CSE ASI BEARISH SETUPThe monthly chart of the CSE All Share Price Index (ASI) reveals a technically significant scenario: the index is currently testing the upper boundary of a long-term ascending channel while also aligning with the 1.618 Fibonacci extension, both of which signal potential reversal pressure ahead.

Key Observations:

Long-Term Resistance: The price is testing the channel’s upper resistance line near the 17,000 – 17,700 zone, where rejection often occurs historically.

Fibonacci Confluence: The current high coincides with the 1.618 Fibonacci extension, a critical level where long rallies often stall or reverse.

Bearish Candlestick Pattern: The formation of a potential bearish reversal candle near the resistance zone is an early signal of seller interest.

Expected Retracement Levels:

Initial support lies at the 0.382 and 0.5 Fibonacci retracement zones, around 15,000 – 14,000.

Deeper correction could target the 0.618 level (~13,000), which aligns with previous breakout structure and the channel midline.

Conclusion:

The ASI appears overextended after a strong bullish leg and is currently showing signs of exhaustion at the top of a multi-year channel. Unless price breaks above and sustains above 17,700, a correction toward the 13,000–14,000 zone is likely, supported by Fibonacci retracement levels and the channel structure.

This presents a potential medium-term bearish outlook for investors and swing traders, with caution advised around current highs.

Cse

ASPI CSEDisclaimer;

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website’s content as such. We do not recommend buying, selling, or holding any stock. Nothing on this website should be taken as an offer to buy, sell or hold a stock. Conduct your due diligence and consult your financial advisor before making investment decisions.

I do not accept any responsibility and will not be liable for the investment decisions you make based on the information provided on the website.

Anuradha Godellawatte

ASIDisclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website’s content as such. We do not recommend buying, selling, or holding any stock. Nothing on this website should be taken as an offer to buy, sell or hold a stock. Conduct your due diligence and consult your financial advisor before making investment decisions.

I do not accept any responsibility and will not be liable for the investment decisions you make based on the information provided on the website.

ASPI CSEDisclaimer;

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website’s content as such. We do not recommend buying, selling, or holding any stock. Nothing on this website should be taken as an offer to buy, sell or hold a stock. Conduct your due diligence and consult your financial advisor before making investment decisions.

I do not accept any responsibility and will not be liable for the investment decisions you make based on the information provided on the website.

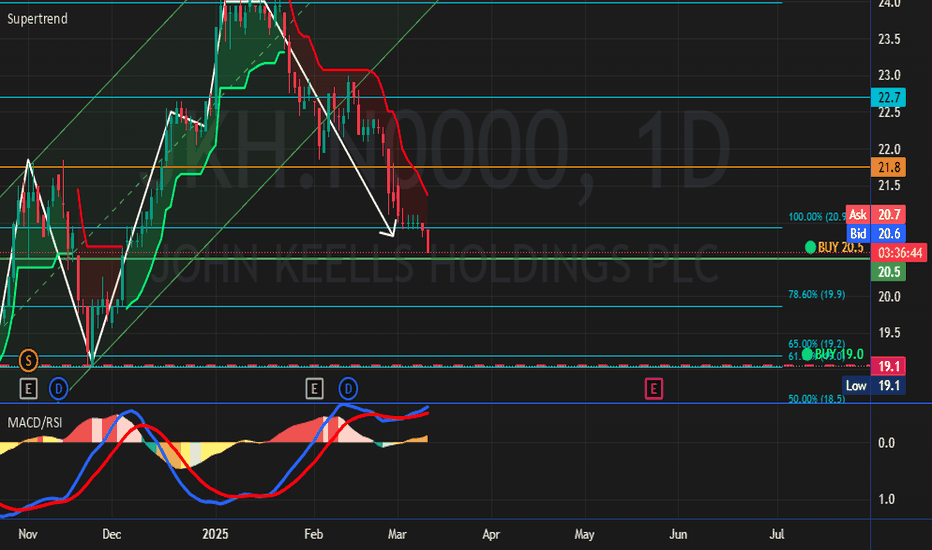

JKH.NDisclaimer;

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website’s content as such. We do not recommend buying, selling, or holding any stock. Nothing on this website should be taken as an offer to buy, sell or hold a stock. Conduct your due diligence and consult your financial advisor before making investment decisions.

I do not accept any responsibility and will not be liable for the investment decisions you make based on the information provided on the website.

TPL.NDisclaimer;

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website’s content as such. We do not recommend buying, selling, or holding any stock. Nothing on this website should be taken as an offer to buy, sell or hold a stock. Conduct your due diligence and consult your financial advisor before making investment decisions.

I do not accept any responsibility and will not be liable for the investment decisions you make based on the information provided on the website.

CALT.NDisclaimer;

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website’s content as such. We do not recommend buying, selling, or holding any stock. Nothing on this website should be taken as an offer to buy, sell or hold a stock. Conduct your due diligence and consult your financial advisor before making investment decisions.

I do not accept any responsibility and will not be liable for the investment decisions you make based on the information provided on the website.

ASI - CSELKDisclaimer

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website’s content as such. We do not recommend buying, selling, or holding any stock. Nothing on this website should be taken as an offer to buy, sell or hold a stock. Conduct your due diligence and consult your financial advisor before making investment decisions.

I do not accept any responsibility and will not be liable for the investment decisions you make based on the information provided on the website.

SAMP.NDisclaimer;

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website’s content as such. We do not recommend buying, selling, or holding any stock. Nothing on this website should be taken as an offer to buy, sell or hold a stock. Conduct your due diligence and consult your financial advisor before making investment decisions.

I do not accept any responsibility and will not be liable for the investment decisions you make based on the information provided on the website.

MGT.NDisclaimer;

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website’s content as such. We do not recommend that any stock should be bought, sold, or held by you. Nothing on this website should be taken as an offer to buy, sell or hold a stock. Conduct your due diligence and consult your financial advisor before making any investment decision.

I do not accept any responsibility and will not be liable for the investment decisions you make based on the information provided on the website.

LFIN.NThe information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and Trading View are not responsible for any investment decisions made based on the content presented herein.

Always do the own research on stock market before making any investment decisions.

ASI - Bull cycle for stock market in Sri lankaLong term targets for ASI indicated in above chart.

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.

LIOC.N00001. Key Technical Observations:

Price Breakout:

The stock has broken above a critical resistance level at 122 LKR (DR). This breakout indicates strong bullish momentum in the short term.

Trendline Resistance:

The stock is currently testing the descending trendline resistance (black diagonal line). A clear breakout above this trendline with volume confirmation could trigger a move toward higher levels.

Support and Resistance Levels:

Immediate Resistance: 124.50 LKR (current level) – needs a daily close above this zone to confirm a continuation of the uptrend.

Support Levels:

117.75 LKR (DM): Acts as immediate support.

115.75 LKR (DS): A fallback support zone.

111 LKR (WM): A key weekly support zone.

2. Indicators:

RSI (Relative Strength Index):

RSI is at 74.14, indicating that the stock is overbought. This suggests the possibility of a short-term pullback or consolidation.

MACD (Moving Average Convergence Divergence):

The MACD line has crossed above the signal line with increasing green histogram bars, signaling a bullish crossover and momentum.

3. Volume and Sentiment:

The breakout above 122 LKR occurred with significant volume, signaling strong buyer interest and bullish sentiment.

Volume confirmation is crucial for validating further upward moves.

4. Potential Targets:

If the stock breaks above the current 124.50 resistance and the descending trendline, the next potential targets are:

130 - 135 LKR Zone (based on previous highs).

Followed by higher levels depending on momentum.

Failure to sustain above 124.50 could see the price retesting supports at 117.75 LKR or 111 LKR.

CALT.N0000 - Weekly Chart UpdateThe Fibonacci retracement levels are plotted based on the all-time high and low values, providing insight into potential support and resistance zones.

The key Fibonacci levels observed on this chart are :

0.236 Level: Around 73.2, which could act as a significant resistance if the stock starts moving up from the current levels.

0.382 Level: Around 60.8, another potential resistance.

0.5 Level: Around 50.7, often considered a pivotal level in retracement analysis.

0.618 Level (Golden Pocket): Around 40.6, which is a critical level and can act as strong support if the price approaches it from above.

Current Price and 21-Week Moving Average (Green Line) :

The price is currently around 43.8, slightly above the 0.618 Fibonacci level (40.6), suggesting the price is in a critical area.

The 21-week moving average (green line) is also near the current price level. This moving average could act as dynamic support if the price remains above it. If it breaks below, it may signal further downside risk.

Descending Trendline Resistance :

The chart shows a strong descending trendline that has been respected multiple times as resistance. The stock would need to break above this trendline to confirm a reversal or more significant bullish momentum.

Support and Resistance Levels :

Immediate Resistance: Around 47.1 (Weekly Mid Resistance) and 53 (Weekly Resistance).

Support Levels: The 0.618 Fibonacci level at 40.6 and the 0.786 level around 26.3 are key support areas. If the price falls below 40.6, the next significant support zone would be around 26.3.

Relative Strength Index (RSI) :

The RSI appears to be in a lower range, which could imply oversold conditions on the weekly chart. This may provide some support for the price, but a confirmed upward trend would still depend on breaking key resistance levels.

Summary:

The stock is in a consolidation phase near critical Fibonacci and moving average levels.

A break above 47.1 and ultimately above the descending trendline could signal the beginning of a potential reversal.

However, if the price falls below the 0.618 level (40.6), there may be a further downside risk, with 26.3 acting as the next major support.

The 21-week MA and the 0.618 level are crucial for maintaining the current consolidation or an upward move, so keeping an eye on these levels is essential.

Disclaimer : The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.

LANKEM DEVELOPMENTS PLC : LDEV.N0000 : CSEOverview

LDEV is the parent company of AGARAPATANA PLANTATIONS PLC (AGPL.N0000) and 98% of group revenue of LDEV is from AGPL.

Strategy

1. Getting exposure to a probable interim dividend expected to be LKR 2.00.

LDEV subsidiary AGPL declared an interim dividend of LKR 1.00 payable on 28th Oct. 2024 which will generate LKR 239M as net dividend (after tax) proceeds for LDEV. As LDEV doesn't have bank borrowings we can assume this dividend receipt will be re-distributed as a dividend to LDEV shareholders. If the board decided to distribute the entire amount, it can be an interim dividend of LKR 2.00.

Assumption: Not deciding to utilize the proceeds in settling intercompany balances.

2. Getting exposure to a continuous dividend stream and exposure to one of the best performing plantation companies in CSE.

AGPL is currently with almost zero net borrowings. If tea prices remain @ current levels, we can expect the dividend stream will continue with enhancements.

EPS FY 2023 = LKR 1.20

EPS 1Q 2024 = LKR 0.71 (If tea prices remain @ current levels with current yields, we can assume a FWD EPS for FY 2024 = LKR 2.84)

Fundamentals

1. FY 2023 earnings

* FY 2023 EPS LKR 1.90

2. Q1 2024 earnings

* 1Q 2024 EPS LKR 1.52

* Assuming AGPL managed to maintain current earnings we can assume a FWD EPS of LKR 6.00 for LDEV. (FWD PE 3)

52 Week Price Range

High : LKR 23.90

Low : LKR 13.80

All time high LKR 38.90

Technical Analysis (Chart Patterns)

* LDEV had created a Descending Wedge pattern during the 2-year price correction and another wedge pattern during last 10 months of consolidation process. During last week both of these patterns recorded break outs.

Potential Pattern Targets

* 10-month consolidation wedge pattern target LKR 22.80

* 2-year descending wedge pattern target LKR 35.30

hSenid Business Solutions PLC / HBS.N0000 / CSEStrategy

1. Portfolio alignment to the sectors that will benefit from the rapid economic recovery of Sri Lanka.

2. Benefit from the expected price recovery/breaking out from the 1-year consolidation range (bottoming out) after post IPO selloff.

Most of the selling came from the account: Mr. O.E.H. Kalvo which had 19,800,000 shares as at 31st Dec. 2021 and are expected to be over by now.

Fundamentals

* Continuous top line growth during last 4 quarters

* As Sri Lanka's economy is on a growth phase exceeding forecasts HBS will benefit from

increased IT budget allocations of other companies and new ventures.

* Business exposure to high growth areas of the world (South Asia, Southeast Asia, Middle East and East Africa)

* Most of the major shareholders opted the dividend in the script form (reinvesting the dividend in the company) instead cash which shows the strong confidence of the company's growth trajectory.

No of shareholders requested for 100% script dividend: 12%

No of shareholders requested for 50% cash & 50% script dividend: 45%

Q1 2024 earnings

Revenue up 30.5% YoY & 7.6% QoQ

New deal closures up 44% YoY

Dividend Yield

Last Dividend LKR 1.25 (Cash/Scrip or both 50/50)

DY : 10.4% (Market DY 4.4% / 1 Year FD rate 8%)

IPO

Opened: 3rd Dec 2021

IPO Price : LKR 12.50

CSE debut Price LKR 28.50

52 Week Price Range

High : LKR 14.00

Low : LKR 10.50

Technical Analysis (Chart Patterns)

* HBS had created a Descending Wedge pattern during the post IPO selloff and a Reverse Head & Shoulder pattern during the 1 yearlong price consolidation (Dividend adjusted chart).

* Both these patterns recorded breakouts during last week.

Potential Pattern Targets

* Multi week descending wedge target LKR 20.00

* Reverse head & shoulder target LKR 14.30

ASI - Elliot Wave PatternThe completion of this pattern typically suggests that the market might enter a corrective phase or a new trend might begin. It’s crucial to keep an eye on the key support and resistance levels and be cautious about the potential market movements.

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.