FCPO / Crude Palm Oil CPO 18 April 2025 Daily Chart Analysis

Yesterday's candlestick closed as a bear bar near its low with a long tail below.

In our previous report, we said the bulls need to create consecutive bull bars closing near their highs to increase the odds of a minor pullback towards the 20-day EMA or April 10 high area.

The market traded above the prior day's high (16 April) but the follow-through buying was limited. The market then reversed to close near its low.

Currently, in the night session, the market gapped up and is an inside bull bar with a prominent tail above.

The bulls want a reversal from a wedge pattern (Mar 25, Apr 9, and Apr 16) and a lower low major trend reversal.

While the market traded higher today (April 17), the bulls couldn't create sustained follow-through buying.

They must create consecutive bull bars closing near their highs to increase the odds of a retest of the 20-day EMA or the April 10 high.

They hope tomorrow (Friday) will close as a strong bull bar so the weekly candlestick will have a long tail below and close above the middle of its range.

The bears want a retest of the January low.

They want a large second leg sideways to down with the first leg being the April 2 to April 9 low.

They see the current move forming a double top bear flag (April 15 and April 17).

They want a strong retest of the April 16 low, followed by a strong breakout below.

They want a big bear bar closing near its low tomorrow (Friday) so that the weekly candlestick will be a strong bear bar. If this is the case, the odds of the market trading at least a little lower the following week will increase.

Exports for the first 15 days are up ITS: 16.95%, AmSpec: 13.55%.

Production is slowly picking up, but not in a big way yet.

Refineries' appetite to buy physical remains lukewarm with the recent sharp falling market.

The market remains Always In Short.

The recent selling has been climactic and slightly oversold.

However, the bulls attempted to create reversals in the last 2 days but both times had limited follow-through buying, with the market reversing to close lower. The bulls are not yet strong.

The move down since April 10 has a lot of overlapping candlestick. (see the 4 hr chart below). While the tight bear channel means persistent selling, the overlapping candlesticks indicate a weaker down phase than the first leg down (April 2 to April 9).

The market formed a tight trading range in the last 3-4 days (small yellow box). The market is in breakout mode.

Traders will wait for a breakout from either direction and trade in the direction of the breakout.

Until then, traders may continue to Buy Low and Sell High (between 4000 and 4080).

The U.S. market will be closed tomorrow for Good Friday.

For now, traders will see if the bears can create a strong bear bar breaking below the April 16 low.

Or will the market trade sideways followed by a retest and breakout above the 4080 level instead?

Crudepalmoil

FCPO - Crude Palm Oil 17/4/2025 Daily Chart Market Analysis

Yesterday's candlestick closed as a bear bar in its lower half with a small tail below.

We said that the recent selling has been climactic and slightly oversold. Perhaps we may see a minor pullback towards the 20-day EMA or April 10 high area?

The market attempted to reverse higher but sold off in the last 30 minutes.

Currently, the candlestick is a small bull inside doji.

The bulls want a reversal from a wedge pattern (Mar 25, Apr 9, and Apr 16) and a small double bottom (Apr 9 and Apr 16)

They see the current move simply as a retest of the April 9 low and want a reversal from a lower low major trend reversal.

They see the last 3 trading days forming a micro wedge (Apr 14, Apr 15, and Apr 16).

They must create strong bull bars with follow-through buying to increase the odds of a TBTL (Ten Bars, Two Legs) pullback.

They want a retest of the 20-day EMA or the April 10 high.

The bears want a retest of the January low.

They want a large second leg sideways to down with the first leg being the April 2 to April 9 low.

If the market trades higher, they want the April 10 high or the 20-day EMA to act as resistance, followed by a reversal from a double-top bear flag.

Exports for the first 15 days are up ITS: 16.95%, AmSpec: 13.55%.

Production is slowly picking up, but not in a big way yet.

Refineries' appetite to buy physical remains lukewarm with the recent sharp falling market.

The market remains Always In Short.

The recent selling has been climactic and slightly oversold.

The move down since April 10 has a lot of overlapping candlestick. (see the 4 hr chart below). While the tight bear channel means persistent selling, the overlapping candlesticks indicate a weaker down phase than the first leg down (April 2 to April 9).

The bulls need to create consecutive bull bars closing near their highs to increase the odds of a minor pullback towards the 20-day EMA or April 10 high area. So far, they have not yet been able to do so.

If the bears get a strong breakout below the April 9 low with strong follow-through selling instead, the odds of a retest of the 3850-3900 area will increase.

Let's monitor the buying/selling pressure tomorrow.

Possible resistance area to pay attention: around the 4040-50 to 4070 area.

Green Bull Flag in FCPO From a technical standpoint, prices have consolidated into a bull flag consolidation pattern since 14 March, breaking out of the flag resistance (orange trend channel) yesterday, albeit with normal volume. This localised breakout coupled with the breakout of the long-term parabolic bowl accumulation pattern at 4,150, a pattern forming since July 2023, signalled a possible continuation of the bullish climb to retest 4350 levels.

Fibonacci retracements can be seen respected at 61%, 50% and 38% respectively. Immediate support is foreseen around the 4,200 levels, a zone created from a combination of both 50% fibo and the high from previous surge – green line support.

Sustained prices above the bull flag pattern for the next two days are likely to drive further upward movement, aiming to breach the 4,350 level and potentially reaching 4,500 levels. This upward momentum may be fueled by short liquidations and breakout buys. Conversely, a drop below the 4,150 level could prompt a retreat towards the crucial support level of 4,000.

Regarding correlated edible oils, technical indicators for CBOT soyoil futures indicate a bullish divergence, with prices rebounding noticeably from recent lows. The trajectory suggests a continuation of the bullish trend following a retracement to the 47-48 cents per pound levels last week.

Trading Idea:

Entry: Long 2 lots FCPO @ 4230

SL: 4190

TP: 1 lot @ 4330 ; another @ 4480

- Darren, Phillip Nova Analyst

A technical overview of Soybean Oil

Since our last analysis of Soybean Oil, the commodity has completed its head and shoulders pattern, now trading at the resistance formed by the previous neckline. Concurrently, we observe an RSI divergence, where the RSI prints lower highs while the prices chart higher highs. This divergence is generally viewed as a bearish indicator, hinting at possible price declines. When paired with decreasing volume, the case for price exhaustion at this juncture becomes more compelling.

The Price & Volume Profile chart serves as another essential tool in pinpointing critical zones. The highlighted POC (‘point of control’) zone represents the price level with the highest frequency of trades. Historically, this has acted as a pivotal support and resistance level for Soybean Oil, demarcating regions of consolidation before prices venture either upwards or downwards. The chart also highlights the volume traded at the different levels as denoted by the volume number at the different price levels. Notably, the current price level showcases a significant volume zone, with the largest volume transacted there.

Looking at the 50 & 200-day moving averages we observe a golden cross which signifies bullishness. But not on the 100 & 200-day moving averages.

On a relative value basis, we can also compare Soybean Oil to its substitute, such as crude palm oil. Here we see 2 defined regimes pre-2021 and post-2021 where the ratio of the two products significantly increased, suggesting that Soybean Oil became relatively pricier than Crude Palm Oil. We have previously delved into this topic in our article “ Fading the Soybean Oil Premium ” where we anticipated a decline in this ratio. Subsequently, this ratio did correct to the 0.06 mark, only to experience a rapid rebound. This surge was attributed to Soybean Oil appreciating at a faster rate than Crude Palm Oil.

Another metric involves contrasting Soybean Oil with its upstream and downstream derivatives: Soybean and Soybean Meal. Once more, we see prices tending to move in tandem until 2021, after which the ratio of Soybean Oil to both Soybean Meal and Soybean underwent a marked shift. With the ratio's support distinctly outlined by pre-2021 resistance, this ratio can be wielded as a metric to identify when Soybean Oil is relatively overpriced compared to its up and downstream products.

In conclusion, a blend of technical indicators seems to point towards more downside for Soybean Oil, such as the RSI divergence and declining volume. Also, prices stuck in the POC have generally preceded breakouts and on a relative value basis, Soybean Oil seems over-extended. We can express this bearish view on soybean oil via a short position on the CME soybean Oil futures at the current level of 63.29, with a stop at 67.50 and take profit at 51.00. Prices are quoted in cents per pound and each $0.0001 increment per pound in the Soybean Oil futures contract is equal to 6.00$.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Reference:

www.cmegroup.com

Fading the Soybean Oil premium.Jumping straight into the technicals, we see a head and shoulder pattern on the daily Soybean Oil chart. With the neckline now broken, it seems a bearish set-up might be possible.

While the technicals are important, understanding where the current price level of soybean oil is in context to other products could help us build further conviction on this idea.

Firstly, the Soybean crush components. Currently, Soybean Oil trades at a pretty large premium against Soybean and Soybean Meal. Looking at the price ratios of Soybean Oil/Soybean & Soybean Oil/Soybean Meal, we also see that both have been trading out of the ‘normal’ range since 2021. With both ratios now trending lower and knocking on the door of the normal range again, we will watch closely to see what happens as we approach this critical juncture.

Secondly, Soybean Oil vs its substitute, Crude Palm Oil. Again, we see Soybean Oil as the outlier here, as prices diverge from Crude Palm Oil, with Soybean Oil trading higher. Looking at the bottom chart, we can clearly see the Soybean Oil/Crude Palm Oil ratio deviating from the average range established in 2018 – 2021. With this ratio recently trending lower, a break below the upper level of the range established (dotted line) could accelerate the closing of this premium, as seen in the 2021 to 2022 period, where the ratio collapsed swiftly.

The technically bearish setup, coupled with Soybean Oil’s relative valuation against the soybean complex and Crude Palm Oil on fundamental standpoint, makes a decent case to short Soybean Oil Futures from here.

To express this view, we can consider setting up the trade in a few ways:

1) An outright short on Soybean Oil using the CME Soybean Oil Futures, at the current level of 60.05, setting our stop at 67 and taking profit at 42, with each 1-point move in the Soybean Oil Futures contract equal to 600 USD.

2) A spread trade between Soybean Oil & Crude Palm Oil, by taking a short position in the CME Soybean Oil Futures contract and a long position in the CME Crude Palm Oil futures contract. Such a setup could potentially allow you to stay profitable even if you turn out to be ‘wrong’ in your market views if it eventually proves that crude palm oil has been underpriced and the soybean premium is closed by crude palm oil rallying. For this trade, it is trickier to set up due to the contract size and tick value difference.

Interested readers can check out one of our previous ideas where we have covered this trade in further detail:

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Reference:

www.cmegroup.com

www.cmegroup.com

www.cmegroup.com

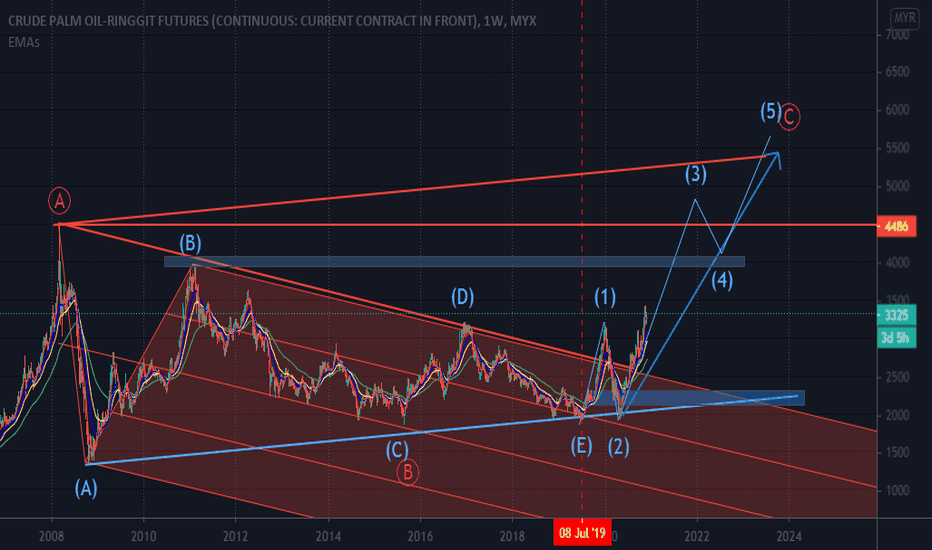

Palm and crude oil long term bullish? R u sure?! 21/June/221)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

Disclaimer

FCPO - A Larger Picture of this bearish moveAfter a few bearish days, I turn to the larger timeframe for a larger picture of the price / trend .

Bearish move this week crossed the Weekly trendline with strong momentum.

I see price continue moving slowly in the next few weeks before another bearish run towards the 4500 level.

Consider this as the leg 1 of its bearish move, it created a lower low. And then rebalance for a few candles before another huge candle.

Estimated price to reach target at reversal zone around: Aug - Oct this year.

If you liked this idea or if you have your own idea about it, please do not hesitate to write in the comments.

Thank you

Showcase: FCPO trade (Short to Long)1. Did a short trade on FCPO as the signs point to downtrend.

2. Price doesn't agree to downward movement as the upbars vol. is higher.

3. We flatten the trade at 5 points cut loss.

4. We then observe the chart and price seems to be moving higher; we have entered Long and will update whether we have achieve target or exit with loss.

July21: FCPO (Daily) - Wide Range, Sideways Up...🐮📈Maintain sideways view, price continued rallying on weak volume, reached prev R@ 406x-418x area.

Expect some retracement upon violating steep UTL, price may find support near S zone.

Major S&R zone

R1: 406x-418x

Major R2: ~4.4k

S1: 366x-386x

Major S2: 3.2-3.4k

Looking for swing long on retrace. Maintaining longer holding period positions lately due to lack of monitoring time.

Lesser posts here, due to TV deleting some of my posts (😤). I still post more in my own public channel. :)

Happy Hunting! 🚀

-JK-

07/07/2021 FCPO ELLIOTT WAVE ANALYSISFCPO, WAVE 3 COMPLETE?

TRADING CONTRACT: SEPT(U) 2021

KEY LEVEL = 3978

CRITICAL LEVEL = 3499

10.06.2021

Trading below 3978 would signal us that wave 3 is complete.

If wave 3 topped, expecting a for sharp correction of wave 4 toward 38.2% area.

As for today, we will monitor 3978 key level, trading above this level will cancel the idea that wave 3 is in place. price movement below our critical level of 3499 will cancel this setup and we will label the chart using corrective sequence. (Switch over to alternate count if this happened)

OUR CRITICAL LEVEL IS BASED ON ELLIOTT RULES THAT WAVE 4 CAN NEVER ENTER WAVE 1 PRICE TERRITORY.

Beware of possible huge gap down on opening, please refer to other commodities chart.

ZL – Soybean Oil

ZS – Soybean

ZM- Soybean Meal

ZC

I AM A GOOD TRADER - You only need one affirmation and this is it. Read these words every day until you don't have to read them anymore. =)

FCPO AUG 2021 : Expended Flat PatternFCPO AUG 2021

Quick update on my trading setup for FCPO Aug 21 contract.

We found a recognizable pattern on chart, Expended Flat wave 4.

Looking for short selling opportunity with impusle movement of wave C.

Validation level for this idea is the extreme top or previous higher high, breaking this level, will go with diagonal triangle idea.

May17: FCPO (Daily) - Bulls Likely Take a Breather...🐮📉CPO: Weekly & Daily Up-Channel top reached last week. 🚀✅

Coupled with slight momentum weakness on Hourly, suggesting an overdue retracement might finally take place.

In case of continued bullish momentum, mainly driven by macro reasons, look to R1: ~4.6k, R2: ~4.8k

Else, price may find support at S1, prev ATH, or UTL1.

❇️April11 Long Call hit R1, next will be R2...

❇️Midterm Bull Cycle: Strong Breakout from R2 marked below from Sept2020...

Happy Hunting! Stay Safe! ⭐️

-JK-

May03: FCPO (Hourly) - Sideways-Up, To Retest HH@419x...🐮🚀200ticks sideways range over the past week or two.

Daily & Hourly strong support: 382x-8x zone still holding, likely to see higher moves from here.

Watch R: 408x, 414x, then HH-419x

❇️ April11 Long Call still intact, haven't priced in the contract change.

❇️ On retest 419x HH, will again stand above Monthly strong R as below.

Happy Hunting! ⭐️🚀

-JK-

FCPO just completed it's corrective wave A=CFCPO just completed corrective wave ABC which A=C

What's direction on next? since first breakout just done !

Is all about elliott wave analysis

✅ naked chart analysis, ❌ indicator

(Disclaimer: for demonstrate own planned trade records study only and education purpose, not for recommend to buy or sell. Trade at your own risk)

April11: FCPO (Weekly) - Bullish, R@4.4k, 4.6k, 4.8-5k 📈🐮🚀

🔅Fed continue with USD printing, US 10yr bond yield consistently rising touching 1.7-1.8%, US Stocks pumped by stimulus money...

🔅Across-the-board commodity spike especially food & grains...

🔅USD Index continue rising despite excessive printing, suppressing EM markets currencies (including our MYR)...

🌐These are all MACRO reasons why CPO will see higher prices going forward.

⚠️ Risk: CPO entering high-production cycle; fluctuating global export demands due to restricted economic activities; COVID recovery progress.

Maintain mid-term bullish view as per last posted ideas below.

❇️ Follow my TG channel for latest market updates. :)

Mar10 ATH call:

Q1 Bullish Call:

CPO Monthly Bullish Cycle:

Mar10: FCPO - March Test ATH & April New ATH 📈🐮🚀💡Q1 Call to ATH in progress...

💡Mid-term CPO Bull Cycle wave counts in progress...

❇️ Holding Long's, aiming ATH, then new ATH.

⭐️ Fundamentals: US Fed excessive money printing > MYR continue weakening > Rising inflationary pressure > Spike in Food/Agricultural Commodities > CPO Bull Cycle

Feb18: FCPO (1D) - Sideways-Up btw 3.5-3.8k before breakout 📈🐮Sideways-Up bias before the eventual Longterm upside breakout to 4k & beyond, commodities are seeing across-the-board rise on hyper-inflationary risk, thanks to massive money printing.

CPO price bounced off major S @ ~3200, subsequently reach R1-R3 upside mentioned in previous post.

Expect further consolidation near wide range top (3500-3800) region, potential retest UTL, before the expected major breakout to 4k & beyond.

🔔Overhead Resistance: 3.6-3.7k, 3.8k

🔔Support Zone: 3.5k, 3.4k

❇️ All R reached on bounce off range low (check out post link below)

❇️❇️ Major Breakout in progress on Longterm chart, link below

Happy Hunting! 🥂🚀

-jk-

Feb08: FCPO (1D) - Sideways-Up to 3.5-3.6k 📈🐮CPO price consolidated past 1-2weeks, supported above UTL & major EMA , bulls took back control by end-Jan.

Staying >320x-2x support will see price attempt to regain 3500 & 3600 resistance levels.

Expect volatile sideways-up situation for coming 1,2weeks till market resume after CNY 🧧🏮

🔔 Overhead Resistance: 344x-9x, 354x-8x

❇️❇️Longterm Outlook: R2 tested, R1 holding on test, attempting to break above. (check out post link below)

Happy Hunting! 🥂🚀

-jk-

FCPO Q1 Outlook: Sideways-Up to ATH 4.4k-4.8k 📈🐮Technicals

Major S: 3.6-3.7k (nearest support) ; 3.2-3.4k (prev consolidation range)

Major R: 3.8-3.9k ; 4-4.2k ; 4.4k (ATH) ; 4.8k (Weekly breakout projection)

👇🏻 Prev idea on potential CPO New Bull Cycle:

👇🏻 Dec Bullish Call on CPO:

🔔 Q1 Risk Factor to Watch:

Covid, Reinstating/further extension of MCO , Political instability (Malaysia), US President transition, US-China trade war (soybean oil deals), Geopolitical tension in Iran/Taiwan

I'm Long bias for FCPO in 1Q2021, looking to initiate Long positions shall Major S holds.

Happy Hunting! 🥂🚀

-jk-

Dec02: FCPO (1D) - Bullish Flag Target Pointing to 3.6-3.7k 🐮CPO price consolidated past 1-2weeks, forming a nice launchpad towards higher price levels -- Bullish Flag pattern. 🚀🚀

Price still running in a mid-term up-channel, with an upside target zone: 3.5-3.6k & 3.7k ; similar to which suggested by the flag.

🔔 Overhead Resistance: 3.4k, 3.5k, 3.6k, 3.7-3.8k

❇️Prev idea still largely intact, only now with added bullishness from potential flag formation.

❇️❇️Longterm Outlook: R1 standing, Heading to R2

In long position for cpo, likely to be my closing trade for yr2020 local futures~ 😎⭐️

Happy Hunting! 🥂🚀

-jk-