SHIBUSD can go x7 from here.Shiba Inu / SHIBUSD is rebounding at the bottom of the 3.5 year Triangle.

The 1week RSI is on a similar sequence as February-May 2023, which eventually rose aggressively by +661.50%.

Considering that the price made last week a Double Bottom with the August 5th 2024 low, this is a unique long term buy opportunity.

Buy and target 0.00008450

Follow us, like the idea and leave a comment below!!

Cryptocurrency

SUIUSD Can it go to $12??Sui / SUIUSD hit last week the Pivot Zone that marked the initial historic opening price, the Feb & Marhc 2024 Highs and October 2024 bottom.

So far this week is reacting with a bounce.

If the bullish trend is sustained, which is also the 0.618 Fibonacci and the 1week RSI bottom like July 2024, then we expect at least a +507.35% rise towards the 1.382 Fib extension.

Buy and target $12.000.

Follow us, like the idea and leave a comment below!!

USDJPY S&R IN 1-H AT MUST WATCH OUTHello Guys Here Is Chart Of USDJPY in 1-H AT

Entry Level: BUY Around 148,300 - 148,000

Target Will Be : 149,300

Support: 148,000 The yellow circles highlight previous points where the price respected this trendline as support

However, if the price breaks below the trendline, the bullish scenario may be invalidated.

BITCOIN Is this the 'most normal' Cycle of them all ??This is not the first time we use a Convergence/ Divergence approach to Bitcoin (BTCUSD) Cycles and certainly not the last one. On the previous one, it helped us to succesffuly predict the end of 2022 bottom but what we couldn't anticipate is how smooth the new/ current Cycle 5 (orange trend-line) would be.

As the title says, this is probably the 'most normal' Cycle of them all, as BTC has been trading within a Channel Up (orange) since the Bear Cycle's bottom more than 2 years ago.

To get a better understanding of this claim, we compare Bitcoin's (BTCUSD) Cycles from their previous top to the next one (with the exception of the first), on this complete mapping analysis, having them all displayed on top of another: Cycle 1 (green trend-line), Cycle 2 (red), Cycle 3 (blue), Cycle 4 (black) and the current one Cycle 5 (orange).

** Diminishing Returns **

As you see, first of all, this showcases the Theory of Diminishing Returns, which suggests that as the market grows and higher adoption is achieved, BTC will show less and less returns in each Cycle. Every Cycle Top has been lower from the previous one.

** Cycle Convergence - Divergence **

Secondly, all Cycles particularly during their Bear Phase and for a short time after, tend to follow a common path. The illustration on this analysis is very clear as it starts with each Cycle's Bear Phase and you can see that when they diverge, they converge again quickly. The most recent Bear Phase was not surprisingly as long as Cycle 4 and almost Cycle 3, which was to be expected as the market has shown an amazing degree of symmetry in the past 10 years. Note that this is also the model that helped as determine very early in 2023 that Cycle 3 would be the best fit for the new Cycle in terms of price action and without a doubt, BTC has been mostly replicating that Cycle.

** What's next for the current Cycle? **

If we compare the current Cycle (5) with Cycle 3 we can see that the Convergence - Divergence Model is holding. So far when Cycle 5 converged, it immediately diverged. And this is exactly what it has been doing since the December High and the marginal January All Time High (ATH). It has started to diverge significantly from Cycle 3 so what the recent pull-back to the 1W MA50 achieved is to normalize it and is about to touch it.

Now that the price hit the bottom of its +2 year Channel Up, we expect to rise, which will achieved convergence and contact with both Cycles 3 and 4, which is what they both did in their last 150 days of their respective Bull Cycles. Technically, this can take Cycle 5 to around $150k.

As we've first mentioned in the crypto space, regarding the last Bear Market being the 'smoothest' in history, we can securely say now that the current Bull Cycle is also the 'most normal' ever.

So what do you think? Does this Cycle regression model offer any useful conclusion as to where Bitcoin might top and if so, is this Cycle indeed the 'most normal' in the history? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

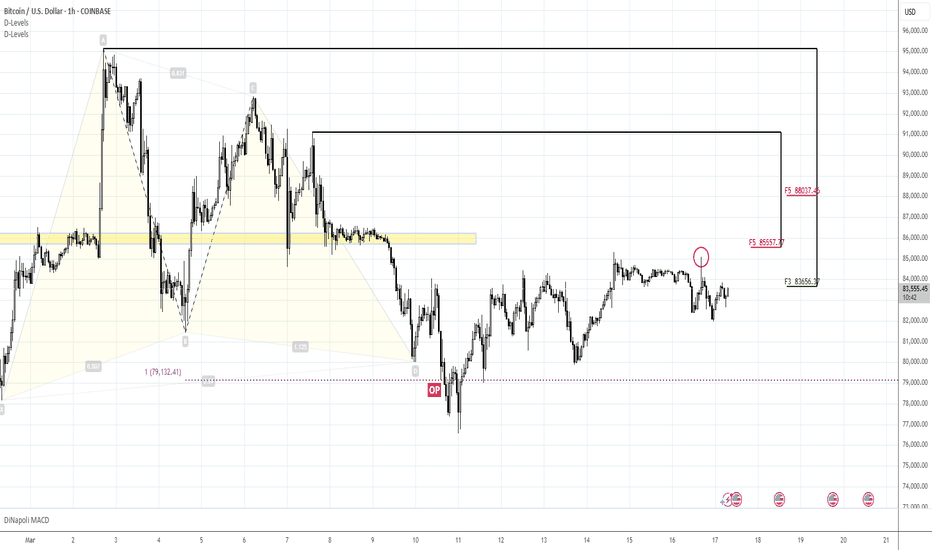

88K is not excluded but not granted as wellMorning folks,

So, we set for 85K sell and it worked. Downside reaction happened, but still, we call you to move stops to breakeven for some case.

The problem that we see is the market behavior. We see it not natural for normal bearish market. BTC stands stubbornly around K-resistance, not showing normal downside extension.

Our scenario of downside continuation from ~85K area is not broken yet, it is valid, and maybe everything will happen as we've suggested initially.

But we see the risk in the way of market behavior. It could lead to more extended upside bounce in the way of upside AB=CD pattern right to 88k resistance .

It means that if you already have bearish positions - move stops to breakeven. If you don't - do not take the new once for awhile. Or, at least, you could take but not more than 25-30% of your normal lot.

Our bearish scenario remains valid until market stands under 85.1K spike (because this is bearish reversal session on daily chart) and below 85.5K resistance in general. Upside breakout means an action to 88K.

Since we do not have the breakout it, I mark our update as "bearish", but we warned you... Take care.

JUPUSDT: Weekly Outlook & Key Levels for JupiterHey everyone! 🌟

Let’s take a look at this weekly cryptocurrency price chart together. Here's what stands out:

We’re looking at two possible scenarios:

Primary Scenario: The price might bounce back from the first support level, marked with a solid yellow arrow.

Secondary Scenario: If it doesn’t, the next potential rebound is from the lower support level, shown with a dashed yellow arrow.

Keep an eye on the numbers highlighted—$0.4310 and $0.3798. These are key price levels that could guide future movements. It’s also essential to monitor liquidity, candlestick patterns, and trading volumes. A strong confirmation, like a favorable candlestick formation and sufficient volume, could signal a rebound.

However, if the price dips below these critical levels, it might shift the perspective. Staying vigilant is key.

Always remember, this is just an observation. Do your own research, stay informed, and keep learning. The journey in the crypto world is as much about growth as it is about numbers! 📚📈✨

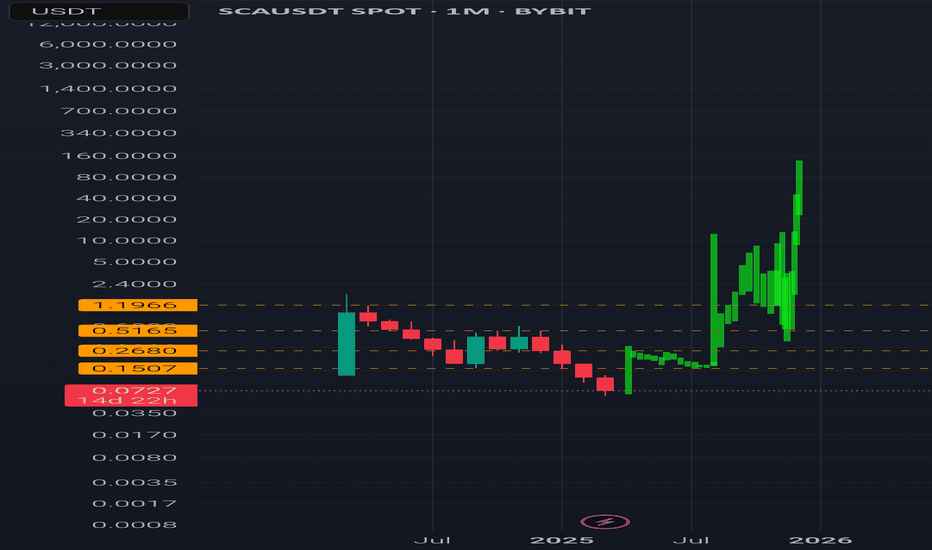

Scallop (SCA) Potential 200x Gains by next bull run

Current Market Overview:

Current Price: $0.07

Market Cap: $8M

Target Market Cap: $200M+

Potential Growth: 25x - 200x

Showing strong accumulation signals, indicating that most weak hands have already exited. With whales now in control, the price action suggests an imminent breakout in the coming bull run.

Key Observations:

✅ Deep Accumulation Phase: The price has been suppressed for a long time, suggesting all early holders have been flushed out.

✅ Whale Accumulation: With fewer retail traders, whales can now dictate price action, leading to a controlled rally.

✅ Bull Market Catalyst: If the Bitcoin cycle and altcoin season play out as expected, SCLP could experience parabolic growth.

Price Targets Based on Market Structure:

TP1: $0.25 → Initial breakout level (6.5x from current price)

TP2: $0.60 → Strong resistance (15x)

TP3: $6.00 → Major psychological level (85x)

TP4: $28.00+ → Full bull cycle potential (400x+)

Market Cap Projections:

At $1.75 (25x Growth): ~$200M market cap

At $6.00 (85x Growth): ~$700M market cap

At $28.00 (400x Growth): ~ SEED_TVCODER77_ETHBTCDATA:3B market cap

TradeCityPro | UNIUSDT Ready to Break the Trend Line👋 Welcome to TradeCityPro Channel!

Let's analyze and review one of the best crypto DeFi projects and projects that have good income in the crypto space!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

In the weekly time frame, we are witnessing a deep correction of this coin and the situation is not very good and these events are also due to the recent negative news in the market, but we experienced a 68 percent drop!

We have now reached an important support which is 5.599 and in terms of price it is really a good price for the yoni but I don't have any suggestions to buy it right now because it is a very strong downtrend and we need to form a structure!

Even if we need to lose a percentage of the movement, we will lose it so that we can enter with the momentum and we do not need to buy a step like the others and for now we will watch for a purchase, but to exit after the level of 4.051, I will exit myself

📈 Daily Timeframe

The same thing is happening on the daily time frame and after being rejected from 18.664 and not reaching this price ceiling, we went for a price correction and formed a box between 12.830 and 15.264

After breaking the bottom of this box, we started a downward movement and I had a bounce to this support and I went to continue the fall and now we have reached the important support of 5.617 and we are probably going to go for a time range and form a box

Currently, it is expected that we will go for a range and form a price structure and we must consider that sellers are no longer willing to sell and have been on it for a few days This is the support level and it is not a good level to buy at the moment, but if we form a box after it breaks, we can buy.

⏱ 4-Hour Timeframe

On the four-hour time frame, this recent decline is also clearly visible on the chart and has even caused us to form a downward trend line of the retracement type.

I should mention that trend lines are divided into two categories: retracement and continuation. Continuing trend lines are those that continue our main trend after the trend line breaks and usually we do not need a trigger to trade it, but retracement trend lines are trend lines that change our main trend and to open a position with them, I myself wait for the trend line to break and a confirmation trigger!

📈 Long Position Trigger

with the above explanation, after the trend line and trigger 6.287 break, we can open a risky long position, but if this happens, by forming a higher bottom and top after breaking that top, we will have a much better trigger and we are more confident that the trend will continue

📉 Short Position Trigger

our task is completely specific, and after breaking 5.721, we can open our position, and we can also continue to do the same with each rejection from this trend line and get confirmation for the position if the volume increases, but our main trigger will still be 5.721

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

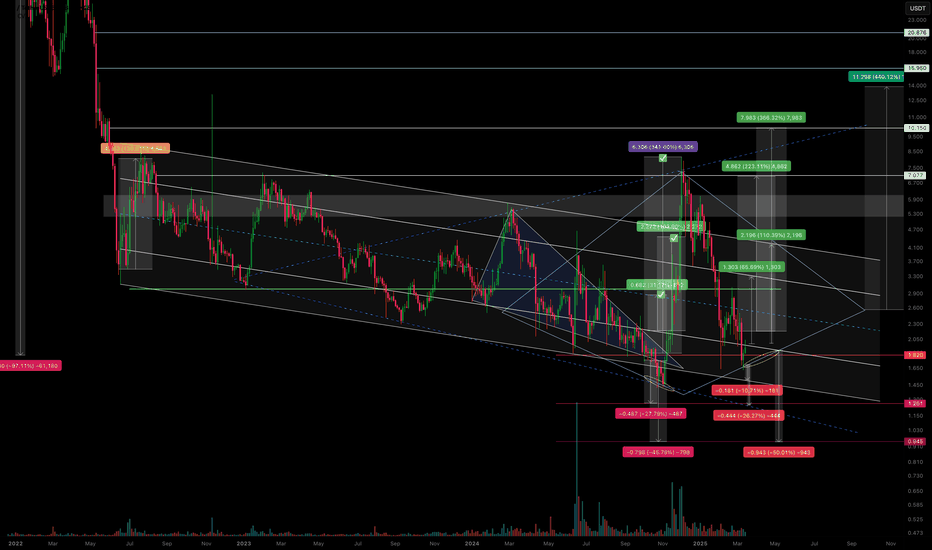

CVX/USDT – Is the scenario repeating? Continuing to work.The previous trading idea has played out with 3 out of 4 marked zones reached.

We saw a false breakout from the descending channel, followed by a pullback in line with the overall market—returning to the channel’s support zone.

I’ve noticed a potential formation of either a diamond pattern or an expanding triangle, but we’ll see how it plays out further.

Regarding declines and support zones:

-10.71% drop to the support of the descending channel.

-26.27% drop to the anticipated support of the expanding triangle.

-50% drop, likely as a squeeze under extremely negative news.

Regarding growth and resistance zones:

+65% rise to the resistance of the internal channel.

+110% rise to the resistance of the external channel (and if a diamond pattern forms, then its boundary).

+246% rise as a second attempt to break out of the descending channel.

+440% rise as a potential realization of diamond pattern pricing (if it forms).

All of this should be factored into your trading strategy, even the less likely scenarios.

I'll share the execution of the previous trading idea in my TG. I've also marked it on the chart.

BTC TRIANGLE CHART PATTERN IN 15-MHello Guys Here Is Chart Of BTCUSDT in 15-M AT

Entry Level: SELL Around 84500

Resistance: The upper trendline of the Triangle 84800

Support: Around below our Target 82000

Target Will Be : 82600

If BTC breaks below this level, the Triangle pattern and,And then it went to more further downside could.

UniversOfSignals | Ethereum – The Never Ending Bear Trend?👋 Welcome to the UniversOfsignals channel!

Current Market Structure – Bearish Trend Dominates

Ethereum (ETH) is currently in a well-defined downtrend, consistently rejecting imbalance zones (highlighted in blue on the chart). Each time price reaches one of these zones, we see a rejection followed by a move lower. This has been a repeated pattern, confirming that sellers remain in control and that ETH is struggling to gain any meaningful bullish momentum.

The presence of a clear descending trendline further supports this bearish structure, as ETH continues to respect this resistance and fails to break higher. Until we see a strong shift in price action, the trend remains intact, and lower prices are likely.

Rejection of Imbalance Zones – No Bullish Confirmation Yet

The imbalance zones act as strong resistance, and so far, every attempt to push above them has resulted in rejection. This means that until one of these imbalance zones is invalidated (i.e., price breaks and holds above one), we cannot consider any bullish scenario.

Each rejection strengthens the bearish case, reinforcing the idea that ETH is likely to continue making lower lows and lower highs. Unless buyers step in with significant strength and push ETH beyond a key resistance level, the safest approach is to assume that the downtrend will continue.

When Can We Consider a Bullish Scenario?

For ETH to turn bullish, we need to see at least one of the following:

Breakout above an imbalance zone – This would indicate a shift in market structure and potential strength from buyers.

Higher highs and higher lows forming – A sign that momentum is shifting away from the current bearish trend.

Price reclaiming key resistance levels – If ETH can reclaim lost ground and sustain above it, it may indicate a potential reversal.

Until one of these conditions is met, there is no reason to be bullish. Any upside move that fails to break a key resistance should be considered a shorting opportunity rather than a bullish reversal.

Key Bearish Confirmation – Lower Prices Expected

As long as ETH keeps rejecting imbalance zones and making lower highs, the market structure remains bearish. The next downside targets are likely to be the previous support levels, with price potentially dropping towards the $1,600-$1,500 range if selling pressure continues.

The projected red price movement on the chart suggests that ETH could consolidate for a bit before continuing its descent. This aligns with the current trend and price behavior.

Historical Context – ETH at 2-Year Lows

ETH is currently trading at a price level last seen two years ago, reflecting significant weakness. Despite temporary rebounds, price action remains suppressed, and we are not seeing the kind of momentum that would indicate a strong recovery.

While some may view this as a “cheap” buying opportunity, the reality is that ETH is showing no bullish strength in its current price action. Without a confirmed trend reversal, simply being at a low price does not make it a good buy. Catching a falling knife is risky, and it is better to wait for confirmation before considering long positions.

Final Thoughts – Patience is Key

ETH remains in a strong bearish trend, and every rejection confirms lower prices.

No bullish confirmation yet – price needs to break a key level before we consider upside potential.

Expect further downside unless market structure changes.

ETH is at historical low levels, but low prices alone do not mean bullish momentum is coming.

As traders, the best approach is to wait for confirmation and trade with the trend. Until ETH proves otherwise, the bearish structure remains dominant, and downside targets remain in play.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Also let me know if you want to see a chart of another coin. I will create it for you.

TradeCityPro | ENAUSDT Ready to Go!👋 Welcome to the TradeCityPro channel!

Let's go together to analyze and review one of my favorite coins and DeFi coins that we are likely to have and experience a movement in the coming days

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

On the weekly time frame, after we hit the 1.2788 level, which was our ATH, we got rejected from it and engulfed the previous weekly candle.

This was also an exit point or a take profit for us, and after this, it is very logical to withdraw some of our capital, and the reason is that the buyers could not do anything and push the price above this level!

📈 Daily Timeframe

On the daily time frame, but after we followed a parabolic move and its slope reached the end of the road, we were rejected by the important resistance of 1.2788

This rejection caused our parabolic move to end and after its failure, we went for an upward move again, but we were rejected by the resistance and went for the support of 0.7857

After the failure of this support and the pullback to it, we went for a rejection again from this resistance and are currently suffering between 0.3282 and 0.4833, with the difference that there is still more presence of sellers for this event

To buy at risk, you can also make a long position at risk after the level of 0.4833 because we can only be active in DeFi and take our coins to DeFi. Now that we are talking about DeFi, you can in this space Also set the liquidity range of the money and we can exit to activate the spot below the level of 0.3282!

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

Bitcoin at a Crossroads

Bitcoin has reached a key support zone after its recent decline and is now in recovery mode. We expect this upward movement to continue until it reaches the identified resistance level, targeting the $95,000 range.

At this point, two potential scenarios are in play, as shown in the chart:

1–Bullish Scenario: If Bitcoin successfully breaks the $95,000 resistance, the path for further upside will be clear, and higher targets could be reached.

2–Bearish Scenario: If the price fails to break this key resistance, a correction and decline toward lower support levels may follow.

The next move for Bitcoin depends on how it reacts at the resistance level.

What are your thoughts on the upcoming price action?

Don’t forget to like and share your thoughts in the comments! ❤️

MDT ANALYSIS📊 #MDT Analysis

✅There is a formation of Descending Channel Pattern in daily chart. Currently #MDT is in bearish way.

After a breakout of the pattern and major resistance level we would see a bullish momentum otherwise the price will drop more 🧐

👀Current Price: $0.02980

⚡️What to do ?

👀Keep an eye on #MDT price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#MDT #Cryptocurrency #Breakout #TechnicalAnalysis #DYOR

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 14, 2025Technical Analysis and Outlook:

In the current week's trading session, Bitcoin has made multiple hits by retesting our completed Outer Coin Dip 78800 on Sunday and Monday. Consequently, the cryptocurrency has experienced a significant uptrend, reaching the inverse (Resistance) Mean Sup 84700 level. This upward oscillation indicates a potential for further price rally and suggests a likelihood of advancing toward the target designated as the Interim Coin Rally 88400. Such developments could facilitate an extension toward the supplementary target of Mean Res 94500 and beyond. If there is a decline from Interim Coin Rally 88400 or its current price level, the coin is expected to retest the completed Outer Coin Dip 78700, potentially reinstating the upward rally.

SOLANA; Heikin Ashi Trade IdeaBINANCE:SOLUSD

In this video, I’ll be sharing my analysis of SOLUSD, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

BTCUSD, Are we going to face 35% Correction ?! (Local View)BTCUSD, Are we going to face 35% Correction ?! (Local View)

Let's take a look at local movements on INDEX:BTCUSD .

Since last post Bitcoin moved in our favor, reached 38,500$.

We have a strong bounce here, which is heading towards upper 40s as long as daily close was above big red candle.

There is a probability, that Bitcoin is going to draw lower high which can be anywhere from 38.2 to 61.8 (Golden Pocket) Fib. In confluence we have several magnets at this range.

Possible stop losses around 43,500$

Fair Value Gap around 44,500$. Possible liquidations Across top 3 exchanges (Binance, OKX, Bybit) totaling around 4.0 Bln. USD. (This number covers last 30 Days Data)

Hence we should take into consideration, that huge amount of liquidity is sitting down in the previous reaccumulation zone. (Suggesting to check out Liquidity Heatmap . Putting link because I am not able to add screenshot.)

- - - - - - - - -

Next I want to mention one weird thread I bumped into on Twitter.

It’s about HTX (ex Huobi), which is owned by Justin Sun. They turned off their proof-of-reserves system, what hints about their insolvency. Onchain analysis say that they have problems with ETH holdings.

Also this is not connected to only HTX, things are being wrong with TUSD and stUSDT (Stacked USDT receipt on TRON Network).

For further details about this event please read thread from adamscochran on twitter . Hence there was around 600 Mln. USDT transfer to JustlandDao yesterday.

In the end, I want to mention, that there is no 100% accurate analysis.

We are dealing with probabilities, just with analysis we are shifting probabilities to our favor.

Best Wishes.

BTCUSD, Are we going to face 35% Correction ?!If we take a look at previous 2 notable cycles we easily notice similarities.

From these 2, 2022-2024 looks more similar to 2016-2017, as long as we had -

Breakout of downtrend line. ✅

Reaccumulation zone. ✅

Testing major bear market impulse (Which in all cases became strong resistance). ✅

What we didn't experience is correction after these 3 moves.

In 2016 it was around 40% (Tested reaccumulation zone)

In 2019 it was around 53% (Tested major support / resistance zone).

As long as current market structure somewhat repeats 2016 move, have possibility to retest top of after trend line breakout reaccumulation zone, which sits around 33-32k.

Percentage wise it's around 35% from ETF top and 23% from current price.

What you think ?

ETHUSD: Cyclical Pivot can slingshot it to at least $6,000Ethereum is almost oversold on its 1D technical outlook (RSI = 35.473, MACD = -206.770, ADX = 45.110) but this 1W candle is rebounding on the P1 trendline, which is the Pivot that started from the November 2021 ATH and already caused the a bounce on the August 5th 2024 contact. A similar P1 trendline was present during the 2018-2021 Cycle and its final contact was the March 2020 COVID crash, which kickstarted the insane rally. All similar rallies have hit at least the 1.5 Fibonacci extension and in some occasions the 2.0 Fib. Consequently we are confident enough to aim for at least the 1.5 Fib (TP = 6,000). Risk seekers can attempt a 9,000 test but more cautiously.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XRP Approaches Critical Support at $2.00Key Technical Level:

XRP is testing the strong $2.00 support level, which has consistently acted as a key price floor since December.

Descending Triangle Formation:

The price action is forming a descending triangle, where decreasing volatility suggests an imminent breakout. This pattern emerges as XRP approaches the intersection of descending resistance and horizontal support.

Bullish or Bearish?

A confirmed breakout above resistance could trigger a strong rally.

A sustained drop below $2.00 would invalidate the bullish outlook, potentially leading to a retracement toward $1.60-$1.80.

Market Perspective:

XRP’s rally from $0.60 to over $3.40 since November suggests that the current correction is likely a phase of profit-taking rather than a full trend reversal. However, traders should remain cautious and watch for confirmation of direction.

Stay alert—XRP is at a decisive moment! 🚀📉

#XRP #Crypto #MarketAnalysis #Trading #TechnicalAnalysis #Cryptocurrency #Bullish #SupportLevel

BITCOIN Is this a Falling Wedge bottom formation?Bitcoin (BTCUSD) is trading since the February 28 Low within a Falling Wedge pattern, below the 1D MA50 (blue trend-line) and at the same time supported by the 1W MA50 (red trend-line).

Throughout its dominant Bull Cycle pattern, the +2 year Channel Up, it has formed another 6 such Falling Wedges, all below the 1D MA50 and all turned out to be market bottom formations, which paved the way for an immediate bullish break-out. On all occasions, the 1D CCI has been almost as low as on the February Low.

The shortest rebound it made before another break below the 1D MA50, was +26.68% and the highest was +106.96%. As a result this gives us a minimum immediate potential Target of $96800 and a maximum of a little more than $150000. Given that the price has touched the bottom of the long-term Channel Up, like the bottom formations of September 06 2024 and September 11 2023, it is quite likely to see the stronger rebound probability taking place.

But what do you think would be the case? Is this a classical Falling Wedge bottom break-out formation and if so what may be the Target? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇