Cryptomonnaie

Cronos is on the move, Could we see it hit $1 soon?The chart is a weekly candlestick chart of CRONOS (CRO) against USD on TradingView, showing price action from late 2023 to a projected point in 2025. Let’s break down the key elements:

Price Movement and Trend:

CRONOS experienced a notable peak around mid-2024, reaching approximately $0.24000, followed by a sharp decline.

After the peak, the price entered a downtrend, forming a descending triangle pattern, which is typically bearish but can lead to a breakout in either direction.

The price has since stabilized in an "Accumulation Zone" between $0.07197 and $0.08925, with the current price at $0.08925 as of April 1, 2025.

Descending Triangle Pattern:

The descending triangle is defined by a downward-sloping resistance line (yellow) and a horizontal support line around $0.08925.

This pattern often signals a potential breakout. A break above the resistance could indicate a bullish reversal, while a break below support might lead to further downside.

The resistance line is currently around $0.13000 to $0.15000, based on the slope.

Accumulation Zone:

The price is in an "Accumulation Zone" between $0.07197 and $0.08925, suggesting that buyers are holding this level and potentially accumulating positions.

Multiple tests of this support level indicate strong buying interest, which could set the stage for a breakout if bullish momentum builds.

Target Projection (TG 1S):

The chart projects a target labeled "TG 1S" at $0.42000, a significant increase from the current price.

This target is likely based on the height of the descending triangle pattern added to the breakout point, a common technical analysis method.

However, reaching $1 (as requested) would require a much larger move, approximately an 11x increase from the current price of $0.08925.

Support and Resistance Levels:

Key support is at $0.07197, with the current price at $0.08925.

Resistance from the descending triangle is around $0.13000 to $0.15000, with a previous high at $0.17018.

A break above $0.17018 could open the door to higher levels, but reaching $1 would require sustained momentum and likely strong fundamental catalysts.

Historical Context and Feasibility of $1:

CRONOS reached an all-time high of around $0.96 in November 2021 during a crypto bull market, so $1 is within historical precedent.

However, the current market environment (as of April 2025) would need to see significant bullish momentum, possibly driven by broader crypto market trends, adoption of the Cronos ecosystem, or major developments in the Crypto.com platform (which CRONOS is tied to).

The $0.42000 target is a more immediate goal, but $1 would require an extraordinary rally, likely over a longer timeframe.

Timeframe:

The chart extends into mid-2025, and the $0.42000 target appears to be a medium-term projection.

Reaching $1 might take longer, potentially into late 2025 or beyond, depending on market conditions.

Bitcoin will reach $180,000 this yearBitcoin’s trajectory is unstoppable—analysts are calling for a climb to $180,000, fueled by institutional adoption, limited supply, and global economic uncertainty. With halving cycles tightening the squeeze and mainstream acceptance soaring, BTC isn’t just a store of value—it’s the financial revolution we’ve been waiting for. Buckle up, the bull run’s coming.

Bitcoin Breakout Confirmed, Aiming for $160K

Chart Analysis:

Bitcoin has just confirmed a major breakout above a key resistance zone, signaling a strong bullish continuation. Let’s dive into the details:

1.Ascending Triangle Breakout:

BTCUSD had been consolidating within an ascending triangle pattern since late 2024, with the upper resistance around $80,000 and a rising support trendline (highlighted in yellow).

The breakout above $80,000 on strong volume confirms the bullish pattern, which is typically a precursor to significant upward moves.

2. Accumulation Zone:

Before the breakout, Bitcoin spent several months in an accumulation zone between $53,837 and $80,000. This phase allowed buyers to build positions, setting the foundation for the current rally.

3.Price Targets:

The measured move of the ascending triangle (height of the pattern) projects a target around $160,000. The height of the triangle is approximately $26,163 (from the base at $53,837 to the resistance at $80,000). Adding this to the breakout point ($80,000 + $26,163) gives a target of ~$106,163. However, considering Bitcoin’s historical tendency to overshoot during bull runs and the psychological significance of $160,000 (as noted on the chart), this level seems like a realistic target.

4. Support Levels:

The previous resistance at $80,000 now acts as strong support. If BTC pulls back, this level should hold to maintain the bullish structure.

Additional support lies around $70,000, aligning with the lower boundary of the recent consolidation range.

5. Momentum Indicators:

While the chart doesn’t display specific indicators like RSI or MACD, the sharp upward move suggests strong momentum. Traders should monitor for overbought conditions on RSI (above 70) as BTC approaches higher levels, which could indicate a potential pullback.

Trade Idea:

Entry: Current price around $84,599.61 (post-breakout confirmation).

Stop Loss: Below $78,000 (to account for minor pullbacks while staying above the breakout zone).

Take Profit: $160,000 (primary target based on the pattern projection and psychological level).

Risk/Reward Ratio: Approximately 1:12, making this a high-probability setup.

Key Levels to Watch:

Resistance: $100,000 (psychological), $120,000, $160,000 (target).

Support: $80,000 (new support), $70,000 (secondary support).

Market Context:

Bitcoin’s breakout aligns with a broader crypto market uptrend, potentially fueled by positive fundamentals such as institutional adoption, favorable regulatory developments, or macroeconomic factors like inflation concerns driving demand for BTC as a store of value. Ethereum’s recent breakout (as seen in similar charts) also supports the bullish sentiment across the crypto market.

Conclusion:

BTCUSD has broken out of a multi-month consolidation pattern, confirming a bullish trend with a target of $160,000. The $80,000 level should now act as strong support, and any pullbacks to this zone could offer additional buying opportunities. Stay cautious of overbought conditions as BTC approaches higher resistance levels. Let’s see how far this rally can go!

PI – Potential Head & Shoulders Pattern Forming📉 PI – Potential Head & Shoulders Pattern Forming

We may be seeing a possible Head & Shoulders structure on the chart — a classic bearish pattern.

If the neckline breaks, this could trigger a downside move, so watch closely for confirmation!

⚠️ Not confirmed yet — stay alert and manage your risk.

📍 Key zone: Neckline support area.

🔔 Follow for more updates and live trade setups

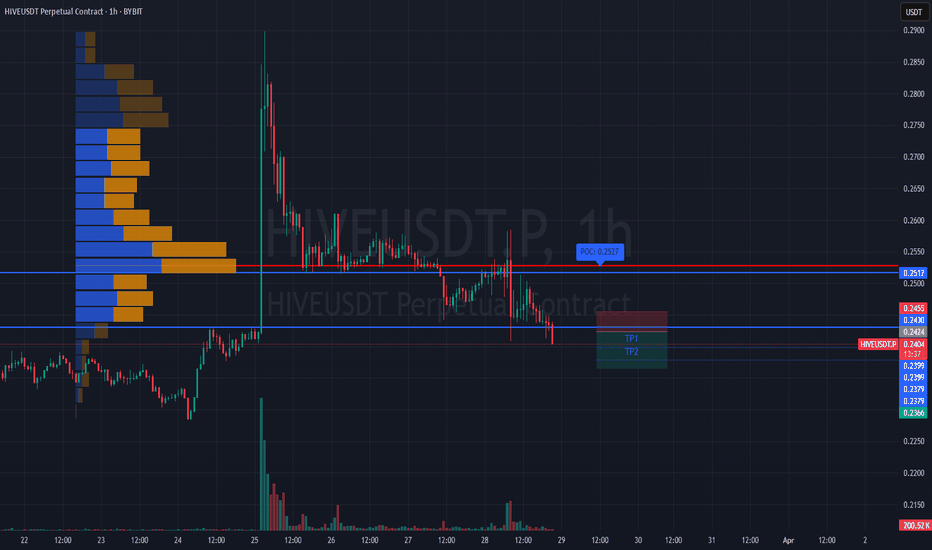

#HIVEUSDT is maintaining a bearish structure📉 Short BYBIT:HIVEUSDT.P from $0.2424

🛡 Stop loss $0.2455

🕒 1H Timeframe

⚡️ Overview:

➡️ The POC (Point of Control) is at 0.2527, marking the area with the highest trading volume and now acting as major resistance.

➡️ The 0.2455 level serves as local resistance — price has already started to decline from that zone.

➡️ Price BYBIT:HIVEUSDT.P is steadily moving lower and staying below volume clusters, confirming the bearish structure.

➡️ A breakdown below $0.2424 could lead to acceleration toward target zones.

🎯 TP Targets:

💎 TP 1: $0.2399

💎 TP 2: $0.2379

💎 TP 3: $0.2366

📢 Watch for confirmation of the $0.2424 breakdown — it’s key for continuation.

📢 If price reclaims $0.2455, the short setup becomes invalid.

BYBIT:HIVEUSDT.P is maintaining a bearish structure — expect quick target reaction if the signal confirms.

XRP/USD Skyrockets to the MoonXRP/USD Breakout Alert! After consolidating below key resistance around $2.107, XRP has surged to $7.25, hitting a target gain of 7.25x! The price has broken through multiple resistance levels, showing strong bullish momentum. Are we heading for new all-time highs? Let’s discuss!

Unpopular opinion: Bitcoin is worthless. Read why.This idea goes against what BTC whales want you to believe, but it’s my educated conclusion. Let me explain why, and it might change your perspective.

The Origins of Bitcoin

Bitcoin was the first cryptocurrency, created by Satoshi Nakamoto in 2008 as the pioneer of blockchain technology.

Big BTC holders claim it’s “digital gold” with a limited supply. Influential figures and institutions like Michael Saylor, BlackRock, and Fidelity promote this narrative, urging you to adopt their logic and buy in.

It’s true that with such big players and media support, Bitcoin’s value has grown tremendously. But does that mean their claims are valid? Let’s dive deeper.

The Problem with FOMO

Today, a coin like “Fartcoin” can pump 50% and make it into the top 100 cryptos. Why? Because convincing people to buy something often works, even if the product lacks long-term value or sustainability. This phenomenon, driven by FOMO (Fear of Missing Out), does not guarantee intrinsic worth.

Let’s Get Logical

Crypto is inherently complex and difficult for the average person to understand. Many simply follow what “smarter” people or influencers say on social media. Even major institutions like BlackRock and traditional finance (TradFi) players have only been in the Bitcoin game for a few years—they’re newcomers to the space.

Now, ask yourself: If Bitcoin is the first cryptocurrency, does that automatically make it the best?

Do we still drive the first cars ever created?

The Flawed First-Mover Advantage

BTC whales want you to believe that the first is the best and will always remain so. They ignore the concepts of improvement, innovation, and technological advancement. Essentially, they’re asking you to buy the “first car” because they own a lot of them.

In reality, Bitcoin was an experimental product that proved finance could exist without traditional banks. It was revolutionary at the time, but technology has since advanced far beyond Bitcoin. Modern blockchain projects, Layer 1 solutions, NFTs, and smart contracts are faster, more sophisticated, and more innovative.

Bitcoin is the “first car,” but it belongs in a museum. The financial system, however, is still riding it to extract as much money as possible before its limitations become widely apparent.

Bitcoin’s Lack of Utility

The internet became mainstream within five years, revolutionizing communication, entertainment, and commerce. Yet after 18 years, Bitcoin remains largely useless—propped up by those who own it and fueled by speculation rather than utility.

This focus on Bitcoin has stifled innovation, as other promising crypto projects struggle to gain attention due to the media’s obsession with BTC.

Why Bitcoin Is NOT Digital Gold

The comparison between Bitcoin and gold is misleading and fundamentally flawed:

Gold is a physical, tangible asset. It cannot be duplicated, and there are costs associated with mining, refining, and maintaining it. It has intrinsic value due to its beauty, utility, and millennia-long cultural significance.

Bitcoin, on the other hand, is a digital object. By nature, digital assets are infinitely reproducible at no cost (copy function in the computer). While Bitcoin’s cryptographic system creates artificial scarcity, its utility can be replicated and improved by countless other projects.

The Fragility of Bitcoin’s Protection

Bitcoin’s value relies on its blockchain’s cryptographic protections, which prevent duplication and ensure secure transactions. However, no digital protection has ever been immune to hacking. Over time, as technology advances, it’s possible someone could crack Bitcoin’s security, change the blockchain, or access wallets by breaking passphrases.

Do you know any protection that lasted forever? Ask Apple and their DRM, ask Microsoft with their software projections.

If that happens, Bitcoin’s value could plummet to zero. Wall Street knows this, and they are profiting while they can. When a hack or major failure occurs, they’ll exit the market, leaving retail investors to bear the losses.

Conclusion

Bitcoin is not “digital gold,” nor is it a reliable store of value. It was an incredible invention that paved the way for blockchain technology, but its time as a leader is nearing its end. Innovation and technological progress have outpaced Bitcoin, and the idea that it will remain dominant forever is a narrative pushed by those who stand to gain the most from it.

Thanks for reading.

Altcoin Market Price Prediction ChartThis innovative chart provides a comprehensive overview of price predictions for the entire altcoin market. Leveraging advanced analytics and state-of-the-art algorithmic models, it highlights key trends shaping the future of this ever-evolving market.

Whether you’re an experienced investor or simply curious about the potential of cryptocurrencies, this chart is a valuable tool to anticipate market movements and refine your strategies. Stay ahead of fluctuations and make informed decisions with a clear and concise vision of the altcoin market's future.

XRP – 15-Min Time Frame Breakout SetupI'm currently watching XRP on the 15-minute timeframe as it approaches the pink resistance level. If we get a breakout above this resistance, my target will be the grey zone, which I’ve identified as a resistance level for potential profit-taking.

Strategy: I’ll monitor the price action closely. Once the breakout is confirmed, I’ll aim for the grey zone as my next target to reduce the position or take profit.

Solana (SOL/USDT) 4H – Bullish Pennant FormationOn the 4-hour chart, Solana is forming a bullish pennant, but we haven’t seen a breakout yet. Once we break through the pennant’s resistance, my target is the green zone, which could be a good area to take profit.

Strategy: I’m waiting for a confirmed breakout from the pennant and will be targeting the green zone for potential profit-taking.

ETH - Bottoming against BTC and USDT ?**Crypto (ETH/BTC and ETH) review**

*General outlook*

Bitcoin is now facing resistance at a crucial pivot point to create the first higher high in months, BTC needs to break through the downward trendline (red) and the pivot high at $65,000. This breakthrough could push Bitcoin towards the highs of $69,000–$72,000 and bring an influx of capital to the broader cryptocurrency market.

Recently, ETH has garnered less attention as other Layer 1 and Layer 2 crypto projects have taken center stage. While ETH/BTC had initially broken down at levels not seen since april 2021, it's now reclaiming its range lows. Meanwhile, ETH/USDT has maintained its range, suggesting ETH might see gains in the coming weeks, provided Bitcoin doesn't break down.

*ETH/BTC* - On a macro scale, the ETH/BTC ratio appears to be moving in a large triangular consolidation pattern. The upward trendline, which will provide support, sits just below the 0.786 Fibonacci level of the entire last wave at 0.0369 ETH/BTC. With levels not seen since april 2021, it is possible that the narrative might shift in favour of ETH.

Zooming in, we can see a Hammer candle on high volume that created the low of the range—a potentially bullish signal. While we had broken down and confirmed from the range, ETH/BTC has since reclaimed it, though not yet confirmed. To confirm re-entry into the range, ETH/BTC needs to close with a daily candle above 0.0407 ETH/BTC. This could signal a quick push towards the range high, which coincides with the downward trendline that will serve as resistance at 0.4613 ETH/BTC.

*ETH/USDT* - ETH has held the low of the range that lies at the 1.618 extension of the previous big M-pattern and coincides with a pivot point now serving as support (see pic 2). The price has pushed through the 50D Moving Average and upward trendline (green) that served as resistance, indicating bullish strength returning to ETH. To confirm the push higher towards $3,000+, ETH needs to break $2,820.

We're still early =)

Have a nice weekend !

ZEDDIT

SUI - Bullish times ahead?

SUI has been seeing very bullish action as of late. On the very long timeframe SUI has formed a possible double bottom with an almost full retrace of the last wave up. Creating a possible Low, Higher High and Higher Low structure on a macro-level (see pic1).

When we zoom into the current view, we are holding the range after forming the first higher high on the daily timeframe in weeks. Right now, we are consolidating and probably creating a W-structure with a first broad target between 1.20-1.40$ after price successfully breaks the 1.12$ price (see pic2).

Finally, SUI’s price is also moving within a downward parallel channel after a major pump, meaning this can be considered a Bull Flag (Bullish) (see pic3).

P.S. This is my first post to try things out, sorry if it is still a bit rough around the edges.

Zeddit

ETH to drop in the next 24 hours - bearish trend Following initial inflows on their first day of trading on Tuesday, the nine spot Ether exchange-traded funds (ETFs) have experienced outflows totaling $179 million over the subsequent two days.

The outflows are driven by more than $1.1 billion exiting Grayscale's incumbent Ethereum Trust, AMEX:ETHE , which was converted into an ETF on Tuesday. Its fee is over 10 times higher than that of the asset manager’s mini Ether ETF, CRYPTOCAP:ETH , which has seen inflows of $119 million over the past three days.

BlackRock’s ETF, NASDAQ:ETHA , leads the inflow ranking with $355 million in inflows over the past three days.

The price of Ether added 2 percent to $3,240 over the past 24 hours. Drizzle will linger over Ether in the next 24 hours, signaling slightly bearish market conditions, but, over a one-week horizon, Ether will see timid sun, which indicates a mildly bullish market.

Follow us for more crypto news and weather reports!

BTC 24-hour upside potential; downside over the 7-day horizonBitcoin reached a five-week high over the weekend supported by hopes of a Republican victory in November. These were slightly dashed on Sunday when the Democratic presidential candidate Joe Biden dropped out of the race, increasing the chances of a Democratic victory. A Republican victory is seen as much more favorable for the cryptosphere.

The SEC has extended its deadline for comments on the potential listing and trading of options on trusts or ETFs holding Bitcoin to between Sept 21 and Nov 20, the US regulator said.

The price of Bitcoin dropped 1.4 percent to $66,838 over the past 24 hours, Trading View’s Bitcoin chart shows. ATTMO forecasts a sunny day ahead for Bitcoin, indicating a potential upside, yet, drizzle within 3 days, extending to the next week, which could announce a bearish trend and downside for the biggest crypto.

Follow us for more crypto news and weather reports!

ETH - bullish 24-hour upside expected!Listing of 8 spot ETH ETFs is expected on July 23! The deadline for returning the final S-1 registration forms for the eight-spot Ether ETF has been set for July 17 by the Securities and Exchange Commission (SEC).

“SEC finally gotten back to issuers today, asking them to return FINAL S-1s on Wed (incl fees) and then request effectiveness on Monday after close for a TUESDAY 7/23 LAUNCH,” conditional on no last-minute hurdles, Bloomberg’s ETF analyst Eric Balchunas, said.

Meanwhile, Reuters reports that Blackrock, Franklin Templeton and VanEck have obtained “preliminary approval” for their spot Ether ETFs. Such ETFs hold an equivalent amount of the underlying asset, contrarily to future ETFs that track futures contracts of the underlying asset rather than the asset itself.

The price of Ether rose 2.3 percent to $3,437 over the past 24 hours. ATTMO predicts strong sun for Ether in the next 24 hours, signaling bullish trend and upside potential over this time horizon.

Follow us for more crypto news and weather reports!

Solana forecast: mostly sunny with upside potential According to ATTMO, Solana is expected to encounter mostly sunny 🌤️ trading conditions in the next 24 hours, indicating slightly bullish potential. Solana is already up 1.8 percent compared to yesterday and is currently trading at around $140. ATTMO predicts rainy 🌧️ trading conditions for Solana in three days, but a recovery and more upside potential ☀️ in seven days. Follow us for more crypto news and weather reports!

BTCUSD: High chance to see 75k+ soon. Here's why!Please see previous btc ideas for more context

☝️Do not act based on my analysis, do your own research!!

The main purpose of my resources is free, actionable education for anyone who wants to learn trading and improve mental and technical trading skills. Learn from hundreds of videos and the real story of a particular trader, with all the mistakes and pain on the way to consistency. I'm always glad to discuss and answer questions. 🙌

☝️ALL ideas and videos here are for sharing my experience purposes only, not financial advice, NOT A SIGNAL. YOUR TRADES ARE YOUR COMPLETE RESPONSIBILITY. Everything here should be treated as a simulated, educational environment. Important disclaimer - this idea is just a possibility and my extremely subjective opinion. Do not act based on my analysis, do your own research!!

ETH facing ☁️, downside risk for the next 24 hours The SEC approved the spot Ether ETF applications of eight asset managers overnight. Blackrock, Ark Invest, Van Eck and Hashdex are some of them.

“We are so thrilled to confirm that the SEC has approved, pursuant to Section 19(b) of the Securities Exchange Act of 1934, our exchange partner CBOE’s proposed rule change to list and trade a @vaneck_us spot #Ethereum ETF on the CBOE!” said the Head of Digital Asset Research of one of the asset managers, Van Eck’s Matthew Sigel.

The above-mentioned approval does not suffice for the listing of the spot ETFs. The asset managers now need to get their S-1 Form (the proper registration statement of the financial product) approved as well and this might take time.

The price of Ether rose 0.5 percent to $3,740 over the past 24 hours. QCP, a crypto asset trading firm, forecasts that its price could rise to $6,000 as a result of this approval, Bitcoin.com reports.

Mixed trading conditions and bearish clouds lie ahead for the global crypto market in the next 24 hours, Ether included. This signals downward pressure. Over a one-week horizon, the sun should break through and shine over it, indicating upside potential.

Follow us for more crypto news and weather reports!

If we skip the summer then 135k soonI am tentatively looking at this summer that we will probably skip it and we will have the peak in place at the end of 2024 already at the beginning of 2024, so if I am 99% wrong again, we will soon be testing 44k and then 69k.

Fasten your seat belts, find the puke bags and enjoy trading safely =D

vVv