TWO SENARIOS - UNDERSTAND THESE SCENARIOSSome $ Dollars $ Are Hiding Here

1) We have a Cup pattern which is a bullish signal.

2) But i have a really bad news : ( If Russia and Ukraine ' s Conflict remains continue we all gonna see a crash in Crypto market, Due to the conflict if market get bearish you will see a rejection at 42800$.

Cryptocrash

DASH-Crash: Is it Over Yet?! May be Getting Close!Dash (DASHUSD) broke its 102.175 support, which invalidates the previous bullish ORANGE pattern. This is significant because it confirms that the larger 2nd-degree correction that started after the May 2021 has NOT yet completed.

Primary RED Pattern

The RED pattern can take DASH all the way down to 61 before seeing a bounce back up. This sees the entire rally from mid-2021 thru September 2021 as nothing more than a big fake-out B-wave rally. This is a bit unusual among cryptos because most others hit higher-highs in November in what looks like a more complete classic B-wave. While there is a chance we've had a truncation of the subwave-c within the larger B-wave, this may also be an indication that DASH gave us the earliest warning of the impending crash across the whole crypto space!

Alt GREEN Pattern

There is a chance that the correction may be over or close to over already, which is the GREEN alt pattern. We'd need to see a sharp 5-wave rally for that pattern to gain traction. If we really are done with the pullback, the target for subwave-(i) would fall between 175 and 325 based on the standard 0.382-0.618 first subwave extension we typically see after a larger completed impulse.

Check out my YouTube explainer video on DASH!

I use Elliott Wave analysis to project price levels for different assets and asset classes. EW is a form a technical analysis that is absolutely NOT based on fundamentals. Please be aware that this is not intended to act as financial advice. I am not a trained or certified financial professional. You may invest based on a strategy tailored to your own skill and risk-tolerance levels.

#dash #bitcoin #ethereum #blockchain #litecoin

Litecoin: Two Paths Lower to Complete the CorrectionLitecoin (LTCUSD) invalidated its original bullish count up once the 106-level broke. The now-primary RED pattern calls for a correction down to around 76, which means the bottom should not be too much farther down.

Primary RED Pattern (lower-low):

Litecoin is in its final C-wave down to complete the larger-degree 4th wave correction that began after the May 2021 peak. This means that the entire rally from the mid-summer bottom to November was actually a fake-out B-wave rally. Assuming A=C equivalence, the bottom projects around 76, which also has strong confluence as the 61.8% retrace of the larger-degree impulsive pattern.

Alt GREEN Pattern (big rally coming soon):

There is a chance that the correction is over due to the depth, sharpness and internal wave structure of Litecoin as well as other altcoins. For this pattern to gain traction, we'd need to see a strong 5-wave impulse rally upwards followed by a 3-wave correction (higher-low). If that is seen, I would immediately become a buyer again! Such a pattern would project to at least 281 for the 1st wave alone.

Alt PURPLE Pattern (much lower-low):

Unfortunately, this is a higher-probability than I would like to admit. As Bitcoin and Ethereum both have plenty of room to the downside to fall farther, LTC could go down to 45 or even the 33-region! Breaking the 74-support would likely mean we're following PURPLE.

Check out my YouTube explainer video!

I use Elliott Wave analysis to project price levels for different assets and asset classes. EW is a form a technical analysis that is absolutely NOT based on fundamentals. Please be aware that this is not intended to act as financial advice. I am not a trained or certified financial professional. You may invest based on a strategy tailored to your own skill and risk-tolerance levels.

#litecoin #bitcoin #ethereum #cryptocurrency #blockchain

DON'T IGNORE THIS ETHEREUM CHART!Hi everyone,

I figured it would be a good idea to share this find with the community. I'll explain below what I'm seeing:

RSI - Matches the same pattern as Ethereum during "consolidation" in 2016 before the euphoric 2017 bull cycle

MACD - Oversold levels not seen in years

Duration of Consolidation - As you can see, the duration of the phases circled in white both span about 90 (270 days)

Retracement - Both ranges circled in white had similar pullbacks of about +50%

Bull Market Support Band - Right before the start of a new bull phase in 2016, the PA trended below the BMSB before breaking out (we are currently at this point when comparing the two)

Obviously this isn't to be taken as FA, but it could be a very unique and rare opportunity to enter the market/add to your position as a bull/long term holder.

Let me know your thoughts!

Twitter @illusivetrades

Bitcoin To 30K. Your welcome. I feel the overview of the Crypto space currently depends mainly on BTC. I wish it wasn't but many eco systems show signs or are forming into a Head & Shoulders. (Most would say this is a bearish chart pattern)

Typically with the market reacting in phases. It seems justified that we would see a reset off a 70k ATH, Impulses are met with corrections.

Although, due to the market caps Cryptos resets are harsher than most which causes them to be labelled as parabolic correctional phases, as 60% retest off tops is the norm.

We also have to factor smart money cashing chips and side stepping bearish market sentiment. If you are trading Crypto, it is best to sell before tops and buy back in at bottoms.

Because of this we get a slow down in momentum which causes for divergences to be formed, this indicator is a way of understanding possible traps before they are laid.

Quick fundamental indicator you can help use is aligning Miners to BTC price to see what they are doing. If miners are dumping its probably alluding to something within the eco system.

I do believe that BTC is due to dump lower, since we have been bullish for nearly a year It seems fair. Also I can see the 30k reset being a great point for a huge bull run next cycle.

TA is subjective as such biases will change. Be on the lookout of updates and let me know if you agree of disagree.

Why BTC will reach 10kIn this video, I explain why BTC will eventually reach sub 20k levels.

BTC likes to drop 85% from all-time highs, we've seen this in 2013 and in 2017.

Adding to that, the current head and shoulder playing out measures a price target to 10k, which is exactly 85% from all-time highs.

Coincidence? I think not.

So what do we do now?

Work hard and save cash.

You don't want to exhaust your cash buying every little dip.

Share your ideas and let us know what you think.

End of Tulip Mania of Modern era or revival in sight for BitcoinFinal support for Bitcoin before it crashes further can be USD 29609. If it closes below 29609 it can crash further to 22594 which is it's 200 Weeks EMA and major major support level. Guys who are invested in Crypto should think of alternative / Real investments like Gold, Equity and Bonds. If top Govts like USA, INDIA, Russia, China and EU don't adapt it and regulate it collectively the future for Crypto is bleak.

Ethereum Officially in Crash: Direct Crash or Bounce First?I have adapted the bearish RED pattern in Ethereum (ETHUSD) as the PRIMARY pattern, and it could take Ethereum all the way down to 1150!

I had the 'trapdoor' opening point set in the 2900-3000 support region, and yes, we have broken below it! We may already be in the 3rd wave of the C-wave down! I have started to unload my positions in Ethereum as we may not get another chance to escape.

If we really are going RED, what should you expect? We should be getting very close to bottoming for the 1st wave of the larger red C-wave, and that mean we should see a sharp 2nd wave bounce back up. This deep zigzag up would be expected get us a "gentleman's exit" around the 3800-4200 region before starting the harrowing 3rd wave down of the larger red C-wave. This means we should have an opportunity to exit after recouping some of the losses. HOWEVER, it's looking more and more like we may crash directly WITHOUT a bounce first. Stay on your toes!

Check out my YT explainer video!

I use Elliott Wave analysis to project price levels for different assets and asset classes. EW is a form a technical analysis that is absolutely NOT based on fundamentals. Please be aware that this video is intended to act as financial advice. I am not a trained or certified financial professional. You may invest based on a strategy tailored to your own skill and risk-tolerance levels.

#ethereum #bitcoin #cryptocurrency #blockchain #crypto

Bitcoin Crash Setup: Direct Crash or Bounce First?Bitcoin (BTCUSD) has now OFFICIALLY invalidated the bullish PURPLE setup that I covered which had us seeing a nested 1-2,i-ii setup in both BTC and ETH. This pullback is such a strong signal, that I have shifted to the RED bearish pattern as my PRIMARY! This pattern calls for a continuation of the pullback that started after our April 2021 top all the way down into the 20k range! GREEN is my bullish alternate pattern.

In Elliott Wave Theory, there is no stronger sign of a major impending trend reversal than seeing a 5-wave impulse break the price down through support. And that's exactly what we have seen in Bitcoin (and Ethereum)! We have a 5-wave impulse down that has broken below the major support at 39,600. While I expect a sharp 2nd wave bounce before the final drop, the GREEN pattern is NOT fully dead! If see a 5-wave impulse up and 3-wave pullback and the price exceeds our ATH, then the it is the RED pattern that is dead!

The RED alt pattern sees the entire rally from summer into November of 2021 as having been an ABC corrective B-wave rally, or a fake-out. That would make the next movement a ferocious C-wave crash down. As C-waves are always 5-wave patterns, we would look for an impulsive 5-wave movement downwards as the 1st subwave of this larger C-wave. And it appears that we more or less have that in place now in BTC and ETH!

From our Nov 10th top to right now, we can easily count a 5-wave impulsive drop that seems to fit appropriate Fibonacci targets. If this really is Wave-1 down of our larger C-wave down, expect a big Wave-2 bounce up to nearly 60k before the final drop begins. This would take the form of a 3-wave zigzag up and offer us a "gentleman's exit" to unload any holdings in preparation for the ensuing crash. However, there is a small chance that we don't get the bounce; if we break below the 32.7k - 35.9k region directly, I'm exiting my positions! That may be an indication that the 3rd wave down of the larger C-wave has already begun!

In summary, don't panic, but please do have your exit strategy prepared in case things turn bearish! Know when you will sell or IF you plan to sell. If you plan to 'hodl', then commit to it! There is a small chance that we have a 5-wave impulse take us right up through our 68k ATH, which would immediately kill the RED pattern, but until we see that, stay on your toes!

Check out my explainer videos on YT!

I use Elliott Wave analysis to project price levels for different assets and asset classes. EW is a form a technical analysis that is absolutely NOT based on fundamentals. Please be aware that this is not intended to act as financial advice. I am not a trained or certified financial professional. You may invest based on a strategy tailored to your own skill and risk-tolerance levels.

#bitcoin #cryptocurrency #blockchain #crypto

That song by ElvisWhen your fake guru is $90,000 off a December close.

It's time to have a serious look at your technical analysis.

Although everyone wanted 100k for Christmas - the logic and reasoning was simply missing (can't even say it was flawed).

The roadmap pointed out the move, with sound reasoning behind why we where likely to go up, down, up and back down AGAIN .

This is the updated version from the first in March last year...

It is not rocket science:

And yet, unless it's plastered with calls for 100k+ it is wrong.

We are not Bearish Bitcoin or crypto, in-fact - quite the opposite, all we want is a good spot buy for the long time hold. We have played this game far too long to care about the sentiment of the retail crowd, the negativity for not posting full on Bullish signals.

All we setout to do was give real Technical Analysis, providing logic and methods for why Bitcoin is doing what' it's doing.

We give the distribution for the major drop.

Even the levels for the move up to it's current ATH.

And going above and beyond not just to tell you when - but providing the logic so you can fish for yourself!

Here's the biggest educational post you will find here on TradingView.

So don't be the fool, don't rush in. Understand how to get in...

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

$BTC Potential SupportBINANCE:BTCUSDT has been underperforming lately, falling into the $40k range once again. The stochastic is starting to show bullish momentum, and 40k is a massively important structural area, but at the same time we see a death cross ensuing as the 50 MA dips below the 200 MA. If this 40k zone holds, Bitcoin and the rest of the crypto market could potentially start a solid recovery, or at least a temporary bounce. However, if $BTC starts to break down that level, things will likely go much lower as people go negative on positions and sell out. I am planning on resuming my routine of making watchlist videos, so be sure to follow! Good Luck!

ETHs CENTURY Parabolic CountermeasureBITSTAMP:ETHUSD The slow down in volume from the most recent parabolic move is an indication of the baton changing hands. Most of the early entries during Sep/Oct run out are going to be cashing chips or dollar cost avg out...

Therefore this is why I believe we're going for the big CENTURY pullback.

2nd Impulsive Run Stats

Lasted 217 days - Volume of 72Mil (Coinbase) With a growth of 1110%

And as we know, parabolic runs = healthy corrections within the eco system.

We already saw a 60% bearish engulf off the ATH. However the candle sticks and price action show this was a FOMO / dip opp rather than a major correction.

This mild breather allowed for late byers to pile in which allowed price to climbing another micro leg or two. (greedy monkey)

FOMO leg-up stats

ETH pushed another 180% off FOMO impulsive in 112d.

Bringing us to... A 329 DAY BULL RUN

This time vol output was 23.3 Million.

*Notice something ?*

Considering we just made a new ATH. Why isn't the volume increasing... Bull Trap. Ladies and Gents.

ETH imo is in a full blown trap phase.

We can tell by matching the RSI (Relative Strength Index) to the overall chart trend to see despite ETH pushing higher the RSI was in fact making lower highs. Causing for a strong case of hidden bearish divergence to form.

Which means due to the a lack of strength coming into the market, price simply cannot maintain its bullish momentum no more. Although we got a 2nd ATH within the cycle I wouldn't be screaming off the roof tops over 12%.

Considering 2018 High was broken by around 230%.

Now I think the July late entries are going to be quite scared and since we didn't see a further breakout -- we could see a blow off top in a form of a BTC head and shoulders

The dotted lines show my S/Rs So I feel if price does sell, 19xx would be the neckline. If the trap holds true this will be the HOLD THE LINEEE. (the last major line of defence) for them later investors.

I feel that POI. Has potential to create a Right shoulder. Now if that happens and we see a move similar too the BTC H&S formation, it wouldn't be off the cards to say a deeper ETH correction is looming.

If we target correctly by timesing the Neckline to the top of the head by two, price lines up to some interesting areas and some key fib extension levels.

We would also get the 100% impulsive correction like the one we had from 2018 bull run and since history loves to repeat its self this theory isn't so wild for it to play out.

I personally wouldn't be calling ETH back to 3 figure territory. Though, I do feel a cycle cleanse is closing in with the phasing of ETH 2.0. So my personal target of ETH is 1150 USD before going on a bullish run to 8k+

Since TA is subjective options do change but as of now I can see a Big winter blowout, Hoo-Hoo.

Please let me know if you agree and can strengthen or weaken this theory and I'll see you in my BTC breakdown.

BTC 80% DROP?Looking through the chart, with repeated cycles of Bitcoin, you would most likely predict another -80% of the crypto giant. Using the 69k high, -80% reveals a drop to the 11k price of 2019 high.

DISCLAIMER NOTICE!

This is only my opinion and not a kind of financial advice to set up a trade or invest. Trading or investing without knowledge is highly risky.

Ethereum 15 minutes selling oppertunity for weekly closeMy previous 15 minutes Ethereum sell entry was perfectly played out.This is another entry for weekly close.

Stop loss moved to breakeven for previous sell entry and partials taken.

This is 1:4 Risk to Reward trade.Close with full volume,because my previous sell entries are still running.

Anatomy of a Crypto Crash: How to Exit Bitcoin GracefullyBitcoin (BTCUSD) has all but invalidated the most bullish PURPLE setup that was discussed in our last update that had us looking at a nested 1-2,i-ii setup in both BTC and ETH. While officially, that would mean that we are in the GREEN alt pattern (not shown) which calls for an ending diagonal up for our final 5th wave, the RED alt pattern has become SIGNIFICANTLY more likely! This pattern calls for a continuation of the pullback that started after our April 2021 top all the way down into the 20k range!

The RED alt pattern sees the entire rally from summer into November of 2021 as having been an ABC corrective B-wave rally, or a fake-out. That would make the next movement a ferocious C-wave crash down. As C-waves are always 5-wave patterns, we would look for an impulsive 5-wave movement downwards as the 1st subwave of this larger C-wave. And it appears that we more or less have that in place now in BTC and ETH!

How to Make a Graceful Exit:

From our Nov 10th top to right now, we can easily count a 5-wave impulsive drop that seems to fit appropriate Fibonacci targets. If this really is Wave-1 down of our larger C-wave down, expect a big Wave-2 bounce up to nearly 60k before the final drop begins. This would take the form of a 3-wave zigzag up and offer us a "gentleman's exit" to unload any holdings in preparation for the ensuing crash. However, there is a small chance that we don't get the bounce; if we break below the 32.7k - 35.9k region directly, I'm exiting my positions! That may be an indication that the 3rd wave down of the larger C-wave has already begun!

In summary, don't panic, but please do have your exit strategy prepared in case things turn bearish! Know when you will sell or IF you plan to sell. If you plan to 'hodl', then commit to it! There is a small chance that we have a 5-wave impulse take us right up through our 68k ATH, which would immediately kill the RED pattern, but until we see that, stay on your toes! (I'll be publishing a similar analysis on Ethereum as well soon!)

Check out my explainer video on YT!

I use Elliott Wave analysis to project price levels for different assets and asset classes. EW is a form a technical analysis that is absolutely NOT based on fundamentals. Please be aware that this is not intended to act as financial advice. I am not a trained or certified financial professional. You may invest based on a strategy tailored to your own skill and risk-tolerance levels.

#bitcoin #cryptocurrency #blockchain #crypto

Polkadot Now has LARGER 1-2 SetupPolkadot (DOTUSD) invalidated its nested 1-2,i-ii setup that was our primary PURPLE pattern by breaking below the 25.75 support. While that is unfortunate and makes the bearish RED alt pattern more likely, the new primary GREEN pattern now identifies our 55-top as larger subwave(i).

And that means our standard overhead targets for DOT have risen substantially . Subwave(iii) now targets 235-349 while Subwave(v) now targets 445-660. There are also strong Fibonacci confluences at 191, 381, and 583 at which we can see pullbacks. The larger 1.618 ext at 1161 still looms and could possibly serve as the major top for Polkadot if things go extra bullishly.

All this is great news as long as we stay over support at 19.69 , which marks the 61.8% retrace of our new green subwave (i). Dropping below that can substantially increase the likelihood of the bearish RED alt pattern manifesting. Officially, breaking below 10.34 will make the bearish red pattern my primary, but in all honesty, if the altcoins are going to see that kind of bearishness, BTC and ETH will flash strong warning signs well before we get that low!

As the rally continues, it will become more and more important to focus more on dollar-cost-averaging (DCA) to purchase DOT as opposed to buying in large lump sum amounts. The risk-level increases as the price rises, so your window is closing on deploying larger amounts of cash. Remember to diversify not only what you purchase but also the TIME of the purchases; that's where DCA can help!

I use Elliott Wave analysis to project price levels for different assets and asset classes. EW is a form a technical analysis that is absolutely NOT based on fundamentals. Please be aware that this is not intended to act as financial advice. I am not a trained or certified financial professional. You may invest based on a strategy tailored to your own skill and risk-tolerance levels.

#polkdadot #dot #polka #crypto

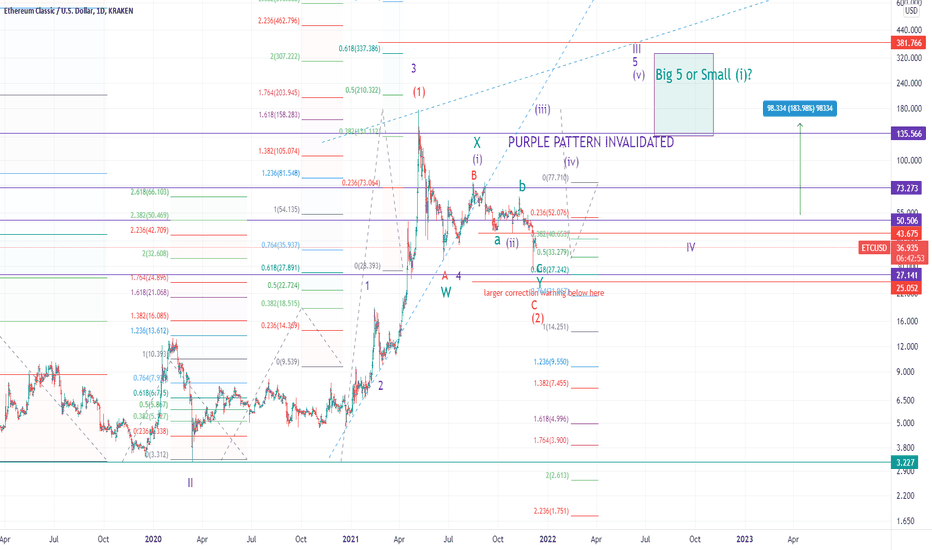

Ethereum Classic Invalidates its 1-2 Setup: Warning Shot?Ethereum Classic ( ETCUSD ) spiked down HARD along with the rest of the crypto universe between 12/3 and 12/4! The whole sector crashed so hard, in fact, that many technical supports were broken with ETC being no exception. Breaking below the 32-38 range means that ETC has pulled back LOWER than the origin-point of what we were calling the Subwave (i), so the purple primary impulsive path has been invalidated. We have more or less confirmed that the bearish red alt pattern is in effect.

More specifically, I have added the new GREEN pattern which interprets the correction from May 2021 to present-day as an Elliott Wave "double-zigzag", an uncommon but not rare formation. Double-zigzags (or double-threes) are 3-wave corrective patterns in which each subwave is ALSO a 3-wave corrective pattern. In the case of ETC, we have all zigzags for subwaves within the larger green double-zigzag pattern. In order to prevent confusion, we use W-X-Y nomenclature to describe the subwaves of a double-zigzag in Elliott Wave Theory.

While this invalidates our immediate upside setup that would've gotten us into the subwave (iii), it does also mean that we cannot project a top at this moment due to the lack of a clear (i)-(ii). And that may be a good thing because what we were calling ETC's subwave (i) was PATHETIC! This gives ETC and many other cryptos a mulligan to get us a better subwave (i). Relying solely on the big picture pattern we have at this moment, I would roughly expect any rally to take us to the 0.382-0.618 extensions of the larger structure from March 2020 - May 2021, which would fall between 131 and 337, but these are very crude estimates.

Other cryptos that have also invalidated their (i)-(ii) setups just like ETC are BCH, FIL and EOS . All of these cryptos were underperforming similarly with unimpressive subwave (i) extensions, and now they all have a blank slate to redeem themselves.

While there is a bit of 'doom and gloom' in these aforementioned cryptos, BTC , ETH, DOT, XLM and MATIC all have their upside setups still intact despite the big selloff. BTC barely hangs onto its nested 1-2,i-ii setup by a thread, but ETH pulled back almost perfectly. This means that our overall big picture targets for subwaves (iii) and (v) are still valid for these cryptos. Ethereum MUST continue to hold its 3307 major support while Bitcoin MUST hold its 39,600 major support. Failure of these two main cryptos to hold their majors supports would be a HUGE warning for the entire crypto space!

Finally, we have LTC, DASH, SOL and LINK. These cryptos invalidated their NESTED 1-2,i-ii setups but not their overall (i)-(ii) setups. What this means is that we can interpret their rallies from summer 2021 until this week as A-B-C 'corrective' rallies, which is indicative of these cryptos potentially continuing their overall structures in the form of 'ending diagonals'. Diagonals subdivide into 5-wave structures but are choppy with lots of overlap, and their subwaves take the form of 3-wave A-B-C structures.

I use Elliott Wave analysis to project price levels for different assets and asset classes. EW is a form a technical analysis that is absolutely NOT based on fundamentals. Please be aware that this video is not intended to act as financial advice. I am not a trained or certified financial professional. You may invest based on a strategy tailored to your own skill and risk-tolerance levels.

#ethereumclassic #ethereum #bitcoin #cryptocurrency #ethereummining

BTC/USDT Not looking greatCurrently Bitcoin is currently below trending support and now forming what looks to be a bearish channel. I do not have much faith it will break out in the near future. Although BTC has fooled us and pumped before, I am just not sure it will this time. It looks like BTC is rebounding from its most recent dump and can soon hit resistance and fall again. I am preparing you for major volatility, it is important that you use this to your advantage and save potential losses.

Will #Ethereum outperform #bitcoin?This is a quick update on my previous Ethereum video!

The price hit the zone I had mentioned in my previous video and bounced from it, I think there is a fact that no one can deny: Ethereum chart just looks more bullish than bitcoin! This is a factual statement! Ethereum dominance is more bullish than bitcoin dominance!

I think 20k target is available for Ethereum in midterm (lets say 3-6 month)!

In the video I have explained why this is the case! Also make sure you watch my bitcoin update!

PS: When speaking about eth.d chart I said "cup and candle" instead of "cup and handle" :))) I am sure you understand why this is a normal thing for a trader to do :))

Let me know what you think people!

Chartmaster

What the Hell happened to Bitcoin? What is next?Holly molly! So bitcoin crashed from 54k all the way towards 42k in a single daily candle! This is a huge crash and over 1B positions in futures market got liquidated!

I will share my thoughts on why this happened? and How we should handle this in coming months?

I can summarize the video in one sentence: do not try to predict markets, rather try to react!

Please let me know what you think about this video so I can continue to improve!

Much love and Thank you for your attention!

Chartmaster

BTC dumpHello everyone...dark day for the crypto market.

The analysis of today will go through a couple of scenarios and my plan depending on the following BTC price action.

I believe this is one of the best videos I have ever made. Hence I suggest you watch it.

I hope this will help you have a better idea of what is going on and have a better plan!

Remember, these are my ideas...any of my posts are explaining my few, and you should always do your own research as I do not dispatch financial advice...ever.

BAT/USD bucks the trend and surges to new all-time high Major cryptocurrencies have been falling due to fears over a new mutation of Covid-19 that may be more transmissible. There are fears it could evade vaccines which brings the possibility of further restrictions and lockdowns.

The sell-off in global markets did not stop BAT from hitting a new all-time high. Basic Attention Token was up 40% at one point before correcting. This made it the best performing crypto in the top 100. A Solana partnership was announced two weeks ago and crypto exchange FTX recently announced support for wrapped BAT.

Basic Attention Token is the crypto token that powers the ‘Brave’ ecosystem. Users can earn these ERC-20 tokens simply by browsing the web with Brave. Creators can use the Brave publisher platform and earn tokens when users view their content. Brave also announced the integration of a crypto wallet on the browser.

‘Brave wallet’ will allow users to manage their crypto without the need for a browser extension. It will be compatible with Polygon, Avax and layer-2 chains which are built on top of Ethereum.

Price action in November has seen BAT trade within the range of $1 and $1.40. This was broken through with price reaching levels above $1.8. $2 could be the next target for bulls, but a drop below $1 cannot be ruled out due to the broader crypto market dipping. Let’s see if BAT can hold a price level above all-time highs.

Bitcoin Big Picture 📈This is a different point of view to Bitcoin. Every one talking about crypto crash, Biggest correction ever, Elon Musk tweets, China and whatever.. I want to show a different analysis on the market. So fasten your seat belt a watch the video. This is my first time making a video because I found a lot of data in this analysis, that if I put it into a usual post you would be confused so I tried a Video this time. This way I can give the information to you completely.

So I like to see your opinion about the analysis and any question you got, so feel free to leave them in the comment section. And if you find this analysis useful share it with your friend so the can take benefits from it.