CRO at a Turning Point ?This is CRO on the daily chart.

Price has interacted multiple times with the key resistance at **0.10649** (black line). It’s now testing that level again, and there's a real possibility it flips it into support.

On top of that, CRO is attempting to reclaim the 200MA, while the 50MA is starting to flatten out—potential signs of a longer-term shift.

That said, this process might take some time and could be volatile. CRO’s relatively small market cap of \$3.33B and this week’s major macro events (starting today with CPI) could add pressure in both directions.

Always take profits and manage risk.

Interaction is welcome.

Cryptomarket

MELANIA: Divergence, Signal, BaseThis is MELANIA on the 1-day chart.

First, I want to emphasize the bullish divergence on the RSI, which started on April 21, while price continued to drop, RSI held or even moved higher.

Second, although we’re still below the 50MA and the chart doesn’t yet have a 200MA, both systems are long:

• PSAR is bullish

• MLR > SMA > BB Center

Third, it appears a base has been forming since June 27.

All these factors combined led me to open a long position, but of course, this is just my view, not financial advice.

Always take profits and manage risk.

Interaction is welcome.

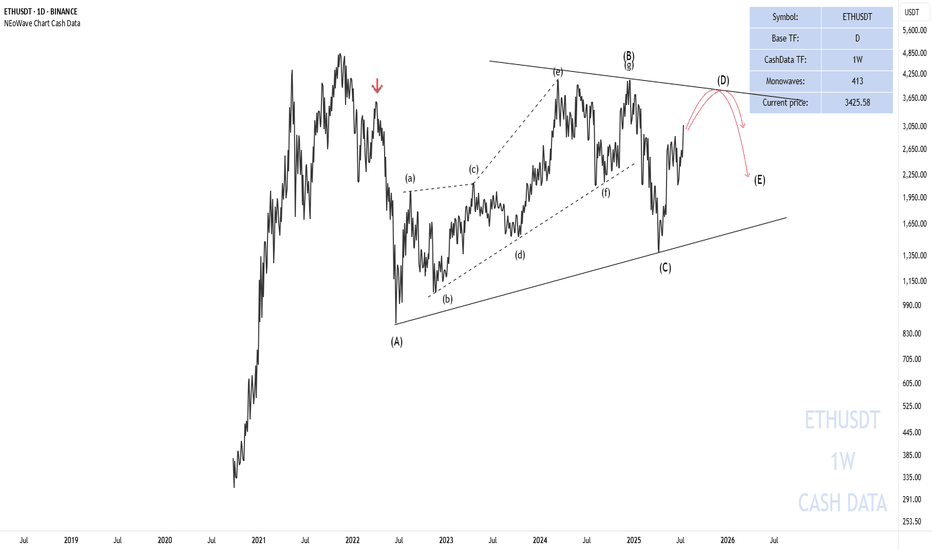

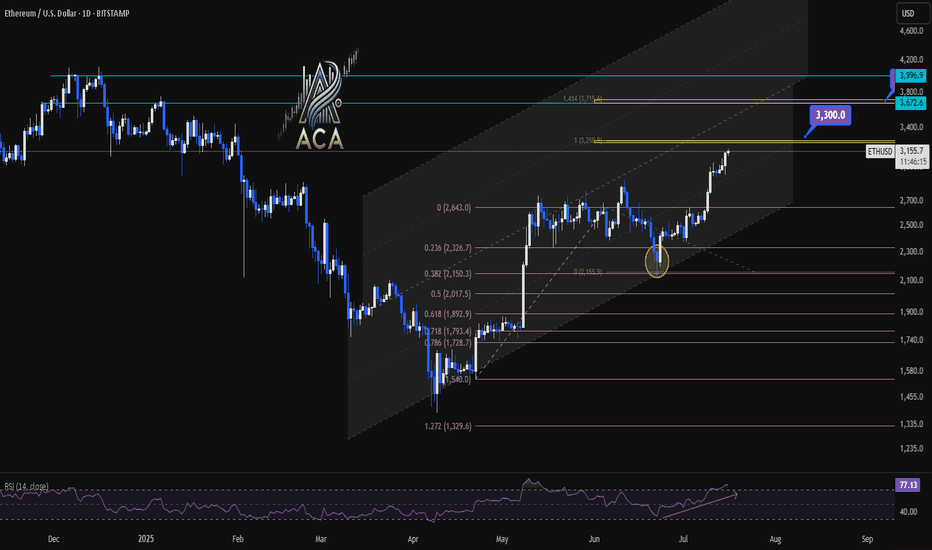

NEoWave Analysis of Ethereum 2025 Cash data chart shows that Ethereum is in a corrective phase and the wave structure from (A) to (C) has been completed. Initially, we expected a flat pattern to form; however, the wave structure-(C) was not an impulse and the flat was not confirmed.

As a result, given that the wave structure (A)-(B)-(C) is corrective and the waves differ in time, it seems that a contracting triangle pattern is forming and we are currently in wave-(D) of this triangle. Furthermore, wave-(D) could rise to $3630-3880 and end. Then a price correction in the form of wave-(E) may occur. This correction could end between $2900-3086 and if this range is broken downwards, wave-(E) could decline to $2000-2230, after which the main bullish move for Ethereum is expected to begin.

Good luck

NEoWaveChart

NEARUSDT Daily Chart Analysis|Strong Breakout & RSI ConfirmationNEARUSDT Daily Chart Analysis | Strong Breakout & RSI Confirmation

🔍 Let’s break down the latest NEAR/USDT daily chart, spotlighting critical resistance, target levels, and momentum signals.

⏳ Daily Overview

NEAR has confirmed a bullish breakout above its long-term descending trendline. This move comes with a surge in price and a strong daily candle—clear evidence of renewed bullish momentum.

📊 Momentum & RSI

RSI has surged to 76 (overbought zone), higher than the typical overbought level of 70. This spike reflects strong buying pressure, but also signals the possibility of near-term pullback or consolidation.

RSI-Momentum Convergence: The RSI uptrend is in lockstep with price action, confirming that bullish momentum is genuine and backed by increasing strength—not a divergence.

🔑 Key Levels

- First Resistance: $3.59—watch this closely as the next hurdle for bulls.

- Breakout Target: $4.85, which corresponds to the measured move (RR1) from the trendline breakout and aligns with the next horizontal resistance.

- Extension Target: $8.01 if momentum persists and price sustains above $4.85 in the coming weeks.

📌 Highlights

- Clear trendline breakout validated by strong RSI convergence.

- RSI has entered the overbought zone (76), backing momentum—watch for either breakout follow-through or brief cooling.

- Key levels: $3.59 (first resistance), $4.85 (breakout target).

🚨 Conclusion

Momentum is with the bulls after the breakout. Eyes on $3.59 as the near-term test; a clean move above opens up $4.85 and potentially $8.01 if momentum continues.

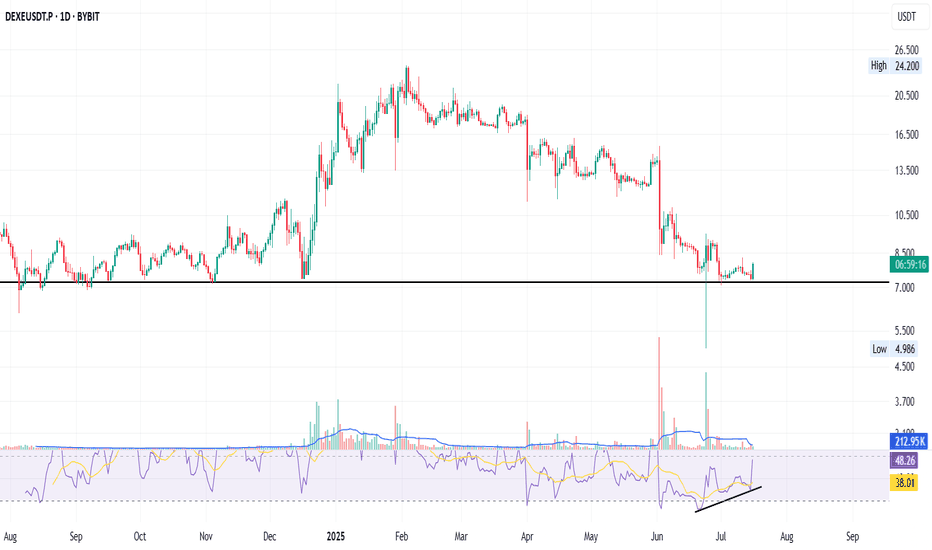

DEXE: Bounce + RSI Divergence + DeFi Strength

DEXE on the daily just bounced off an 11-month-old support - the key black line.

A strong bullish divergence on the RSI has been building for over a month — now confirming with momentum.

That long green wick under support? It’s signalling buyer interest and possible accumulation.

Fundamentals:

DEXE powers decentralized governance (DAO) with AI + DeFi alignment.

It enables transparent on-chain decision-making and sustainable DAO growth.

Backed by real partnerships, aiming for fair, merit-based participation.

I’m long: not financial advice.

Always take profits and manage risk.

Interaction is welcome.

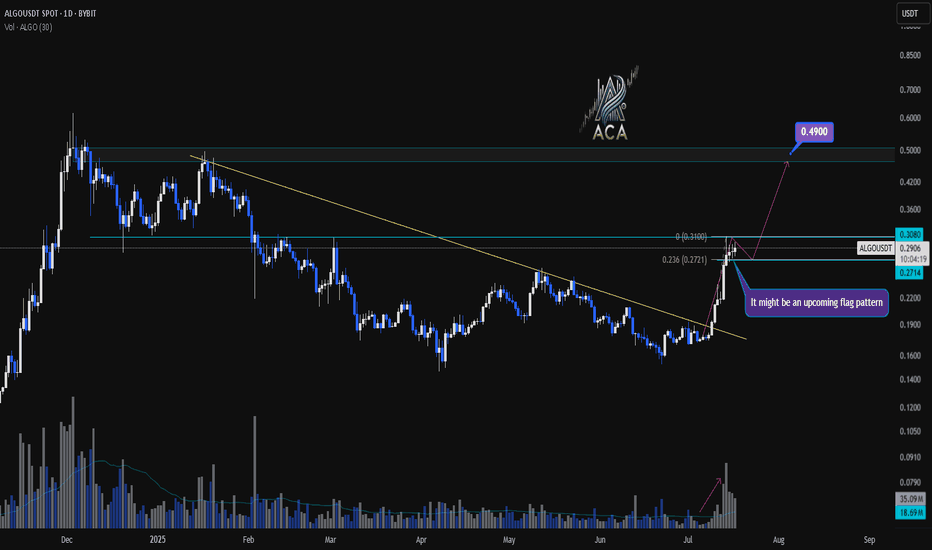

ALGOUSDT Daily Chart Analysis | Continuational patternsALGOUSDT Daily Chart Analysis | Momentum Picks Up on Higher Timeframe

🔍 Let’s break down the latest ALGO/USDT daily chart, highlighting a shift in market structure and key bullish signals.

⏳ Daily Overview

A decisive breakout above the long-standing descending trendline has flipped the narrative for ALGOUSDT. Increased volume during the breakout points to robust bullish momentum, suggesting buyers are regaining control at this multi-month inflection point.

🔔 Flag Pattern & Chart Structure

- Bullish flag pattern is emerging after the recent breakout, as price consolidates in a tight range—a classic continuation formation.

- Former trendline resistance is now acting as support, confirming a notable shift on the higher timeframe.

📐 Fibonacci & Target Levels

- The 0.236 Fibonacci retracement at $0.2771 is providing immediate support, with price consolidating above this anchor level.

- Upside targets:

- First resistance at $0.3080, which aligns with horizontal supply and previous pivot highs.

- If the flag pattern resolves upward, the next Fibonacci extension points to $0.4900, marking a significant confluence and potential for further gains.

📊 Key Highlights

- Strong daily candle and surging volume confirm momentum shift.

- Watch the developing flag pattern for breakout confirmation.

- Major trendline break on the daily signals structural reversal.

- $0.3080 is the immediate target; $0.4900 is the extended objective from the flag/Fibonacci alignment.

🚨 Conclusion

ALGOUSDT is setting up a compelling bullish scenario—keep a close eye on price behavior at the flag and $0.3080 level. A breakout may trigger the next impulsive move toward $0.4900.

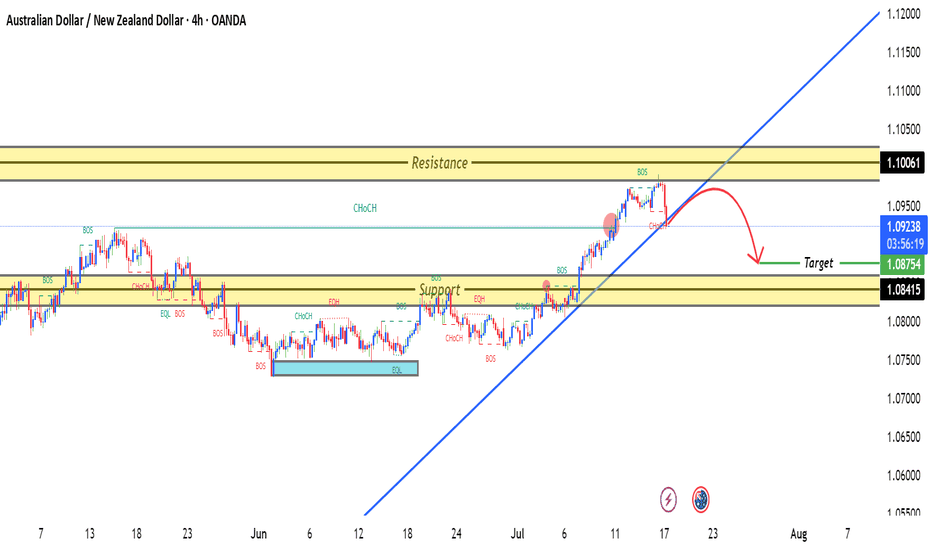

AUDNZD 4H TIME FRAME ANALYSISAUDNZD is currently in a short-term downtrend on the 4-hour chart. Price has been forming lower highs and lower lows, confirming bearish pressure. Recent candles show rejection at higher levels, supporting downside continuation.

1.09400 – 1.09550: Strong resistance zone where price was previously rejected multiple times.

1.09380 (your entry) aligns with a minor lower high, reinforcing this level as a valid sell area.

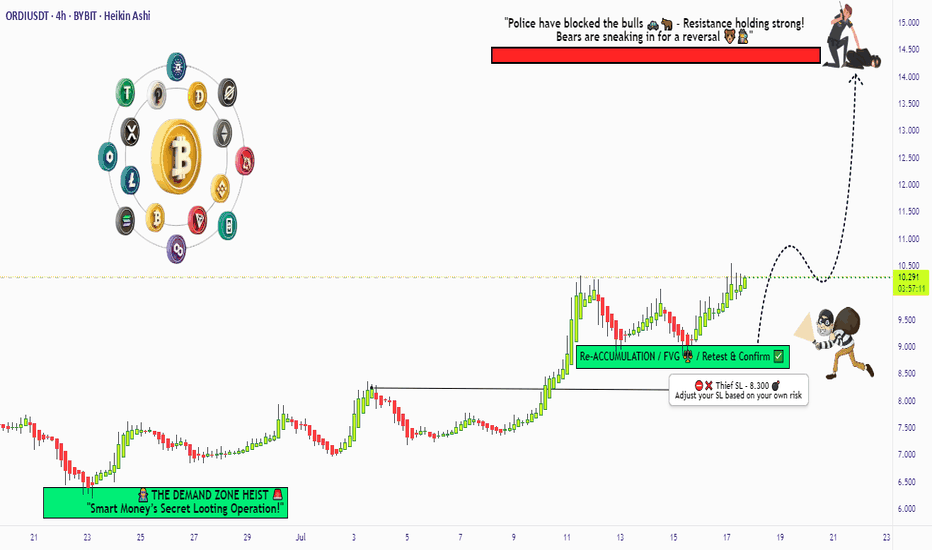

"ORDI/USDT: Pirate’s Treasure Trade! Bullish & Loaded"🚨 ORDI/USDT HEIST ALERT! 🚨 ORDI/USDT Bullish Raid Plan (Thief Trading Style) 💰🎯

🌟 Attention Market Pirates & Profit Raiders! 🌟

🔥 Thief Trading Strategy Activated! 🔥

📌 Mission Brief:

Based on our elite Thief Trading analysis (technical + fundamental heist intel), we’re plotting a bullish robbery on ORDI/USDT. Our goal? Loot profits near the high-risk resistance zone before the "Police Barricade" (bear traps & reversals) kicks in!

🚨 Trade Setup (Day/Swing Heist Plan):

Entry (📈): "The vault is open! Swipe bullish loot at any price!"

Pro Tip: Use buy limits near 15M/30M swing lows for safer pullback entries.

Advanced Thief Move: Layer multiple DCA limit orders for maximum stealth.

Stop Loss (🛑): 8.300 (Nearest 4H candle body swing low). Adjust based on your risk tolerance & lot size!

Target (🎯): 14.400 (or escape early if the market turns risky!).

⚡ Scalper’s Quick Loot Guide:

Only scalp LONG!

Rich thieves? Go all-in! Broke thieves? Join swing traders & execute the plan slowly.

Use trailing SL to lock profits & escape safely!

💎 Why ORDI/USDT? (Fundamental Heist Intel)

✅ Bullish momentum in play!

✅ Macro trends, & intermarket signals favor upside!

✅ News-driven volatility? Expect big moves!

⚠️ WARNING: Market Cops (News Events) Ahead!

Avoid new trades during high-impact news!

Trailing stops = Your best escape tool!

💥 BOOST THIS HEIST!

👉 Hit LIKE & FOLLOW to strengthen our robbery squad! More lucrative heists coming soon! 🚀💰

🎯 Final Note: This is NOT financial advice—just a thief’s masterplan! Adjust based on your risk & strategy!

🔥 Ready to Raid? Let’s STEAL Some Profits! 🏴☠️💸

👇 Drop a comment & boost the plan! 👇

(🔔 Stay tuned for the next heist!) 🚀🤫

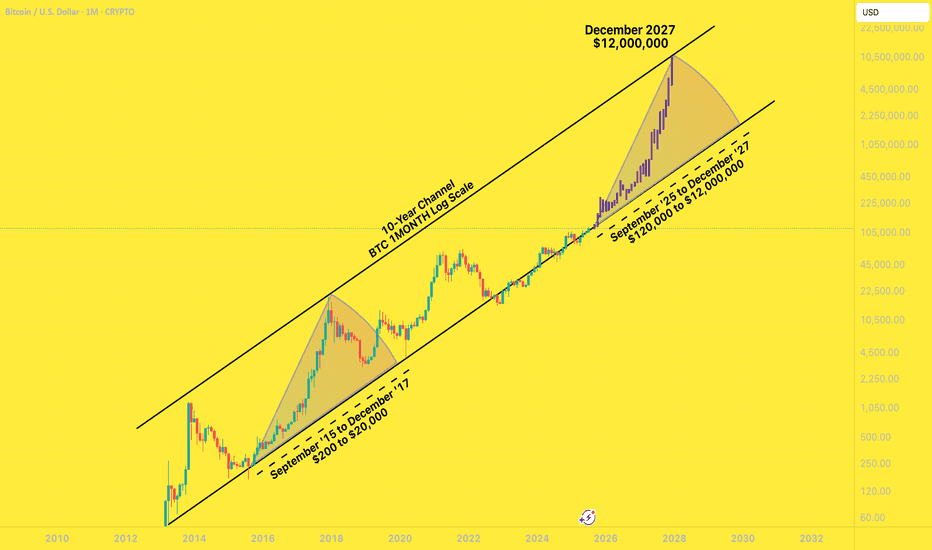

BTC to $12,000,000 December '27I had a years-old bookmarked chart from @MillionaireEconomics that I wanted to update and pick a random, extremely bullish candle pattern from the last time BTC came off the bottom channel to slap on it.

Riddle me this:

Why shouldn't Bitcoin go to $12,000,000 by December 2027?

Saylor continues to lead the way for global companies to scramble to build their own BTC warchests. These early adopters are having investor money dumped into them by the truckload.

Countries are stacking BTC

The BTC ETFs are a smash hit

Trump is all for making his own multi-billy family bitty stack

Mid-curvers will sell far too early, for far too little.

In the next two years, you'll be bombarded with countless, seemingly good reasons to sell your Bitcoins for hundreds of thousands of dollars - and then millions of dollars.

A shocking number of people will be far too early to sell. They will wake up in a cold sweat, night after night, haunted by their "could-have-been" stack, the number that updates in their head ten times a day, going up by six or seven figures a day .

... until they FOMO right back in at $11,999,999.

ETH — Trade Closed! Massive Profit SecuredI’m officially closing my Ethereum position — this trade is now a success story!

I posted right here that ETH was a buy at $2400, then doubled down at $1800. I even echoed the call on Reddit for good measure.

Today, I’m liquidating the entire position with a huge gain. No regrets, just clean execution. 🧠💸

To all the mad lads still holding — good luck and may your conviction be rewarded.

See you next year for the next big swing.

Take your profits, you lunatics! 😄🔥

Total crypto MC - 1DThe total crypto market capitalization on the daily timeframe has formed a Falling Wedge pattern, which is typically a bullish reversal pattern. The price has broken out above the upper resistance line of the wedge, confirming the breakout. Currently, the price is undergoing a retest of the breakout level, which now acts as support. If this support holds successfully, it is expected that the market will experience an upward move in the near term, signaling potential bullish momentum.

#DOGEUSDT: Swing Trade Targeting $0.50| Swing Trade| Setupsfx_|Hey there! Everyone

DOGEUSDT is at a turning point right now, and it looks like it might just reverse course and head towards its target price of $0.50. This is a swing trade, which means it could take a few weeks, or even months, to complete.

We’d really appreciate your support.

Thanks

Team Setupsfx_

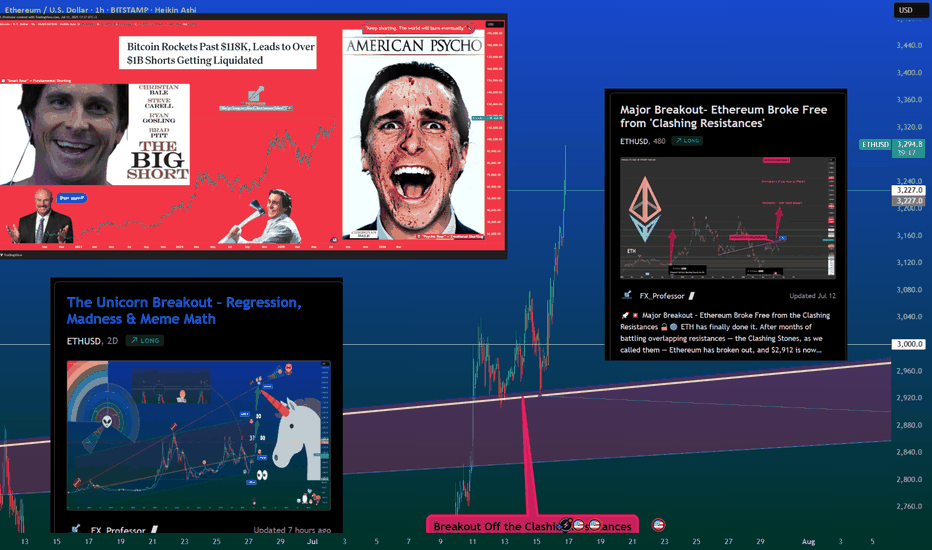

Ethereum Breakout and Liquidations – A Lesson in Bear Traps and 📚💥 Ethereum Breakout and Liquidations – A Lesson in Bear Traps and Risk Management 🧠📈

Today, July 16th, Ethereum gave us a real-time masterclass in market psychology and risk management.

Let’s start with the facts:

📊 Liquidation Data

🔻 $36.34M in long liquidations

🔺 $86.02M in short liquidations

💣 Total ETH liquidations: $122.36M (data mentioned on video might differ, i made a small mistake)

🌐 Across crypto: $351M liquidated (more shorts than longs)

This imbalance tells us one thing: a bear trap played out, and it played out hard.

🧠 Educational Takeaways

1. Bear Traps Are Real — and Expensive

A bear trap occurs when the market appears bearish, drawing in short sellers — only to violently reverse upward. Today’s Ethereum move was a textbook example. If you’ve been following my analysis, we discussed the regression lines, divergences, and structure that all warned against going short at support.

2. Open Interest and Sentiment Signals

Open interest has been declining — which means fewer speculative positions. That often creates space for a real, organic move, not one fueled by overleveraged noise.

3. Spot vs. Leverage – Risk Control First

Leverage isn’t the enemy — unmanaged leverage is. I personally use a dedicated high-risk account to trade fast setups. This keeps my core capital untouched and my psychology stable.

✅ Risk is defined before the trade.

✅ Entries are structured like bullets — small, multiple attempts.

4. The Mental Game is the Real Game

Trading isn’t just technical. It’s deeply psychological. Whether you’re trading Ethereum, Bitcoin, or altcoins like AVAX and XRP, emotions must be managed before capital is deployed.

5. Like-Minded Community = Sharper Edge

My best trades and insights often come from conversations with trusted, sharp minds in this space. Surrounding yourself with serious traders can be the difference between evolving — and evaporating. To my brother Vlatko (met on Tradingview, been hanging around online ever since, met in person once, now a true friend that we frequently disagree but always agree to respect and empower each other = The power of our community here on TV!)

Final Word:

When markets move fast, lessons appear even faster.

Study the traps. Respect the levels. Structure your risk.

And above all: trade with a plan that allows joy.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

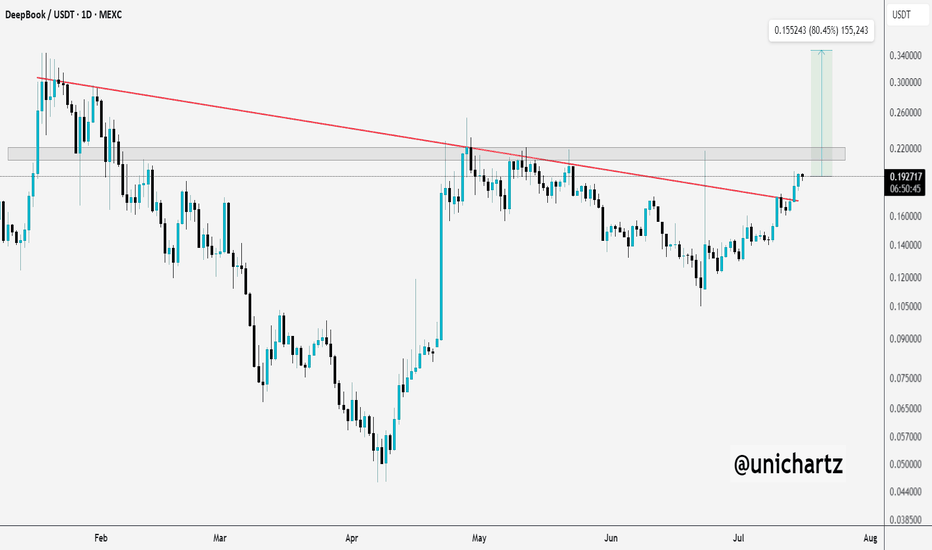

Breakout Alert: $DEEP Aiming for 80%+ If Resistance Flips$DEEP/USDT just broke out of a clean downtrend line and is now approaching a strong resistance zone around $0.22.

Momentum looks solid, and the breakout is backed by strong bullish candles.

If price can flip this zone into support, we might see a potential 80%+ move toward the $0.34–$0.35 region.

DYOR, NFA

Crypto Market Update – July 14th🔷Market Update – July 14th: Another Winning Move 🧠🔥

Another week, another breakout – and we’ve been tracking it every step of the way.

💸 Entries? Perfect.

✅ Targets? Hit.

🧠 Psychology? Nailed.

Today, we reached 122,795 , hitting a key target with precision. From there, we took partial profits — and are now watching the next leg toward 127K+ .

We’ve had 4 amazing entries lately, all executed with structure, risk control, and vision.

Today’s move? Just the latest in a series of well-calculated trades.

📉 Support now rests at 120,500 , with deeper support still valid around 114,921 .

This isn’t just a lucky guess — it’s the outcome of following levels, structure, and behavior.

But if you want to go deeper into what’s really happening beneath the surface ...

📊💸 Read the NEW Deep Dive Part III:

The Next BIG Whale Play Unfolds →

Inside it:

🐳 How the bear trap is being set

🧠 Why this is a disbelief rally

⚠️ Why shorting now = adding fuel to the fire

💥 And why this may be the first leg of a much bigger run...

Stay sharp. Stay structured. Stay ahead.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

📊💸 And don’t miss Deep Dive Part III – The Next BIG Whale Play Unfolds:

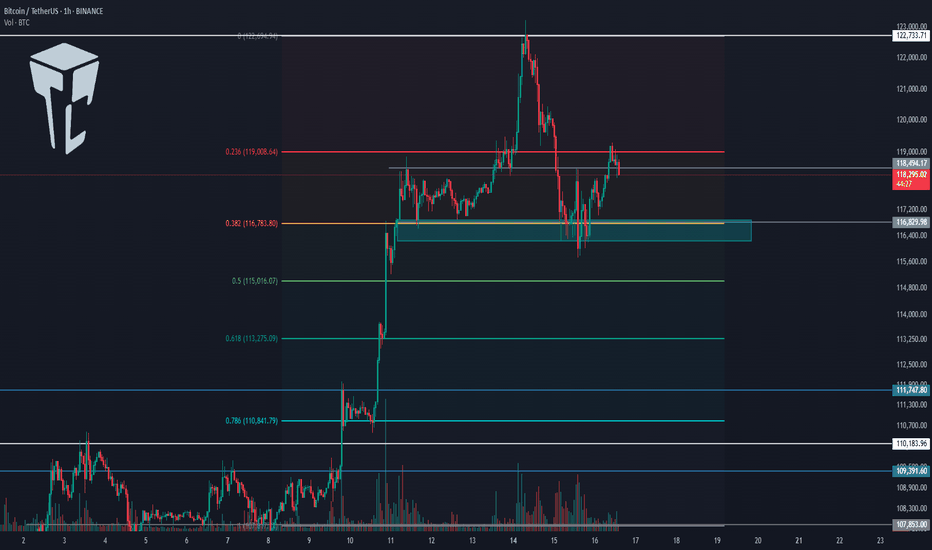

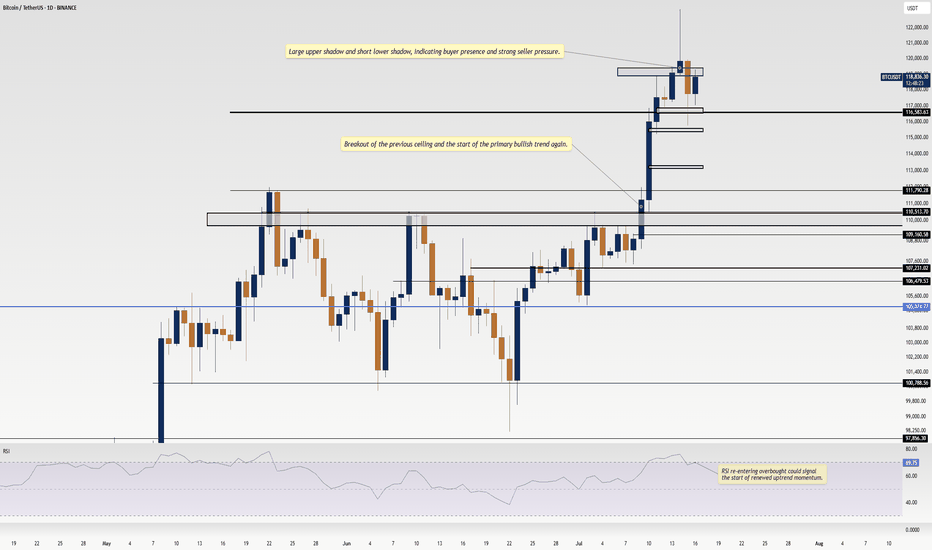

TradeCityPro | Bitcoin Daily Analysis #130👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis, I’ll go over the futures triggers for the New York session.

⏳ 1-hour timeframe

As you can see in the 1-hour timeframe, Bitcoin was supported at the 116829 zone yesterday and is now moving upward.

📈 The long position trigger at 118494 has been activated, and the price is currently pulling back to this level.

💥 The 0.236 Fibonacci level is right above the price, and if it breaks, the price can continue moving upward.

⚡️ The current local top is 122733, which can be the first target for the long position. Breaking this level would also be our main trigger for a long entry.

👑 BTC.D Analysis

Bitcoin dominance is still falling and has now confirmed below the 63.96 zone.

🔍 Currently, the trend is fully bearish, and breaking 63.50 will confirm continuation of the downtrend.

📅 Total2 Analysis

Total2 is rising alongside the drop in Bitcoin dominance and has confirmed above 1.33.

🎲 The next resistance is at 1.41, and the current uptrend can continue toward that level.

📅 USDT.D Analysis

Tether dominance has confirmed below 4.36 and is continuing its downward move.

✔️ The next support is at 4.22, and breaking this level would initiate the next major bearish leg.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

ETHUSDT 1D Chart Analysis | RSI Strength & Fibonacci TargetsETHUSDT 4H Chart Analysis | RSI Strength & Fibonacci Targets in Play

🔍 Let’s break down the latest ETH/USDT setup — bullish momentum is building with confluences pointing toward key upside targets.

⏳ 4-Hour Overview

Ether continues climbing within a well-defined ascending channel, with recent candles holding above mid-level support. Price is pressing higher from a clean bounce at the 0.5 and 0.618 Fibonacci retracement zone ($2,017–$1,899), signaling the correction has likely ended.

📉 Fibonacci Levels & RSI Confirmation

- The strong recovery aligns with rising volume and a bullish structure.

- RSI is pushing into overbought territory (above 73), often a sign of strength during trends—not exhaustion.

- ETH is now positioned for a breakout continuation move if momentum holds.

🎯 Bullish Targets Ahead

- Immediate resistance: $3,300 (1.414 Fib extension + historical supply)

- Next major target: $3,700 (1.618 extension + upper channel confluence)

- Pullback zones: $2,950 (mid-channel) and $2,017 (Fib support base)

📊 Key Highlights:

- Price is respecting the rising channel structure — higher lows, higher highs in play.

- Volume supports the breakout narrative, rising on green candles.

- RSI breakout supports trend continuation, not exhaustion.

- Targets at $3,300 and $3,700 remain actionable on a confirmed breakout.

🚨 Conclusion:

ETH is showing a multi-variable bullish setup with clear continuation potential. A strong move above $3,300 could quickly send price toward $3,700. Pullbacks to $2,950–$2,017 could offer high-risk/reward re-entry zones. Momentum favors bulls — stay alert.

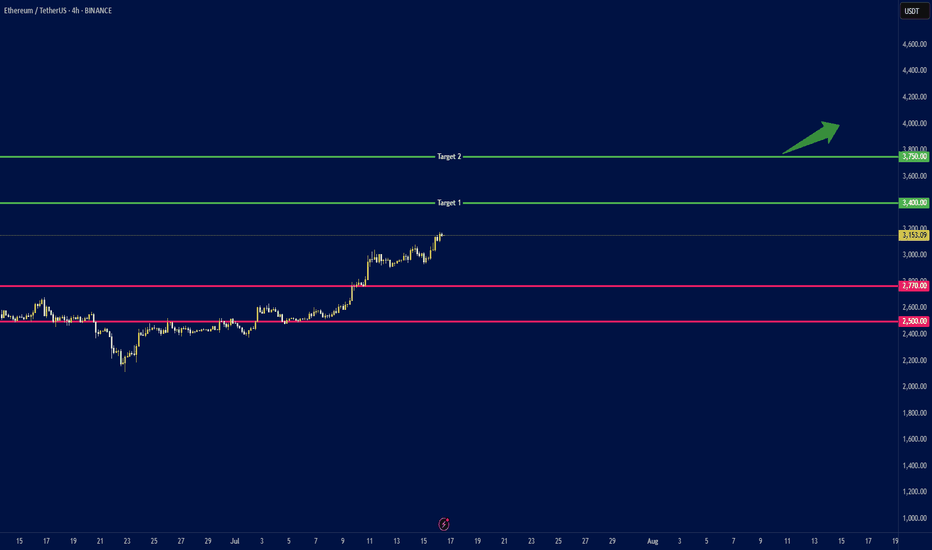

ETH to $4K ? Whales Accumulate as ETFs Break Records🕞 Timeframe: 4H

.

🟢 Bias: Bullish

1. 🧭 Fundamental Overview:

📈 Massive Institutional Inflows:

Ethereum ETFs have recorded over $1.2 billion in net inflows this July, with $908M just in the week ending July 11. This strong demand from institutional players (notably through ETHA and Bitwise) has pushed ETF AUM above $13.5 billion.

🏢 Corporate Accumulation:

Companies such as SharpLink Gaming have begun adding ETH to their balance sheets. SharpLink's 10,000 ETH (~$49M) purchase highlights growing corporate adoption of Ethereum as a store of value and strategic reserve.

🛠️ Ecosystem Resilience:

Ethereum continues to lead in network upgrades (e.g., Dencun), institutional DeFi, and tokenized assets—strengthening the long-term fundamentals of the chain.

2. 🧠 Sentiment & On‑Chain Metrics

🏦 Institutional Sentiment:

Ethereum ETFs have seen 12 straight weeks of inflows, outperforming Bitcoin in institutional allocation growth (ETH: 1.6%, BTC: 0.8%).

🐋 Whale Activity & Exchange Flows:

Declining ETH balances on exchanges suggest accumulation and reduced sell pressure. Whales and smart money are taking positions.

📊 Public Sentiment:

Bullish expectations remain strong amid price consolidation above key levels and positive ETF momentum.

3. 🔼 Key Levels:

Support: $2,770 and $2,500 (major trendline and psychological level).

4.🎯 Price Targets:

Short‑term (2–4 weeks):

If ETH breaks above $3,150: next targets at $3,400 and $3,750.

Medium‑term (by end of Q3 2025):

ETH could reach $3,500 with potential upside to $4,000.

.

.

.

⚠️ Disclaimer: This analysis is for educational purposes and not financial advice. Please do your own research and risk management.

.

✅ If you like this analysis, don't forget to like 👍, follow 🧠, and share your thoughts below 💬!

Bitcoin Ranges While Altcoins Rise — Follow the Liquidity TrailHeyy traders, it’s Skeptic from Skeptic Lab! 💙 Dropping a red-hot update on Bitcoin and the crypto market to catch the next big wave. We’re diving into the Daily timeframe and market dynamics to track where the money’s flowing. here’s the play:

✔️ Daily Timeframe

As we flagged in my last Bitcoin chart, the $ 120,000 level is a liquidity magnet with heavy action. The July 14 candle tried breaking it but failed, leaving a downward shadow showing strong seller presence at this level. Plus, last week we hit the 4-week pivot point on the Weekly , and as expected, we’re now ranging around $120,000. Does this mean we ditch crypto? Big NO.

📊 Bitcoin Dominance (BTC.D)

Let’s zoom in on BTC.D —it’s gone sharply bearish, with yesterday’s candle screaming capital exiting Bitcoin. Traders who profited up to $120,000 are locking in gains and moving funds elsewhere. So, what’s the story?

Bitcoin broke its ceiling after 168 days, surging 10% to $122,000. Buyers took profits, pulling liquidity out.

Where’s the money going? Let’s test two theories:

USDT? Nope. USDT.D is also bearish.

Altcoins? Bingo! TOTAL2 (altcoin market cap) smashed its Daily resistance at 1.34 after months, signaling liquidity flooding into altcoins.

📉 Which Altcoins? Here’s the trick: check pair/BTC ratios . For example, to pick between Solana or Ethereum, compare S OL/BTC and ETH/BTC . The one with a stronger uptrend is soaking up more liquidity from Bitcoin.

🔔 Key Insight: This liquidity flow game is a game-changer for crypto traders. Want a full dominance tutorial? Let me know —it’ll show you how to track where the money moves and which coins get the most action.

🔼 Key Takeaway: Bitcoin’s ranging at $120,000, but altcoins are heating up as BTC.D drops. Hunt for altcoins with bullish pair/BTC charts to ride the liquidity wave. Risk management is your lifeline—cap risk at max 1%–2%. I’ll catch you in the next analysis—good luck, fam! <3

💬 Let’s Talk!

Which altcoin are you eyeing? Hit the comments, and let’s crush it together! 😊 If this update lit your fire, smash that boost—it fuels my mission! ✌️

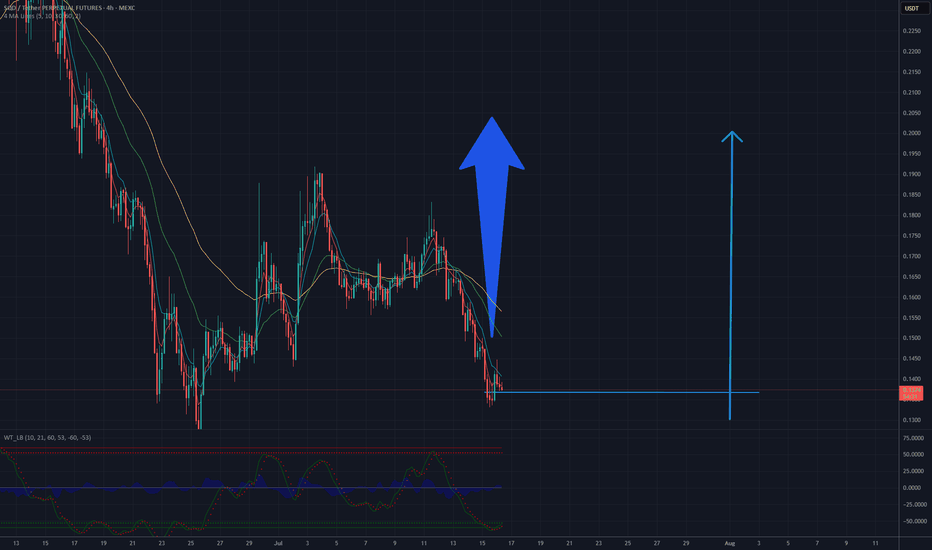

SQD/USDT – Bullish Reversal in Sight with Target at $0.20After a prolonged downtrend, SQD/USDT has reached a significant support zone between $0.13–$0.137, where a local bottom appears to be forming. The WT_LB oscillator is showing a positive divergence — price is making lower lows while the indicator is making higher lows — which often signals a potential reversal. The price is beginning to consolidate above the support, with early signs of strength emerging through small breakouts. If the pair breaks above the $0.15–$0.16 resistance range, momentum could accelerate, potentially driving the price toward the $0.20 target, aligning with the previous high from early July.

Potential TP: 0.20 USD