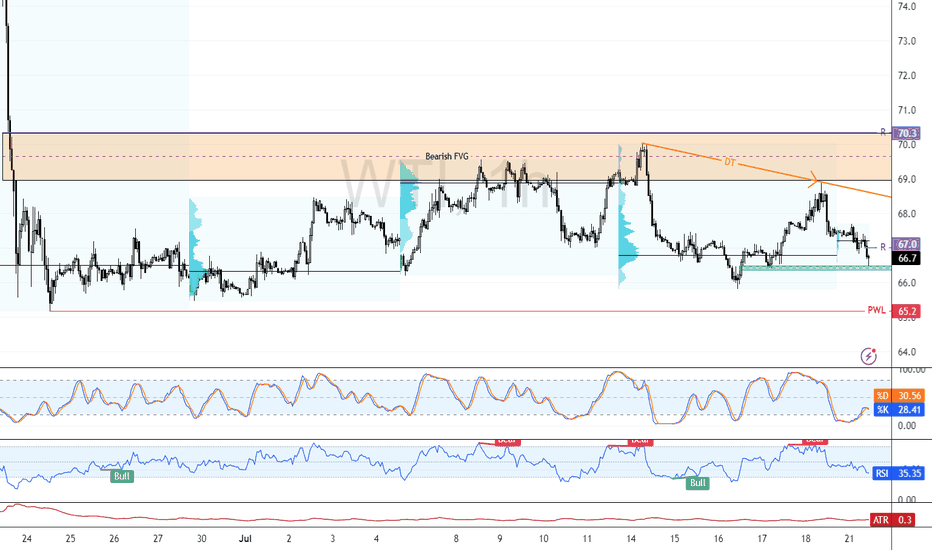

WTI Crude Eyes Bullish Momentum Above $68.9FenzoFx—WTI Crude Oil broke resistance at $68.9 in the last session, now trading near $70.6. This breakout supports a bullish shift.

Yet, RSI 14 and Stochastic indicate overbought conditions, suggesting possible consolidation. Support at $68.9 could offer a discounted entry if prices retreat.

Watch for bullish signs like candlestick formations and inverted FVG around the $68.9 support.

Crudeoilforecast

Market Analysis: Oil Prices Ease – Market Awaits Fresh CatalystMarket Analysis: Oil Prices Ease – Market Awaits Fresh Catalyst

WTI crude oil is also down and remains at risk of more losses below $64.60.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI crude oil price continued to decline below the $66.00 support zone.

- It traded below a connecting bullish trend line with support at $65.60 on the hourly chart of XTI/USD at FXOpen.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI crude oil at FXOpen, the price struggled to continue higher above $67.50. The price formed a short-term top and started a fresh decline below $66.00.

There was a steady decline below the $65.80 pivot level. The bears even pushed the price below $65.00 and the 50-hour simple moving average. The price traded below a connecting bullish trend line with support at $65.60.

Finally, the price tested the $64.75 zone. The recent swing low was formed near $64.73, and the price is now consolidating losses. On the upside, immediate resistance is near the $65.60 zone. It is close to the 50% Fib retracement level of the downward move from the $66.42 swing high to the $64.73 low.

The main resistance is $65.80. A clear move above it could send the price towards $66.40. The next key resistance is near $67.50. If the price climbs further higher, it could face resistance near $70.00. Any more gains might send the price towards the $72.00 level.

Immediate support is near the $64.60 level. The next major support on the WTI crude oil chart is near $63.20. If there is a downside break, the price might decline towards $60.00. Any more losses may perhaps open the doors for a move toward the $55.00 support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Oil Bulls Watch $67.0 for Breakout ConfirmationFenzoFx—Crude Oil trades slightly above the bullish FVG at $66.5, showing sideways momentum on the 1-hour chart. The $65.5 support is backed by volume interest and could drive prices higher.

If this level holds, bulls may target a retest of the descending trendline. For confirmation, a close above the $67.0 resistance is needed.

Please note that a close below $66.5 would invalidate the bullish outlook.

WTI Crude Oil Climbs Higher Amid Market OptimismMarket Analysis: WTI Crude Oil Climbs Higher Amid Market Optimism

WTI Crude Oil price climbed higher above $66.50 and might extend gains.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude Oil price started a decent increase above the $66.60 resistance levels.

- There was a break above a connecting bearish trend line with resistance at $67.15 on the hourly chart of XTI/USD at FXOpen.

Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price started a decent upward move from $65.50. The price gained bullish momentum after it broke the $66.50 resistance and the 50-hour simple moving average.

The bulls pushed the price above the $67.00 and $67.50 resistance levels. There was a break above a connecting bearish trend line with resistance at $67.15.

The recent high was formed at $67.63 and the price started a downside correction. There was a minor move toward the 23.6% Fib retracement level of the upward move from the $65.54 swing low to the $67.63 high.

The RSI is now above the 60 level. Immediate support on the downside is near the $67.15 zone. The next major support on the WTI Crude Oil chart is near the $66.60 zone or the 50% Fib retracement level, below which the price could test the $65.50 level. If there is a downside break, the price might decline toward $64.70. Any more losses may perhaps open the doors for a move toward the $63.50 support zone.

If the price climbs higher again, it could face resistance near $67.85. The next major resistance is near the $70.00 level. Any more gains might send the price toward the $72.50 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Momentum Cools as Oil Eyes Reentry From $67.6FenzoFx—Crude Oil bounced from $66.2, a support backed by the volume profile point of interest, but lost momentum after hitting the bearish FVG.

Currently trading near $68.2 with Stochastic overbought. A pullback to $67.6 can offer a low-risk reentry. The bullish bias remains intact above $65.2, with $70.3 as the next target.

Market Analysis: Oil Slides — Traders Eye Macro TriggersMarket Analysis: Oil Slides — Traders Eye Macro Triggers

WTI Crude oil is down over 15% and remains at risk of more losses.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude oil extended losses below the $68.00 support zone.

- A major bearish trend line is forming with resistance near $65.60 on the hourly chart of XTI/USD at FXOpen.

Technical Analysis of WTI Crude Oil Price

On the hourly chart of WTI Crude Oil at FXOpen, the price struggled to continue higher above $77.00 against the US Dollar. The price formed a short-term top and started a fresh decline below $72.00.

There was a steady decline below the $70.00 pivot level. The bears even pushed the price below $68.00 and the 50-hour simple moving average. Finally, the price tested the $63.70 zone. The recent swing low was formed near $63.69, and the price is now consolidating losses.

On the upside, immediate resistance is near the $65.60 zone. There is also a major bearish trend line forming with resistance near $65.60. The next resistance is near the $66.80 level or the 23.6% Fib retracement level of the downward move from the $76.93 swing high to the $63.69 low.

The main resistance is $70.30 and the 50% Fib retracement level. A clear move above the $70.30 zone could send the price toward $71.90.

The next key resistance is near $76.90. If the price climbs further higher, it could face resistance near $78.00. Any more gains might send the price toward the $80.00 level.

Immediate support is near the $63.70 level. The next major support on the WTI Crude Oil chart is near $62.00. If there is a downside break, the price might decline toward $60.00. Any more losses may perhaps open the doors for a move toward the $55.00 support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Oil Price Surges at Monday Open Amid US Strikes on IranOil Price Surges at Monday Open Amid US Strikes on Iran

As shown on the XBR/USD chart, the Brent crude oil price formed a bullish gap at the opening of financial markets this Monday, surpassing last week’s high.

Only three days ago, we drew attention to Donald Trump’s statement that a decision regarding US involvement in the Iran-Israel conflict would be made within two weeks – yet over the weekend, US aircraft dropped bombs on Iran’s nuclear facilities.

Now oil prices are likely to be affected by Iran’s potential move to block shipping traffic through the Strait of Hormuz. According to Reuters, analysts suggest that in such a scenario, the oil price could climb to $100.

Technical Analysis of the XBR/USD Chart

The ascending channel plotted last week remains valid.

The fact that the price is pulling back (as indicated by the arrow) from the high set at the market open suggests the market had already priced in a significant risk of US involvement in the Iran-Israel military conflict.

Key points:

→ Technical support in the near term may be provided by the area where the lower boundary of the blue channel intersects with the $76 level (which acted as resistance at the end of last week).

→ Ultimately, fundamental factors and official statements will play a decisive role in oil price movements. It’s worth noting that, following the strikes on its territory, Iran is threatening retaliation against the US.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XBR/USD Chart Analysis: Oil Price Falls After Trump’s DecisionXBR/USD Chart Analysis: Oil Price Falls After Trump’s Decision

As shown on the XBR/USD chart, the price of Brent crude oil has pulled back from yesterday’s 4.5-month high following a statement from the White House that President Donald Trump will make a decision within the next two weeks on whether the United States will take part in the Israel-Iran conflict.

According to Reuters, the US President is facing backlash from some members of his team over the prospect of launching a strike against Iran, which could drag the US into yet another prolonged war.

Technical Analysis of the XBR/USD Chart

From a technical standpoint, Brent crude oil price is developing within an upward channel (marked in blue), though several bearish signals are appearing on the chart:

→ a bearish gap that formed overnight;

→ a false bullish breakout (indicated by an arrow) above the $76.50 level, drawn from the 13 June high;

→ bearish divergence on the RSI indicator;

→ a break of the recent local ascending trendline (marked in orange).

Given the steep angle of the rising blue channel, it is reasonable to assume that bears may attempt to break through its lower boundary, which is currently acting as support. Whether this scenario materialises in the oil market will largely depend on developments in the Middle East.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

WTI Crude Oil Regains Bullish MomentumWTI Crude Oil Regains Bullish Momentum

WTI Crude oil prices climbed higher above $70.00 and might extend gains.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude oil prices started a decent increase above the $65.00 and $68.50 resistance levels.

- There is a major bullish trend line forming with support at $71.50 on the hourly chart of XTI/USD at FXOpen.

Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price started a decent upward move from $65.00 against the US Dollar. The price gained bullish momentum after it broke the $68.50 resistance and the 50-hour simple moving average.

The bulls pushed the price above the $69.50 and $71.50 resistance levels. The recent high was formed at $74.80 and the price started a downside correction. There was a minor move below the 50% Fib retracement level of the upward move from the $69.55 swing low to the $74.83 high.

The RSI is now below the 60 level. Immediate support on the downside is near the $71.50 zone. There is also a major bullish trend line forming with support at $71.50 and the 61.8% Fib retracement level of the upward move from the $69.55 swing low to the $74.83 high.

The next major support on the WTI crude oil chart is near the $69.50 zone, below which the price could test the $67.90 level. If there is a downside break, the price might decline toward $65.20. Any more losses may perhaps open the doors for a move toward the $63.75 support zone.

If the price climbs higher again, it could face resistance near $72.50. The next major resistance is near the $74.80 level. Any more gains might send the price toward the $78.50 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Israel Strikes Iran. Oil and Gold Prices SurgeIsrael Strikes Iran. Oil and Gold Prices Surge

According to media reports, Israel launched a large-scale overnight strike on Iranian territory, targeting dozens of military and strategic facilities linked to the country’s nuclear programme and missile capabilities. Israeli officials justified the action by citing an existential threat from Tehran, which, according to their intelligence, is accelerating its development of nuclear weapons and expanding its arsenal of ballistic missiles.

In response, Iran has vowed severe retaliation, stating that the United States and Israel will “pay a heavy price” for the attack. US President Donald Trump has urgently convened a meeting to assess the situation.

Commodities Market Reaction

In the wake of these developments, gold — the primary safe-haven asset — surged sharply. The XAU/USD price broke above its May high, rising past $3,440. However, the all-time high near $3,498 remains intact for now.

Oil prices also spiked due to fears of supply disruption. The military conflict threatens shipping through the Strait of Hormuz, a crucial chokepoint through which one-fifth of the world’s oil supply passes. Traders quickly priced in the risk of war, anticipating a supply shortage driven by large-scale instability in the Middle East.

Technical Analysis of the XBR/USD Chart

Brent crude oil price has risen to the upper boundary of a large-scale descending channel (shown in red), which is defined by lower highs from 2024–2025. As anticipated, this upper boundary acted as resistance, with the price forming a peak above $76 before reversing downward (as illustrated by the black arrow).

From a technical standpoint, following such a sharp rally, Brent is vulnerable to a corrective move. In this scenario, a pullback into the orange zone is possible, where support may be found at:

→ The psychologically important $70 level;

→ The 50% Fibonacci retracement level;

→ The former resistance of the purple descending trendline, now turned support.

Nevertheless, given the scale of the geopolitical threat, it is unlikely that market sentiment will allow Brent to decline significantly in the near term.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XBR/USD Chart Analysis: Oil Price Rises to Key ResistanceXBR/USD Chart Analysis: Oil Price Rises to Key Resistance

Yesterday, the price of Brent crude climbed above $65.60 — the highest level in over a week.

According to media reports, several bullish factors are driving this move:

→ Stalled negotiations between the US and Iran over abandoning Iran’s nuclear programme in exchange for lifting oil export sanctions;

→ Wildfires in Canada, which have significantly reduced oil output;

→ Market reaction to the OPEC+ meeting held over the weekend;

→ A weakening US dollar.

Technical Analysis of the XBR/USD Chart

From a technical standpoint, Brent crude oil:

→ Has been forming a short-term ascending channel (marked in blue) since the beginning of the week;

→ Has approached a major resistance level.

This resistance is defined by the upper boundary of a narrowing triangle, with its central axis around the $63.70 level — a price that could be considered a fair value based on trading over the past one and a half months.

This situation points to two possible scenarios:

→ A downward reversal from the key resistance, with expectations that the price will return to the triangle’s central axis. A break below the lower boundary of the local blue channel would support this scenario.

→ An attempt at a bullish breakout of the triangle. While this scenario cannot be ruled out, it appears less likely due to the global economic slowdown risks posed by tariff-related trade barriers.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Analysis: WTI Crude Oil Price Could Gain Bullish PaceMarket Analysis: WTI Crude Oil Price Could Gain Bullish Pace

WTI Crude Oil is gaining bullish momentum and might even test $62.75.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude Oil climbed above the $60.50 and $60.80 resistance levels.

- There was a break above a key bearish trend line with resistance at $60.80 on the hourly chart of XTI/USD at FXOpen.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price started a fresh upward move from $59.45 against the US Dollar. The price gained bullish momentum after it broke the $60.00 resistance.

The bulls pushed the price above the 50% Fib retracement level of the downward move from the $62.76 swing high to the $59.45 low. The price even climbed above the 50-hour simple moving average. Besides, there was a break above a key bearish trend line with resistance at $60.80.

It tested the $61.50 resistance zone and the 61.8% Fib retracement level of the downward move from the $62.76 swing high to the $59.45 low.

The RSI is now near the 50 level and the price could aim for more gains. If the price climbs higher again, it could face resistance near $62.00. The next major resistance is near the $62.75 level. Any more gains might send the price toward the $63.45 level or even $65.00.

Conversely, the price might correct gains and test the $60.80 support level. The next major support on the WTI Crude Oil chart is near the $59.45 zone, below which the price could test the $58.00 zone.

If there is a downside break, the price might decline toward $56.50. Any more losses may perhaps open the doors for a move toward the $55.50 support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Oil Prices Surge Amid Threat of Strike on IranOil Prices Surge Amid Threat of Strike on Iran

As shown on today’s XBR/USD chart, Brent crude oil prices have jumped (as indicated by the arrow) to a one-week high. This surge follows U.S. intelligence reports suggesting that Israel may be preparing to strike Iran’s nuclear facilities.

Although CNN, citing officials, noted that it remains unclear whether Israeli leaders have made a final decision, oil prices are rising as markets price in the risk of escalation disrupting Middle Eastern oil supply chains:

→ Iran is the third-largest oil producer within OPEC.

→ There is concern that Iran could retaliate by blocking the Strait of Hormuz in the Persian Gulf — a key shipping route used by Saudi Arabia, Kuwait, and others to export oil products.

Technical Analysis of XBR/USD

Brent crude oil price has climbed towards the descending trendline (marked in black), drawn through key highs from April and mid-May. From a bearish perspective, this key resistance could trigger a downward pullback.

On the other hand, recent price action in Brent suggests upward momentum (indicated by blue lines), with the $65.20 level — previously a cap — potentially turning into support after a breakout.

Whether the black resistance line is broken will largely depend on geopolitical developments. It is possible that reports of an imminent missile strike on Iran may later be refuted.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

WTI Crude Oil Price Targets Fresh GainsWTI Crude Oil Price Targets Fresh Gains

WTI Crude oil prices are gaining bullish momentum and might even test $63.50.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude climbed above the $60.90 and $61.50 resistance levels.

- There is a key rising channel forming with support at $61.30 on the hourly chart of XTI/USD at FXOpen.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price started a fresh upward move from $60.10 against the US Dollar. The price gained bullish momentum after it broke the $60.90 resistance.

The bulls pushed the price above the 50% Fib retracement level of the downward move from the $63.45 swing high to the $60.08 low. The price even climbed above the 50-hour simple moving average.

It tested the $62.15 resistance zone and the 61.8% Fib retracement level of the downward move from the $63.45 swing high to the $60.08 low. There is now a key rising channel forming with support at $61.30.

The RSI is now near the 50 level and the price could aim for more gains. If the price climbs higher again, it could face resistance near $62.15. The next major resistance is near the $62.65 level. Any more gains might send the price toward the $63.45 level or even $65.00.

Conversely, the price might correct gains and test the $61.30 support level. The next major support on the WTI crude oil chart is near the $60.90 zone, below which the price could test the $60.10 zone.

If there is a downside break, the price might decline toward $58.50. Any more losses may perhaps open the doors for a move toward the $55.50 support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Analysis: WTI Crude Oil TumblesMarket Analysis: WTI Crude Oil Tumbles

WTI Crude oil is down over 10% and remains at risk of more losses.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude oil prices extended downsides below the $60.00 support zone.

- A major bearish trend line is forming with resistance near $57.25 on the hourly chart of XTI/USD at FXOpen.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price struggled to continue higher above $60.00 against the US Dollar. The price formed a short-term top and started a fresh decline below $58.00.

There was a steady decline below the $57.75 pivot level. The bears even pushed the price below $56.20 and the 50-hour simple moving average. Finally, the price tested the $55.00 zone. The recent swing low was formed near $55.01, and the price is now consolidating losses.

There was a minor move above the $55.50 level. On the upside, immediate resistance is near the $56.10 level and the 23.6% Fib retracement level of the downward move from the $59.49 swing high to the $55.01 low.

The next resistance is near the $57.25 level. There is also a major bearish trend line forming with resistance near $57.25. The trend line is near the 50% Fib retracement level of the downward move from the $59.49 swing high to the $55.01 low.

The main resistance is near a trend line at $57.75. A clear move above the $57.75 zone could send the price toward $59.45. The next key resistance is near $62.25. If the price climbs further higher, it could face resistance near $63.20. Any more gains might send the price toward the $65.00 level.

Immediate support is near the $55.00 level. The next major support on the WTI crude oil chart is near $53.00. If there is a downside break, the price might decline toward $52.00. Any more losses may perhaps open the doors for a move toward the $50.00 support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crude Oil Tests Critical Support Level at $65.10FenzoFx—Crude Oil is consolidating below the $65.10 resistance, trading around $64.30. The price remains above the 50-period SMA on the 4-hour chart, confirming a bullish trend. However, the Stochastic Oscillator crossing above 20 signals overbought conditions, suggesting a potential pullback.

If oil stays below $65.10, a bearish wave could follow, targeting $62.31 and then $61.75.

Bullish Scenario: A close and stabilization above $65.10 could trigger the uptrend, targeting $67.60.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at FenzoFx Decentralized Forex Broker

Market Analysis: WTI Crude Oil Rebounds in TandemMarket Analysis: WTI Crude Oil Rebounds in Tandem

WTI Crude oil prices climbed higher above $60.00 and might extend gains.

Important Takeaways for WTI Crude Oil Price Analysis Today

- WTI Crude oil prices started a recovery wave above the $60.00 and $61.50 resistance levels.

- There was a break below a connecting bullish trend line with support at $63.00 on the hourly chart of XTI/USD at FXOpen.

Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price started a recovery wave from $58.40 against the US Dollar. The price gained bullish momentum after it broke the $60.00 resistance and the 50-hour simple moving average.

The bulls pushed the price above the $61.50 and $62.00 resistance levels. The recent high was formed at $64.20 and the price started a downside correction. There was a minor move below the 23.6% Fib retracement level of the upward move from the $59.87 swing low to the $64.18 high.

There was a break below a connecting bullish trend line with support at $63.00. The RSI is now below the 50 level. Immediate support on the downside is near the $62.0 zone or the 50% Fib retracement level of the upward move from the $59.87 swing low to the $64.18 high.

The next major support on the WTI crude oil chart is near the $61.50 zone, below which the price could test the $59.90 level. If there is a downside break, the price might decline toward $58.40. Any more losses may perhaps open the doors for a move toward the $56.20 support zone.

If the price climbs higher again, it could face resistance near $64.20. The next major resistance is near the $65.00 level. Any more gains might send the price toward the $68.50 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crude Oil AnalysisFenzoFx—Crude Oil started a bullish wave from $55.15, trading at around $62.20. Momentum slowed near $63.90 resistance.

The Stochastic Oscillator indicates short-term overpricing as Crude Oil remains below $63.90, keeping the bearish trend intact. Price may dip toward $58.90 support, with further pressure potentially driving it to $55.15.

If Crude Oil surpasses $63.90, the bearish outlook invalidates, targeting $65.10 resistance.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at F enzo F x Decentralized Forex Broker

Crude Oil Holds Rebound Above $55Crude oil's sharp rebound from the $55 support—aligned with the 0.618 Fibonacci retracement of the 2020–2022 uptrend—faced immediate resistance at the long-standing support-turned-resistance zone around $63.80, established in 2021.

A decisive move above $63.80 may clear the way for further gains toward $66, $68, $69.60, and ultimately $73. On the downside, a drop below $58 would bring $55 back into focus.

A clean break below that level could trigger further downside toward $49 per barrel, which aligns with the lower boundary of crude oil's long-term uptrend.

With global powers competing for oil, key events this week include:

🔹 OPEC report amid tariffs and efforts to regain market share

🔹 US–China trade talks

🔹 Chinese GDP, IP, Retail Sales (Wed)

Written by Razan Hilal, CMT

Crude Oil Found Support: What's Next?FenzoFx—Crude oil tested the $58.9 level as support and bounced back from it. The primary trend is bearish; therefore, it will likely resume if the price closes and stabilizes below this support.

If this scenario unfolds, the next bearish target could be the $55.15 support level.

>>> Win $160.0 prize every week by joining FenzoFx contest.

Trump Goes "The Peacemaker", as Crude Oil Turns Gradually LowerThe notion that crude oil prices might decrease due to an abatement of the Ukraine's war not seems to be counterintuitive, as the conflict has historically led to increased oil prices due to supply disruptions and geopolitical tensions.

There are several factors that could contribute to a decrease in oil prices if tensions were to ease.

Factors Contributing to Decreased Oil Prices:

Easing of Sanctions on Russia: If tensions between the U.S. and Ukraine were to ease, it might lead to a relaxation of sanctions on Russia, potentially allowing more Russian oil to enter the global market. This increase in supply could help reduce prices.

Market Perception of Reduced Conflict: The market might perceive a decrease in conflict as a sign of reduced risk to global oil supplies, leading to lower prices. This perception could be influenced by expectations of increased oil availability from Russia and other regions.

OPEC Production Increases: If OPEC decides to increase production, as it has recently done, this could add more oil to the market, further pressuring prices downward.

Global Economic Concerns: Economic slowdowns or concerns about global growth can reduce demand for oil, leading to lower prices. The Ukraine conflict has contributed to economic uncertainty, and its abatement might not necessarily increase demand if global economic concerns persist.

Fundamental considerations

Well, in early March 2025, oil prices fell due to a combination of factors, including tensions between the U.S. and Ukraine and OPEC's decision to gradually increase output. Brent crude fell to around $71.08 per barrel, and WTI to about $68.01 per barrel.

Impact of Sanctions: Despite sanctions not directly targeting Russian oil, they have affected its exports by limiting financing and causing some buyers to avoid Russian crude. Easing these sanctions could increase Russian oil exports, potentially lowering global prices.

Market Dynamics: The war in Ukraine initially caused oil prices to surge due to supply concerns. However, if the conflict were to abate, market dynamics could shift, leading to decreased prices as supply risks diminish and global economic factors come into play.

Post war challenge

Crude oil and gasoline prices today are moderately lower, but crude oil tends to breakthrough a long-term 3 - to - 4 years low.

Crude oil prices are under pressure as US tariff uncertainty weighs on the outlook for energy demand.

Also, ramped-up Russian oil exports boost global supplies and are negative for prices.

In addition, crude prices have some negative carryover from Wednesday when weekly EIA crude inventories rose more than expected to a 7-month high.

Conclusion

In summary, while the Ukrainian war has historically driven oil prices up due to supply disruptions and geopolitical tensions, an easing of tensions could lead to decreased prices through increased supply, reduced market risk, and global economic factors.

--

Best 'Peacemaking' wishes,

@PandorraResearch Team 😎