CVR – Ready to Run, Monthly Confirmation In

Tons of strength showing on $CVRUSDT—expecting continuation from here and even more once the trendline breaks.

The monthly candle is confirming the move, pointing to a potential 6-month uptrend. Looks like this one is finally ready for the run we’ve been waiting for.

Buying here and stacking more around 90c if given the chance.

First target: above $2.

BINANCE:ENAUSDT may have gotten away—but this one won’t.

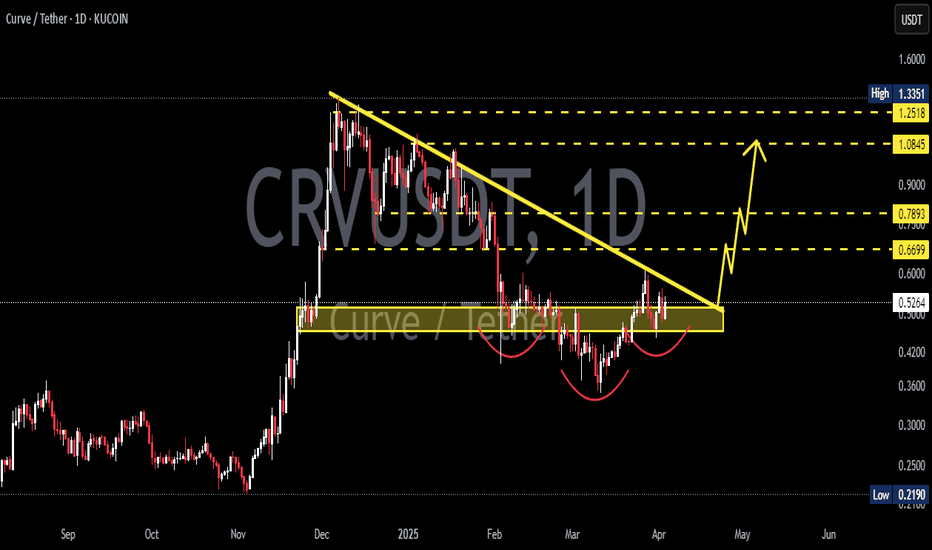

Crvusdtlong

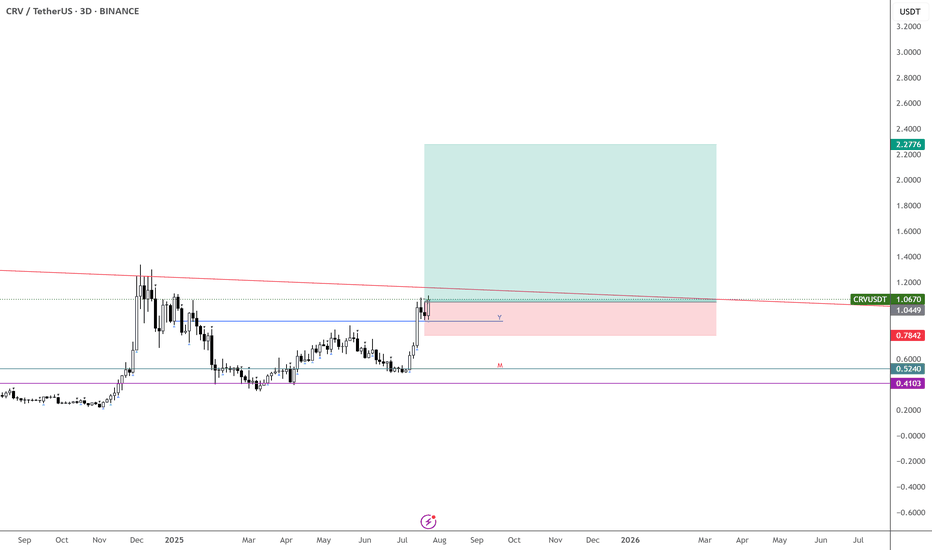

CRVUSDT 3D CURVE DAO TOKENDecided to update the idea. As always, key support and resistance levels are marked on the chart — along with price reactions at those zones.

Currently, we’re observing a potential breakout from a bull flag formation. The mid-term target lies in the $2.3 – $3.4 range, with a possible extension up to $4.8 as a maximum target.

⚠️ Don’t forget: there’s still a chance we get a retest of the bull flag — around the $0.64 level — before any major move to the upside. Manage your entries accordingly

CRV/USD on Coinbase Daily Chart Shows Strong Turn UpCRV/USD on Coinbase. This is a daily chart. The grey MA is the 200. The green is the 314 MA.

Looking at a 3d chart it is easy to see CRV is making a turn around after long downtrend.

The Daily chart here show a move up after ranging roughly between the 200 and 314ma's.

I have an alert set for a cross about the 200ma on the daily chart. If all looks good on lower time frames (1 and 4 hour) will be a LONG for me.

This is a really nice setup that could run and run. No prediction of take profit area. Just go with it and wait for a turn around. Could also be like the previous spike.

CRVUSDT Weekly Analysis – Major Trend Shift Unfolding!!Curve DAO Token (CRV):

Market Structure Overview

Uptrend Phase (2021 – mid-2022):

CRV was in a healthy bullish structure, printing consecutive Higher Highs (HH) and Higher Lows (HL). Momentum was strong and sentiment bullish.

Downtrend Phase (mid-2022 – end of 2024):

Price flipped structure and entered a long correction. We saw a series of Lower Highs (LH) and Lower Lows (LL) confirming the downtrend, following a firm rejection from the resistance zone (~$2.1).

Potential Reversal & New Uptrend (Post Dec 2024):

December 2024 marked a major structural shift. We printed a new Higher High and followed it with a Higher Low — a textbook uptrend confirmation.

Support Zone: $0.22 - $0.33

This area acted as a strong historical base — price respected this zone during accumulation and reversal attempts multiple times over the last 2 years.

Recent price action shows a bounce with volume, confirming demand interest.

Resistance Zone: $1.90 - $2.10

A heavy supply zone where price got rejected in past rallies.

A breakout and weekly close above this zone could signal the start of a strong continuation rally toward higher targets ($3.5+ range).

Break of Downtrend Line

The long-term diagonal resistance trendline has been broken decisively.

Price is consolidating above the trendline with structure favoring bulls — a strong signal of trend reversal.

Bullish Roadmap (if trend sustains)

The current rally could head toward $1.24 (mid-level key resistance).

If price holds and creates a Higher Low (HL), next upside extension could target the $2+ resistance zone.

Sustained break and hold above $2.10 will open room for a macro shift back toward bullish price discovery phases.

The macro chart of CRV is showing a clear transition from a multi-year downtrend into a potential uptrend. Confirmation through structure (HH & HL), breakout of long-term resistance, and a strong support base sets a solid technical foundation.

Keep CRV on your radar.

Patience is key. Let price confirm through weekly closes.

If you find this analysis helpful, please hit the like button to support my content! Share your thoughts in the comments, and feel free to request any specific chart analysis you’d like to see.

Happy Trading!!

#CRV/USDT#CRV

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.6600.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.6614

First target: 0.6840

Second target: 0.7120

Third target: 0.7420

CRV/USD "Curve Dao Token vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.4600) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 3H timeframe (0.3800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.5800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CRV/USD "Curve Dao Token vs U.S Dollar" Crypto Market Heist Plan is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, On Chain analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CRVUSDT - keep an eye on itCRV one on the most bullish coins in every bullish wave.

Daily chart shows a consolidation of symmetrical triangle pattern.

It gives positive sign as it breaks 0.5 fib , 50ema ... But still need more confirmation for being bullish

Valid to buy now

Ur target is 2$ at least in case of breakout the symmetrical triangle pattern

Best regards Ceciliones 🎯

CRVUSDT Potential Long Term Accumulation-DistributionAs On 01June 2024

In this analysis, we focus on a long-term accumulation strategy for CRVUSDT.

Accumulation Zones:

$0.4720: Identified as an accumulation entry point for 10-20% of your position. Potential price movement of approximately 10-15%.

$0.4300: Stronger accumulation zone for an additional 5-10%. Potential price movement of 20-25%.

$0.3750-0.3300: Critical demand zone, optimal for accumulating 10-20% of the position. Potential price movement of 35-45%.

Distribution Zones:

$0.7000: First major distribution zone for partial distribution of accumulated assets (1-5%). Potential price movement of 50%.

$1.1410: Next distribution zone for further distribution (5-10%). Potential price movement of 145%.

$2.0974: Higher distribution zone, ideal for 10-20% distribution. Potential price movement of 305%.

Volume Analysis: Increased volume at support levels indicates strong buying interest and validates accumulation zones.

Current market sentiment shows a mix of consolidation with potential bullish reversal signals, supported by the harmonic pattern and volume spikes at lower levels.

This long-term accumulation strategy for CRVUSDT focuses on systematically entering positions at identified accumulation zones and distributing at key distribution zones. This methodical approach aims to capitalize on both the technical patterns and market sentiment, ensuring a balanced risk-reward ratio.

Additional Details about Curve DAO Token (CRV):

Market Cap: Approximately $400 million

Fundamentals: Curve DAO Token is a decentralized exchange optimized for stablecoin trading. It provides low slippage and low fee swaps between stablecoins, making it an essential component of the DeFi ecosystem.

Potential: Increasing adoption of DeFi and the need for efficient stablecoin trading solutions.

Previous Idea:

The One Thing Everyone's Missing About CRVUSDT - Curve◳◱ On the BINANCE:CRVUSDT chart, the Bband Breakout pattern suggests an upcoming trend shift. Traders might observe resistance around 1.4705 | 1.7378 | 2.4061 and support near 0.8022 | 0.4012. Entering trades at 1.2631 could be strategic, aiming for the next resistance level.

◰◲ General Information :

▣ Name: Curve

▣ Rank: 99

▣ Exchanges: Binance, Kucoin, Huobipro, Gateio, Mexc, Hitbtc

▣ Category / Sector: Financial - Decentralized Exchanges

▣ Overview: Curve Finance is a decentralized exchange optimized for low slippage swaps between stablecoins or similar assets that peg to the same value (e.g. wBTC/renBTC). The protocol employs a Automated Market Maker that was built specifically to give DeFi users low slippage and liquidity providers steady fee revenue.

◰◲ Technical Metrics :

▣ Current Price: 1.2631 ₮

▣ 24H Volume: 138,006,035.406 ₮

▣ 24H Change: 6.943%

▣ Weekly Change: 4.76%%

▣ Monthly Change: 327.13%%

▣ Quarterly Change: 351.68%%

◲◰ Pivot Points :

▣ Resistance Level: 1.4705 | 1.7378 | 2.4061

▣ Support Level: 0.8022 | 0.4012

◱◳ Indicator Recommendations :

▣ Oscillators: NEUTRAL

▣ Moving Averages: STRONG_BUY

◰◲ Summary of Technical Indicators : BUY

◲◰ Sharpe Ratios :

▣ Last 30 Days: 9.88

▣ Last 90 Days: 4.84

▣ Last Year: 1.00

▣ Last 3 Years: 0.20

◲◰ Volatility Analysis :

▣ Last 30 Days: 1.89

▣ Last 90 Days: 1.32

▣ Last Year: 1.11

▣ Last 3 Years: 1.12

◳◰ Market Sentiment :

▣ News Sentiment: N/A

▣ Twitter Sentiment: N/A

▣ Reddit Sentiment: N/A

▣ In-depth BINANCE:CRVUSDT analysis available at TradingView TA Page

▣ Your thoughts matter! What do you think of this analysis? Share your insights in the comments below. Your like, follow, and support are greatly valued and help sustain high-quality content.

◲ Disclaimer : Disclaimer

The content provided is for informational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult a qualified professional before making any financial decisions. Use of the information is solely at your own risk.

▣ Explore the Power of Charting with TradingView

Unlock a wide range of financial analysis tools, data, and features to elevate your trading experience. Take a tour and see the possibilities. If you decide to upgrade your plan, you can receive up to $30 back. Discover more here - affiliate link -

CRVUSDT Potential Long Term Accumulation-DistributionIn this analysis, we focus on a long-term accumulation strategy for CRVUSDT.

Accumulation Zones:

$0.4720: Identified as an accumulation entry point for 10-20% of your position. Potential price movement of approximately 10-15%.

$0.4300: Stronger accumulation zone for an additional 5-10%. Potential price movement of 20-25%.

$0.3750-0.3300: Critical demand zone, optimal for accumulating 10-20% of the position. Potential price movement of 35-45%.

Distribution Zones:

$0.7000: First major distribution zone for partial distribution of accumulated assets (1-5%). Potential price movement of 50%.

$1.1410: Next distribution zone for further distribution (5-10%). Potential price movement of 145%.

$2.0974: Higher distribution zone, ideal for 10-20% distribution. Potential price movement of 305%.

Volume Analysis: Increased volume at support levels indicates strong buying interest and validates accumulation zones.

Current market sentiment shows a mix of consolidation with potential bullish reversal signals, supported by the harmonic pattern and volume spikes at lower levels.

This long-term accumulation strategy for CRVUSDT focuses on systematically entering positions at identified accumulation zones and distributing at key distribution zones. This methodical approach aims to capitalize on both the technical patterns and market sentiment, ensuring a balanced risk-reward ratio.

Additional Details about Curve DAO Token (CRV):

Market Cap: Approximately $400 million

Fundamentals: Curve DAO Token is a decentralized exchange optimized for stablecoin trading. It provides low slippage and low fee swaps between stablecoins, making it an essential component of the DeFi ecosystem.

Potential: Increasing adoption of DeFi and the need for efficient stablecoin trading solutions.

CRV/usdt buying idea hi everyone im msnp

ok today we have CRV i think he has good potential for mid term like 6 month to get above 1$

we hit ATL and bonus up and before any major pullback we saw 0.36 now we are in a correction but when bull trend start? i think we have to test 50% of W pivot ( 0.27 -0.26 ) and we have a expending triangle but the important thing is BTC how he is acting in this period of time

i think we are in a good phase

TARGET 1 : 0.50 %

target 2 : 0.85%

target 3 : 1.5 %

#CRV/USDT#CRV

The price is moving in a descending channel on the 12-hour frame and is sticking to it very well and is expected to break it upwards

We have a bounce from a major support area in green at 0.5250

We have an uptrend on the RSI indicator that was broken upwards which supports the rise

We have a trend to stabilize above the 100 moving average which supports the rise

Entry price 0.3000

First target 0.4000

Second target 0.5071

Third target 0.5071

CRVUSDT 1H - Needs to break the triangleCRVUSDT 1H - Needs to break the triangle

TRADEX BOT NEWS:

We already have an improved version of the autotrading bot. This version allows for scalability of the project. The bot needs much less resources, we have eliminated weak links making the process much more straightforward. As for execution, there is almost no delay, it is immediate at market price.

We are now improving the mathematical execution logic to summarize the tests with different strategies.

It will be ready very soon :)

If you like my AT, and you agree with the approaches, please FOLLOW ME and press BOOST so we can share it with more people. We are working on an automated trading tool so that everyone can apply their strategies in a VISUAL and PROFESSIONAL way, as we present in the analysis.

Thank you!

_______________________________________________________

CRVUSDT 1H - Needs to break the triangle

CRV is in a critical resistance zone of the triangle that it has been forming.

If you want to join a bullish rally, you must break these levels. Otherwise, the price structure will deteriorate more and more and it will no longer be attractive to hold.

LEVELS:

TP: 0.38

BUY: 0.267

SL: 0.255

SUPPORT: 0.21

Good luck in your decision making.

______________________________________________________

Automated Cryptocurrency Trading Bots: All these strategic alternatives can be configured with TradeX BoT, since it will allow you to position in both directions without having to block any amount per position. It will only be necessary for the conditions to be met, either downward or upward, for the orders to be executed in one direction or the other, taking the necessary deposits from your portfolio.

TradeX BoT (in development): Tool to automate trading strategies designed in TradingView. It works with both indicators and technical drawing tools: parallel channels, trend lines, supports, resistances... It allows you to easily establish SL (%), TP (%), SL Trailing... multiple strategies in different values, simultaneous BUY-SELL orders, conditional orders.

This tool is in the process of development and the BETA will soon be ready for testing.

FOLLOW ME and I will keep you informed of the progress we make.

I share with you my technical analysis assessments on certain values that I follow as part of the strategies I design for my portfolio, but I do not recommend anyone to operate based on these indicators. Inform yourself, educate yourself and build your own strategies when investing. I only hope that my comments help you on your own path :)

CRV/USDT Trading Scenario UpdateThe asset is currently trading at $0.2568, which is significantly lower than its local high of $6.7862—a decline of over 97%. However, despite this drop, the Curve Finance platform continues to draw attention from market participants, maintaining a Total Value Locked (TVL) of $1.8 billion, indicating a high level of trust in the ecosystem.

Volume profile analysis shows considerable interest in the asset within the current price range, which could signal the formation of a strong support level. Increased trading volumes further suggest heightened buyer activity, creating potential for a price recovery.

CRVUSDT 4H - LONGS within the bearish channelCRVUSDT 4H - LONGS within the bearish channel

If you like my AT, and you agree with the approaches, please FOLLOW ME and press BOOST so we can share it with more people. We are working on an automated Trading tool so that everyone can apply their strategies VISUALLY and PROFESSIONALLY, as we present in the analysis.

Thank you!

____________________________________________________________________

CRVUSDT 4H - LONGS within the bearish channel

CRV is the CURVE token, one of the most important platforms of the DEFI system.

CRV is within a bearish channel that has been correcting its value from $1.30. Within this channel, it is beginning to create a floor and a reversal figure that can generate large profits as long as we respect the SL.

LEVELS:

SL: 0.2424

Resistance 1: 0.5052

Resistance 2: 0.62 (top of the bearish channel)

TP: 0.902

_____________________________________________________________________

Crypto Trading Automated Bots:

You can configure all these strategic alternatives with TradeX BoT, since it will allow you to position in both directions without having to block any amount per position. It will only be necessary for the conditions to be met, either downwards or upwards, for the orders to be executed in one direction or the other, taking the necessary deposits from your portfolio.

TradeX BoT (in development): Tool to automate trading strategies designed in TradingView. It works with both indicators and technical drawing tools: parallel channels, trend lines, supports, resistances... It allows you to easily establish SL (%), TP (%), SL Trailing... multiple strategies in different values, simultaneous BUY-SELL orders, conditional orders.

This tool is in the development process and will soon be ready for BETA testing.

FOLLOW ME and I will keep you informed of the progress we make.

I share with you my technical analysis assessments on certain stocks that I follow as part of the strategies I design for my portfolio, but I do not recommend anyone to operate based on these indicators. Get informed, train yourself and build your own strategies when it comes to investing. I only hope that my comments help you on your own path :)