ETH | Ethereum - Weekly Recap & Gameplan - 03/08/25📈 Market Context:

Traders are currently anticipating a potential 0.25% rate cut at the September FOMC meeting, which continues to support the broader bullish outlook.

While the market pulled back following weaker-than-expected Non-Farm Payroll data, overall sentiment remains optimistic.

Greed has cooled off into a more neutral stance. Historically, August often brings some consolidation or pullbacks — but the structural bias for crypto market remains bullish.

🧾 Weekly Recap:

ETH started the retracement movement after building a bullish trend over the past couple of weeks.

It’s mainly being affected by Bitcoin's bearishness, so we’re closely following BTC’s price action.

ETH has tapped into the Weekly Fair Value Gap, which is a key level for me.

We may see a bounce from here.

📌 Technical Outlook & Game Plan:

I expect to see another low on ETH before we go up — as I’m also anticipating one more leg down on Bitcoin.

So I’ll wait for a final bearish expansion and a trap for late sellers before positioning for longs.

After that, I want to see price closing above the purple line at $3500.

🎯 Setup Trigger:

A candle close above the $3500 level will be my signal to look for long setups.

📋 Trade Management:

Stoploss: Below the swing low that breaks above $3500

Take Profit: Targeting $3870, but will trail and lock in aggressively in case of deeper downside expansion.

💬 Like, follow, and comment if this breakdown supports your trading! More setups and market insights coming soon — stay connected!

Cryptolevels

Bitcoin Price Flow From Liquidity Grabs to Structural BreakoutsBitcoin Price Action Analysis:

In recent sessions, Bitcoin has been consistently making Breaks of Structure (BoS) to the upside, indicating a strong bullish trend. Most recently, after forming another BoS, the market retraced downward and precisely tapped into a previously established Bullish Order Block (OB). This reaction led to a temporary upward movement; however, during this process, the market also created a zone of internal liquidity.

Currently, Bitcoin is showing signs of a downward move again, potentially aiming to capture Internal Drawdown Market (IDM) liquidity. Just below this level lies another key Order Block, which could serve as a strong support zone. If the price reacts positively from this region, we might see the market initiate another upward leg, potentially forming the next Break of Structure to continue the bullish narrative.

Note: Always perform your own research (DYOR) before making any trading decisions.

BTC | Bitcoin - Weekly Recap & Gameplan - 03/08/25📈 Market Context:

Traders are currently anticipating a potential 0.25% rate cut at the September FOMC meeting, which continues to support the broader bullish outlook.

While the market pulled back following weaker-than-expected Non-Farm Payroll data, overall sentiment remains optimistic.

Greed has cooled off into a more neutral stance. Historically, August often brings some consolidation or pullbacks — but the structural bias for Bitcoin remains bullish.

🧾 Weekly Recap:

• After printing new all-time highs, BTC began a healthy retracement.

• Price action closely mirrored the Nasdaq's (NQ) pullback during the week.

• We saw a small bounce mid-week, but no strong reversal confirmation yet.

📌 Technical Outlook & Game Plan:

→ I’m watching for price to revisit the long-term bullish trendline.

→ A slight deviation into the HTF demand zone would be ideal for long entries.

→ Bonus confluence: This area also aligns with the 0.5 Fibonacci retracement (Equilibrium level), providing a key discount zone.

🎯 Setup Trigger:

I’ll be watching for a confirmed bullish break of structure (BOS) on the 1H–4H timeframes to signal a reversal.

On confirmation, I’ll look to enter a swing long position.

📋 Trade Management:

• Stoploss: Below the 1H–4H demand swing low

• Take Profit:

→ I’ll trail stops and lock in profits aggressively

→ Main target: $119,820

💬 Like, follow, and comment if this breakdown supports your trading! More setups and market insights coming soon — stay connected!

AVAX – Hidden Chance for Latecomers🔥AVAX – High-Potential Setup Amid Market Catch-Up

While many crypto assets have surged in the recent bullish wave, AVAX appears to have been left behind — and that could present a high-reward opportunity ahead.

From both a fundamental and on-chain perspective, this project shows promising signs, especially with notable activity among whale wallets. I believe AVAX has the potential for a strong long-term rally — but there’s one critical condition to watch.

Price has recently reacted to a key custom demand zone. However, for confirmation of buy-side strength, we need to see a clean breakout and daily close above the ~$28 level. If that breakout is confirmed, I’ll be looking to accumulate for a long-term hold, with a target of $65 — and possibly up to $100 if momentum continues.

That said, risk management remains my top priority. I’ll allocate no more than 3–4% of my total portfolio to this position.

Keep an eye on the $28 breakout. If the trade is triggered, I’ll provide updates here.

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

XRP/USDT Potential Reversal Zone — “Bottom Tested,Bullish Flag!📉 Chart Analysis Summary

The divided chart indicates XRP trading between a critical support zone near $3.05–$3.09 and overhead resistance around $3.19–$3.23, forming what could be a bullish pennant or descending wedge setup on the 30-minute timeframe:

Support Zone (~$3.05–$3.09):

Price retested this level multiple times (labeled as “$$$” and “c”), clearly identifying a demand zone.

Ichimoku cloud support lies nearby, adding technical relevance to the floor.

Resistance Trendline & Green Line (~$3.19–$3.23):

A descending trendline is visible, showing lower highs and building compression.

A breakout above this resistance zone is necessary to signal bullish continuation.

Projected Path:

The schematic arrow suggests a bounce off support, followed by consolidation, and then a breakout above resistance, targeting the $3.25–$3.30+ zone and potentially higher.

🔍 Context from Recent Market Commentary

Support Holding Above $3.11–$3.15: Analysts highlight strong support around $3.11–$3.15, where institutional and retail interest appears concentrated

TradingView

+13

TradingView

+13

CoinCentral

+13

.

Resistance & Consolidation at $3.30: While XRP briefly surpassed $3.30, it encountered rejection and remains rangebound. A confirmed break beyond this level could validate the bullish carry-forward

CryptoPotato

CoinDesk

.

Wave-Elliott Bull Case: Various Elliott Wave scenarios forecast targets as high as $5.25, $6.85, or even $10–$15 should Wave 5 materialize, though this depends on market strength and momentum

CoinCentral

.

✅ Trading Outlook

Bullish Scenario:

Bounce off $3.05–$3.15 support.

Break above $3.23–$3.30 resistance.

Potential upside targets:

Near term: $3.30–$3.40.

Medium term: $4.64 or $5–$6, with strong case for $6.85 if momentum and on-chain demand strengthen

CryptoPotato

+15

TECHi

+15

CoinGape

+15

.

Bearish Scenario:

Failure to hold $3.05–$3.11 risk retest toward $2.95 or lower zones ($2.30–$2.70)

TECHi

.

🧭 What to Watch

Key Level Role

$3.05–$3.11 Critical support/demand zone

$3.19–$3.23 Short‑term resistance/framing compression

~$3.30+ Confirm bullish breakout — key trigger for Wave 5 and higher targets

🧠 Overall Take

This chart is painting a classic consolidation near strong support with a visible descending upper boundary. If XRP holds the ~$3.05 zone and breaks above $3.23–$3.30 with conviction, it could initiate a bull move toward $3.40–$4.00, and potentially even $5–$6+ depending on volume and momentum.

However, breaks below $3.11 may open deeper downside risk. For many traders, this is a simple risk-reward setup: entry near the lower channel with a stop under $3.05 and initial profit targets at $3.30–$3.40.

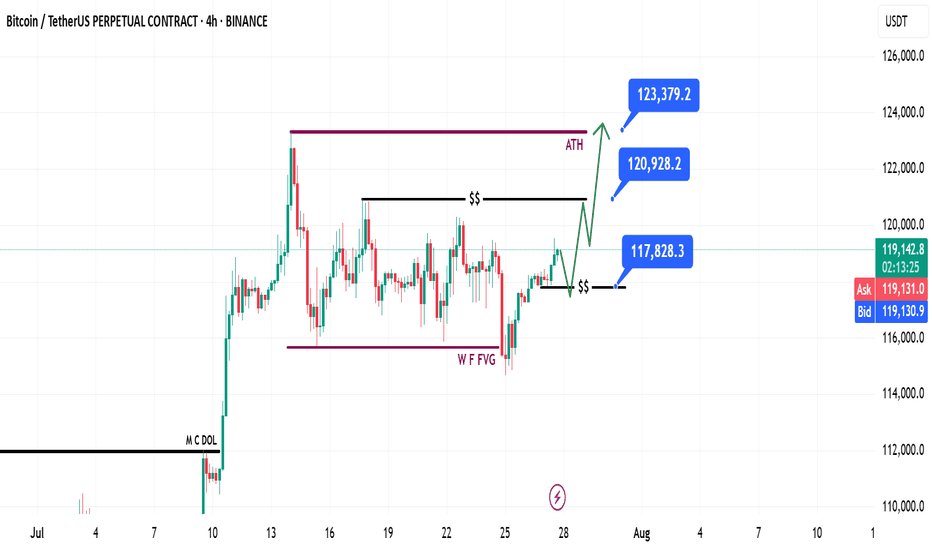

Bitcoin Weekly Recap & Gameplan | 27.07.2025📈 Market Context:

Bitcoin maintained its bullish momentum, driven by continued institutional demand and a supportive U.S. policy backdrop.

Last week’s gameplan played out well — solid profits were captured (see linked chart below).

🧾 Weekly Recap:

• Price made a bullish retracement into the Weekly FVG (purple line) exactly as projected in last week's post.

• From here, I expect continuation toward new all-time highs.

📌 Technical Outlook:

→ First, I expect a short retracement and a 4H swing liquidity grab at 117,828$.

→ Then, a strong continuation move toward ATH targets.

🎯 Setup Trigger:

Watch for:

✅ 4H liquidity sweep

✅ 15M–30M bullish break of structure (BOS)

This is the confirmation zone for potential long setups.

📋 Trade Management:

• Stoploss: Below confirmation swing low

• Targets:

– 120,938$

– 123,400$

💬 Like, follow, and drop a comment if this outlook helped — and stay tuned for more setups each week!

ETH Dominance Eyes 12.60%ETH.D on the Daily

Next resistance is approaching near the 0.236 Fib level, around 12.60%.

In my view, this level will eventually flip to support — but it may take time. Price could need a retest, or wait for the 50MA (maybe even the 200MA) to assist the breakout.

Either way, we’ll be here to watch it unfold.

Always take profits and manage risk.

Interaction is welcome.

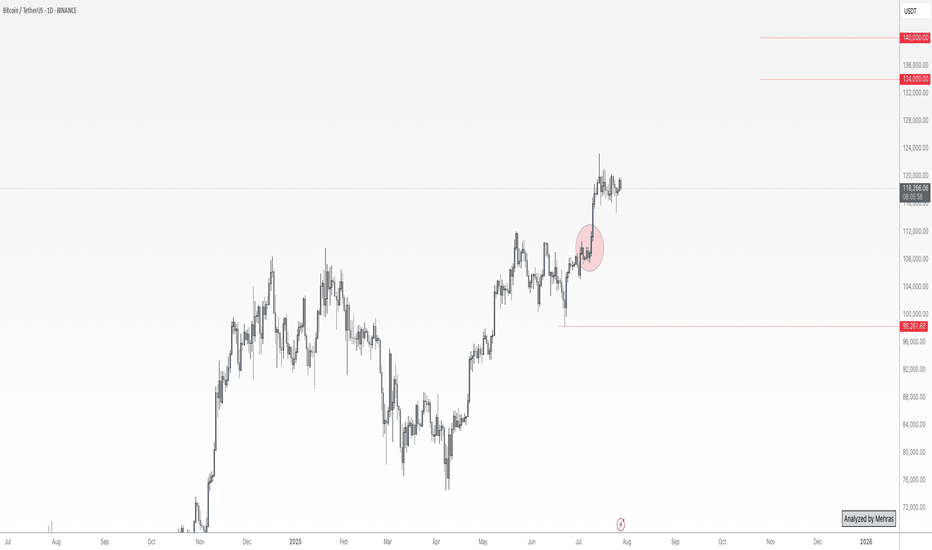

BTC Roadmap Ahead: Ideal Entry, TP Zones & What to AvoidAs long as Bitcoin stays above the ~$98,200 zone on the daily timeframe, I believe the bullish trend remains intact.

No need to panic — what we need now is rational decision-making, not emotional reactions.

Since price has reached a key area around $118K–$120K, I’ve already taken partial profits at this level.

If no major fundamental changes occur and conditions remain stable, I see the maximum target for this leg somewhere between $134K and $140K, where I plan to secure additional profits.

Right now, my main objective is to increase my Bitcoin holdings.

The first buy zone I’m watching is around $110K, clearly marked with a red circle on the chart.

When price reaches this zone, I won’t enter immediately — I’ll wait for consolidation and confirmation, as a deeper correction is still possible.

There’s no need to rush — patience is power.

📌 All I’m trying to do is accumulate as much Bitcoin and sats as I can — because I know one day, I’ll be proud of it.

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

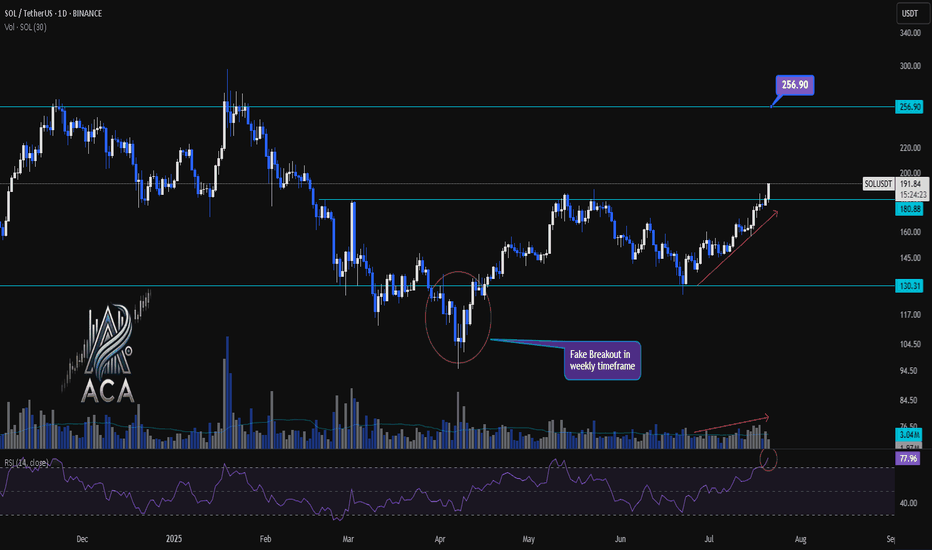

SOLUSDT 1D Chart Analysis | Accumulation Breakout Signals....SOLUSDT 1D Chart Analysis | Accumulation Breakout Signals Fresh Momentum

🔍 Let’s drill into the SOL/USDT daily chart, focusing on the recent breakout above the accumulation range, key support and resistance levels, RSI momentum, and volume confirmation for a robust bullish scenario.

⏳ Daily Overview

SOLUSDT has decisively broken out above a prolonged accumulation box, marking a significant shift in market structure. A daily close beyond this range now serves as a strong indicator for renewed bullish momentum. RSI is currently above 77, signaling that buyers are commanding momentum. Notably, volume has surged in tandem with price, confirming trader participation behind this breakout move.

📈 Technical Convergence and Trend Structure

- Accumulation Zone Break: After consolidating within a clear box for weeks, SOLUSDT closed above the upper boundary (around $180.88–$191.05), signaling a possible trend reversal or continuation.

- Daily Close Signal: A daily close outside the accumulation box offers high conviction for bullish continuation. This close acts as a potential entry signal for trend-followers.

- RSI Momentum: The RSI sits above 77—deep in the overbought territory. A close here not only confirms buyer strength but often precedes sustained uptrends when accompanied by price breakouts.

- Volume Surge: Volume has increased with the breakout, providing confirmation the move isn’t a false start, but likely fueled by real demand.

- Weekly Fake Breakout: There was a notable false breakout in the weekly timeframe, quickly reclaimed by bulls. This flip suggests buyers fended off downside attempts and now drive higher prices.

🔺 Bullish Setup & Targets

- First Target: $256.90 — marking the next major resistance on the chart and a logical upside objective for traders.

- Key Trigger: A confirmed daily (or weekly) close above the accumulation range with strong volume is essential for validating the upward trajectory.

📊 Key Highlights

- The breakdown of the accumulation box—now turned support—marks a pivotal structural change.

- RSI and price are making new local highs, solidifying the case for continued bullish momentum.

- Volume is climbing in sync with the move, offering real confirmation versus a potential fakeout.

- Recent fake breakout on the weekly chart, immediately negated, emphasizes that buyers are regaining—and likely maintaining—control.

🚨 Conclusion

SOLUSDT appears set for higher prices following the confirmed breakout above the accumulation range. Signs of trend health include an overbought RSI, volume confirmation, and the swift invalidation of a recent weekly fake breakout. As long as daily closes stay above the breakout level, the path remains clear for a rally toward $256.90. A strong daily close and continued volume will be your best signals for bullish continuation.

BTC Weekly Recap & Outlook 20/07/2025📈 BTC Weekly Recap & Outlook

Market Context:

Price continued its bullish momentum, fueled by institutional demand and supportive U.S. policy outlook.

We captured solid profits by following the game plan I shared earlier (see linked chart below).

🔍 Technical Analysis

✅ BTC made a strong bullish move, breaking into new all-time highs.

📊 The daily RSI entered overbought territory, which signaled the potential for a short-term retracement or consolidation.

Currently, price is ranging, and RSI is cooling off. That tells me the market is likely building energy for the next leg up — but not before a significant liquidity run.

🎯 Game Plan

I'm watching for one of two potential setups:

1️⃣ Liquidity Sweep to the Downside

- A run of the daily swing low

- Into the most discounted range (0.75 Fib zone)

OR

2️⃣ Tap into the Weekly FVG Zone (marked with the purple line)

Either move would create the liquidity and energy needed to fuel a breakout above the equal highs (EQHs) marked by the black line.

🚀 Target

First Target: EQHs (Black Line)

Second Target: Price Discovery (new ATHs)

💬 Let me know your thoughts or drop your own chart ideas below!

📌 Follow for Weekly Recaps & Game Plans

If you found this useful, make sure to follow for weekly BTC updates, market outlooks, and detailed trade plans based on structure and liquidity.

ETHEREUM - ETH Weekly Recap & Projection 13.07.2025Current Structure

Ethereum is showing a clear bullish bias.

Last week’s price action broke above a significant weekly swing level with solid candle closures — suggesting continuation.

Short-Term Scenarios

We could see two potential outcomes:

• A consolidation range forming at current levels

• A short-term retracement influenced by Bitcoin’s movement

Due to ETH’s high correlation with BTC, traders should review Bitcoin’s chart to understand ETH’s likely path.

Trading Plan

Wait for Bitcoin to complete a retracement

Monitor ETH for LTF (lower timeframe) confirmation and bounce

Seek long setups below the CME Gap (pink line)

Step 2 will serve as the trigger to initiate any positions on ETH.

Macro Risk-On Catalyst – Powell Resignation?

There are growing rumors regarding Federal Reserve Chairman Jerome Powell potentially resigning.

If confirmed, this could result in a strong rally across risk assets, including ETH — likely pushing prices higher without traditional pullbacks.

Summary

• ETH broke major weekly structure

• Watch BTC for clues — correlation remains high

• Plan favors long entries after BTC retrace + ETH LTF confirmation

• Powell resignation rumors could accelerate bullish trend

Feeling the waves (Ripple $XRP)Setup

The price has been consolidating since the explosive move from ~50c to $3 last year. There has been a wide $1 price range between $2 and $3. A failed breakdown below a still rising 30-week moving average and new 4-month high suggest underlying bullishness.

Signal

Should there be any follow-through to last week's big up-move, then any pullback to the golden pocket between the 50% and 61.8% Fibonacci retracement levels could trigger a rebound.

Bitcoin Daily in a large pennant with apex end of July

Bitcoin is once again getting rejected off the Fib circle just above.

This is also just under a 618 Fib extension and so a combined rejection zone.

Beneath this, we have support on that Bold dashed line. This is a Local line of supprt but has strength.

And so, we find outselves in apennant again and that apex is around 22 July.

PA tracts before the apex.

As will be explained in the monthly chart I iwll post later, this all points towards a Calm July, possibly RED month.

PA does however, have the ability and strength to push higher if the Bulls decide to make a move.

The MACD

The Daily MACD is just above Neutral and has enough room to move.

So, if we drop, support is arouns 103K

If we loose that then 100K and then we land on that red 236 Fib circle that will offer a sliding line of support.

But I do not think we will get there just yet

Enjoy

Xrp - The expected rally of +50%!Xrp - CRYPTO:XRPUSD - is still clearly bullish:

(click chart above to see the in depth analysis👆🏻)

Ever since Xrp rallied more than +550% in the end of 2024, we have been witnessing a quite expected consolidation. However Xrp still remains rather bullish and can easily retest the previous all time highs again. Maybe, we will even see another parabolic triangle breakout.

Levels to watch: $3.0, $10.0

Keep your long term vision!

Philip (BasicTrading)

Bitcoin Mid Term Game Plan - BTC PLANBitcoin just broke a key resistance level with strength.

I expect a new all-time high soon, likely the summer top.

Summer markets are usually weak for risk assets and strong for gold. Seasonality matters, keep that in mind.

I expect risk markets to sell off until mid-July to early August. I’ll start buying once we break structure again.

The plan:

Wait for BTC to hit $110K

Look for a reversal from that level

Start aggressively shorting alts, beginning with ETH and memecoins

Hold shorts until late July / early August

Close positions and shift back to buying

BTC.D ANALYSIS BTC.D – Daily Chart Analysis 🧠

Bitcoin dominance is forming a rising wedge pattern – a typically bearish structure.

We’re now at the upper resistance; a rejection here could trigger a strong move down, opening the path toward 56–57% levels.

If confirmed, altcoins might get temporary relief.

Watch for a break of the lower trendline for confirmation.

Not financial advice – DYOR

SatochiTrader Expecting a huge BTC CRASH AFTER This..BTC Market Update by SatochiTrader

EVERY CRASH DID START WITH A FALSE INCREASE TREND.

Depending on the market sentiment and price action, BTC is currently showing strength with a positive trend. However, based on deeper data and insights held by myself and a small group of early-cycle followers, this current movement may be a deceptive signal — potentially foreshadowing a major crash.

This is not trading advice. Those who are confident in the long position should continue, and those on the other side should stay prepared as well.

We have previously explained that the current cycle appears to have ended. Since 2013, BTC has consistently respected its macro cycle targets. The end of such a cycle typically leads to significant corrections.

A cycle ending implies not just a retracement, but the potential for a major crash. Hedge funds and real BTC whales understand the underlying indicators and risks at play. Our expectation remains clear: BTC may soon fall below the 100K level, with $85K identified as a critical support and target zone.

Stay sharp. Stay informed. The market may look bullish — until it isn't.

The best way to follow BTC is not the news.. but the cycle overview.

This update is an education update, which means the high expectations of the upcoming correction for BTC.

Compared to last quarter, miners are now less severely underpaid, though profitability remains low

Bitcoin Bounce Alert: Holding the $100K Fortress! 📉 Market Context & Technical Levels

Key support at ~$100K: As the chart shows and multiple analysts confirm, this level continues to act as a strong defence zone. Cointelegraph noted bulls have been “defending the $100K key support level strongly,” triggering bounces during dips

Descending channel overhead: Bitcoin has retraced into a downward channel. A clean breakout above ~107K–109K (past recent peaks) is needed to signal a bullish shift .

Liquidity target at ~106K: Plenty of orders await in that region—flipping it to support may pave the way for another push higher .

📊 Indicators & Momentum

RSI dip near 25 during the latest drop indicates oversold conditions—often a precursor to rebounds

.

Volume surge on rebounds suggests absorbing sell pressure and strong accumulation interest at lower levels.

🚩 Key Price Zones to Watch

Level Significance

$100K Crucial support; losing it risks a slide toward $95K–97K or even $92K

.

$105K–106K Liquidity zone; flipping here as support could confirm upward momentum .

$107K–109K Resistance from channel tops and prior highs; a successful break is key to next leg up .

$112K–$112K+ If breakout occurs, upside targets extend toward prior ATH near $112K and beyond .

🎯 Chart Analysis Summary

Your chart shows three distinct bounces from the $100K–100.7K supply zone (highlighted in blue) and the latest one includes a sharp wick and rebound. This aligns with broader market dynamics emphasizing support at $100K and building liquidity at $106K. The arrow projection signals a probable retest of ~106K, with room to challenge ~107–109K after consolidation.

🧭 Trade Outlook

Bullish scenario: Hold above $100K → reclaim $106K → trendline breakout → potential rally to $112K+.

Bearish risk: Fails support at $100K → breakdown toward $95K–92K region.

📌 Bottom Line

Support $100K is alive and well. Bounces have been crisp and volume-backed.

Next test lies at $105–106K. That’s the battleground—flip it, and we may see bitcoin reclaim recent highs.

Watch the channel overhead (~107K–109K). A breakout could open the door to fresh records.

✅ Conclusion: BTC is defending its psychological base firmly. If this zone holds once more, the path to $106K and beyond is in focus. Breaking above demands conviction, but it’s the pivot to watch.

Ethereum Price Reversal ? $2100 Support & Altcoin Season OutlookAfter an extended period of consolidation, Ethereum (ETH) has finally retested the critical support level of $2,100, which aligns closely with the 0.5 Fibonacci retracement level of the bullish trend that began in April. This confluence of technical factors strengthens the validity of this level as a strong demand zone.

The price action suggests that ETH may be gearing up for a bullish reversal, as it respects both horizontal support and key Fibonacci structure. Historically, the 0.5–0.618 retracement zone acts as a high-probability reversal area in trending markets, particularly when accompanied by volume stabilization and long-tailed candles on the daily chart.

Trade Plan: Spot and Futures Positions

Given the current structure, this presents a favorable opportunity to accumulate ETH on spot for the anticipated altcoin season. In addition, leveraged long positions in futures can be considered with clearly defined risk parameters.

Entry Zone: Around \$2,100

Stop Loss: \$2,000 (below key support)

Target Levels:

Primary Target: $2,500 (previous resistance / psychological level)

Secondary Target: $2,600 (major structure high)

The risk-to-reward ratio remains attractive, particularly if the broader crypto market continues its uptrend and Bitcoin maintains stability.

Market Context

Broader macro sentiment and the dominance cycle suggest capital rotation into altcoins could be near. With Ethereum leading major Layer 1s, a recovery from this level could catalyze a wider altcoin rally**, making this an important zone to watch for both intraday traders and swing investors.

⚠️ Note: Due to ongoing geopolitical tensions between Israel, Iran, and the United States, global financial markets—including crypto—may experience heightened volatility. Traders are advised to manage risk carefully and avoid overleveraging during uncertain macro conditions.

Bitcoin (BTCUSDT) 4H AnalysisBitcoin is currently consolidating around $105,523 after a strong rally and forming a short-term sideways structure. It is still unable to break the immediate resistance of $ 111 K.

Key Technical Observations:

BTC has been ranging between $101,409 and $105,523

RSI at ~51.38 indicates a neutral zone, signaling indecision in momentum

Support holding at $105,396, but price action is flat

Bulls need to reclaim $111,633 to regain momentum

Major Levels to Watch:

Resistance: $111,633 → $122,318

Support: $105,396 → $101,409 → $97,340 → $93,343

A break above $111,633 could trigger bullish continuation, while a fall below $101,409 might open the path to deeper support zones.

Patience is key — wait for breakout confirmation before making moves.

This is not financial advice. Always DYOR and manage risk.

Like, share & comment if you find this analysis helpful!

#Bitcoin #BTC #BTCUSDT