When Altseason? Clues in other chart Ex) #1Hi guys.

So Its no secret bitcoin has been ripping.

We are at new all time highs, and in full on price discovery mode.

I recently posted an ongoing macro analysis on ADA (Cardano) supporting my theory that it is one of the better alts to be investing in for alt explosion.

I want to look elsewhere to see if i can find supporting evidence that its time to invest or trade altcoins.

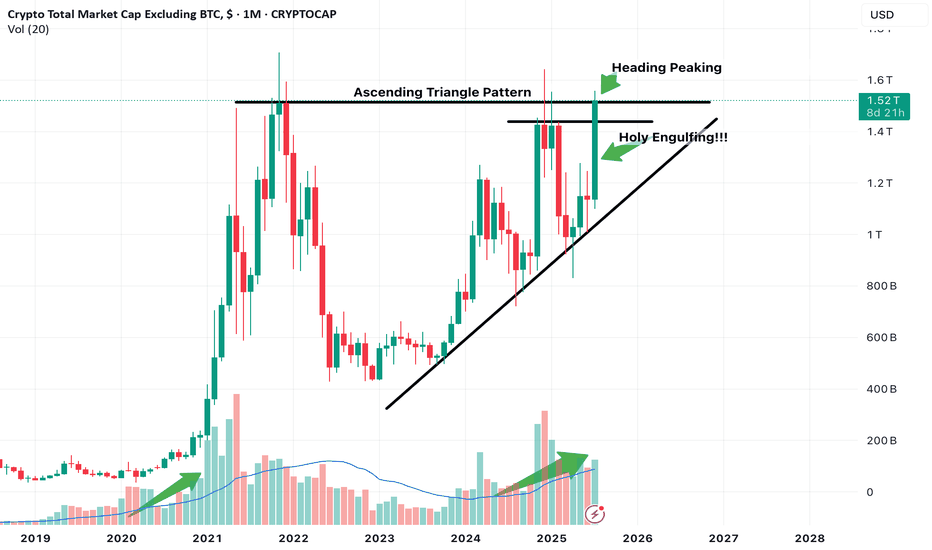

One chart that can be used is the Total Market Cap of Crypto excluding Bitcoin.

This chart showcases total altcoin market capitalization and its movements.

I believe certain Technical developments can really help us gauge at whats to come.

NOte this is on the 1 Month timeframe aka looking into Macro developments.

Just focusing on Candlestick action.

Notice we have been in this ascending channel trend, along with a potential Ascending triangle pattern development which if breakout occurs with confirmation can push Altcoin market cap higher indicating that liquidity is entering altcoins which indicates potential Uptrend.

The month of July so far is in position to print a massive engulfing Bullish candle, which is a great sign.

The upper part is also peaking its head above the Horizontal resistance line. Need to observe confirmation of this breakout. Look for it in smaller timeframes, ill look for it in the 3 day or 5 day.

We are also in position to print a higher high first time in a while.

Notice also Volume. We are seeing currently similar increasing volume as previous alt coin market cap expansion.

Keep an eye out on more posts to add to evidence that supports we are in the verge of potential altcoin season.

Cryptoinvesting

Should You Invest in Uniswap $UNI Crypto Right Now?Grab your popcorn, or whatever you vibe with—because today I will analyze Uniswap. Yep, the decentralized trading protocol that lets you swap tokens like Pokémon cards, but without asking mom for permission.

So, what is Uniswap? Simple. It’s like the vending machine of the crypto world. Wanna swap your Ethereum CRYPTOCAP:ETH for some Shiba Inu? Go ahead. No sign-up. It’s peer-to-peer, decentralized.

Remember those juicy monthly demand levels at $3.868 and $4.750 we discussed at the Set and Forget Trading Community? Yeah, those weren't just random numbers pulled from a bingo machine. That’s where big buyers stepped in, creating a supply and demand imbalances. Translation: There were way more people wanting to buy than sell, which made the price go UP. Magic? No. Just basic market dynamics, people.

And guess what? Those levels played out beautifully. Buyers showed up, price popped, and if you were patient, you got paid. If you weren’t… well, you can enjoy your bag of regrets.

Now, here’s where it gets interesting. The daily timeframe is now trending UP. We’ve officially seen the creation of a fresh imbalance at $5.19. That’s our new price level for buying Uniswap. But are we buying right now? NOPE.

Because here’s the golden rule of trading and investing: Patience is key. I know, I know—it’s boring. Waiting feels like watching paint dry… but on the blockchain. But trust me, the market doesn’t care about your feelings or my feelings.

We're waiting for price to pull back into $5.19, where the last big buyers left a footprint the size of a crypto whale. When will it get there? We don't know. THEN we’ll look to repurchase. Not before.

So remember—Uniswap is a beast in the DeFi world. Supply and demand is your best friend. And above all, don’t chase the pump. Let it come to you. Like a well-trained dog… or a well-behaved altcoin.

$AVAX: Avalanche – Snowballing Gains or Melting Away?(1/9)

Good evening, everyone! 🌙 CRYPTOCAP:AVAX : Avalanche – Snowballing Gains or Melting Away?

With AVAX at $23.07, is this blockchain beast a sleeper hit or a slippery slope? Let’s avalanche into it! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 23.07 as of Mar 25, 2025 💰

• Recent Move: Up from $18, below $40 highs, per data 📏

• Sector Trend: Crypto volatile, AVAX rides the waves 🌟

It’s a rollercoaster—hold tight for the drop! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $9.56B (414.78M tokens) 🏆

• Operations: Scalable L1 for DeFi, dApps, subnets ⏰

• Trend: $1.121B DeFi TVL, whale buys, per posts on X 🎯

Firm in L1 race, but market’s a blizzard! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Whale Action: 500K tokens moved, per posts on X 🌍

• DeFi Strength: $1.121B TVL holds firm, per data 📋

• Market Vibe: Bearish Fear Index (34), yet resilient 💡

Snowballing quietly amid crypto storms! ❄️

(5/9) – RISKS IN FOCUS ⚡

• Market Correction: Bearish pressure could sink it 🔍

• Competition: Solana, Ethereum vie for dApps 📉

• Macro Woes: Trade tensions, rates shake things ❄️

It’s a chilly slope—brace for ice! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Scalability: 4,500 TPS, beats rivals 🥇

• DeFi Base: $1.121B TVL, solid ecosystem 📊

• Adoption: Enterprise use grows, per data 🔧

Got a snowy peak of potential! 🏔️

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility, high off $59 peak 📉

• Opportunities: Whale buys, subnet growth 📈

Can it snowball or melt under pressure? 🤔

(8/9) – POLL TIME! 📢

AVAX at $23.07—your take? 🗳️

• Bullish: $30+ soon, whales fuel it 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $18 looms, correction hits 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

AVAX’s $23.07 price tags a volatile gem 📈, with DeFi strength but market risks 🌿. Dips are our DCA jackpot 💰—buy low, ride high! Gem or bust?

XRP Weekly-Monthly Analysis / Retracement Levels for BuyWeekly - Monthly trend: Bearish

Chart Pattern: Head & Shoulders (H&S) - Bearish Continuation Pattern

Bearish Candlesticks signals:

HANGING MAN (Bearish, Single Candlestick pattern) / Weekly Timeframe / 09 DEC 2024

BEARISH ENGULFING (Bearish, Double Candlestick pattern)/ weekly Timeframe / 27 JAN 2025

TWEEZER TOP (Bearish, Double Candlestick pattern) / 1 Day timeframe / 20 FEB 2025

FALLING THREE METHODS (Bearish, five-fold Candlestick pattern) / 1 Day timeframe / 07 MAR 2025

Retracement Fib Price Levels:

0.00% (3.4000)

23.60% (2.6879)

38.20% (2.2474)

50.00% (1.8914)

61.80% (1.5353)

78.60% (1.0284)

100.00% (0.3827)

Good prices for buy (the lower the better):

61.80% (1.5353) – Golden Zone / Golden Pocket

78.60% (1.0284) – Entry Zone

Between 78.60% (1.0284) and 100.00% (0.3827) is the Risk Zone, which we have the Neckline of the ‘’ Quadruple Bottom Pattern ‘’ at the price range ‘’ 0.6291 – 0.7850 ‘’

I am having buy limit at 0.78500 on the neckline of ‘’ Quadruple Bottom Pattern ‘’.

MARA ($MARA) Q4—$214.4M HAUL STUNS MARKETMARA ( NASDAQ:MARA ) Q4—$214.4M HAUL STUNS MARKET

(1/9)

Good Morning, TradingView! MARA Holdings ( NASDAQ:MARA ) smashed Q4 ‘24 with $ 214.4M revenue, up 37% YoY 🌍 Bitcoin hoard hits $ 3.94B—let’s unpack this mining beast! 💰

(2/9) – REVENUE SURGE

• Q4 Take: $ 214.4M, 37% up from $ 156.8M 📈

• Net Income: $ 528.3M, 248% leap 🌟

• BTC Price: 132% boost adds $ 119.9M 💸

NASDAQ:MARA ’s cashing in—halving? What halving?

(3/9) – BLOCKS BUZZ

• Blocks Won: 703, up 25% from 562 🚗

• Hashrate: 53.2 EH/s, 115% jump 🔧

• EPS: $ 1.24, beats $ 0.32 loss call 🌞

NASDAQ:MARA ’s grinding—blocks stack, stock pops!

(4/9) – BTC HOARD

• Stash: 45,659 BTC, $ 3.94B haul 🌍

• Growth: 197% since Jan ‘24—22,065 bought 💼

• Bitdeer: $ 532M loss—ouch 😕

NASDAQ:MARA ’s stacking—rival’s stumbling!

(5/9) – RISKS IN SIGHT

• Costs: $ 127.4M energy, up 70% ⚠️

• Volatility: BTC swings sting 🐻

• Halving: $ 64.2M output hit 🔒

NASDAQ:MARA ’s hot—can it dodge the chill?

(6/9) – SWOT: STRENGTHS

• Haul: $ 214.4M, profit beast 💪

• Blocks: 25% more—mining grit 🏋️

• Hoard: $ 3.94B BTC—stack king 🌱

NASDAQ:MARA ’s tough—built to last!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Energy costs bite 🙈

• Opportunities: BTC price, AI pivot—zing 🌏

Can NASDAQ:MARA vault past the snags?

(8/9) – NASDAQ:MARA ’s $ 214.4M Q4, what’s your vibe?

1️⃣ Bullish, $ 20+ stacks up 😎

2️⃣ Neutral, Solid, risks linger 🤷

3️⃣ Bearish, Costs clip it 😞

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:MARA ’s $ 214.4M Q4 and $ 3.94B BTC pile stun—mining hauler Costs creep, but grit shines—gem or bust?

BITCOIN ($BTC) DIPS TO $82K—FEAR OR FORTUNE?BITCOIN ( CRYPTOCAP:BTC ) DIPS TO GETTEX:82K —FEAR OR FORTUNE?

(1/9)

Good Morning, TradingView! Bitcoin ( CRYPTOCAP:BTC ) slumped to $ 82,000, lowest since Nov ‘24 💰 Market’s glum, let’s unpack this crypto dip! 🌐

(2/9) – PRICE SLIDE

• Drop: $ 82K, 20% off $ 109K high 📊

• Month: Altcoins down 30%+ 💧

• Fear Index: 10/100, rock bottom 😟

CRYPTOCAP:BTC ’s shivering, gloom’s thick!

(3/9) – TECH TELL

• 200-Day MA: $ 81,500, support holds 🌟

• RSI: 28, oversold, bounce hint 🚀

• Past: Aug ‘24 $ 49K to $ 100K 📈

CRYPTOCAP:BTC ’s teetering, rebound or rubble?

(4/9) – MARKET MOOD

• Fear: Lowest since FTX ‘22, $ 16K 🌍

• History: Extreme fear sparks rallies 🌞

• Outflows: $ 1B from ETFs, trade woes 💼

CRYPTOCAP:BTC ’s testing, panic or patience?

(5/9) – RISKS IN PLAY

• Trump: Tariff talk, no crypto juice ⚠️

• Volatility: Bear turn stings 🐻

• Stablecoins: Inflows, sideline cash 🔒

CRYPTOCAP:BTC ’s wobbly, can it dodge the funk?

(6/9) – SWOT: STRENGTHS

• Base: $ 82K holds, tough nut 💪

• Past: Fear flips to gold, $ 100K+ 🏋️

• Liquidity: Central banks ease 🌿

CRYPTOCAP:BTC ’s gritty, battle-tested!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Sentiment sinks 😕

• Opportunities: Fear buys, rate cuts 🌏

Can CRYPTOCAP:BTC vault past the blues?

(8/9) – CRYPTOCAP:BTC ’s $ 82K dip, what’s your take?

1️⃣ Bullish, $ 100K rebound soon 😎

2️⃣ Neutral, Holds, risks linger 🤷

3️⃣ Bearish, $ 70K slide looms 😞

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

CRYPTOCAP:BTC ’s $ 82K slump spooks, fear at 10 🪙 $ 1B ETF outflows sting, but history hints bounce, gem or gloom?

JUPITER ($JUPUSD)—SOLANA’S DEFI STAR SHINES?JUPITER (JUP)—SOLANA’S DEFI STAR SHINES?

(1/9)

Good morning, X! Jupiter (JUP) is buzzing 💸 $ 3.7B Nov ‘23 volume, $ 1.07 price 🌍 Q1 ‘25 let’s unpack this crypto contender!

(2/9) – VOLUME HUM

• Nov ‘23: $ 3.7B—Solana DEX lead 💡

• Jan ‘25: $ 3M revenue—fees stack 📊

• Supply: 1.35B JUP—$ 1.45B cap 🌟

JUP’s hauling—Solana’s DeFi engine!

(3/9) – CASH GLOW

• Fees: 500K−650K daily—Ultra Mode 🚀

• Buyback: 50% fees snag JUP—locked 🌞

• Price: $ 1.07—down 65% from $ 1.85 💎

JUP’s cash flows—steady grind!

(4/9) – BIG MOVES

• Buyback: 16M+ JUP/mo.—supply shrinks 📈

• Sanctum: SOL debit card—real spend 🌐

• Features: DCA, futures—DeFi zip 🚗

JUP’s stretching—crypto’s toolbox!

(5/9) – RISKS ON TAP

• Delay: Mainnet lags—Q1 ‘25 wobbles ⚠️

• Control: Team grips—central snag 🔒

• Comp: Uniswap bites—tight race 📉

Hot buzz—can it dodge the traps?

(6/9) – SWOT: STRENGTHS

• Lead: $ 3.7B vol.—Solana champ 💪

• Cash: $ 3M Jan—fee beast 🏋️

• Tools: Swap, futures—steady juice 🌱

JUP’s a DeFi hauler—built tough!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Token lock, 65% drop—eek 🙈

• Opportunities: Buybacks, Solana lift—zing 🌏

Can JUP vault past the snags?

(8/9) – JUP’s $ 1.07 buzz—what’s your take?

1️⃣ Bullish—$ 3+ stacks up 😎

2️⃣ Neutral—Solid, risks linger 🤷

3️⃣ Bearish—Dips below $ 0.63 😕

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

JUP’s $ 3.7B vol and $ 1.07 price pile up—Solana hauler 🪙 Buybacks spark, risks loom—gem or bust?

COINBASE ($COIN) Q4—CRYPTO CASH PILES UPCOINBASE ( NASDAQ:COIN ) Q4—CRYPTO CASH PILES UP

(1/9)

Good evening, TradingView! Coinbase ( NASDAQ:COIN ) just dropped a Q4 banger 💰 $ 2.27B revenue, up 138% YoY 🌍 Full ‘24 hits $ 6.29B—let’s unpack this crypto hauler!

(2/9) – REVENUE SURGE

• Q4 Take: $ 2.27B 🌟 138% leap from ‘23

• Full ‘24: $ 6.29B 💼 115% climb

• Subs: $ 2.3B 📈 64% jump

NASDAQ:COIN ’s raking it in—trades and fees soar!

(3/9) – EARNINGS POP

• Q4 EPS: $ 4.68 🏆 beats $ 2.11 guess

• Net: $ 1.3B 🌞 300% YoY surge

• EBITDA: $ 3.3B 💪 two years of green

NASDAQ:COIN ’s cash flow hums—profit’s real!

(4/9) – BIG MOVES

• Global Cut: 19% Q4 from overseas 🌐

• Next Up: Derivatives, USDC push 📊

• Stock Dip: Flat post-earn 🤔 profit grabs?

NASDAQ:COIN ’s stretching wide—crypto’s workhorse!

(5/9) – RISKS ON DECK

• Crypto Swings: Price drops sting 🕸️

• SEC Suit: Regs loom ⛔ costs nip

• Rivals: Binance lurks ⚡ tight race

Hot streak—can it sidestep the traps?

(6/9) – SWOT: STRENGTHS

• Haul: $ 2.27B Q4 🚛 volume beast

• Subs: $ 2.3B 💡 steady stream

• Profit: $ 3.3B EBITDA 🏋️ cash stack

NASDAQ:COIN ’s hauling freight—built tough!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Trade lean 🌫️ thin ice

• Opportunities: Global reach 🌏 reg wins

Can NASDAQ:COIN outpace the bumps?

(8/9) – NASDAQ:COIN ’s $ 2.27B Q4—what’s your take?

1️⃣ Bullish—$ 350+ in sight 😎

2️⃣ Neutral—Good haul, risks linger 🤷

3️⃣ Bearish—Crypto dips drag it down 😕

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:COIN ’s $ 2.27B Q4 and $ 6.29B ‘24 pile up big—crypto hauler 🪙 High P/E, but cash flows—gem or jinx?

PI NETWORK—CRYPTO’S MOBILE STAR SHINES BRIGHT? $PIUSDTPI NETWORK—CRYPTO’S MOBILE STAR SHINES BRIGHT?

(1/9)

Good afternoon, TradingView! Pi Network’s buzzing—47M users, $ 2.57 IOUs 📈🔥. Q1 ‘25 mainnet looms—let’s unpack this tap-to-earn enigma! 🚀

(2/9) – USER RUSH

• Base: 47M users—18M KYC’d 💥

• Mainnet: 8M migrated—4.4B Pi 📊

• Model: Tap daily—no rigs, no sweat

Pi’s humming—massive crowd, mobile zip!

(3/9) – PRICE BUZZ

• IOUs: $ 2.57—up from $ 0.668 🌍

• ‘25 Hope: 1−5—$ 2B-$ 10B cap 🚗

• Bull Dream: $ 50—$ 100B stretch 🌟

Pi’s flickering—hype or gold?

(4/9) – SECTOR SNAP

• Crypto Cap: $ 2.5T—BTC, ETH lead 📈

• Vs. Peers: Pi lags utility—Hamster flops 🌍

• Edge: 47M vs. altcoin minnows

Pi’s a wildcard—value or vapor?

(5/9) – RISKS IN VIEW

• Delay: Mainnet stalls—Q1 ‘25 shaky ⚠️

• Control: Core team grips—central snag 🏛️

• Crash: Hype fades—$ 0.50 risk 📉

Hot buzz—can it dodge the bust?

(6/9) – SWOT: STRENGTHS

• Crowd: 47M—crypto king 🌟

• Easy: Tap-to-earn—low bar 🔍

• Green: SCP—no power guzzle 🚦

Pi’s a steady beast—user gold!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: No use, locked Pi—boo 💸

• Opportunities: Emerging markets—zing 🌍

Can Pi zap past the haze?

(8/9) – Pi’s $ 2.57 buzz—what’s your vibe?

1️⃣ Bullish—$ 5+ shines bright.

2️⃣ Neutral—Waits, risks hover.

3️⃣ Bearish—Fades below $ 0.50.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

Pi’s 47M users and $ 2.57 IOUs spark zing—crypto wildcard 🌍. Big crowd, big risks—gem or bust?

My Long-term BTC Idea March 2025 IMPORTANT MONTH FOR BITCOINBitcoin (BTC) Analysis - Not Financial Advice

Disclaimer: This is not financial advice. These are real trend lines that you can draw yourself. While the current trend appears bearish, it might also present a good buying opportunity. Personally, I’ve struggled to trade Bitcoin successfully because emotions often get the better of me. For instance, I saw WIF at $0.02 but didn’t buy because I had also seen it at $0.00002. This example highlights that the current price isn’t always a reason to avoid buying. That said, I am currently holding off.

Key Insights from the Chart:

Current Price Action: BTC is around $86,845, correcting after hitting a high near $96,500. It appears to be testing a support line within an ascending channel.

Trend Channels:

The broader ascending channel (orange lines) suggests a long-term bullish trend.

Mid-range correction lines and resistance levels (purple lines) highlight key price zones.

Support and Resistance Levels:

Key support: $69,077, $64,877, and $49,673.

Major resistance: $109,087 (upper boundary of the orange channel).

Buying Zones:

Golden Buy Zone: Around $15,446, ideal for long-term entries during deep corrections.

Perfect Buy Zone: Slightly above $29,166, a strong buy area if BTC pulls back.

Bear Market Bottom: Approximately $40,147, a solid long-term support level.

Market Outlook:

Short-term: The correction might continue until BTC tests the mid-level purple line or the $73,721 level. A bounce from these levels could signal a continuation of the bullish trend, potentially pushing toward the $109,000 target.

Long-term: If BTC stays within the ascending orange channel, a long-term target above $109,000 remains realistic.

Risk Factors: A break below the correction line or falling outside the channel would indicate a bearish reversal.

Personal Perspective:

With the monthly candle closing in three days, BTC needs to push upward to form a wick, signaling bullish potential. If not, attention shifts to the weekly candle. Predicting the outcome is uncertain—this could either be a buying opportunity or a liquidation zone. Remember, back in 2021, BTC hit FWB:65K , then dropped to $30k, which turned out to be a great buying opportunity as it later surged to $67k.

Altcoin Season:

Some believe altcoin season is coming, but I think it already happened in 2024. Raydium (RAY) soared from $0.12 to $9, and coins like WIF and Fartcoin also surged. Unfortunately, many low-quality coins have been pumping, with less-experienced investors driving the trend.

Conclusion:

Despite the current bearish sentiment, this market phase might offer solid buying opportunities if key support levels hold. The next few days are crucial—watch how the monthly candle closes and monitor the weekly candle for further signals. As always, trade carefully, and don’t let emotions dictate your decisions.

GALAComprehensive Analysis of GALA

🔹 Project Introduction:

GALA is a blockchain-based ecosystem focused on developing decentralized gaming (GameFi) and NFTs. The project aims to give players full control over their in-game assets while introducing a new economic model for the gaming industry.

📊 Technical Analysis of GALA/USDT

🔍 Overall Market Condition:

GALA is currently trading within a mid-term ascending channel and is sitting at a key support zone that will determine the next major price direction.

🟢 Bullish Scenario:

Key Support Zone:

$0.02435 – $0.02684 (Blue Box)

If this support holds, the price could move toward the midline of the ascending channel.

The next major resistance lies within the red zone:

$0.05949 – $0.06914

This resistance acts as a crucial ceiling for the price.

🚀 Potential Targets After Breaking the Red Resistance:

✅ TP1: Channel Top

✅ TP2: Breakout Above the Channel → Higher Price Levels

🔴 Bearish Scenario:

If the blue support zone fails to hold:

The price could drop to the bottom of the ascending channel + weekly support

🏁 (Gray Box)

Losing this level may trigger a new bearish trend.

📈 Trend Confirmation Factors:

✔ Increasing volume on breakouts → Confirms bullish momentum

✔ Declining volume on pullbacks → Indicates weak selling pressure

✔ RSI near 50: A move towards 70 (Overbought Zone) signals bullish strength

📌 Summary & Suggested Strategy:

🔹 Holding the blue support → Targeting the red resistance

🔹 Breaking the red resistance → Potential move towards TP1

🔹 Breakout above the channel → Strong bullish rally

🔹 Heavy rejection → Key support at the bottom of the channel (Gray Box)

⚠️Risk Management:

Monitor trading volume & RSI behavior to confirm breakouts or reversals.

Axie Infinity (AXS)🎯 Introduction

AXS (Axie Infinity Shards) is the native token of the Axie Infinity ecosystem, a popular blockchain-based game operating on the "Play-to-Earn" model. Players can earn AXS tokens by breeding, battling, and trading digital creatures known as "Axies." This token is also used in governance mechanisms, staking, and in-game transactions. The growth in AXS’s value is tied to the ongoing development of the game and its wider adoption within the cryptocurrency world.

📊 AXS Technical Analysis

Current Status:

On the weekly timeframe, AXS is in a long-term range-bound zone:

📈 Range High: Red zone (11.186 - 12.605)

📉 Range Low: Gray zone (3.840 - 4.414)

Key Support and Resistance Zones:

Daily Support: Purple zone (5.581 - 5.932)

This zone has acted as a key support level. If lost, the price is likely to fall toward the lower range (gray zone).

Daily Resistance: Yellow zone (6.910 - 7.328)

Breaking through this level could trigger a price move towards the range high (red zone).

Upcoming Scenarios:

🟢 Bullish Scenario:

If the purple support zone holds and the yellow resistance is broken:

Move towards the range high (red zone).

A breakout above the red zone will lead to price targets based on Fibonacci levels:

🎯 TP1: 20.007 - 24.056

🎯 TP2: 41.929 - 48.315

🎯 TP3: 67.896 - 77.108

Important Note: At each of these targets, profit-taking 💵 is strongly advised.

🔴 Bearish Scenario:

If the purple support zone is lost, the price may drop towards the lower range (gray zone).

🎯 Suggested Entry Points:

Break above the daily yellow resistance with a stop loss below the gray zone.

Break above the red resistance with a stop loss below the purple zone.

Indicators and Volume:

RSI:

Crossing above the midpoint of the RSI may indicate a bullish move.

Entering the Overbought region could lead to sharp upward movements 🚀.

📊 Volume Analysis:

Increased volume during resistance breaks is crucial; otherwise, there’s a higher risk of false breakouts.

📌 Summary:

AXS is currently at a critical level. Price behavior in relation to the identified support and resistance zones will determine the future trend. Effective risk management through stop-loss and close monitoring of trading volume are key to success in trading this coin. 💡

Recommendation: Always consider the overall market conditions and any related news regarding the Axie Infinity project before making trading decisions.

Guide to Wealth Building: Understanding Money, Investing WiselyThe Ultimate Guide to Wealth Building: Understanding Money, Investing Wisely, and Securing Your Financial Future 💰📈

Introduction

Navigating personal finance, investment strategies, and the nature of money in today's world requires a blend of old wisdom and new insights. Here's how to beat inflation, invest in assets, and understand fiat currency to grow your wealth effectively. We'll also discuss blue chip tickers for crypto, stocks, commodities, and indices for informed investing. 📊💡

The Money We Use: Fiat vs. Hard Assets

What is Fiat Money? - Learn about fiat currency, its inherent instability, and how inflation devalues it over time. Discover why many consider it less reliable for long-term wealth preservation. 🏦🔄

The Case for Hard Assets: Explore why hard assets like AMEX:GLD (gold), real estate, or digital currencies are seen as stores of value, offering protection against inflation and currency devaluation. 🏠

Investment Wisdom for the Modern Age

Asset Allocation: Understand the importance of diversifying your portfolio across stocks (e.g., NASDAQ:AAPL , NASDAQ:MSFT ), bonds, real estate, and cryptocurrencies (e.g., CRYPTOCAP:BTC , CRYPTOCAP:ETH ). Learn how to pick assets with intrinsic value to safeguard your investments. 🗃️🌐

Value Investing: Dive into the principles of value investing, focusing on buying assets at a discount to their true worth. This strategy provides a margin of safety in volatile markets. 🧐💸

Long-term vs. Short-term Investing: Grasp why patient investing can yield compound growth over speculative trading, making time your ally in building wealth. ⏳📈

Key Concepts for Financial Education

Inflation Protection: Strategies to protect against inflation include investing in assets that historically appreciate or at least maintain value, like commodities (e.g., COMEX:GC1! for gold futures). 🛡️🔥

Understanding Market Cycles: Learn to navigate economic cycles, knowing when to buy low and sell high based on market trends and economic indicators. 🌊📉📈

Digital Currencies: An introduction to cryptocurrencies as a new form of hard money, focusing on their scarcity and potential as an investment. Notable blue chip tickers include CRYPTOCAP:BTC (Bitcoin), CRYPTOCAP:ETH (Ethereum), CRYPTOCAP:BNB (Binance Coin), and CRYPTOCAP:SOL (Solana). 💱🔒

Blue Chip Tickers/Assets for Diversified Investment

Stocks: Look at well-established companies like NYSE:JNJ (Johnson & Johnson), NYSE:PG (Procter & Gamble), and NYSE:VZ (Verizon) for stability and dividends. 📊🍏

Indices: For broad market exposure, consider AMEX:SPY (S&P 500 ETF), AMEX:DIA (Dow Jones Industrial Average ETF), and NASDAQ:QQQ (Nasdaq-100 ETF). 🌍

Commodities: Besides gold, consider oil (e.g., AMEX:USO for the United States Oil Fund) for energy market investment. 🛢️

Crypto: Beyond CRYPTOCAP:BTC and CRYPTOCAP:ETH , look into CRYPTOCAP:SOL (Solana) and CRYPTOCAP:XRP (Ripple) for diversified crypto exposure. 🔗

Practical Steps to Financial Freedom

Educate Yourself: Resources for financial education, from books on economics to online courses on investing, emphasizing the need to understand before you invest. 📚🎓

Diversification: How to diversify your investment portfolio to spread risk and capture growth across different sectors and asset classes, using the tickers mentioned. 🌈

Financial Planning: Tips on creating a financial plan that includes saving, investing, and retirement planning, ensuring you're prepared for future financial stability. 📝🌅

Conclusion

This guide is crafted to help you understand money, invest wisely, and secure your financial future. By focusing on assets over cash, long-term growth, and education, you can beat the system designed around fiat currency and inflation. Understanding and investing in blue chip tickers for crypto, stocks, commodities, and indices can provide a solid foundation for lasting wealth. 🚀🏆

ADA/USDT A Bullish Bounce on the Horizon ?The chart shows Cardano (ADA) pulling back to retest the breakout zone, presenting a potential long opportunity if support holds.

Key Observations

1. Retest of Pattern: ADA has broken out of a pattern and is now retesting the breakout zone, which aligns with a critical support area.

2. Support Zone ($0.90–$0.88): This is an important level where price is likely to bounce if buyers step in.

3. Bullish Confirmation Needed: Waiting for a bullish candlestick pattern at this level would confirm a potential reversal.

4. Target Levels: If the bounce occurs, the immediate target would be $1.00+, with further potential upside depending on market momentum.

Strategic Implications

Monitor the $0.90–$0.88 zone for bullish signals.

Enter long positions upon confirmation of a bullish candlestick pattern.

Stop-loss placement below $0.88 to manage risk effectively.

ADA is at a crucial retest point. A strong bounce from support could provide a profitable long setup with targets above $1.00. Keep this pair on watch for confirmation.

Bitcoin Post-Halving Shockwave: Why 2025 Could Still See a Mega Now that the much-anticipated 2024 halving is in the rearview, the big question is: Will Bitcoin continue its explosive post-halving trend? My long-term chart analysis suggests that BTC remains on track for a powerful rally—if certain key support zones hold and historical patterns play out. Here’s what I’m seeing:

Post-Halving Volatility

We’ve already witnessed a surge in volatility around the 2024 halving date (which occurred earlier this year). Historically, halvings have often propelled multi-month bull markets, though they don’t always ignite immediately. Keep an eye on the next few quarters for signs of a prolonged uptrend.

Mature Ascending Channel Since 2017

The broad rising channel (outlined on the chart) has been a reliable guidepost. Multiple touchpoints along its upper and lower boundaries highlight how BTC has respected this structure for years. As long as price remains within this channel, the long-term bullish bias stays intact.

Critical Support Zones (S1, S2, S3)

I’ve identified major horizontal levels where strong buying pressure has historically emerged. If the market corrects from current levels, these supports could offer prime “buy the dip” opportunities—or serve as warnings if they fail to hold.

2025 Outlook

If previous cycles are any indication, we may see a continued grind upwards heading into 2025. Bitcoin’s supply dynamics, combined with growing institutional interest, support the potential for a high-volatility, high-upside environment. However, it’s essential to stay flexible and keep tabs on macro factors.

Bottom Line: The halving has come and gone, but its after-effects may just be warming up. Whether you’re bullish or bearish, always back your technical analysis with robust risk management. What are your thoughts on Bitcoin’s post-halving trajectory? Let me know in the comments below!

Compound (COMP)

🔢 COMP Analysis

🔹 Overall Status:

The COMP coin, after following an ascending channel, successfully broke above the channel’s ceiling. At the PRZ zone (which includes the ascending channel ceiling and weekly resistance), selling pressure led to a price correction, pushing the price down to the 0.382 Fibonacci level.

✅ Key Point:

Stabilizing above the PRZ zone can accelerate price growth toward Fibonacci targets.

Trading volume in this area is crucial as it can provide stronger signals about the buyers' or sellers' dominance.

🔹 Support and Resistance Analysis:

1️⃣ Support Levels:

First Support: 0.382 Fibonacci level around $79-$81.

Second Support: 0.5 Fibonacci level around $68-$71.

Third Support: 0.618 Fibonacci level near $60-$62.

2️⃣ Resistance Levels:

PRZ Zone: Weekly resistance and broken ascending channel ceiling (around $92-$103).

Bullish Targets:

First Target: 1.618 Fibonacci level (already achieved).

Second Target: 2.618 Fibonacci level near $300-$330.

Third Target: 3.272 Fibonacci level around $500-$550.

Final Target: 3.618 Fibonacci level near $720-$750.

🔹 Price Movement Prediction:

1️⃣ Bullish Scenario (if price stabilizes above PRZ):

If the price stabilizes above $140 (PRZ zone), it may head toward the 2.618, 3.272, and 3.618 Fibonacci levels.

Increased trading volume above PRZ will confirm buyers' dominance.

2️⃣ Bearish Scenario (if the correction continues):

If the 0.382 Fibonacci level is broken, the price correction could extend to the 0.5 and 0.618 Fibonacci levels.

These levels could offer attractive opportunities for re-entry via laddered buying.

🔹 RSI and Entry Signals:

The RSI indicator on the weekly timeframe is at 72.71 (overbought zone), indicating possible selling pressure.

Positive Note: A bullish divergence between the price and RSI suggests the uptrend may resume after a correction.

The ascending RSI trendline can act as support.

✅ Conclusion and Recommendations:

1️⃣ Key Levels:

Supports: $79-$81 (0.382), $68-$71 (0.5), and $60-$62 (0.618 Fibonacci).

Resistances: $130-$140 (PRZ) and higher targets at $300-$330, $500-$550, and $720-$750.

2️⃣ Entry Strategies:

Laddered buying near 0.5 and 0.618 Fibonacci support levels if the correction continues.

Entry after price stabilizes above the PRZ zone ($130) with rising trading volume.

3️⃣ Risk Management:

Pay close attention to trading volume and price action near critical levels.

Monitor the RSI indicator to assess trend strength and identify potential corrections or continued growth.

💡 Final Recommendation:

In the current conditions, wait for technical confirmations (such as stabilization above resistance or corrections to lower levels) before entering. Prioritize capital management to minimize risks.

SOLANA (SOLUSD): Bullish Confirmation Signal

I see 2 strong bullish confirmations on Solana

after a retracement to a recently broken key horizontal support.

The price went up and violated a neckline of a double bottom pattern

and a resistance line of a falling wedge pattern.

We can anticipate a bullish movement to a current ATH now.

❤️Please, support my work with like, thank you!❤️

CHAINLINK (LINKUSD): Bullish Move After Breakout

Link broke and closed above a significant horizontal daily resistance.

Retesting the broken structure, the price bounced and violated

a resistance line of a falling wedge pattern.

It indicates a highly probable coming resumption of a bullish trend.

With a high probability, the price will hit 26.5 level soon.

❤️Please, support my work with like, thank you!❤️

BINANCE COIN (BNBUSD): Bullish Wave is Coming

Binance Coin leaves one more strong bullish clue.

After a strong bullish wave, the price formed a falling wedge pattern.

Its breakout is a strong bullish signal.

With a high probability, growth will resume soon and the price will

reach at least 683 level.

❤️Please, support my work with like, thank you!❤️

BINANCE COIN (BNBUSD): More Growth is Coming

BNBUSD is retesting a significant demand zone based on a rising trend line

and a recently broken horizontal neckline of a huge ascending triangle pattern.

The market has a great potential to continue growing.

First, we can expect a test of November's high - 660

and a consequent continuation to 700 level.

❤️Please, support my work with like, thank you!❤️

ARTYFACT - Best ALT Coin to Buy After Trump Win

Trump's victory send a clear bullish signal to the entire crypto universe.

Bitcoin updated the all-time high even before the official victory was declared.

The alt season is coming soon, as the crypto investors will start calibrating their crypto portfolios, buying alts on BTC profits.

Checking hundreds of different long-term buying opportunities, the one that provides the best reward potential is of course ARTYFACT.

Being stuck on historic lows, the market already demonstrates a strong bullish sentiment.

A recent Change of Character on a daily gives a strong technical analysis confirmation and indicates that more growth is coming.

The price may easily continue growing and reach 0.55 level this week already. That gives 20%+ net gain if you just buy from current prices.

With a mid-term realistic target being 1.0 level, you can easily double the invested amount before the end of the month.

From a fundamental standpoint, the ARTYFACT team is preparing a lot of interesting projects.

Its confirmed presence in Epic Games, XBOX and PlayStation stores promises the attraction of a wider audience and inflow of larger capitals.

While the sleepy ones are still thinking to buy bitcoin from current prices, be smart and start investing in altcoin. Let ARTY be the perfect pick for your porfolio.

$ARTYFACT (ARTYUSDT): Best Investing Choice of This Year?!

We - the UnitedSignals team, rarely observe crypto.

As Bitcoin leaves reliable bullish clues now, many traders are looking for trusted coins to invest in.

$ARTYFACT is one of the rare coins that provide a good investing opportunity both from the fundamental and technical perspectives.

From the technical standpoint, the price is obviously bottoming, failing to update the lows dozens of times.

Demand started to finally observe the excess of supply, not letting the bears dominate anymore.

A huge liquidity zone that the price is testing at the moment may attract the buyers. Analyzing the order flow and studying COT data, we see huge buying orders being distributed from its top to its bottom.

It will inevitably lead to a bullish imbalance and a rapid, strong bullish movement.

From a fundamental side , the project is preparing Artyfact Beta launch and a lot of other upcoming events in Artyfact ecosystem, that will attract more investors.

Here is the trading range for buying the coin:

0.34 - 0.38

As the 0.34 is the current historic low, any price level below that will give you a safe stop loss.

We recommend 0.32.

For taking the profit, we suggest waiting for the test of 0.56 level - important recent historic resistance.

As this level is reached, close half of your position and expect a bull run much higher.

That will be a perfect and safe investing plan for you to follow.

$ARTYFACT (ARTYUSDT): Bearish Trend is Over! Behold Accumulation

Market cycles psychology is universal:

it works on Forex, Stocks, Commodities markets

and of course it can be applied for making prediction on Crypto market.

Analyzing the long term price action on AMEX:ARTY on a daily time frame,

we see a strong bearish trend that started in spring of This year.

The coin lost more than 80% before it finally found the bottom.

Since July, we see a clear shift in the momentum.

The price stopped updating the lows and, in addition to that,

violated a resistance line of a huge falling parallel channel.

That was a clear sign of the strength of the buyers and the exhaustion of the sellers.

At the moment, we see a clear accumulation stage.

The price is stuck within a wide horizontal range.

With a high probability, the smart money - the institutional traders

are accumulating long positions now.

As the price managed to respect the lower boundary of the range multiple times already,

it provides a perfect zone to buy the market from.

Realistically, the price will bounce and reach at least the upper boundary of the range.

With a stop loss lying below its lows, you can get 260% Return on Investment.

A longer term confirmation, will be the completion of the accumulation stage.

The breakout of the resistance of the range will indicate a highly probable start of a new bullish trend and a rally to the current historic highs.

What are your thoughts, traders?