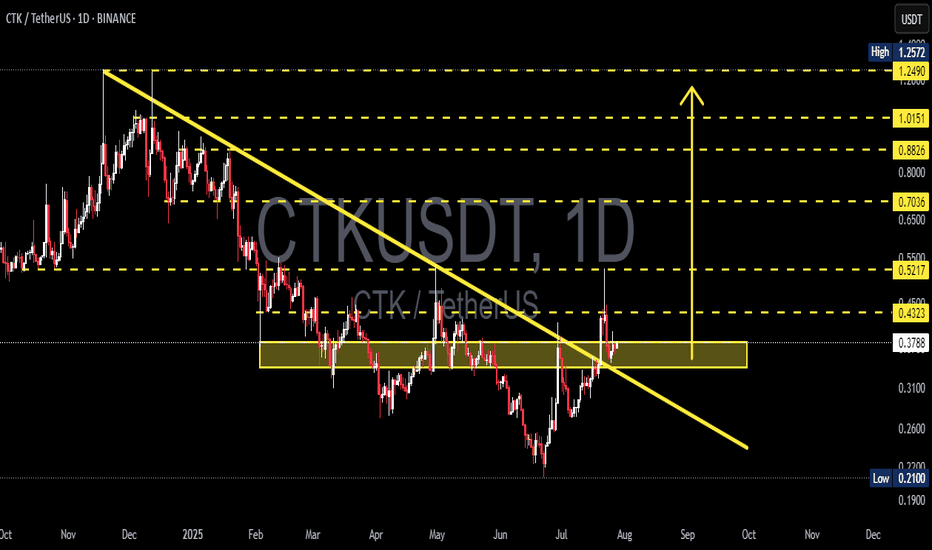

CTKUSDT at Critical Retest After Major Trendline Break!CTK/USDT has successfully broken out of a long-term descending trendline that has dominated the price since November 2024, signaling a potential trend reversal from bearish to bullish. The price is now retesting a crucial supply-turned-demand zone in the $0.36 - $0.39 area, which now acts as new support.

📊 Pattern and Price Structure

Descending Trendline Breakout: A clear breakout above the long-term downtrend, indicating the start of bullish sentiment.

Key Zone (Yellow Box): The $0.36 - $0.39 area previously acted as resistance multiple times and is now being tested as support.

Potential Reversal Pattern: The overall structure resembles a possible Inverse Head & Shoulders, with a neckline around $0.43.

---

🟢 Bullish Scenario

If the price holds above $0.36 and breaks through the minor resistance at $0.4323:

Next bullish targets are:

$0.5217

$0.7036

$0.8826

Up to $1.0151 as a major historical resistance

A breakout above $0.4323 with strong volume would confirm the bullish continuation.

---

🔴 Bearish Scenario

If the $0.36 support fails to hold:

Potential downside levels to watch:

$0.31

$0.26

Down to the key low at $0.21

A breakdown of this zone would invalidate the reversal setup and suggest continuation of the downtrend.

---

📌 Conclusion

CTK is at a critical decision point. The breakout from the downtrend is an encouraging signal, but its validity depends on whether the price can hold the new support and push above the next resistance. Volume confirmation will be key to identifying the next move.

#CTKUSDT #CryptoBreakout #AltcoinAnalysis #TrendlineBreakout #TechnicalAnalysis #SupportResistance #CryptoSetup #BullishReversal #CTKAnalysis

Ctk

Shentu Back To Baseline, 200% Minimum, Fast!We have a very good chart setup here but I will focus on one target only and the short-term, "back to baseline."

Shentu is about to make a strong jump. One of those that can leave us with our mouths wide open. Similar to 30-April but without the rejection and lower low.

This time, the jump will result in long-term growth. Of course, there can be some daily growth first before this jump. The 200% profits potential target is the minimum, there is huge potential for growth, CTKuSDT, long-term. As well as mid-term. And I am telling you now about the short-term, so everything is pointing up.

The main low happened in April. The recent lower low is a form of consolidation with a bearish bent. This type of consolidation can produce higher lows or lower low but the end result doesn't change, which is a strong rise with a higher high compared to the last high.

This is one is good and already on the move. Four days green, but this is only the start.

Thank you for reading and good profits. It will be great.

Namaste.

CTKUSDT | %756 Daily Volume Spike Dont Sleep on This!CTKUSDT Daily Analysis

Volume Surge: Daily trading volume has increased by 756%, signaling a notable rise in market activity.

Demand Zones:

Below Green Line: Key levels where potential demand zones are identified.

Blue Box: Highlighted as a favorable area for buyer activity.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

CTK looks bullishIt looks like we have a large diametric on the chart that we are now in the F wave selection.

By maintaining the green range, it can move up to complete the G wave.

Closing a daily candle below the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

CTKUSDT(Shentu) Daily tf Range Updated till 14-06-24CTKUSDT(Shentu) Daily timeframe range. closely if you look at the chart its a high risk and reward Price action. so have to trade carefully. now if it fails at 0.8176 it will lead to 0.6239. but if it defends 0.8176 that will lead to a retrace back.

CTK LOOKS BULLISH (1D)We have good bullish confirmations on the chart. (iBOS and CH and broken trigger line)

If a pullback occurs on the green level, it is a good opportunity for buy/long positions.

The targets are marked on the chart

Closing a daily candle below the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

CTK - Breakout from the channel - Short Trade#CTK/USDT #Analysis

Description

---------------------------------------------------------------

+ CTK has clearly established a well-defined channel, and currently, the price is breaking downward from this channel.

+ This signals a bearish trend, offering a potential opportunity for a short trade.

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: 0.8780

Stop Loss: 0.9558

------------------------------

Target 1: 0.8236

Target 2: 0.7732

Target 3: 0.7342

------------------------------

Timeframe:4H

Capital Risk: 1-2% of trading capital

Leverage: 5-10x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights.

Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

CTK/USDT Ready to Resume its Bullish Momentum? 👀🚀CTK Analysis💎Paradisers, let's turn our attention to #CTKUSDT, where current trends hint at a potential bullish rally emerging from its crucial support zone.

💎An analysis of #Shentu's recent market dynamics reveals an impressive 48% surge from its recent peak and hit a resistance zone. However, the resilience observed at the $0.712 support level suggests a gateway to an upward trajectory.

💎Despite facing challenges in surpassing previous highs, leading to a temporary bearish sentiment, the $0.712 support level holds pivotal importance for #CTK. It stands on the brink of triggering a significant bullish surge with a fresh evaluation.

💎As forward-thinking traders, we always have a Plan B ready. If #CTK sees a further decline from this support, we are prepared for a bullish resurgence starting from the secondary support at $0.64. It's crucial to note, though, that a dip below this threshold could signal the onset of deeper bearish trends.

💎Maintain flexibility in your trading strategies and keep a sharp eye on market movements, Paradisers. Your ParadiseTeam is diligently monitoring, ready to navigate you through these evolving market landscapes.

CTK/USDT Ready for an Upward Momentum | 👀🚀CTK Analysis💎Paradisers, let's focus on #CTKUSDT, as the current trends offer a glimpse of a potential bullish turnaround from its essential support zone.

💎A review of #Shentu's latest market activity reveals a considerable 38% drop from its recent high. Yet, the tenacity shown at the support level of $0.612 suggests a doorway to an upward movement.

💎Despite the hurdles in achieving new highs or surpassing previous landmarks, which has led to a temporary bearish sentiment, the $0.612 level is crucial for #CTK. This point is on the cusp of initiating a substantial bullish wave with a fresh assessment.

💎As forward-looking traders, we're perpetually equipped with a Plan B. If #CTK declines further from this support, we're poised for a bullish comeback starting from the secondary support at $0.578. It's important to acknowledge, however, that a descent below this marker could indicate an onset of more profound bearish trends.

💎Maintain adaptability in your trading strategies and keen vigilance on market trends, Paradisers. Your ParadiseTeam is diligently tracking, ready to guide you through these evolving market conditions.

CTKUDT 80%+ Profit Symphony in Mid-Term PlayCTKUDT is experiencing a fiery surge as the bulls triumphantly safeguard the demand zone.

Before this, a pivotal breakthrough above the descending channel has been observed, marking a significant trend shift.

The current landscape unmistakably favors the bulls, and we anticipate a solid profit potential exceeding 80% in the mid-term. CTK is likely to be a standout performer in the current market heat.

CTK, another impulse on the way?If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment! Also, check out the links in my signature to get to know me better!

SEED_ALEXDRAYM_SHORTINTEREST1:CTK

Found this on a scan and have been tracking well.

Stalking it since mid-Dec.

Time to take notice, MO.

Reacted from level identified, moved to an AOI identified, with a reaction out of said AOI.

IF:THEN.

NEVER a certainty, obvi, but interesting.

#CTK/USDT#CTK

The price has been moving in a bear flag since July 2022

We are about to break that pattern by breaking the downtrend

Supported by oversold on MACD

Current price 0.530

First goal 0.820

Second goal 1.015

Which represents 200% of the current price

This rise will be faster if the moving average breaks 100

You must pay attention to the correction points on the chart

#CTK/USDT 1D (ByBit) Descending wedge on supportShentu (a.k.a. CertiK) looks likely to reverse after printing that morning star with a dragonfly doji at the bottom.

Relative Strength Index (RSI) also bounced back on oversold territory, revisiting 100EMA resistance would make sense.

⚡️⚡️ #CTK/USDT ⚡️⚡️

Exchanges: ByBit USDT, Binance Futures

Signal Type: Regular (Long)

Leverage: Isolated (3.0X)

Amount: 5.4%

Current Price:

0.4665

Entry Zone:

0.4628 - 0.4384

Take-Profit Targets:

1) 0.5175

1) 0.5678

1) 0.6181

Stop Targets:

1) 0.3947

Published By: @Zblaba

$CTK #CTKUSDT #Shentu #CertiK #BSC shentu.technology

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +44.5% | +78.0% | +111.5%

Possible Loss= -37.2%

Estimated Gaintime= 1-3 months

www.shentu.technology

CTK/USDT Eyeing a Breakout Above Key Resistance?👀🚀Shentu 💎 Paradisers, let’s focus on CTKUSDT as it’s currently making a noteworthy move in the market. It's testing a significant resistance level, setting the stage for a potential bullish breakout.

💎 Looking back at #Shentu market trajectory, it has effectively maneuvered a descending channel, breaking upwards. Currently, it is approaching the internal resistance at $0.770. Overcoming this barrier could significantly heighten the chances of a bullish move, with the next target being the strong resistance at $1.286.

💎 Nonetheless, in the dynamic world of cryptocurrency, #CTK traders should be ready for a range of outcomes. If it encounters difficulties in breaching its internal resistance and maintaining its bullish momentum, the market trend could shift. This scenario might require traders to recalibrate their strategies, possibly focusing on a bullish recovery from a lower support level at $0.653.

💎 Crucially, if #CTK falls below this support level, it would call for a thorough reassessment of the situation. Such a development might indicate challenges in sustaining the bullish trend and necessitate a strategic shift in trading tactics. 🌴💰

Shentu / US Dollars (CTKUSDT) Coin Analysis 11/09/2023Fundamental Analysis:

Shentu Chain is a security-focused delegated proof-of-stake blockchain designed for the secure execution of mission-critical applications, including DeFi, NFTs, and autonomous vehicles. The platform places a strong emphasis on cross-chain compatibility and operates as a Cosmos Hub with comprehensive compatibility for EVM (Ethereum Virtual Machine) and Hyperledger Burrow. It also supports eWASM and Ant Financial's AntChain. Shentu Chain offers a Security Oracle that delivers real-time monitoring of on-chain transactions across various protocols, proactively identifying and flagging potential malicious vulnerabilities before they can be exploited. Depending on their security score, audited blockchain projects from any protocol may qualify for ShentuShield membership, a decentralized reimbursement system designed to compensate users for crypto assets that are lost or stolen due to security issues. ShentuShield memberships are open to all community members of eligible blockchain projects, providing an added layer of security for crypto asset holders in case of unexpected events.

Projects on Shentu Chain have the option to code in DeepSEA, an exceptionally secure programming language supported by prominent organizations such as the Ethereum Foundation, Qtum Foundation, and IBM. DeepSEA seamlessly interfaces with the Shentu Virtual Machine (SVM), which is fully compatible with EVM. SVM introduces innovative ways to access, verify, and incorporate risk-related information into smart contract decisions. The native digital utility token of Shentu Chain is CTK, which serves as the core utility for various on-chain functions, including operating the Security Oracle and ShentuShield systems, covering gas costs on the Shentu Chain, and participating in governance decisions within the network.

ShentuShield is a decentralized membership system designed to facilitate reimbursements for lost or stolen cryptocurrency assets from any blockchain protocol. The decision-making process for reimbursements lies entirely in the hands of ShentuShield members, who can be blockchain projects or individual community supporters. Members have the option to participate in various capacities, either as Collateral Providers or Shield Purchasers. Collateral Providers contribute their own collateral, typically in the form of CTK tokens, and in return, they earn staking rewards on their staked CTK. They also receive a portion of the fees paid by Shield Purchasers.

Shield Purchasers, on the other hand, set aside funds from the Pool to act as a reserve for potential reimbursements of their own cryptocurrency assets. In exchange for this protection, Shield Purchasers pay a fee in CTK, which directly benefits the Collateral Providers. The CTK fees collected from Shield Purchasers are used to compensate Collateral Providers in the event of a reimbursement request.

This unique system fosters a collaborative ecosystem where participants collectively share the responsibility of safeguarding crypto assets and providing reimbursement support. It offers transparency through a list of publicly viewable and audited clients, ensuring accountability and trust within the community.

The Security Oracle comprises a decentralized network of operators equipped with cutting-edge security technologies, responsible for assessing the trustworthiness of mission-critical smart contracts, particularly those employed in DeFi applications. As compensation for delivering real-time, updatable security scores, these operators are rewarded with CTK tokens. The Security Oracle is designed for interoperability, making it compatible with any protocol. This interoperability empowers users of various protocols to make informed decisions before engaging with smart contracts. Smart contracts that have integrated the Security Oracle can proactively identify and block potentially malicious transactions, thereby mitigating the risk of cryptocurrency asset loss.

Although the Shentu Virtual Machine (SVM) is fully compatible with the Ethereum Virtual Machine (EVM), its architecture is inspired by the widely used x86-64 OS process model found in computers worldwide. There is also potential for future extensions to support arm64. The SVM introduces the capability to configure on-chain security parameters, allowing smart contracts to interact with one another in ways that align with their individual risk tolerances. Moreover, the SVM is designed to incorporate a smart contract sandbox, which isolates the operation of smart contracts, particularly those that haven't been adequately secured, from the broader system. This isolation enhances security and minimizes potential risks associated with unverified smart contracts.

DeepSEA is a highly secure programming language and compiler toolchain that seamlessly integrates with the Shentu Virtual Machine (SVM), Ethereum Virtual Machine (EVM), eWASM, and Ant Financial's AntChain. DeepSEA has received research grants from Ethereum, IBM-Columbia, and Qtum to advance its exceptionally secure programming language. When developers use DeepSEA for coding, the language automatically generates mathematical proofs to demonstrate the alignment between the intended specification and the actual code. This automatic proof generation enables a more comprehensive level of formal verification and correctness in smart contract development, enhancing security and reliability.

Technical Analysis:

We have applied Fibonacci retracement tools, extending from $0 to $3.97 the so called last great bullish cycle. Within this analysis, we have identified potential support and resistance areas on the chart based on the retracement levels.

In addition to the retracement levels, we have utilized Fibonacci projection tools to delineate additional potential support areas below the previous all-time low price. This projection is based on the most recent market cycle. Consequently, we have established two potential support levels at $0.45 and $0.2.

Furthermore, we have outlined three potential price targets using the Fibonacci retracement levels from the ATH cycle. These targets are anticipated within the next few weeks to months and are as follows:

First Target Price (1 TP): $0.85

Second Target Price (2 TP): $1.5

Third Target Price (3 TP): $2

These levels serve as key reference points for our analysis, guiding our expectations for future price movements.

Sentiment Analysis:

Considering the possibility of depreciation in the total market capitalization of cryptocurrencies and the price of Bitcoin (BTC) in the upcoming months, it is reasonable to consider employing a Dollar Cost Averaging (DCA) strategy for long positions at the specified support levels.

CTK ANALYSIS (12H)Hi, dear traders. how are you ? Today we have a viewpoint to BUY/SELL the CTK symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

CTK SHORT SETUPHi, dear traders. how are you ? Today we have a viewpoint to SELL/SHORT the CKT symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You