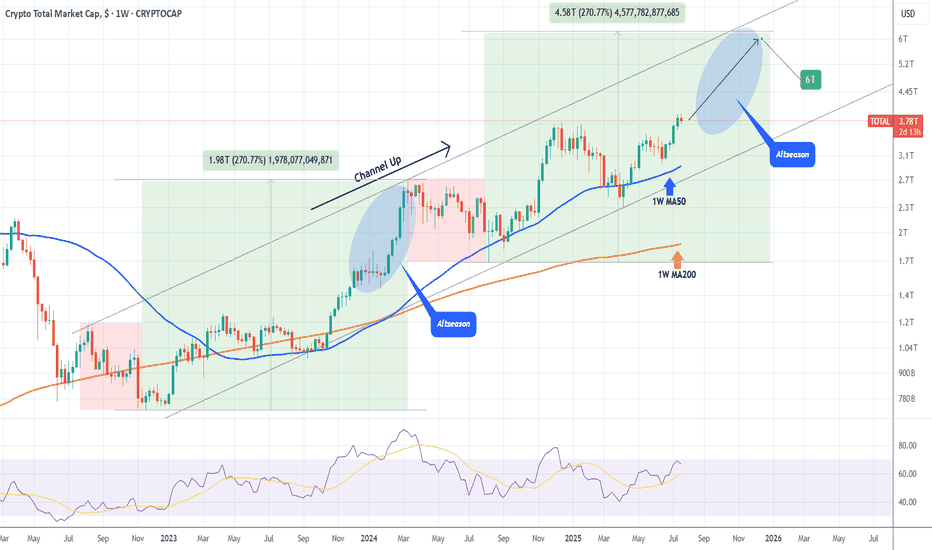

TOTAL CRYPTO MARKET CAP expected to hit $6 Trillion!The Crypto Total Market Cap (TOTAL) has been on a Channel Up since the 2022 market bottom and since the April 07 2025 Low (Higher Low for the pattern), it's initiated the new Bullish Leg, already turning the 1W MA50 (blue trend-line) into Support.

As long as this holds, we expect it to complete a +270% rise from the August 05 2024 Low, similar to the Bull Cycle's first Green Phase, and reach at least a $6 Trillion Market Cap!

More importantly, we expect this final part (blue ellipse) to be what is commonly known as an Altseason, where the lower cap coins show much higher returns and disproportionate gains to e.g. Bitcoin.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Cryptototalmarketcap

$TOTAL Crypto Market Cap - Banana Zone or Bull Trap!?Massive day for CRYPTOCAP:TOTAL Crypto Market Cap with 9% move UP, breaking above the 200DMA and last cycle’s ATH.

Got rejected at the .618 Fib ~$3.19T, so work still needs to be done to confirm this region.

Expect a retest at $3T to decide if the market goes to $3.2T or back down to $2.85T

As I've been saying this past month, this is either the biggest bull trap all cycle, or it's the start of the PARABOLA 🍌

$TOTAL Crypto Market Cap BULL TRAP AlertBULL TRAP 🚨

New money has been coming into the market as shown on the Crypto CRYPTOCAP:TOTAL Market Cap, hence why you haven’t seen “rotations” in coins, but it appears to be drying up.

There’s been major resistance at the 200DMA, which is just below the previous ATH at $3T, and PA is being squeezed between the 9DMA.

Combine this with a heated RSI, it appears to be a bear flag in the making.

The trendline from Oct. ’23 gives confluence with the 50DMA as support.

*The only savior I see at this point is price smashing through the 200DMA and flipping support into the green accumulation box.

Regardless, this move is coming to an end later this week to test support or breakout.

Again, I’ll reconfirm my stance that this is the most obvious bull trap I’ve seen all cycle. Although I hope to be wrong 🥲

Having said that, after support is confirmed on the move, we are going to VALHALLA 🚀

Bookmark this 🤓

Crypto Total Market Cap (CRYPTOCAP:TOTAL) As of March 12, 2025, the Total Crypto Market Cap sits at 2.63T USD.

Let’s dive into the monthly chart for a technical breakdown:

Since 2016, price has been moving within a long-term ascending channel. Right now, we’re testing the lower trendline support zone (2.4T - 2.5T).

This level has historically acted as a strong base – both the 2017 and 2021 bull runs kicked off from similar support zones.

Volume profile shows a 15-20% increase over the past 3 months, indicating growing buyer interest and improving market liquidity.

RSI is at 40 (neutral zone), not yet in oversold territory but signaling a potential base for a recovery.

Bullish Scenario: If the 2.5T support holds, we could see a move toward the channel’s midline (3T - 3.5T range), potentially retesting the 2021 highs above 3T.

Bearish Risk: A break below 2.5T could lead to a deeper pullback toward 2T, so keep this level on your radar.

💡 My Take: I believe we’re either at the bottom or just a few weeks away from the start of a new uptrend. April could mark the beginning of a bull run, signaling the end of the bloodbath – at least based on the technicals of the Total Market Cap.

What’s your view? Will the 2.5T support hold, or are we in for another correction?

$TOTAL Crypto Market Cap Signals End of CorrectionCALLING IT NOW 🚨

THAT WAS THE BOTTOM OF THE DIP 💯

✅ Bounced beautifully off the 50DMA

✅ RSI is fully reset to when the Trump Pump started

✅ Volume has turned bullish to signal trend reversal

✅ The Crypto CRYPTOCAP:TOTAL Market Cap needs to stay above 3.2 - 3.3T

Some clustered days around this region will signal even more strength.

🚀 3.6 - 3.7T reclaims bullish trend.

SANTA CLAUS IS COMING TO TOWN 🎅

Crypto Total Market Cap targetsTotal I track since 2023. By my idea top of the market was in 2021 spring

I use my fib and mark green block zone for accumulation CRYPTOCAP:TOTAL

Now all money almost in BTC and we swept ath total.

Now is time to send it to two next levels, it's hard to say about timing but most likely top for btc and alt season will be spring - autumn 2025.

Around 5 Trillion conservative targets for capitalisation

Based on Trade on indicator you can track how it goes on W timeframe!

I use my custom indicator set for more factors in my analysis. April correction playing out good, same like summer 2022 bottom.

July and August we saw the buy back signals!

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

From Breakout to Boom: The Future of Bitcoin and AltcoinsNow price created H&S with means the price can react to this situation and breaks the neckline and will go up. and also , the price can follow the butterfly pattern and go up.

The cryptocurrency market is growing as expected, with the overall market value (covering Bitcoin, Ethereum, and altcoins) indicating a breakout. This development paves the way for a major upward trend in the coming months.

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Crypto Altcoin Marketcap Altcoins have not been preforming well over the last few months.

They have been consolidating in a downward wedge. It is time for altcoins to takeoff to new all time highs.

If altcoins breakout of this wedge than we can see a big move to the upside over the next 8-12 months.

Total Crypto Marketcap --- PLan Your Exit#TOTAL Crypto has already doubled from it's bear bottom, to it's most recent high.

We are almost in 2024, well into crypto summer now

time is really running out to prepare your portfolio for the inevitable Bull market euphoria phase.

I bring this chart up just to remind everyone, that this cycle has potential to be one of the worst in terms of multiple expansions we have seen so far.

We have gone from exploding 340X in one cycle.. to 33X the last cycle.

I expect this time round it will be a single digit multiplier.

We have to hope and pray we do indeed break the previous ATH , and we don't double top at 3 trillion.. of which there is no guarantee!

My realistic target is around 5 Trillion Dollars, which may sound pessimistic at only 3.5X from here ... but that means your Altcoins adding at least a Trillion dollars of value from here!

Optimistically i'm looking at around 7 trillion dollars, no mean feat!

BTC.d at 30% would equal BTC 2.1 Trillion or $110k per coin.

Crypto Market Slowed Down Within Wave 4 CorrectionGood morning Crypto traders! Crypto market slowed down yesterday with an interesting spike down into important support area for a higher degree wave 4, from where we can see a quick stabilization. Well, we believe that more upside is coming for wave 5 of (3), just be aware of more complex wave 4 here if the market stay slow and sideways for a longer period of time.

TOTAL MACRO ANALYSISTOTAL CRYPTO MARKET CAP;

-Has exploded since it entered into Ichimoku Cloud.

-Typically, we see prices reach the opposite side of the cloud.

-That area also lines up with the yellow neckline as resistance.

-I think we pump the remainder of the year for the most part.

-Could see a sell-off after the end of the year.

-I would think dips on the new year are for buying before the BTC halving

Please follow me here for more crypto analysis and a safer way to read charts to minimize risk.

**This idea is not financial advice, its just my 2 cents.

Thanks for your time!

~Cosmicbag

Crypto Total MC sending while MC excluding Alts lagging behindBTC spot ETF has been approved. This is why i have been saying to load up at these bear market levels. Not a time to fomo now, be patient. Its a NEWS pump.

The risk of not loading at these Bear Market levels is too high. Once we dip start scooping, prepare for all scenarios, keep in mind a black swan can always still appear with the state of the world.

Crypto Total market cap sending and hit a resistance on weekly, while the Market Caps excluding BTC is lagging behind still.

This is due to the BTC dominance pump, breaking through its local high. Expect Alts to lag behind as predicted, this is a BTC ETF not an altcoin ETF.

BUT money flows in BTC people take profit then they start buying alts, this is what has happened since inception. Be patient and keep scooping cheap alts.

BTC Dominance sending, alts will suffer most likely if this rally continues. But then you scoop and ride em when BTC starts dropping.

Crypto Total Market Cap Trend AnalysisExpecting a fall of around 7% towards 950 Billion level as per the broadening wedge pattern after which a massive 90% rally will happen towards 1.8 Trillion level.

This 7% fall will sweep the liquidity to fuel the upside move and is highly likely to happen.

I see downside in BTC chart as well to corelate with this scenario.

Good to look for investment opportunities during this fall instead of panicking.

This is not a buy or sell recommendation, do your own due diligence before taking any action.

Peace!!

Crypto Total Market Cap (TOTAL) can jump by over 40%💎 This is a follow-up on our last #TOTAL forecast, where we anticipated the continuation of the downtrend but considered an alternative scenario as well. Now, the tide has turned as the bulls conquered the supply zone, making our alternative scenario the main focus.

💎We witness the fascinating transformation of resistance into support, with #TotalMarketCap trading close to the long-term uptrend trendline. As long as we avoid a new lower low on the daily chart, the crypto total market capitalization is poised to surge further.

💎This could mark a significant uptrend, particularly since our critical resistance is positioned near 1.6T, a staggering 40% above the current demand zone. Paradisers, take note that this bodes well for the overall cryptocurrency market, and certain altcoins may experience growth of x5, x10, or even more in the upcoming weeks.

💎The MCP team diligently monitors the current support while unearthing those precious crypto gems. Stay tuned as we navigate the exhilarating crypto landscape! 🌴

TOTAL (Crypto Total Market Cap) Index Analysis 05/01/2022Fundamental Analysis:

a very simple way of Fundamentally analyzing this Index is to look for the other markets indices including US and Europeans ones, such as Dow Jones and S&P 500, it is very observable that these Equity Markets are very much inflated and shall Retrace to the lower levels and correct themselves and get converged to their intrinsic values.

in other word we can say the liquidity shall get diverted from these markets to some other Asset Class, this means gold and silver as well as Digital Assets which are Cryptocurrencies and their underlying technology such as Blockchain and even their future Projects like DeFi and related Financial and Applied Areas.

By looking at the current statues of the Equity Indices and analyzing them we can come to the conclusion that these markets are doomed to fall soon hence a massive transaction of their liquidity to these new Asset class.

lets look at some of our analysis on these Indices such as DJI:

US 500:

it seems very obvious to us that the collapse of these markets shall Couse a huge rise on other alternative markets

assuming the minimum retracement or fall of 20% for each market and considering their Market capitalization of 40.7 Trillion for US500 and 10 Trillion Dollars of DJI and of course the market capital of other European markets.

the Domino effect of markets fall shall consequences to the other markets fall around the world, we can expect minimum of 4 to 10 Trillion dollars of Liquidity shifts from these markets to the Crypto currencies Industry and ecosystems.

these massive amount of liquidity shift shall Couse a huge pomp and rise in the new and even old Projects on various sectors of Crypto world.

mean while we may have some more fall of the Total Market Capitalization of cryptos to lower levels due to some existing fear and Rug pool and Scam Projects but these events should not be having any long term effect and can get recovered on a very fast pace.

the other factors of the wealth transition to the decentralized finance world can be the totalitarians policies and dids of the different establishments around the world such as China, India, middle east counties, or even the implode of some dictatorships systems Like turkey and Iran which will drive the Public funds to more stable and liquidly asset class such as cryptos.

the world banking system too has lots of over leveraged Projects which can be liquidated and Couse a huge market collapse and distrust with their investors the public which will eventually Couse the wealth transition to the decentralized transparent venues such as Blockchain based Cryptocurrencies.

Technical Analysis:

There exist A Hidden Bullish Divergence of Price with MACD, it occurs on a Bullish trend and it is a very significant Sign of Bullish trend continuation.

the Hidden Bullish Divergence is specified with the Green connecting lines.

we draw the Fibonacci retracement from the low point of 0 to the ATH where we can see the dips of the Price falls are having perfect confluences with the Retracement Levels of Fibonacci hence we defined our two Targets using the same Fibonacci extension Levels.

as the Markets fall chances are still exist, we can use the retracement levels of the Fibonacci to specify the support areas and the market Reaccumulating zones for its new bullish trend initiations.

Altcoin Marketcap hitting SupportThis chart shows the total Crypto Market Cap excluding BTC and ETH which at time of writing represent approximately 70% of the market capitalization (look at Dominance for BTC 49% and ETH 20%).

The chart indicates a bounce at the levels where we bounced in January 2023.

We can surely drop lower, BTC dominance and ETH dominance may possibly breakout more to the upside before an altseason. But i think that the risk/reward in this zone for buying alts is relatively low, especially when comparing certain alts to their BTC and ETH pairs.

Time to get the Alt Scoop out once this week and all the data is out. CPI was good at 4% we still await the following though:

Wednesday 14th June

- US PPI

- Fed's interest rate decision

- FOMC press conference

Thursday 15th June

- ECB European Central Bank interest rate decision

- US Retail Sales

- US Jobless Claims

Friday 16th

- BOJ Japan Central Bank interest rate decision

I want to see what the market reaction is going to be to all of the above before deploying more capital into altcoins

Total lost a critical level of supportThis first part of the year was a good one for Crypto bulls with Total rising around 70% from the bottom to the top.

However, after the mid-April top, Crypto Total Market Cap has started to drop, and what, at first, looked like a normal correction is looking more and more like a reversal to the main bearish trend at this moment.

In favor of this outlook is the fact that yesterday Total lost an important level of support at 1.05-1.06 and this would suggest, at least technically, that this year's rise is no more than a correction, not a reversal.

At this moment, as said, the market is under 1.05-1.06 support which should provide resistance now and we could expect continuation to the downside in the next weeks.

In conclusion, I'm looking to sell rallies on major coins

Crypto Total Market Cap - Daily Chart Analysis (DCA) Hello and thank you for taking the time to read my post. Today, we analyze the Crypto Total Market Cap chart on the daily scale, which represents the combined capitalization of the entire cryptocurrency market. This chart often provides clearer and more reliable signals, possibly due to the fact that it cannot be traded directly. As we delve into the classic price patterns present on this chart, make sure to get comfortable and follow along as we progress from left to right, examining the most recent price patterns.

Analysis:

Starting with a 245-day descending triangle, we can see that it has already broken out. The breakout target is illustrated on the chart and is still in progress. Within this ascending triangle, we witnessed a few smaller price patterns, such as a bearish continuation pattern in the form of a descending triangle and a bullish reversal pattern as a rectangle, which led to the breakout. Since then, an uptrend has emerged, and the price has successfully surpassed the 200 EMA and maintained its position above it.

Currently, we're observing the latest price pattern, a head and shoulders formation. Given its position, it appears to be a continuation pattern, as it's neither at the top nor the bottom. At 47 days old, it's possible that the right shoulder is still forming. The price is holding remarkably well above the neckline, indicating strong support at this level. While we cannot predict the direction of the breakout, the stronger the support, the higher the likelihood of a bullish continuation.

Conclusion:

This leads us to our price target. To determine this, we take the height of the price pattern and add it to the potential breakout point of the right shoulder. The resulting target can be seen on the chart. If this scenario plays out, we can anticipate a higher market capitalization for the entire crypto market, which is a positive development for the industry.

In conclusion, the Crypto Total Market Cap daily chart presents various classic price patterns that can provide valuable insights for traders and investors. Monitoring these patterns and the overall market trend can help market participants make informed decisions and better prepare for potential price action.

Please note that this analysis is not financial advice. Always do your own due diligence when investing or trading.

If you found this analysis helpful, please like, share, and follow for more updates. Happy trading!

Best regards,

Karim Subhieh

BTC Dominance is DominatingThe 49% Resistance area for BTC D. has been at play since the summer of 2021 when we first hit that resistance level.

You can see in previous areas BTC D finding resistance was bullish, money flowed into Alts and Total Crypto MC pumped hard. The 3d retrace was marked by a further dip in overall Crypto MC but coincided with a drop in BTC price. Currently since the last time resistance was hit we have seen several alts pop off and BTC find resistance at 30800.

While BTC D was rejected at resistance once more on 12 April, a retrace occured that found support around 47%.

Currently we are bouncing back to the resistance at 49%. BTC Dominance

Over the last 3 days BTC Dominance has been pumping back to resistance.

If it breaks out to the upside, expect ALTS to bleed, would be a good moment to load up on Altcoins.

Hitting Resistance and breaking down to previous levels would likely be bullish for altcoins as long as BTC price either stabilizes (ideal scenario) or pumps along with the alts.

Patiently waiting...