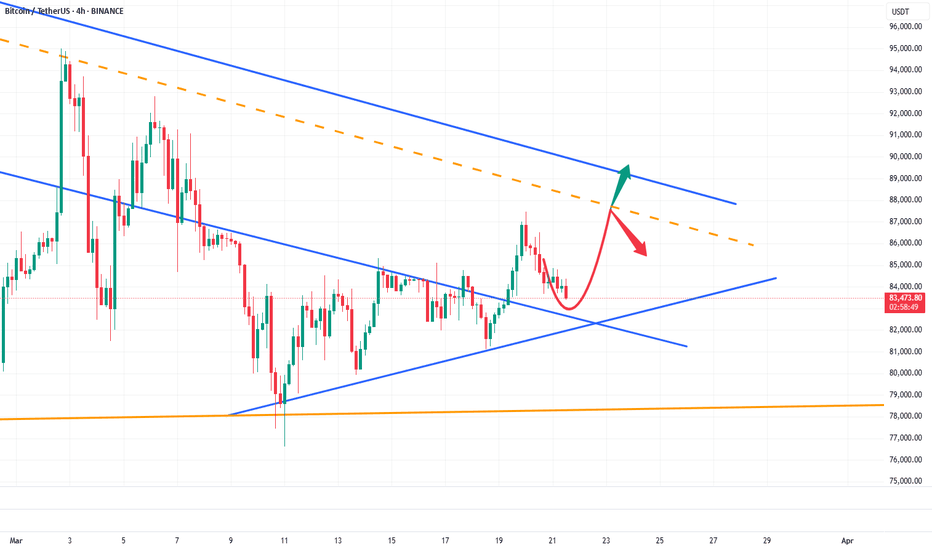

BTC: Accumulate energy for the rise and soar into the sky!📍BTC's volatility has narrowed, with selling pressure showing signs of weakening. Throughout the choppy price action, the 84000-83500 zone has established itself as a critical support area in the short-term structure. This level now serves as a key defensive line.

📍Following this consolidation phase, BTC may stage a rebound from this support region. If the price manages to break through the resistance around 84800 with strength, further upside momentum could drive it towards the 90000 level.

🔎Trade Idea:

BTCUSD:Buy at 83500-83000

TP:84500-85000

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Cryptorhythms

ENJ USD one of the few tokens worth your timeA fantastic project constantly in development with real world use.

I think there is still time for entry just below current price.

Dashed white lines are my take profit

Dynamic RSI Zones indicator by Cryptorhythms

DRSI settings

RSI 14

Overbought Decay 60

OversoldDecay 60

TF 3D

t.me

For more information join the CryptoRhythms Telegram group and tell them Flinty sent you

BTC The best things come to those who waitWith everyone screaming long, 16k, ATH, Bull Run, Parabolic...

Pour yourself a glass of your favourite smooth bourbon on the rocks.

Sit back, zoom out and slowly take a sip.

There's no rush.

Just look at the volume profile.

Place your long orders below 5k.

The price should go a little lower than that for the entry of champions.

Check back next week.

Go enjoy your weekend.

If you don't subscribe to CryptoRhythms indicators, check them out.

On this chart is Dynamic RSI zones

Telegram: t.me

or check out the TradingView page for a whole suite of free or professional indicators

www.tradingview.com

The Inverse PhoenixIn Ancient Greek folklore, a phoenix is a long-lived bird that cyclically regenerates or is otherwise born again. Associated with the sun, a phoenix obtains new life by arising from the ashes of its predecessor.

Will Bitcoin Rise from the Ashes?

Possibility to see the rare fulcrum pattern, if we get another mini ihs pattern forming on the right side.

This would fuel a rise for an epic short squeeze.

Or kektinuation will be assured if the right wing fails to materialize.

Bottom shorting and BitMEX 10x liquidation level CONSPIRACYThis chart shows levels at which people entered short and the levels at which they liquidate using 10x leverage on BitMEX

Blue boxes short entry

Red boxes liquidation level

Volume profile indicator seen on the left was used to determine this.

WHITE - BUY VOLUME

GREY SELL VOLUME

Life is full of coincidences right?

Look at how quick liquidation levels are reached after shorting the bottom

Then look how quickly the price drops again afterwards.

Still think trading contracts on BitMEX is a good idea?

The indicator is only available with a trading view subscription

If you don't already have one, please use my referral link.

Click the link then go to sign up.

tradingview.go2cloud.org

If you noticed the Dynamic RSI indicator at the bottom,

Yes it indicates buy and sell levels and supports alerts.

For more info please head over to this Telegram channel for details on how to obtain.

t.me

Just mention Flinty sent you

Miner Capitulation Recovery? Buy signal on Hash RibbonsMiner Capitulation / Hash Ribbons has signaled a buy on daily suggesting that hash rate is stabilizing. Hash ribbons flipped a few days ago and today the SMA 10 crossed over the SMA 20 which is the secondary condition for a long.

Looking at a long term scope, this strategy was supposed to beat even an early buy & hold. Mostly by reducing drawdowns significantly. So I made a quick backtest to see if the number actually held up and they do. $100 invested in MC versus a buy & hold. It significantly outperformed!

Realize this is not a quick in and out strategy, as you can see average trade is held for a few months. It does accomplish the goal of reducing drawdowns though (but not eliminating them). Now all we need is a time machine to play this from 2011 onwards. :)

Have a kick ass & prosperous 2020 everyone!

Similar pattern from 2018Comparing price action, volume, moving averages.

About half the volume this year

Pattern is very similar

Below MA's, same as last year

Looking at 6900 for long but 7200-7300 is support, so being patient and won't enter until support confirmed over the next few days probably.

Log vs Linear parallel channel comparisonOn the left is the log chart with parallel channels.

Notice the price just wicked close to the bottom of the main up channel and the bottom of the current down channel for LTF

On the right is the linear chart with parallel channels.

Notice the 11-12k candles rejected off the centre of the main up channel and we are below the centre of the current down channel for LTF

it's a bit basic and the channels might not be accurate depending on TF viewed and if you want to include candle bodies or wicks but it will give you an idea.

Shakeout/spring vs Drop after distribution On the left we have the coinbase 4hr chart from October.

You can see the shakeout drop from 7990 to 7300

There is a spike in volume which acts as a spring to pump price to 10540

On the right we have the coinbase 4hr chart from November.

Don't be fooled in to thinking this is the same price action.

After distribution finished, the price dropped.

Slowed by the moving average, walls on exchanges to encourage people to long.

Compare the volume profile.

So far there is no volume here and once enough leveraged longs are in, I expect the drop to continue.

There could be a small rise to liquidate bottom shorters, in which case I would be looking at 9030-9070.

BTC Wyckoff AccumulationPS - Preliminary Support (buys provide a bounce to slow move down)

SC - Selling Climax (Buys absorb remaining sells , end of panic sell off)

AR - Automatic Rally (Price rise caused by volume buys and lack of sells on the orderbook)

ST - Secondary Test (retest of support, may occur multiple times)

Shake Out - Volume sell to drop price encouraging inexperienced traders to close their longs opened at ST and possibly cause additional panic sells

Spring - Buy orders filled from Shake Out and price rises sharply and orders clear remaining sell orders

Test - Test of available supply. Low supply results in price mark up breaking previous resistance levels

SOS - SIgn of Strength (Often a result of high volume buying or fomo after a spring)

LPS - Last Point of Support (Test for Resistance / Support flip, Puillback)

BU - Back-up - After a jump across the creek move, the price often experiences retest of support and will pull back close to the low after the SOS

TR - Trading Range (Caused by profit taking at the end of the SOS and re-accumulation at the new price range)

Length / duration can vary.

Set range high as next high after SOS

Set range low as LPS after SOS

BTC at channel bottomSo price finally broke both Symmetrical triangle and Descending triangle on the Daily chart.

Price is currently at the bottom of the upward channel on the Monthly and the Downward channel on Weekly / Dailly.

If you are following the 16k possibility called for October, that would put the price at the top of the upward channel for the end of October.

I have marked the futures expiry dates on the Daily with vertical dashed lines.

I have also marked the quarter ends on the monthly with the same lines.

I closed all longs when price broke the bottom of the box where another bounce from the descending triangle back into the symmetrical triangle was expected and opened shorts.

I have longs around 5900 marked with a horizontal line '3 MONTH waiting for retest'.

Will keep an eye on funding as even with the pumps I have been taking advantage of longs pay shorts on funding.

I may open long around 7300-7500, 6900 6400 depending on price action but in no rush at the moment

Bitcoin building long - consolidation - clearing orderbooksBuilding long below 10k

Action looks like order books being cleared for fast moves

Chart has TV volume profile indicator

if you don't have a subscription, use my referral and get one.

tradingview.go2cloud.org

SmartFibo

Bull Bear FIlter and BBF Signals, see my good friend:

t.me

www.tradingview.com

MCMA - Multi custom moving average just my own script to show multiple moving averages

Difficulty Ribbon - A New Blockchain Based Bitcoin IndicatorIntro

Introducing the Bitcoin Difficulty Ribbon. When the ribbon compresses, or flips negative, these are the best times to buy Bitcoin. The ribbon consists of simple moving averages on mining difficulty so we can easily see the rate of change in difficulty.

Attribution

This Indicator was created by Willy Woo of Woonomics based upon the ideas of Vinny Lingham.

An in depth article can be found here regarding the difficulty ribbon: woobull.com

Extras

We added some Moving Average options to choose from if you want to experiment.

We also added background coloration signals. Yellow is the beginning of compression, and green is the fully compressed or inverted signal.

Use these signals as an added confirmation signal alongside other blockchain based FA or long term TA indicators.

Instructions to add to the chart correctly

1.Add Indicator, and it will appear below price chart.

2.Click on the ribbon line and drag it up onto the price chart. (gives you separate scales)

3.Set both price and difficulty ribbon scale to logarithmic (right click on scale)

Cryptorhythms

Did you Like this idea? Do you like Free Indicators (check my profile)? Please give this idea a like and follow me! I regularly post crypto analysis, price action strategies and free indicators.

Questions? Comments? Want to get access to an entire suite of proven trading indicators? Come visit us on telegram and chat, or just soak up some knowledge. We make timely posts about the market, news, and strategy everyday. Our community isn't open only to subscribers - everyone is welcome to join.

For Trialers & Chat: t.me/cryptorhythms

July 4th Action & CME Gaps to Fill July 4th Action & CME Gaps to Fill

Just a few quick thoughts about our current situation... as always not financial advice, DYOR, etc!

I think the chart write up mostly speaks for itself. Still a few CME gaps to close one above us @ 11,500-12000. I suspect we may end up in this area tomorrow.

Then on the 4th of July when CME is close we gap down. There are a few gaps below us the first one at 8500-8900, which I think we will test. Then there is another at 7200-7450 that was only partially filled.

There is a scalp long opportunity available for the near term followed by a contraction afterwards.

Did you Like this idea? Do you like Free Indicators (check my profile)? Please give me a like and follow! I post crypto analysis, price action strategies and free indicators regularly.

Questions? Comments? Want to get access to an entire suite of proven trading indicators? Come visit us on telegram and chat, or just soak up some knowledge. We make timely posts about the market, news, and strategy everyday. Our community isn't open only to subscribers - everyone is welcome to join.

For Trialers & Chat: t.me/cryptorhythms

Next Bitcoin Bull Run Climax -Top Cap Derived EstimateTop Cap Derived Estimate for Next Bull Run Climax

Intro

A great indicator to use for catching the upper bounds in a bull run is top cap. Historically it has perfectly coincided with previous blow off tops. Another good one to use is the Puell Multiple . Let me also qualify this long positon as a HODL / long term position - not a speculative move.

Description

TopCap = Average Cap * 35

TopCap / TotalCoinSupply = Estimated Bullrun Climax

Ideas/Hypothesis

Please note that as the next bullrun occurs, Top Cap will continue to rise as well, which is why this is not an absolute value, but rather a potential range. I think anywhere from 50-90k is possible based on this setup.

Peak/Plateau Cycle

After a climax, and during a bear market, the top cap will continue increasing until it reaches a plateau point. I call this "Peak to Plateau." Then it goes flat for a bit and starts increasing again as the next bull cycle materializes. 'I call this Plateau to Peak."

As time goes on, the percent increase of each peak/plateau phase is diminishing (as other indicators corroborate as well, such as the Mayer Multiple or MVRV).

Your thoughts?

Do you have an opinion or idea regarding Top Cap, or the price projections here? I would love to hear your input so I can further refine and improve the indicator!

Closing Remarks

Enjoying this indicator/idea or find it useful? Please give me a like and follow! I post crypto analysis, price action strategies and free indicators regularly.

Questions? Comments? Want to get access to an entire suite of proven trading indicators? Come visit us on telegram and chat, or just soak up some knowledge. We make timely posts about the market, news, and strategy everyday. Our community isn't open only to subscribers - everyone is welcome to join.

For Trialers & Chat: t.me

BTC potential targets aboveI am currently looking for indication the next move will take us to the 61.8, possibly 78.6 fib

The 61.8 fib lines up with current level and size of earlier candle 3240 - 3470

Looking at volume profile I have orders to add long if we retouch the 3240 support or wick to 0 fib at 3200

I already have a short open from 36 so will keep a close stop on long, 3160-3180 but will be monitoring the price if it drops to that level

Magenta dashed lines are just rough support / resistance lines

Grey boxes are order blocks from last year

Purple and Blue vertical lines are just guides for candle height

Signals from Crypto-Sticks TSI - Long signal on QSPAnother entry for you all in the public library Crypto-Sticks series. More STILL to come! What I particularly love is these indicators give you an added 3rd dimension to viewing them otherwise. You can see how much fluctuation occurred, get better divergence signals, find higher/lower extremes, and use in combination for secondary confirmation!

Here's an example of how to use the Crypto-Sticks TSI for trading signals. I also plotted this range's signals the indicator would've generated. TSI allows you to ride a trend longer than RSI, but its also slightly lagging.

Please remember that you will potentially have to adjust the TSI overbought and oversold levels to suit the volatility of the instrument you are working with. In the future I will implement a feature that does this automatically, but for now its manual.

The OB/OS zones are given in two levels, because often you can find a line of best fit that will hit "small movements" and one that will hit "big movements."

Heiken Ashi (default setting) candles adds some more clear trend changing points which can be executed at the second candle going in either direction. Other coins/charts will require their own strategy - you could potentially have to tweak that parameter. In this example you would enter on 2nd green, exit on 2nd red. Example on HA:

Volume weighting the HA candles adds a different dimension to the indicator which I have to explore more fully. Please note on this indicator i believe it provides no additional value, but I left it in as YMMV. An example of VW+HA:

Enjoying this indicator or find it useful? Please give me a like and follow! There are many more indicators to be released in this series, not to mention I post crypto analysis and other free indicators regularly.

Questions? Comments? Want to get access to an entire suite of proven trading indicators? Come visit us on telegram and chat, or just soak up some knowledge. We make timely posts about the market, news, and strategy everyday. Our community isn't open only to subscribers - everyone is welcome to join.