DOGEUSD: This is the rally that will deliver $1.00Doge is neutral on its 1D technical outlook (RSI = 52.126, MACD = -0.009, ADX = 40.011), recovering from its prior oversold state and testing the 1W MA50 for the first time in 3 weeks. The current rebound is being made after touching the 1W MA200, which is technically the new long term bottom, similar with August 5th 2024 and October 9th 2023. As shown, this is a once in a year buy opportunity that aims for the 1.618 Fibonacci extension on the HH trendline. The trade is long, TP = 1.000.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Cryptocurrency

BTCUSD: Can $160k be a very 'pessimistic' target estimate?Bitcoin is neutral on its 1W technical outlook (RSI = 50.359, MACD = 2868.500, ADX = 51.194) and having rebounded almost on its 1W MA50, there couldn't be a better buy opportunity for the rest of the year. Basically the price is now ranged inside the 1W MA50 and top trendline of the Pi Cycle, while the 1W CCI hit the -100.00 oversold limit. This has been the most efficient buy entry in August 2024 August 2023 even on the Cycle before in June 2021.

Even if the market doesn't make an 'excessive top' above the Channel Up, like the last two Cycles, hitting $160,000 would still be under the top of the Channel Up and the top of the Pi Cycle. No matter how high this target seems now, it will still be a pessimistic, 'bad case' scenario.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

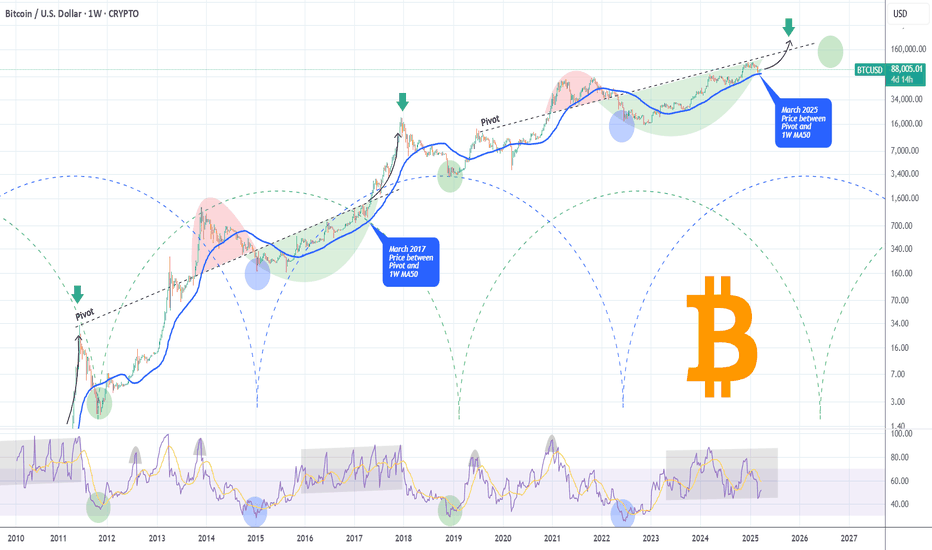

BITCOIN Mega Cycle starting the final Parabolic Rally.This is not the first time we review the Mega Cycle Theory on Bitcoin (BTCUSD). This states that in reality BTC's Cycle's since the beginning aren't 4 as traditional models suggest but 2. And in fact instead of the 4th, we are currently on just the 2nd BTC Mega Cycle.

Well this Theory has for sure a better gel with the stock market trend in the past 15 years but what's more important is that the price is now (March 2025) within the underlying Pivot trend-line and the 1W MA50 (blue trend-line), which is the same level it was coming toward the end of the 1st Mega Cycle. That was when it broke above the Pivot and started the hyper aggressive Parabolic Rally.

This Pivot trend-line is essentially the level that starts after the initial Cycle rally and acts as a Resistance turned Support and then Resistance again until the Cycle's final Parabolic Rally. Practically the Cycle mapping is more effectively viewed on the 1W RSI sequence. We are now at the stage when the 1W RSI ranges for the past 2 years between overbought (80.00) and neutral (45.00) like it was in 2016 - 2017.

In any case, this is yet another study showing that Bitcoin's Top can be at around $150k, which is currently marginally above the Pivot and as we head towards the end of 2025, the bar is raised to as high as $200.

So do you think we are just starting the final year Parabolic Rally to at least $150k? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

S&P500 This is the buy opportunity of the year for a 7000 TargetThe S&P500 index (SPX) is in the process of posting its 2nd straight green 1W candle, following a streak of 4 red weeks since the February 17 peak. That streaκ was technically the Bearish Leg of the 1.5-year Channel Up and as you can see, it made a direct contact with its bottom (Higher Lows trend-line).

As the same time, the 1W RSI almost touched the 40.00 Support that priced the October 23 2023 Low, which was the previous Higher Low of the Channel Up. The similarities don't stop there as both Bearish Legs had approximately a -10.97% decline, the strongest within that time-frame.

The Bullish Leg that followed that bottom initially peaked on a +28.85% rise, almost touching the 2.236 Fibonacci extension. Assuming the symmetry holds between the Bullish Legs as well, we can be expecting the index to start the new Bullish Leg now and target 7000 by the end of the year, which is marginally below both the 2.236 Fib ext and a potential +28.85% rise.

This may indeed be the best buy opportunity for 2025.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN historically sees huge rally when Gold peaks. This time?Bitcoin (BTCUSD) is coming, slowly but surely, out of a consolidation following the test and hold of its 1W MA50 and one of the reasons it is about to rally strongly may be flying under the radar for the majority.

That reason has to do with Gold (XAUUSD) and its long-term Cycles. As you can see on this 1W chart, every time Gold peaked in the past 10 years, BTC started the parabolic rally of its Bull Cycle. Equally during Gold's past 2 Cycles, when it revisited that peak and tested that Resistance, it made a Double Top and declined again, which for Bitcoin was translated into a Bear Cycle confirmation.

With the help of the Sine Waves, we can be expecting that Gold Double Top in early April 2026, which means that by that time BTC will already be in its new Bear Cycle. As a result, it is suggested be already out of the market with our profits by the end of 2025.

So based on all that, if Gold makes its Cycle Top now, which is highly likely, Bitcoin will start a parabolic rally. Now, will it be the strongest of its Bull Cycle as the past Cycles suggested? Could be, but even if its not, it should be enough to replicate the late 2024 one and give one final opportunity for profit making.

But what do you think? Is Gold's potential peak here give a very favorable rally to Bitcoin? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DOGEUSD making a huge bullish break-out. Eyes 0.800.Dogecoin (DOGEUSD) broke today above the Lower Highs trend-line that started 2 months ago (on the January 18 High).

The natural Resistance remains of course technically the 1D MA50 (blue trend-line) but with the 1D RSI already trending upwards and the price rebounding from the recent low at the bottom of the 1-year Channel Up, we can already claim that the new Bullish Leg has already started.

If it makes just a simple repeat of the previous Bullish Leg (which during Bull Cycles every rally is generally more aggressive than the previous), it can top the Channel Up and make a Higher High at $0.800.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

KAVAUSD – Midpoint Retest with a Shot at a Daily Higher LowCOINBASE:KAVAUSD / COINBASE:KAVAUSDC

Watching KAVA here on the daily, and it’s at a key decision point that could define the next leg. We’ve got two sets of Fibonacci retracements drawn: the first from the March 2024 high to the August 2024 low, and the second from the August low to the December high. Right now, price is retesting the 50% level of the larger March–August move—aka the midpoint of the macro range—and it's still holding above the 50% retracement of the more recent August–December leg. We’re also sitting right on the 38.2% Fib of that second move, which tends to act as a key area for potential higher lows.

The idea here is simple: I’m playing for a daily higher low. We had a strong move off the December lows, followed by a healthy consolidation, and this is where bulls need to step in. Structure-wise, this is the ideal area for bulls to attempt a defense if the trend is going to continue. EMAs are curling up, and price is still holding above the 12 and 26 EMAs for now, which gives me confidence in a potential bounce.

If the Trade Goes as Planned (Bullish Case)

If buyers step in here and confirm a higher low—ideally somewhere between $0.48 and $0.50—we’d expect a continuation toward the recent high at $0.56. If that level breaks, then $0.64 becomes the next area of interest based on prior price structure and confluence with the upper Fib retracement levels. From there, we could even make a push toward the $0.74 area, where the last major rejection happened in late 2024.

A strong bounce here also sets up a potential inverse head and shoulders structure on the daily if we revisit that neckline around $0.56 again with momentum. In short, a higher low here gives the bulls the setup they need to retake trend control.

If the Trade Fails (Bearish Case)

If price fails to hold the $0.48–$0.50 region and breaks below the August–December 50% Fib level, then we’re likely heading back to the $0.44 zone. That’s where the 200-day SMA is sitting, and it’s also a major pivot from previous support. A loss of that zone opens the door to a full retrace toward $0.39 or even $0.37—last seen during the November-December basing structure.

In that case, the trend would flip neutral at best and would require a fresh base-building phase before bulls could even think about regaining momentum.

TL;DR

Thesis: Playing for a daily higher low above key Fib levels and EMAs.

Bullish Target: Reclaim $0.56 → push toward $0.64–$0.74 if momentum follows through.

Bearish Invalidator: Break below $0.48 = likely revisit of $0.44 or lower.

Not financial advice. Just sharing my thinking as I try to stack confluence and play the levels. Let’s see if this bounce gets legs.

IP – Coiled Triangle with a $10 STORY to Tell?COINBASE:IPUSD / COINBASE:IPUSDC

We’ve got a clean symmetrical triangle forming post-initial listing volatility, and price is nearing the apex. Volume’s dropping off, just like you'd expect in the final stages of compression—classic pre-breakout behavior.

What caught my eye here is how this triangle lines up with a Fibonacci extension target up near $10. Yeah, sounds bold, but zoom out on a log chart and it actually looks pretty reasonable. The measured move from the initial impulse, paired with the triangle breakout structure, gives a clear path to that 1.618 extension level. Throw in the fact that the volume profile starts thinning out above $6, and there’s potential for a swift move if it catches a bid.

Triangle Compression and Breakout Setup

We’re in the late innings of this triangle consolidation. Lower highs, higher lows, volume fading—textbook stuff. If price can get through the $6 zone with conviction, the structure says we could see an aggressive breakout. If not, we’re probably looking at one more fakeout or shakeout before direction resolves.

Fibonacci Extension and Log Chart Math

Using Fib extensions on a log scale paints a pretty compelling picture. $10 sits right at the 161.8% extension off the initial run, and log charts smooth out the scale enough to show how that level isn’t just hopium—it’s structured speculation. The triangle adds context: this isn’t about chasing highs, it’s about waiting for the breakout confirmation from a pattern that’s been compressing for weeks.

Volume Profile and Context

VPVR shows strong acceptance around $5 and fading resistance above. If bulls can flip that region into support, the path to higher prices opens up fast. A breakout from this triangle above $6.25 or so, ideally on volume, could be the signal that this thing is ready to move.

Curious if anyone else is watching this chart. We’ve got a clear triangle, confluence with Fib levels, and log-scale structure supporting a much higher target. Could be a breakout worth watching—or just another consolidation that needs more time to cook.

Not financial advice. Just tracking setups, patterns, and potential. Let’s see if the STORY plays out.

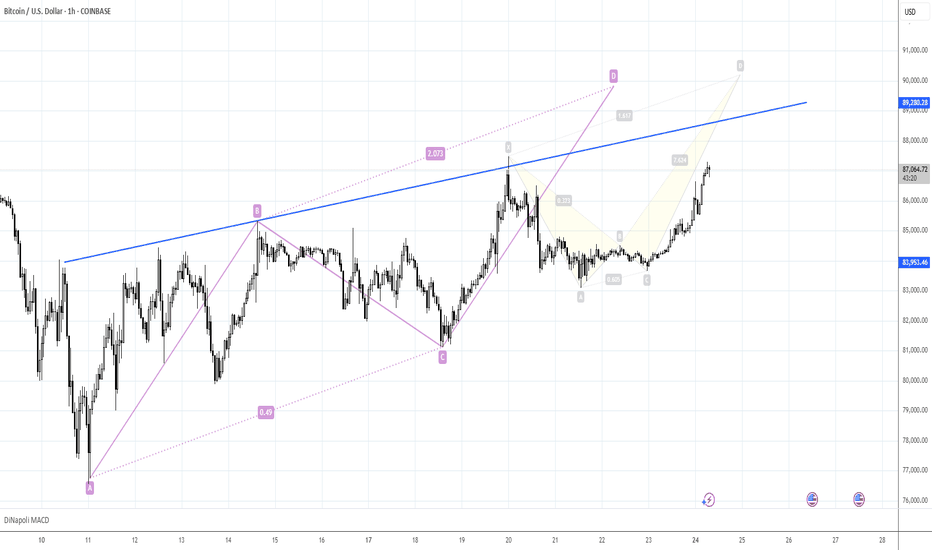

24/03/25 Weekly outlookLast weeks high: $87,453.65

Last weeks low: $81,140.91

Midpoint: $84,297.28

Great weekly close for the bulls! A reclaim of the weekly high in the dying hours of the week is a huge win and has spurred on an early run for the weekly high.

The overall goal for this move should be $91,000 in my opinion, and a must not lose area is $86,000 or 0.75 line/ last weeks weekly high.

What happens at $91,000 is yet to be determined and I have an idea many will be tentative around that area. On the high time frames a reclaim of this level unlocks the capability to retest the highs from a TA standpoint as price re-enters the range bound environment. A rejection of that level would make a $73,000 retest a very real possibility.

In terms of altcoins we're seeing some strength returning with some strong gains but relative to their sell-offs it is a a drop in the ocean so far. Currently the market conditions are a traders dream but a long term investor/holders nightmare. No major news is planned to come this week so unless something drastic happens TA should be the driving factor this week.

BITCOIN just broke above 4H MA200 for the 1st time in 1.5 month!Bitcoin (BTCUSD) broke today above its 4H MA200 (orange trend-line) for the first time in more than 1.5 month (since February 04). This is on its own a major bullish signal but fortunately for buyers, it is not the only one.

Just yesterday, the price also broke above the February 21 Lower Highs trend-line, the first medium-term Resistance of the market that basically started the brutal sell-off of late February and breaking above it technically restores the bullish sentiment back to the market and at the same time formed a 4H MA50/100 Bullish Cross for the first time in more than 2 months (January 18).

Obviously the complete confirmation will come if BTC breaks above its Channel Down but given the fact that 2 Resistance levels already broke and that the bottom looks like a W-shaped recovery pattern, we can already set a Target on the 99500 Resistance, which just so happens to be marginally below the 2.0 Fibonacci extension.

But what do you think? Is this 4H MA200 break-out the bullish signal the market needed after such a long time? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

What BTC is showing?! Full Scenario As of now market is really slow... Why?

As the History of BTC shows that market never formed a new high with out retesting its Support or previous Resistance level, as in 2020 market break its Resistance level which was 19,000 and market formed a new high in 2021 which was 68,000 after that market didn't formed a new high until it retested its last support level 19,000. After retesting 19,000 market shows us a new high of 109,000 and since Market has formed a new high it didn't retested its Support level which is 68,000, so According to me history will be repeated here, till market don't retest its previous level which is 68,000 market will be slow and bearish. After that market will perform a new high.

According to RSI there is also a bearish divergences which support my vision.

Watching for the same 90K area Part IIMorning folks,

Here is just minor update to our last idea. BTC mostly was flat in recent two sessions, so action is started only today.

So, the plan that we've prepared remains valid. Since an area around 90K is a strong resistance, we think that short entry attempt there is relatively safe, and at least should give us the chance to turn it to breakeven trade.

Now, on 1H chart we have two patterns that point on the same area.

ETH Breakout Setup: Eyeing $2,550 Target!"Key Observations:

Strong Support Level: ETH has bounced from a strong support zone around $1,792 - $1,905.

Retest & Buy Zone: Price has broken above a key level and is now retesting it, indicating a potential buy opportunity.

Resistance Zone: A key resistance zone is marked near $2,557.71.

Target Levels: The first target is set at $2,557.71, with a possible further extension to $2,854.38.

Bullish Confirmation: If ETH maintains support above $1,981, the uptrend towards the target is likely.

Trading Idea:

Entry: Buy on successful retest.

Stop Loss: Below the strong level at $1,905 - $1,792.

Take Profit: First target at $2,557.71, extended target at $2,854.38.

This setup follows a classic breakout and retest strategy, suggesting bullish momentum if Ethereum sustains above key levels.

Bitcoin Breakout: Potential Rally Towards $110K!"Key Observations:

Descending Channel: The price has been moving downward within a channel, showing lower highs and lower lows.

Support Level: Marked near $79,912.83, where the price recently bounced.

Breakout Scenario: BTC appears to be breaking out of the channel, suggesting a potential bullish trend.

Target: The projected target is $110,146.67, indicating a significant upward move.

Stop Loss: Positioned below the support level to manage risk in case of a price reversal.

Trading Idea:

A long trade setup is suggested, with entry upon confirmation of the breakout.

Stop-loss below the recent low ($79,912.83) to minimize risk.

Profit target near $110,146.67, aligning with previous resistance levels.

This setup follows a classic breakout and retest strategy, expecting bullish momentum if Bitcoin sustains above the resistance zone.

Falling Wedge Pattern For ZCash??When a security's price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move.

The trend lines drawn above the highs and below the lows on the price chart pattern can converge as the price slide loses momentum and buyers step in to slow the rate of decline.

Before the lines converge, the price may breakout above the upper trend line.

BITCOIN vs GOLD History will be repeated.Bitcoin has often been described as the digital Gold. And with good reason as it posseses the scarcity attribute of Gold like no other asset.

More often than not, we've seen Bitcoin replicate Gold's trading pattern and why not, as market psychology under certain set of conditions tend to be similar.

What better patterns to repeat than the long term ones. And on these charts you seen those.

Bitcoin's current Cycle is a Cup and Handle pattern, similar to Gold's formation after its former September 2011 ATH following the amazing rally after the launch of its ETF in the early 2000s.

Once Gold crossed above its MA50, it never broke back below it, in fact is provided support for its Handle twice.

Bitcoin is on a similar situation right now having held its MA50 last week, the 2nd time it supports it since the Handle did in August 2024.

Based on this Gold fractal, this is the best time to buy BTC again for its final rally of the year.

Follow us, like the idea and leave a comment below!!

APTOS priced long term bottom. Perfect long here.Aptos / APTUSD is trading inside a Triangle since its very first low historically and the price seems to be stabilizing after February's Low on its bottom.

In the meantime, it is double bottoming on the 1.5 year Support Zone with the 1week RSI formation common on all prior bottoms.

Buy and target 15.00 (Resistance A).

Follow us, like the idea and leave a comment below!!

BTCUSD: The Cycle won't peak before September!Bitcoin remains neutral on its 1W technical outlook (RSI = 47.334, MACD = 3198.500, ADX = 54.017) which, having kept the 1W MA50 intact as Support, suggest that this is the ideal level to buy again upon the continuation of the Bull Cycle. Despite the recent 2 month correction, the Cycle hasn't peaked and according to the Pre-Halving/ Post-Halving theory, that suggests that the time from the Cycle's Bottom to the Halving is almost identical to the time form the Halving to the Cycle's Top, we have until the end of September before the bull run is over. And that's because the range from the Cycle's Bottom to the 4th Halving was 75 weeks (525 days), which indicates that it will take around the same amount of time from the Halving before the Bull Cycle tops. See how amazingly consistent that has been on all of prior 3 Cycles. Consequently, the best strategy here would be to hold and start selling in September.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

AVAXUSD Channel Down bottomed. Bullish Leg to target $45.Avalanche (AVAXUSD) has been trading within a Channel Down for the past 12 months and on March 11 it priced the latest Lower Low. At the same time, the 1D RSI is on an uptrend, a technical Bullish Divergence.

It is the same kind of Bullish Divergence we also saw on the August 05 2024 Lower Low bottom. That bottom produced a Bullish Leg that almost reached the 0.9 Fibonacci retracement level. As a result, we can turn bullish here, targeting a $45.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN Will this historic level break too?Bitcoin (BTCUSD) remains supported on its 1W MA50 (blue trend-line), which is its main Bull Cycle Support, despite the recent volatility. As mentioned numerous times, in periods of uncertainty it helps you maintain an objective long-term perspective if you zoom out and look on the wider time-frames.

On this 1W chart, we can see that so far all of BTC's Cycle's have followed the same pattern. The Bear Cycle bottoms and the first bounce of the Bull Cycle aims at breaking above the ATH Lower Highs trend-line (blue Arc). It is what we call the 'Growth Channel' that guides the market from its Cycle bottom to break above the ATH Lower Highs and when it does the Parabolic Rally Phase (green Rectangle) starts. The most aggressive part is when the price breaks also above its Growth Channel.

This is the only Resistance level that has yet to be broke on this Cycle. If it does, the market will explode to Targets above $200k that will start putting it to capitalization levels that would require earth shattering catalysts in terms of adoption. A continuation of expansion within the boarders of the Growth Channel however can easily target $150k. Notice that throughout the whole process of the Growth Channel expansion on all Cycles historically, the 1W MA50 (blue trend-line) tends to hold and support.

So what do you think will happen this time? Will Bitcoin break above the Growth Channel and offer us another proper Parabolic Rally or will it be a more standard rise within it? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin's Wedge Breakout – Big Move Incoming?"Key Observations:

Descending Wedge Breakout:

BTC has been trading within a descending wedge pattern, which is typically a bullish reversal formation.

The price has now broken above the wedge, signaling potential upside momentum.

Buy Setup:

A buy entry is marked around $83,900 - $85,000.

The stop-loss is placed near $79,154 - $80,000, just below the previous support.

The target is set at $90,126, aligning with a key resistance level.

Trade Strategy:

Bullish case: If BTC sustains above the breakout level, it could rally toward $90,000+, offering a strong risk-reward opportunity.

Bearish case: If BTC falls back below $83,305, it may invalidate the bullish breakout and revisit lower support.

Conclusion:

This setup suggests bullish potential with a favorable risk-to-reward ratio. Traders should monitor BTC’s reaction at the buy zone and adjust their stop-loss accordingly.

BITCOIN approaching the critical 1day MA50 test.Bitcoin / BTCUSD has found the support it desperately needed on the 1week MA50 and rebounded.

Now it faces the most important Resistance of its Cycle, the 1day MA50.

Every time this broke in the last 2 years, the market started a strong rally.

Buy and target 140000, which would be just under the Pi Cycle Top.

Follow us, like the idea and leave a comment below!!