DOGEUSD preparing the final rally to $1.00Dogecoin / DOGEUSD has hit this month and so far holding its 1month MA50.

This Cycle isn't that different from the previous two, although it is naturally a not as aggressive as the market has matured.

According to the 1week RSI, the market is at the bottom of the final Bull Cycle pull back before the final rally for the Cycle Top.

We expect it to reach at least $1.00 by the end of this year.

Follow us, like the idea and leave a comment below!!

Cryptocurrency

PEPEUSD: Bottom highly likely priced. Target 0.00008.Pepe turned neutral on its 1D technical outlook (RSI = 46.389, MACD = 0.000, ADX = 26.088) as it has been on a small short term bounce but still limited under the 1D MA50. The latter is the level to break as it has been the Resistance of this bearish wave of the 2 year Channel Up with two rejections on Jan 17th and Jan 2nd. The recovery on the 1D RSI is a strong sign of a bottom, much like September 20th 2023. Technically that took place on a 1D Death Cross, a formation we completed 4 weeks ago. The bullish wave that started then, hit the 1.618 Fibonacci extension. Long term trade is buy, TP = 0.00008.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

ETHEREUM Megaphone bottom like March 2020Ethereum (ETHUSD) is currently on the first week of rebound after 3 straight red weeks when it was unable to break above the 1W MA50 (blue trend-line). This is taking place on a Lower Lows trend-line, technically the bottom of a 1-year Megaphone since the March 11 2024 High.

The market is no stranger to long-term Megaphone consolidation periods like that as last time we saw this was on the June 2019 - March 2020 Megaphone, which eventually broke upwards after the brutal COVID crash Bearish Leg that touched bottom. This is quite similar to the current Bearish since late December. Notice how perfectly aligned the Fibonacci retracement levels are.

Based on this, we expect at least a 1.5 Fibonacci extension test at $6000 before this Cycle tops at the end of the year.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DOW JONES This is why chances of a brutal rebound are so high.Dow Jones (DJIA) has been trading within a Channel Up since the July 31 2023 High and last week it hit (marginally breached) its 1W MA50 (blue trend-line) for the first time since the week of October 30 2023. The price went on to test the bottom of the Channel Up and rebounded back above the 1W MA50.

This is an incredibly strong long-term bullish signal and it is not the only one. The market also made a Lower Low rebound on the 3-month trend-line while the 1W CCI got oversold below -150.00 and is rebounding. The last time we got these conditions fulfilled was exactly 2 years ago on the March 13 2023 Low.

That was when the index made a similar Megaphone Lower Low rebound on oversold 1W CCI that initiated a +13.57% rally. Both Megaphone fractals emerged after Dow rose by +21.00%.

In fact, every oversold 1W CCI rebound has produced very aggressive rallies. Based on those similarities with the March 2023 fractal, we expect the index to hit 46150 (+13.57%) minimum by July. If the more aggressive scenario of the November 25 2024 rally that made a Channel Up Higher High on the 1.5 Fibonacci extension prevails, then our more optimistic scenario is 48900 (Target 2) by September, which could technically be the end/ Top of the current Bull Cycle.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

The Bitcoin Google trends wedge pattern. Good day traders & investors,

Is the Google trends search for Bitcoin about to explode ?! The chart pattern is a bullish one. The Google trend search topped out back in 2017 and has been in a wedge pattern since then. The search/interest recently broke out of this 8 year wedge pattern and this month retested the breakout. This is typically a bullish pattern and shows the interest and search volume is picking up and could very soon explode again.

The settings for this search was world wide , bitcoin and a custom time interval set from Jan 1st 2009 to Mar 19th 2025

Since inception the interest for Bitcoin gained volume/growth until it peaked in 2017. Ever since then the interest and searches has been making lower lower highs until very recently (last Oct) where it made a higher high as it broke out of this wedge. Also, since 2017 while making lower highs the google trend has been making higher lows, thus forming this wedge pattern. The break out and retest of this pattern is what shows the signs of strength and a possible explosion of interest in the near future.

I have underlaid both timelines of the price and the Google trend to match, and we can clearly see that when the search trend rises, so does the price which shows a strong correlation.

All of my other cycle analysis shows that May/June time could see higher prices, so you could say this is a sneak peak or confluence to other indicators.

Let me know what you think in the comments below what you think. Does Google trend holds any weight? Do you think this wedge pattern and break out could lead to anything big?

Please like and share. My socials are listed in the bio

Kind regards,

WeAreSatoshi

BITCOIN The 2021 Pivot trend-line that is coming to its rescue.Bitcoin (BTCUSD) has stayed stable after last week's rebound on the 1W MA50 (blue trend-line), which has been the level that offered support on the Bull Cycle Channel's previous Higher Low (August 05 2024).

Technically however, that is not the only major Support level that may be coming to BTC's rescue as we've identified the Pivot trend-line that started on the April 12 2021 High as a Resistance and since then made another 2 contacts (as rejections). This is the first time now that is being tested as Support.

During the previous Cycle (2018 - 2021) a similar Pivot trend-line was the level that supported Bitcoin during the last year of its parabolic rally on January and June 2021. The June 2021 contact in particular tested the 1W MA50 as well, which is the exact situation we're in right now. That double support hold initiated the final rebound towards the Cycle's new All Time High (ATH).

Check also how similar the 1W CCI patterns between the two fractals are and based on that, a 1W CCI reading at 200.00 would be a solid level to sell and take profit. As a result, we expect this Cycle's Channel Up to accelerate the current rebound, technically its Bullish Leg and make a new ATH, which would be the Cycle's new Top, ideally with a CCI at 200.00.

So do you think this cyclical Pivot trend-line is coming along with the 1W MA50 to BTC's rescue? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTCUSD: This isn't the Top by any meansBitcoin remains slightly bearish on its 1D technical outlook (RSI = 41.137, MACD = -3097.700, ADX = 33.471) as even though it appears its trading on a macro bottom, just over the 1W MA50 (1W RSI = 45.068), it hasn't broken out yet. The market undoubtedly took a psychological hit with February's drop but despite the voices calling for a new bear market, we are here to show you why this Cycle hasn't topped yet and is still far from doing so.

This metric measures BTC's temporary stops/ tops during a Bull Cycle. It is a Halving-to-Halving method, starting on the most recent Halving and ending on the next one. Stop 1 is where the starting Halving takes place and the market pulls back. Stop 2 is the next pullback on the 0.236 Time Fibonacci level. The 0.382 Fib prices Stop 3 and basically the Cycle Top. This has been happening on both previous Cycles exactly as described and on the 2012-14 Cycle it just had to be adjusted a little before the 1st Halving due to the Cycle being much shorter since it was the earliest. Nevertheless, it fits the Stop points perfectly.

Note also that distance from the Halving (Stop 1) to Stop 3 has always been 76/78 weeks. This suggests the we can have a new Cycle Top by October 20th 2025 the latest.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

BITCOIN HEADING TO 77600 LEVELIt seems that there's an atmosphere of panic. When traders see significant price drops, it can lead to a cascade of selling, with more people fearing losses. This fear can create a liquidity trap where those entering long positions are quickly taken out as prices continue to decline.

In such scenarios, liquidations occur when leveraged positions are forcibly closed by exchanges to prevent further losses, which adds even more selling pressure. The cycle can become self-reinforcing; as prices dip, more traders panic and sell, leading to further declines.

Based on this scenario, I am confident in entering a short position with a favorable risk-to-reward ratio toward the 77600 level.

Follow me for more analysis

BITCOIN The 0.5 Fib Golden Rule! This is not a Bear Market yet!Bitcoin (BTCUSD) shook the bullish market sentiment last month, as late February saw it drop aggressively not just from the 109k All Time High (ATH) but also below the key psychological Support of $90000. We have discussed already how the 1W MA50 (blue trend-line) coming to its rescue, is the critical Support and rightfully so, but there is also another critical condition that is currently showing incredible strength, keeping BTC into Bull Cycle territory (for now).

That is the 0.5 Fibonacci retracement level Golden Rule. This suggests that BTC's corrections/ pull-backs up to the 0.5 Fib level are technical and perfectly systemic, especially with the 1W MA50 supporting. If anything, such pull-backs during a Bull Cycle are the most optimal buy opportunities. We are currently on an exact such opportunity as the price hit last week both the 1W MA50 and the 0.5 Fib.

In the past 10 years since the August 2015 Bear Cycle bottom, every correction up to the 0.5 Fib was a buy. In the 4 cases it broke, 2 were the signals of the 2018 and 2022 Bear Cycles and the other 2 signals of the market correcting the bullish overreaction to the Libra (2019) and Musk (2021) rallies. The latter though was still contained above the 1W MA50 and so would the 2019 one if it wasn't for the March 2020 COVID crash.

As a result, we still see no cause for concern (yet) and so far this is the best buy opportunity for Bitcoin since last year and the August 05 2024 Low.

But what do you think? Is this 0.5 Fib Golden Rule coming to push Bitcoin higher to its next ATH? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Phemex Analysis #68: Is It A Good Time to Buy Ethena (ENA) Now?!Ethena has rapidly ascended in the decentralized finance (DeFi) sector, notably propelling its stablecoin, USDe, to become the world's largest by market capitalization within a year. In December 2024, Ethena Labs introduced USDtB, a stablecoin backed by BlackRock's tokenized money market fund, BUIDL, aimed at stabilizing USDe during bearish crypto market phases. More recently, a proposal has been put forward to integrate Ethereal, a decentralized exchange (DEX), into Ethena's reserve management system. This integration seeks to enhance trading capabilities for USDe and distribute governance tokens to ENA holders, further enriching the ecosystem.

Despite these fundamental advancements, ENA's price has experienced significant volatility. After reaching a high of $1.32, the token's value declined by approximately 75%, hitting a low of $0.33. However, the downward momentum has recently slowed, coinciding with a broader market recovery. This shift has led many to question whether now is an opportune time to invest in ENA, especially considering its substantial real-world developments.

Potential Scenarios

1. Continued Downtrend

If ENA fails to maintain current support levels at $0.316, it could test lower price points. Factors such as broader market downturns or negative investor sentiment could exacerbate this decline.

Pro Tips:

Short Positions: Experienced traders might consider short-selling strategies to capitalize on potential declines, especially if the price drops below $0.316 with high volume.

Buying at Support Levels: Long-term investors may consider accumulating ENA gradually near established support levels such as $0.26 and $0.20.

2. Consolidation Phase

ENA may enter a consolidation phase, trading within a defined range as the market seeks direction. This period of sideways movement could last until new catalysts emerge.

Pro Tips:

Range Trading: Identify key support ($0.316) and resistance levels ($0.48) to execute buy and sell orders effectively within the trading range.

Patience: Avoid overtrading during consolidation; wait for clear signals before making significant moves.

3. Bullish Reversal

Given ENA's recent positive developments and technical indicators, there is potential for a bullish reversal. Sustaining levels above recent resistance points could signal renewed investor confidence and an upward trend.

Pro Tips:

Breakout Entry: If the price breaks above the $0.40 resistance level with high volume, consider a long position with profit targets at $0.48, $0.54, and $0.70.

Accumulate Gradually: Consider dollar-cost averaging to build a position without exposing yourself to immediate market volatility.

Conclusion

Deciding to invest in ENA requires careful consideration of these scenarios. By employing strategic approaches tailored to each potential outcome, traders can better navigate the complexities of the cryptocurrency market. As always, thorough research and prudent risk management are essential when making investment decisions.

Tips:

🔥 Break free from "buy low, sell high"! Our new Pilot Contract empowers you to profit from ANY market direction on DEX coins with up to 3x leverage. Go long, go short, go further!

Check out Phemex - Pilot Contract today!

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

SHIBUSD can go x7 from here.Shiba Inu / SHIBUSD is rebounding at the bottom of the 3.5 year Triangle.

The 1week RSI is on a similar sequence as February-May 2023, which eventually rose aggressively by +661.50%.

Considering that the price made last week a Double Bottom with the August 5th 2024 low, this is a unique long term buy opportunity.

Buy and target 0.00008450

Follow us, like the idea and leave a comment below!!

SUIUSD Can it go to $12??Sui / SUIUSD hit last week the Pivot Zone that marked the initial historic opening price, the Feb & Marhc 2024 Highs and October 2024 bottom.

So far this week is reacting with a bounce.

If the bullish trend is sustained, which is also the 0.618 Fibonacci and the 1week RSI bottom like July 2024, then we expect at least a +507.35% rise towards the 1.382 Fib extension.

Buy and target $12.000.

Follow us, like the idea and leave a comment below!!

USDJPY S&R IN 1-H AT MUST WATCH OUTHello Guys Here Is Chart Of USDJPY in 1-H AT

Entry Level: BUY Around 148,300 - 148,000

Target Will Be : 149,300

Support: 148,000 The yellow circles highlight previous points where the price respected this trendline as support

However, if the price breaks below the trendline, the bullish scenario may be invalidated.

BITCOIN Is this the 'most normal' Cycle of them all ??This is not the first time we use a Convergence/ Divergence approach to Bitcoin (BTCUSD) Cycles and certainly not the last one. On the previous one, it helped us to succesffuly predict the end of 2022 bottom but what we couldn't anticipate is how smooth the new/ current Cycle 5 (orange trend-line) would be.

As the title says, this is probably the 'most normal' Cycle of them all, as BTC has been trading within a Channel Up (orange) since the Bear Cycle's bottom more than 2 years ago.

To get a better understanding of this claim, we compare Bitcoin's (BTCUSD) Cycles from their previous top to the next one (with the exception of the first), on this complete mapping analysis, having them all displayed on top of another: Cycle 1 (green trend-line), Cycle 2 (red), Cycle 3 (blue), Cycle 4 (black) and the current one Cycle 5 (orange).

** Diminishing Returns **

As you see, first of all, this showcases the Theory of Diminishing Returns, which suggests that as the market grows and higher adoption is achieved, BTC will show less and less returns in each Cycle. Every Cycle Top has been lower from the previous one.

** Cycle Convergence - Divergence **

Secondly, all Cycles particularly during their Bear Phase and for a short time after, tend to follow a common path. The illustration on this analysis is very clear as it starts with each Cycle's Bear Phase and you can see that when they diverge, they converge again quickly. The most recent Bear Phase was not surprisingly as long as Cycle 4 and almost Cycle 3, which was to be expected as the market has shown an amazing degree of symmetry in the past 10 years. Note that this is also the model that helped as determine very early in 2023 that Cycle 3 would be the best fit for the new Cycle in terms of price action and without a doubt, BTC has been mostly replicating that Cycle.

** What's next for the current Cycle? **

If we compare the current Cycle (5) with Cycle 3 we can see that the Convergence - Divergence Model is holding. So far when Cycle 5 converged, it immediately diverged. And this is exactly what it has been doing since the December High and the marginal January All Time High (ATH). It has started to diverge significantly from Cycle 3 so what the recent pull-back to the 1W MA50 achieved is to normalize it and is about to touch it.

Now that the price hit the bottom of its +2 year Channel Up, we expect to rise, which will achieved convergence and contact with both Cycles 3 and 4, which is what they both did in their last 150 days of their respective Bull Cycles. Technically, this can take Cycle 5 to around $150k.

As we've first mentioned in the crypto space, regarding the last Bear Market being the 'smoothest' in history, we can securely say now that the current Bull Cycle is also the 'most normal' ever.

So what do you think? Does this Cycle regression model offer any useful conclusion as to where Bitcoin might top and if so, is this Cycle indeed the 'most normal' in the history? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

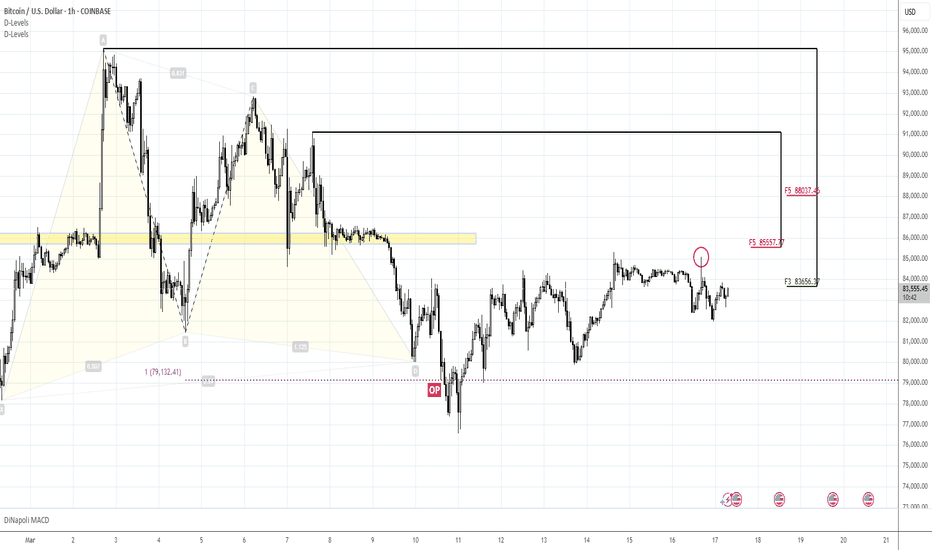

88K is not excluded but not granted as wellMorning folks,

So, we set for 85K sell and it worked. Downside reaction happened, but still, we call you to move stops to breakeven for some case.

The problem that we see is the market behavior. We see it not natural for normal bearish market. BTC stands stubbornly around K-resistance, not showing normal downside extension.

Our scenario of downside continuation from ~85K area is not broken yet, it is valid, and maybe everything will happen as we've suggested initially.

But we see the risk in the way of market behavior. It could lead to more extended upside bounce in the way of upside AB=CD pattern right to 88k resistance .

It means that if you already have bearish positions - move stops to breakeven. If you don't - do not take the new once for awhile. Or, at least, you could take but not more than 25-30% of your normal lot.

Our bearish scenario remains valid until market stands under 85.1K spike (because this is bearish reversal session on daily chart) and below 85.5K resistance in general. Upside breakout means an action to 88K.

Since we do not have the breakout it, I mark our update as "bearish", but we warned you... Take care.

JUPUSDT: Weekly Outlook & Key Levels for JupiterHey everyone! 🌟

Let’s take a look at this weekly cryptocurrency price chart together. Here's what stands out:

We’re looking at two possible scenarios:

Primary Scenario: The price might bounce back from the first support level, marked with a solid yellow arrow.

Secondary Scenario: If it doesn’t, the next potential rebound is from the lower support level, shown with a dashed yellow arrow.

Keep an eye on the numbers highlighted—$0.4310 and $0.3798. These are key price levels that could guide future movements. It’s also essential to monitor liquidity, candlestick patterns, and trading volumes. A strong confirmation, like a favorable candlestick formation and sufficient volume, could signal a rebound.

However, if the price dips below these critical levels, it might shift the perspective. Staying vigilant is key.

Always remember, this is just an observation. Do your own research, stay informed, and keep learning. The journey in the crypto world is as much about growth as it is about numbers! 📚📈✨

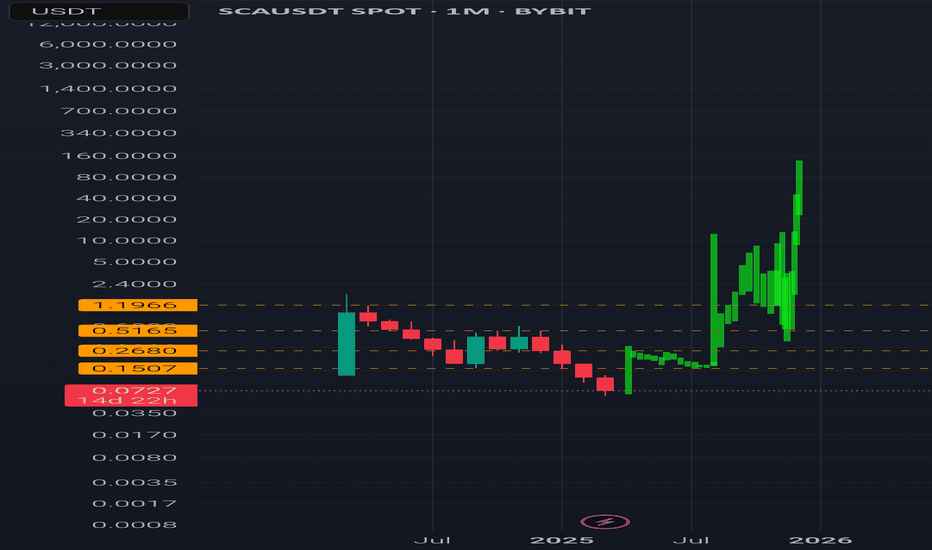

Scallop (SCA) Potential 200x Gains by next bull run

Current Market Overview:

Current Price: $0.07

Market Cap: $8M

Target Market Cap: $200M+

Potential Growth: 25x - 200x

Showing strong accumulation signals, indicating that most weak hands have already exited. With whales now in control, the price action suggests an imminent breakout in the coming bull run.

Key Observations:

✅ Deep Accumulation Phase: The price has been suppressed for a long time, suggesting all early holders have been flushed out.

✅ Whale Accumulation: With fewer retail traders, whales can now dictate price action, leading to a controlled rally.

✅ Bull Market Catalyst: If the Bitcoin cycle and altcoin season play out as expected, SCLP could experience parabolic growth.

Price Targets Based on Market Structure:

TP1: $0.25 → Initial breakout level (6.5x from current price)

TP2: $0.60 → Strong resistance (15x)

TP3: $6.00 → Major psychological level (85x)

TP4: $28.00+ → Full bull cycle potential (400x+)

Market Cap Projections:

At $1.75 (25x Growth): ~$200M market cap

At $6.00 (85x Growth): ~$700M market cap

At $28.00 (400x Growth): ~ SEED_TVCODER77_ETHBTCDATA:3B market cap

TradeCityPro | UNIUSDT Ready to Break the Trend Line👋 Welcome to TradeCityPro Channel!

Let's analyze and review one of the best crypto DeFi projects and projects that have good income in the crypto space!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

In the weekly time frame, we are witnessing a deep correction of this coin and the situation is not very good and these events are also due to the recent negative news in the market, but we experienced a 68 percent drop!

We have now reached an important support which is 5.599 and in terms of price it is really a good price for the yoni but I don't have any suggestions to buy it right now because it is a very strong downtrend and we need to form a structure!

Even if we need to lose a percentage of the movement, we will lose it so that we can enter with the momentum and we do not need to buy a step like the others and for now we will watch for a purchase, but to exit after the level of 4.051, I will exit myself

📈 Daily Timeframe

The same thing is happening on the daily time frame and after being rejected from 18.664 and not reaching this price ceiling, we went for a price correction and formed a box between 12.830 and 15.264

After breaking the bottom of this box, we started a downward movement and I had a bounce to this support and I went to continue the fall and now we have reached the important support of 5.617 and we are probably going to go for a time range and form a box

Currently, it is expected that we will go for a range and form a price structure and we must consider that sellers are no longer willing to sell and have been on it for a few days This is the support level and it is not a good level to buy at the moment, but if we form a box after it breaks, we can buy.

⏱ 4-Hour Timeframe

On the four-hour time frame, this recent decline is also clearly visible on the chart and has even caused us to form a downward trend line of the retracement type.

I should mention that trend lines are divided into two categories: retracement and continuation. Continuing trend lines are those that continue our main trend after the trend line breaks and usually we do not need a trigger to trade it, but retracement trend lines are trend lines that change our main trend and to open a position with them, I myself wait for the trend line to break and a confirmation trigger!

📈 Long Position Trigger

with the above explanation, after the trend line and trigger 6.287 break, we can open a risky long position, but if this happens, by forming a higher bottom and top after breaking that top, we will have a much better trigger and we are more confident that the trend will continue

📉 Short Position Trigger

our task is completely specific, and after breaking 5.721, we can open our position, and we can also continue to do the same with each rejection from this trend line and get confirmation for the position if the volume increases, but our main trigger will still be 5.721

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️