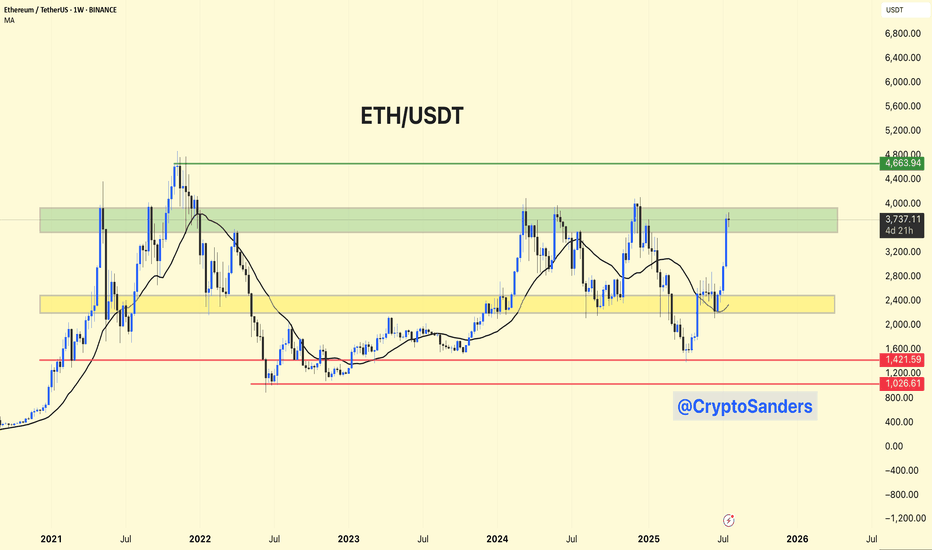

ETH/USDT – Weekly Chart Analysis !! ETH/USDT – Weekly Chart Analysis

ETH is testing a major historical resistance between $3,700 – $4,000 (highlighted green zone).

A clean breakout above this level could push price toward the next key resistance at ~$4,660.

Previous accumulation zone around $2,400 – $2,800 (yellow box) now acts as strong support.

Long-term floor at $1,420 and $1,025, though currently far below.

Bullish Breakout Potential: If ETH sustains above the green resistance, it may retest $4,660+.

A failure to break above $4K could lead to a healthy pullback toward the yellow zone (~$2,800).

Stay updated and manage your risk accordingly.

DYOR | NFA

Cryptosanders

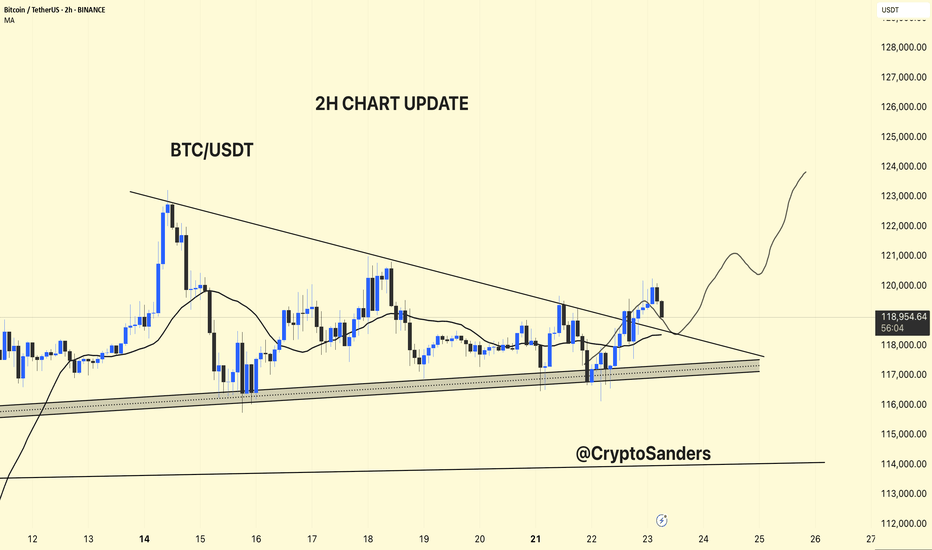

BTC/USDT – 2H Chart Update!!BTC/USDT – 2H Chart Update

Breakout Confirmed:

BTC has broken above the descending trendline but is currently facing resistance at around $ 119,500.

Support Zone:

Strong ascending support between $ 117,000 and $ 118,000 remains intact.

Moving Average:

Price is currently testing the 2H MA (~$118.3). Holding above this could confirm bullish continuation.

Outlook:

If BTC holds above $ 118,000, a move toward $ 123,000–$ 125,000 is likely.

Failure to hold may retest $117K support.

Bias: Short-term bullish unless price breaks below ascending trendline.

Thanks for your support!

DYOR. NFA

ETH/USDT 1DAY CHART UPDATE !!ETH has broken out of a long-term downtrend (black diagonal trendline) and is now in a consolidation phase below the $2,800–$2,850 resistance.

The price is currently $2,612, showing hesitation below the key horizontal resistance.

Resistance Zones:

$2,800–$2,850: Key horizontal resistance. Breaking above this confirms bullish continuation.

$3,200 and $3,600: Medium to long-term bullish targets.

Support Zones:

$2,000–$2,200: Strong horizontal support + ascending trendline + 50 EMA (red line)

$1,410: Key long-term support (unlikely to be tested soon unless the market reverses)

ETH breaks and closes above $2,850 ➝ $3,200 → $3,600 → $3,800+ likely to rise

The structure suggests that a higher low will likely form before the breakout.

If ETH rejects at $2,850, expect a retest of $2,000–$2,200 (golden zone)

This would create a bullish higher low setup and could be a strong buy-dip opportunity.

Thanks for your support!

DYOR. NFA

BTC/USDT CHART UPDATE !!Chart Pattern: Inverted Head and Shoulders (iH&S)

The chart shows a classic reversal pattern of the head and shoulders formation.

Left Shoulder: Late January 2025

Head: April 2025

Right Shoulder: Potentially forming near current levels (~$100K–$102K)

This bullish reversal pattern often leads to a strong bounce if the neckline is respected.

Support Zones:

$98,000 – $100,000: 50 EMA (red) and retest of the area near the neckline

$94,500 – $95,000: 200 EMA (green), last resort support

Resistance Levels:

$108,000 (horizontal neckline resistance)

$112,000 and $125,000 (bullish breakout targets)

Scenario Outlook

Bullish Case: If BTC maintains the $100K area and breaks above $108K with volume → rally towards $115K–$125 K.

Bearish Case: Breakdown below $94K invalidates the iH&S structure.

Thanks for your support!

DYOR. NFA

BTC/USDT Chart Analysis.

BTC has been in an uptrend since early April 2025, breaking above a strong horizontal resistance line (visible in the chart).

However, we can now observe a descending channel (falling wedge) after the peak, indicating a potential pullback.

Support Levels:

The price has tested the 50-day SMA (red) and is approaching the 200-day SMA (green), which is a strong dynamic support (around $94,740–$98,000).

Horizontal support lines are around the $103,000 and $100,000 levels, acting as immediate support.

Price Pattern:

The pattern resembles a bullish flag or descending wedge, suggesting a possible continuation of the previous upward move if a breakout occurs.

Before a bullish reversal, a retest of support levels (highlighted in the blue circle) near the moving averages is possible.

Future Path (as drawn on the chart):

Possible pullback to around $100,000–$98,000 levels.

Reversal and breakout are expected to be between $112,000 and $115,000 initially, and possibly higher to $125,000–$130,000.

Volume & Momentum:

No volume data is shown, but the price action indicates a correction with weakening momentum.

Trend lines are sloping upwards, indicating underlying strength despite the correction.

Trade Setup Based on This Analysis

Entry Zone: Around $100,000–$98,000 (if price tests support and forms reversal patterns like a bullish engulfing or hammer).

Stop-Loss: Below $94,000 (below the 200 SMA and the trendline support).

Short-Term Target: $112,000–$115,000.

Mid-Term Target: $125,000–$130,000.

Risk Considerations

If BTC breaks below the 200 SMA and horizontal support near $94,000, the trend may weaken.

Thanks for your support!

DYOR. NFA

USDT dominance chart!The chart shows USDT.D (Tether dominance) moving within a descending channel.

Currently, USDT.D is testing the upper resistance of the channel, around 4.65%.

If the dominance gets rejected at this level, the next potential target is the lower channel support around 3.9-4.0%.

This could indicate a risk-off environment where traders move capital from stablecoins (USDT) to more volatile assets like Bitcoin or altcoins.

The 50 and 200 moving averages provide dynamic resistance levels that support this potential downside move.

Thanks for your support!

DYOR. NFA

ETH/USDT – Weekly Chart AnalysisETH/USDT Unique Technical Structure: Large Accumulation + Recovery Setup

This chart shows Ethereum’s price action over the past few years, highlighting key support and resistance areas. A strong visual signal (blue arrow) indicates bullish potential.

Chart Pattern Implications:

The pattern on this chart is not a classical shape (e.g., cup and handle), but it does show a Wyckoff-style accumulation phase followed by a failed breakout and reaccumulation:

Strong base formed between $1,000-$1,400

A series of lower highs and a range-bound structure after the 2022 peak

The bullish projection illustrated by the arrows shows a potential recovery towards the ATH again

This setup suggests that Ethereum is at a critical juncture – either:

It retests current support and begins a new uptrend.

Or it risks another test of the $1,400-$1,050 range before a breakout.

Risk-Reward: Current levels ($1,796) offer attractive long-term entries if you’re bullish.

Caution Zone: If ETH breaks below $1,400 with volume, $1,050 becomes the next key defense.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT – Weekly Chart Analysis (Long-Term View)BTC/USDT Chart Pattern: Multi-Year Cup and Handle Formation

The chart shows a textbook “cup and handle” formation, a highly reliable bullish continuation pattern. This pattern has played out over several years (2021-2025), indicating long-term accumulation and a breakout attempt.

Cup Phase:

Extended from mid-2021 to early 2024.

Formed a deep and rounded base, often indicating institutional accumulation.

The rounded lows reflect a gradual sentiment recovery from the 2022-2023 bear market.

Handle Phase:

A short-term consolidation after moving above the $70,000-$74,000 resistance area.

Price action pulled back marginally after hitting $110,000, forming higher lows near $85,000.

The structure resembles a bull flag or pennant, which is usually seen before the next upward move.

Key Support and Resistance Areas:

Key Support $70,000–$74,000. Previous resistance turned into support

Psychological Support $85,000 Local Retracement Low

Immediate Resistance $100,000–$110,000 Near ATH, selling pressure area

Long-term Target $130,000+ Measured move from cup pattern

Volume: Volume was high during the breakout from late 2024 to early 2025, which validates the breakout from the cup resistance area.

If BTC breaks above $100,000–$110,000 with strong volumes, we can expect continuation towards:

$130,000 (short-term target)

$150,000–$180,000 (extension based on pattern symmetry)

Bearish Risks:

Failure to hold $85,000 could lead to a retest of the $70K support area.

Sustained breakdown below $70K would invalidate the bullish pattern, but this seems unlikely given the strong fundamentals and macro structure.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Based on the BTC/USDT 4-hour chart:Current Price Levels: Bitcoin is currently trading around 85,269.35 USDT.

Support and Resistance:

Support Zones: A crucial support zone marked in green suggests strong buying interest between 80,000 and 81,000 USDT.

Resistance: The upper trend line indicates resistance; if Bitcoin can break it, it could target levels close to 88,000 USDT.

Bullish Case: A breakout above the upper trend line could lead to an upward rally towards 88,000 USDT or above.

Bearish Case: If the price breaks below the support zone, a downward move toward 75,000 USDT can be expected.

Monitor the trade closely to see how it reacts around these crucial levels. Based on the price action, adjust your strategy accordingly. Feel free to ask if you have further questions or need analysis on specific indicators!

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT 1DAY CHART UPDATE !!50-day moving average (red line):

This is a short-term trend indicator. It reacts more quickly to price changes and is often used to identify short-term trends.

When the price is above this moving average, it usually indicates bullish momentum; when it is below, it may signal bearish momentum.

200-day moving average (green line):

This is a long-term trend indicator. It provides a smooth moving average that helps identify the overall trend over a long period.

A price above this line indicates a long-term bullish trend, while a price below it indicates a potentially bearish market.

Current Analysis

Price Action: As of the current date, the price is hovering around the 80,000 USDT, just below the 50-day MA, which may indicate a potential resistance area.

Convergence of MAs: The behavior of both the 50-day and 200-day MAs can provide insight:

If the 50-day MA crosses above the 200-day MA (a “golden cross”), this typically indicates a bullish signal.

Conversely, if it crosses below (a “death cross”), this can indicate a bearish sentiment.

Support and Resistance: The chart also shows areas of support (horizontal green lines) around 76,000 to 80,000 USDT. If the price breaks this resistance, it may have room to move towards the next levels indicated.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT 1DAY CHART UPDATE !!A downward trendline connecting the recent high points indicates bearish pressure.

A horizontal support level around 77,500 USDT shows where the price has struggled to drop.

Current Price:

As of your chart's timestamp, BTC is trading at approximately 79,883.75 USDT.

Potential Movement:

If the price can break above the descending trendline and stay above the support level, there could be potential upward momentum. The upward arrow suggests a bullish outlook.

Key Levels to Watch:

Resistance: Look for resistance at trendline breaks and the next significant levels above the current price (e.g., 82,500 USDT).

Support: The 77,500 USDT level is crucial; a drop below it could signal further downward movement.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT 4H Chart Update. Current Price: ~$78,336

BTC has broken below the symmetrical triangle and is testing the key horizontal support between $78,424 and $79,183.

A wick is visible below the support, but the candle closed within the area, indicating a potential fakeout or demand absorption.

Resistance (downtrend line): ~$85,500

Support Zones:

Primary: $78,424

Secondary: $79,183

Immediate Resistance: $82,000 – $83,000 (recent breakdown zone)

Outlook & Scenarios:

Bullish Reversal Scenario (Green Arrow):

The green arrow projection suggests a potential bounce from this demand zone.

If BTC reclaims $80K+ with strong momentum, it could aim for the descending trendline near $85K.

A bullish confirmation would be a 4H candle close above $80.5K–$81K.

Bearish continuation (if support fails):

If the price fails to hold this support zone, the next downside targets could be:

$76,000

$73,500

Sentiment factor:

The previous sentiment (Fear & Greed Index: 28 – Fear) reflects ongoing market caution.

Price action near key support in the fear zone could trigger a short squeeze or panic sell-off, depending on volume and reaction.

Summary:

BTC is at crucial support, and unless volume confirms a deeper breakdown, the bounce is likely to be short-lived.

Moving back above $80K would signal that bulls are regaining control.

Want any strategy ideas for trading this setup?

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT 4H Chart Analysis !!Current Price: $83,809

The chart shows a symmetrical triangle pattern, indicating a possible breakout soon.

Upper Resistance: Around $86,000

Lower Support: Around $82,000

Key Support Levels: $79,183 and $78,424

Bullish Breakout (Green Arrow)

If BTC breaks above the resistance trendline (~$86K), it could see a strong move towards $90K-$92K.

Confirmation would be a candle close above $86K with volume.

Bearish Breakdown (Red Arrow)

If BTC loses the support trendline (~ GETTEX:82K ), it could drop towards $79K-$78K.

The candle closing below GETTEX:82K could fuel further selling.

Market Sentiment:

Fear & Greed Index: 28 (Fear) – Investors remain cautious.

The direction of the breakout will depend on market sentiment and volume.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC Dominance Chart Analysis. 50-day MA: 61.94% (Notable Support Level)

200-day MA: 59.21% (Strong Support)

Trend: The chart shows a bullish trend in BTC dominance since the beginning of the year, with higher lows forming.

Resistance Level: A key resistance area lies around 63%, which the price is currently testing.

Support Level: The 50-day and 200-day moving averages provide solid support below current levels.

Update Points

Short-term outlook: If BTC dominance stays above 62%, it could reach 63% resistance.

Long-term indicators: Continued support at the moving averages suggests bullish sentiment if BTC can maintain its position.

Market Conditions: Monitor fluctuations in altcoin performance, which could impact BTC's dominance positively or negatively.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT 1DAY CHART UPDATE !!A downward trend line indicates resistance; the price is struggling to move above this line.

The green line at around 78,000 to 79,000 USDT is a crucial support level, providing a base for the price movement.

Recent fluctuations: The price shows a recent bounce, indicating a potential bullish reversal if it breaks the trend line.

Future forecast: The upward arrow indicates a bullish outlook; if the upward movement continues, then targets around 102,500 to 110,000 USDT can possibly be set.

If you have specific questions or need further analysis on certain aspects, feel free to ask!

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT 4-Hour Chart Analysis. The chart shows Bitcoin (BTC) previously trading within an ascending channel (marked by two parallel black lines).

Recently, BTC broke below this channel, signaling a bearish shift in momentum.

BTC is currently attempting to retest the lower boundary of the broken channel.

This is critical—if BTC fails to reclaim the channel, it could confirm a downtrend continuation.

The chart suggests a possible short-term bounce toward resistance around $85,000-$86,000.

However, after this retest, BTC is expected to drop sharply toward $79,000 - $78,400 (green support zone).

$79,059 & $78,424 are identified as key support zones.

If BTC reaches these levels and holds, a rebound is possible.

If broken, BTC could see a deeper decline toward lower levels.

Breakout invalidation: If BTC breaks above $86,000 with strong volume, it could regain bullish momentum and move higher.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

USDT.DOMINANCE 4HOUR CHART UPDATE !!A downward trend in USDT dominance typically signals growing confidence in riskier assets (such as Bitcoin and altcoins), as traders move funds out of stablecoins and into crypto investments.

Breakout Attempt

The latest price action shows a breakout from the descending channel.

This signals a potential reversal, during which traders may return funds to USDT due to market uncertainty or a correction in crypto prices.

The black line forecasts a strong upward move in USDT dominance.

If this happens, it could indicate that investors are selling crypto holdings and moving funds into stablecoins in anticipation of a market decline.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Ethereum (ETH/USDT) 1D Chart Update ETH is still trading inside a descending channel, showing signs of a possible reversal. The price is bouncing off support levels around $1,750-$1,830, with a possible retest of higher resistance levels. The 50-day moving average (red line) is acting as a dynamic resistance above the price.

Bullish scenario: ETH needs to sustain above $1,830 to confirm a short-term correction. If ETH breaks the $2,200-$2,400 resistance zone, a rally toward $2,800-$3,000 could follow.

Bearish scenario: Rejection at the resistance could push ETH back towards $1,830 and possibly $1,750. A loss of $1,750 could trigger a further decline towards $1,600.

Resistance: $2,200, $2,400, $2,800

Support: $1,830, $1,750, $1,600

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Bitcoin (BTC/USDT) 4H Chart Update. BTC has broken out of a descending triangle, leading to a strong upside.

Currently trading inside an ascending channel, facing resistance near $90,000.

Bullish Scenario:

If BTC holds above $87,000-$88,000, a continuation toward $92,000-$95,000 is possible.

A strong breakout from this channel could lead to an attempt at $100,000.

Bearish Scenario:

A rejection at the channel's top may push BTC back to the $84,000-$85,000 support level.

If the support breaks, BTC could drop to $79,000-$78,400

Resistance: $90,000, $92,000, $95,000

Support: $85,000, $84,000, $79,000

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BNB/USDT Daily Chart Update. BNB remains inside a descending channel, facing resistance at the upper boundary.

Ichimoku Cloud Resistance: The price is struggling to move above the red Ichimoku Cloud, which may indicate continued bearish pressure.

100MA Rejection: The 100-day moving average (purple line) acts as a strong dynamic resistance.

Bearish Scenario:

If the rejection persists, BNB could drop towards $500-$480, which aligns with the lower channel support.

A confirmed breakdown would extend losses towards $450 and lower.

Bullish Breakout:

A breakout above $663 and the 100MA would increase momentum, potentially targeting $750-$800. A breakout of the descending channel would confirm a trend reversal.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Bitcoin (BTC/USDT) 4-hour chart.

Price: Currently around $82,753.16, showing a slight increase of +0.05%.

Trend line: A descending trend line is visible, indicating potential resistance. If the price breaks above this line, it could signal a bullish reversal.

Support level: There is a strong support level at $78,424.30, which has been tested multiple times.

Indicators: The price is currently in the cloud, indicating a state of indecision. The green cloud above indicates potential resistance, while the red cloud below indicates previous bearish momentum.

Resistance: Keep an eye on the descending trend line and the upper edge of the cloud.

Support: The $78,424 level acts as a crucial support area.

Monitor breakouts: A breakout above the trend line may indicate an uptrend, while a breakdown below the support level may signal a further decline.

Volume analysis: Monitor trading volume to confirm breakouts.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

ETH/USDT Weekly Chart Analysis. The Ethereum (ETH/USDT) weekly chart suggests a potential bullish reversal from a key support area. Here are the details of the analysis:

Support area: Around $1,750 – $1,830, where the price recently rebounded.

Resistance levels:

First target: $4,015

Key resistance: $4,663, which marks a key breakout level.

ETH has bounced off historical support levels, indicating potential accumulation.

If the price sustains above $1,800, the next target is $4,015, followed by $4,663 if the momentum continues.

A break below $1,747 – $1,700 could lead to further declines, with the next strong support near $1,053.

Look for a confirmation of a breakout above $2,000 to confirm a strong uptrend.

Keep an eye on volume and indicators (RSI, MACD) for further confirmation of momentum.

Risk management is important in volatile market conditions.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

BTC/USDT 4HOUR CHART UPDATE !!The BTC/USDT 4-hour chart suggests a descending channel pattern, indicating a possible continuation of the bearish trend until a breakout occurs.

Descending Channel:

Price activity remains within a downward-sloping channel, with lower highs and lower lows.

The upper trendline acts as resistance, while the lower trendline provides dynamic support.

Resistance: Near $85,000 to $87,500, aligned with the upper trendline.

Support: Around $78,424, the lower limit extending to $72,000 if a breakdown occurs.

(Red Arrow):

If BTC fails to break the resistance, it could drop towards $78,424 and possibly lower.

(Blue Arrow):

A breakout above the descending channel (~$87,500) could trigger a bullish run towards $90,000+.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA