Cup And Handle

BANKNIFTY -CnH - BO -Daily Here's a technical analysis of the **Bank Nifty (Nifty Bank Index)** chart you've shared:

---

### 🧠 **Pattern Analysis: Cup & Handle + Double Bottom**

- The chart clearly shows a **Cup and Handle** pattern forming from **December 2024 to mid-April 2025**, followed by a **bullish breakout** above the neckline at **₹51,990.40**.

- Within the base of the cup, there is also a visible **Double Bottom** (highlighted on chart), adding further **bullish confluence**.

---

### 💥 **Breakout Confirmation**

- **Neckline**: ₹51,990.40

- **Current price**: ₹54,290.20 (Already broken out with strong follow-through)

- Breakout candle shows a **2.21% gain** with **high volume**, confirming a **valid breakout**

---

### 🎯 **Target Projection**

- **Cup depth**: ~₹4,111.85

- **Target = Neckline + Depth = ₹51,990 + ₹4,111 = ₹56,100** (aligned with resistance at **₹56,050.70** on chart)

- Also, an alternative smaller cup handle gives a target of ~**₹54,467**, which seems to be almost achieved

---

### 📊 **Volume Analysis**

- Strong volume spike at the breakout = confirmation of institutional buying

- Volume also increased on the right side of the cup and during the handle, which is ideal in such patterns

---

### 🧱 **Support and Resistance Levels**

- **Immediate Support**: ₹51,990 (neckline)

- **Major Support Below**: ₹47,870 and ₹47,702 (double bottom zone)

- **Next Resistance Zone**: ₹56,050.70 (cup projection target)

---

### 📌 **Summary**

- ✅ **Bullish breakout from Cup & Handle**

- ✅ Double Bottom within the structure adds confidence

- ✅ Volume confirmation present

- 📈 **Upside Target**: ₹56,000+ zone

- 🔁 Potential for retest of ₹52,000 before continuation

AXISBANK – Classic Cup & Handle Breakout | Targeting 1280 & 1320🧠 Technical Analysis:

AXISBANK has formed a textbook Cup and Handle pattern over the past few months. The breakout above the resistance zone around ₹1199 marks a potential start of a new bullish rally.

🔹 Cup Formation: Rounded bottom between Dec 2024 - Apr 2025

🔹 Handle Formation: Consolidation range in Oct - Dec 2024

🔹 Breakout Candle: Strong bullish candle with increasing volume

🔹 200 EMA: Price is now well above the 200 EMA, adding to the bullish bias

🎯 Targets:

Target 1: ₹1280

Target 2: ₹1320

These levels are based on the measured move technique and previous swing highs.

🛡️ Support:

Immediate support lies around the breakout zone near ₹1199

Next strong support is near ₹1090 (200 EMA)

📊 Volume:

Breakout accompanied by a surge in volume confirms buyer interest and validates the pattern.

📌 Conclusion:

AXISBANK is showing strong bullish momentum with a confirmed breakout from a well-defined Cup and Handle formation. As long as it sustains above ₹1199, the stock could potentially rally toward ₹1280 and ₹1320 in the coming sessions.

📅 Keep it on your radar for bullish continuation setups!

Disclaimer:

This analysis is shared purely for educational and informational purposes and should not be considered as financial advice or a recommendation to buy or sell any security. Always do your own research and consult with a qualified financial advisor before making any investment decisions. Trading and investing involve risk.

Cup and handle formingI've been watching PIUSDT.P since launch as I have been part of the program in its early days of inception. I have over 8000 mined pi, 1700 of which I cashed in at launch as a "thank you" that ill probably kick myself later on.

Im not overly familiar with this Cup and Handle formation but it caught my eye just now after I received a notification of a trendline break last night.

Cigna Corporation Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Cigna Corporation Stock Quote

- Double Formation

* (Cup & Handle Structure)) | Completed Survey

* ((No Trade)) & Invalid Wave Structure | Subdivision 1

- Triple Formation

* (EMA Settings)) Ending At 315.00 USD | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 95.00 USD

* Entry At 93.00 USD

* Take Profit At 102.00 USD

* (Uptrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

Gold initiates its trajectory toward the $4,000 markGold (XAU/USD) has confirmed a major bullish breakout from a long-term Cup and Handle formation, pointing to a macro target of $4,044.90. While price approaches immediate resistance at $3,404.72, the bullish structure remains intact above the breakout support zone. A retracement towards ISL or SL zones could offer potential re-entry opportunities in line with the prevailing uptrend.

GBPCHF: Pullback Trade From Key LevelAnother potential pair to consider buying from a key support level is 📈GBPCHF.

Following a test of an important daily structure, the price has formed a cup and handle pattern.

A bullish breakout of the neckline serves as a strong confirmation of an upward trend.

It is likely that the pair will continue to rise and reach the 1.1000 level in the near future.

Gold’s decline is not over yet, aim at: 3160-3150Gold fell below the 3200 mark several times during the test. Although it recovered above 3200 several times, the rebound momentum is gradually weakening, giving short sellers the opportunity to counterattack.

From the perspective of the morphological structure, gold has perfectly constructed an arc top structure, laying a solid foundation for gold to usher in a retracement at any time. The 4-hour candle chart shows that the fall has just begun, so gold still has plenty of room for retracement. At present, gold has rebounded slightly after touching around 3200, but if it cannot break through the 3216-3220 zone during the rebound, it will further confirm the downward trend of gold, then gold will inevitably retreat to the 3160-3150 zone, and in the process of decline, once the profit chips are cashed in or even panic selling is triggered, gold may even have the opportunity to retreat to the 3130-3120 zone!

Therefore, in terms of short-term trading, I still advocate shorting gold in batches. The decline of gold has not ended. Let us look forward to gold bringing us huge profits during the retracement!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Gold: Sell@3188-3200Gold has continued its strong rally, hitting a new all-time high, with bullish sentiment running extremely hot.

However, we must approach this rationally — every new high is usually followed by a technical pullback.

Currently, the 3200 level is a significant psychological resistance, as well as a key threshold for short-term bullish momentum.

From a technical perspective, the sharp recent rally has shown signs of momentum exhaustion, with clear overbought signals emerging.

📌 Strategy Suggestion:

Consider building short positions around the 3188–3200 zone

If 3137 is broken, further downside could extend to 3112–3090

⚠️ Risk Management Notes:

The larger the rally, the stronger the pullback potential

Avoid chasing long positions at these levels to prevent getting trapped at the top

Keep position sizes under control and set stop-losses to guard against sudden volatility

Wishing everyone smooth trades and solid profits!

Total 3 targeting 1.5TWelcome back dearest reader,

This is going to be a short one, all information is in the chart above.

Total 3 has been in a Massive Cup and handle formation.

Measured from the base of the cup till the top of the handle gives us a ''total 3'' price target of 1.5T$ which is 100x from here. If you were to do a different analysis and like flags more then we come to the same price target of 1.5T$ (Blue bars).

Price action is now retesting resistance from march 2024 as support. When this is done i expect blast-off mode.

~Rustle

WTI Crude Oil | Potential Cup Formation with Volume Support.I’m spotting a potential Cup formation on the 30-min chart of WTI Crude Oil (USOILSPC), backed by strong volume profile zones. The price has recently pulled back to a low-volume area and is now consolidating with higher lows forming the right side of the cup.

A break above the $60.60–$60.80 zone could trigger bullish continuation toward $64+, with strong support seen around the $59–$59.30 range (volume shelf).

Setup Details:

• Pattern: Cup (early stage)

• Entry idea: Break & retest above $60.60

• TP: $64.00

• SL: Below $58.90

• Volume profile confirms accumulation near the lows

Watching closely for confirmation before adding more size. This is part of a low-risk entry using a funded account model.

#CrudeOil #WTI #VolumeProfile #CupFormation #BreakoutTrade #SmartMoneyConcepts

DOW JONES INDEX (US30): Bearish More From Resistance

It looks like US30 is returning to a bearish trend again.

I see a strong bearish sentiment after a test of a key daily resistance.

The price formed an inverted cup and handle pattern and we see

a strong bearish imbalance with London session opening.

Goal - 39.685

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD: Bullish Move From Support 🇳🇿🇨🇦

There is a high chance that NZDCAD will go up from the underlined support.

As a confirmation, I spotted a cup and handle pattern on an hourly chart.

Goal - 0.792

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETHEREUM (ETHUSD): Strong Bullish Move Ahead?!

It looks like we have a valid liquidity grab after a test

of a key weekly structure on Ethereum.

After a false violation of the underlined area,

the price formed a cup and handle pattern

and violated its neckline with a bullish imbalance on an hourly chart.

I think that the market can remain bullish and reach at least 1700 level.

❤️Please, support my work with like, thank you!❤️

EURUSD, Bullish Bias, Fundamental and Technical AnalysisFundamental Analysis

1. Endogenous factors of EURO is getting better while USD is down

2. Seasonality shows EURO bullish in April while USD bearish

3. increased pressure of interest rate cut in USD in also leading towards DXY bearish

4. COT data shows net increase in EUR and decrease in USD

5. Sentiments shows bullish in EUR 11/8, while USD is 4/5.

6. LEI, Endogenous and Exogenous factors all in favor of Bullish momentum in EURUSD.

Technical Analysis

1. Cup and Handle Formation

2. Breakout appeared

3. Breakout Retest

4. Buy in parts

i. Long 1% at current price

ii. Long 1% @ 1.09017

5. Stop loss below Handle

6. Projection Target 1.165

7. Take profit on Major resistance levels

DOLLAR INDEX (DXY): Time To RecoverThe Dollar Index appears poised for a retreat after testing a key support area on a 4-hour chart.

A robust bullish engulfing candle indicates strong buying activity in that region.

As a confirmation, I see a cup and handle pattern on that and a breakout of its neckline.

I anticipate a bullish upswing to at least 102.79.

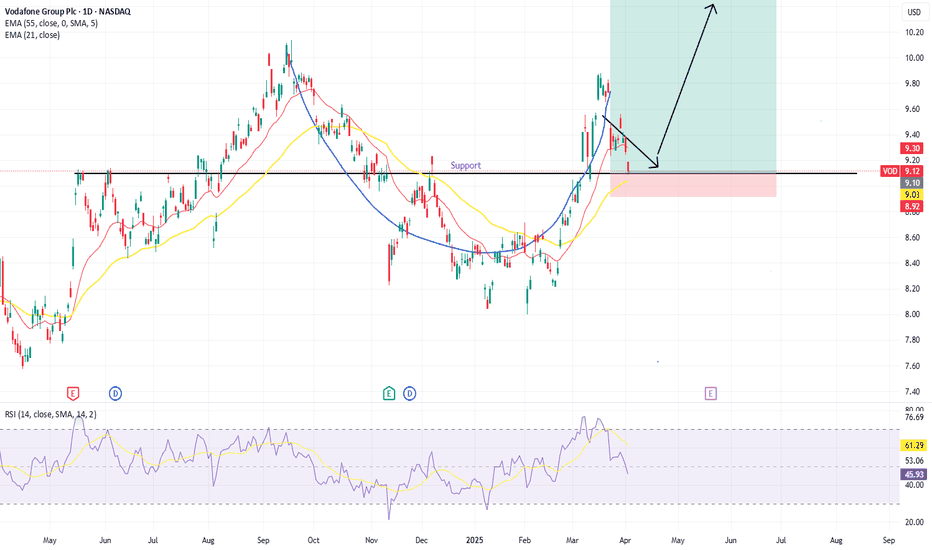

VOD - Cup and HandleThere appears to be a cup and handle pattern forming in $NASDAQ:VOD. It had strong push upward last summer and has drifted back down through the end of the year, with another strong increase back near its highs. We are now seeing a retraction following the handle portion of the pattern and today reached a significant support line. I would expect to see a little bit more consolidation in this area before we get another strong push upward. With the majority of operations occurring in Asia, Africa and Europe, this may a little safer play than the turmoil unfolding in American companies from recent tariffs.