BITCOIN's Trump effect: The 2025 PARABOLIC FINALE is coming!Bitcoin (BTCUSD) has completed 3 straight green 1W candles, making an impressive start into Q2 2025. But is it a coincidence or systemic behavior of technical trends?

It certainly is no coincidence the structure that the market has with Trump under President. Q1 has been undoubtedly disastrous due to the Trade War fueled by back and forth tariffs. But this is a pattern we've seen before and more specifically in Trump's 1st Term during Q1 2017.

As you can see, BTC was again under heavy volatility during Trump's 1st Term Q1, even though the correction wasn't as hard initially. What's more interesting however, is that in both Terms, the U.S. Dollar Index (DXY, blue trend-line) topped in Q1 and started collapsing. In 2017 that was the catalyst that fueled BTC's insane Parabolic Rally for the rest of the year.

Can the current Dollar collapse kick-start a rally for the rest of 2025? If the Trade War stabilizes, it certainly looks so. It is no coincidence that in 2017 Trump came out storming that the Dollar was too high just like he states now that the Interest Rates are too high, pressuring the Fed to cut.

So what do you think? Is the rest of 2025 destined to be as strong as 2017? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Cryptocurrencies

Ethereum Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring ETHUSDT for a buying opportunity around 1620 zone, Ethereum was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 1620 support and resistance zone.

Trade safe, Joe.

BITCOIN $140k will come sooner than you think!Bitcoin (BTCUSD) eventually made the strong rebound we've been talking about on the highly important Support cluster of: a) the 1W MA50 (blue trend-line), b) the former All Time High (ATH) trend-line and c) the Higher Lows Zone of the current Bull Cycle.

This Triple Hold Move is expected to produce the strongest rally of the Bull Cycle, the Parabolic Rally. But even if it is similar to the 'weakest' rally of this Cycle, then we should be expecting at least a +92.94% rise from the bottom, which translates to a price marginally above $140000. And that could come as early as this August.

So do you think we'll be seeing a rally at least as strong as last year's? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DOGE The 1D MA50 that starts historic rallies happened.Dogecoin (DOGEUSD) broke and closed 2 days ago above its 1D MA50 (blue trend-line) for the first time in 3 months (since January 18 2025) and basically the start of the Trade War fueled correction. This was achieved after the price hit and rebounded on the 2-year Higher Lows Zone.

This is a major bullish development as every time DOGE closed above its 1D MA50 following a Higher Lows Zone test, it started a major Bullish Leg of the current Bull Cycle. At the same time, the 1D RSI signaled a huge Bullish Divergence on that bottom, consistent with all previous bottoms within that 2 year span.

As for how high this new expected rally can get, we expect at least a test of the 1.5 Fibonacci extension, which is still lower that all rallies before it. Conservative long-term Target at $0.9000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN Well well well.. The break-out happened..Bitcoin (BTCUSD) completed a massive break-out yesterday as it convincingly left the 1D MA50 (blue trend-line) behind on its strongest 1D green candle since . The foundation of this was a 1D RSI Bullish Divergence on the April 08 2025 Low.

This is the same kind of Bullish Divergence that took place on the September 06 2024 Low and resulted in a similar Lower Highs bullish break-out. After an October 02 2024 re-test of the 1D MA50, the trend-line became the new Support all the way to the 3.382 Fibonacci extension (measured from the last Lower High).

As a result, we expect BTC's next medium-term Target to be $130000 (just below the new 3.382 Fibonacci extension).

So do you think the pattern will be repeated? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin Potential DownsidesBINANCE:BTCUSDT Hey Traders, in today's trading session we are monitoring BTCUSD for a selling opportunity around 89,500 zone, Bitcoin is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 89,500 support and resistance area.

Trade safe, Joe.

BITCOIN Most POWERFUL Signal Activated—Former ATH IS NOW SUPPORTBitcoin (BTCUSD) completed two straight green 1W candles and has started off this week equally impressive, approaching 4-week Highs! This is a direct consequence of the 1W MA50 (blue trend-line) holding as a Support, similar to what happened on the last two Higher Lows of the 3-year Channel Up on August 05 2024 and September 11 2023.

The hidden catalyst perhaps behind this strong move may be the fact that the April 07 2025 Low, besides the 1W MA50, it also rebounded on the former All Time High (ATH) Resistance Zone (red), which now turned into Support (green). This is the Zone that started with the November 08 2021 Cycle High and rejected BT on March 11 2024, April 08 2024, June 03 2024 and July 29 2024.

As long as this critical Support cluster (1W MA50, 2021 ATH Zone) holds, we are expecting the 1W MACD to form a new Bullish Cross, the first since October 14 2024, which technically confirmed the new Bullish Leg of the 3-year Channel Up.

In fact all previous 3 Bullish Legs got confirmed by a 1W MACD Bullish Leg and the minimum the rose by was +105.30%. As a result, after the Bullish Cross is confirmed, we will be expecting to see at least $150000 on this current bull run.

But what do you think? Can this hugely important Support cluster lead Bitcoin to $150k? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Tron Potential DownsidesBINANCE:TRXUSDT

Hey Traders, in today's trading session we are monitoring Tron for a selling opportunity around 0.25 zone, Tron is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 0.25 support and resistance area.

Trade safe, Joe.

The Black Swan Method- Making TA as a trader is like reading a magical ball but some major unpredictable events are out of control.

- i usually accurate most of the time but i should be a fool to think i am always right, it's impossible to make TA in that markets conditions.

- So this post is not to make some kind of predictions but to warn peoples on what's going on right now.

- i will try to explain very basically the situation (with my bad english skills, so forgive me if i make some mistakes) :

1/ the first attack was based on Luna and UST, some entities started to short UST/Luna with some billions $, FTX and SBF surely did it. Luna tried to save the situation with their BTC reserve but it was effortless. they lost all. (Luna have never been hacked, important to specify this )

2/ the fail of UST was the first step to create a snowball effect.

3/ 3AC, Celsius, Voyager, and much more were all involved in Luna/UST and Anchor Protocol witch was giving 18% returns on UST. They used customers funds in UST and staked, when the situation started to turn really bad for Luna, they tried to save the situation trading customers funds and they failed. (any of those companies have been hacked, important to specify this )

4/ FTX used customers funds and started to short their own products, FTT, SOL, SRM, etc , Binance saw the move and twitted that they will drop all their FTT.

FTX locked their customers wallets. FTX used 8B$ Customers funds to short markets. they are still right now trying to short USDT on Binance. (FTX have never been hacked, important to specify this).

5/ The snow ball started to be transformed in an avalanche. The damage here is huge. An exchange implosion of this magnitude is a gift to bitcoin haters all over the world.

6/ Sam bankman-fried was a Trojan horse in the crypto space, surely backed by banks and govs, a kind of worm witch have to be eradicated.

7/ Soon bankers will tell you, " u saw what happened with your exchanges ??!!, better use CDBC and stick with Banks!! ", this is their ultimate goal.

- i pray for everyone who got caught up in this mess and lost money with those bad actors.

- i hope you take care of yourself and continue to be a part of this journey.

- i hope it doesn't turn you off of crypto witch are here to stay in the future.

- BTC is resilient. No matter the magnitude of the earthquake.

- Buy BTC

- Store in Ledger, Trezor or Paper Wallet.

- Hodl and come back later.

Have faith in what you believe and fight. Thanks for reading!

PS : Not sure this post will get me banned or censored, but at this point the freedom of speech is an human right.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of April 18, 2025Technical Analysis and Outlook:

During the price movements observed throughout the week, Bitcoin has remained close to the previous Mean Support level of 85200 and appears poised to initiate an upward breakout, targeting the newly developed Mean Resistance level of 86400. This breakout may facilitate a retest of the completed Interim Coin rally at 88400, with additional expansions of targets also being a possibility. It is critical to acknowledge that potential for downward momentum may arise from a rechallenge of either the Interim Coin Rally at 88400 or the Mean Resistance at 86400.

DOGEUSDT Potetial DownsidesHey Traders, in today's trading session we are monitoring DOGEUSDT for a selling opportunity around 0.17000 zone, DOGEUSDT is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 0.17000 support and resistance area.

Trade safe, Joe.

BITCOIN's secret catalyst. The Gold-to-Crypto Rotation Is ComingBitcoin (BTCUSD) is attempting to form a new medium-term bottom here, following the Tariffs-led sell-off of the past 2 months. While the crypto market is consolidating and accumulating, the Gold market is smashing every historic All Time High (ATH) after the other.

This is not the first time we see this divergence between Gold and BTC and this is what historically delivers what we call 'Gold-to-Crypto Rotation'. This happens when Gold peaks, making its Bull Cycle Top, initiating a capital transition to BTC, hence starting the final rally of its Bull Cycle.

This has already taken place 3 times in its short history and Gold's sheer ferocity of the 2025 rally, indicates that we may possibly be about to repeat another one.

So what do you think is Gold about to top and offer a mass exodus a capital to Bitcoin, hence kickstarting a massive rally? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ATOMUSDT Breakout And Potential RetraceHey Traders!

In today's session, we're keeping a close eye on ATOMUSDT as it presents a potential buying opportunity around the 4.13000 zone.

After trading in a prolonged downtrend, ATOM has successfully broken out, signaling a possible trend reversal. Right now, the pair is in a correction phase, and it’s approaching a key support/resistance level near the 4.13000 area — a critical retracement zone we’re watching for potential bullish continuation.

Trade safe, Joe.

ETHUSDT – Eyeing a Potential Rejection Near 1650 ResistanceEthereum is currently in a downtrend, and the recent upward move appears to be part of a correctional phase. Price is now approaching the descending trendline and a key resistance area around $1650, which previously acted as support.

This zone could serve as a potential rejection area, especially if the broader bearish structure holds.

BTCUSDT – Watching for a Potential Short Near 87KBitcoin is currently trading within a broader downtrend, and the recent bullish move appears to be a correctional phase within that structure. Price is approaching a key resistance zone around $87,000, which aligns with the descending trendline and a previous support-turned-resistance level.

This confluence zone could act as a strong rejection area, offering a potential selling opportunity if bearish confirmation is seen. I’ll be watching for reversal signals (e.g., bearish candlestick patterns, momentum divergence) around that level to validate a short setup.

BITCOIN just triggered the ultimate post-Halving BUY SIGNAL!Bitcoin (BTCUSD) hit last week the top of the green Gaussian Channel (GC), a key indicator as last time it did (September 02 2024), kickstarted the massive 2024 rally towards the end of the year.

In fact, it can be argued that when BTC makes contact with the GC during a Bull Cycle, it is the ultimate pull-back Buy Signal after Halving events. More specifically, during the previous Cycle and after the May 2020 Halving, the price touched the GC three times (August 31 2020, July 19 2021 and September 20 2021), all of which were the most optimal pull-back Buy Entries as Bitcoin rebounded instantly.

So far during this Cycle and after the April 2024 Halving, this is the 2nd time the GC is tested. As mentioned the first also initiated an instant rebound. As a result, the current GC test is technically considered a very strong buy opportunity for the remainder of the Cycle, which based on the Time Cycles of the last 2 Cycle Tops, it should peak around October 06 2025.

So what do you think? If buying now towards a potential October 2025 Top, the perfect opportunity? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN Sell everything in October!Yep, kind of a clickbait title but it doesn't fail to serve justice to this very important Bitcoin (BTCUSD) chart.

Today's analysis displays in the most illustrative way the extremely tight symmetry between BTC's Cycles and how this can help us time our Sell at the Top of the Cycle and equally have the patience to buy as close to the next Bottom as possible.

As you see, in the past +10 years since the 2014 Bear Cycle, every Cycle has almost identical time ranges/ durations. All three Bear Cycles since then, lasted for approximately 1 year, and both Bull Cycles for almost 3 years (152 weeks, 1064 days to be exact). More specifically, the last two Bear Cycles were exactly 1 year long, the 2018 one started on the week of December 11 2017 and ended on December 10 2018 and the next Bear Cycle started on November 15 2021 and ended on November 07 2022. So it's been December-to-December and November-to-November Bear Cycles respectively.

If this high degree of symmetry continues to hold, counting 1064 days from the last Cycle Bottom o November 07 2022, gives a time estimate for the next Cycle Top on (the week of) October 06 2025. If also that holds for the Bear Cycle, expect an October-to-October duration, with an approximate bottom on October 12 2026.

So Sell everything up to October 2025 and Buy back as we get close to October 2026 is the strategy?

Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

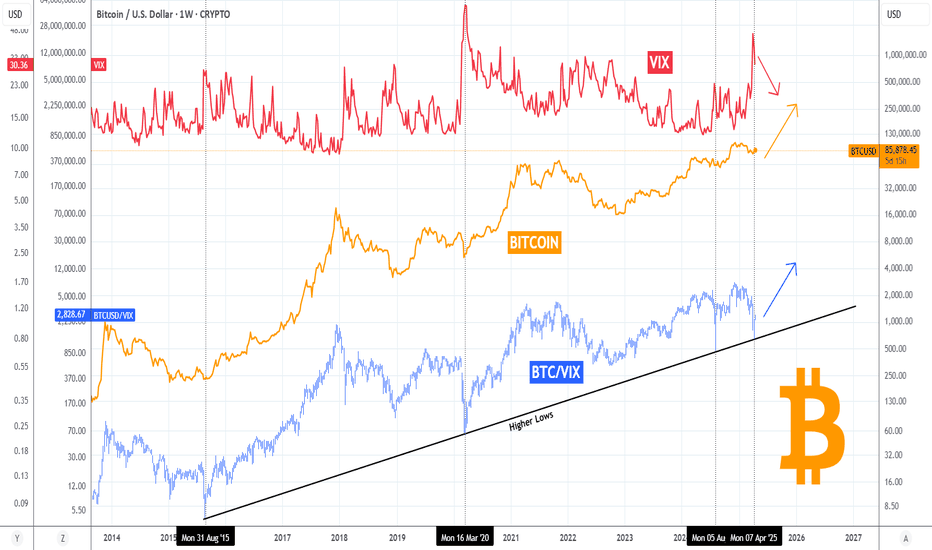

BITCOIN's ultimate VIX bottom signal-Last time gave +100% profitBitcoin (BTCUSD) is attempting to make yet another green day, yesterday not only did it close above its 1D MA50 again but was also the 4th green day in the last 6. This attempt is showing that the trend is gradually shifting again towards long-term bullish but today we'll present to you another one, this time in relation to the Volatility Index (VIX).

BTC's (orange trend-line) recent rise is naturally on a negative correlation with VIX (red trend-line) which is currently pulling back after it's most aggressive spike since the COVID flash-crash (March 2020).

Their ratio BTCUSD/VIX (blue trend-line) made a very interesting contact with the Higher Lows trend-line that has been holding since the August 24 2015 Low, which was the bottom of the 2014 Bear Cycle. Since then it made Higher Lows on March 16 2020, August 05 2024 and the most recent, April 07 2025. Every time it was a bottom indication and a massive rally followed. The 'weakest' of all was the previous one, which 'only' gave a +105% rise approximately. Based on that, there is no reason not to expect BTC to hit at least $150k by the end of this Bull Cycle.

Do you think that's a plausible target? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN's 1D MA50 Flip = GREEN LIGHT for the NEXT BIG PUMP!Bitcoin (BTCUSD) closed Saturday's 1D candle above the 1D MA50 (blue trend-line) for the first time in more than 2 months (since February 03)! The 1D MA50 got tested and rejected the price 6 times since then. At the same time, the price marginally broke above the Lower Highs trend-line that started on the January 20 All Time High (ATH).

This is the most powerful short-term bullish combination as it was staged on a Bullish Divergence 1D RSI, which is on Higher Lows against the bearish trend's Lower Lows. Technically such break-outs immediate Target is the 2.0 Fibonacci extension, which now happens to be just below the $100k mark at $99500. In not such a coincidental fashion, that is he last Resistance level that run through February 05 - 21 before BTC's strong tariff sell-off.

So do you think the 1D MA50 break is the green light for a $99500 rally? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin(BTC/USD) Daily Chart Analysis For Week of April 11, 2025Technical Analysis and Outlook:

In this eventful trading week, Bitcoin surpassed our key and completed Outer Coin Dip 78700 and another Outer Coin Dip 74500 target. As a result, we have robust rally development, and current development suggests a continuing rally as it aims to target a Mean Resistance level of 85200 and to retest the completed Interim Coin Rally 88400. There is also potential for additional target expansions. It is essential to note that a downward momentum may arise from the rechallenge of the Interim Coin Rally 88400 and/or the Mean Resistance at 75200.

BITCOIN Can it start an insane rally on CHEAP MONEY??Bitcoin (BTCUSD) seems to be at a point where it last was at the beginning of its current Bull Cycle in October 2022. And that's the point where the Global Liquidity Cycle Indicator (black trend-line) bottomed and started rising, confirming the more on Higher Lows.

This huge buy formation has been present on every BTC Cycle, usually at its bottom (but on the 2015 case, a little after) and signaled the huge monetary supply into the global markets, which translates into rising prices and rallies.

This is the first time we see the same rising liquidity formation twice in a Cycle. Can this be the driving force that BTC needs for its final and strongest parabolic rally of the Cycle towards the end of the year?

Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇