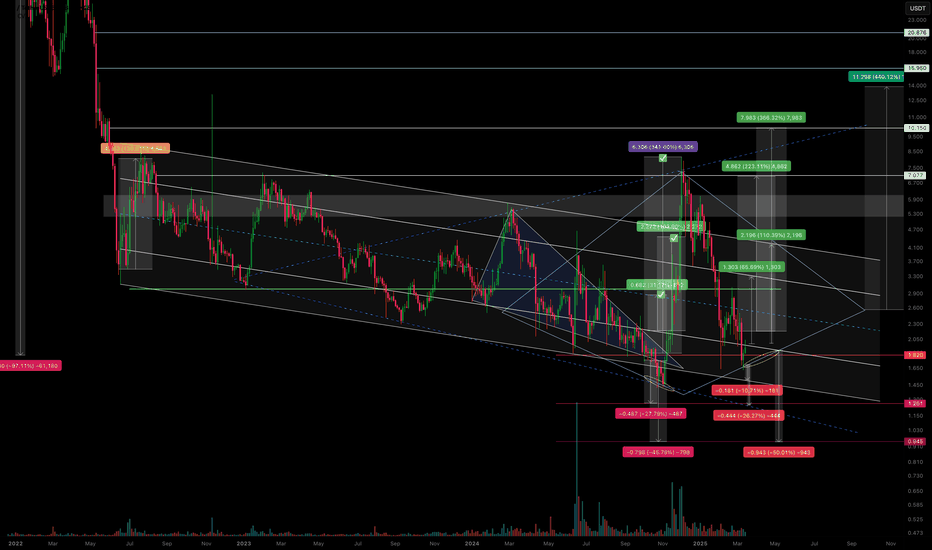

CVX/USDT – Is the scenario repeating? Continuing to work.The previous trading idea has played out with 3 out of 4 marked zones reached.

We saw a false breakout from the descending channel, followed by a pullback in line with the overall market—returning to the channel’s support zone.

I’ve noticed a potential formation of either a diamond pattern or an expanding triangle, but we’ll see how it plays out further.

Regarding declines and support zones:

-10.71% drop to the support of the descending channel.

-26.27% drop to the anticipated support of the expanding triangle.

-50% drop, likely as a squeeze under extremely negative news.

Regarding growth and resistance zones:

+65% rise to the resistance of the internal channel.

+110% rise to the resistance of the external channel (and if a diamond pattern forms, then its boundary).

+246% rise as a second attempt to break out of the descending channel.

+440% rise as a potential realization of diamond pattern pricing (if it forms).

All of this should be factored into your trading strategy, even the less likely scenarios.

I'll share the execution of the previous trading idea in my TG. I've also marked it on the chart.

Cryptocurrency

BTC TRIANGLE CHART PATTERN IN 15-MHello Guys Here Is Chart Of BTCUSDT in 15-M AT

Entry Level: SELL Around 84500

Resistance: The upper trendline of the Triangle 84800

Support: Around below our Target 82000

Target Will Be : 82600

If BTC breaks below this level, the Triangle pattern and,And then it went to more further downside could.

UniversOfSignals | Ethereum – The Never Ending Bear Trend?👋 Welcome to the UniversOfsignals channel!

Current Market Structure – Bearish Trend Dominates

Ethereum (ETH) is currently in a well-defined downtrend, consistently rejecting imbalance zones (highlighted in blue on the chart). Each time price reaches one of these zones, we see a rejection followed by a move lower. This has been a repeated pattern, confirming that sellers remain in control and that ETH is struggling to gain any meaningful bullish momentum.

The presence of a clear descending trendline further supports this bearish structure, as ETH continues to respect this resistance and fails to break higher. Until we see a strong shift in price action, the trend remains intact, and lower prices are likely.

Rejection of Imbalance Zones – No Bullish Confirmation Yet

The imbalance zones act as strong resistance, and so far, every attempt to push above them has resulted in rejection. This means that until one of these imbalance zones is invalidated (i.e., price breaks and holds above one), we cannot consider any bullish scenario.

Each rejection strengthens the bearish case, reinforcing the idea that ETH is likely to continue making lower lows and lower highs. Unless buyers step in with significant strength and push ETH beyond a key resistance level, the safest approach is to assume that the downtrend will continue.

When Can We Consider a Bullish Scenario?

For ETH to turn bullish, we need to see at least one of the following:

Breakout above an imbalance zone – This would indicate a shift in market structure and potential strength from buyers.

Higher highs and higher lows forming – A sign that momentum is shifting away from the current bearish trend.

Price reclaiming key resistance levels – If ETH can reclaim lost ground and sustain above it, it may indicate a potential reversal.

Until one of these conditions is met, there is no reason to be bullish. Any upside move that fails to break a key resistance should be considered a shorting opportunity rather than a bullish reversal.

Key Bearish Confirmation – Lower Prices Expected

As long as ETH keeps rejecting imbalance zones and making lower highs, the market structure remains bearish. The next downside targets are likely to be the previous support levels, with price potentially dropping towards the $1,600-$1,500 range if selling pressure continues.

The projected red price movement on the chart suggests that ETH could consolidate for a bit before continuing its descent. This aligns with the current trend and price behavior.

Historical Context – ETH at 2-Year Lows

ETH is currently trading at a price level last seen two years ago, reflecting significant weakness. Despite temporary rebounds, price action remains suppressed, and we are not seeing the kind of momentum that would indicate a strong recovery.

While some may view this as a “cheap” buying opportunity, the reality is that ETH is showing no bullish strength in its current price action. Without a confirmed trend reversal, simply being at a low price does not make it a good buy. Catching a falling knife is risky, and it is better to wait for confirmation before considering long positions.

Final Thoughts – Patience is Key

ETH remains in a strong bearish trend, and every rejection confirms lower prices.

No bullish confirmation yet – price needs to break a key level before we consider upside potential.

Expect further downside unless market structure changes.

ETH is at historical low levels, but low prices alone do not mean bullish momentum is coming.

As traders, the best approach is to wait for confirmation and trade with the trend. Until ETH proves otherwise, the bearish structure remains dominant, and downside targets remain in play.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Also let me know if you want to see a chart of another coin. I will create it for you.

TradeCityPro | ENAUSDT Ready to Go!👋 Welcome to the TradeCityPro channel!

Let's go together to analyze and review one of my favorite coins and DeFi coins that we are likely to have and experience a movement in the coming days

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

On the weekly time frame, after we hit the 1.2788 level, which was our ATH, we got rejected from it and engulfed the previous weekly candle.

This was also an exit point or a take profit for us, and after this, it is very logical to withdraw some of our capital, and the reason is that the buyers could not do anything and push the price above this level!

📈 Daily Timeframe

On the daily time frame, but after we followed a parabolic move and its slope reached the end of the road, we were rejected by the important resistance of 1.2788

This rejection caused our parabolic move to end and after its failure, we went for an upward move again, but we were rejected by the resistance and went for the support of 0.7857

After the failure of this support and the pullback to it, we went for a rejection again from this resistance and are currently suffering between 0.3282 and 0.4833, with the difference that there is still more presence of sellers for this event

To buy at risk, you can also make a long position at risk after the level of 0.4833 because we can only be active in DeFi and take our coins to DeFi. Now that we are talking about DeFi, you can in this space Also set the liquidity range of the money and we can exit to activate the spot below the level of 0.3282!

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

Bitcoin at a Crossroads

Bitcoin has reached a key support zone after its recent decline and is now in recovery mode. We expect this upward movement to continue until it reaches the identified resistance level, targeting the $95,000 range.

At this point, two potential scenarios are in play, as shown in the chart:

1–Bullish Scenario: If Bitcoin successfully breaks the $95,000 resistance, the path for further upside will be clear, and higher targets could be reached.

2–Bearish Scenario: If the price fails to break this key resistance, a correction and decline toward lower support levels may follow.

The next move for Bitcoin depends on how it reacts at the resistance level.

What are your thoughts on the upcoming price action?

Don’t forget to like and share your thoughts in the comments! ❤️

MDT ANALYSIS📊 #MDT Analysis

✅There is a formation of Descending Channel Pattern in daily chart. Currently #MDT is in bearish way.

After a breakout of the pattern and major resistance level we would see a bullish momentum otherwise the price will drop more 🧐

👀Current Price: $0.02980

⚡️What to do ?

👀Keep an eye on #MDT price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#MDT #Cryptocurrency #Breakout #TechnicalAnalysis #DYOR

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 14, 2025Technical Analysis and Outlook:

In the current week's trading session, Bitcoin has made multiple hits by retesting our completed Outer Coin Dip 78800 on Sunday and Monday. Consequently, the cryptocurrency has experienced a significant uptrend, reaching the inverse (Resistance) Mean Sup 84700 level. This upward oscillation indicates a potential for further price rally and suggests a likelihood of advancing toward the target designated as the Interim Coin Rally 88400. Such developments could facilitate an extension toward the supplementary target of Mean Res 94500 and beyond. If there is a decline from Interim Coin Rally 88400 or its current price level, the coin is expected to retest the completed Outer Coin Dip 78700, potentially reinstating the upward rally.

SOLANA; Heikin Ashi Trade IdeaBINANCE:SOLUSD

In this video, I’ll be sharing my analysis of SOLUSD, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

BTCUSD, Are we going to face 35% Correction ?! (Local View)BTCUSD, Are we going to face 35% Correction ?! (Local View)

Let's take a look at local movements on INDEX:BTCUSD .

Since last post Bitcoin moved in our favor, reached 38,500$.

We have a strong bounce here, which is heading towards upper 40s as long as daily close was above big red candle.

There is a probability, that Bitcoin is going to draw lower high which can be anywhere from 38.2 to 61.8 (Golden Pocket) Fib. In confluence we have several magnets at this range.

Possible stop losses around 43,500$

Fair Value Gap around 44,500$. Possible liquidations Across top 3 exchanges (Binance, OKX, Bybit) totaling around 4.0 Bln. USD. (This number covers last 30 Days Data)

Hence we should take into consideration, that huge amount of liquidity is sitting down in the previous reaccumulation zone. (Suggesting to check out Liquidity Heatmap . Putting link because I am not able to add screenshot.)

- - - - - - - - -

Next I want to mention one weird thread I bumped into on Twitter.

It’s about HTX (ex Huobi), which is owned by Justin Sun. They turned off their proof-of-reserves system, what hints about their insolvency. Onchain analysis say that they have problems with ETH holdings.

Also this is not connected to only HTX, things are being wrong with TUSD and stUSDT (Stacked USDT receipt on TRON Network).

For further details about this event please read thread from adamscochran on twitter . Hence there was around 600 Mln. USDT transfer to JustlandDao yesterday.

In the end, I want to mention, that there is no 100% accurate analysis.

We are dealing with probabilities, just with analysis we are shifting probabilities to our favor.

Best Wishes.

BTCUSD, Are we going to face 35% Correction ?!If we take a look at previous 2 notable cycles we easily notice similarities.

From these 2, 2022-2024 looks more similar to 2016-2017, as long as we had -

Breakout of downtrend line. ✅

Reaccumulation zone. ✅

Testing major bear market impulse (Which in all cases became strong resistance). ✅

What we didn't experience is correction after these 3 moves.

In 2016 it was around 40% (Tested reaccumulation zone)

In 2019 it was around 53% (Tested major support / resistance zone).

As long as current market structure somewhat repeats 2016 move, have possibility to retest top of after trend line breakout reaccumulation zone, which sits around 33-32k.

Percentage wise it's around 35% from ETF top and 23% from current price.

What you think ?

ETHUSD: Cyclical Pivot can slingshot it to at least $6,000Ethereum is almost oversold on its 1D technical outlook (RSI = 35.473, MACD = -206.770, ADX = 45.110) but this 1W candle is rebounding on the P1 trendline, which is the Pivot that started from the November 2021 ATH and already caused the a bounce on the August 5th 2024 contact. A similar P1 trendline was present during the 2018-2021 Cycle and its final contact was the March 2020 COVID crash, which kickstarted the insane rally. All similar rallies have hit at least the 1.5 Fibonacci extension and in some occasions the 2.0 Fib. Consequently we are confident enough to aim for at least the 1.5 Fib (TP = 6,000). Risk seekers can attempt a 9,000 test but more cautiously.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XRP Approaches Critical Support at $2.00Key Technical Level:

XRP is testing the strong $2.00 support level, which has consistently acted as a key price floor since December.

Descending Triangle Formation:

The price action is forming a descending triangle, where decreasing volatility suggests an imminent breakout. This pattern emerges as XRP approaches the intersection of descending resistance and horizontal support.

Bullish or Bearish?

A confirmed breakout above resistance could trigger a strong rally.

A sustained drop below $2.00 would invalidate the bullish outlook, potentially leading to a retracement toward $1.60-$1.80.

Market Perspective:

XRP’s rally from $0.60 to over $3.40 since November suggests that the current correction is likely a phase of profit-taking rather than a full trend reversal. However, traders should remain cautious and watch for confirmation of direction.

Stay alert—XRP is at a decisive moment! 🚀📉

#XRP #Crypto #MarketAnalysis #Trading #TechnicalAnalysis #Cryptocurrency #Bullish #SupportLevel

BITCOIN Is this a Falling Wedge bottom formation?Bitcoin (BTCUSD) is trading since the February 28 Low within a Falling Wedge pattern, below the 1D MA50 (blue trend-line) and at the same time supported by the 1W MA50 (red trend-line).

Throughout its dominant Bull Cycle pattern, the +2 year Channel Up, it has formed another 6 such Falling Wedges, all below the 1D MA50 and all turned out to be market bottom formations, which paved the way for an immediate bullish break-out. On all occasions, the 1D CCI has been almost as low as on the February Low.

The shortest rebound it made before another break below the 1D MA50, was +26.68% and the highest was +106.96%. As a result this gives us a minimum immediate potential Target of $96800 and a maximum of a little more than $150000. Given that the price has touched the bottom of the long-term Channel Up, like the bottom formations of September 06 2024 and September 11 2023, it is quite likely to see the stronger rebound probability taking place.

But what do you think would be the case? Is this a classical Falling Wedge bottom break-out formation and if so what may be the Target? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

TradeCityPro | MNTUSDT Effects of Bybit Hack👋 Welcome to the TradeCityPro channel!

Let's analyze and examine the main chain mantle coin and examine the effects of the Bybit hack last month

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

On the weekly time frame, this coin was in good condition and was near its new high and could even break this resistance level well!

But the continuous events of the crypto market caused a deep correction of 50% of this chart, from Trump's tariffs to the Bybit hack, and since the MNT coin was one of the main Bybit holding coins, it caused its recent fall.

In this timeframe, we made our purchase for DeFi at the level of 0.6577 and now it is only a little in profit, although we took out some with the weekly engulfing candle, but I will continue to hold and if we lose 0.5457, I will exit completely.

📈 Daily Timeframe

In the daily timeframe, after the daily box between 0.5457 and 0.6622 broke and momentum entered, we started our move and reached a very important resistance level of 1.3947 and after that we recorded a lower ceiling.

After breaking the important bottom of 0.9311, the exit trigger It was our spot that became active and after pulling back to it, we experienced a continued decline and now we are back to important support which was previously the ceiling of our ascending box and is an important level for us!

It is not a good time to buy again right now and we need to form a new structure, but the fact that we have a weak downtrend can be a good sign in itself, but we still need to create new space for now. For selling, I will wait and cash out my coins below 0.5457 and say goodbye to this coin without bias :))

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Solana (SOL) Price Analysis: Key Support & Resistance LevelsCurrent Market Structure

SOL is holding a major support level around $110, which could act as a launchpad for a short-term rally.

This support has historically served as a strong demand zone, attracting buyers looking for a potential rebound.

Upside Potential: Resistance Zones to Watch

If SOL maintains $110 support, it could rally toward:

$140 (first key resistance level)

$150 (historical rejection zone)

These levels have previously triggered selling pressure, so traders should watch for possible rejections.

Downside Risk: Key Support Levels

If SOL fails to hold $110, further downside could lead to a test of:

$80, a stronger support level from previous price action.

Conclusion & Strategy

Bullish Scenario: Holding $110 could trigger a move toward $140–$150, but a breakout above these levels is necessary for sustained upside.

Bearish Scenario: A break below $110 could accelerate losses, leading to a retest of $80 support.

Key Watchpoint: Reaction at $140 resistance—a rejection here could indicate another leg down, while a strong breakout could confirm further bullish momentum.

XAUUSD SHORT CHART MAPPING IN 1-H ATHello Guys Here Is Chart Of XAUUSD in 1-H AT

Sell Entry: Below 2886

Resistance: 2886 - 2890

Target: 2866 - 2860

Break-even: Your entry price (likely around 2880)

If price breaks below 2860, expect it to hit 2840 for support. If it moves above 2900, the setup may be invalid.

BITCOIN Money Supply, Dollar and Bonds pushing for MEGA RALLY!This is not the first time we publish a Bitcoin (BTCUSD) analysis in relation to the U.S. Dollar Index (green trend-line) or Chinese Bonds (red trend-line) and Global Liquidity (blue trend-line). In fact we have been doing this since the late 2022 bands in China and like the highly bearish sentiment that was in the market then, we decided to dive into this cross-asset analysis yet again in order to put the current sentiment in perspective.

Well it couldn't be more relevant. What we discovered is that all the financial assets mentioned above have yet again aligned to offer the strongest bullish confirmation for BTC since the November 2022 Bear Cycle bottom!

More specifically, we are a little past the point where the DXY peaks and declines aggressively, Global Liquidity bottoms and starts rising, while Chinese bonds (our CN02Y/CN20Y ratio) bottom and rise aggressively. In the past 10 years this combination of events has happened 6 times, 2 times during each Cycle: one at the bottom of the Cycle and the other when the final, most aggressive rally starts.

Notice also that (naturally) this is where the stock market (SPX, black trend-line) also bottoms and starts rising aggressively.

As a result, the above market conditions are an indication that despite the recent monthly correction and turbulence due to a number geopolitical and other trade fundamental reasons, the macro-economic parameters remain intact for the wider picture of this Cycle. Truthfully, this is where an announcement next week of future Fed Rate Cuts would come very handy.

So what do you think of this analysis above? Are you fearful that a new Bear Cycle is starting or more confident that the market will soon recover and price a new High? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Selling?Morning folks,

So, Monday's plan has worked perfect, we're at 85K. Today we have to keep an eye on daily chart, where bearish grabber pattern might be formed and trigger downside action.

In general upside action is rather slow, so bearish context stands intact. We see only one risk for it - non-market driving factors, such as a D. Trump flood on X. But, this is out of our control.

That's why we keep everything as it is - 85K is considered for short entry. If we get daily bearish grabber also - all the better.

Next target stands around 74K

XRP | Head and Shoulders Pattern.

Head: $3.4.

Left Shoulder: $2.9.

Right Shoulder: $3.0.

The Neckline: $2.00.

Components of the Pattern:

Left Shoulder: Represents the first peak at $2.9, where the price rose and then retreated to the neckline at around $2.00.

Head: The highest peak at $3.4, the topmost point of the pattern, followed by a retreat to the neckline at $2.00.

Right Shoulder: The second peak at $3.0, lower than the head, followed by a retreat to the neckline at $2.00.

Neckline: Remains at approximately $2.00, a horizontal support level connecting the lows after the left shoulder and the head and the right Shoulder.

Implications of the Pattern:

The pattern remains a bearish reversal pattern, indicating a weakening of bullish momentum after reaching the head at $3.4.

If the price breaks below the neckline ($2.00) with increased volume, this confirms the pattern’s completion and signals a significant decline.

Current Situation (March 2025):

The current price ($2.2) is very close to the neckline ($2.00), making a breakout likely in the coming days.

The potential crossover of the moving averages (blue and red lines) supports the possibility of a trend change.

NOTE:

If the price bounces off the neckline ($2.00) with increased volume, this invalidates the pattern.

In this case, the price might attempt to retest resistance at $3.0 (right shoulder peak) or even $3.4 (head peak).

Conclusion:

The Head and Shoulders pattern: indicates a strong potential for a bearish reversal, if the price breaks below the neckline ($2.00). Confirmation of the breakout with increased volume is essential, while considering fundamental news that might influence the market.

Ethereum: Rebound from here or Drop to $881?Hey everyone! Let’s explore what’s happening on Ethereum’s monthly chart. Right now, there seem to be two main possibilities to keep in mind. The first and more likely scenario involves a dip toward the lower price zones—around 881.56—and then testing important supports near 579.41 and 756.03. Observations suggest that if the price heads down to these areas, there could be a bounce, though a deeper move is possible (even if it seems less likely). On the flip side, if the price climbs from its current level toward its previous peak, we’d want to revisit this analysis for updates.

Key price zones are highlighted on the chart, showing where a lot of buying or selling could happen. A change in trend would typically be confirmed by a clear candlestick pattern and solid trading volume, so those are worth watching. As with any market, unexpected moves can always occur, so it’s good to stay prepared and flexible.

Remember, these are just observations based on the monthly chart, and personal research is always important. Stay curious, stay safe, and never hesitate to dig deeper into your own analysis before making any decisions. Good luck out there! 💼📈