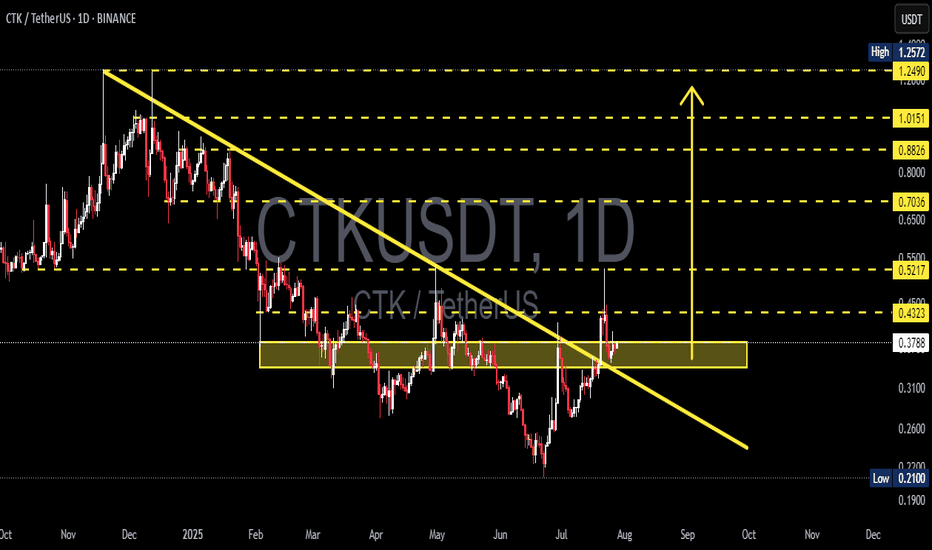

CTKUSDT at Critical Retest After Major Trendline Break!CTK/USDT has successfully broken out of a long-term descending trendline that has dominated the price since November 2024, signaling a potential trend reversal from bearish to bullish. The price is now retesting a crucial supply-turned-demand zone in the $0.36 - $0.39 area, which now acts as new support.

📊 Pattern and Price Structure

Descending Trendline Breakout: A clear breakout above the long-term downtrend, indicating the start of bullish sentiment.

Key Zone (Yellow Box): The $0.36 - $0.39 area previously acted as resistance multiple times and is now being tested as support.

Potential Reversal Pattern: The overall structure resembles a possible Inverse Head & Shoulders, with a neckline around $0.43.

---

🟢 Bullish Scenario

If the price holds above $0.36 and breaks through the minor resistance at $0.4323:

Next bullish targets are:

$0.5217

$0.7036

$0.8826

Up to $1.0151 as a major historical resistance

A breakout above $0.4323 with strong volume would confirm the bullish continuation.

---

🔴 Bearish Scenario

If the $0.36 support fails to hold:

Potential downside levels to watch:

$0.31

$0.26

Down to the key low at $0.21

A breakdown of this zone would invalidate the reversal setup and suggest continuation of the downtrend.

---

📌 Conclusion

CTK is at a critical decision point. The breakout from the downtrend is an encouraging signal, but its validity depends on whether the price can hold the new support and push above the next resistance. Volume confirmation will be key to identifying the next move.

#CTKUSDT #CryptoBreakout #AltcoinAnalysis #TrendlineBreakout #TechnicalAnalysis #SupportResistance #CryptoSetup #BullishReversal #CTKAnalysis

Ctkusdtlong

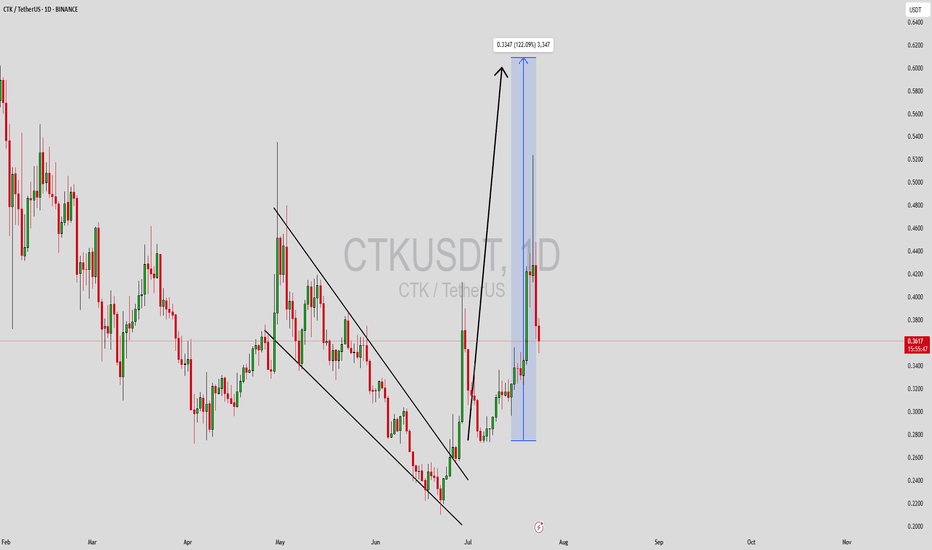

CTKUSDT Forming Falling WedgeCTKUSDT is currently trading within a well-defined falling wedge pattern, a classic technical indicator that often signals a bullish breakout. The structure reflects a period of consolidation after a prolonged downtrend, with gradually narrowing price action hinting at a potential reversal. Volume remains healthy, suggesting sustained market interest and accumulation at lower levels. With expectations of a 110% to 120% gain, CTK appears poised for a breakout that could catch the attention of momentum traders and longer-term investors alike.

The falling wedge is known for its high-probability breakout potential, especially when accompanied by consistent volume and investor accumulation. CTKUSDT has shown multiple rejections at resistance while maintaining higher volume spikes on up moves—indicative of strong buyer interest. As it approaches the apex of the wedge, a breakout above resistance could ignite a strong bullish rally, particularly if confirmed by increased volume and a close above key moving averages.

CertiK (CTK) has garnered notable attention in the blockchain security space, offering real-time auditing and on-chain monitoring services. With rising concerns around security and smart contract vulnerabilities, projects like CertiK are becoming increasingly relevant. This fundamental strength adds further confidence to the technical bullish outlook for CTKUSDT.

Traders and investors should closely monitor this setup. A breakout from the wedge may lead to a sharp move, creating an excellent entry opportunity with favorable risk-reward. If the current structure holds and breaks upward, the target zone of over 100% upside is a realistic and achievable move based on historical wedge performance.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

CTKUSDT Forming Strong Bullish ReversalCTKUSDT is currently displaying a strong bullish reversal setup with a well-formed falling wedge pattern on the chart. This classic pattern is known for signaling a potential breakout after a period of consolidation and downward pressure. As the price approaches the apex of the wedge with increasing volume, technical traders are eyeing a potential breakout to the upside, which could yield gains in the range of 90% to 100%+ based on historical wedge breakouts.

The volume dynamics are aligning with the price structure, suggesting accumulation at lower levels. This behavior often precedes major bullish moves, particularly when supported by a clear technical base. The falling wedge breakout, if confirmed with a daily close above the upper trendline, could open the doors to a strong bullish trend, especially with broader market sentiment showing signs of recovery.

Investor interest in CTKUSDT has been steadily growing, and recent market developments suggest that the project is gaining attention for its fundamentals as well. This makes the current technical setup even more compelling, as it combines strong chart signals with improving investor confidence. The 1D chart structure supports a bullish narrative, and traders should watch for volume spikes and retest confirmations after breakout for added validation.

Given the confluence of technical patterns, volume behavior, and growing market engagement, CTKUSDT stands out as a high-potential altcoin poised for an aggressive move. Traders looking for breakout opportunities in the current crypto cycle should keep a close eye on this pair.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

CTKUSDT | %756 Daily Volume Spike Dont Sleep on This!CTKUSDT Daily Analysis

Volume Surge: Daily trading volume has increased by 756%, signaling a notable rise in market activity.

Demand Zones:

Below Green Line: Key levels where potential demand zones are identified.

Blue Box: Highlighted as a favorable area for buyer activity.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

CTK/USDT Still Strong 💪

The current market structure for CTK/USDT remains bullish. I anticipate a potential 20-40% bullish movement in the upcoming days. However, please note that this statement is based on personal observation and should not be considered as financial advice. Invest wisely and conduct thorough research before making any trading decisions. 🚀📈🔥

#CTK/USDT#CTK

The price has been moving in a bear flag since July 2022

We are about to break that pattern by breaking the downtrend

Supported by oversold on MACD

Current price 0.530

First goal 0.820

Second goal 1.015

Which represents 200% of the current price

This rise will be faster if the moving average breaks 100

You must pay attention to the correction points on the chart

Shentu / US Dollars (CTKUSDT) Coin Analysis 11/09/2023Fundamental Analysis:

Shentu Chain is a security-focused delegated proof-of-stake blockchain designed for the secure execution of mission-critical applications, including DeFi, NFTs, and autonomous vehicles. The platform places a strong emphasis on cross-chain compatibility and operates as a Cosmos Hub with comprehensive compatibility for EVM (Ethereum Virtual Machine) and Hyperledger Burrow. It also supports eWASM and Ant Financial's AntChain. Shentu Chain offers a Security Oracle that delivers real-time monitoring of on-chain transactions across various protocols, proactively identifying and flagging potential malicious vulnerabilities before they can be exploited. Depending on their security score, audited blockchain projects from any protocol may qualify for ShentuShield membership, a decentralized reimbursement system designed to compensate users for crypto assets that are lost or stolen due to security issues. ShentuShield memberships are open to all community members of eligible blockchain projects, providing an added layer of security for crypto asset holders in case of unexpected events.

Projects on Shentu Chain have the option to code in DeepSEA, an exceptionally secure programming language supported by prominent organizations such as the Ethereum Foundation, Qtum Foundation, and IBM. DeepSEA seamlessly interfaces with the Shentu Virtual Machine (SVM), which is fully compatible with EVM. SVM introduces innovative ways to access, verify, and incorporate risk-related information into smart contract decisions. The native digital utility token of Shentu Chain is CTK, which serves as the core utility for various on-chain functions, including operating the Security Oracle and ShentuShield systems, covering gas costs on the Shentu Chain, and participating in governance decisions within the network.

ShentuShield is a decentralized membership system designed to facilitate reimbursements for lost or stolen cryptocurrency assets from any blockchain protocol. The decision-making process for reimbursements lies entirely in the hands of ShentuShield members, who can be blockchain projects or individual community supporters. Members have the option to participate in various capacities, either as Collateral Providers or Shield Purchasers. Collateral Providers contribute their own collateral, typically in the form of CTK tokens, and in return, they earn staking rewards on their staked CTK. They also receive a portion of the fees paid by Shield Purchasers.

Shield Purchasers, on the other hand, set aside funds from the Pool to act as a reserve for potential reimbursements of their own cryptocurrency assets. In exchange for this protection, Shield Purchasers pay a fee in CTK, which directly benefits the Collateral Providers. The CTK fees collected from Shield Purchasers are used to compensate Collateral Providers in the event of a reimbursement request.

This unique system fosters a collaborative ecosystem where participants collectively share the responsibility of safeguarding crypto assets and providing reimbursement support. It offers transparency through a list of publicly viewable and audited clients, ensuring accountability and trust within the community.

The Security Oracle comprises a decentralized network of operators equipped with cutting-edge security technologies, responsible for assessing the trustworthiness of mission-critical smart contracts, particularly those employed in DeFi applications. As compensation for delivering real-time, updatable security scores, these operators are rewarded with CTK tokens. The Security Oracle is designed for interoperability, making it compatible with any protocol. This interoperability empowers users of various protocols to make informed decisions before engaging with smart contracts. Smart contracts that have integrated the Security Oracle can proactively identify and block potentially malicious transactions, thereby mitigating the risk of cryptocurrency asset loss.

Although the Shentu Virtual Machine (SVM) is fully compatible with the Ethereum Virtual Machine (EVM), its architecture is inspired by the widely used x86-64 OS process model found in computers worldwide. There is also potential for future extensions to support arm64. The SVM introduces the capability to configure on-chain security parameters, allowing smart contracts to interact with one another in ways that align with their individual risk tolerances. Moreover, the SVM is designed to incorporate a smart contract sandbox, which isolates the operation of smart contracts, particularly those that haven't been adequately secured, from the broader system. This isolation enhances security and minimizes potential risks associated with unverified smart contracts.

DeepSEA is a highly secure programming language and compiler toolchain that seamlessly integrates with the Shentu Virtual Machine (SVM), Ethereum Virtual Machine (EVM), eWASM, and Ant Financial's AntChain. DeepSEA has received research grants from Ethereum, IBM-Columbia, and Qtum to advance its exceptionally secure programming language. When developers use DeepSEA for coding, the language automatically generates mathematical proofs to demonstrate the alignment between the intended specification and the actual code. This automatic proof generation enables a more comprehensive level of formal verification and correctness in smart contract development, enhancing security and reliability.

Technical Analysis:

We have applied Fibonacci retracement tools, extending from $0 to $3.97 the so called last great bullish cycle. Within this analysis, we have identified potential support and resistance areas on the chart based on the retracement levels.

In addition to the retracement levels, we have utilized Fibonacci projection tools to delineate additional potential support areas below the previous all-time low price. This projection is based on the most recent market cycle. Consequently, we have established two potential support levels at $0.45 and $0.2.

Furthermore, we have outlined three potential price targets using the Fibonacci retracement levels from the ATH cycle. These targets are anticipated within the next few weeks to months and are as follows:

First Target Price (1 TP): $0.85

Second Target Price (2 TP): $1.5

Third Target Price (3 TP): $2

These levels serve as key reference points for our analysis, guiding our expectations for future price movements.

Sentiment Analysis:

Considering the possibility of depreciation in the total market capitalization of cryptocurrencies and the price of Bitcoin (BTC) in the upcoming months, it is reasonable to consider employing a Dollar Cost Averaging (DCA) strategy for long positions at the specified support levels.

CTK/USDT - CertiK: Resistance_Breakout◳◱ A Resistance Breakout has been identified on the $CTK / CRYPTOCAP:USDT chart. The price has broken above a key resistance level, indicating a potential bullish trend. The next resistance key levels are located at 0.765 | 0.791 | 0.86, and the major support zones can be found at 0.696 | 0.653 | 0.584. Consider entering at the current price zone of 0.753 and targeting higher levels.

◰◲ General info :

▣ Name: CertiK

▣ Rank: None

▣ Exchanges: Binance, Bybit, Gateio, Mexc, Hitbtc

▣ Category/Sector: Infrastructure - Smart Contract Platforms

▣ Overview: None

◰◲ Technical Metrics :

▣ Mrkt Price: 0.753 ₮

▣ 24HVol: 534,404.273 ₮

▣ 24H Chng: 1.074%

▣ 7-Days Chng: N/A

▣ 1-Month Chng: N/A

▣ 3-Months Chng: N/A

◲◰ Pivot Points - Levels :

◥ Resistance: 0.765 | 0.791 | 0.86

◢ Support: 0.696 | 0.653 | 0.584

◱◳ Indicators recommendation :

▣ Oscillators: NEUTRAL

▣ Moving Averages: STRONG_BUY

◰◲ Technical Indicators Summary : STRONG_BUY

◲◰ Sharpe Ratios :

▣ Last 30D: N/A

▣ Last 90D: N/A

▣ Last 1-Y: 1.11

▣ Last 3-Y: -0.43

◲◰ Volatility :

▣ Last 30D: N/A

▣ Last 90D: N/A

▣ Last 1-Y: 0.90

▣ Last 3-Y: 1.19

◳◰ Market Sentiment Index :

▣ News sentiment score is N/A

▣ Twitter sentiment score is 0.70 - Bullish

▣ Reddit sentiment score is 0.84 - V. Bullish

▣ In-depth CTKUSDT technical analysis on Tradingview TA page

▣ What do you think of this analysis? Share your insights and let's discuss in the comments below. Your like, follow and support would be greatly appreciated!

◲ Disclaimer

Please note that the information and publications provided are for informational purposes only and should not be construed as financial, investment, trading, or any other type of advice or recommendation. We encourage you to conduct your own research and consult with a qualified professional before making any financial decisions. The use of the information provided is solely at your own risk.

▣ Welcome to the home of charting big: TradingView

Benefit from a ton of financial analysis features, instruments and data. Have a look around, and if you do choose to go with an upgraded plan, you'll get up to $30.

Discover it here - affiliate link -

Ctk | Perfect Breakout CTKUSDT

Breakout has already been confirmed

Now we will Buy on Retest,

It is to be seen whether the retest will be successful or not, take the entry only on the successful retest, the activity of the buyers must be displayed at the retesting point.

When you see Bullish Candles (Momentum Candle) at the Retesting Point, take Trade only.

This was our opinion, Allah knows best.

Remember: We only give ldea's from our

experience and knowledge, it does not

mean that it will be 100% correct, the

market is always unpredictable, anything

can happen anytime.

Always trade with your own research and

knowledge. If You Are Satisfied With Our

Work Then Join.

CTK Brake it or Make it momentCTKUSDT technical analysis update.

CTK currently sitting at its support zone , waiting to bounce back. This is the crucial moment for CTK, the break it or make it moment.

IMO, CTK will possible to bounce back from the current support zone, this is a good time to buy some spot and expect it to grow to $3-$5.

Still, we need to observe the situation carefully, as it might break this support level and trigger a panic sell (which is not impossible).

For spot, Buy zone: $0.71 - $0.81 ; cut loss below $0.67

For swing traders,

Long now with small volume

Stop loss: $0.69

TP 1: $0.943

TP 2: $1.074

CTKUSDT Posible To Bounce Back!CTKUSDT technical analysis update.

CTKUSDT possible to bounce back from the current support zone, If the price breaks below $0.68 then we can expect a significant correction.

Buy zone :$0.780 - $0.810

Stop loss: $0.70

TP 1: $0.870

TP 2: $0.945

TP 3: $1.06

TP 4:$1.28

Always keep stop loss

CertiK (CTK) coin formed bullish Gartley for upto 13.50% moveHi dear friends, hope you are well and welcome to the new trade setup of CertiK (CTK) coin with Bitcoin pair.

On a 4-hr time frame, CTK has formed a bullish Gartley pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

CertiK (CTK) coin forming bullish BAT | A good buy opportunityHi friends, hope you are well and welcome to the new trade setup of CertiK (CTK) coin with US Dollar pair.

Previously we had a nice harmonic trade of CTK:

Now On a 2-hr time frame chart, CTK is very close to complete the final leg of bullish BAT pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

CTKUSDT 350% Potential!CTKUSDT Technical analysis update

CTKUSDT is currently trading at 0.85

CTK price multiple times touched its Support zone in daily chart and the price consolidated from the last 75 days, expecting a bounce back from the current support.

You can take this trade on the spot market.

expecting 300-400% return in a year.

accumulation Zone ctk blast is comingWhat Is the Accumulation Area?

The accumulation area on a price and volume chart is characterized by mostly sideways stock price movement, which is seen by investors or technical analysts as indicative of large institutional investors buying, or accumulating, a large number of shares over time.

This can be contrasted with the distribution zone, where institutional investors begin selling their shares. Being able to recognize whether a stock is in the accumulation zone or the distribution zone is helpful to investing success. The goal is to buy in the accumulation area and sell in the distribution area.