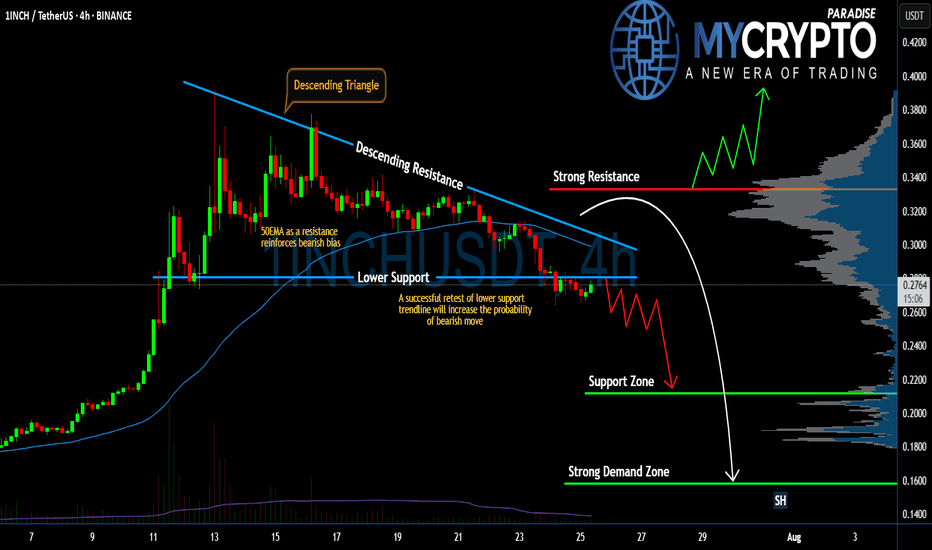

#1INCH Setup Favors Bears | Can Bears Pull it Down Further? Yello Paradisers! Are you prepared for what might be the next big move on #1INCHUSDT? The #1INCHNetwork is flashing clear warning signs:

💎#1INCH is currently trading inside a Descending Triangle, a pattern that historically favors bears. The price has broken down the lower support and is coming to retest it. If #INCHUSD retests the lower support and doesn't enter the descending triangle, the probability of the bearish pressure will increase.

💎The 50 EMA is acting as a strong dynamic resistance, reinforcing the bearish bias. Every attempt to reclaim higher levels has been rejected, and as long as we remain capped below the descending resistance, bulls are at a clear disadvantage.

💎A successful retest of the lower support trendline will significantly increase the probability of a breakdown. If this triangle finally breaks to the downside, we should be watching the $0.2116 support zone as the first key level to catch any temporary reaction.

💎But the real danger — and opportunity for patient traders — lies lower. If $0.2116 fails, the next strong demand zone sits at $0.1582, which could be the level where real buyers finally step back in. Until then, any bullish scenario remains invalid unless the price breaks and closes above the strong resistance at $0.3332.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

Cryptoanalysis

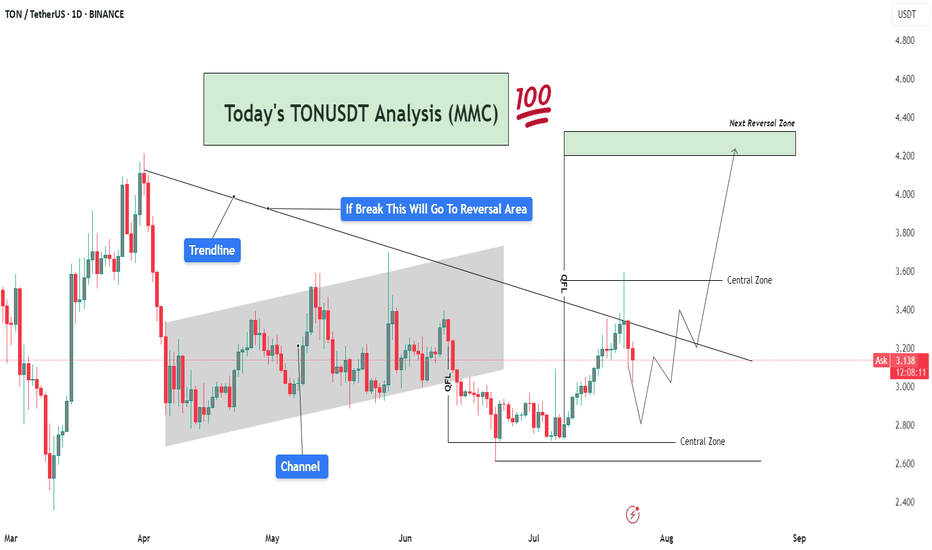

TONUSDT Analysis – Trendline Breakout Target To Reversal Area🧠 Market Sentiment & Context:

TONUSDT (Toncoin vs USDT) is currently trading at $3.13, showing signs of compression within a well-defined MMC structure. After forming a clear QFL (Quick Flip Level) base, the market is approaching a decisive breakout level, with a strong rejection or breakout likely in the coming days.

This chart displays confluence from trendlines, channel breaks, central zones, and QFL demand zones, providing multiple layers of structure-based decision-making. Here's a deeper dive 👇

🔍 Technical Breakdown – What the Chart Is Telling Us:

🔸 1. Major Trendline Resistance – Bearish Control Zone

The descending trendline drawn from prior highs is acting as dynamic resistance.

Price tested this line recently and faced rejection, showing that sellers are still active.

However, the consolidation below the trendline suggests accumulation, not panic selling — a classic sign of smart money positioning before a breakout.

🔸 2. Previous Channel Structure – Broken & Retested

The price previously moved inside a slightly rising parallel channel, reflecting a slow and steady bullish phase.

The channel has now been broken, but TON quickly reclaimed structure via a strong bullish engulfing candle from the QFL base, hinting that this was a liquidity grab (stop hunt) before the real move.

🔸 3. QFL (Quantity Following Line) – Institutional Demand Zone

The QFL base at around $2.85–$3.00 was created after a swift sell-off followed by immediate bullish response.

This is a high-probability MMC reversal structure, where large buyers typically enter.

Since this QFL held firm, it has created a solid foundation for bullish momentum, provided the trendline is eventually broken.

🧭 What's Happening Now – Price Action Update:

Price is caught between two major Central Zones:

Lower Zone: $2.85 – $3.15 (Support)

Upper Zone: $3.50 – $3.70 (Resistance)

The current movement shows price creating higher lows, indicating bullish pressure building beneath the trendline.

Volume remains low, which means the market is waiting for a catalyst (news or breakout) before a directional push.

📌 Key Reversal Zone Ahead – Eyes on $4.20 to $4.40

If price breaks and closes above the descending trendline and crosses the upper central zone, we can anticipate a strong bullish move toward the Next Reversal Zone marked around $4.20–$4.40.

This zone has historical confluence as:

Previous strong supply zone

Psychological round number

Fibonacci extension alignment

This will likely be the profit-booking area for swing traders and early buyers from the QFL zone.

📈 Trade Scenarios Based on MMC:

✅ Bullish Scenario (High Probability If Breakout)

Price breaks the trendline → Pullback → Retest of $3.50–$3.60 zone

Bullish continuation to $4.20–$4.40 Reversal Zone

Ideal entry on retest after breakout

Stop-loss below $3.00

❌ Bearish Scenario (If Rejected Again)

Rejection from trendline leads to re-test of lower Central Zone

Breakdown of QFL level (~$2.85) would invalidate bullish setup

Potential drop toward $2.60 zone for liquidity sweep

🧠 MMC-Based Observations:

🔹 MMC Element 📍 Explanation

🔺 Trendline Key resistance from macro downtrend

🟩 Central Zones Neutral battleground for buyers/sellers

🔻 Channel Break Confirmed bearish momentum earlier, now tested

✅ QFL Strong base, showing early smart money entries

🎯 Reversal Zone High-risk area, expect volatility and profit-taking

📌 Strategic Summary:

Bias: Bullish (as long as price holds above $3.00)

Confirmation Needed: Daily candle close above trendline & $3.50 zone

Target 1: $3.85

Target 2: $4.20–$4.40 (main reversal)

Invalidation: Close below $2.85 (QFL loss)

🚨 Final Thoughts:

TONUSDT is showing clear smart money footprints via the QFL formation and trendline pressure. The setup is ideal for MMC-based breakout traders waiting for confirmation before entering. Volume spike + trendline break will likely spark the next impulsive rally.

Stay patient, and trade the reaction, not the prediction.

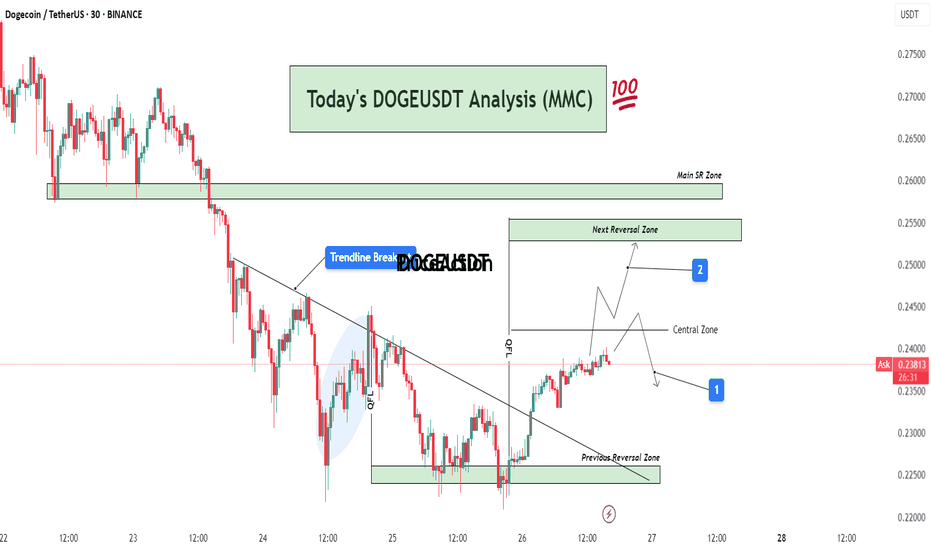

DOGEUSDT Analysis : Bullish Breakout, Reversal Zones + Target📊 Full Technical Analysis:

This chart presents a structured and precise MMC-based analysis of DOGE/USDT on the 30-minute timeframe, integrating key price action zones, trendline structure, and potential market scenarios.

🧩 1. Downtrend Phase and Trendline Formation

DOGE was in a continuous downtrend, creating lower highs and lower lows. A bearish trendline had been acting as dynamic resistance for multiple sessions. Price consistently respected this trendline, indicating strong seller dominance.

However, after repeated taps on the trendline and rejection from lower support, price finally broke above the trendline — marking a potential trend reversal or corrective phase.

🔄 2. Previous Reversal Zone – Demand Zone (0.225–0.228)

This zone acted as the major turning point where buyers aggressively stepped in. The demand was previously tested and respected, indicating strong accumulation here.

From this zone, a bullish reversal was initiated, leading to the current price rally.

This area can now be considered a structural support base – ideal for watching future re-tests or consolidation.

🔁 3. Central Zone – Decision Area (0.238–0.240)

This is a critical intraday resistance zone acting as a central decision-making area for traders.

Two Key Scenarios Could Play Out from Here:

Scenario 1 (Marked by Blue Box 1):

Price could face rejection from this zone and fall back slightly toward minor support levels for a retest or liquidity grab. If bullish pressure sustains, a higher low may form before continuation upward.

Scenario 2 (Marked by Blue Box 2):

If price breaks above the central zone with strong volume, momentum can push it toward the Next Reversal Zone between 0.250–0.255.

In either case, watching price behavior and candle structure near the central zone is critical for confirmation of the next move.

🔼 4. Next Reversal Zone – Supply/Resistance (0.250–0.255)

This zone marks a historical resistance area where DOGE faced heavy selling pressure before.

If price reaches this zone, expect:

Either profit-taking and short-term selling from intraday traders.

Or a possible breakout continuation if broader market sentiment remains bullish.

This zone will act as a key test of DOGE's strength and market conviction.

📌 5. Main SR Zone – Strong Structure (0.258–0.260)

Beyond the Next Reversal Zone lies the Main SR (Support-Resistance) Zone, where price has reacted strongly in the past.

If DOGE manages to break and hold above the 0.255 range, this zone will likely become the next upside target and strong resistance zone.

🔍 Additional Market Context:

Breakout Volume: The trendline breakout was accompanied by rising volume, which suggests stronger conviction behind the move.

QFL Zone: Price structure also aligned with a QFL (Quick Flip Level) bounce within the shaded region before breakout, further validating the bullish pressure.

Psychological Levels: 0.240 and 0.250 are psychological levels, which often act as magnet points and temporary resistance/support.

🧠 Mirror Market Concepts (MMC) Insight:

This analysis is rooted in Mirror Market Concepts, where the market tends to reflect past behavioral zones. Each marked zone (Demand, Central, Reversal, SR) is based on previous reaction points that guide current sentiment.

The market is now in a mirror reaction phase, moving from the previous demand zone toward historical supply zones. If the symmetry continues, the pattern supports a gradual bullish continuation with measured pullbacks.

✅ Trading Plan (Educational Purpose Only – Not Financial Advice):

Entry Zone 1: Breakout traders may have entered after the trendline breakout near 0.233–0.235.

Entry Zone 2: Conservative traders can look for retest confirmation in the Central Zone.

Target Zone: Next Reversal Zone (0.250–0.255) and possibly Main SR (0.260).

Stop Loss: Below the Previous Reversal Zone (~0.224) for swing setups.

Risk-to-Reward: RR setup of 1:2 or higher possible depending on entry strategy.

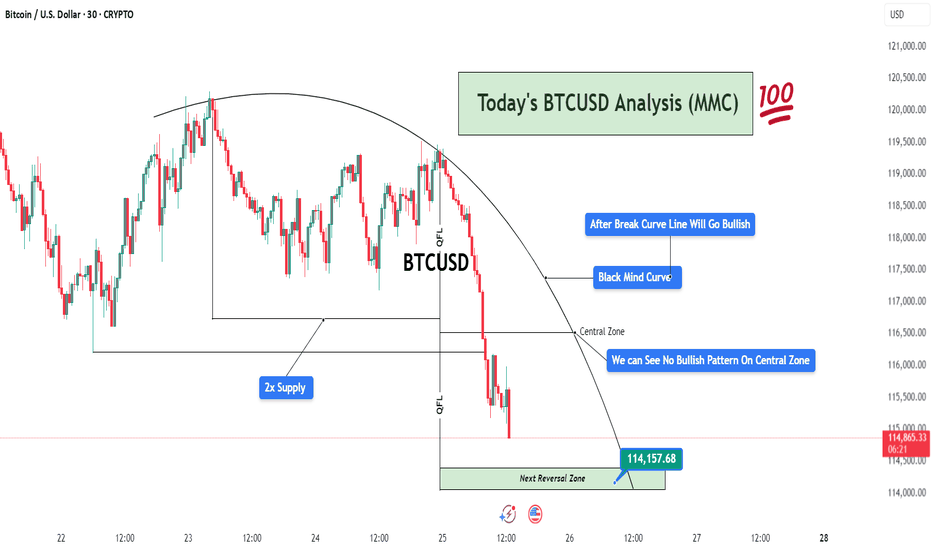

BTCUSD Analysis (MMC) – Bearish Flow Toward Reversal ZoneThis 30-minute BTCUSD chart highlights a well-structured bearish movement following the MMC (Mirror Market Concepts) framework. The analysis centers around the Black Mind Curve, multiple QFL drops, and supply/demand imbalances, presenting a professional outlook on current price action and potential reversals.

🧠 Black Mind Curve – Mapping Market Psychology

The Black Mind Curve is a visual representation of the market’s psychological behavior and serves as a dynamic resistance throughout this structure. Price respected the curvature, slowly losing bullish strength while forming lower highs.

This curve mirrors a distribution phase, where smart money unloads long positions before initiating a downside move.

Your annotation: “After Break Curve Line Will Go Bullish” implies that unless the curve is cleanly broken with strong bullish conviction, the bias remains bearish.

So far, the price is respecting the curve, reinforcing sellers’ control.

🔵 2x Supply Zone – Aggressive Selling Region

The supply zone is tested twice, confirming the presence of institutional-level sellers. This zone becomes critical because:

First touch: Minor reaction, but no follow-through.

Second touch: Strong rejection with extended downside move.

The double rejection clearly shows that buyers are trapped, fueling bearish momentum.

From an MMC view, this confirms the beginning of the “Mirror Market Shift” — where smart money rotates out of longs and traps retail longs near resistance.

📉 QFL (Quick Flip Liquidity) Events – Momentum Crashes

Two major QFL-based breakdowns appear in the chart after price consolidated within ranges. These drops are essential to understand:

QFL reflects market structure breaks where liquidity is engineered, and a sharp sell-off follows.

The first QFL drop occurs after the curve-resistance rejection, and the second confirms continuation.

These are liquidity runs, used to clear stop-losses and maintain bearish pressure.

This creates a domino effect — each QFL level becomes a signal of deeper imbalance.

⚠️ Central Zone – No Bullish Pattern Detected

The Central Zone marks a temporary support or midpoint level — a place where price might find footing if buyers show up.

However, as you noted:

“We Can See No Bullish Pattern On Central Zone”

No bullish engulfing candle.

No pin bar rejection.

No spike in volume.

No market structure shift.

This confirms that buyers are either weak or absent in this zone. MMC traders use this info to stay with the dominant trend (bearish) until proven otherwise.

🟩 Next Reversal Zone – 114,157.68 (Critical Demand Zone)

The green zone marked as “Next Reversal Zone” is a key level to monitor:

This area aligns with historical demand, where BTC previously reversed or slowed down.

Price is likely to hunt liquidity below recent lows before a potential bullish reaction.

It’s a Smart Money zone — designed to trap breakout sellers and absorb volume for a reversal.

Traders should watch for:

Bullish engulfing patterns

Break of structure to the upside

Divergence with RSI/volume

Sweep and reclaim setup

Once the price enters this zone, MMC reversal tactics come into play — buyers may step in aggressively here.

📅 Fundamentals & Timing

At the bottom of the chart, we see upcoming U.S. economic news events, which can act as volatility catalysts. Price could reach the reversal zone just before or during high-impact news, which aligns perfectly with smart money manipulation.

Be cautious of fakeouts around news time.

Confirmation is key before entry.

🧭 Final Outlook & MMC Strategy

Trend Direction: Bearish until 114,157.68 zone is hit.

Momentum Drivers: QFL drops, strong rejection from 2x supply, absence of bullish signals.

Key Watch Level: 114,157.68 – wait for MMC reversal pattern here.

Invalidation: If price breaks and closes above the Black Mind Curve with volume.

📌 Trade Idea Summary (For Caption Use):

BTCUSD respecting MMC Black Mind Curve. 2x Supply Zone triggered QFL breakdowns. No bullish confirmation at Central Zone. Eyes on Next Reversal Block near 114,157.68. Watch for reaction and potential reversal setup. #SmartMoneyMoves

DOGEUSDT Analysis : Demand Zone Retest Before New Highs Target📊 Overview:

Today's DOGEUSDT analysis (12H chart) under the Mirror Market Concept (MMC) framework reveals a potential bullish continuation or corrective phase based on two major conditions. The market structure is transitioning after a strong impulsive move, triggered by a 2x Demand Zone breakout, and is now in the retesting phase.

🔍 Key Technical Breakdown:

High Broken with IF Candle:

A significant previous swing high was broken decisively by an Initiation Flow (IF) candle, indicating institutional activity or aggressive buying pressure.

This confirms a shift in market structure toward a bullish trend.

2x Demand Zone:

This zone has served as a strong base for price accumulation and an impulsive breakout.

The market responded well with a sharp rally post this demand, validating it as a critical support.

Blue Ray Zone (Support Zone):

The bullish breakout was partially driven by this inner trendline zone (referred to as Blue Ray), where price respected the rising support channel before breakout.

This shows smart money liquidity engineering prior to the breakout.

Retesting Zone:

Currently, the price is retracing toward a previously broken demand zone.

If this zone holds, it could provide an optimal entry for continuation.

📈 Two Scenarios (Conditions):

✅ Condition 1: Bullish Breakout to Next Reversal Zone

If the retest holds and price prints bullish confirmation (e.g., engulfing or pin bar), we can expect price to move up toward the next key reversal zone between $0.3100–$0.3300.

This zone is marked as a potential supply/reversal zone, where large sell-offs may occur.

This path follows the continuation structure under MMC, aligning with trend-following buyers.

⚠️ Condition 2: Failure to Hold Demand → Deeper Pullback

If the current demand zone fails to hold and price re-enters below the central zone (~$0.2700), we could expect a deeper correction.

Price may then revisit lower demand regions, potentially toward $0.2200 or lower, depending on rejection strength.

📌 Important Notes:

The central zone acts as a pivot level, defining whether bulls or bears gain short-term control.

Monitor the reaction from retesting area closely — candle confirmation is key before any trade execution.

This chart follows Mirror Market Concepts (MMC), combining smart money behavior, demand/supply reversal logic, and psychological market zones.

💬 Final Thoughts:

DOGEUSDT is currently in a critical phase. The market has shown strength, but now it's about confirmation. Patience is key — wait for a clean break or rejection around the retesting zone to determine the next direction. The analysis favors bullish continuation, but being flexible with both scenarios gives traders an edge.

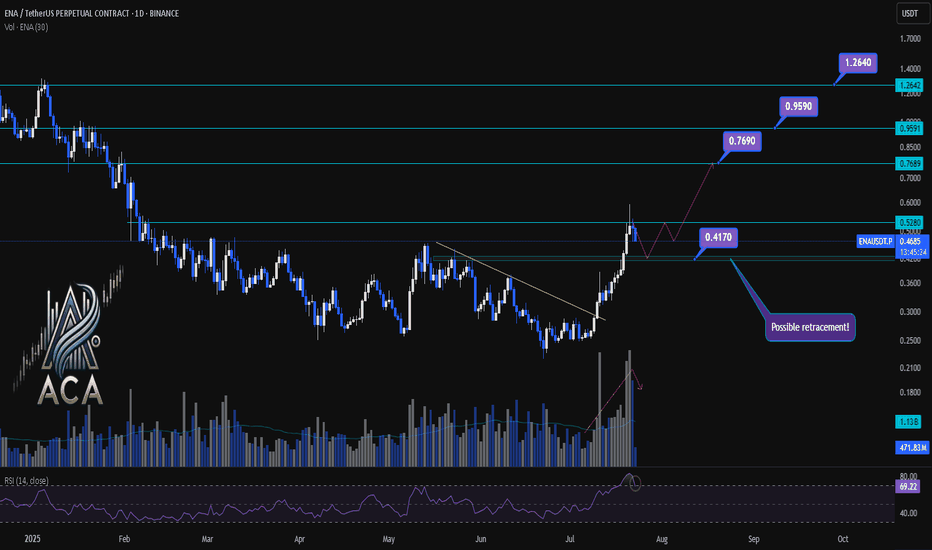

ENA/USDT Chart Analysis | Volatility Signals & Bullish TriggersENA/USDT Chart Analysis | Volatility Signals & Bullish Triggers

🔍 Let’s dive into the ENA/USDT perpetual contract and analyze recent price action, focusing on momentum shifts and key breakout scenarios.

⏳ Daily Overview

The daily chart shows that ENA recently reentered the overbought zone on the RSI, which can serve as a potential trigger for traders watching momentum shifts. Earlier, price action broke decisively above a long-standing descending trendline, resulting in a rapid, nearly 100% surge, a classic RR2 move off the trendline. This breakout coincided with a visible uptick in trading volume, confirming strong demand behind the move.

Now, during the ensuing rest or correction phase, trading volume is decreasing—often a constructive sign suggesting either profit-taking or a healthy pullback rather than panic selling.

🔺 Bullish Trigger & Setup:

- RSI Signal: Reentry into the RSI overbought zone is a potential long trigger, especially if confirmed by price action.

- Confirmation Level: A daily close with strong volume above $0.528 would add conviction to a bullish setup.

- Trendline Reference: The break above the recent trendline fueled the rapid advance, showing the importance of watching such key resistance levels.

📊 Key Targets (on further bullish confirmation):

- $0.769 — First upside resistance.

- $0.959 — Next bullish target.

- $1.264 — Extension target if momentum continues and broader market sentiment remains supportive.

🚨 Conclusion:

Eyes are on the $0.528 level—closing above it with volume, especially while RSI holds in the overbought zone, could provide the next strong entry signal. Current declining volume during pullbacks suggests this is likely a profit-taking phase or standard correction, not bearish capitulation. Keep monitoring RSI, volume profile, and price closes for the next actionable opportunity.

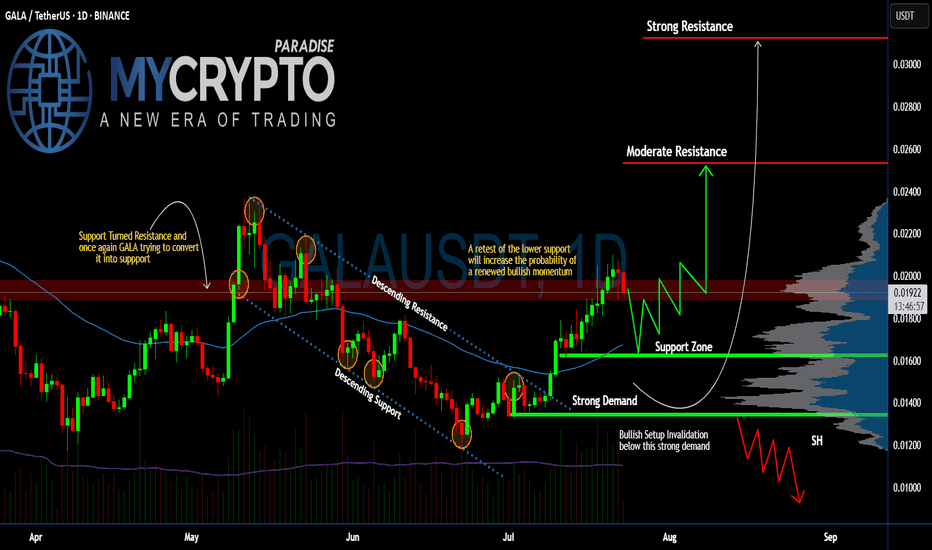

Can #GALA Sustain the Current Bullish Momentum or Will it Fall?Yello, Paradisers! Is this #GALA pullback just a healthy retest before another explosive rally, or are we about to see a deeper drop that will wipe out impatient bulls? Let’s break it down:

💎After weeks of trading inside a descending channel, #GALAUSDT finally broke above the descending resistance, sparking renewed bullish momentum. The breakout has pushed the price toward the $0.020 zone, but now #GALA has encountered a resistance zone (previously support). The question remains: will GALA maintain this level or revisit lower supports before proceeding higher?

💎The current structure shows #GALAUSD attempting to convert its previous resistance into new support around $0.018–$0.020. A clean retest of this support zone would significantly increase the probability of a sustained bullish continuation. The 50EMA acting as support and positive macro trend in crypto market reinforces our bullish bias.

💎If buyers remain in control, the first upside target is the moderate resistance at $0.0253. However, the major profit-taking and strong selling pressure are expected near the $0.0312 zone, where the strongest resistance lies. A successful break and hold above this level would confirm a more aggressive bullish trend.

💎On the flip side, the bullish setup becomes invalid if #GALA loses the strong demand zone at $0.0162–$0.0134. A confirmed close below $0.0134 would flip the structure bearish and open the door for another leg down.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

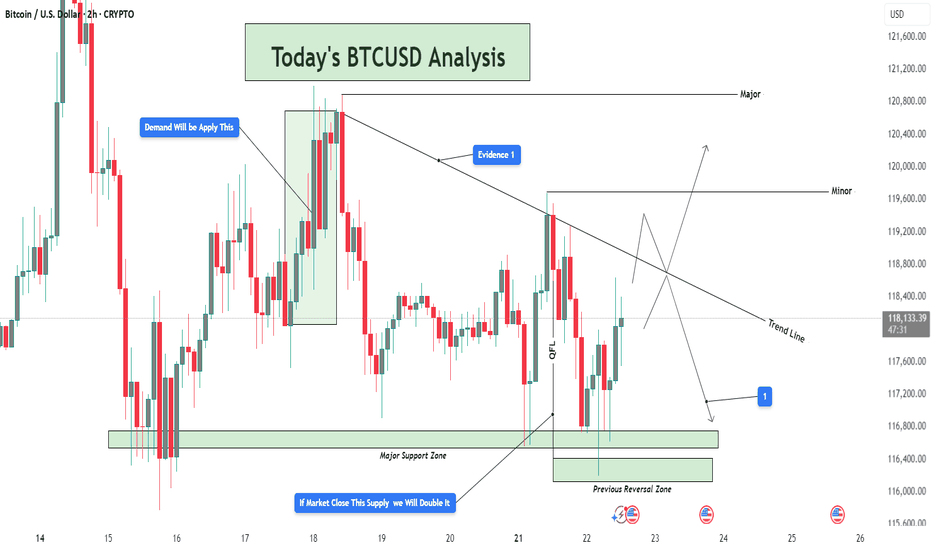

BTCUSD Analysis – Supply Pressure vs Demand Rejection 📊 Overview:

This BTCUSD 2-hour chart is giving us a clear structure of how price is currently reacting between a strong demand base and a descending trendline supply. We're at a critical decision point, where both buyers and sellers are gearing up for a potential breakout or breakdown. Let’s break it down level by level.

🟢 Demand Zone – Major Support Holding Firm

The Major Support Zone marked at the bottom of the chart is not just any random area—it has been tested multiple times and acted as a launchpad for bullish moves previously. This is also aligned with the Previous Reversal Zone, which adds confluence to this demand base.

Price dipped into this zone and immediately rejected with strong bullish candles, showing aggressive buyer interest.

This is a high-probability area for long setups as long as price stays above it.

You’ve noted on the chart: “If market closes this supply, we will double it” – that makes sense because a confirmed hold above this base increases the probability of upside continuation.

🔻 Trendline & Supply Zone – The Wall Ahead

Moving up the chart, price is being pressured by a descending trendline, acting as dynamic resistance. This trendline is not just drawn for decoration—it has rejected price at least twice already, and is also intersecting with a minor horizontal resistance zone.

This creates a confluence of resistance, making it a tough wall for buyers to break through without strong volume.

You’ve labeled it as “Evidence 1”, meaning the first confirmation of supply reacting here.

If BTC fails here again, we could easily see another pullback to the 116,800 – 116,400 range.

⚖️ QFL Pattern in Play

The QFL (Quick Flip Logic) is in action, where price aggressively dropped and formed a base, followed by a sharp move up. Price is now attempting to return to that base (demand zone) for a potential flip back upward.

If QFL holds and price breaks above the trendline, this will be a strong reversal confirmation.

This aligns with many institutional trading strategies which look for such formations near support zones.

📈 Potential Bullish Scenario:

Break above the descending trendline resistance

Price sustains above Minor Resistance Zone (around 118,800 – 119,600)

Next target: Major Resistance Zone between 120,800 – 121,200

This could create a higher-high structure and resume overall bullish trend

📉 Potential Bearish Scenario:

Failure to break the trendline

Rejection leads to price retesting the Major Support

If that zone breaks cleanly (especially below 116,400), price may drop toward 115,600 or lower

This opens up a possible short opportunity depending on price action and momentum

🎯 Conclusion:

This chart is a textbook example of consolidation between major zones. Bulls are defending hard at the bottom while bears are pushing down from the top. The direction of the breakout will dictate the next major move. Until then, wait for confirmation, avoid early entries, and let the market show its hand.

🧠 Patience = Profits.

🕒 Chart Timeframe: 2H

📌 Strategy in Focus: Supply & Demand Zones, Trendline Breakout, QFL Base Pattern

📍 Sentiment: Neutral-Bullish (Watching Trendline Reaction)

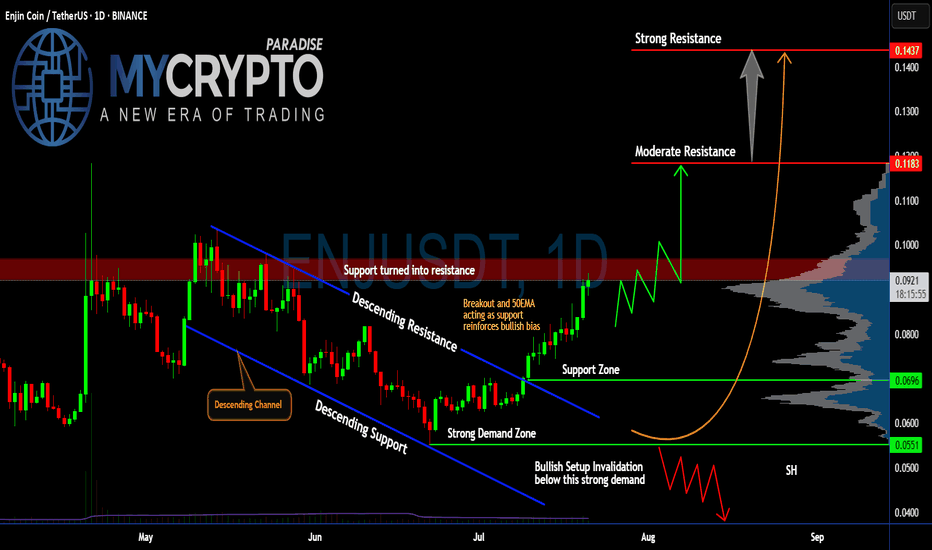

Will #ENJ Soar Further or a Trap is Set Ahead? Watch Closely Yello, Paradisers! Is this breakout on #ENJUSDT the start of a strong bullish reversal, or just another trap before a brutal flush to shake out late buyers? Let’s break it down:

💎After weeks of bleeding inside a clear descending channel, #EnjinCoin has finally broken out of the descending resistance, showing the first real bullish momentum in a while. Price is currently trading around $0.0917, with the 50EMA now acting as fresh support—this adds weight to the bullish bias for #ENJ.

💎If bulls can break above the resistance zone (previously support) between $0.091 and $0.096, we could see a push toward the moderate resistance at $0.1183. That’s the first major hurdle where sellers are expected to step in. A clean breakout above this level would open the door for a larger move toward the strong resistance at $0.1437, where a heavy supply zone sits, and profit-taking will likely accelerate.

💎The strong demand zone between $0.0551 and $0.0696 has been respected multiple times in the past, with aggressive buying every time price dipped into it. This is classic accumulation behavior, which often precedes stronger impulsive legs up—if volume keeps supporting this move.

💎But don’t get trapped, Paradisers. If the price breaks back below $0.0696 and especially loses the strong demand at $0.0551, the bullish setup for #ENJUSD will be invalidated. That would likely trigger a deeper correction, pushing us back toward $0.04. We’ll wait patiently for the next high-probability setup before taking any new positions.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

BTC Weekly Recap & Outlook 20/07/2025📈 BTC Weekly Recap & Outlook

Market Context:

Price continued its bullish momentum, fueled by institutional demand and supportive U.S. policy outlook.

We captured solid profits by following the game plan I shared earlier (see linked chart below).

🔍 Technical Analysis

✅ BTC made a strong bullish move, breaking into new all-time highs.

📊 The daily RSI entered overbought territory, which signaled the potential for a short-term retracement or consolidation.

Currently, price is ranging, and RSI is cooling off. That tells me the market is likely building energy for the next leg up — but not before a significant liquidity run.

🎯 Game Plan

I'm watching for one of two potential setups:

1️⃣ Liquidity Sweep to the Downside

- A run of the daily swing low

- Into the most discounted range (0.75 Fib zone)

OR

2️⃣ Tap into the Weekly FVG Zone (marked with the purple line)

Either move would create the liquidity and energy needed to fuel a breakout above the equal highs (EQHs) marked by the black line.

🚀 Target

First Target: EQHs (Black Line)

Second Target: Price Discovery (new ATHs)

💬 Let me know your thoughts or drop your own chart ideas below!

📌 Follow for Weekly Recaps & Game Plans

If you found this useful, make sure to follow for weekly BTC updates, market outlooks, and detailed trade plans based on structure and liquidity.

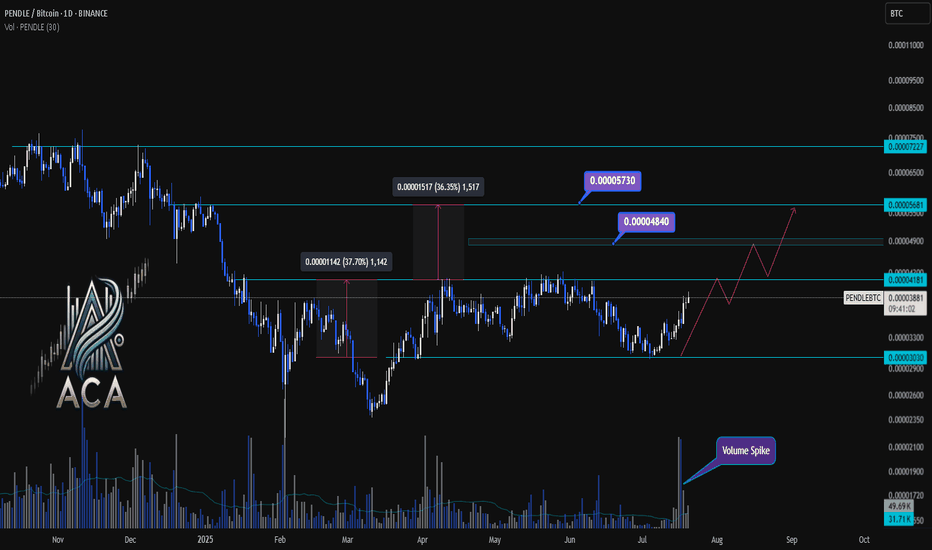

PENDLEBTC 1D Chart Analysis | Accumulation Breakout ConfirmedPENDLEBTC 1D Chart Analysis | Accumulation Breakout Confirmed

🔍 Technical Breakdown

PENDLE/BTC has officially broken out above a key accumulation box, confirming strength as the daily candle closed above the 0.00004181 resistance zone. This marks a significant structural shift after months of sideways consolidation.

📈 Key Observations

Accumulation Phase: The prolonged sideways structure acted as a re-accumulation range. The recent breakout suggests strong hands absorbing supply before expansion.

Breakout Momentum: Prior rallies from this region resulted in +36% and +37% moves. Similar behavior is expected if this breakout sustains.

Target Zones:

🎯 First Target: 0.00004840 (mid-range resistance)

🎯 Extended Target: 0.00005730 (macro resistance)

📊 Volume Spike confirms genuine breakout demand. If BTC remains stable, PENDLE may repeat its historical rally patterns toward the upper resistance zones.

🚀 Conclusion

With a clean close above the range high and confirmed volume, PENDLE/BTC appears poised for further upside. Momentum traders may eye pullbacks into 0.00004180 as potential entries.

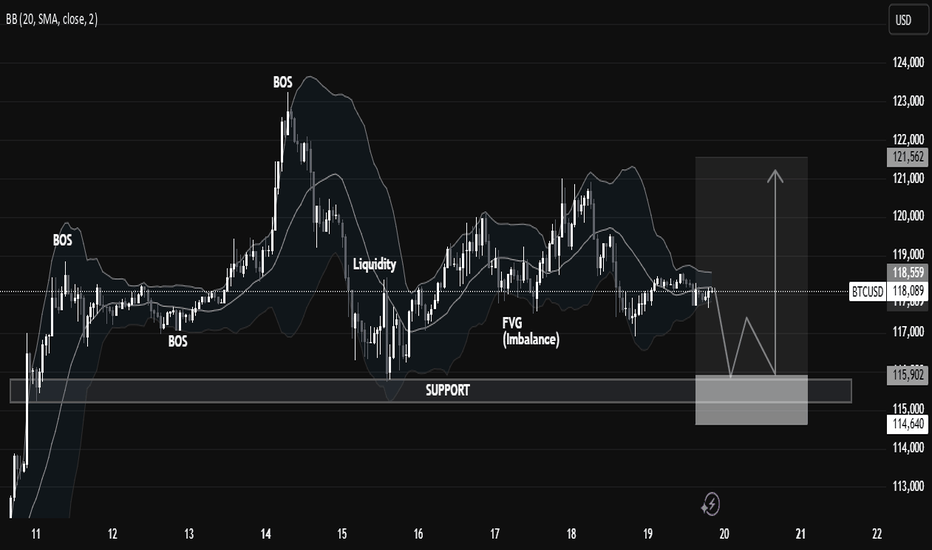

BTCUSD Technical Analysis | Smart Money Concept (SMC) BreakdownBTCUSD Technical Analysis | Smart Money Concept (SMC) Breakdown

🧠 Smart Money Market Structure Insight

📌 Key Elements Identified:

BOS (Break of Structure): Multiple BOS points indicate bullish intent early on. However, the latest BOS on July 14 followed by a significant drop signals a shift in momentum—possibly a distribution phase.

Liquidity Sweep: Price swept prior equal lows/liquidity before reversing, a typical Smart Money trap setup.

FVG (Fair Value Gap) / Imbalance: Identified around the mid-section of the chart—price filled partially but failed to hold, suggesting internal weakness.

Strong Support Zone (Demand Area): Marked between 115,000 - 114,640; this zone is anticipated to act as a springboard for bullish reversal.

📉 Current Price Action Observation:

BTCUSD is hovering around 118,152 - 118,560, moving sideways with lower highs indicating compression.

Price is projected to form a "W" pattern or double bottom in the shaded region.

Expected liquidity grab beneath 115,902 followed by potential bullish reaction targeting 121,562, as indicated by the white arrow.

🧩 Strategic Outlook & Potential Play:

🔻 Bearish Sweep First:

Market likely to sweep the support one more time, tapping into deeper liquidity pools between 115,000–114,640.

This is aligned with the concept of Smart Money hunting for retail stop-losses before reversing.

🔼 Bullish Recovery After Sweep:

Strong probability of bounce due to presence of:

Fair Value Gap (already tested),

Fresh demand zone,

Liquidity grab setup.

Projected Bullish Target: 121,562

Confirmation Needed: A strong bullish engulfing or BOS on lower timeframes near support.

🏷️ Conclusion:

This BTCUSD setup is a textbook Smart Money scenario: BOS ➝ Liquidity Grab ➝ FVG ➝ Reversal from Demand. Traders should wait for confirmation from the support region before entering long positions.

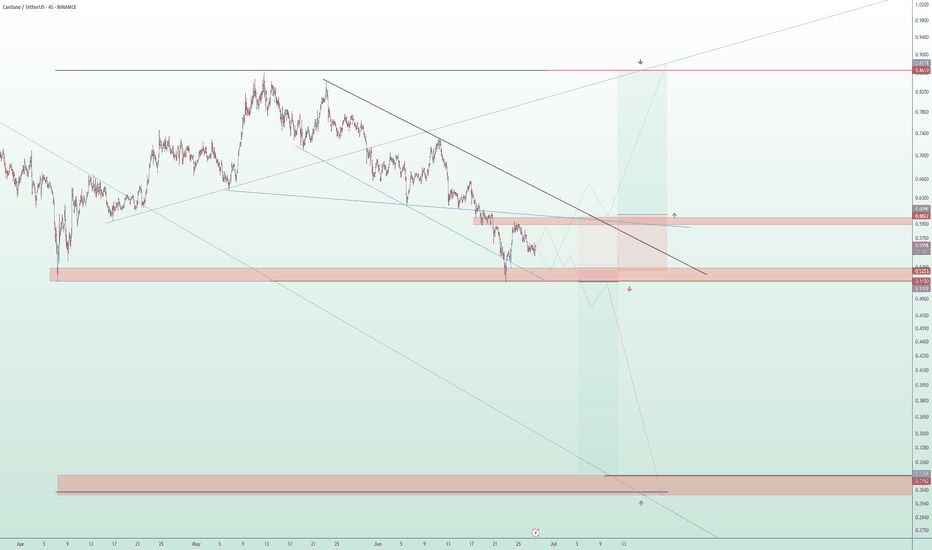

Major Move Ahead for ADA – Breakout or Breakdown?

🔍 ADA/USDT Analysis – Dual Scenario Setup (BUY & SELL)

Currently, ADA is ranging between major supply and demand zones. Two clear scenarios are in play depending on how price reacts to key levels:

📈 Bullish Scenario (Long):

Entry: On breakout and confirmation above $0.6027

Target: $0.869 (major resistance zone)

Stop Loss: Below $0.523

Trigger: Break of descending trendline and solid structure above $0.6027

📉 Bearish Scenario (Short):

Entry: Around $0.5120 (rejection from supply zone)

Target: $0.315 (strong demand zone)

Stop Loss: Above $0.6027

Trigger: Failed breakout and rejection from $0.5120 level, with confirmation below it

📌 Based on the descending channel structure, this might have been the final leg of the downtrend, and a reversal to the upside could be underway. However, for confirmation, we prefer to wait for stronger price action signals before fully committing.

🛑 Always use risk management. Market remains bearish until proven otherwise.

TRX Approaching Cup Breakout – Market Decision Imminent

TRX/USDT – Daily Chart Analysis

TRX is shaping a textbook Cup Pattern on the daily timeframe — a strong bullish continuation signal if confirmed. Price has gradually curved upward, and we are now testing the key resistance area at 0.29–0.30.

📌 Key Scenarios:

🔹 Bullish Breakout Scenario:

A confirmed breakout and daily close above 0.30 would validate the cup formation and set the stage for a rally toward the next target zones at 0.35 and 0.45 — measured based on the cup’s depth.

🔹 Bearish Rejection Scenario:

If the resistance holds, expect a pullback toward the midline (~0.24) for potential accumulation and base-building before the next move.

💡 Volume confirmation and breakout momentum are critical to watch here. The market is approaching a decision point.

🟢 Our directional bias remains bullish — we anticipate the breakout to occur, leading to an upward continuation. However, we’ll wait for confirmation of the breakout and completion of the pattern before entering a long position.

ETHUSD | 1W Time Frame | BITSTAMP ExchangeDate: July 18, 2025

The recent up-trend of Ethereum over the past few weeks has generated optimism among many supporters of this token. However, the critical resistance level at $4,000 poses a significant challenge to this bullish momentum. For the most optimistic Ethereum enthusiasts, who are hoping for a two-digit price, the ultimate goal is for Ethereum to reach $10,000 and beyond. Achieving this will hinge on breaking through the $4,000 resistance. If this barrier remains intact, Ethereum may continue to follow its previous disappointing trend.

On the other hand, Ethereum is currently supported by a substantial price floor around $1,600, which aligns with the SMA400 on the weekly time frame. While this level provides a solid foundation for mid-term and long-term holders looking to re-enter the market, it is essential to approach this support with caution. A sustained hold above this level is crucial for maintaining bullish sentiment; otherwise, a downturn could lead to further declines.

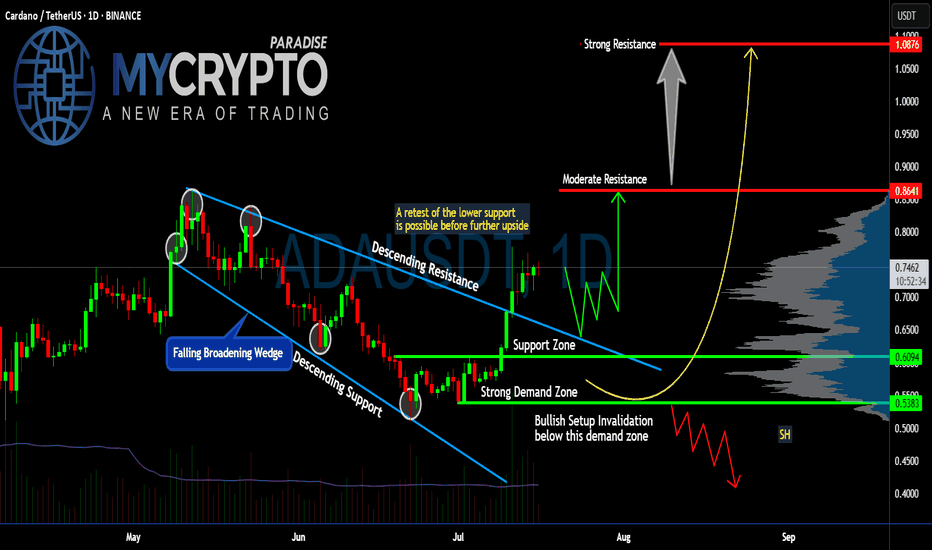

Is #ADA Ready For a Major Move or a Trap is Ahead? Watch this Yello, Paradisers! Is this breakout on #Cardano the start of a major upside move or just another bull trap waiting to flush out impatient traders? Let’s break down the latest #ADAUSDT setup:

💎After weeks inside a falling broadening wedge, #ADA finally broke above the descending resistance, signaling a potential trend reversal. The breakout above $0.70 has pushed the price toward the current $0.74 zone. The soaring volume and a positive broader market outlook reinforce our bullish bias. While this looks bullish, the key question is whether #ADAUSD will hold above its reclaimed support or retest lower levels first.

💎The structure is straightforward: #ADA reclaimed the support zone around $0.70 after bouncing strongly from the demand zone near $0.61–$0.60. This demand zone remains the critical area to watch—any healthy retest here would provide a high-probability continuation setup for bulls.

💎If buyers maintain control, the first target sits at the moderate resistance of $0.86. That’s where the next notable selling pressure is expected. But the real battle will take place near the strong resistance at $1.08—a zone where major distribution and profit-taking could occur.

💎However, the bullish setup becomes invalid if #ADAUSD loses the $0.61–$0.60 demand zone. A confirmed close below $0.538 would flip the structure bearish, signaling a potential continuation to lower lows.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

Is #THETA Ready For a Major Reversal or Another Fakeout ahead?Yello, Paradisers! Is this breakout the beginning of a bullish reversal for #THETA or just a setup to trap the herd before a sharp dump? Let’s break down the setup of #ThetaNetwork:

💎After weeks of slow bleeding inside a falling wedge, #THETAUSDT has broken out of this pattern. The price is currently hovering around $0.718, and it’s the first time in weeks we’re seeing real bullish momentum starting to build. The volume is slowly picking up, so the probability of a bullish push is higher.

💎A clean breakout above the descending resistance now opens the door toward moderate resistance at $0.999. That’s the next key hurdle where we expect sellers to show up. If bulls are strong enough to clear that zone, we’re targeting the strong supply level at $1.284, where significant distribution will likely begin.

💎Why this setup matters: The support zone between $0.60 and $0.66 has acted as strong demand for multiple weeks now for #THETAUSD. Price wicked into it again recently and got bought up quickly, forming a potential higher low. This kind of accumulation behavior often precedes a strong leg up if volume confirms the move.

💎However, if price loses the key support at $0.60, and more importantly breaks below the setup invalidation level at $0.439, we’ll treat this as a failed breakout and expect a deeper correction. That would bring us back into the lower demand zones, and we’ll sit on our hands until the next proper high-probability entry appears.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

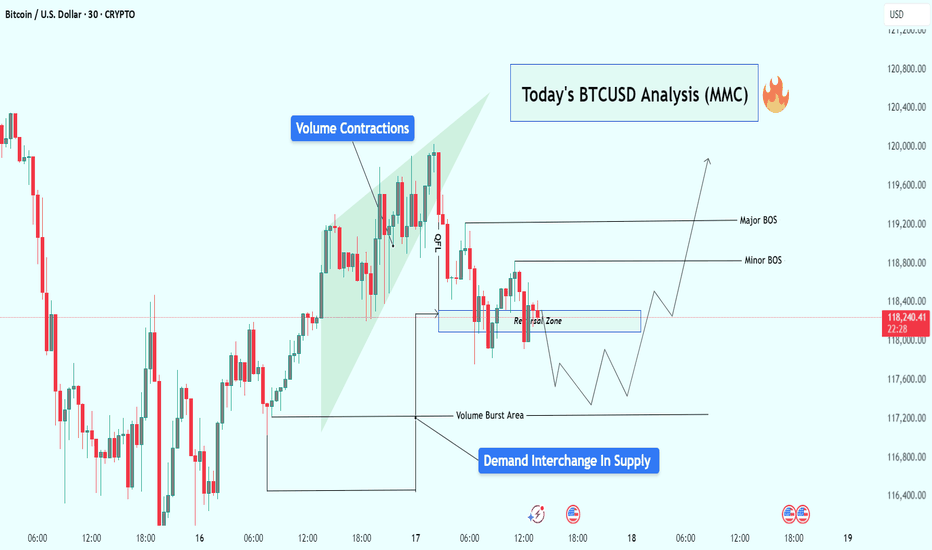

BTCUSD Analysis : Reversal Brewing from Volume Burst Demand Zone🧠 Overview:

Bitcoin is currently showing signs of a potential bullish reversal, following a classic Market Maker Cycle (MMC) pattern. The price action has been clean, respecting both volume dynamics and structural levels, setting the stage for a possible breakout above key areas of interest.

Let’s dive into the detailed breakdown:

🔍 Key Technical Elements:

1️⃣ Volume Contractions – Early Sign of Momentum Shift

At the top left of the chart, we observe a sharp upward move, followed by volume contraction within a rising wedge. This typically represents:

Absorption of orders

Reduced volatility

Market indecision

This kind of structure often precedes a reversal or aggressive breakout, depending on how price behaves near liquidity zones.

2️⃣ Fakeout/Trap Above – Classic MMC Manipulation Phase

After the rising wedge formed, BTC experienced a quick fakeout (stop hunt) just above the highs, then dropped sharply. This was the manipulation leg — a clear signal that liquidity above the wedge was taken and smart money is now repositioning.

🧠 Market makers love to trap breakout traders before moving the opposite way. The drop confirms manipulation is complete.

3️⃣ Reversal Zone + Demand Interchange into Supply

Price then entered a marked reversal zone which was previously an area of demand — now interchanging into supply. This zone is critical because:

It aligns with volume burst zones

It acted as support turned resistance

Multiple rejections confirm order flow shift

This tells us smart money is now testing this area to accumulate or trap sellers.

4️⃣ Volume Burst Area – Institutional Involvement Confirmed

We can clearly identify a Volume Burst Area, where price spiked with strong momentum — this is not retail trading. This zone is now being revisited for a potential bullish re-accumulation.

Expect reaction from this area, as it likely contains unmitigated buy orders from institutions.

5️⃣ Break of Structure (BOS) Mapping:

Minor BOS: Breaks short-term lower highs, showing early intent.

Major BOS: Breaks significant structure, confirming shift in trend direction.

A successful retest of demand and then break of both BOS levels will likely lead to a strong bullish continuation.

📈 Trade Plan & Potential Price Path:

There are two potential bullish entry strategies forming:

✅ Scenario 1: Clean Breakout Plan

Price holds the current reversal zone

Breaks Minor BOS, then Major BOS

Retest of BOS confirms continuation

📍 Target: $119,600+

✅ Scenario 2: Liquidity Sweep Entry

Price dips lower into Volume Burst Area

Sweeps liquidity below and prints a bullish reaction

Enters from discount zone

Same upside targets apply

🧠 This would be a smart money entry — entering from the lowest point of pain for retail traders.

🧵 Final Thoughts:

BTC is setting up beautifully for a reversal continuation pattern within the MMC framework. We’ve seen:

📉 Initial drop (accumulation phase)

🎭 Fake breakout (manipulation phase)

📈 Upcoming expansion (breakout phase)

All signs point to a high-probability move upward, especially if price confirms with BOS + retest. Be patient, wait for price action to align with structure and volume clues.

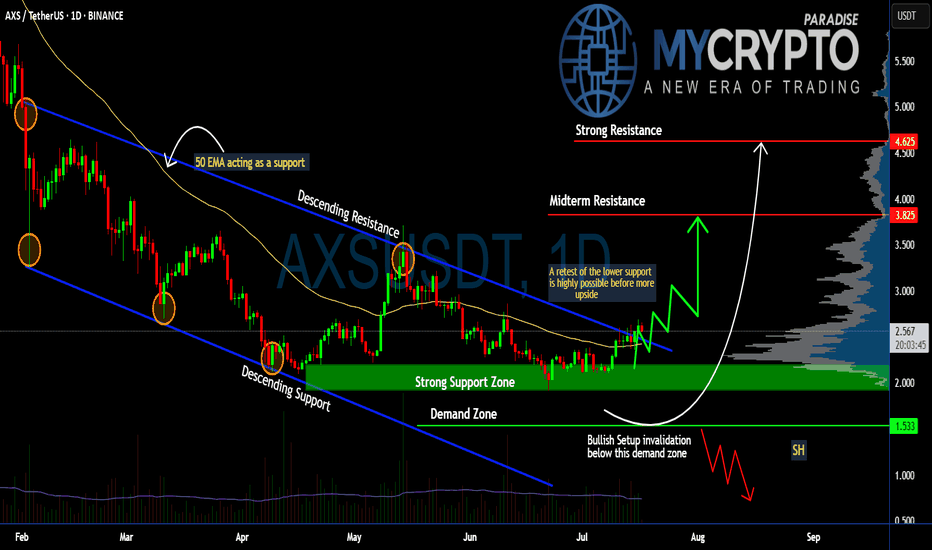

Can #AXS Bulls Sustain the Momentum or Will it Fall? Key LevelsYello, Paradisers! Will #AXS finally deliver a strong upside move, or are we just seeing another setup to trap impatient bulls before a deeper drop? Let’s break down the latest #AXSUSDT structure:

💎After months inside a descending channel, #AxieInfinity has finally broken above the descending resistance, showing early signs of a potential trend reversal. The current price trades around $2.56, but history tells us a retest of lower levels is still highly possible before any sustained upside move. The soaring volume and a positive broader market outlook reinforce our bullish bias.

💎The structure is clear: the strong support zone sits between $2.20–$2.00, and this is the first critical level to watch. A healthy retest here would provide a high-probability continuation setup for bulls. Below that, the demand zone at $1.53 is the last stronghold—losing this level would invalidate the bullish scenario completely.

💎If buyers maintain control, the first upside target stands at the midterm resistance of $3.82, where some profit-taking and selling pressure are expected. A clean breakout above this zone could push the price toward the strong resistance at $4.62, where major distribution could occur.

💎However, the bullish setup becomes invalid if #AXSUSD loses the $1.53 demand zone. A confirmed daily close below this level would flip the structure bearish and open the door for a move to new lows.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

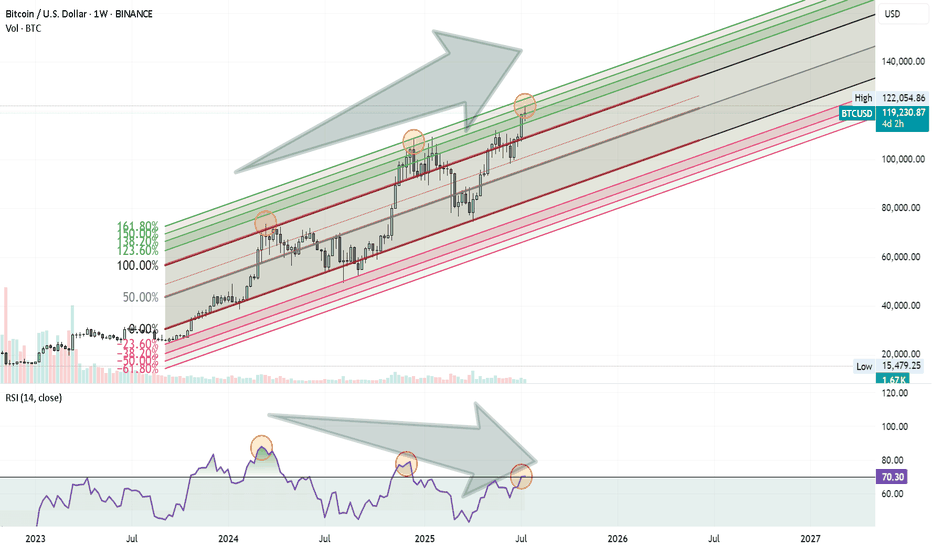

Bitcoin Rally Losing Steam?Bitcoin might be approaching a Turning Point . Here’s what I’m seeing on the weekly chart:

Price is moving inside an ascending Fibonacci channel.

It’s getting close to the 1.60 (160%) extension level, which has acted as a reversal zone before.

At the same time, the RSI is showing a clear negative divergence, suggesting that momentum is weakening.

These signs combined could mean we’re not far from a significant correction.

Nothing is confirmed yet, but it’s a setup worth keeping an eye on.

1INCHUSDT - fear zone, return to the channel, growth potential1inch - is a decentralized exchange (DEX) aggregator that combines multiple DEXs into a single platform, aiming to provide users with the most efficient routes for swaps across all platforms.

📍 CoinMarketCap : #160

📍 Twitter(X) : 1.3M

The coin has already been listed on exchanges during the distribution phase of the cycle and was partially sold off in waves. Then, in line with the overall market, it declined to more reasonable accumulation prices, shaking out small investors and those who entered positions on positive news.

The price has been moving within a horizontal channel for a couple of years, and the channel’s percentage range reflects the coin’s liquidity. Currently, the coin is in a fear zone, at its lowest price levels. In moments like this, very few people have funds left to accumulate positions, as they’ve already been trapped by optimistic bloggers and a positive news background earlier.

Many were wiped out recently due to a breakdown and consolidation below the previous support of the inner channel, and now there's emptiness and fear below. What’s happening now is an attempt to return back into the inner channel. If this zone holds, the channel targets may be realized.

Resistance zones where the price may react are marked on the chart. Potential final downside wicks are also indicated. It’s important to allocate funds wisely for position building and use proper percentage distribution, according to your own experience!

______

📌 Not financial advice. Observing structure and recurring phases.

Operate within your strategy and with an awareness of risks.

BTCUSD Analysis : Bitcoin Trend Shifted/Bullish Pattern + Target🧭 Overview:

Bitcoin’s recent price action has delivered a textbook sequence of institutional liquidity play, volume-driven breakout, and supply zone rejection. After rallying on increasing volume, BTC tapped into a significant 3x Supply Zone—which also served as a previous reversal point—and was swiftly rejected. The market is now trading around a key decision zone where traders must stay alert for a confirmed bullish reversal, or risk getting caught in further downside.

🔍 Step-by-Step Technical Breakdown:

🔸 Liquidity Grab + Volume Expansion

The move began with a liquidity sweep, as BTC pushed above recent highs, hunting stop-losses and inducing breakout traders. This kind of price manipulation is typical of smart money accumulation/distribution zones.

Immediately following that, we observed a volume expansion—a strong signal that institutional players had stepped in, propelling BTC upward with conviction. This expansion pushed price sharply into the 3x Supply Zone, a critical zone of interest from a previous bearish reversal.

🔸 3x Supply Zone – The Turning Point

Once price entered the 3x Supply Zone, bearish pressure resumed. No bullish continuation pattern appeared on the second attempt into this zone—confirming that sellers were defending it aggressively. This area has now been validated as a strong supply barrier, capable of initiating trend reversals.

🔸 Major BOS – Structural Shift Confirmed

Price broke below key support around $120,500, which marked a Major Break of Structure (BOS). This BOS is crucial—it represents a shift from a bullish to bearish market structure and is often the signal that retail longs are trapped.

This BOS was followed by a mini reversal zone, but again, no bullish confirmation appeared there—highlighting market weakness.

🔸 Minor BOS & Trendline Breakdown

Further downside action led to a Minor BOS near $117,800, reinforcing the bearish sentiment. Additionally, the ascending trendline—which had supported BTC’s rally—was decisively broken and retested from below. This confirms a shift in momentum, now favoring sellers.

📍 Current Price Action – Critical Decision Zone

BTC is currently hovering around $117,000, right at a potential demand zone. While there was a brief bullish reaction, the market hasn’t formed a valid bullish reversal pattern yet.

There’s a clear message from the chart:

“We want a bullish pattern here—otherwise, support will break and supply will double.”

In simple terms, unless bulls step in with structure (higher low, engulfing candle, etc.), sellers will likely take over, and price may test deeper support levels.

🎯 What to Watch Next:

✅ Bullish Case:

If BTC forms a strong reversal pattern (e.g., double bottom, bullish engulfing, or inverse head & shoulders), we can expect a short-term recovery back to:

Target 1: $118,500

Target 2: $120,000–$120,500

❌ Bearish Case:

Failure to hold this zone and no clear bullish pattern = likely continuation to the downside, potentially targeting:

$116,000

Even $114,500 in extended moves

🧠 Trading Insights (Educational):

Volume + Structure = Edge

Don’t rely solely on candlestick signals—combine them with structural breaks and volume to get confluence.

Supply Zones Aren’t Just Rectangles

The 3x Supply Zone was powerful because it had historical context, volume convergence, and psychological resistance. These layered factors make zones more reliable.

BOS Isn’t a Trendline Break

BOS means real structural shift. In this case, lower highs and lower lows confirmed the change.

💡 Final Thoughts:

BTC is at a make-or-break level. The recent rejection at the 3x supply zone has shifted the momentum, and buyers must prove their strength now—or risk watching the price unravel further.

Stay patient, wait for structure, and never fight momentum.

Can #BAND Bulls Maintain this Momentum or Will Bears Win? Yello, Paradisers! Is #BANDProtocol breakout from the falling wedge legit—or are bulls walking straight into a trap? Let's dig into the latest setup of #BANDUSDT:

💎After trading for weeks inside a falling wedge, #BAND has finally broken out with solid momentum. The breakout above the resistance trendline at around $0.66 has already occurred, and the price is currently hovering near the $0.72 zone. While this move is promising, it’s now all about whether this breakout can hold or fake out.

💎The structure here is clear: #BANDUSD reclaimed the demand zone between $0.60–$0.66 after bouncing off strong support at $0.504. This zone now becomes the most important area to watch in the short term. A retest of this level would offer a high-probability continuation setup, especially since the 50EMA is now acting as dynamic support beneath the price.

💎If bulls can maintain control, we have a clear path toward the moderate resistance at $0.992. That’s where the next wave of selling pressure is expected. But the real prize is the strong resistance zone near $1.180. That’s the level where major distribution could occur, and it's where we’ll be watching closely for profit-taking signs.

💎However, the bullish thesis breaks down completely if the price drops back below the $0.60–$0.66 demand zone. In that case, our invalidation point sits firmly at $0.504. A close below that support would indicate bears are back in control, and we’d shift to a defensive stance, targeting lower re-entry zones.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴