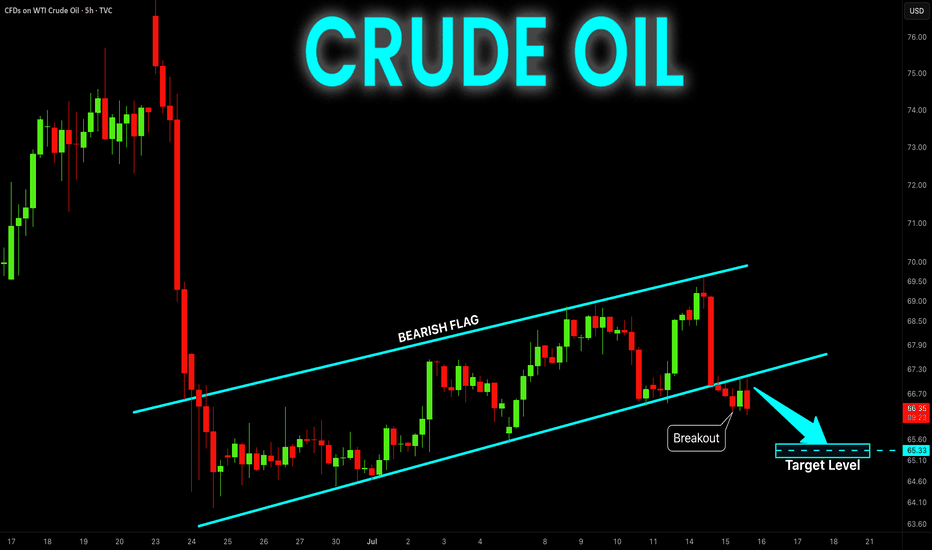

CRUDE OIL BEARISH BREAKOUT|SHORT|

✅CRUDE OIL broke the rising

Support line which is now a resistance

And the price made a retest an a pullback

So we we are bearish biased and we

Will be expecting a further

Bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

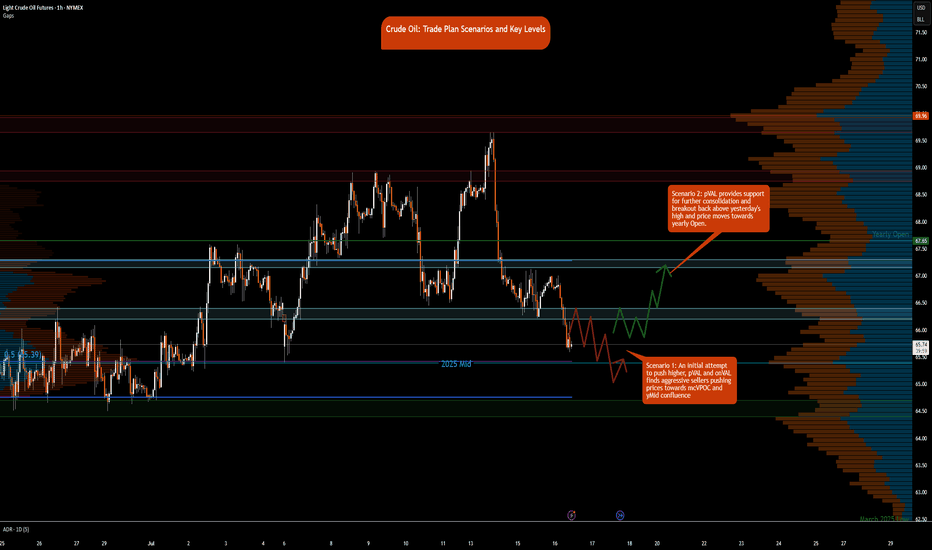

Crude Oil Trade Plan Scenarios and Key Levels

NYMEX:CL1!

It’s Wednesday today, and the DOE release is scheduled for 9:30 a.m. CT. This may provide fuel—pun intended—to push prices out of the two-day consolidation. Also, note that the August contract expires on July 22, 2025. Rollover to the September contract is expected on Thursday/Friday. You can see the pace of the roll here at CME’s pace of roll tool . The chart shows that rollover is about 70% complete, and CLU25 has higher open interest. Note, the front-month August contract is still trading at higher volume.

What has the market done?

Crude oil is in a multi-distribution profile since the peak witnessed during the Iran-Israel conflict. Crude oil formed a strong base above the 64s and traversed towards the 69s. Prices were rejected at these highs and have since reverted back towards the monthly Volume Point of Control, monthlyVPOC.

What is it trying to do?

The market is in active price discovery mode and has formed multi-distributions since June 23. The market has been consolidating after prices at highs were rejected.

How good of a job is it doing?

The market is active and is also providing setups against key levels. Patience to take trades from these higher time frame levels is what is required to trade crude oil currently. Otherwise, there is a lot of volatility and chop that can throw traders off their plan.

Key Levels:

• Yearly Open: 67.65

• Neutral zone: 67.15–67.30

• 2-Day VAL (Value Area Low): 66.40

• Neutral zone: 66.40–66.20

• 2025 Mid-Range: 65.39

• Key Support: 64.40–64.70

What is more likely to happen from here?

Scenario 1: An initial attempt to push higher, pVAL and onVAL finds aggressive sellers pushing prices towards mcVPOC and yMid confluence

Scenario 2: pVAL provides support for further consolidation and break back above yesterday's high and price moves towards yearly Open.

Glossary:

pVAL: Prior Value Area Low

onVAL: Overnight Value Area Low

yMid: 2025 Mid-Range

mcVPOC: Micro Composite Volume Point of Control

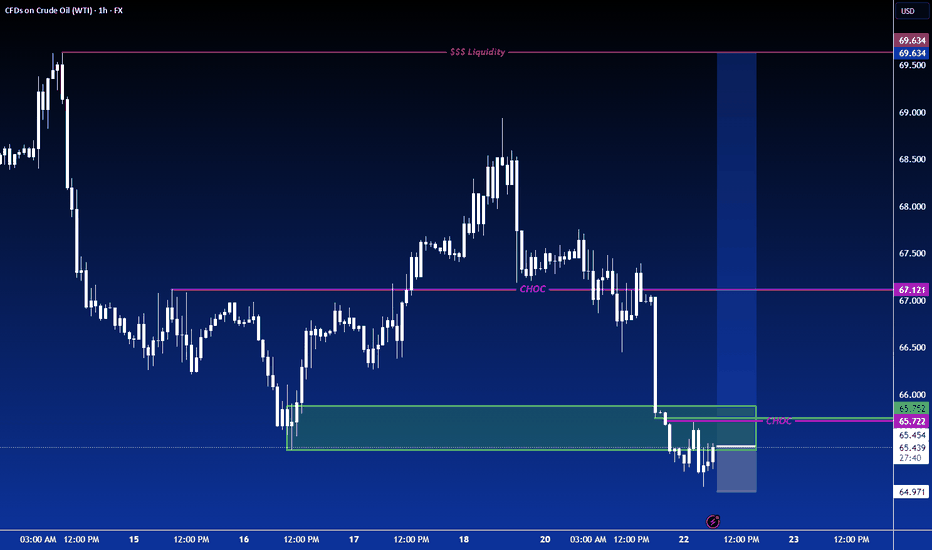

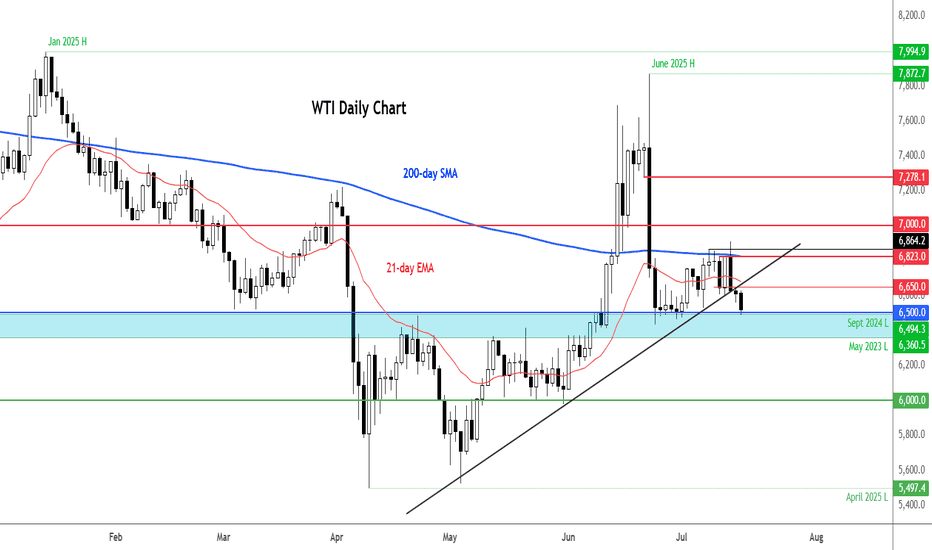

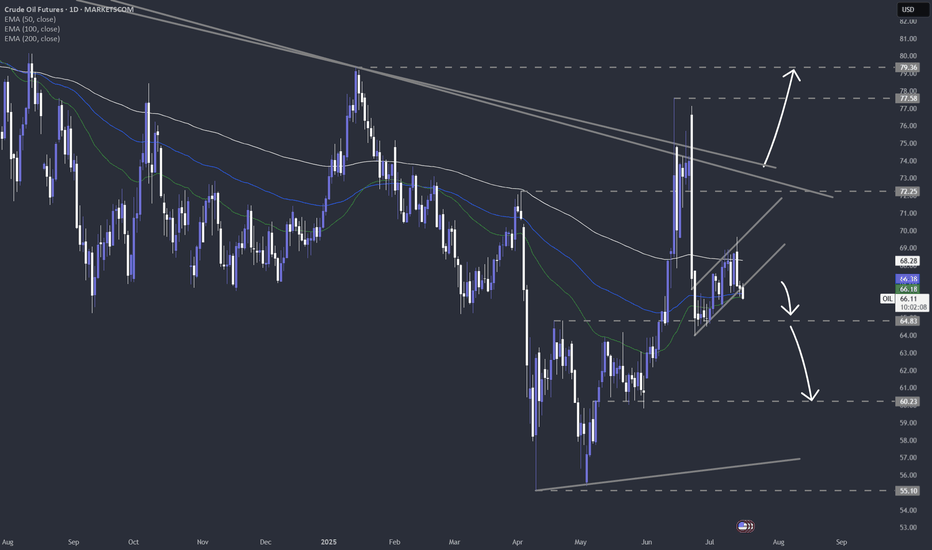

Crude oil extends fallsThe crude oil market has entered a fragile and uncertain phase, with prices retreating from recent highs. While WTI crude is still holding above the critical $65 mark on a closing basis, it was below this handle at the time of writing. So, the overall tone remains cautious, with a bearish tilt expected to persist in the near term.

Technical Outlook: WTI Breaks Key Support

The WTI crude chart shows a breakdown of a short-term bullish trend line, and lower lows. The price failed to reclaim the 200-day moving average and found strong resistance since. Currently, it is testing support around $65.00. A daily close below this level could trigger further bearish momentum, with the next support zones seen at $64, and then the next round handles below that. $60 per barrel could be reached if the macro backdrop doesn't improve.

Geopolitical Factors: Trump’s Tariff Threats Dismissed

Donald Trump’s threats of 100% tariffs on countries buying Russian oil sparked initial concern but were ultimately shrugged off by the market. Traders interpreted the 50-day delay in enforcement and Trump’s historical pattern of backing off such threats as signs that immediate supply disruptions were unlikely.

OPEC+ Strategy: Supply Returning to the Market

OPEC+ has announced a larger-than-expected production increase of 548,000 bpd for August, with another 550,000 bpd potentially coming in September. This roll-back of earlier voluntary cuts aims to recapture market share, especially as U.S. shale production slows. However, the added supply may cap price gains, particularly as demand is expected to ease after the peak U.S. driving season.

By Fawad Razaqzada, Market Analyst with FOREX.com

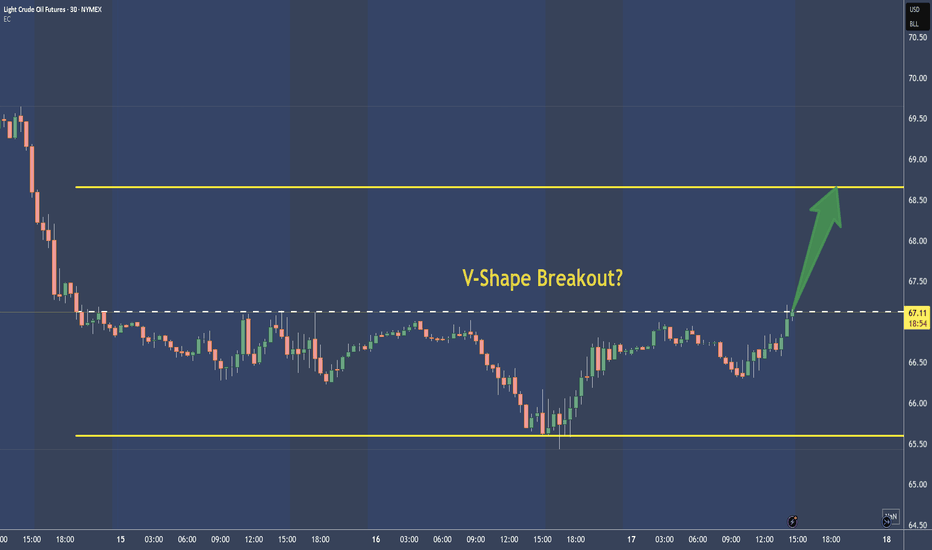

Could we see the WTI oil bears getting pleased any time soon?The technical picture of MARKETSCOM:OIL is showing a possible bearish flag formation, which may lead WTI oil to some lower areas. Is that the case? Let's dig in.

NYMEX:CL1!

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

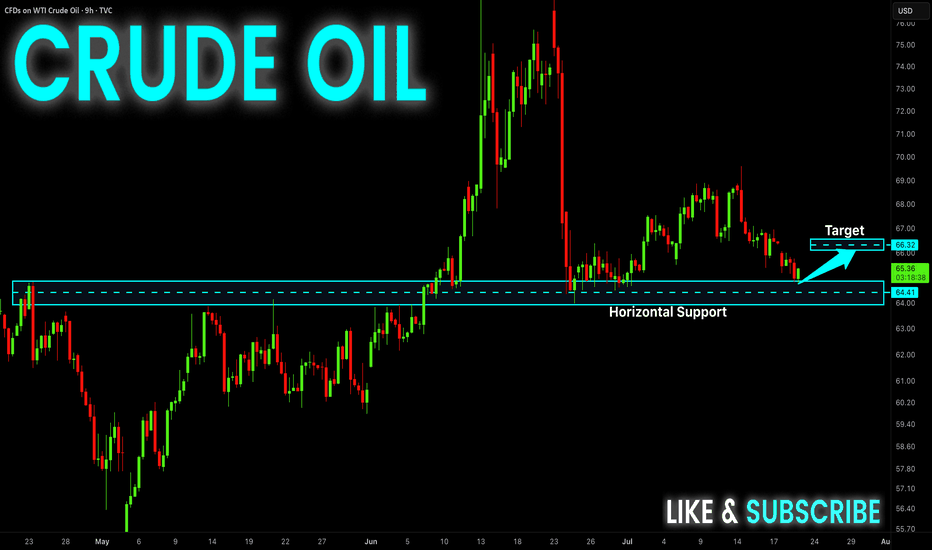

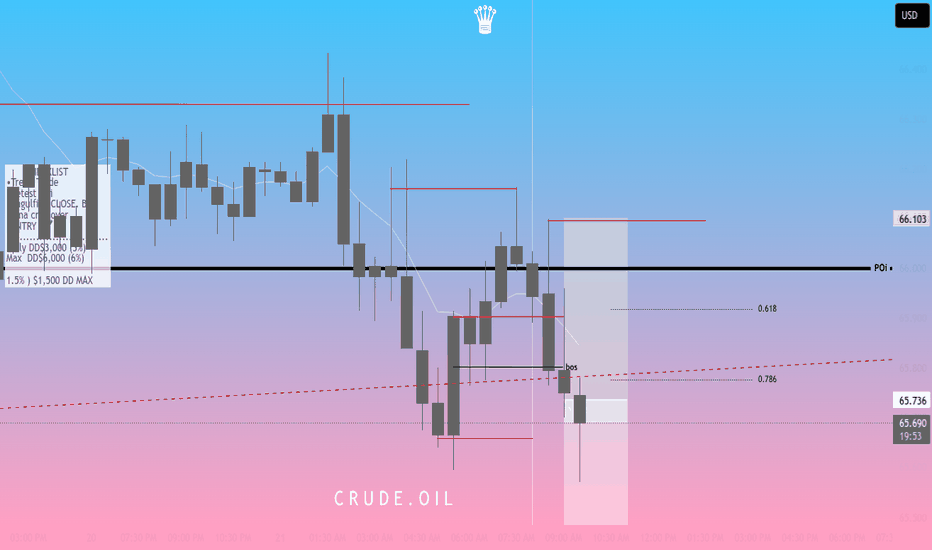

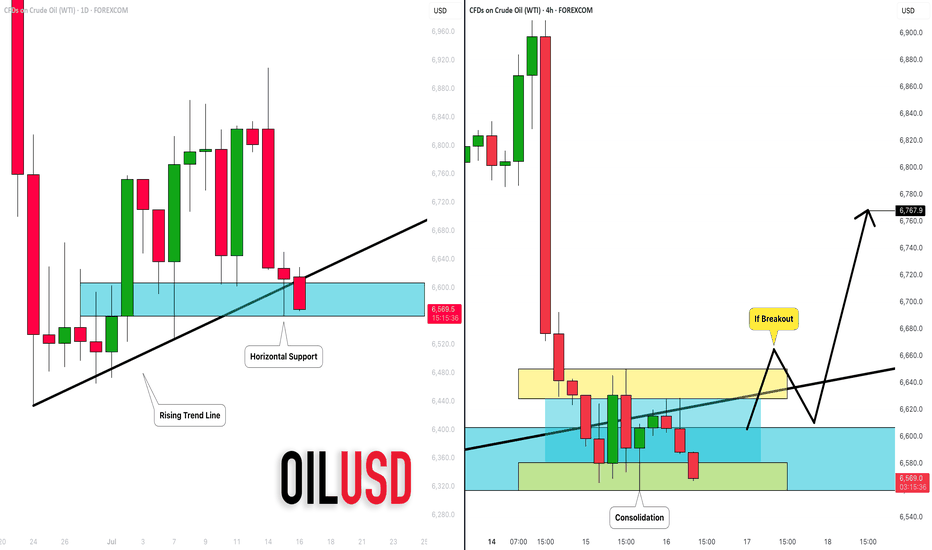

CRUDE OIL (WTI): Your Trading Plan Explained

Do not forget that today we expect Crude Oil Inventories data

release - it will be 10:30 am NY time.

Ahead of this news, the market is testing a significant daily support cluster

that is based on a rising trend line and a horizontal structure.

You signal to buy will be a bullish breakout of a minor intraday

horizontal resistance on a 4H.

4H candle close above 66,5 will be your confirmation.

A bullish continuation will be expected to 67.6 then.

I suggest waiting for the news release first and then check how

the market prices in the news. If our technicals align with fundamentals,

it will provide an accurate setup.

Alternatively, a bearish violation of a blue support will push the prices lower.

❤️Please, support my work with like, thank you!❤️

CRUDE OIL Bearish Flag Breakout! Sell!

Hello,Traders!

CRUDE OIL is trading in a local

Downtrend and formed a bearish

Flag pattern and now we are

Seeing a bearish breakout

So we are bearish biased

And we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTI Crude Oil Reverses Lower Near $70 ResistanceA bearish engulfing candle has formed on the daily WTI crude oil chart, with its high perfectly respecting the 38.2% Fibonacci retracement just beneath the $70 handle. Given that the bounce from the June low has been relatively weak compared to the sharp decline from $78, I’m now on alert for a potential break beneath the $64 support level.

That said, the 200-day SMA and EMA currently sit between $65.21 and $65.31, which could offer near-term support. Should oil prices attempt to grind higher within the 1-hour bullish channel, bears may look to fade rallies into the weekly pivot (67.59) or the $68.00 handle, positioning for a potential rollover. A clean break below the 200-day averages would shift focus firmly back to $64, near the June low.

Matt Simpson, Market Analyst at City Index and Forex.com

WTI Crude Oil Climbs Higher Amid Market OptimismMarket Analysis: WTI Crude Oil Climbs Higher Amid Market Optimism

WTI Crude Oil price climbed higher above $66.50 and might extend gains.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude Oil price started a decent increase above the $66.60 resistance levels.

- There was a break above a connecting bearish trend line with resistance at $67.15 on the hourly chart of XTI/USD at FXOpen.

Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price started a decent upward move from $65.50. The price gained bullish momentum after it broke the $66.50 resistance and the 50-hour simple moving average.

The bulls pushed the price above the $67.00 and $67.50 resistance levels. There was a break above a connecting bearish trend line with resistance at $67.15.

The recent high was formed at $67.63 and the price started a downside correction. There was a minor move toward the 23.6% Fib retracement level of the upward move from the $65.54 swing low to the $67.63 high.

The RSI is now above the 60 level. Immediate support on the downside is near the $67.15 zone. The next major support on the WTI Crude Oil chart is near the $66.60 zone or the 50% Fib retracement level, below which the price could test the $65.50 level. If there is a downside break, the price might decline toward $64.70. Any more losses may perhaps open the doors for a move toward the $63.50 support zone.

If the price climbs higher again, it could face resistance near $67.85. The next major resistance is near the $70.00 level. Any more gains might send the price toward the $72.50 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USOIL RISKY LONG|

✅CRUDE OIL is trading along

The rising support line

And as the price is going up now

After the retest of the line

I am expecting the price to keep growing

To retest the supply levels above at 70.20$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CL1! Short Setup – Fading Into Volume Shelf📉 CL1! Short Setup – Fading Into Volume Shelf

🔹 Context:

Price just tapped into a heavy upper volume shelf (68.35–68.50) — the exact area where the prior breakdown started. This zone aligns with rejection highs and the upper edge of the VRVP profile.

📌 Setup Logic:

🔺 Entry: 68.36–68.50 (into supply zone)

⛔ Stop: 68.75 (above liquidity peak)

🎯 Target: 66.78 (prior demand + volume node)

📐 RRR: ~4.0:1

⚠️ Trigger: Do not enter early — wait for rollover of price which it looks like we are getting now.

📊 Why It Matters:

📈 VRVP shows clear upper and lower volume shelves

📛 Price has overextended into a prior rejection zone

🔁 Potential for a mean-reversion leg once we confirm momentum breakdown

📷 See attached chart for full zone layout

🧠 Let me know if you’re entering or watching this one 👇

#CrudeOil #CL1 #FuturesTrading #VolumeProfile #SciQua #OrderFlow

TRADING IDEA - US CRUDE OIL - BEARISH FLAG, CONCERNS ON GLOBAL EFOREXCOM:USOIL

The US Crude Oil prices went down yesterday, mostly because of the tariffs and concerns on demand.

Here is what the Bloomberg is writing: " OPEC+ is discussing a pause in its oil production increases from October is fueling concerns about a slowdown in global energy demand. In addition, the intensification of US tariffs risks slowing global economic growth and energy demand after President Trump ramped up tariffs on numerous countries this week, including a 50% tariff on Brazil."

So, despite the pause in oil production increase, which is supposed to be bullish factor the oil prices, we may see the slowdown in global economy and supposedly a recession because of Trump's tariffs. This is a long-term bearish factor for the oil. I think that we will see another bearish impulse here, according to what we observe on the chart.

There is a nice bearish flag and i am planning to short it with a target nearby 6,540.00 support level.

🔽 a pending sell stop order at 6615.3 with

❌a stop loss at 6680.9 and

🤑a take profit at 6544.0

Trade cautiously! Preserve your deposits!