XRP Ready To Grow: $4.5 w/ 5X Lev = 475% Profits PotentialThe last time XRP moved above EMA55 daily was in early November 2024, you know pretty well what happened right after. Just a few days after EMA55 was conquered as resistance XRP grew from a price of $0.54 to a peak of $2.90 in less than one month. It continued to rise and peaked again but this time at $3.40. The market turns bullish above EMA55 and this same signal is active, valid, live today.

XRPUSDT has been fighting with EMA55, fluctuating around this level, since late April. Now, this resistance is no more. The bullish bias is fully confirmed after a decisive higher low. This is it... This is all we need, the next target is up.

» 95% is the easy target at $4.50. With 5X lev. we get 475%.

We've done this together many times before... This is not the last target but since this is a strong resistance we can wait for the retrace and enter again once support is found. That is, there will be a stop at this level.

This is a strong chart setup. The price is not the best ever, it would be better to enter lower and that is why we have only 5X. With a lower price we can do 7X, 8X and even up to 10X. Hardly ever I recommend more than 10X, it just isn't necessary and the risk is too high.

I am wishing you great profits and continued success.

This is a friendly reminder to let you know that XRP is ready to grow.

Thank you for reading.

Namaste.

Crypto

Evolving Price & Candle Patterns: BitcoinLook what is happening here with the candle patterns and price action. In the most recent challenge of resistance something changed. Change is good. It can mean the end of this sideways period.

At (1) Bitcoin finds resistance and immediately starts a decent. The same happens at (2). When we reach (3) everything changes. (1) & (2) produced a low and lower low. The down-move was extended. (3) produced only two red candles, a strong higher low and the third day was a full green candle moving above the descending trendline resistance. The price pattern is now erratic, completely different to previous moves.

Now, consider (4). If the strong green candle was intended as a bull-trap, then we would expect a down-move to follow right after the peak, just as it happened with (1) and (2). But nothing, after (4), Bitcoin has been sideways within the bullish zone.

This change is good, bullish.

A drop can develop anytime but the market already had two changes to produce a down-wave, (3) and (4). The fact that a down-move didn't materialize means that the market has something different in store for us, change. This change is good because when resistance is challenged, prices tend to drop when the market is moving within a range. No drop can signal the end of the range trading which in turn can translate into the start of the next bullish wave.

If this idea turns out to be true, Bitcoin will start growing within days. Growth should be strong because consolidation has been happening for months.

Namaste.

[CRYPTO] - Last Pump of the BULL CYCLE is ComingWe can see a highly organised bull cycle , with each multi-month consolidation wedge followed by a major leg upward, ending in breakout and continuation.

At the moment the CRYPTOCAP:TOTAL is breaking through the descending resistance again and ready to break thorough the 0.786 Fibo level as well - clear sign of the new up-rally beginning. Prior patterns (Q3 2023 and Q2 2024) led to vertical rallies , and the current structure suggests another leg may target the $6T+ zone in coming quarters.

What makes this different from past cycles is the underlying strength in Ethereum and other Altcoins. CRYPTOCAP:BTC.D has started to roll off highs, while projects like CRYPTOCAP:SOL , CRYPTOCAP:SUI and AI-related chains ( NYSE:FET , GETTEX:TAO , EURONEXT:RNDR ) are gaining TVL and developer traction. This is not just retail speculation—institutional capital is increasingly driving flows.

Moreover , Bitcoin ETF keeps getting huge daily inflows, the narrative of Coinbase including in S&P500 and Stablecoins velocity rising helps in spreading the crypto narrative between insituational & retail investors.

You can read more about why I expect a ton of money to inflow crypto in the next 6 - 12 months in one of the previous ideas: Again/

Overall , the chart structure, macro catalysts, and expanding adoption point toward a potential parabolic leg into late 2025 or early 2026. As long as the market holds above $3.3T, the breakout is valid and bulls are in control. The target is $5.5T —and possibly higher.

If Pulsechain reaches a penny, it would = a 325XOr around $165 billion in user-based valuation, excluding the significant portion of coins held by the founder.

It's certainly a long shot, and it would probably depend on Ethereum's price reaching well into the teens

(which, as you know, I strongly support).

Thus, it is definitely within the realm of possibility considering the low initial user base and the potential influx of individuals who will join EVMs in the upcoming years.

Is #RENDER Ready for a Reversal or Will it Continue to Fall?Yello, Paradisers! Is this just another range before a full reversal or a sneaky trap waiting to punish early buyers of #RENDER? Let's see the latest analysis of #RENDERUSDT:

💎After several weeks of slowly bleeding within a clean descending channel, #RENDERUSDT is now attempting a breakout from that structure. While the move isn’t confirmed just yet, this is the first real signal that sellers are losing momentum, and a shift could be on the table. Price is currently hovering just above the $3.15–$3.20 zone, and the next few candles will be key.

💎If buyers step up and push #RENDER through this upper trendline with strength, we have a clear runway toward the moderate resistance at $4.20. And if that gets taken out, the next strong resistance area comes in at $5.35, where we expect heavy distribution. But for now, it’s all about reclaiming and holding above this descending structure.

💎So what gives this setup real potential? The demand zone at $2.97 held like a fortress. If it fails, the next line of defense is a strong demand zone at $2.50. Buyers defended it multiple times and sparked a mini-reversal off the bottom of the channel. This demand zone is our launchpad, and as long as the price stays above it, bulls are still in control.

💎But make no mistake: if price loses $2.97, the bullish setup is invalidated. That would open up a deeper drop back toward $2.50 or lower, and we’ll step aside to wait for a better entry again.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

Is a Breakout Imminent for #GRT or Another Bull Trap is Ahead?Yello, Paradisers! Are we looking at a clean breakout setup that could send #GRT flying or is this the perfect trap to wipe out early bulls? Let's see the latest #GRTUSDT moves:

💎The daily chart on #GRTUSD is showing a perfectly formed descending channel, with price now hovering just above the lower boundary—a zone that has consistently held as strong descending support. After multiple rejections from the upper boundary and rebounds off the lower trendline, the price has now shown its first serious signs of momentum since bottoming in the strong demand zone

💎This structure has been in play since early May for #TheGraph, with each bounce from the support line giving temporary relief, only for the price to get slapped down at the descending resistance. But this most recent bounce looks different—it’s happening directly above a well-defined demand zone between $0.0668–$0.0700, a level that has historically attracted strong buyer interest.

💎A breakout above the descending resistance trendline, ideally with a strong daily close above $0.085–$0.090, would invalidate the bearish pressure and likely trigger a sharp leg up. The mid-term resistance sits around $0.1032, and clearing that would open the door to a retest of $0.1318, a level that previously acted as a strong rejection zone.

💎If the price fails to reclaim the descending channel and rolls over again, especially losing $0.0668 on a daily close, the bullish structure would be invalidated. That would shift focus toward the support zone at $0.053, and if that breaks, the next target becomes $0.0300—a brutal drop that would liquidate most late longs and signal deeper downside.

Stay disciplined. The next big opportunity will come to those who wait, not those who chase.

MyCryptoParadise

iFeel the success🌴

HolderStat┆ETHUSD seeks to $3200KUCOIN:ETHUSDT surged after breaking out of a triangle and pushing through multiple resistance levels. The latest move above $2,900 confirms a bullish continuation, with $3,200 as the next major zone. Consolidation below resistance has built the base for the current rally.

BTC/USDT : Breaks Out – New Highs In Sight After Smashing $111K!By analyzing the Bitcoin (BTC) chart on the weekly timeframe, we can see that the price has finally started to rally as expected—successfully hitting the $111,700 target and even printing a new high at $111,999 with an impressive pump.

This analysis remains valid, and we should expect new all-time highs soon.

The next bullish targets are $124,000 and $131,800.

THE WEEKLY TF ANALYSIS :

Tesla (TSLA) 1-hour chartTesla (TSLA) 1-hour chart im provided, here are the key bullish target points indicated by the chart analysis:

📈 Bullish Target Points (Upside Levels):

First Target Point:

🔹 Around $338.00 – $340.00

This level is marked as the initial breakout target, likely based on recent price structure and resistance zone.

Second Target Point (Extended Target):

🔹 Around $362.00 – $364.00

This is the higher target zone, representing a potential move if bullish momentum continues strongly. Likely aligning with a measured move or previous highs.

🧠 Context:

Price has broken out of a descending triangle/wedge pattern, a bullish signal.

It's also moving above the Ichimoku cloud, showing short-term bullish trend continuation.

Holding above the breakout level (around $305–$308) is critical to maintain upward momentum.

ADA/USDT : ADA Rally in Motion – Over 20% Gain and More to Come?By analyzing the Cardano (ADA) chart on the 3-day timeframe, we can see that after revisiting the $0.57 zone, the price once again followed the previous analysis and encountered strong buying pressure—rallying up to $0.61 so far.

The return from the previous entry has now exceeded 8%, and the overall gain from the full move stands above 20%.

The next bullish targets are $0.76, $0.93, $1.05, and $1.33.

(A deeper and more detailed analysis is recommended for long-term investment decisions.)

THE MAIN ANALYSIS :

Bitcoin (BTC/USDT) on the 1-hour timeframeBitcoin (BTC/USDT) on the 1-hour timeframe:

🔽 Bearish Target Points (Downside Levels):

First Target: ~116,157.55 USDT

This level is close to the upper edge of the Ichimoku Cloud (Kumo), which can act as initial support.

Second Target: ~113,686.49 USDT

This is the deeper pullback level, marked clearly as the main "Target Point" on the chart. It aligns with historical structure and is near the lower part of the cloud.

🧠 Summary:

The chart suggests a potential pullback from the recent all-time high (~118,110 USDT).

If price breaks below 116k, the next major support is ~113.6k.

Traders might look for buy entries at these levels if price action confirms support.

USD/CHF (1-hour timeframe)USD/CHF (1-hour timeframe), the analysis appears to include:

Ascending triangle pattern (with higher lows and a horizontal resistance).

Ichimoku Cloud for trend analysis.

Two marked target levels with projected breakout potential.

Identified Targets:

1. First Target:

🔹 Around 0.80000

This is just above the current resistance zone and seems to be the initial breakout target if price breaks the horizontal resistance.

2. Second Target (Final Target):

🔹 Around 0.80300 – 0.80350

This is the next higher resistance or profit-taking zone based on projected move from the triangle breakout.

---

Summary:

If the price breaks and closes above the horizontal resistance (approx. 0.79850), your potential targets are:

🎯 Target 1: 0.80000

🎯 Target 2: 0.80300–0.80350

Keep an eye on price action and volume confirmation before entry. Let me know if you want stop-loss suggestions or a risk/reward breakdown.

GBP/USD chart (1H timeframe)GBP/USD chart (1H timeframe), potential breakout from a descending channel, supported by the Ichimoku Cloud and marked target levels.

📈 Current Analysis Highlights:

Price is near the lower end of the descending channel.

A bullish reversal setup is forming.

I'm drawn two Target Points indicating a breakout and continuation.

---

🎯 Target Levels (as per your chart):

1. First Target Point:

🔹 1.36200 — This is the initial resistance level or TP1 if price breaks above the Ichimoku cloud and mid-channel resistance.

2. Final Target Point:

🔹 1.36800 — This is the upper resistance zone and aligns with the top of the descending channel, a likely TP2 area if bullish momentum continues.

---

✅ Summary:

Entry idea: After confirmation of a breakout above the cloud (~1.35600).

TP1: 1.36200

TP2: 1.36800

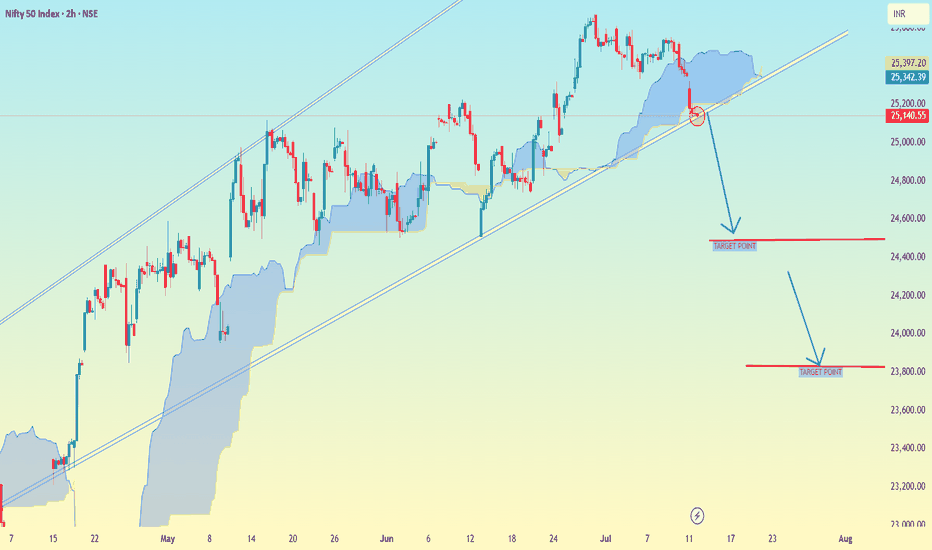

Nifty 50 Index (2h time frame)Nifty 50 Index (2h time frame), here is the analysis and potential target levels:

🔍 Technical Breakdown:

Trendline Break: The chart shows a rising trendline which has been broken to the downside.

Ichimoku Cloud: Price has moved below the cloud, indicating bearish momentum.

Arrows & Levels: Two downward arrows suggest potential drop zones.

🎯 Target Levels (as marked on chart):

1. First Target Zone:

📍 Around 24,400

Likely first support zone / take-profit level after breakdown.

2. Second Target Zone:

📍 Around 23,800

Deeper correction zone based on prior support and structure.

✅ Summary:

If the breakdown sustains below the trendline and cloud:

Immediate target: 24,400

Extended target: 23,800

Let me know if you want stop-loss ideas or a risk/reward plan for this trade.

BITCOIN's PUMPs are Getting LARGER this Bull Market...However, it may take a bit longer to realize those expansionary moves.

If Bitcoin adheres to the established cycle pattern, we can anticipate a minimum surge of 103% that should carry us into the fourth quarter of this year.

Consolidation ----> Fake breakdown ----> then expansion.

Are you ready?

(BTC/USDT) appears to be around $120,000.(BTC/USDT) appears to be around $120,000.

Here's a quick analysis of what the chart suggests:

Timeframe: 1D (Daily)

Current price: ~$111,150

Technical Indicators:

Ascending triangle breakout is indicated.

Ichimoku Cloud shows bullish momentum (price above the cloud).

The breakout is targeting a horizontal resistance zone around $120,000.

✅ Target Zone:

Target Point (based on breakout projection): $120,000 – $124,000

This target aligns with previous resistance levels and technical breakout patterns.

Let me know if you want a more detailed technical breakdown (e.g., support/resistance zones, volume analysis, RSI, etc.).

DeGRAM | SUIUSD got out of the channel📊 Technical Analysis

● Price pierced the four-week falling-channel roof and the apex of a contracting triangle, turning 2.88 support into a launchpad and carving a sequence of higher lows.

● Breakout measured move and channel mid-band converge at 3.15; a close above there exposes the next horizontal barrier and channel top at 3.46. Risk is framed by the former triangle base at 2.88 and major swing floor 2.69.

💡 Fundamental Analysis

● Sui’s on-chain TVL has climbed >15 % since 25 Jun after zkLogin main-net rollout and Mysten Labs’ new developer grants, underpinning demand despite broad market lethargy.

✨ Summary

Long 2.90-3.05; hold above 3.15 targets 3.46. Invalidate on a 4 h close below 2.88.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Altcoins Market Cap: We on the Verge of a 5T Exposion!Hey crypto traders! Let’s dive into this monthly chart of the Altcoins Market Cap. You won’t believe what’s brewing!

We’re currently approaching a critical channel support at 200B, a level that might act as a springboard for massive rally — check out the jumps from channel support in 2019 and 2023! Each time the market cap hit this support, it skyrocketed, and now we’re at that pivotal moment again.

The chart projects a jaw-dropping target of $5T within the next 24 months if history repeats itself!

The price action shows we’re testing the lower boundary of this ascending channel, with the market cap sitting around 239.65B. A bounce here could send altcoins on a parabolic run, potentially hitting 5T by mid-2026. But if support fails, we might see a dip toward 100B — let’s keep an eye out!

Key Levels to Watch:

Support: 175B (channel support)

Resistance: 1.55T, 5T (projected target)

Breakdown Risk: 100B

Are altcoins about to explode to 5T, or will we see a deeper correction? Drop your thoughts below!

PS take a look at others vs. btc price action here:

XRP/USDT Monthly Chart: History Repeating Itself?Hey traders! Let’s dive into this monthly XRP/USDT chart. I’ll be honest — I’m skeptical about this outcome, but let’s break it down because it could actually happen!

The chart screams déjà vu, with XRP’s price action mirroring the 2014-2018 period. Back then, XRP broke out from its 2014 ATH in 2017, leading to a massive rally. Fast forward to now, and we’re seeing a similar setup, but with a twist. XRP is struggling to break through the 2018 ATH resistance zone around $3.31, which reminds me of the Breakout Consolidation phase we saw in 2017. Historically, this consolidation led to a breakout, and the chart hints at a potential repeat!

If XRP breaks out soon, we could see a parabolic move, potentially targeting much higher levels. However, the current resistance is a tough hurdle, and if it fails, we might see a pullback to lower supports.

Key Levels to Watch:

Resistance: $3.31 (2018 ATH)

Support: $1.643 (previous consolidation low)

Breakout Target: To be determined (potentially parabolic)

Breakdown Risk: $0.650

I’m not fully convinced, but the setup is intriguing — could this be XRP’s moment to shine? What do you think? Let’s discuss below!