Cryptolevels

BTC Breakout or Bull Trap? Key Confirmation Levels Ahead

If you're leaning bullish, it's more prudent to wait for a confirmed breakout above 88,000, followed by a weekly close above the 86,000 level. Ideally, a successful retest should hold within the 85,000–86,000 range to validate the breakout structure. Any failure to hold this zone on the retest would likely signal a fake out which, given current price action and resistance pressure, remains a high-probability scenario in my view.

Bitcoin faced a sharp decline to the 75,000 level following the announcement of tariffs, which triggered panic and heightened uncertainty across the crypto market. Currently, BTC is attempting to reclaim the key 85,000 resistance zone. However, a descending trendline is capping upward momentum, adding to the difficulty of a clean breakout. A decisive weekly close above 86,000 could invalidate the bearish setup and open the door for bullish continuation till 100-108K. Conversely, failure to break and close above this level would likely lead to a swift drop toward the 71,000 support zone, with minimal structural support in between.

A weekly close below the 85,000 level would confirm bearish continuation, opening the door for a retest of the 72,000 support zone — a key structural level that previously acted as a demand area. Failure to hold above 72,000 could invalidate the current range and trigger a deeper correction toward the prior macro support around 55,000. Based on current momentum and price structure, a move toward the 55,000 region appears increasingly probable in the near term.

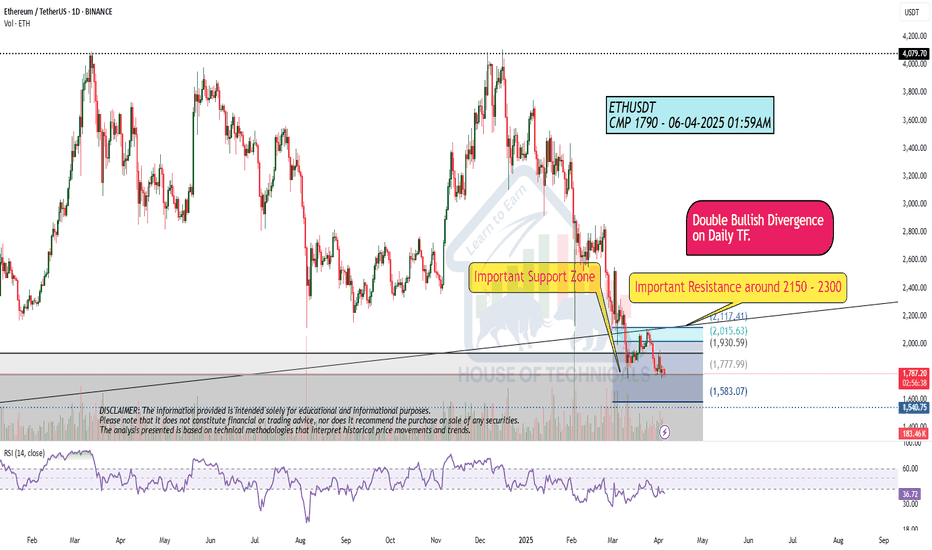

ETH - LOWER LOWS incoming - SELL OFF CONTINUESETH - Lower Lows possibly ahead given current BEARISH MARKET STRUCTURE.

From the break out below the channel, to the RETEST & CONTINUATION of BEARISH MOMENTUM / SELLS - there is a high chance these Red Candles will extend to the next PYSHC LEVEL OF 1,250

1,000 &

POSSIBLY TOUCH 750.

From there I'd prefer not to predict but I would not be surprised of a massive Bull Run off of those KEY LEVELS.

SAFE SL - ABOVE 2,000

TP1 - 1,674 - HIT

TP2 - 1,250

TP 3 - 800

ETH Long Term Prediction - Ethereum Game Plan ETH broke the bullish weekly structure and is currently retracing lower. I don’t see any signs of strength on the chart yet.

I expect the price to first hit $1250 and see a rejection there a possible bounce.

However, the real target is $870 (2022 low). That level holds significant liquidity, so I expect it to be taken out, triggering a potential capitulation. I’ll be looking for spot buys and long-term long setups in anticipation of another possible bull run.

Bitcoin Prediction - Crypto MarketBitcoin has broken the weekly structure to the downside, and we’ve been bearish since then.

However, the monthly chart still looks bullish, and I expect the price to return to the monthly demand zone and get a reaction from there.

I believe the crypto market could turn bullish again by the end of summer 2025.

Possible scenario:

We short from the current levels down to the monthly demand zone, sweeping the engineered weekly liquidity (by 'engineered,' I mean a level designed to push price higher). That level is around $67,000.

I’ll be watching for LTF confirmations to take longs from that zone.

Most likely, the monthly demand zone will hold and send us toward new all-time highs.

Bitcoin Weekly For The Value Hunters & Range Enjoers. With lack of significant bid in the books until 70k. Ideally we drop to value sooner than later & gather demand with a range through summer. Supply has been chasing price down, with perps traders off loading latest positions yesterday in the US session.

This will be painful to most crypto traders but good for range trade enjoyers & spot value hunters.

Key levels: 70/71k Weekly & this is both spot & perps largest resting order blocks in the order books.

Daily BITCOIN Bull Bear candles showing return of the Bulls ?I have used this chart often and have posted it here on a number of occasions with out the Bull Power Bear Power Histogram by CEYHUN active.

This is how the chart Looks when it is active.

This indicator calculates trading action to determine if a Candle is Bullish or Bearish and is VERY ACCURATE

And, Currently, Today's candle is GREEN, for the first time in a LONG TIME.

We can see how the candles have remained RED for most of the Drop in channel.

But now, while we sit on support on a Fib Speed Resistance Fan, we are GREEN.

Long Term, we can see that the climb back to current ATH could be tough. The VRVP on the right is clearly showing rising levels of resistance we climb higher.

Currently, we need to watch closely, to see that candle remain Green and that we do not loose support here.

I feel Bullish

Dogecoin Daily Chart Analysis: A Fresh Start Ahead ?Hello friends, let's analyze Dogecoin, a cryptocurrency, from an Elliott Wave perspective. This study uses Elliott Wave theory and structures, involving multiple possibilities. The analysis focuses on one potential scenario and is for educational purposes only, not trading advice.

We're observing the daily chart, and it appears we're nearing the end of Wave II, a correction. The red cycle degree Wave I ended around 2024 December's peak. Currently, we're nearing the end of red Wave II, which consists of black ((W)), ((X)), and ((Y)) waves. Black ((W)) and ((X)) are complete, and black ((Y)) is nearing its end.

Within black ((Y)), we have Intermediate degree blue (W), (X), and (Y) waves. Blue (W) and (X) are complete, and blue (Y) is nearing its end. Inside blue (Y), red A and B are complete, and red C is nearing its end. Once red C completes, blue (Y) will end, Once blue (Y) completes, means black ((W)) will end that means higher degree cycle wave II in red will end.

If our view remains correct, the invalidation level for this Elliott Wave count is 0.04913. If this level holds and doesn't touch below it, we can expect a significant reversal to unfold wave III towards new highs. This is an educational analysis, and I hope you've learned something by observing the chart and its texture.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

#BTCUSDT.. single supporting area, holds or not ??#BTCUSDT. perfect move as per our last couple of ideas regarding #btcusdt

Now market have current supporting area that is around 82300

Keep close that level because if market clear that level then we can expect a further drop towards downside next areas.

Good luck

Trade wisely

Is Bitcoin on the Verge of a Massive Breakout?Bitcoin's wave ((4)) has successfully completed a W-X-Y corrective formation. If Bitcoin manages to decisively break above the key resistance level of 88,826, it could trigger a powerful impulsive rally, potentially driving prices toward the next major targets at 95,250 - 99,508 - 109,176.

Additionally, the parallel channel's lower trendline is offering substantial support, preventing further downside movement. A strong breakout above this channel could significantly enhance bullish momentum, increasing the probability of Bitcoin reaching new all-time highs.

We will update you with further information.

Cronos is on the move, Could we see it hit $1 soon?The chart is a weekly candlestick chart of CRONOS (CRO) against USD on TradingView, showing price action from late 2023 to a projected point in 2025. Let’s break down the key elements:

Price Movement and Trend:

CRONOS experienced a notable peak around mid-2024, reaching approximately $0.24000, followed by a sharp decline.

After the peak, the price entered a downtrend, forming a descending triangle pattern, which is typically bearish but can lead to a breakout in either direction.

The price has since stabilized in an "Accumulation Zone" between $0.07197 and $0.08925, with the current price at $0.08925 as of April 1, 2025.

Descending Triangle Pattern:

The descending triangle is defined by a downward-sloping resistance line (yellow) and a horizontal support line around $0.08925.

This pattern often signals a potential breakout. A break above the resistance could indicate a bullish reversal, while a break below support might lead to further downside.

The resistance line is currently around $0.13000 to $0.15000, based on the slope.

Accumulation Zone:

The price is in an "Accumulation Zone" between $0.07197 and $0.08925, suggesting that buyers are holding this level and potentially accumulating positions.

Multiple tests of this support level indicate strong buying interest, which could set the stage for a breakout if bullish momentum builds.

Target Projection (TG 1S):

The chart projects a target labeled "TG 1S" at $0.42000, a significant increase from the current price.

This target is likely based on the height of the descending triangle pattern added to the breakout point, a common technical analysis method.

However, reaching $1 (as requested) would require a much larger move, approximately an 11x increase from the current price of $0.08925.

Support and Resistance Levels:

Key support is at $0.07197, with the current price at $0.08925.

Resistance from the descending triangle is around $0.13000 to $0.15000, with a previous high at $0.17018.

A break above $0.17018 could open the door to higher levels, but reaching $1 would require sustained momentum and likely strong fundamental catalysts.

Historical Context and Feasibility of $1:

CRONOS reached an all-time high of around $0.96 in November 2021 during a crypto bull market, so $1 is within historical precedent.

However, the current market environment (as of April 2025) would need to see significant bullish momentum, possibly driven by broader crypto market trends, adoption of the Cronos ecosystem, or major developments in the Crypto.com platform (which CRONOS is tied to).

The $0.42000 target is a more immediate goal, but $1 would require an extraordinary rally, likely over a longer timeframe.

Timeframe:

The chart extends into mid-2025, and the $0.42000 target appears to be a medium-term projection.

Reaching $1 might take longer, potentially into late 2025 or beyond, depending on market conditions.

Bitcoin will reach $180,000 this yearBitcoin’s trajectory is unstoppable—analysts are calling for a climb to $180,000, fueled by institutional adoption, limited supply, and global economic uncertainty. With halving cycles tightening the squeeze and mainstream acceptance soaring, BTC isn’t just a store of value—it’s the financial revolution we’ve been waiting for. Buckle up, the bull run’s coming.

VIDT Datalink Hodl positionVIDT looks to clear the weekly descending trend-line at $0.04000 so it can commence its bull market structure.

Wait for break above and buy the strength

Bitcoin is so close to falling into a Bear, repeating Aug 2023First off, this maybe the last time I post this chart. Binance are Stopping USDT use from tomorrow morning. I have used this chart since around March 2020 and it is my most trusted,. A sad day for me. This chart saw me through Bulk Run, Deep Bear and now this Recovery and Bull run.

ANYWAY, the Arrow points towards a time in 2023 when we were so close to dropping into a Bear market for a number of reasons. Lets just say that Long Red Candle shoiwed a sudden weakening of Sentiment, A Lot of selling and confidence went.

It took a number of weeks for confidence to return.

And Now, we have a Similar thing. FEAR is high

AND I AM BUYING MORE BITCOIN - this is excellent...because when the price rises again, this maybe the last we see this price range.

We have Loads of support below.

It is that RED 236 Fib circle that is dragging PA down, as I mentioned last week. This and the Fact that the Weekly MACD is still falling Bearish

As you can see, the weekly MACD hits Neutral around 21 April, in 3 weeks time. It is from this point forwards that I believe we will see major shift's in Sentiment and PA action. Possibly earlier but maybe not strongly.

Also note how the Histogram is levelling out. We need to see a White candle in the coming weeks or we could be facing bigger issues maybe.

The Daily version of this same chart shows us very clearly where we are.

This is Great News. We have broken through that 236 Red Fib circle. It is now Support. though we are under a line of resistance. But we broke through that in the recent past.

I still think we will visit 78K again for a very short period of time. ( Hopefully, nothing is certain)

Currently, the shorter term charts show Support found on the 618 Fib retracement line. And we need to see if this holds

Over all, We are near the end of the first phase of this pause in Pushes higher. We have that wall at 109K to break through in the longer Term. Once Weekly MACD is on neutral, we will wait fo rthe daily to get there also and then we can push higher with Strength.

This push maynot be a single push. the Weight of BTC with its current price holds back the sprints to ATH we once saw.

Patience is a Virtue

HOLD and BUY MORE

BTCUSDT - single supporting area , holds or not??#BTCUSDT - just reached at his current important supporting area that is around 83600

keep close that level,

overall market stay in range as per our last idea regarding #BTCUSDT.

so now below 83600 market can drop towards his old supporting areas.

good luck

trade wisely

Why We Are Expecting a Short Position in BTCUSD: Detailed Analys1. Breakout from Consolidation Phase

BTCUSD has recently broken out of a prolonged consolidation phase, which is a strong indicator of a potential shift in market sentiment. Consolidation typically occurs when price moves within a narrow range, as buyers and sellers remain in equilibrium. This phase often acts as a buildup for a significant breakout in either direction.

Recent Price Action:

BTCUSD was trading in a tight range, forming a horizontal consolidation zone with well-defined support and resistance levels. This range was consistently tested, but no decisive movement occurred until the recent downside breakout.

Significance of Breakout:

The breakout below the consolidation zone signals that the sellers have gained control, leading to an increase in bearish momentum. A decisive breakout from consolidation often results in strong directional movement, favoring the breakout direction.

2. Break of Previous Low – Confirmation of Bearish Trend

One of the most compelling reasons to initiate a short position is that BTCUSD has broken below a significant previous low.

Previous Low as Support:

The prior low acted as a critical support level that was tested multiple times during the consolidation period. When price decisively breaks below this level, it suggests that the support has failed, indicating increased selling pressure.

Breakout Confirmation:

A confirmed breakout below the previous low typically attracts more sellers and triggers stop-loss orders placed by buyers, leading to a further downward push. This kind of price action is a strong confirmation that the bearish trend is likely to continue.

3. Retest and Better Entry Opportunity

Ideal Short Entry:

After the initial breakout, BTCUSD may retest the broken support (now acting as resistance), providing an ideal opportunity to enter a short position.

Retests often occur when price temporarily pulls back toward the breakout zone, giving latecomers a chance to enter at a better risk-reward ratio.

If the retest is rejected near the previous support level (now resistance), it reinforces the validity of the breakout and provides a high-probability short entry.

Low Risk, High Reward Setup:

Entering after a retest allows placing a stop-loss slightly above the previous support-turned-resistance zone while targeting the next key support level, enhancing the risk-reward ratio.

4. Increased Bearish Momentum and Volume Confirmation

Volume Spike on Breakout:

A breakout accompanied by high volume further validates the move. Volume often acts as a confirmation that the breakout is genuine and not a false move. The increase in selling volume confirms that more market participants are aligned with the bearish outlook.

Momentum Indicators:

Momentum indicators like RSI and MACD are showing bearish divergence or have moved below key levels, suggesting that downward momentum is increasing. A break below the consolidation zone with rising bearish momentum adds further conviction to the short trade.

5. Macro and Sentiment Analysis Supporting Bearish Outlook

Macroeconomic Factors:

Broader market factors, such as increased risk aversion in global markets, regulatory concerns, or bearish sentiment surrounding cryptocurrencies, further strengthen the bearish case.

Sentiment Shift:

A shift from bullish optimism to bearish sentiment among traders often accelerates the downtrend, as fear takes over and more sell orders flood the market.

🎯 Target and Risk Management

Primary Target:

Initial target would be the next major support level, which can be identified through historical price levels or Fibonacci extensions.

Stop-Loss Placement:

Stop-loss should be placed slightly above the retested resistance level to minimize risk in case of a false breakout.

✅ Summary:

We are expecting a short position in BTCUSD primarily because:

A strong breakout occurred after a prolonged consolidation.

Price broke below a key previous low, confirming a bearish trend.

A potential retest provides a better entry point with low risk and high reward.

Volume and momentum indicators support the continuation of the downtrend.

This setup presents an excellent opportunity to capitalize on the bearish momentum in BTCUSD. 🚀

Technical and Statistical Time-Series Analysis for Bitcoin (BTC)Technical and Statistical Time-Series Analysis for Bitcoin (BTC) 📈

Bitcoin is currently trading around $82,000, having breached the critical support level at $80,548. This breakdown, combined with a potential daily close below this level, indicates a likelihood of accelerated downward momentum towards the corrective cycle's end target of $71,823. This target is anticipated to be reached within a short timeframe, between April 9th and 11th.

Price Movement Predictions : 🔮

March 30th - 31st:

A price rebound from $80,548 to $85,098 is expected, serving as a retest. Any rejection from the $85,098 range will signal a continuation of the corrective downtrend. 📉

March 31st - April 10th:

Continuation of the downward cycle is anticipated, targeting the following levels:

First Target: $76,123 🎯

Second Target: $71,823 🎯

April 11th or 12th:

A potential trend reversal towards a strong uptrend is foreseen. 🚀

Invalidation of the Scenario : ⚠️

This scenario will be invalidated if the price breaks above and closes above $90,000. This breakout and close, especially if sustained for three consecutive days, would signal the end of the correction and the resumption of the uptrend towards a new peak. 🔝

Notes : 📝

These predictions are based on technical analysis and do not constitute investment advice. 🚫

The cryptocurrency market is highly volatile, and trading involves significant risk. Proceed with caution. 🚨

It is very important to pay close attention to the economic market news, that can change any technical analysis. 📰

Technical and Statistical Time-Series Analysis For Dominan (BTC)Bitcoin dominance is currently at 62.24%, a level it has reached during the latest bullish wave in a three-year continuous uptrend. This coincides with the formation of an all-time high in the recent fifth wave.

Current Situation Analysis:

Bitcoin Dominance Level: Bitcoin dominance indicates the percentage of control Bitcoin investors hold. When Bitcoin dominance is high (as it is here at 62%), it signifies that Bitcoin investors control the market, supporting the uptrend. 📈

Uptrend: The three-year continuous bullish wave indicates the strength of the current trend. 🚀

Fifth Wave: In Elliott wave theory, the fifth wave often represents the end of an uptrend. Therefore, the formation of an all-time high in this wave may indicate an approaching trend reversal. 📉

Predictions:

The market may target the 65.70% level before it begins to reverse. 🎯

A daily close below the 60.30% level may signal the beginning of a change in the uptrend, with an initial target at 52.5%. 📉

Notes:

Technical analysis is one tool among many used by traders and investors. 📊

Bitcoin dominance analysis is part of the market analysis tools that contribute to decoding trades. 🔍

Financial markets are volatile and cannot be predicted with absolute accuracy. ⚠️

Recommendations:

Monitor the mentioned support and resistance levels (65.80%, 60.30%, and 52.5%). 👀

Use other technical analysis tools to confirm signals. ✅

Consider other factors that may affect the market, such as economic news and political events. 📰

Always exercise caution in trading. 🚨

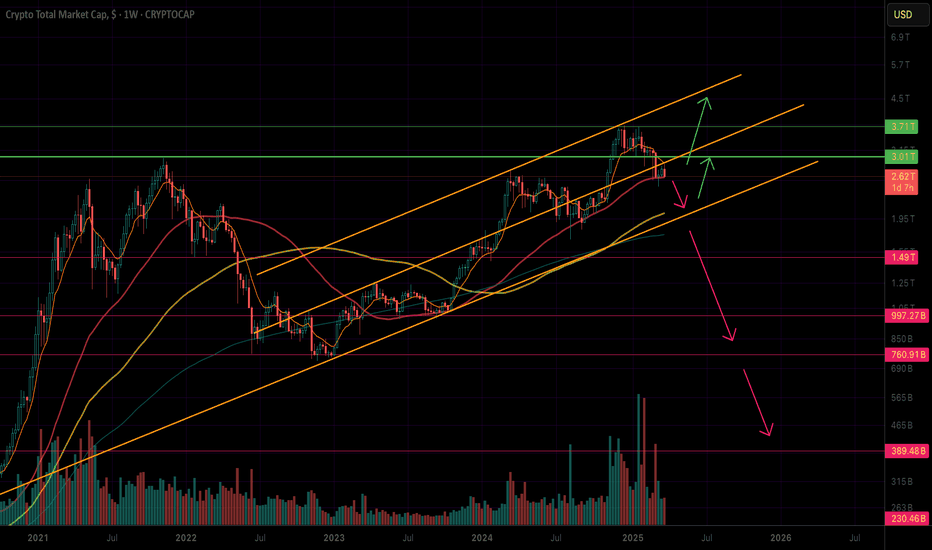

The "Good" Crypto Narrative Is OverIt's been a while since I've done a bit of a deep-dive on this market and why I don't believe it'll sustain a significantly higher value in the future. I no longer have the stamina to write a long-winded post. It's exhausting at this point, and I don't need to reiterate it. Instead, I'll summarize recent developments and their impact on the crypto narrative.

1) The TOTAL crypto market cap currently rests below the all-time high from 2021. This is even including stablecoins. There is $144B worth of USDT currently in circulation. In 2021, that number was $80B. Meanwhile, stock indexes and several individual stocks are significantly up from their last peaks. From a "store of value" standpoint, this doesn't look great, particularly factoring in inflation. Adjusted for inflation, Bitcoin itself is sitting below its inflation-adjusted 2021 all-time high, which is around $84K.

2) Bitcoin active addresses are back to 2017 levels and BELOW the levels from even the previous bear market! This implies that "authentic" adoption has stagnated and begun a decline. studio.glassnode.com

3) In the eyes of a growing number of investors, Trump and Elon's crypto push has only solidified the crypto market as a joke and as a global symbol of greed and corruption.

4) Gold has far outpaced Bitcoin as a store of value during this recent period of turbulence, disproving Bitcoin as a possible safe haven. Here is the Bitcoin/Gold chart for reference:

5) Still, if cryptocurrencies completely ceased to exist, there would be no net-negative effect on the world. In fact, it may be a net-positive. Unless this suddenly changes, crypto does not have any real world value. You cannot say this about most MIL:1T + markets: If most major companies and resources ceased to exist, we'd see a very significant (mostly negative) impact on our daily lives, almost immediately.

In summary, I don't think people will be coming in droves to invest in this market. I think that ship has sailed. The opportunity for it to prove itself has waned, and it has been overtaken by largely bad actors. If anything, I think people are more likely to be forced to buy it than enter the market willingly.

From a technical standpoint, a breakdown from the big uptrend channel in the chart above would likely confirm that the top is in.

---------------------------------------------

Beware, a crypto narrative still exists, but it's only the one fed to us by those in power. It will be important not to fall for it. I worry that people will be forced to own cryptocurrencies, at the expense of their freedom. And even in a situation where crypto prices continue to increase, it is unlikely to be seen positively.

Once we graduate from these strange and confusing times, rife with dissociation, monopolies, grift, and power consolidation, it seems more likely that humanity will look at crypto as part of an uncomfortable past. If we never move on to more optimistic times, and things continue to become more dystopian, well, then that would be a time where crypto adopters can say, "hey, we were right!" But...at what cost?

Regardless, it will always be possible to profit from the volatility, hence my attempts at trading a little recently, with a focus on Litecoin. So, trading opportunities will present themselves, which will keep at least some people interested in this market. I think it is unlikely to be enough liquidity to sustain significant new all-time highs.

Here is my last big post, where I detailed more reasoning - this was prior to the Bitcoin ETF's:

And here is a recent post, where I describe how my own thoughts about the market evolved, from when I first entered in 2017 to the present:

As always, this represents only my opinion, and is meant for speculation and entertainment only, not as financial advice. There are many other opinions out there. It is your responsibility to develop critical thinking.

Thanks for reading as always!

-Victor Cobra