DOGE Looking Strong as Support HoldsDOGE Looking Strong as Support Holds

🔹 1. Support Zone Validated

The chart shows Dogecoin retested the lower boxed region around $0.221–$0.223, and bounced sharply from that zone. Given the heavy spike in volume during the retest, this suggests aggressive buying and accumulation—a hallmark of bullish conviction.

CryptoRank

The Tradable

🔹 2. Fibonacci 0.618 Support Bounce

On the 4‑hour timeframe, DOGE held firm above the critical Fibonacci 61.8% retracement level, and delivered a strong rebound—indicating technical significance and buyer interest at this level.

Blockchain News

🔹 3. Double-Bottom + Trendline Breakout

Analysts have identified a classic double-bottom formation, with price clearing the neckline (~$0.230–$0.231) and then retesting it successfully. Holding this retest confirms a breakout, suggesting more upside ahead.

Crypto Basic

🔹 4. Whale Activity & Accumulation

On-chain data shows $250 million in Dogecoin accumulation by whales, especially around the support zone—creating a structural demand base and reinforcing the bullish setup.

CoinCentral

🎯 Price Targets & Key Levels

Scenario Levels Rationale

Bullish continuation $0.239–$0.241 union resistance First resistance zone—price must reclaim to continue bullish momentum

$0.260–$0.280 Reclaiming $0.241 could open room toward mid‑channel resistance or prior highs

$0.300+ Potential target if momentum sustains and broader breakout occurs

Bearish invalidation $0.223 support Invalid break below suggests fading momentum—risk of correction to $0.215–$0.218

$0.215–$0.218 Secondary support zone if expansion of sell side continues

⚙️ Trade Setup for a Bullish Bias

Entry Focus: Consider entering long near $0.223 if price retests and holds, with a tight stop just below support.

Stop-Loss Zone: Slightly beneath $0.221 to account for volatility.

Targets: Scale out around $0.241, with larger targets at $0.260–$0.280, and possibly $0.30+ on sustained strength.

Confirmation: Watch for rising volume, break and close above resistance zones, and bullish indicator alignment.

⚡ Market Sentiment & Broader Themes

Momentum Shift: A bearish retrace reversed quickly amid accumulation, suggesting strong buyer commitment.

CryptoRank

The Tradable

AInvest

Double Bottom Status: Analyst commentary supports a reversal setup, with targets toward $0.310–$0.46 if the neckline holds.

Crypto Basic

AInvest

CryptoRank

Macro View: DOGE remains within a bullish channel; some forecasts project

Cryptoeducation

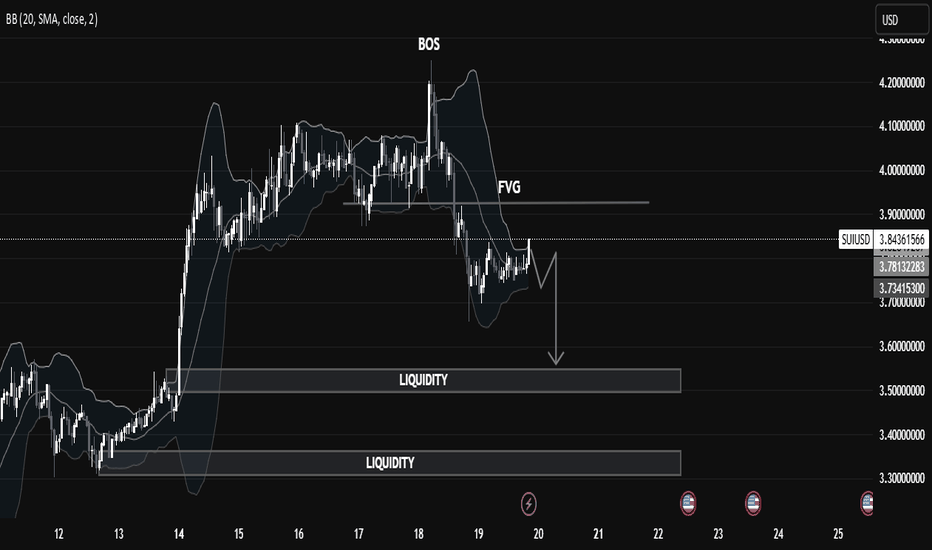

SUIUSD Liquidity Trap in Motion: Price Targeting Deeper Pools🧠 Market Structure Insight (SMC Framework)

🔍 1. Break of Structure (BOS):

The most recent BOS around the $3.95 level marked a bull trap, indicating a transition from bullish momentum to a distribution phase. This suggests institutional players offloaded liquidity at premium prices before initiating a markdown.

🕳️ 2. FVG (Fair Value Gap):

A visible Fair Value Gap (Imbalance) remains unmitigated above the current price action. This zone acted as a supply area, where price sharply moved down, leaving inefficiency in its trail—now serving as a potential point of rejection if revisited.

📌 Liquidity Zones:

Upper Liquidity Cleared: Price has swept highs before reversal (a sign of engineered liquidity grab).

Double Liquidity Pools Below:

First pool: Around $3.55 - $3.60

Second pool: Deep liquidity around $3.30 - $3.35

These levels are highly attractive for Smart Money to target next, suggesting continuation to the downside.

📉 Current Price Behavior:

Market is consolidating in a tight range just below FVG, signaling potential re-accumulation of sell orders.

The chart pattern suggests a potential lower high forming, likely to precede a bearish leg towards liquidity zones.

Bollinger Bands show compression, hinting at volatility expansion soon.

🎯 Trade Outlook (Not Financial Advice):

🔻 Bearish Bias:

Unless price breaks above the FVG zone with strong bullish momentum, the probability favors a bearish continuation targeting:

1st Target: ~$3.55

2nd Target (Deeper liquidity grab): ~$3.30

A rejection from FVG followed by a BOS to the downside would serve as confirmation for this bias.

📚 Educational Takeaway:

This chart is a clean illustration of Smart Money Concepts in play:

BOS > FVG > Liquidity Sweep

Price respects institutional footprints: grab liquidity, fill imbalances, then drive toward untouched liquidity zones.

Recognize market intent through structure shifts and imbalance reaction.

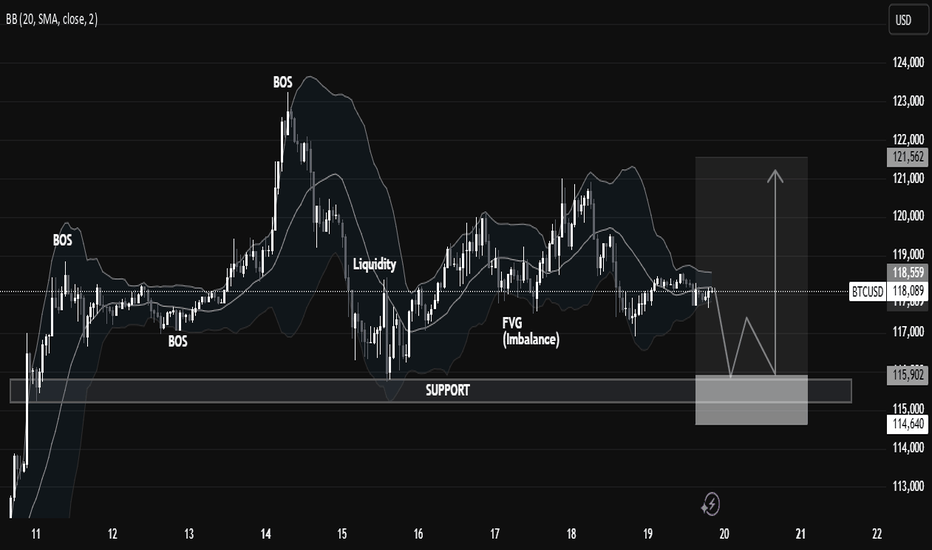

BTCUSD Technical Analysis | Smart Money Concept (SMC) BreakdownBTCUSD Technical Analysis | Smart Money Concept (SMC) Breakdown

🧠 Smart Money Market Structure Insight

📌 Key Elements Identified:

BOS (Break of Structure): Multiple BOS points indicate bullish intent early on. However, the latest BOS on July 14 followed by a significant drop signals a shift in momentum—possibly a distribution phase.

Liquidity Sweep: Price swept prior equal lows/liquidity before reversing, a typical Smart Money trap setup.

FVG (Fair Value Gap) / Imbalance: Identified around the mid-section of the chart—price filled partially but failed to hold, suggesting internal weakness.

Strong Support Zone (Demand Area): Marked between 115,000 - 114,640; this zone is anticipated to act as a springboard for bullish reversal.

📉 Current Price Action Observation:

BTCUSD is hovering around 118,152 - 118,560, moving sideways with lower highs indicating compression.

Price is projected to form a "W" pattern or double bottom in the shaded region.

Expected liquidity grab beneath 115,902 followed by potential bullish reaction targeting 121,562, as indicated by the white arrow.

🧩 Strategic Outlook & Potential Play:

🔻 Bearish Sweep First:

Market likely to sweep the support one more time, tapping into deeper liquidity pools between 115,000–114,640.

This is aligned with the concept of Smart Money hunting for retail stop-losses before reversing.

🔼 Bullish Recovery After Sweep:

Strong probability of bounce due to presence of:

Fair Value Gap (already tested),

Fresh demand zone,

Liquidity grab setup.

Projected Bullish Target: 121,562

Confirmation Needed: A strong bullish engulfing or BOS on lower timeframes near support.

🏷️ Conclusion:

This BTCUSD setup is a textbook Smart Money scenario: BOS ➝ Liquidity Grab ➝ FVG ➝ Reversal from Demand. Traders should wait for confirmation from the support region before entering long positions.

Serios Traders Trade Scenarios, Not Certaintes...If you only post on TradingView, you're lucky — moderation keeps discussions professional.

But on other platforms, especially when you say the crypto market will fall, hate often knows no limits.

Why?

Because most people still confuse trading with cheering for their favorite coins.

The truth is simple:

👉 Serious traders don't operate based on certainties. They work with living, flexible scenarios.

In today's educational post, I'll show you exactly how that mindset works — using a real trade I opened on Solana (SOL).

________________________________________

The Trading Setup:

Here’s the basic setup I’m working with:

• First sell: Solana @ 150

SL (stop-loss): 175

TP (take-profit): 100

• Second sell: Solana @ 160

SL: 175

TP: 100

I won’t detail here why I believe the crypto market hasn’t reversed yet — that was already explained in a previous analysis.

Today, the focus is how I prepare my mind for different outcomes, not sticking to a fixed idea.

________________________________________

The Main Scenarios:

Scenario 1 – The Pessimistic One

The first thing I assume when opening any position is that it could fail.

In the worst case: Solana fills the second sell at 160 and goes straight to my stop-loss at 175.

✅ This is planned for. No drama, no surprise. ( Explained in detail in yesterday's educational post )

________________________________________

Scenario 2 – Pessimistic but Manageable

Solana fills the second sell at 160, then fluctuates between my entries and around 165.

If I judge that it’s accumulation, not distribution, I will close the trade early, taking a small loss or at breakeven.

________________________________________

Scenario 3 – Mini-Optimistic

Solana doesn’t even trigger the second sell.

It starts to drop, but stalls around 120-125, an important support zone as we all saw lately.

✅ In this case, I secure the profit without waiting stubbornly for the 100 target.

Important tactical adjustment:

If Solana drops below 145 (a support level I monitor), I plan to remove the second sell and adjust the stop-loss on the initial position.

________________________________________

Scenario 4 – Moderately Optimistic

Solana doesn’t fill the second order and drops cleanly to the 100 target.

✅ Full win, perfect scenario for the first trade

________________________________________

Scenario 5 – Optimistic but Flexible

Solana fills the second sell at 160, then drops but gets stuck at 120-125(support that we spoken about) instead of reaching 100.

✅ Again, the plan is to close manually at support, taking solid profit instead of being greedy.

________________________________________

Scenario 6 – The Best Scenario

Solana fills both sell orders and cleanly hits the 100 target.

✅ Maximum reward.

________________________________________

Why This Matters:

Scenarios Keep You Rational. Certainties Make You Fragile.

In trading, it's never about being "right" or "wrong."

It's about having a clear plan for multiple outcomes.

By thinking in terms of scenarios:

• You're not emotionally attached to a single result.

• You're prepared for losses and quick to secure wins.

• You're flexible enough to adapt when new information appears.

Meanwhile, traders who operate on certainties?

They get blindsided, frustrated, and emotional every time the market doesn’t do exactly what they expected.

👉 Trading scenarios = trading professionally.

👉 Trading certainties = gambling with emotions.

Plan your scenarios, manage your risk, and stay calm. That's the trader's way. 🚀

Trading Miscalibration: Crypto Aims Too High, FX Aims Too LowI was thinking about something fascinating—the way traders approach different markets and, in my opinion...

One of the biggest mistakes traders make is failing to calibrate their expectations based on the market they’re trading.

📌 In crypto, traders dream of 100x gains, refusing to take profits on a 30-50% move because they believe their coin is going to the moon.

📌 In Forex and gold, the same traders shrink their expectations, chasing 20-30 pip moves instead of riding 200-500 pip trends.

Ironically, both approaches lead to frustration:

🔴 Crypto traders regret not taking profits when the market crashes.

🔴 FX and gold traders regret not holding longer when the market runs without them.

If you want to be a profitable trader, you must align your strategy with the reality of the market you’re trading.

________________________________________

Crypto: Stop Aiming for the Moon—Trade Realistic Outcomes

Crypto markets are highly volatile, and while 10x or 100x gains can happen, they are rare and unpredictable. However, many traders have been conditioned to expect extreme returns, leading them to ignore solid 30-50% gains—which are already fantastic trades in any market.

🔴 The Problem: Holding Too Long & Missing Profits

Many traders refuse to take profits on a 30-50% move, convinced that a 10x ride is around the corner. But when the market reverses, those unrealized gains disappear—sometimes turning into losses.

🚨 Frustration:

"I was up 50%, but I got greedy, and now I’m back to break-even—or worse!"

✅ The Fix: Take Profits at 30-50% Instead of Waiting for 10x

✔️ Take partial profits at key resistance levels.

✔️ Use a trailing stop to lock in gains while allowing for further upside.

✔️ Understand that even professional traders take profits when they’re available—they don’t blindly hold for the next 100x.

📉 Example:

If Bitcoin jumps 30% in a month, that’s already a massive move! Instead of waiting for 200%, a disciplined trader locks in profits along the way. Similarly, if an altcoin is up 50% in two weeks, securing profits makes sense—instead of watching it all disappear in a market dump.

________________________________________

FX and Gold: Stop Thinking Small—Aim for Big Market Trends

On the other hand, when it comes to Forex and gold, many traders shrink their expectations too much. Instead of capturing multi-hundred-pip moves, they settle for 20-30 pip scalps, constantly entering and exiting the market, exposing themselves to unnecessary whipsaws.

🔴 The Problem: Exiting Too Early & Missing Big Trends

Unlike crypto, where traders hold too long, in FX and gold, they don’t hold long enough. Instead of riding a 200-500 pip move, they panic-exit for a small profit, only to watch the market continue without them.

🚨 Frustration:

"I closed at 30 pips, but the market kept running for 300 pips! I left so much money on the table!"

✅ The Fix: Target 200-500 Pip Moves Instead of Scalping

✔️ Focus on higher timeframes (4H, daily) for clearer trends.

✔️ Set realistic yet ambitious targets —200-300 pips in Forex, 300-500 pips in gold.

✔️ Use a strong risk-reward ratio (1:2, 1:3, even 1:5) instead of taking premature profits.

📉 Example:

• If EUR/USD starts a strong downtrend, why settle for 30 pips when the pair could drop 250 pips in a week?

• If gold breaks a major resistance level, a move of 300-500 pips is entirely possible—but you won’t catch it if you exit at 50 pips.

________________________________________

Why Traders Fail to Calibrate Properly

So why do traders fall into this misalignment of expectations?

1️⃣ Social Media & Hype Culture – Crypto traders are bombarded with "to the moon" narratives, making them feel like 30-50% gains are not enough. Meanwhile, in Forex, traders get stuck in a scalping mindset, thinking that small, frequent wins are the only way to trade.

2️⃣ Fear of Missing Out (FOMO) vs. Fear of Losing Profits (FOLP)

• In crypto, FOMO keeps traders holding too long. They don’t want to miss "the big one," so they refuse to take profits.

• In FX and gold, fear of losing small profits makes traders exit too soon. They don’t let trades develop because they fear a pullback.

3️⃣ Misunderstanding Market Structure – Each market moves differently. Crypto is highly volatile but doesn’t always go 10x. Forex and gold move slower but offer consistent multi-hundred-pip trends. Many traders don’t adjust their strategies accordingly.

________________________________________

The Solution: Align Your Strategy with the Market

🔥 In crypto, don’t wait for 10x— start taking profits at 30-50%.

🔥 In FX and gold, don’t settle for 30 pips—hold for 200-500 pip moves.

By making this simple mental shift, you’ll:

✅ Trade smarter, not harder

✅ Increase profitability by targeting realistic moves

✅ Reduce stress and overtrading

________________________________________

Final Thoughts: No More Frustration!

The calibration problem leads to frustration in both cases:

⚠️ Crypto traders regret not taking profits when the market crashes.

⚠️ FX and gold traders regret not holding longer when the market trends.

💡 The solution? Trade according to the market's behavior, not emotions.

Crypto: From "HODL Paradise" to a Speculator’s PlaygroundDuring past bull markets, a simple HODL strategy worked wonders.

Bitcoin and Ethereum set the market trend, and altcoins followed with explosive gains. If you bought the right project before the hype wave, the profits were massive.

However, today’s market is vastly different:

✅ Liquidity is unevenly distributed – Only a handful of major projects attract serious capital, while many altcoins stagnate.

✅ Investors are more sophisticated – Institutional players and smart money dominate, making retail-driven pumps less frequent.

✅ Not all coins pump together – Only projects with real utility and solid tokenomics see sustainable growth.

________________________________________

2. What Matters Now? Strategies for the New Crypto Era

To succeed in the current market, you need a more calculated approach. Here’s what you should focus on:

🔹 Technical Analysis

You can’t just buy blindly and hope for a moonshot. Understanding support and resistance levels, price patterns, trading volumes, etc. is crucial.

Example: If an altcoin has surged 50% in a few days and reaches a strong resistance level, it’s not a buying opportunity—it’s a sell signal for short-term traders.

🔹 Tokenomics and Supply Mechanics

In 2017 and 2021, as long as a project had a compelling whitepaper, it could attract investors. Now, you need to analyze total token supply, distribution models, utility, and vesting schedules.

Example: If a project has an aggressive vesting schedule where early investors and the team receive new tokens monthly, there will be constant selling pressure. No matter how good the technology is, you don’t want to be caught in a dumping cycle.

🔹 Market Psychology and Speculative Cycles

Crypto is driven by emotions. You need to recognize when the crowd is euphoric (time to sell) and when fear dominates (time to buy).

Example: If a project is all over Twitter, Telegram, and TikTok, it might already be near the top. On the other hand, when a solid project is ignored and trading volume is low, it could be a prime accumulation opportunity.

________________________________________

3. Realistic Expectations: 30-50-100% Are the New "100x"

If catching a 10x or 100x was common in the past, those days are largely over. Instead, 30-50-100% gains are far more realistic and sustainable.

Why?

• The market is more mature, and liquidity doesn’t flood into random projects.

• Most "100x" gains were pump & dump schemes, which are now avoided by smart investors.

• Experienced traders take profits earlier, limiting parabolic price action.

Recommended strategy:

1. Enter early in a solid project with clear utility and strong tokenomics.

2. Set realistic profit targets (e.g., take 30% profit at +50%, another 30% at +100%, and hold the rest long-term).

3. Don’t wait for a “super cycle” to make money—take profits consistently.

________________________________________

4. Conclusion: Adapt or Get Left Behind

The crypto market has evolved from a “HODL Paradise” where almost any coin could 10-100x into a speculator’s playground, favoring skilled traders and informed investors.

To stay profitable, you must:

✅ Master technical analysis and identify accumulation vs. distribution zones.

✅ Pick projects with solid tokenomics and avoid those with aggressive unlock schedules.

✅ Set realistic expectations—forget about 100x and aim for sustainable 30-100% gains.

✅ Stay flexible and adapt to market psychology and emerging trends.

Crypto is no longer a game of luck. It’s a game of knowledge and strategy. If you don’t adapt, you’ll be stuck waiting for a 100x that may never come.

So, at least this is my opinion. But what about you? Do you think crypto is still a "HODL paradise," or are we fully in the era of skilled traders and speculators?

Will we ever see another cycle where almost everything pumps together, or is selective investing the new reality?

I’d love to hear your thoughts—drop a comment below and let’s discuss

Don't Confuse "DYOR" with Confirmation Bias in Crypto TradingIn the crypto space, influencers and self-proclaimed crypto gurus constantly tell you to " do your own research " (DYOR) while presenting coins that will supposedly do 100x or become the "next big thing." They always add, " this is not financial advice ," but few actually explain how to do proper research.

On top of that, most influencers copy each other, get paid by projects to promote them, and—whether they admit it or not—often contribute to confirmation bias.

What is confirmation bias? It’s the psychological tendency to look for information that confirms what we already believe while ignoring evidence that contradicts it.

For example, if you want to believe a certain altcoin will 100x, you’ll naturally look for articles, tweets, and videos that say exactly that—while ignoring red flags.

How do you distinguish real research from confirmation bias?

This article will help you:

• Understand confirmation bias and how it affects your investments

• Learn how to conduct proper, unbiased research

• Discover the best tools and sources for real analysis

________________________________________

What Is Confirmation Bias & How Does It Sabotage Your Investments?

Confirmation bias is the tendency to seek, interpret, and remember information that confirms what we already believe—while ignoring evidence to the contrary.

In crypto, this leads to:

✔️ Only looking for opinions that confirm a coin is "going to the moon"

✔️ Avoiding critical discussions about the project’s weaknesses

✔️ Believing "everyone" is bullish because you're only consuming pro-coin content

The result?

• You make emotional investments instead of rational ones

• You expose yourself to unnecessary risk

• You develop unrealistic expectations and are more vulnerable to FOMO

________________________________________

How to Conduct Proper Research & Avoid Confirmation Bias

1. Verify the Team & Project Fundamentals

A solid crypto project must have a transparent, experienced team. Check:

• Who are the founders and developers? Are they reputable or anonymous?

• Do they have experience? Have they worked on successful projects before?

• Is the code open-source? If not, why?

• Is there a strong whitepaper? It should clearly explain the problem, the solution, and the technology behind it.

Useful tools:

🔹 GitHub – Check development activity

🔹 LinkedIn – Verify the team's background

🔹 CoinMarketCap / CoinGecko – Check market data and tokenomics

2. Analyze Tokenomics & Economic Model

A project can have great technology but fail due to bad tokenomics.

Key questions to ask:

• What’s the maximum supply? A very high supply can limit price growth.

• How are the tokens distributed? If the team and early investors hold most of the supply, there’s a risk of dumping.

• Are there mechanisms like staking or token burning? These can impact long-term sustainability.

Useful tools:

🔹 Token Unlocks – See when tokens will be released into circulation

🔹 Messari – Get detailed tokenomics reports

3. Evaluate the Community Without Being Misled

A large, active community can be a good sign, but beware of:

• Real engagement vs. bots. A high follower count doesn’t always mean real support.

• How does the team respond to tough questions? Avoid projects where criticism is silenced.

• Excessive hype? If all discussions are about "Lambo soon" and "to the moon," be cautious.

Where to check?

🔹 Twitter (X) – Follow discussions about the project

🔹 Reddit – Read community opinions

🔹 – See how the team handles criticism

4. Verify Partnerships & Investors

Many projects exaggerate or fake their partnerships.

• Is it listed on major exchanges? Binance, Coinbase, and Kraken are more selective.

• Are the investors well-known VCs? Funds like A16z, Sequoia, Pantera Capital don’t invest in just anything.

• Do the supposed partners confirm the collaboration? Check their official sites or announcements.

Where to verify?

🔹 Crunchbase – Check a project's investors

🔹 Medium – Many projects announce partnerships here

5. Watch the Team's Actions, Not Just Their Words

• Have they delivered on promises? Compare the roadmap to actual progress.

• What updates have they released? A strong project should have continuous development.

• Are they selling their own tokens? If the team is dumping their coins, it’s a bad sign.

Useful tools:

🔹 Etherscan / BscScan – Track team transactions

🔹 DefiLlama – Check total value locked (TVL) in DeFi projects

________________________________________

Final Thoughts: DYOR Correctly, Not Emotionally

To make smart investments in crypto, you must conduct objective research—not just look for confirmation of what you already believe.

✅ Analyze the team, tokenomics, and partnerships.

✅ Be skeptical of hype and verify all claims.

✅ Use on-chain data, not just opinions.

✅ Don’t let FOMO or emotions drive your decisions.

By following these steps, you’ll be ahead of most retail investors who let emotions—not facts—guide their trades.

How do you do your own research in crypto? Let me know in the comments!

Crypto influencers: The Good, The Bad and The UglyThe crypto space is evolving fast, and with it, the influence of social media figures has grown exponentially.

Crypto influencers have become a major source of information, ideas, and trends for traders and investors alike. But are they really helping, or are they just creating noise?

Let's break it down into three categories: The Good, The Bad, and The Ugly.

________________________________________

The Good: Learning and Discovery

One undeniable benefit of crypto influencers is access to information. With thousands of projects emerging every months, it's impossible to keep track of everything on your own. Influencers often highlight new projects, provide market insights, and share educational content, making it easier for retail investors to stay informed.

Their content can serve as a starting point for research, helping you discover opportunities you might have missed otherwise. Instead of spending hours searching for new projects, you can get a curated list of potential investments, saving time and effort.

However, the key here is not to blindly follow , but to use their insights as a research tool to dig deeper and verify information before making investment decisions.

________________________________________

The Bad: Copy-Paste Content & One-Sided Narratives

While some influencers provide value, many simply recycle the same information. If you follow multiple influencers, you might notice that most of them talk about the exact same projects, using almost identical arguments.

Why? Because they often copy each other or are paid to promote specific coins. Instead of offering genuine analysis, they just ride the hype wave.

Another major issue is the lack of balance in their narratives. The majority of influencers focus only on bullish scenarios, constantly pushing the idea that prices will rise. Very few discuss the risks, potential corrections, or exit strategies.

This creates a dangerous mindset among beginner investors, making them believe that crypto only goes up, leading to FOMO-driven decisions instead of well-thought-out investments.

________________________________________

The Ugly: Hype-Driven, Clickbait Influencers

And now, we get to the worst of the bunch—the aggressive, loud, and sensationalist influencers who have taken over social media. These are the ones who:

🚨 Shout in every video, promising to make you a millionaire overnight

🚨 Hype up "the next 1000x coin" without any real analysis

🚨 Push FOMO-driven narratives to drive engagement, not to educate

Their goal? Clicks, views, and affiliate commissions.

Many of these influencers don’t even trade or invest themselves—they simply capitalize on the excitement of others. They prey on new and inexperienced investors, convincing them to buy into the hype without considering the risks.

But let’s be honest… How many people have actually gotten rich following their advice?

Most of these so-called “expert picks” end up crashing once the hype fades, leaving followers with losses while the influencers move on to the next pump-and-dump scheme.

________________________________________

Final Thoughts: How to Navigate the Crypto Influencer Space

Not all influencers are bad, but you need to approach them with a critical mindset. Here are a few tips to stay safe:

✅ Use influencers as a research tool, not financial advisors – Always do your own due diligence.

✅ Look for balanced perspectives – Avoid those who only push bullish narratives.

✅ Be skeptical of hype-driven content – If someone is shouting about a guaranteed 100x coin or even 1000x, it's most probably a scam.

✅ Follow influencers who discuss risk management – Real traders know that both gains and losses are part of the game.

At the end of the day, your success in crypto depends on your own research and strategy, not on blindly following influencers. Stay informed, stay cautious, and don’t fall for the hype! 🚀📉

What do you think about crypto influencers? Have you ever made (or lost) money following their advice? Share your thoughts in the comments! 🔥👇

Understanding Tokenomics- Short Guide for Crypto InvestmentsEveryone dreams of finding that 100x crypto gem, but if you want to have a fighting chance beyond just buying random coins and praying that one hits, there’s one thing you need to do: master tokenomics. Tokenomics is the key to a crypto project’s price performance, and nearly every 100x crypto gem in history has had great tokenomics. This guide will teach you tokenomics from top to bottom, making you a savvier investor.

What is Tokenomics?

Tokenomics refers to the economic structure and financial model behind a cryptocurrency. It encompasses everything from supply and demand dynamics to token distribution and utility. Understanding these factors can give you a significant edge in identifying potential high-reward investments.

Supply and Demand

At its core, tokenomics boils down to two things: supply and demand. These two elements have a massive impact on a token's price. Even if a project has the best tech and marketing, it may not translate into great price performance unless it also has solid tokenomics.

Supply-Side Tokenomics

Supply-side tokenomics involves factors that control a cryptocurrency's supply. There are three types of supplies, but for the purposes of finding 100x gems, we focus on two: maximum supply and circulating supply.

Maximum Supply: This is the maximum number of coins that can ever exist for a particular project. For example, Bitcoin has a maximum supply of 21 million, which means there will never be more than 21 million Bitcoins in existence.

Circulating Supply: This is the amount of coins that are circulating in the open markets and are readily tradable. Websites like CoinMarketCap or CoinGecko can provide these values for most crypto projects.

Example: Bitcoin has a maximum supply of 21 million, making it a highly sought-after asset, especially in countries with high inflation. In contrast, Solana has a circulating supply of over 400 million but a maximum supply of infinity due to inflation, where the supply increases forever as the network creates more coins to reward miners or validators.

Inflation and Deflation

Inflation: Some projects have constant token inflation, where the supply goes up forever. While we generally prefer not to have inflation in tokenomics, some inflationary coins perform well as long as the inflation is reasonable. To determine if inflation is reasonable, convert the yearly inflation percentage to a daily dollar amount and compare it to market demand.

Deflation: Some projects have deflationary mechanisms where tokens are removed from circulation through methods like token burns. For example, Ethereum burns a part of the gas fee with every transaction, potentially making it net deflationary.

Rule of Thumb: Prefer projects with deflationary tokenomics or a maximum supply. Some inflation is okay if it’s reasonable and supported by market demand.

Market Cap

Market cap is another critical factor, defined as circulating supply multiplied by price. To find coins with 10x or even 100x potential, look for ones with lower market caps. For instance, a cryptocurrency with a market cap under $100 million, or even under $50 or $10 million, offers more upside potential but also carries more risk.

Example: Binance Coin (BNB) has a market cap of around $84 billion 579 USD at the time of writing). For a 10x gain, it would need to reach a $870 billion market cap, which is highly unlikely anytime soon. Hence, smaller projects with lower market caps are preferable.

Unit Bias

The price of the token can affect its performance due to unit bias, where investors prefer to own a large number of tokens rather than a fraction of a more expensive one. This psychological phenomenon makes smaller unit prices preferable for 100x gems, assuming all else is equal.

Fully Diluted Value (FDV)

FDV is calculated as maximum supply times price. Be cautious of projects with a large difference between their market cap and FDV, as it indicates potential future dilution. A good rule of thumb is to look for an FDV of less than 10x the current market cap.

Trading Volume

High trading volume relative to market cap ensures that the market cap number is reliable. A volume-to-market-cap ratio above 0,001 is decent.

Initial and Current Distribution

Initial Distribution: Check how widely the tokens were initially distributed. Avoid projects where a significant percentage of tokens are held by founders or venture capitalists.

Current Distribution: Use tools like Etherscan to analyze the current distribution of tokens. Look for a large number of unique holders and a low percentage held by the top 100 holders.

Vesting Schedule: Analyze the vesting schedule to understand when team or investor tokens will be unlocked, as these can impact the token's price.

Demand-Side Tokenomics

Demand-side tokenomics refers to factors that drive demand for a token, such as its utility and financial incentives.

Token Utility

The primary driver of demand is a token’s utility. Strong utilities include:

Paying for gas fees on a network

Holding to access a protocol

Getting discounts on trading fees

Governance tokens generally lack strong utility unless they are actively used and valued by the community.

Financial Incentives

Staking rewards and profit-sharing models, like those offered by GMX, incentivize holding tokens long-term. Sustainable financial incentives drive demand.

Growth and Marketing Allocation

Allocations for growth initiatives, such as influencer marketing, community rewards, or airdrops, help generate demand indirectly. Look for projects with healthy allocations for growth and marketing.

Conclusion

Tokenomics is the most crucial factor in analyzing and finding potential 100x crypto gems. However, other aspects like the underlying technology, marketing, and community also play significant roles. Combining a thorough understanding of tokenomics with broader fundamental analysis will enhance your investment decisions.

Blum Project Analysis!!!Today, I want to introduce you to another Tap-To-Earn project and see if it is worth your time.

In the previous articles, I explained Notcoin and the Hamster Kombat project. If you have time, take a look at these articles.

The name of this project is Blum .

Please stay with me.

-----------------------------------------------------------------------

What is Blum?

The Blum Token is a cryptocurrency associated with the Blum Crypto Project on Telegram . While specific details about the creators and core team might be limited, the project focuses on community engagement, utility, and promoting blockchain adoption. The token serves various purposes within the project’s ecosystem, from facilitating transactions to enabling governance and rewarding community participation

-----------------------------------------------------------------------

Now, let's check the Blum project with the help of SWOT ( Strengths-Weaknesses-Opportunities-Threats ).

What is the SWOT !?

SWOT (Strengths-Weaknesses-Opportunities-Threats) analysis is a framework used to evaluate a company's competitive position and to develop strategic planning. SWOT analysis assesses internal and external factors, as well as current and future potential.

🔸 Strengths : The game's style makes it difficult for the bot to jam every token_The active Telegram community currently has 11 million followers Blum selected by Binance labs team as featured airdrop

🔸 Weaknesses : No whitepaper _ Poor website _ Boring game _ The total number of tokens is not clear - the distribution method may not be fair _ the development team is unclear_The goal of the project is very general_ Low number of followers compared to other competitors on X platform _ Currently, you can become a member by invitation only_ It only has roadmap until the end of 2024_ The game environment is very simple.

🔸 Opportunities : Hard Forks to improve the Blum project_ Willingness of big investors to invest _ Improving the website and white paper_ Improve the game environment

🔸 Threats : High number of miners _ Emergence of Whales _Unspecified fee_ Hackers _ Competitors_Laws and regulations of countries

Can you add other parameters to the options above or not!?

-----------------------------------------------------------------------

Conclusion : Due to the fact that there are more Tap-to-Earn games these days, we should be a little careful in choosing the game, because no matter what you like, you will eventually have an income for the time you spend.

According to the description above, if you want to enter the BLUM project, you should only consider it a hobby and not spend a lot of time on it because it has many ambiguities and weaknesses.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Crypto wallets beginners guideUnderstanding Cryptocurrency Wallets

What is a Cryptocurrency Wallet?

When we think of a wallet, we usually imagine a pocket accessory holding cash and cards. However, digital currencies don't exist in a physical form or specific location. Cryptocurrencies, account balances, and transactions exist on a blockchain.

What is Blockchain?

Blockchain is a term for a continuously updated ledger of transactions.

How Do Cryptocurrency Wallets Work?

A cryptocurrency wallet has software that creates and stores your private and public keys, interacts with the blockchain, monitors your balances, and allows you to send and receive cryptocurrency. Think of it as a key to access your funds on the blockchain.

Simplified Analogy: Online Banking

Imagine your bank is the blockchain, your bank account number is the public key, your crypto wallet is your online banking app, and your login credentials are your private key.

• Bank as Blockchain: The bank records all transactions to and from your account, just like the blockchain records transactions to and from your public key.

• Online Banking App as Crypto Wallet: You use the app to check balances and make transactions, similar to how you use a crypto wallet.

• Login Credentials as Private Key: Your username and password are needed to access your account, just like your private key is needed to access your cryptocurrency.

• Public Key as Bank Account Number: Providing your bank account number allows people to send you money, similar to how a public key allows people to send you cryptocurrency. However, they can’t take funds without your private key.

Importance of Private Keys:

It's crucial to keep your private key private. If someone gains access to it, they can transfer your funds, and unlike traditional banking, there's no way to recover lost cryptocurrency.

Types of Cryptocurrency Wallets

Cryptocurrency wallets are broadly categorized into hot and cold wallets.

Hot Wallets

Hot wallets create and store your private keys online, making them more vulnerable to hacks. Examples include desktop or mobile app wallets.

Cold Wallets

Cold wallets, or hardware wallets, create and store your private keys offline, offering the highest level of security.

Examples include devices like BC Vault and the Ledger Nano Backup Pack.

Setting Up Your Own Crypto Wallet

Step-by-Step Guide:

1. Download the App: Go to the App Store or Google Play and search for the wallet you want and Download the app.

2. Create a New Wallet: Open the app and tap “Create New Wallet.”

3. Accept Terms: Review and accept the terms of service.

4. Pick a Username: Choose a username for receiving crypto easily.

5. Set Privacy Preferences: Choose whether to allow others to search for you by username.

6. Add Security: Use face ID or set up a 6-digit passcode for extra security.

7. Back Up Your Wallet: Write down the 12-word recovery phrase on paper and store it securely. This phrase is your private key.

Transferring Crypto from an Exchange

1. Log in to Your Exchange.

2. Send Crypto: Tap “Send,” choose the cryptocurrency, and enter the amount.

3. Enter Wallet Address: Use the QR code or paste the address from your wallet.

4. Confirm and Send: Verify the details and complete the transaction.

Eureka Moment: The Importance of Recovery Phrases

If someone gets hold of your 12-word recovery phrase, they can access your funds. This demonstrates the critical importance of keeping your private key secure.

Conclusion:

Storing your cryptocurrency on a hardware wallet is the safest, most secure way to manage your funds. Follow the steps outlined to set up your wallet, transfer your funds securely, and always protect your private key. For further security, use the official links provided to purchase recommended hardware wallets.

Stay safe and happy investing!

How to Keep Your Seed Phrase Safe?Steps to Keep Your Seed Phrase Safe:

Write Down the Seed Phrase Correctly:

Allocate 30-60 minutes in a quiet, private place without strangers or video surveillance.

Use a pen and paper to write down the seed phrase accurately.

Verify the Seed Phrase:

Double-check the spelling and word order to ensure correctness. An incorrect seed phrase will not restore access to your assets.

Choose a Safe Storage Location:

Store the written seed phrase in a secure location, such as a safe or a document storage with a combination lock or biometric access.

Do Not Memorize the Passphrase:

Even if you can remember the seed phrase, always keep a written version as a backup.

Use Reliable Materials:

Consider using water-resistant paper or titanium plates to write down your seed phrase. If using regular paper, ensure it's sturdy and use ink or pencil that won't fade over time.

Avoid Digital Storage:

Do not take pictures of your seed phrase with a smartphone.

Do not store your seed phrase on a computer, smartphone, or any electronic device to avoid the risk of hacking or theft.

Keep the Seed Phrase Private:

Never share your seed phrase with anyone. Even wallet support services should never ask for your passphrase.

Avoid Entering the Seed Phrase Online:

Never enter your seed phrase on any website, even if it claims to be for verification, technical support, or authorization.

Inform Trusted Individuals:

Let close, trusted individuals know about the existence of the seed phrase in case they need to access it in an emergency.

Regularly Check the Seed Phrase:

Periodically verify that the seed phrase is still in place and undamaged. If any signs of damage appear, generate a new seed and transfer your assets to a new wallet.

Consider a 25th Word:

Some hardware wallets offer the option to add a 25th word, which you can create to add an extra layer of security. This additional word is only known to you and increases the security of your wallet.

By following these tips, you can significantly enhance the security of your seed phrase and ensure that your cryptocurrency assets remain protected.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Why Are Token Standards Needed?Token standards are crucial because they guide developers on creating and using tokens within a particular blockchain protocol, ensuring compatibility and interoperability among products developed using the same standard.

Token Standards

Token standards are essentially a set of agreed-upon rules that outline the design, development, behavior, and operation of cryptocurrency tokens on a specific blockchain protocol. For these standards to be effective, they must gain wide adoption. Without broad acceptance, these rules cannot be considered "standards" since standards are rules generally followed by a large community.

Why Are Token Standards Needed?

Compatibility: Token standards ensure that all products built using that standard can work together seamlessly.

Composability: In programming, a composable system allows developers to reuse existing components to create new products, which is also applicable to token creation.

Efficiency: Token standards enhance interoperability between smart contracts. When smart contracts follow token standards, they can manage all tokens on the network effectively.

Common Token Standards

ERC-20: The most popular token standard on Ethereum, allowing for the creation of fungible tokens. Examples include Shiba Inu, Tether, Uniswap, and ApeCoin.

BEP-20: A token standard on the Binance Smart Chain (BSC), sharing similar properties with ERC-20 due to their architectural similarities.

ERC-721: This standard allows for the creation of non-fungible tokens (NFTs) on Ethereum, used by many popular NFTs.

ERC-777: An improved fungible token standard over ERC-20, providing enhanced privacy and addressing certain issues with ERC-20 tokens.

ERC-1155: This standard helps reduce costs by allowing transactions to be grouped, and can be used for both fungible tokens like the Basic Attention Token and non-fungible tokens like CryptoPunks.

Wrapped Tokens

Tokens on different blockchains typically cannot interact with each other. Wrapped tokens address this issue by representing assets on one blockchain in a form that can be used on another. For example, Wrapped Bitcoin (WBTC) on the Ethereum blockchain is an ERC-20 token backed 1:1 by real Bitcoin. This allows WBTC holders to use Bitcoin within the Ethereum network for trading, farming, staking, and interacting with other ERC-20 tokens.

Token standards enable the use of diverse assets within the same blockchain, solving the problem of asset incompatibility and providing flexibility for the network.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

5 RULES DISCIPLINED TRADERS FOLLOW 👨🎓Hey guys! In this article you will learn about 5 RULES DISCIPLINED TRADERS FOLLOW, let's dive in it!

But before you do so, make sure you follow my page and turn TradingView notifications ON! Let's go!

1️⃣ Follow Financial Plan, Do Not Go All In

A trading plan is a written set of rules that specifies a trader's entry, exit, and money management criteria for every buy or sell entry.

Do not go all in! Want to lose most or all of your money real fast? Make outsized trading bets, like a roulette player betting it all on red or black.

In fact, big trading bets are a form of gambling.

So avoid gambling, stop going “all in” in single stock or coin.

Start planning your investments, invest in the long-term at least 10% of your income every month in markets and other assets. If you invest a certain amount every month, you are buying shares in good times as well as bad times.

In good times, the value of your shares increase. If you keep your cool and stick with the plan even when the market is down, you get more shares for your money. These additional shares boost investment returns when the market rebounds.

This is a big part of the reason why regular stock investors get a higher long-term return compared to safer investments despite the temporary ups and downs in the market.

A long-term investor has a minimum of a 20-year time horizon; this time frame enables them to avoid playing it safe and to instead take measured risks, which can ultimately pay off in the long run.

2️⃣ Treat Trading Like A Business

To be successful, you must approach trading as a full- or part-time business, not as a hobby or a job.

If it's approached as a hobby, there is no real commitment to learning. If it's a job, it can be frustrating because there is no regular paycheck.

Trading is a business and incurs expenses, losses, taxes, uncertainty, stress, and risk. As a trader, you are essentially a small business owner and you must research and strategize to maximize your business's potential.

Think in Long term – Don’t trade like you are going to retire tomorrow

Have a Clean Trading Office That inspire you

Have a trading Plan for Your Trading Business

Don’t Present Yourself all Over the Market – Have a Proper EDGE over the Market

Have a Strict Daily Trading Routine & Follow it Continuously

Always Protect Your Trading Capital

Have Solid Trading Journal

3️⃣ Don't Trade Everyday

You don't have to open trades every day

Beginners tend to think that professional traders open their trades every day. But this is not true. Professional traders wait for good trading opportunities and only then enter the market.

Some days there will be no good trading opportunities. Sometimes the volatility will be too low, and you simply will not be able to take more or less decent profits. Sometimes, on the contrary, the volatility will be too high, and you will not be able to open your trades safely. There can be many different reasons in the market when it is best to refrain from trading.

Experienced traders know when to sit back and just wait. At the same time, most novice traders constantly open new positions because they think they should trade. But in the end, they make bad trades and constantly suffer losses.

If you don't find valid good entry points, but still open new trades, you will lose much more money than if you had the patience and stayed out of the market.

4️⃣ Accept Losses, Losses = Learning

It is much more useful to accept the fact that losses are the norm rather than the exception. It is also vital to define your potential losses before you enter any trade. Define your possible loss, or risk, in comparison to your possible reward, or profit. It is also vital that you don't take losing personally.

5️⃣ Risk Only What You Can Afford to Lose

Let the profits flow and cut the losses. This idea is one of the most common among traders.

As George Soros said:

It doesn't matter if you're right or wrong. What matters is how much you earn when you are right and how much you lose when you are wrong.

The key to trading success is to grow your profitable trades.

Traders who are afraid of losing their money often stop paying attention to the market situation and become too attached to the current profit. They make their decisions about open positions based only on the fear that the price will not reach their profit.

We know that unfixed profits still belong to the market. But once you start cutting back on your winning trades, you also cut your risk to reward ratio.

Of course, sometimes the market will give you less profit than you bargained for. And that's okay. To trade successfully, you must free the market and stop restricting it.

But if you are trading with money that you fear losing, you will not have that luxury. Instead, you will be afraid of losing your accumulated profits and you will not be able to sit back and let the market do its job.

The beauty of using multiple risk-reward ratios is that you can ignore your winning ratio and still make good money. If you reduce this ratio, you are faced with the need to make a high percentage of profitable trades in order to make a profit. Basically, you yourself are reducing your chances of achieving success.

Stay tuned for further updates!

Always learn, never give up!

Best regards

Artem Shevelev

The Significance of Trading Volume: Understanding Its ImportanceHey there, fellow traders! Today, let's dive into the fascinating world of cryptocurrency trading volume. Think of it as our market's fluctuations – a constant flow of transactions across various exchanges. The trend is your friend and the volume is your vision of trading.

What's Cryptocurrency Trading Volume?

Imagine this: as you sip your morning coffee, traders around the globe are already immersed in the action, making buy and sell trades that impact the trading volume.

And just take a look!

Now, you might be wondering, what’s going on? Well, trading volume ain't just a bunch of fancy digits. It's a sneak peek into how traders are feeling, their trades about where their prices are heading. When volume shoots up like a rocket, it usually rides alongside big price fluctuations, impacting potential trends in the market.

How Does Trading Volume Affect Crypto Trading: Why Is Trading Volume Important?

There are always two scenarios when we talk about a cryptocurrency: up and down. Imagine it is like this: the price is like a mirror that reflects what folks who want to buy and sell think is fair.

When the number of people looking to buy is nearly the same as those wanting to sell, the price is still in the flat. This tells us that everyone has a good sense of what the price should be, creating a well-organized market. The number of people buying and selling is roughly the same. It's like having a balanced situation.

But I should be honest: stability is not always the norm in the wild world of crypto. This market is moving, thanks to stuff happening outside and decisions made by all sorts of investors, from big shots to regular folks hoping to score quick gains.

How much trading a specific cryptocurrency sees can change based on how exciting people find the project, when it gets added to major trading platforms, and how much buyers are willing to pay compared to sellers. So, checking out how active a cryptocurrency is in trading can give us a clue about how confident people are in its potential, which in turn can hint at how much the price might shift.

Websites like Coinmarketcap check how much trading a cryptocurrency does over time and how easy it is to turn it into actual money. If trading with crypto was simple, its price didn't pump or dump hard when people buy or sell. But for less-known cryptocurrencies on smaller trading platforms, not much trading can cause the price to move fast with just a few trades. But here's the thing: that lack of trading can also mean a chance to grab it at a low price on one platform and sell it for more on another.

This situation is called arbitrage. Here are a few strategies which you can use.

1) Classic arbitrage is the arbitrage between exchanges

2) Funding arbitrage is the arbitrage between exchanges that trade with futures and rais from traders a funding.

3) Futures arbitrage

Futures arbitrage is called convergence arbitrage. The mechanic is that you go long on one exchange and short a futures contract on another. Let's say you believe Bitcoin's price will hit 60k dollars. On one exchange, there's a contract lagging by 5k dollars, but on the other price was without difference. When the price converges, you'll close it at 60k dollars, minus trading fees and funding costs, pocketing the profit difference.

That’s how it works, traders. The new article will be about trading volume and how to use it in your trading strategy. Your subscriptions are always appreciated. Thank you!

Practical advice for a novice traderPractical advice for a novice trader

- It doesn't matter what size of the deposit you have, start gaining experience with symbolic sums: $10/50/100, as you gain skills, you can increase the deposit, but be prepared to lose. In addition, with such an initial deposit, the logic of the behavior of market participants will open up to you.

- Do not invest in trading those funds, the loss of which will affect the quality of your life, only what you are ready to lose.

- Do not rush to leave your main job, let trading be your hobby for some time, perhaps it will grow into something more over time (but this is not certain).

- More trades does not mean more profit, you can make several trades in a month and earn more than if you made dozens of trades a day, and sometimes it’s best to be out of the market, but this is very difficult without experience.

90% of a trader's time is spent on analyzing the instrument and the situation, forget about the rush, opportunities appear and disappear every day, know how to wait.

- The first transactions can be made on paper, on an unfamiliar chart, but just take into account not only the profit or loss, but also the time spent.

- It doesn’t matter what timeframes you work on, as long as you manage to trade profitably, but you need to start studying the chart with higher timeframes: monthly, weekly, daily and go lower, so you will understand the whole picture.

- There is no endless growth, as well as an endless fall, markets are cyclical, and reversals usually occur at the most unexpected moments.

Do not make decisions on emotions, only a well-thought-out plan. Develop your own trading strategy, according to your initial data and temperament.

- Don't ask others where to buy and where to sell, they don't know.

- If the instrument has already made several hundred percent growth from the bottom, then it is not rational to enter it without stops, if the profit from the bottom is several thousand percent, then it is contraindicated to enter such an instrument on growth without waiting for a significant rollback!

- Even if everything points to a specific direction of movement, always allow 1% for the opposite option, this can save you from significant losses. Always control risks.

- If you make a profit, withdraw at least a part, regularly, you must understand why you are spending your time on this. Ideally, over time, withdraw all the money invested, so it will be easier for you to psychologically operate with a deposit.

There are no universal strategies. Your trading strategy should be well-considered, but at the same time adaptable to the current market situation. Something works well in a rising market, and does not work well in a falling one, and vice versa. You will be able to earn if you quickly adapt to the situation and skillfully manage risks.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Domino principe in crypto marketBINANCE:BTCUSDT

Let's start with what the S&P500 is.

The S&P 500 is a stock market index made up of 500 large companies whose total shares are traded on the New York Stock Exchange (NYSE) or NASDAQ.

The NASDAQ index - trades over 3,000 stocks. This exchange specialises in stocks of high-tech companies

I will not torture you with charts, but I will tell you why the classical stock market indices affect the cryptocurrency. Correlation of the cryptocurrency and stock market.

The S&P 500 and NASDAQ indices include stocks of technology companies, incl. crypto companies. For example, Coinbase Global , Riot Blockchain , etc. In other words, their indicator reflects the state of the entire sector of the economy.

Cryptocurrencies are highly correlated with US technology stocks, as they belong to the same class - risky instruments.

They are bought, counting on a strong price increase, and sold at the slightest signal of impending problems. And inflation and geopolitical uncertainty motivate to seek protection in safe-haven assets.

In April, the US reported inflation of 8.3% (money is depreciating, prices for goods and services are rising), the main reason is that they have printed too much money, the national currency has to be strengthened. All this immediately affected the stock and crypto markets. Bitcoin was the first to react. Based on this, we can build a chain of influence: world events / inflation > stock market > bitcoin > altcoin > panic around stables.

Panic is subject to the Domino principle. One event affects another, causing a chain reaction, and everything gradually tends to destruction. We will try to illustrate this principle.

Following the record crash of the $LUNA Terra token and its $UST stablecoin, increased volatility has been seen across all stablecoins. Someone, as usual, knew everything in advance. Back in April, there were many articles about how Terra has a weak algorithm and can easily play the death spiral scenario. The bottom line: “If the price of $LUNA comes under pressure, $UST holders may fear that the $UST peg is under threat and decide to buy out their UST positions. To do this, $UST is burned, and $LUNA is minted and sold on the market. This will further exacerbate the fall in the price of $LUNA, pushing more $UST holders to sell their $UST.”

There are many theories about the group of people behind this pressure. It boils down mainly to the fact that pressure is exerted in order to regulate the crypt. This is not so important. The trouble is that the system failed, and if this is possible within the framework of the "game rules", but it does not matter by what method this was achieved, it would have happened sooner or later.

Investigation to be! The US Securities and Exchange Commission (SEC) is investigating the decoupling of UST from the dollar. And in the United States, they pass a law on the regulation of stablecoins by the end of 2022.

The situation with LUNA put the strongest pressure on the market, $UST was shaking for several days until it completely died, the situation escalated, panic attacks seized all sectors of the market, the domino principle was launched.

USDT ≠ UST ?

What does stable mean? $USDT is backed by fiat dollar reserves and assets. Those. For every $USDT, there is a real $1 US. This distinguishes $USDT from algorithmic $UST.

Part of the securities backed by $USDT is related to the Chinese real estate sector, which is in crisis. If these securities depreciate, then the peg may lose the rate 1:1.

And this fear has been around for a long time, so Tether is reducing the share of commercial paper, increasing the share of the real dollar.

In February 2021, Tether agreed to provide reports as part of the settlement of allegations of covering up the loss of funds and lying about the state of the reserves.

As of March 31, Tether had assets of at least $82.4 billion, as well as $82.2 billion of liabilities related to the digital tokens it issued.

But this does not change the reasons for the shorts, because the specific sources of commercial paper have not been disclosed.

Do not forget that during a general panic, fear provokes fear, each event causes two more, all this grows exponentially, and someone is sure to profit from it, this is the golden law.

After analyzing the current situation, I can note a lot:

Stablecoins, not so stable. If not backed by real $, and even here you can bet.

You can’t panic, otherwise volatility is inevitable, and sometimes you can even make money on it.

Be vigilant, remembering that panic takes over everyone. At such times, risk is everywhere, analyze what you are doing and be careful.

A crisis is a difficult time, on the other hand, it is a time of opportunity.

Study what you invest in, these are market conditions.

The cryptocurrency market is directly related to the stock market. First of all, the stock market affects Bitcoin .

Is it really that bad?

Cryptocurrency has already experienced difficult times. The market cannot go up all the time, the current situation is quite natural. But it was at such times that the most significant projects of the sphere were born and developed on the market.

Collective panic cant strongly shake the market, any token and even shake $USDT. Don't despair, we are in the right place.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* For more ideas please hit "Like" and "Follow"!

BTC - How sharks lure fish🐟Now, through the efforts of a market maker, something similar to the Head and Shoulders can be traced on the chart.

This is drawn in order to lure inexperienced traders who will be trapped into shorts.

However, experienced traders know that a H&S is a reverse setup!

Knowing how to spot traps of the market maker is just as important as knowing how to find your formations. This skill will help you better predict future market movements and trade in the direction of wind.

What do you think of this idea? What is your opinion? Share it in the comments📄🖌

If you like the idea, please give it a like. This is the best "Thank you!" for the author 😊

P.S. Always do your own analysis before a trade. Put a stop loss. Fix profit in parts. Withdraw profits in fiat and reward yourself and your loved ones

EOS / USDT | The perfect buy call ! ; )Hey , guys !

Lets check this coin together !

———

We can see awesome moment to buy right now , guys !

Add this coin to your watching list !

And read more ideas here @Professional_Crypto_Analytics

———

Have an awesome profit !

Best wishes

2. What are Exchanges? 🤔😛 <<<Crypto Education>>>In the world of cryptocurrencies there are two types of exchange. CEX and DEX. The graph shows the difference for each one.

What you should know about CEX:

Used to change fiat to crypto and crypto to fiat.

CEXs can block your money without warning for any reason.

The CEX may ask to verify your identity and origin of funds.

Some cannot serve clients depending on their location.

What you should know about DEX:

DEXs are smart contracts that exchanges run.

To use a DEX you need to already have cryptocurrencies in possession since they do not have fiat money input.

Most DEXs trade only with assets from the same chain where they are located. Ex Uniswap is used to exchange ERC-20 Ethereum tokens.

DEX can be used from your software or hardware wallet.